Pinned straw:

Interesting article (from Stockheed) just published yesterday on the perceived state of play in the Lithium market & speculating on where we're headed.

Some interesting commentary out of Liontown & Pilbara's quarterly results presentations, as well as a look at the incredible recent volatility in recent pricing.

Lithium might be back but the ride will be wild - Stockhead

Worth a quick read & helps illuminate what I think many Lithium market watchers & believers sense - that we're likely getting closer to a turning point & it may not take much (i.e. just like the recent Chinese environmental crackdown on several Lepidolite mines) to really ruffle some feathers & cause a bump in prices.

Add in the very large short position (>15% in Pilbara) and any unexpected change in the prevailing "over supply" narrative - could lead to some fireworks & a serious short squeeze.

*** Copy of article below ***

Lithium might be back but the ride will be wild

Mining 31 Jul 2025 Kristie Batten

Has lithium truly begun its 'next cycle'? If so, strap in. Pic via Getty Images

There’s been some violent gyrations in lithium markets over the past couple of weeks but sentiment appears to be turning.

Liontown Resources (ASX:LTR) managing director Tony Ottaviano pointed out on Tuesday that spodumene futures had surged by US$60 per tonne on Friday but then dropped by US$50/t on Monday.

“Notwithstanding that, we’ve seen some green shoots in the past two weeks,” he said.

Pilbara Minerals (ASX:PLS) managing director Dale Henderson is cautiously optimistic.

“There are signs the lithium winter may be lifting, but it’s early in this change,” he said yesterday.

“The lithium market has long been marked by volatility, with prices prone to sharp and sometimes counterintuitive swings.

“The volatility is not incidental. It reflects a still nascent market with limited liquidity, few futures mechanisms and undeveloped trading infrastructure. Pricing remains inefficient.

“In this environment, short term moves are often driven by sentiment, policy signals or speculative flows, rather than durable shifts in supply and demand.”

Henderson pointed that the price had sunk to levels over the past year that made much of the global lithium sector unprofitable.

“This was not the result of a fundamental oversupply alone, but an immature market that remains in development,” he said.

“The recent price rally, which began late in the June quarter and accelerated into July, follows this pattern, a sentiment-led rebound triggered by perceived supply risks.

“In this case, Chinese regulatory reviews of brine and lepidolite operations and the suspension of a major project fuelled renewed price momentum.”

According to reports, eight lithium mines in Jiangxi are being scrutinised, which could potentially lead to suspensions.

Shanghai Metals Market’s baseline forecast for August was a 300 tonne surplus, but it suggested even limited disruptions could reduce monthly supply by 2000-2500t.

In the case of moderate disruption, meaning a temporary suspension of Jiangxi mines, the impact would be 8000-10,000t in August, easing to 5000t a month by the December quarter.

If mines are completely shut down, it forecasts a 10,000t impact to supply in August, escalating to 14,000t a month by the end of the year.

“Now, we remain cautiously optimistic but continue to monitor whether the flagged supply side adjustments will eventuate,” Henderson said.

Picking the bottom

Joe Lowry, the US-based founder of advisory Global Lithium, believes the lithium winter has ended.

“I believe the market has bottomed and we’ve started the next cycle,” he said in a video posted to X.

IGO boss Ivan Vella yesterday seemed less convinced, commenting on the unseasonably cold winter in Perth this year and comparing it to the lithium winter.

“I suspect it’ll warm up in Perth a lot before we see a real shift in the lithium market,” he said.

Henderson cautioned it was a partial correction at this stage and not yet a full recovery and prices still remained well below the levels needed to incentivise new production.

“While near-term pricing is volatile, the long-term demand picture remains robust and continues to strengthen,” he said.

He said global electric vehicle sales reached five million units in the June quarter, up 27% year-on-year, while EV penetration hit 50% in China in June and 25% for the rest of the world.

Energy storage system demand is also building.

“Forecasts indicate 40% year-on-year growth for ESS in this calendar year alone,” Henderson said.

“Together, EVs and ESS are expected to account for something like 90% of lithium demand by 2030, highlighting a powerful and durable and structural demand trend.”

Late last week, Canaccord Genuity analysts conceded that demand was much stronger than it expected and low pricing had hollowed out future supply growth.

“As demand growth overtakes supply growth, we see a much tighter market and potential for continued pricing improvements,” the firm’s research team, led by Reg Spencer, said.

“There still appears to be oversupply today, but we think demand growth is rapidly eating into this. By 2027, additional will supply be needed and in the absence of higher incentive levels, this could elicit a more dramatic pricing response.

“We think the down cycle in the sector has now likely passed and see lithium equities as set to benefit.”

Agree with your sentiments and take @Goldfish.

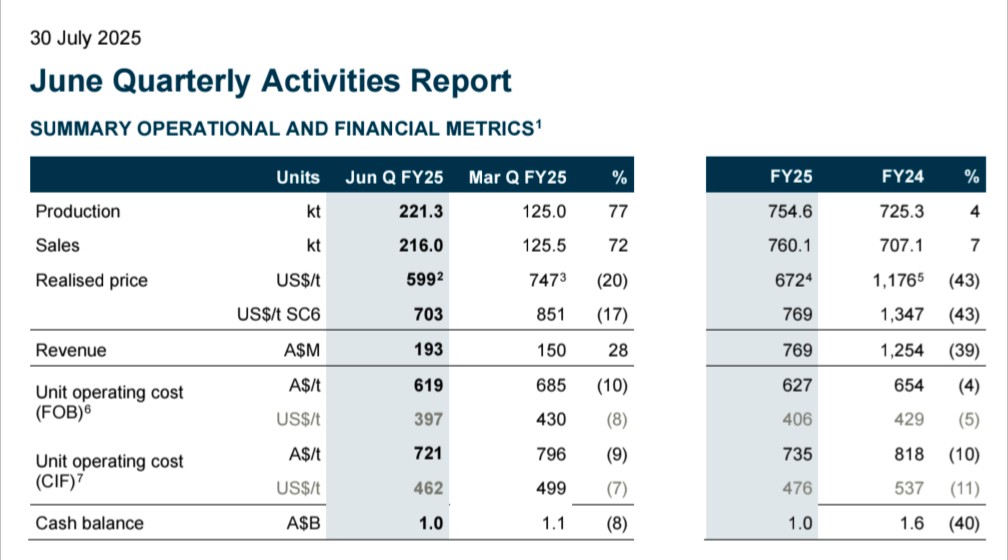

I thought it was a really strong quarterly result, especially against the backdrop of a horrific rout of Lithium prices to crazy lows during the quarter.

They continue to work on controlling everything within their power (primarily cost base), while also scaling up production in a disciplined way to drive down unit operating costs.

Given Lithium pricing remaining well below incentive pricing, against a backdrop of multi-year double digit growth in end-user markets (EV, BESS, etc) - it is only a matter of time before the compounding growth in lithium demand overwhelms the growth (albeit much slower now) in global supply. It won't take a lot to tip over a market slightly in surplus into a slight deficit, which should continue to drive a recovery in lithium prices to more sustainable levels.

Do not believe we'll see the boom levels of a few years ago again, but do believe we'll see a steady recovery to pricing levels that maintain incentive to bring on lower cost supply to meet the growing demand - and likely a better balanced market (rather than the post-boom supply driven bust of recent years).

A very solid quarterly and have been increasing my holdings in PLS - it is best positioned of the pure-play Australian Spodumene Lithium miners with large cash balance, huge operating leverage for when prices recover, and a double-digit short position which (while it has been a winning strategy for some time) could be quite painful to unwind with any sustainable recovery in pricing.

Happily held!