Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

28th July 2025: Quarterly Cash Flow Report [6 pages] plus Quarterly Activities Report [15 pages].

This had me stumped for a minute:

That's from page 5 of today's June Qtr cash flow report. 151,592 (@ question 8.6) divided by 86,778 (@ question 8.3), which is the calculation that question 8.7 is requesting, equals 1.75, which is less than 2, so question 8.8 should not be "N/A". What the...?

Well, a quick look back at the previous pages (I always start with the "Quarters of Funding Available" and then work back from there) had me quickly realising that they were actually profitable for the quarter, so the number @ 8.3 is actually their profit / incoming cash for the quarter rather than their "Total relevant outgoings" as labelled at 8.3. And 8.7 only applies to companies who are still burning cash, i.e. have used more money than they've made in the quarter, and that isn't Bellevue this particular quarter. Bellevue are cashflow positive now.

And it gets better:

It was a great quarter, but June (the last month of the quarter) was their best month of the quarter, and was record breaking in terms of gold production, averaged realised price, record gold recovery (95%), increased average grade (5.4 g/t gold), and record development rates with each jumbo averaging 311 metres for the month (go DVP!).

From a share price perspective, it was a green morning, with BGL up as high as 90.5 cps at one point, which was +5.85% above Friday's 85.5 cps close, however the euphoria didn't last into the afternoon, and BGL closed down half a cent for the day, at 85 cps (cents per share), which probably had something to do with that line I've highlighted in the red rectangle above - BGL are not providing guidance until next week - or the week after (in early August) which may be when they provide their FY25 full year report.

Most of the more important stuff in today's report was already known by the market due to BGL's announcement on July 7th titled Record free cash flow and strong finish to FY25 [4 pages]. The market realised during today that there wasn't much new news today and that they'd have to wait until August for the most important bit, the outlook and guidance.

So let's look at the financial health of the company.

They had $152 million worth of cash and gold on hand at June 30th, however BGL do have $100m of debt.

The good news is that that debt is all with Macquarie who remain bullish on BGL, and all of that $100m of debt is not due to be repaid until 2027:

Source: Page 4 of their Quarterly Cash Flow Report today.

For those who don't follow BGL, they have a history of surprise capital raisings, with their latest being a AU$156.5 million equity placement in April 2025, primarily to close out near-term hedging contracts and strengthen their balance sheet, allowing more gold production to benefit from favorable spot gold prices. A portion of the funds (approximately A$40 million) was also allocated to working capital.

To get their initial $200 million PLF (project loan facility) from Macquarie Bank back in 2021, Bellevue had hedged a significant amount of their gold production at prices that are now well below current market levels, leading to potential losses. By spending $110.5 million in April to close out most of those hedging contracts, the company can now sell their gold at much higher spot prices, improving their cash flow.

They still have some hedging in place, but it's not much now, and it's even less as a quarterly number:

Source: Page 7 of today's Quarterly Activities Report.

Bugger all this year (just 5.73 koz) then between 11 and 17.85 koz per quarter through until Q4 of FY2027, then between 17.88 and 20.63 per quarter for those last three quarters through until Q3 of FY2028. To put that in some context, they produced 38.94 koz in the June quarter this year and they're still ramping up. In the month of June they produced 18.2 koz, so they're up to a quarterly run rate of 54.6 koz gold production based on their June production, or 218.4 koz per annum of production, and they're still ramping up.

Have a look at how much being unhedged for the majority of the June quarter positively affected their cash flow:

Source: Page 3 of today's Quarterly Activities Report.

- Realised gold price of A$5,147/oz in June Qtr vs $3,259/oz in March Qtr.

- Gold Revenue of $199.5m in June Qtr vs $84m in March Qtr.

- Free Cash Flow of $67m in June Qtr vs a $30m loss in March Qtr.

And they're getting their costs down also, with their June AISC (All-In Sustaining Cost) of A$2,253/oz being lower than 3 of the preceeding 4 quarters and much lower than the March Qtr when their AISC was A$3,124/oz, as shown above.

The main reason why I've broken my own "never trust BGL management again" rule (again) and am holding BGL (again) is the thesis that they would have to get their act together and start making money out of what is after all one of the higher grade gold mines in WA, OR they would get bought out by somebody because of the amount of gold that they have there, and the high grades. So either (a) a recovery in the share price on the back of vastly improved performance, or (b) a significant premium paid by an acquirer. My thoughts were that if (a) failed, then (b) would surely happen because the asset is just too good to be run into the ground by poor management. It seems like (a) is playing out, and (b) is on hold at this point.

They updated us on their "Strategic Review" today:

Source: From pages 7 & 8 of today's Quarterly Activities Report.

Their new COO could well be this guy: Campbell Baird, Mining Executive, Perth [LinkedIn]

Never heard of him, but that's not surprising considering his background at Metals X, Artemis Resources, Indiana Resources, Indus Coal, Focus Minerals, Vulcan Resources, Iron Ore Company of Canada and Plutonic Gold way back in 1996 to 1998 - none of those are companies I was following when he was working at them. Interesting that the longest he stayed at any of those companies was just under 4 years at Vulcan Resources; He was at the first 4 (in that list - which are his four most recent jobs apart from running his own consulting firm called CCB Capital) for less than 2 years (from 1 year and one month, up to 1 year and 11 months). Might not be the same guy that BGL have just hired as their new COO, but I have a feeling it is.

Anyway, I'm not in BGL for their management quality, hell no!! I am in them for their high grade gold at Bellevue. If they don't work out how to make money there, someone else will, and it looks like they are working out how to make money there, so that's good.

Normally, I make excellent management (competent & trustworthy with great track records) a prerequisite for my investee companies, but Bellevue Gold is an exception to that rule because of the value of their gold, so it's more of an arbitrage play in my view, as I've explained.

They don't always work out, but I think this one will. Not advice, just my personal thoughts on this particular company.

Further Reading: 30-April-2025: Investor site visit presentation [34 pages]

07-May-2024: Commercial-production-declared--expansion-studies-commence.PDF

Plus: East Coast & USA Roadshow Presentation.PDF (07-May-2024, titled: "Set for growth and superior financial returns.")

Website: https://bellevuegold.com.au/

Investor Page: https://bellevuegold.com.au/investor-centre/

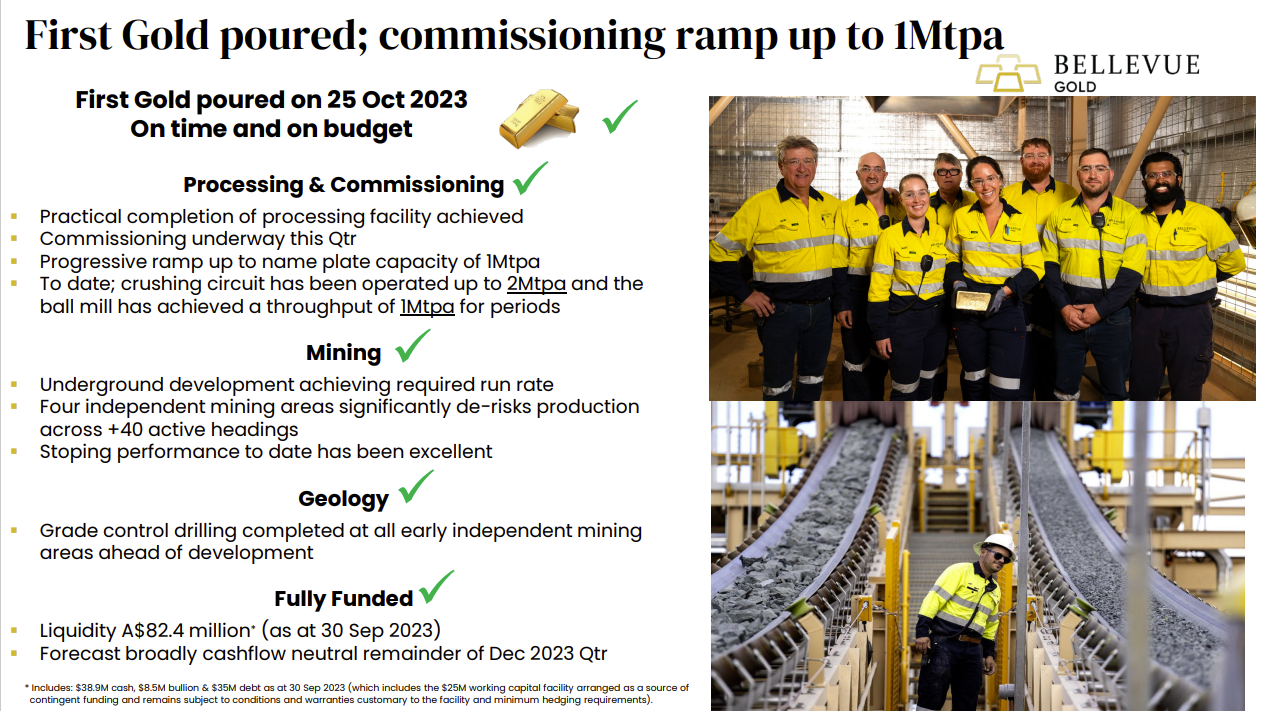

The concern was whether they could get to this point (commercial production declared) without another CR, and they have, so well done Bellevue!

Disclosure: I hold BGL Shares.

28-Jan-2024: Bull Case straw for BGL - I added them to my SMSF on Thursday (25th Jan 2024).

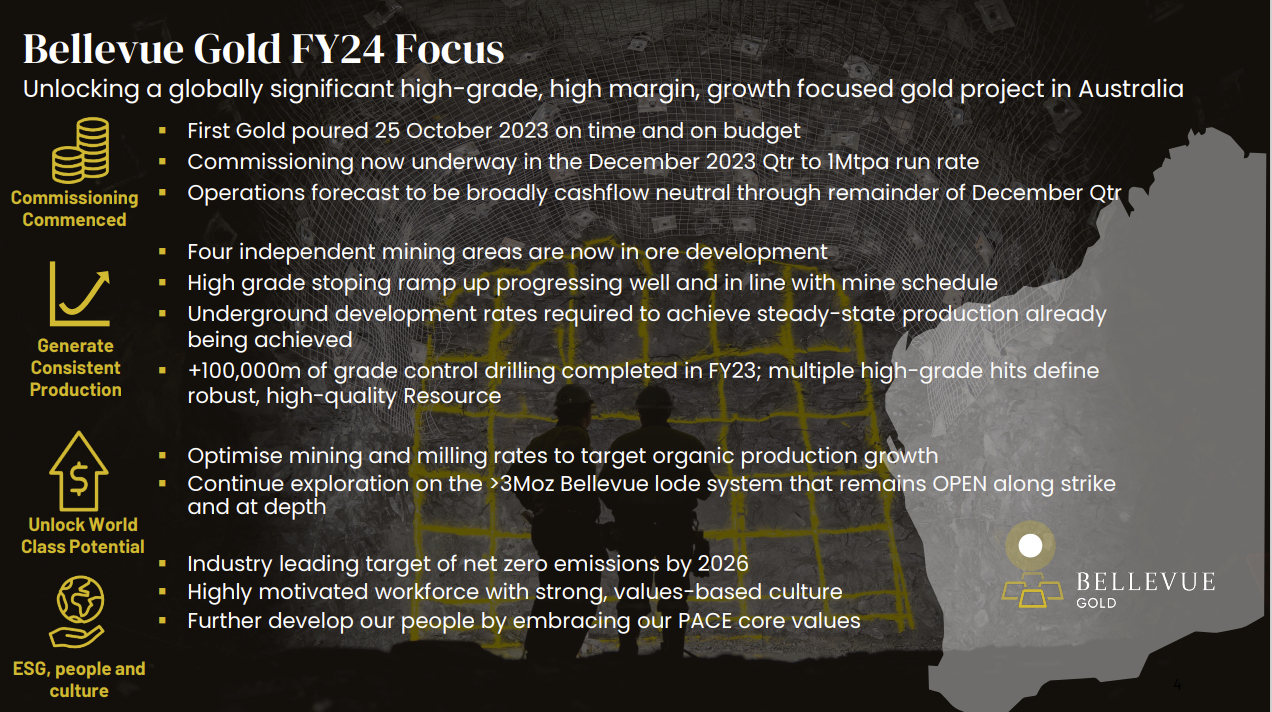

The SP has come down ~30% from a high of $1.84 in early December to $1.29 in late January. The company is going through the commissioning phase and ramping up the Bellevue gold mill to nameplate capacity currently, and the December Quarterly Activities Report will be telling in terms of how smoothly that has been going. That should be lodged by BGL to the ASX's announcements platform during the next three business days (the last 3 in January - and January 31 is their deadline for lodging that report). If things are going badly, then the share price will go even lower, but if things are going alright I reckon we could see some upside from here.

The following slides are from their November East Coast Roadshow Presentation slide deck:

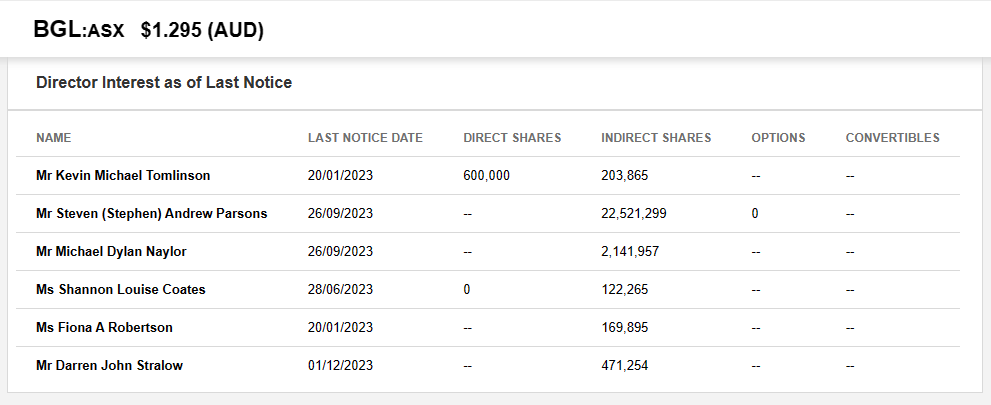

Some skin in the game - some more than others, but all directors own some shares:

Bellevue (BGL) currently have three substantial shareholders:

- 15.16%, Blackrock, the world's largest asset managers, they own and manage iShares ETFs and their IAU iShares Gold Trust ETF has US$25.6 Billion in AUM and their IAUF iShares Gold Strategy ETF has US$34.5 Billion in AUM.

- 5.71%, Van Eck, another ETF provider, Van Eck specialises in mining and materials ETFs and they have their NUGG Physical Gold ETF as well as their global gold miners ETFs, GDX (VanEck Gold Miners ETF, with US$11.4 Billion of FUM) and the US-listed GDXJ (VanEck Junior Gold Miners ETF, with US$3.8 Billion of FUM, available through NYSE Arca - or NYSEARCA - which is an electronic communications network - or ECN - used for matching orders - rather than a physical stock exchange.) and GDXJ holds BGL.

- 5.03%, Vanguard, the OG of ETFs, Vanguard's founder Jack Bogle is credited with inventing Index Funds (ETFs), and Vanguard have included BGL in at least two of their ETFs - see below.

According to https://fintel.io/so/au/bgl, "Bellevue Gold Limited (AU:BGL) has 63 institutional owners and shareholders that have filed 13D/G or 13F forms with the US Securities Exchange Commission (SEC). These institutions hold a total of 266,994,874 shares. Largest shareholders include AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C, INIVX - International Investors Gold Fund Class A, GDXJ - VanEck Vectors Junior Gold Miners ETF, SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FKRCX - Franklin Gold & Precious Metals Fund Class A, PRAFX - T. Rowe Price Real Assets Fund, Inc., ASA Gold & Precious Metals Ltd, Dfa Investment Trust Co - The Asia Pacific Small Company Series, and VTMGX - Vanguard Developed Markets Index Fund Admiral Shares."

From Bellevue's own website: (https://bellevuegold.com.au/)

Bellevue Gold Limited is an Australian Securities Exchange (ASX) listed company developing the high-grade Bellevue Gold Project. The Project has a current global Mineral Resource of 9.8Mt @ 9.9 g/t gold for 3.1 Moz, including a Probable Ore Reserve of 6.8 Mt @ 6.1 g/t gold for 1.34 Moz, making it one of the highest grade gold discoveries in the world and the highest grade gold development project in Australia.

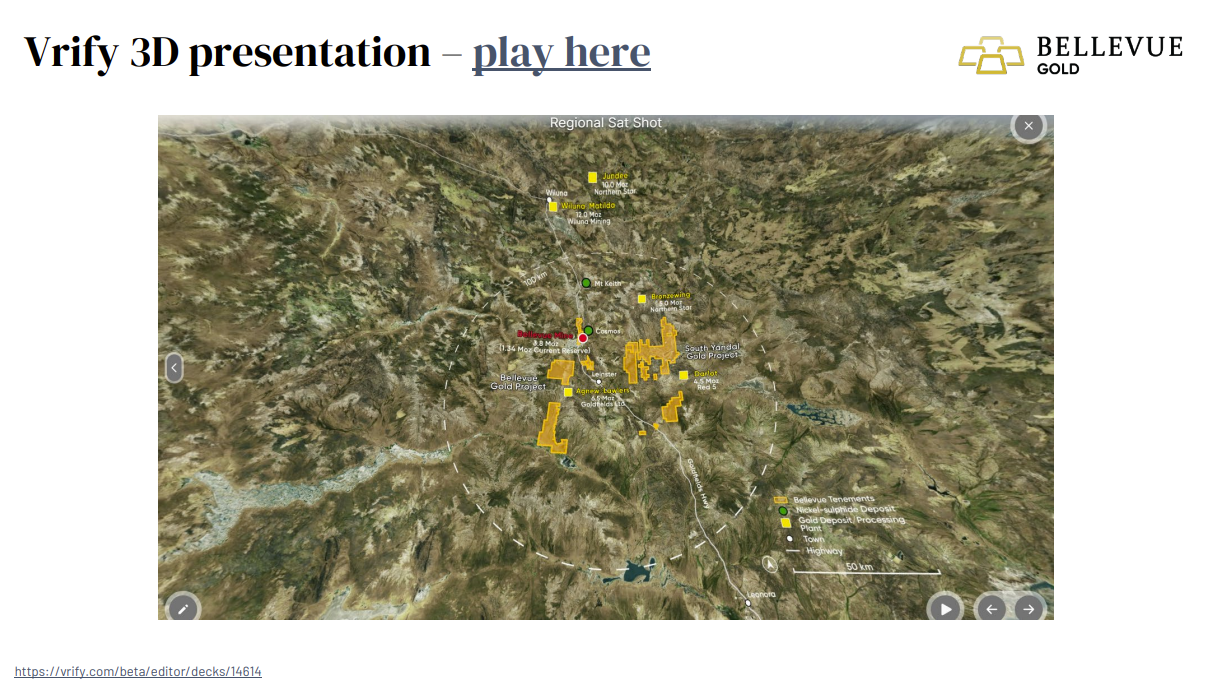

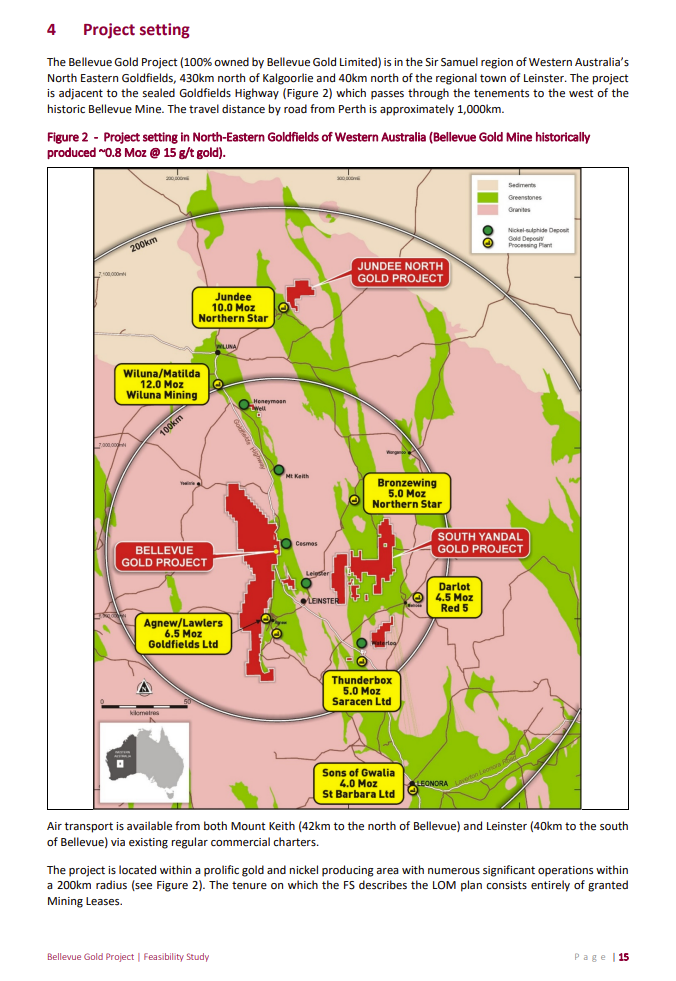

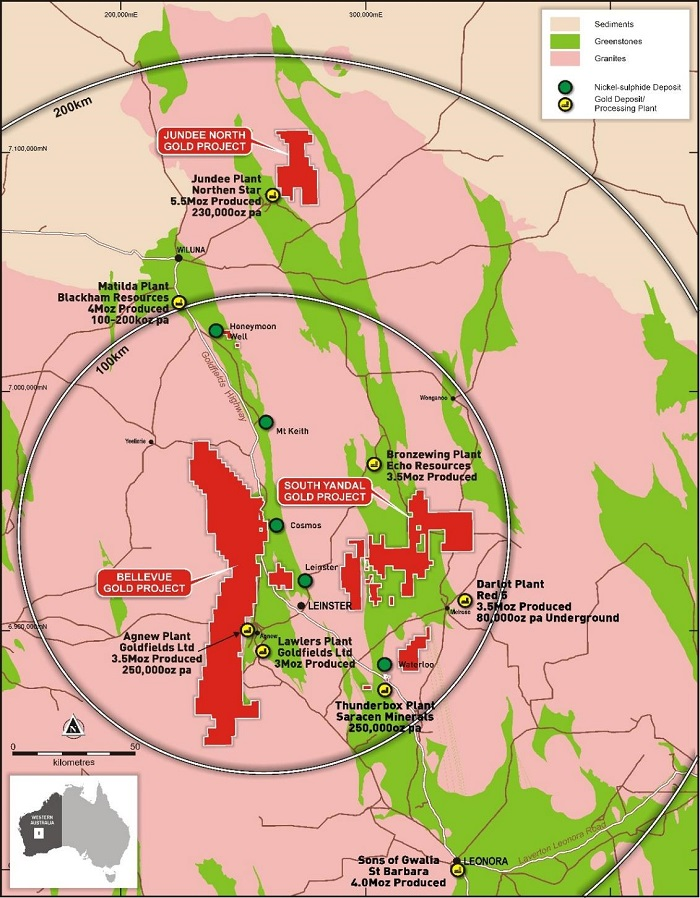

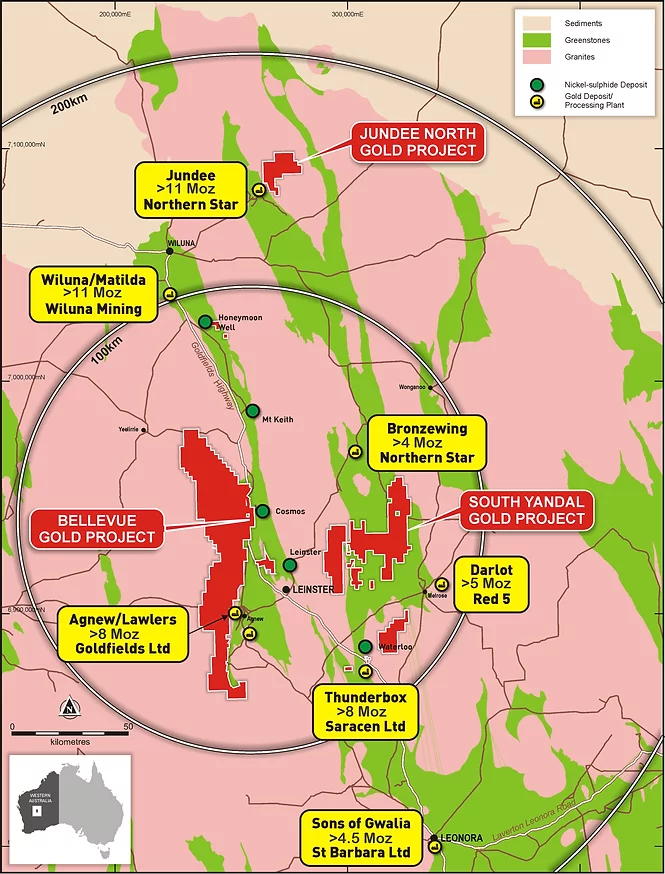

The Project is located 40km to the north west of Leinster in the Goldfields region of Western Australia and sits in a major gold and nickel producing district with mines such as Jundee (ASX:Northern Star), Agnew & Lawlers (Goldfields), Darlot (ASX:Red 5), Bronzewing (ASX:Northern Star), and Thunderbox (ASX: Northern Star) all in close proximity.

The Company has a highly skilled Board of Directors and Management team with a track record of discovery success and corporate growth and a strong supportive global institutional shareholder base.

--- end of excerpt ---

So, looking at all of that, including the number of ex-NST people at BGL (their MD & CEO, their COO, their CFO and their Chief Sustainability Officer and Head of Corporate Development all worked previously at Northern Star Resources, as I have highlighted about 8 images up), and the fact that their Bellevue Gold Project is located in close proximity to three of Northern Star's mines (Jundee, Bronzewing and Thunderbox) and also close to Red 5's (RED's) Darlot satellite underground gold mine (that helps feed RED's KOTH mill), I think it's fair to assume that there MIGHT be some M&A down the track... Economies of scale and all that. NST acquires BGL, or RED acquires BGL, or BGL acquires RED, something along those lines - I would prefer BGL to be a target than a hunter, but that would of course depend on the prices paid at the time.

Source: Bellevue Stage One FS (feasibility study) 18-Feb-2021

That map above is nearly 3 years old, so there have been some changes, including Gwalia now being owned by Genesis (GMD) instead of St Barbara, Thunderbox now being owned by NST (after the Saracen-Northern Star merger), and Wiluna Mining (formerly known as Blackham Resources) going into voluntary administration in July 2022, with mining ceasing in December 2022 and final ore processing completed in February 2023.

https://bellevuegold.com.au/bellevue-gold-project/

I'm heading back over there in a couple of weeks for a few days - to the SW of WA, SW of Bunbury. Flying, not driving, to Perth, then driving, so won't be going through the WA goldfields.

Source: Bellevue Gold Project (gres.com.au) [GRES = GR Engineering Services, GNG.asx, who I also hold shares in]

See also: Project_Focus_-_Bellevue_Gold_Project.pdf (gres.com.au)

Source: Bellevue Gold Project, Australia (mining-technology.com)

Source: https://247solar.com/bellevue-gold-mining-raises-the-sustainability-bar/

Not all positive unfortunately:

Bellevue Gold: Bellevue Gold Limited fined $41,000 after it left 'visible salt scar' (9news.com.au)

https://www.wa.gov.au/government/announcements/gold-miner-fined-hypersaline-spill-0

(21) Bellevue Gold Limited: Overview | LinkedIn

Investor Centre | Bellevue Gold | ASX:BGL | Australia

Disclosure: Despite getting pissed off with management in December 2022 when they said they didn't need to raise capital and then promptly did a CR (including an SPP) when the share price rose... I have now taken a fresh look at the company in the new light of their current position and the substantial de-risking of their Bellevue Gold Project which is nearing the end of the commissioning phase now and should be approaching nameplate capacity if things are going OK, so looking at BGL as a gold producer now who should be a top 20 Aussie gold producer, so not large, but not insignificant either, and as potentially one of the more profitable ones in the future based on those high gold grades they keep finding, I'm back onboard BGL. Bought some in my SMSF on Thursday (25th Jan 2024).

03-Aug-2023: Exceptionally-high-grade-infill-drilling-results.PDF

BGL (Bellevue Gold) is a company I've held before, and I've also been critical of management, particularly when they said they were fully funded through to production and then announced an opportunistic CR within a few weeks when the share price was up on a couple of positive announcements. Being able to trust management is usually a prerequisite for me in terms of one of the boxes that I need to tick before investing in a company (or speculating more than investing with a company that is burning through cash but should become a profitable gold producer shortly). Trusting management often boils down to whether they do what they say they are going to do, and saying they are fully funded through to production sends a clear message to the market (and their investors in particular) that they will not be raising more capital, at least for the next few months, and they said that, and then did a raising shortly afterwards, so a big "Fail" on that score for mine.

I'm not against capital raisings, indeed they are often necessary and expected, and can be a good way to increase your exposure to a good company - if the CR is extended to ALL shareholders rather than just an elite group (such as a placement). However, unexpected CRs force existing shareholders to stump up more cash or be diluted (i.e. make your existing holding worth less, as it's a lesser share of the company because the company has issued more shares), and we make our investing decisions based on a number of assumptions, and we have to make those assumptions based on what we know, which includes what the company's management has told us, so when they say one thing and then do another, that's not good at all.

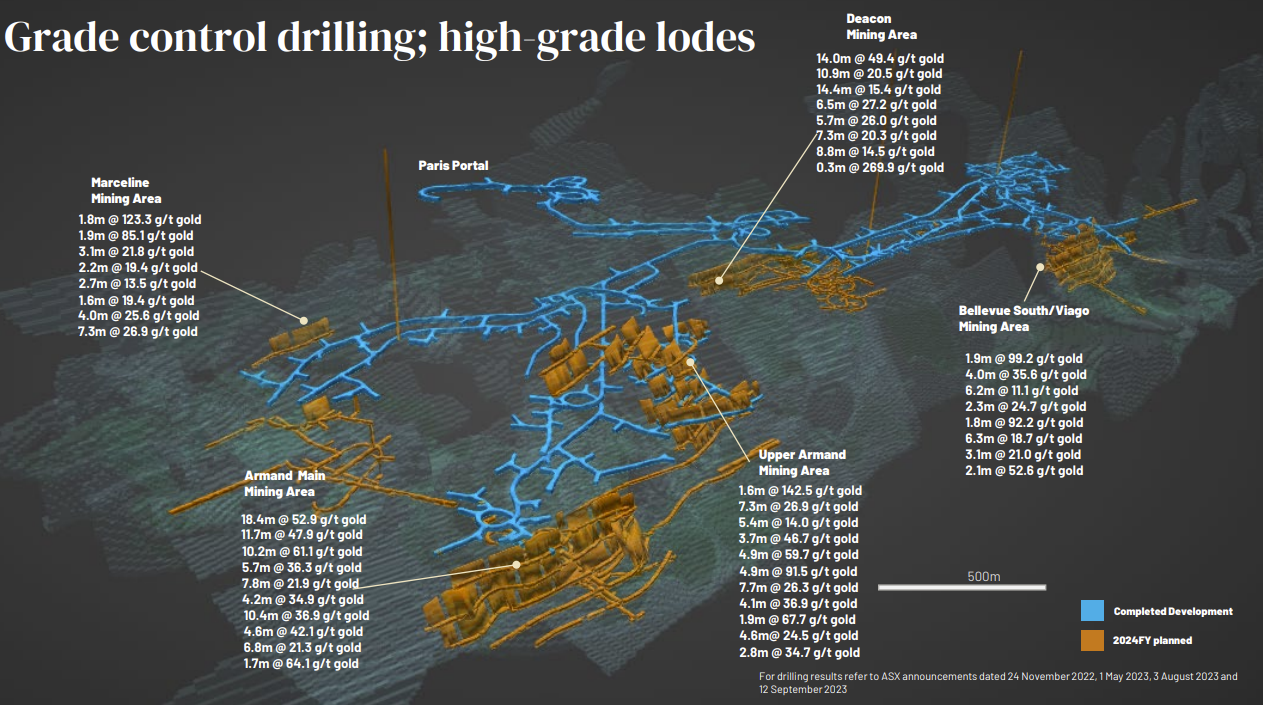

All that said, BGL is finding some VERY good grades of gold at the minute. Have a gander at these numbers:

When you have companies that are profitable mining gold with ore that contains only 1 (one) gram of gold per tonne of ore, these results, which range up to 99.2 grams/tonne, suggest a very high grade deposit indeed.

So I guess that's the positive with Bellevue - they have some great grades which should result in lower costs and higher profits, when they get around to processing that ore. Maybe it's like that famous Tiger Woods quote, "Winning takes care of everything."

Maybe...

Disclosure: I do not hold BGL shares at this time.

07-Dec-2022: Yes @Gprp - in answer to your #Business Model/Strategy Straw earlier today - Management have indeed been very naughty - and have lost a fair amount of credibility in my eyes also - which is why I sold down more than half of my BGL position here in my Strawman.com virtual portfolio today - moving that money into RMS (Ramelius Resources, which look better to me sub-$1/share). I only have just over $1K worth of BGL IRL (1,000 shares, to keep me following them, because they COULD become a decent producer one day). I have a lot more RMS IRL, and I'm building an RMS position here on SM once again. RMS are a proven gold producer who always find ways to get around their issues, such as their recent issues with a number of their mines nearing the end of their useful lives. And I rate their (RMS') management quite highly. BGL - not so much, after this week's developments.

On the 29th November at the Macquarie WA Forum - BGL said this on the first page of their presentation (after the standard disclaimer pages) - - -

Then they went on to explain how close they were to becoming producers.

I won't reproduce the whole presentation again here, but it was very compelling. Here it is: 2022 Macquarie Western Australia Forum Presentation [29-Nov-2022]

That's a link to the presentation (as supplied on the BGL "announcements" page of their website) because the file is too large to upload to this site (believe me, I tried and failed).

Here's the crux of the issue as explained by me along with their recent share price history:

I like the opportunity. I like the contractors they've got building the plant (GR Engineering Services, or GRES, ASX:GNG, who I hold both here and IRL) and I like the contractors they've got to do the actual gold mining - Develop Global - Bill Beament's new company (he's the dude that built NST up from nothing to become Australia's second largest gold miner). But I no longer like Bellevue Gold's management too much.

I haven't dumped them completely, but I hardly had any to start with. On the one hand I can see that they wanted to sieze the opportunity, but what about all of the punters who believed what they said on the 29th and bought into the company at prices ranging all the way up into the $1.20s, only to have them pull this one? Raising money at $1.05, which naturally drags the share price back down to damn close to $1.05. Not a good look Bellevue!

It will be interesting if the market dumps them based on this credibility damage, or forgives them because it's all about the future value? I view management quality as a very important factor in my investments, and it's pretty high up on my checklist actually, and after this, Bellevue no longer tick that box.

10-June-2022: Bellevue Gold (BGL) updated their recent update after the market closed this evening (at 6:15pm) - see here: Project Production, De-risking and Growth Update-update

This is an update to the update released on Tuesday (07-June-2022): Project Production, De-risking and Growth Update

So far I've noticed some cosmetic changes such as a frame around figure 3 at the bottom of page 5, and that the wording of the 3rd dot point under the "Key Points" heading on page 1 has changed from:

"The life-of-mine (LOM) Reserves and Mineral Inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

to now:

"The life-of-mine (LOM) Project LOM inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

...which I'm guessing is to do with complying with the JORC code in relation to gold Reserves. Interesting that they do not provide any explanation of what has changed in the updated version of the update. I just opened both documents in different tabs and switched between them to pick up any differences. If you line the pages up exactly and switch between them you can easily see if anything has changed. So far I've only noticed those two changes that I've mentioned (wording on page 1 for one of those dot points and the frame around figure 3 on page 5), but there's probably some more further in.

Still looks like a very decent project to me. But then - I hold BGL shares, as well as shares in GNG (who are building the gold processing plant at Bellevue) and also Develop Global - who have been appointed mining contractor (mining has commenced already at Bellevue).

GR Engineering (GNG) has commenced early works and has ordered the long-lead and critical path items required for the plant construction. GNG is a company I have held shares in for many years and have written about here extensively. GNG are quite busy at the moment with a number of contracts on the go at the same time. They do have a division which generates recurring revenue from the energy sector (Upstream PS) but the bulk of GNG's revenue is from completing studies (FS, PFS, BFS, DFS, etc., i.e. Feasibility, Pre-Feasibility, Bankable and Definitive Feasibility Studies) and doing EPC (Engineering, Procurement and Construction) contracts, which means their revenue tends to be quite lumpy. After having a bit of a dry spell for a couple of years, they had an excellent first half and are tracking to back that up with an equally good second half (for FY22) - they also pay a very generous fully franked dividend yield. Definitely a company I'm happy to hold through their cycles, but I trim at the highs and load up when they look particularly cheap, trading around a core position. At over $2/share they are fairly fully priced compared to when they are down at $1/share or lower. They closed bang on $2/share today after rising +2% (or +4c) on a down day for the market. In April 2020 they were trading ay 64 cents/share. Very cheap at the time. It was a quiet period for them, but work always picks up again eventually, and it has recently.

GNG are one of two ASX-listed EPC contractors who specialise in the design and construction of gold processing plants. The other one is Lycopodium (LYL) who I also hold. LYL do most of their work in Africa, while GNG do most of theirs here in Australia. But that's not set in stone, that's just historical, and GNG do also do work outside of Australia and LYL do occasionally perform work here in Australia, but as a general rule LYL specialise in working in areas of the world where there are increased sovereign risks, and they get paid accordingly. Both are very good at what they do, and both have excellent risk management processes in place to deal with the risks they face, which are substantial. GNG tend to win the majority of the gold plant EPC contracts for new gold projects located here in Australia.

DVP (Develop Global) is Bill Beament's new company, the man, the legend, who built NST up from nothing to become Australia's second largest listed gold miner, behind NCM (Newcrest Mining) and also one of the top 10 largest gold miners in the world (both in terms of market capitalisation and ounces of gold produced per annum). Bill started off in mining services before he got into gold mining, and now he's back in mining services again. I think there are exciting times ahead for DVP. I'm excited to see where Bill B takes DVP.

Disclosure: I hold shares in BGL, GNG, DVP, NST and LYL (all mentioned above).

You can keep up-to-date with the Bellevue Gold Project development here: Investor Centre | Bellevue Gold | ASX:BGL | Australia

Image Source: July 2019: Bellevue Gold Ltd delineates 1.8 million ounces in under 18 months at namesake WA project (proactiveinvestors.com.au)

Updated version from the Bellevue website below:

07-June-2022: Bellevue Gold (BGL) is the only gold project developer that I currently hold. I hold plenty of producers but only one developer that is not already producing, and I chose BGL because of the outstanding grades and low costs. This morning they have presented the following to the ASX:

- Project Production, De-risking and Growth Update [34 pages]

- Project Production, De-risking & Growth Update Presentation [25 pages]

They describe the Bellevue Gold Project as: "The “Standout” high-grade, high margin growth gold project in Australia" and then back that up with the stats.

It's worth reading if you want exposure to gold via an emerging producer who has substantially de-risked the project already and is powering ahead with the development.

As I said, the main attractions for me are the high grades of gold, and the projected low costs.

That compares very favourably with current ASX-listed gold producers, who are almost all producing gold at a higher cost per ounce than BGL's projected A$1,000 to A$1,100/oz.

They also have a good management team there:

You can click on those images to make them larger. At least, you can on the PC version of the Strawman.com website. Not sure about the mobile device (app) version.

Disclosure: I hold BGL shares.

11-Sep-2021: Macquarie sometimes stop covering companies for a period either because they are raising capital for them, or because they are in negotiations to raise capital for them. Macquarie were involved in BGL's CR in mid-2020 and they have just been named as one of the underwriters of the current CR by BGL.

See here: Bellevue Gold kicks off $106m placement, three brokers on board (afr.com, 02-Sep-2021)

and here: Gold play Bellevue set to launch $100m placement, two brokers hired (afr.com, 08-July-2020)

If those stories are behind a paywall, the main info is that Bellevue Gold is currently attempting to raise $106 million in an institutional placement underwritten by Canaccord, Goldman Sachs and Macquarie. It was also Canaccord Genuity and Macquarie Capital that organised the July 2020 raising.

Of the seven (7) brokers covered by FNArena.com, (Citi, Macquarie, Morgans, UBS, Credit Suisse, Morgan Stanley and Ord Minnett) - Only Macquarie currently covers Bellevue Gold (BGL) and they have an "Outperform" rating and a $1.40 PT/TP (price target/target price, a.k.a. target) for BGL. The following shows a little bit of their more recent coverage, with the most recent at the top and the least recent at the bottom.

Disclosure: I hold BGL shares. It should be noted that FNArena does NOT cover a number of other brokers (other than the seven listed above - in bold) - and some of the ones that they do NOT cover who MIGHT be covering BGL include Canaccord Genuity and Goldman Sachs who both - along with Macquarie (who FNArena DO cover) - have been involved with capital raisings on behalf of Bellevue Gold.

[Click on the below image to make it bigger]

14-July-2021: Bellevue receives attractive project debt funding proposals

Bellevue receives overwhelming response to call for project debt funding proposals

Bellevue to draw up shortlist of potential lenders after securing non-binding debt offers of up to A$289M from 12 leading Australian and overseas institutions

KEY POINTS

- Bellevue has received indicative debt funding proposals for the Bellevue Gold Project from 12 leading domestic and offshore financial institutions, with non-binding offers up to A$289m (ranging between $170m and $289m)

- Bellevue had A$94m cash on hand at 30 June 2021; The project’s estimated capital cost in the Stage 1 Feasibility Study was A$255m (see ASX release dated 18 February 2021)

- The debt offers contain attractive commercial terms consistent with project financing of this nature

- Given the number of highly competitive offers, Bellevue will devise a short-list of potential lenders

- The strong response from lenders comes as the Company prepares to complete the Stage 2 Feasibility Study on its Bellevue Gold Project this quarter

- This study will consider expanding processing capacity from 0.75Mtpa to 1Mtpa as part of a strategy which would grow the production rate and increase project economics for minimal extra capital cost

- The Stage 2 Feasibility Study will be based on Bellevue’s recently increased global Resource of 3.0Moz at 9.9g/t gold (see ASX release dated 8 July 2021)

--- end of excerpt --- [click on link at the top for the full announcement]

Disclosure: I hold BGL shares.

23-June-2021: Drilling Results Underpin a Proposed Upscaled Operation

Bellevue Gold Project, Western Australia

Further exceptional drilling results underpin a proposed upscaled mining operation to 1Mtpa, to grow production rate and increase project economics for minimal extra cost

In light of these results, the deadline for new drilling data to be included in the upgraded feasibility study has been extended to ensure their full impact on the project’s value is captured

KEY POINTS

- Strong step out drilling results pave way for further increases in Resources and Reserves across the project; current total Resources of 2.7Moz at 9.9 g/t include 1.2Moz at 11.0 g/t of Indicated Resources and a Reserve of 0.69Moz at 8.0 g/t

- Drilling has identified significant extensions at the Deacon North and Marceline lodes, with the extensions expected to add further ounces at a low level of capital intensity

- Due to the location of the discoveries, they are expected to deliver a significant increase in the project economics for the upgraded Stage 2 Feasibility Study; the lodes sit proximal to planned development that was incorporated into the Stage 1 Feasibility Study

- Latest extensional results outside the Reserve at Deacon North/Marceline have defined some of the best intersections on the Project to date, results include:

- 5.6m @ 62.7g/t gold from 496.4m (UG drilling)

- 12.5m @ 18.8g/t gold from 704.7m

- 10.1m @ 9.7g/t gold from 412.2m (UG drilling)

- 0.8m @ 288.2g/t gold from 670.2m

- 2.7m @ 113.2g/t gold from 450m (UG drilling)

- 1.4m @ 125.7g/t gold from 524.6m

- 2.2m @ 22.9g/t gold from 447.7m and 2.7m @ 13.4g/t gold from 491.2m

- 3.8m @ 25.4g/t gold from 579.3m (UG drilling)

- 5.3m @ 14.9g/t gold from 417m

- 14.3m @ 5.5g/t gold from 692.3m

- 4.3m @ 15.6g/t gold from 696.6m

- 0.9m @ 97.0g/t gold from 376.3m

- 1.8m @ 42.1g/t gold from 506.8

- 2.3m @ 19.6g/t gold from 693m

- In light of the latest drilling results, the updated Feasibility Study is considering the option of expanding the production plant capacity by 33% from 0.75Mtpa to 1.0Mtpa at start-up

- Increase in processing capacity will see an increase in production and the overall project economics from the Stage 1 study that delivered $1.1B of free cash flow (at $2,300/oz) at bottom quartile All in Sustaining Costs (AISC)

- Given the potential impact of the latest results on the Resource, the cut-off date for inclusion of fresh drilling data in the upcoming Stage 2 Feasibility Study has been extended with the study now expected to be released in the September quarter, 2021

- Such an expansion is expected to incur minimal additional capital costs due to growth provisions contained in the original Feasibility Study underground mine design and upscalable plant layout: refer Figure 1 [image below]

- The Company remains well funded to complete existing works and exploration with $116m in cash and equivalents (as at 31 Mar 2021)

- Short-list of potential project lenders expected to be completed within weeks. Long lead items including Ball Mill purchase and construction of the mine camp are anticipated to commence in the September quarter

- Grade control drilling has commenced, as previously announced. Results confirm excellent orebody continuity of the Bellevue lode system with results (included in ASX announcement on 16 June 2021) of:

- 5m @ 76.4g/t gold from 55m (incl 2m @ 176.6g/t)

- 5m @ 31.7g/t gold from 43m

- 5m @ 30.5g/t gold from 28m

- 2m @ 48.9g/t gold from 20m

- 5m @ 17.1g/t gold from 52m

- 3m @ 24.8g/t gold from 42m

- 5m @ 14.5g/t gold from 27m

- 5m @ 12.5g/t gold from 35m

- Step-out and Infill drilling continues with five surface rigs and two underground rigs operating

- “These results are entirely consistent with our goal of growing the production rate and project economics for a minimal increase in the capital cost.” – Bellevue MD Steve Parsons

--- click on the link at the top of this straw for the full announcement ---

[I hold BGL shares, which rose +5% today to $0.925/share.]

16-June-2021: Highly Successful Grade Control Drilling Program Results

Bellevue Gold Project, Western Australia

Highly successful grade control drilling program demonstrates excellent continuity of Bellevue orebody

Exceptional results of up to 176.6g/t on a 10m x 10m drill pattern continues to de-risk the project

KEY POINTS

- The commencement of grade control drilling is a key de-risking step within the Company’s stated strategy of development and further Resource growth at the Bellevue Gold Project

- Grade control drilling on the Tribune lode at Bellevue has returned a host of strong results, including:

- 5m @ 76.4g/t gold from 55m (including 2m @ 176.6g/t)

- 5m @ 31.7g/t gold from 43m

- 5m @ 30.5g/t gold from 28m

- 2m @ 48.9g/t gold from 20m

- 5m @ 17.1g/t gold from 52m

- 3m @ 24.8g/t gold from 42m

- 5m @ 14.5g/t gold from 27m

- 5m @ 12.5g/t gold from 35m

- The results demonstrate the excellent continuity of the high-grade mineralisation at Bellevue, and further de-risks the project

- The results reinforce the robustness of the Resource within the planned open pit development at Bellevue

- Two rigs are now operating full-time on grade control, completing the drill out of Resources ahead of mine development

- At the Marceline and Deacon North lodes, step-out and infill drilling continues, with four surface rigs and two underground rigs targeting further Resource growth

- Underground development continues ahead of schedule with more than 2km of development completed; Development now 200 vertical metres below surface; Armand and Marceline declines are currently being accessed in conjunction with the rehabilitation of the existing decline

Bellevue Gold Limited (ASX: BGL) is pleased to report a host of strong grade control drilling results which demonstrate the continuity of the high-grade mineralisation at its Bellevue Gold Project in WA.

The grade control drilling program at the Tribune lode was conducted on a 10m x 10m grid and returned intersections grading up to 176.6g/t.

Bellevue Managing Director Steve Parsons said: "These results provide more firm evidence that not only is the Bellevue mineralisation exceptionally high grade, but it also exhibits strong continuity.

“Whilst expected, the continuity is highly valuable because it helps underpin the de-risking and the successful development of the project."

Bellevue now has two rigs exclusively drilling grade control at Tribune, one of which is dedicated to the open pit areas and the other to the early underground development areas. At the same time, step-out and infill drilling is ongoing at both the Marceline and Deacon North lodes.

--- click on the link at the top for the full announcement ---

[I hold BGL shares.]

28-April-2021: Quarterly Activities Report

March 2021 Quarterly Report

Highly successful quarter sets up Bellevue to be a high-grade, long-life producer

Stage One Feasibility Study completed; Subsequent Global Resource increase to 2.7Moz at 9.9g/t, including Indicated Resources of 1.2Moz at 11.0g/t gold paves way for potential growth in production and project economics as part of Stage Two Feasibility Study in progress.

Further drilling underway aimed at increasing and upgrading Resources at Marceline, Deacon North and the open pits for inclusion in Stage Two Feasibility Study.

KEY POINTS

- Stage One Feasibility Study delivered; key findings include:

- Bellevue Gold Project expected to be ranked among Australia’s Top-25 gold mines based on annual production

- Forecast to be one of the most profitable gold operations in Australia based on a Life of Mine (LOM) EBITDA Margin of 63% (based on gold price of A$2,300/oz)

- Initial projected mine life of 7.4 years

- Average annual production of 160,000oz in years 1 to 5 and a LOM average of 151,000ozpa

- LOM AISC costs of $1,079/oz

- Maiden Probable Ore Reserve of 2.7Mt at 8.0g/t gold for 690,000oz (based on a gold cut-off grade price of A$1,750/oz)

- LOM Mineral Resources and Ore Reserves of 5.6Mt at 6.4g/t gold for 1.1Moz

- Standout ESG credentials; including low levels of carbon, water and energy on a per ounce basis

- First gold pour targeted for December quarter 2022

- Strong ongoing exploration success during the quarter, including significant drill results at the Marceline discovery and two new emerging discoveries; Lucknow and Lucien.

- Subsequent to end of March quarter, Maiden Resource for the Marceline discovery announced: 0.98Mt at 9.7g/t gold for 310,000oz, including Indicated Resources of 410,000t at 10.1g/t gold for 130,000oz.

- Marceline and Deacon North sit in the upper levels of the mine plan, close to planned underground development, meaning their inclusion in the Stage Two Feasibility Study currently underway could have a positive impact on forecast financial returns.

- The Paris Decline has progressed >1,300m, advancing an average of 233m/month during the quarter. Stage 1 development is more than half completed, with current mining contract works on track for completion at the end of 2021.

- Experienced project director, Rod Jacobs, appointed.

- Bellevue is well-funded, with $116 million in cash at 31 March 2021.

- A 3D viewer of the project and recent discovery is available at: https://inventum3d.com/c/BGL/Bellevue

Bellevue Gold Limited (ASX: BGL) is pleased to report on an outstanding quarter during which the Company set itself to be a high-grade, long-life producer in a Tier-1 location.

--- click on the link at the top for the full report ---

[I hold BGL shares. I'm attracted to their project location, their high grades, and their low projected costs. Be aware however that they are targeting gold production some time in calendar 2022, not this year, so there will be no sales or cashflow coming in for some time.]

16-Mar-2021: Latest Marceline results to underpin Stage 2 Feasibility

These latest results included hits of up to 45.5g/t gold. I hold some BGL shares.

08-Mar-2021: Firstly, when looking at Bellevue Gold (BGL), there is a small question mark over their corporate governance in that their company secretary is also their CFO, who is also an executive director of the company, and owns around $1.2m worth of shares (1.46m BGL shares) - and he (Mike Naylor) forgot to seek shareholder approval for the appointment of Grant Thornton as auditor of the Company at their 2018 AGM. However, Grant Thornton were the appointed auditors of BGL from 20 November 2018 until 2 February 2021 (when the appointment of Ernst & Young commenced). Naylor subsequently also did not seek shareholder approval at the 2019 or 2020 AGMs. It wasn't until they changed auditors in Feb this year that they picked up on their error, or more likely their new auditors - Ernst & Yong - picked up on it. BGL have just had to go to the Supreme Court of WA to get that sorted. Had that application NOT been successful (it was), they would now be in breach of sections 327B(1)(b), 327C(2), 328A and 328B of the Corporations Act 2001 (Cth) and they would have been suspended from trading on the ASX by now.

While all's well that ends well, there are significant costs involved in taking matters to the supreme court, and it was of course entirely avoidable if Mike Naylor as Company Secretary, Chief Financial Officer, and an Executive Director of the company, had done his job properly.

I had similar concerns with MX1 (Micro-X) a couple of years back where they were routinely having to seek relief from the supreme court for breaches of the Corporations Act. All related to non-disclosures, late disclosures, or failure to lodge documents as required. MX1 seem to have got their sh!t together more recently but it's something to be aware of if it becomes a pattern.

Speaking of management, Steve Parsons, BGL's MD, holds 30.33m BGL shares, currently worth around $25m, so he's certainly got skin in the game. Parsons and Naylor have both been with the company since 2017 when the company was called Draig Resources. They changed their name to Bellevue Gold in July 2018. Parsons has over 20 years experience in the mining industry with a track record of mineral discoveries, corporate growth, international investor relations and creating shareholder wealth. Mr Parsons oversaw the discovery and delineation of the Banfora Gold Project in Burkina Faso in West Africa and the subsequent takeover of the company by a North American gold company in 2016. He is Currently a Director of Blackstone Minerals Limited (ASX:BSX) and Auteco Minerals Limited (ASX:AUT). He is a former Director of Centaurus Metals Limited (ASX:CTM) and African Gold Limited (ASX:A1G). Shareholders in CTM, A1G and BSX would all be happy with the share price graphs of those companies over the past year, and while BGL have been falling since early December and AUT have been falling since early August, both of them are still up over the past 12 months.

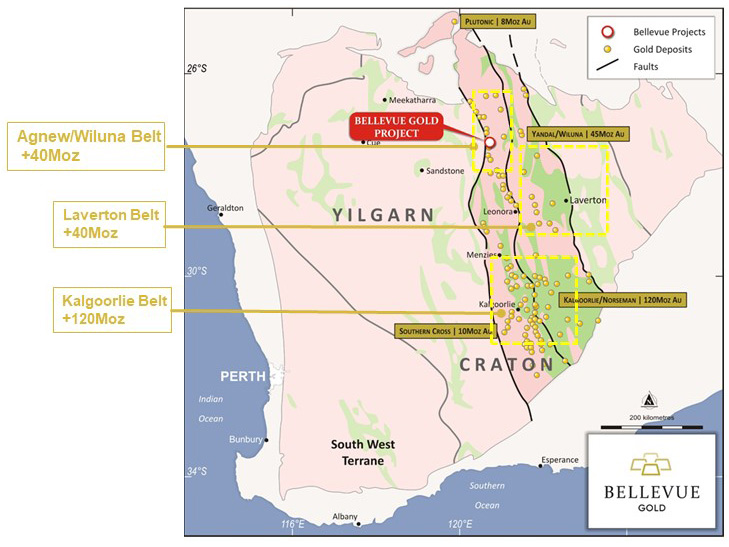

BGL own the high-grade Bellevue Gold Project situated 400km north west of Kalgoorlie in Western Australia which sits within a high-grade gold and nickel district on the prolific Wiluna-Norseman gold belt. Bellevue is within 100km of numerous producing goldmines and in close proximity to world-class nickel mines.

In their recent (05-Mar-2021) BMO Conference Investor Presentation, BGL provided the following dot points:

- One of the highest-grade new gold discoveries globally with a 2.4Moz at 10g/t Resource located in one of the highest rated mining jurisdiction globally. High-grade maiden Reserve of 690koz at 8g/t;

- Forecast to be a Top 25 Australian producer, 151kozpa LOM at an AISC of A$1,079/oz*, EBITDA Margin of 63% (assuming A$2,300/oz), IRR of 58% pre-tax, 1.4yr payback pre-tax;

- A significant and growing Mineral Resource - 2.4Moz gold. Resource has grown at ~70koz per month at a discovery cost of A$21/oz since the BGL discovery drill hole in Dec quarter 2017;

- Historical gold operation with 28km’s of existing underground infrastructure and recent metallurgical testwork achieved average 97% recoveries (gravity recoveries from 58%-85%);

- ESG vision to be best in class - Forecast levels of Greenhouse Gas (GHG) emission intensity at 0.296 t CO2 e/oz, and energy use at 5.108 GJ /oz; among the lowest of Australian gold mines; and

- Strong cash balance of $127.6m as at 31 Dec 2020 to accelerate the dual track strategy of resource growth and project development.

* The LOM plan contains approximately 29.6% Inferred Mineral Resources. An Inferred Mineral Resource has a lower level of confidence than an Indicated Mineral Resource and there is no certainty that further exploration work will result in the conversion of the material into an Indicated Mineral Resource.

Click here to access the full presentation. I like BGL, I did hold shares in them last year for a short period, but then rotated that money into something else. I like where their mine is located (reasonably near Kalgoorlie, in WA). Management have skin in the game. Their gold grades are really good - with an estimated reserve grade of 8 grams of gold per tonne of ore (8g/t) - Slide 10 shows that they should have the second highest reserve grade of the top 20 Australian Gold Mines of all ASX-listed gold producing companies, second only to Fosterville which is owned by Kirkland Lake Gold which is HQ'd in Toronto, Canada and their listing on the ASX (KLA) is a secondary listing - so I do not even consider KLA to be an Australian gold mining company. KLA are a mid-tier Canadian gold miner who own a really high grade gold mine in Victoria, Australia.

Back to BGL. Their cost profile is forecast to be in the bottom quartile of comparable Australian Gold Mines and developers (see slide 9) with a projected LOM (life of mine) average AISC (all in sustaining cost) of $1,079/oz, with only 5 of the 36 mines they list on slide 9 having a lower AISC. Those 5 are:

- Fosterville (KLA), $403/oz,

- Thunderbox (NST, formerly SAR before they merged with NST), $731/oz,

- Cowal (EVN, $933/oz),

- Tanami (Newmont, NYSE: NEM), $1017/oz, and

- Mt Magnet (RMS), $1,047/oz.

All costs are expressed in Australian dollars.

When looking at other project developers who are not yet in production, it might be instructive to compare Bellevue (BGL, with their $1,097/oz AISC) to:

- Karlawinda (CMM), $1,165/oz

- Warrawoona (CAI), $1,290/oz

Capricorn Metals' (CMM's) Karlawinda project construction is well advanced, and first gold production in currently expected in the June 2021 quarter, so in the quarter beginning next month. Calidus' (CAI's) Warrawoona project is at an earlier stage, with site works having just begun this month and their first gold pour planned for the first half of CY 2022.

But, once again, back to BGL. Bellevue has some high quality companies involved in their BGP (Bellevue Gold Project) FS (feasibility study, see slide 5) including Entech and GR Engineering (ASX:GNG, who I hold shares in). For that reason, I think we can assume that their grades and costs are roughly in the ballpark, i.e. not too far from where they should land once they are actually producing. On that basis, with such high grades and low costs, I think that BGL looks like the best of the current gold project developers who are building gold mines here in Australia at this point in time. I also think they have recently been oversold. It appears that the market may be agreeing with that assessment also, because BGL are currently up +17.42% so far today, or up +11.5c to 77.5c, and I bought some this afternoon at 77.5c/share in one of my RL (real life) portfolios. I also added them to my Strawman.com scorecard again today.

08-Oct-2020: New High-Grade Gold Shoot Confirmed at Bellevue

New high-grade shoot confirmed at Bellevue with hits of up to 58g/t gold

New shoot, called Armand, defined over a 450m strike length and remains open; Plus, first EIS hole in new area hits gold, highlighting the potential for repeat structures to the east of the Deacon lode.

Key Points

- New high-grade Armand lode discovered at the Bellevue gold project in Western Australia, with drilling returning a host of high-grade results over a 450m strike that remains open to the north, down dip and down plunge

- The results include:

- 4.6m @ 13.8 g/t gold from 364.8m in DRDD517

- 1.9m @ 58.0 g/t gold from 380.5m in DRDD513

- 2.3m @ 27.0 g/t gold from 416.3m in DRDD508

- 1.9m @ 29.7 g/t gold from 378.8m in DRDD524

- 2.1m @ 9.8 g/t gold from 369.1m in DRDD516

- 1.5m @ 14.6 g/t gold from 352.2m in DRDD506

- 6.1m @ 14.5 g/t gold from 457.5m in DRDD505 (refer ASX 01/10/20)

- 3.7m @ 26.2 g/t gold from 372.3m in DRDD496 (refer ASX 01/10/20)

- Armand remains open along strike and down dip and has been defined as a previously undiscovered extension of the historic Bellevue lode. Drilling is ongoing to incorporate the new high-grade shoot into the next Resource update planned for the current quarter

- The first two holes of a three-hole Western Australia government co-funded EIS program drilled into an area east of the Deacon Shear intersects gold, revealing the potential for another lode. Gold mineralisation is associated with quartz-pyrrhotite veining and free gold which is analogous to the Bellevue, Deacon and Viago lodes

- The results include:

- 1.2m @ 9.0g/t gold from 1057m and 1.6m at 9.3g/t gold from 1096m downhole in DRDD327 extension and a 400 metre step out drill hole to north with

- 0.4m @ 42.3g/t gold from 646.7m downhole in DRDD309 extension

- Project development is proceeding well. The new portal has been completed and connects with the existing underground development. Ground conditions and advancement rates are in line with expectations with over 200m of development completed to date

- Bellevue is set to invest $35 million into exploration and resource definition over the next 15 months in its dual-track strategy of aggressive exploration in parallel with project development

- Exploration will include ongoing infill drilling, step-out drilling, resource grade control drilling, and regional exploration at Bellevue including the high priority Yandal and Kathleen Valley Gold Projects

- Underground drilling to commence this quarter, capitalising on the lower costs and increased productivity compared with surface drilling

- Step-out drilling will target multiple Down Hole Electromagnetic (DHEM) conductors at Bellevue click here to view 3D Inventum model of the Bellevue deposit

- Exploration drilling will also begin at the highly promising Yandal and Kathleen Valley gold projects, which sit within trucking distance of the Bellevue project

--- click on the link at the top for the full announcement ---

01-Oct-2020: Further High-Grade Results Pave Way for Upgrade of Resource

Bellevue Gold Project, Western Australia: Further high-grade results pave way for upgrade of Indicated Resource

Hits up to 163g/t also point to extensions of the Deacon, Deacon North and Bellevue Lodes; Indicated Resource upgrade set for this quarter.

--- click on the link above for full details ---

Also, recently: 24-Sep-2020: Annual Report plus 16-Sep-2020: Precious Metals Forum Investor Presentation

[I have a small position in BGL, so I do own some BGL shares, having already sold half of them at slightly higher levels than where they are today.]

27-Aug-2020: Appointment of mining contractor and early works underway at Bellevue Gold Project (BGP).

Appointment of mining contractor paves way for portal firing and mechanised re-entry to start this month

Early-works underway as part of strategy to pursue project development and ongoing exploration in parallel

Key Points

- Specialist underground mining contractor GBF Mining and Industrial Services Pty Ltd, part of the Macmahon group of companies (ASX:MAH) has been engaged for Stage 1 at the Bellevue Gold Project in Western Australia

- Stage 1 includes construction of a new portal to enable large-scale mining equipment to access the historical underground workings

- New portal that links up with existing decline will also enable construction of underground drilling platforms, which will accelerate infill and exploration drilling as well as reduce costs and allow for a low capital-intensive restart

- The existing decline will be refurbished and used for exploration and future haulage

- Underground inspections have been completed to the de-watered levels

--- click on link above for more ---

[I hold BGL shares]

12-Aug-2020: Completion of Share Purchase Plan

I hold BGL shares, but chose not to participate in the BGL SPP where holders could buy between $2,500 and $30,000 worth of new BGL shares at $1 each.

The SPP was open to 7,656 Eligible Shareholders. The Company received valid applications from 2,896 Eligible Shareholders representing a participation rate of 37.83% and an average application amount of approximately $16,000.

In response to the strong demand from shareholders (and as set out in section 4.3(a) of the SPP Offer Booklet released on the ASX on 20 July 2020), the Company has decided to increase the size of the SPP by $15 million above its original target of $20 million, raising a total of $35 million.

The strong interest in the SPP required a scaling back of valid applications that Bellevue received under the SPP in accordance with the terms and conditions set out in the SPP Offer Booklet. The scale back was calculated as follows:

Shareholding at Record Date, Allocation Policy, Number of Eligible Shareholders.

1 – 1,000 shares, 1,000 SPP shares allocated, 403 shareholders.

1,001 – 29,999 shares, 78% of the Eligible Shareholder's valid application allocated, 1,835 shareholders.

30,000+ shares, 100% of the Eligible Shareholder's valid application allocated, 658 shareholders.

The Company will refund applicants the difference between the new shares (New Shares) issued to them and the parcel of shares the applicant applied for (calculated at the issue price) on or around 18 August 2020.

The Company is of the view that the scaling methodology applied allowed for the most equitable allocation of bids across the shareholder base taking into consideration shareholder holdings as at the Record Date.

--- click on the link for the full announcement ---

BGL has traded as low as 98c today after the big drop in the gold price overnight, and is currently trading at around $1.04 as I type this.

07-07-2020: Maiden Indicated Resource 860,000oz at 11.6g/t gold

Bellevue Gold - Maiden Indicated Resource 860,000oz at 11.6g/t gold Result includes high-grade core of 480,000oz at 15.5g/t gold; Stage 2 drilling underway to upgrade and grow the 2.3Moz Resource in parallel with project development work in 2H 2020

Key Points

- Bellevue marks its transition to project developer with a maiden Indicated Resource of 860,000oz grading 11.6g/t gold; The Resource has been independently estimated by a leading consultant

- A further increase in the Indicated Resource is anticipated for the December quarter, with Stage Two infill drilling to upgrade more of the Resource, which stands at 2.3Moz at 10.0g/t gold (0.86Moz at 11.6g/t Indicated and 1.4Moz at 9.2g/t Inferred)

- The majority of the Indicated Resource consists of a high-grade core of 480,000oz at 15.5g/t at the Viago and Deacon lodes which remain open in all directions. Mineralisation sits within close proximity to existing underground infrastructure, with further expansion drilling continuing in 2H CY 2020

- Underground drilling to commence in 2H CY 2020 with the benefit of a significantly lower cost profile versus surface exploration and increased drilling productivity rates (per metre) from underground; Step-out drilling is targeting multiple Down Hole Electro-Magnetic (DHEM) conductors at the Project

- Drill Intersects outside of the current Indicated Resource ready for future inclusion include:

- 2.3m @ 39g/t gold from 819m

- 3.9m @ 21g/t gold from 197.1m

- 2.4m @ 27.4g/t gold from 269.9m

- Infill drilling from the Viago and Deacon Lodes confirm further exceptional grade with results including:

- 5.0m @ 23.5 g/t gold from 481m

- 7.4m @ 15.4 g/t gold from 573.8m

- 6.1m @ 17.7 g/t gold from 561.0m

- Three pronged drilling strategy underway focussing on growing the Indicated Resource, further extensional drilling to grow the overall Resource by extending known mineralisation and further planned regional drilling to follow up on the recent Government Well discovery 7km from the existing Resource as well as other high priority Bellevue analogue targets

- Work commenced by Industry leading mining consultant Entech Pty Ltd who was appointed as study manager to advance the project as announced in the latest project update, for further information click here (ASX 24/06/20)

- Since the Company’s discovery drill hole in December quarter 2017 the Resource has grown to 2.3Moz at 10.0g/t gold (0.86Moz at 11.6g/t Indicated and 1.4Moz at 9.2g/t Inferred) and remains open in all directions

- The Indicated Resource was drilled on 40m x 40m and 40m x 20m or closer drill spacings; over 240,000m of diamond core drilling clearly demonstrates the robust and consistent nature of the Bellevue high-grade mineralised system.

Bellevue Gold (ASX: BGL) is pleased to announce a maiden Indicated Resource of 860,000oz at 11.6g/t gold at its Bellevue Gold Project in West Australia.

The Indicated Resource forms part of Bellevue’s total 2.3Moz global Resource at 10g/t (860,000oz at 11.6g/t Indicated and 1.4Moz at 9.2g/t Inferred).

A total of 240,000m of diamond drilling has now been completed at the Project, infilling selected areas of the previous 80m x 80m drill grid on which the Inferred Resources were based, to 40m x 20m and 40m x 40m drill spacing and in places a closer drill spacing. All drilling has been conducted as diamond core from surface.

Included in the Indicated Resource is a spectacular higher-grade core of mineralisation including 480,000 ounces at 15.5g/t gold Indicated hosted in the Viago and Deacon Main Resource areas. This mineralisation is within a few hundred metres of existing development and contains consistent high-grade high sulphide mineralisation that will be targeted in the early mine life at the project.

Infill drilling is ongoing, with an increase to the Indicated Resource expected in the December quarter, which is intended to convert more of the substantial Inferred Resource adjacent to high grade core as a priority. Drilling will also target extensions to current Resources and the recent Government Well discovery which is located 7km from the existing Resource (see ASX release dated 10th June, 2020) as well as other identified Bellevue analogue outcropping targets to the north.

From a project perspective as announced in the recently released project update click here, industry leading mining consultant Entech has been appointed as study manager and is assisting with ongoing studies. Tenders for both pit wall rehabilitation, underground re-entry and development and stripping have been received from multiple contractors with a strong interest shown in bidding for the works. Dewatering is also continuing according to plan. A recently completed 3D LIDAR survey in the historical underground workings highlights the competency of the surrounding ground conditions click here.

Bellevue Managing Director Steve Parsons said the Company now had two clear avenues for creating further shareholder value.

“This Indicated Resource and the increases to come will underpin the economic studies on the project, which are now well underway,” Mr Parsons said.

“Completion of these studies will mark the transition to the project development phase, which we believe will demonstrate the technical and economic strengths which come from having a large, high-grade project with simple metallurgy and access to existing infrastructure in a Tier-1 location.

“There is also huge potential to continue growing the overall inventory at Bellevue, where the mineralisation remains open in multiple directions and we have numerous well-established targets, some with known mineralisation.

“We are confident that the combination of economic and technical studies and Resource growth will drive further increases in shareholder value.”

--- click on link at the top of this straw for the rest of this announcement, including diagrams and graphics ---

Disclosure: I hold BGL shares.

24-June-2020: Metallurgical Tests Return Exceptionally High Recoveries

Bellevue Gold Project Update

Metallurgical Tests Return Exceptionally High Recoveries from Conventional Processing

Recoveries averaging 97.8%, combined with upcoming maiden Indicated Resource, further underpins economic studies and pave the way for start of development

Key Points

- Exceptional results from metallurgical tests, including:

- Overall gravity and leach recoveries from all lodes averaging 97.8%

- Exceptional gravity-only component recovery from all lodes with results ranging from 73.6% to 91.7%

- Standard reagent consumptions from all lodes

- Gold deportment well distributed across all size fractions

- Geotechnical, visual inspections and test work programs completed in preparation for underground re-entry. Test work reveals favourable conditions for standard ground support requirements. Click here (please open on PC) for 3D LIDAR hand held scan of the historical development

- Tenders prepared and reviewed for early works in preparation for underground rehabilitation and development requirements

- Drilling from underground set to start in December quarter, 2020

- Industry-recognised mining consultant, Entech Pty Ltd, has been appointed as Study Manager to assist with ongoing studies to advance the project

- Resource conversion to maiden Indicated Resource on track for release in coming weeks

- 10,000m regional discovery drilling has commenced along the highly prospective 20km Bellevue mineralised corridor

Bellevue Gold (ASX: BGL) is pleased to advise that metallurgical testwork at its Bellevue Gold Project in Western Australia has returned exceptionally strong results.

The testwork has generated recoveries averaging 97.8 per cent across the multiple lodes. Importantly, these results were achieved using conventional gravity and leaching processes and standard reagents.

The testwork confirmed that the Bellevue lodes are exceptional in respect to extracting gold using conventional gravity and CIL processing flowsheets. The testwork is also in line with original production at the Bellevue Lode between 1988-1996, which reportedly averaged ~96 per cent recovery from the gravity and CIL circuits.

Bellevue is also pleased to advise that it has made significant progress on several fronts as part of its preparations for development.

The Company has appointed independent metallurgical consultant Mr. Nathan Stoitis to assist with the metallurgical studies for the project. Further metallurgical test work is being conducted on the gravity recoverable gold component to optimise the gravity circuit design requirements. This study work will feed into other studies currently being performed.

The geotechnical inspections completed by independent geotechnical consultants MineGeoTech Pty Ltd and test work programs have been completed for the pit walls and underground areas that have been accessible in preparation for mechanised re-entry.

New and existing diamond drill core along with geophysical surveys and logging were used to determine the support requirements. These tests revealed the ground conditions are considered favourable for standard ground support requirements.

Tenders for both pit wall rehabilitation, underground development and stripping have been received from multiple contractors with a strong interest shown in bidding for the works. All tenders are currently being assessed for the commencement of early works.

A resource update is pending which will upgrade a portion of the current 2.2Moz at 11.3 g/t gold Inferred Resource(*1 ) to the Indicated category. All recent drilling has been focussed on infill; step-out exploration drilling has now resumed. The updated resource will focus on the Indicated category only.

Bellevue Managing Director Steve Parsons said the outstanding metallurgical results joined the growing list of strong results being generated across the board at Bellevue.

“We have established a 2.2Moz resource at 11.3gpt(*1), we have just hit high-grade gold 7km away from the resource and we are now finalising a maiden Indicated resource,” Mr Parsons said.

“These exceptional recovery rates, combined with the economic studies and other preparations underway, will position us to develop a project in a Tier One location with very high grades and a host of other extremely attractive features.”

“All work that has been conducted on the underground infrastructure, points to a very low level of capital intensity for mechanised re-entry which is an amazing result given underground entry has not occurred in over 23 years. The 3D LIDAR survey highlights the competency of the surrounding ground conditions. ”

“We are currently on track with our dewatering program that will allow us to drill from underground in the fourth quarter of this calendar year.”

3 Technical Detail- Underground Infrastructure and Metallurgy Underground Infrastructure

The LIDAR point cloud survey data shows the condition of the existing underground infrastructure, highlighting the state of the current ground conditions as being considered suitable for mechanised re-entry to be established. Advice from independent geotechnical consultants is that the results from new and existing diamond drill core along with geophysical surveys and logging were used to determine the support requirements. These tests revealed the ground conditions are considered favourable for standard ground support requirements.

Click here for 3D LIDAR scan of development drive (please open on PC).

Metallurgy

Testwork has been conducted on ½ NQ core from the Bellevue, Tribune, Deacon and Viago lodes at the Bellevue Project. Samples were processed at ALS laboratories in Perth for communition and gold extraction by conventional gravity and cyanide leach gold recovery. All samples are from primary lode types.

Gravity and Leach testwork

Gravity and leach testwork followed typical gravity recovery followed by cyanidation with oxygen sparge over differing grind sizes, with and without lead nitrate addition tested on the 106µm tests. All tests were conducted in saline water received from site at pH 9.2, with a cyanide addition of 0.05%w/v.

Of note from the gravity and leach testing are the following points:

- Exceptional gravity recoveries were returned across the four lode sources, varying from 73.6% to 91.7%.

- Overall leach recoveries were very high, averaging 97.8% across the four lodes, ranging from 95.4.% to 99.6%. It is important to note that the head grades of the samples tested were also high, leading to the high recovery values.

- All lodes are grind size sensitive with gold recovery increasing when ground from 150µm down to 75µm.

- Both lime and cyanide consumption are considered to be at standard levels for the cyanidation of gold lodes in saline water. The slight exception is the Viago Lode, which has elevated cyanide consumption of 1.13kg/t. While this is higher than all the other tests, it is still not considered excessive.

Overall, the Bellevue lodes tested behave well when subjected to typical gold recovery methods. They achieve remarkably high gravity gold recoveries as well as overall gold recoveries under standard processing conditions.

A size by assay on the four samples was conducted. All the samples showed that the gold is largely evenly disseminated across the size fractions, with no real bias towards fine or coarse gold, with the exception of Viago, that has a higher proportion of coarser gold.

Comminution testwork consisted of SMC Hardness testing, Bond Crusher work index (Cwi), Bond Rod (Rwi) and Ball (Bwi) work index and Abrasion index. Results of the Bond Ball work index are in line with most Archaean lode gold systems in Western Australia with results shown below in Table 2.

--- for Tables 1 and 2 and the remainder of this announcement, click here ---

End Notes

*1. All material assumptions and technical parameters underpinning the Mineral Resource estimate (6.1Mt @ 11.3 g/t gold for 2.2M ounces of gold) in the ASX announcement titled "Bellevue Resource increases 23% - Maiden Resource at Deacon" and dated 24 February 2020 continue to apply and have not materially changed since last reported. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that the form and context in which Brian Wolfe and Sam Brooks, (being the relevant Competent Person's) findings are presented have not been materially modified from the original market announcement.

--- end ---

Disclosure: I hold BGL (Bellevue Gold) Shares.

11-June-2020: Macquarie Mining and Energy Forum Presentation

Disclosure: I hold BGL shares. High grades. Great story. Not producing anything yet however, so high risk.

10-June-2020: Bellevue hits high-grade gold in first regional hole

Bellevue hits high-grade gold 7km from existing 2.2Moz at 11.3 g/t Inferred Resource(*1)

First regional hole in 20km Bellevue Trend intersects 17m @ 4.2 g/t from 19m

Key Points

- First hole in maiden regional drilling program on the 20km-long Bellevue Trend hits 17m @ 4.2 g/t from 19m, including 3m @ 9.7 g/t from 19m and 3m @ 11.6 g/t from 33m at the Government Well prospect

- The Government Well prospect has been defined over 1.2km by field mapping; RC drilling now completed over 500m of strike, with assays pending on three holes

- Visible gold mineralisation was panned over a 1m interval in one of these holes associated with pyrite mineralisation in quartz veining

- The reported intersection is 180m along strike of an historical RC result of 2m @ 18.7 g/t gold from 32m (refer ASX 11-Apr-2019) (*2); There has been no drilling between the two results

- Further regional exploration of 10,000m is planned and budgeted for the calendar year

Bellevue Gold (ASX: BGL) is pleased to advise that it has intersected high-grade gold 7.4km north of its Bellevue Gold Project in WA.

The intersection at the Government Well prospect was recorded in the first regional exploration hole drilled by the Company on the 20km-long Bellevue Trend.

The Government Well prospect is estimated by mapping to be 1.2km long. Bellevue has drilled four RC holes along a 500m stretch of this strike, with assays from the final three holes pending.

Bellevue Managing Director Steve Parsons said it was an outstanding start to the Company’s regional exploration campaign.

“This result supports our view that there is huge scope to grow the inventory at Bellevue,” Mr Parsons said. “The Bellevue Gold Mine sits within a 20km-long mineralised corridor which has been subjected to very limited exploration.

“The drilling at Government Well represents our first foray away from the mine area and given the strength of this result, we will conduct follow-up drilling at the first opportunity.”

In parallel with the exploration drilling, the Company is finalising its upcoming maiden Indicated Resource at Bellevue, where the Inferred Resource stands at 2.2Moz at 11.3 g/t(*1), and has initiated economic studies on the project.

--- click on link at the top of this straw for more - including technical details of the drilling ---

Disclosure: I hold BGL shares.

End Notes (*1, *2):

- All material assumptions and technical parameters underpinning the Mineral Resource estimate (6.1Mt @ 11.3 g/t gold for 2.2M ounces of gold) in the ASX announcement titled "Bellevue Resource increases 23% - Maiden Resource at Deacon" and dated 24 February 2020 continue to apply and have not materially changed since last reported. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and that the form and context in which Brian Wolfe and Sam Brooks, (being the relevant Competent Person's) findings are presented have not been materially modified from the original market announcement.

- For full details of these Exploration results, refer to the said Announcement or Release on the said date. Bellevue Gold is not aware of any new information or data that materially affects the information included in the said announcement.

Post a valuation or endorse another member's valuation.