Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Lithium giant’s $43,000 price forecast gets local mining stocks racing

Alex GluyasMarkets reporter

Nov 18, 2025 – 11.20am

One of the world’s largest lithium suppliers has set the commodity market racing after predicting that the price of the battery material could double next year amid a boom in demand for energy storage.

The comments from Ganfeng Lithium chairman Li Liangbin at an industry event have turbocharged a rally in ASX-listed miners and wrong-footed short sellers, who were betting on the market to remain challenging. Li said demand could surge 30 per cent next year and lift prices as high as 200,000 yuan ($43,000) a tonne, according to local publication Cailian.

The most traded carbonate contract on the Guangzhou Futures Exchange surged 9 per cent, closing at the upper limit of 95,200 yuan a tonne on Monday. Prices of spodumene, the type of lithium mined in Australia, rose 3.4 per cent to $US1075 a tonne, according to S&P Global Platts.

Shares in major producers SQM and Albemarle rallied as much as 14 per cent and 9.3 per cent, respectively. That spilled over to the S&P/ASX 200 on Tuesday, with PLS and Liontown Resources among the few stocks in the green. The broader sharemarket sank 1.9 per cent by the closing bell.

Lithium stocks have rebounded sharply in recent months amid rising demand for large-scale battery storage, which helps stabilise electricity grids and support the data centres that power artificial intelligence.

“This change in energy storage demand has put a rocket under the entire sector,” said Sam Berridge, the portfolio manager of Perennial’s Natural Resources Fund. “That rally has been helped along by the fact short interest in the sector was quite extreme, so a lot of those short sellers will be trying to get out while lithium prices are rallying.”

The percentage of PLS shares held by short-sellers has fallen from a peak of 18.5 per cent two months ago to now sit at 14 per cent, according to the securities regulator. The share price of the lithium producer, which was the most shorted stock on the ASX, has nearly tripled over the past six months, forcing hedge funds to cover their bets by buying up the stock.

DNR Capital’s Australian Emerging Companies Fund has profited handsomely from the rebound in lithium stocks after buying positions in several miners including PLS and Liontown earlier this year.

“The market [is] beginning to recognise the rapidly growing opportunities in stationary energy storage and the ongoing penetration of electric vehicles,” said portfolio manager Sam Twidale.

“Following several years of lithium companies cancelling expansion plans and cutting investment, we believe the resulting reduction in overcapacity could see prices normalise more quickly than the market anticipates.”

Major brokers are also rapidly recasting their lithium forecasts to account for the imminent surge in demand. Barrenjoey has been the most bullish, upgrading its spodumene price forecast for next year to a whopping $US3250 a tonne, triple the current price. Other Wall Street banks including Citi and JPMorgan have also upgraded their forecasts this month.

Morgan Stanley flagged on Tuesday that demand for electric vehicles continues to strengthen, with sales in China rising 32 per cent in October from a year earlier to a record 1.1 million units.

However, Macquarie warned clients this week that news flow surrounding the restart of Chinese battery giant Contemporary Amperex Technology’s huge Jianxiawo project could trigger a short-term reversal.

“We believe news of a potential restart could be announced in the near term. Such a development may shock the futures market, weigh on equities, presenting a profit-taking opportunity,” they wrote in a note to clients. “However, given the medium-term constructive narrative, we think this could present a buy-the-dip opportunity.”

Production at the mine has been suspended since CATL failed to get an extension on a permit that expired in early August, which kick-started the rally in lithium prices and stocks. CATL was told earlier this month it needed to pay 247 million yuan for the lithium mining rights at the project.

Macquarie flagged the earliest possible restart for CATL’s mine would be December this year, a timeline that ultimately could slip to after the Chinese New Year in February given the number of review steps required.

The broker also warned that lithium stocks are trading far above prices of the underlying commodity. PLS and Mineral Resources are trading at an implied spodumene price of $US1300 a tonne, while Liontown is even more expensive at $US1500 a tonne. The lofty valuations are deterring some fund managers such as Argonaut from beefing up their exposure to the sector.

“We’re cautious because I think the stocks have run a bit hard,” said Argonaut portfolio manager David Franklyn. “The market is factoring in spodumene at about $US1500 a tonne and probably now expecting $US2000 a tonne so the question is whether that’s reasonable.”

PLS Share Price Slump Today due to CATL reopening Yichun Mine in the near future:

from Discovery/Alert.com

When Will Production Resume at the Yichun Mine?

According to reports from China's Securities Times, CATL is expected to resume operations at the Jianxiawo lithium mine soon, following approximately one month of suspension. The company has been actively engaged in negotiations with regulatory authorities to expedite the renewal process.

Industry sources familiar with Chinese mining regulations suggest that standard license renewal procedures typically require two to three months, making this expedited timeline notable. The accelerated process likely reflects both CATL's strategic importance to China's industrial policy and the economic impact of the production halt.

Technical preparations for restart have been underway throughout the suspension period, with maintenance crews maintaining equipment readiness to minimize the transition time once regulatory approval is secured. This preparatory work includes safety inspections, equipment calibration, and workforce scheduling to ensure a smooth production ramp-up.

The mine's expected restart timeline aligns with China's broader policy objectives of maintaining stable supply chains for its dominant electric vehicle manufacturing sector, which represents a strategic national priority in the country's industrial development plans.

What Factors Are Influencing the Permit Renewal Process?

Several key elements are affecting the timeline for resumption:

- Regulatory Scrutiny: China's increased oversight of mining operations has introduced more comprehensive compliance reviews before license renewals are granted. This includes assessments of environmental management systems, safety protocols, and resource utilization efficiency.

- Environmental Compliance: Stricter standards for extraction activities now require mining operations to demonstrate improved water management, reduced emissions, and comprehensive reclamation planning. Sources within the industry indicate that CATL has invested significantly in environmental technologies at the Yichun site to meet these elevated standards.

- Capacity Control Measures: Government efforts to manage lithium production growth reflect Beijing's strategic approach to resource management. Authorities are balancing the need for adequate supply with concerns about oversupply driving down prices and threatening the economic viability of domestic producers.

- Administrative Procedures: Bureaucratic processes for permit renewal involve multiple agencies including the Ministry of Natural Resources, environmental protection authorities, and local government officials. This multi-stakeholder approval process introduces complexity that can extend timelines even for priority projects.

Technical experts note that the Chinese government has recently implemented a more sophisticated regulatory framework that considers not just compliance factors but also strategic supply chain considerations in the permit renewal process. This approach reflects the maturation of China's mineral resource governance as the country balances immediate industrial needs with longer-term resource conservation goals.

Broader Context of China's Lithium Industry

How Does This Fit Into China's Resource Strategy?

The temporary suspension at Yichun aligns with Beijing's broader approach to managing its critical mineral resources. China has been implementing policies to:

- Control excessive capacity in the EV battery sector through strategic production quotas and licensing requirements

- Ensure sustainable development of lithium resources by implementing more rigorous extraction standards and requiring improved recovery rates

- Maintain strategic leverage in global supply chains by balancing domestic production with overseas investments and acquisitions

- Balance environmental concerns with production needs through enhanced regulatory oversight and technological upgrading requirements

China's approach reflects a sophisticated understanding of lithium's strategic importance beyond immediate market considerations. The country's planners recognize that control over lithium resources provides significant geopolitical leverage in an era of accelerating global energy transition.

Recent policy documents from China's National Development and Reform Commission emphasize the concept of "resource security" as a key component of national security, placing lithium among a select group of minerals deemed essential to the country's industrial autonomy and technological leadership.

What Other Developments Are Affecting China's Lithium Sector?

The Yichun situation occurs against a backdrop of significant changes in China's lithium landscape:

- New mining licenses being granted to companies like Yongxing Special Materials represent a careful expansion of production capacity to meet growing domestic demand while avoiding market oversupply

- Consolidation among smaller producers has accelerated as authorities favor larger, more technologically advanced operations that can implement best practices in extraction and processing

- Increased focus on recycling and alternative technologies, with major investments in lithium recovery from spent batteries and development of sodium-ion alternatives for certain applications

- Growing competition from international lithium sources, particularly in Australia, Chile, and Argentina, challenging China's dominant position in the processing segment of the supply chain

Geological experts note that China's domestic lithium resources, while significant, face challenges including lower average grades and more complex mineralogy compared to some international deposits. This geological reality has shaped the country's dual strategy of developing domestic resources while securing overseas supply through strategic investments and long-term agreements.

Supply Chain Implications

How Might the Resumption Affect Global Lithium Markets?

The anticipated restart of operations at the Yichun mine is expected to stabilize lithium prices that had surged following the suspension. Market analysts anticipate:

- Gradual normalization of spot prices as supply concerns ease, with potential reversion to pre-suspension levels within 4-6 weeks of resumed production

- Reduced pressure on battery manufacturers' input costs, supporting continued cost reduction trajectories for electric vehicle batteries

- Restored confidence in supply chain reliability, potentially reducing the risk premium currently embedded in lithium futures contracts

- Potential moderation of speculative trading activity as market fundamentals reassert themselves over short-term disruption concerns

Trading patterns on the Shanghai Metals Market suggest that sophisticated investors are already positioning for price stabilization, with futures contracts showing decreased volatility as information about the expected resumption has circulated through industry channels.

For international markets, the Yichun resumption represents one factor in an increasingly complex global lithium landscape, where production expansions in Australia and South America are counterbalanced by accelerating demand growth from battery manufacturing facilities worldwide. India's recent development of a battery-grade lithium refinery illustrates the global race to develop processing capacity.

Lithium stocks rip amid warning of more China disruptions

Gus McCubbingMarkets reporter

Aug 27, 2025 – 5.46pm

ASX-listed lithium stocks ripped higher on Wednesday after UBS warned that the disruptions to Chinese supply, which have triggered a spike in the price of spodumene, would likely continue for longer than expected.

The suspension of production of a major mine owned by Chinese battery giant Contemporary Amperex Technology earlier this month had already triggered a huge rally in lithium stocks, with the price of the white metal soaring about 70 per cent from a June low of $US575 a tonne.

ASX-listed lithium stocks rocketed on Wednesday after UBS warned disruptions to production of the white metal in China could continue for longer than first expected. Tony McDonough

CATL, the world’s largest manufacturer of electric vehicle batteries, said on August 10 that its lithium mine in China’s Jiangxi province would only be temporarily halted for at least three months after it failed to extend a key mining permit, according to Bloomberg.

But UBS analyst Levi Spry published a note on Tuesday which said the investment bank’s China team had now concluded that the CATL mine could be closed for 12 months because of the ongoing licensing issue.

This meant lithium prices could jump another 32 per cent in the next year.

As a result, UBS has upgraded PLS, Australia’s largest pure-play lithium company, from a “sell” to “neutral” and revised short-term share price target to $2.30, up from $1.60. It also upgraded fellow lithium producer IGO from “sell” to “neutral”, with a revised short-term share price target of $5.75, up from $4.80.

This came after PLS chief executive Dale Henderson on Monday said he was confident the lithium market would turn in his favour over the long run, after an extended price slide for the battery metal dragged the miner to a near $200 million annual loss.

“Exactly how long-lived [the delay] is remains to be seen, with higher prices potentially solving permitting issues more quickly and incentivising some latent capacity,” Spry said in the note. “Nonetheless, we see material upgrades to IGO and PLS earnings per share.”

UBS has also upgraded Mineral Resources to “buy” from a “sell” with its short-term share price target rising to $40.40 from $37.40, based on the expected disruptions.

“We upgrade Mineral Resources to buy following upgrades to our lithium price forecast, reflecting expectations for strict execution of Chinese mining right investigations, and resultant supply disruption,” UBS analyst Lachlan Shaw said in a separate note.

The upgrades unleashed a broad-based jump in ASX lithium stocks on Wednesday, with PLS jumping 8.8 per cent to $2.34, IGO up 3.9 per cent to $5.35, Mineral Resources 6.8 per cent to $37.45, and Liontown Resources 9.5 per cent to 92¢.

CATL’s mine, a key source of China’s supply of lithium, has been closely monitored by traders, who reportedly flew drones over the project last week as speculation mounted about its permit renewal.

Lithium prices surged in September last year when CATL suspended production at its project in Jiangxi, but swiftly reversed in February when the company announced it would restart the operation.

Wednesday’s share price jump comes after a burst of short covering in lithium stocks last week, with Perennial’s Natural Resources Trust portfolio manager Sam Berridge saying lithium had formed part of a broader rotation into resources stocks.

“There’s a preference from a number of funds to directing flows into the most shorted stocks within the resources sector – so lithium certainly ticks that box,” he said.

Major development over the weekend in global Lithium supply, with news CATL has had to suspend mining at its major Jianxiawo mine (estimated at 3% of global lithium supply) – and is likely to remain shuttered for at least a few months.

In what is a pretty immature market with volatile price-discovery, this could throw lithium market participants into a flutter, and on top of the ongoing double-digit compounding demand story – could tip the scales back into a balanced or even slight-deficit market much sooner – leading to a sustained rally in pricing back from recent super low prices.

This also follows hot on the heels from Liontown (LTR)’s major capital raising to shore up its balance sheet,- and which saw not just the government’s National Reconstruction Fund take up $50M of shares in the $266M institutional raising, and subsequently supersized to $316M to allow China’s Canmax Tech (one of the world’s largest battery chemicals makers) to also take up $50M of shares in the raise (following its inspection of the flagship Kathleen Valley mine last week).

Current news and Canmax’s move have all the hall-marks of a significant turning point in Lithium sentiment and positioning for higher prices and what is likely to be a more balanced market.

Throw on top massive short positions (3rd & 4th most shorted companies with 13-15% short) – and the resulting scramble to cover could be explosive in our listed majors (PLS & LTR) and indeed all quality hardrock & brine miners globally.

Interesting times ahead – and will be interesting to see their moves on the bourse today, and broking houses commentary over coming days.

Suspect China has belatedly realised that while its battery makers may be “winning today”, flooding the market with Lithium to suppress prices so far below incentive pricing for such a sustained period – is in fact sowing the seeds of “losing tomorrow” when raging global compounding demand for massive growth in BESS/EV ends up swamping current supply (as no one will be financing or bringing on any but the lowest cost new supply, given such sustained sub-par pricing).

ARTICLES re CATL MAJOR MINE CURTAILMENT (From Bloomberg):

CATL Suspends Output at China Lithium Mine for Three Months - Bloomberg

CATL Suspends Output at China Lithium Mine for Three Months

By Annie Lee and Alfred Cang

August 10, 2025 at 6:12 PM GMT+10

Takeaways by Bloomberg AI Hide

- CATL has suspended production at a major lithium mine in China's Jiangxi province for at least three months, according to people familiar with the matter.

- The suspension came after the company failed to extend a key mining permit which expired on Aug. 9, one of the people said.

- CATL is still in talks with government agencies to secure a renewal, but is preparing for the halt to last months, according to a person briefed on the matter.

Battery giant Contemporary Amperex Technology Co. Ltd. has suspended production at a major lithium mine in China’s Jiangxi province for at least three months, according to people familiar with the matter.

CATL, the world’s largest manufacturer of electric-vehicle batteries, has announced internally that the Jianxiawo mine would be temporarily halting operations, they said. One of the people said the suspension came after the company failed to extend a key mining permit which expired on Aug. 9.

CATL didn’t immediately respond to questions from Bloomberg outside business hours.

The lithium industry has been buffeted in recent weeks by extreme volatility in the spot, futures and equity markets, and the Jianxiawo operation has been in particular focus, given questions over its permit renewal. Last week traders flew drones over the mine, forecast to account for about 3% of the world’s mined production, in the hope of gauging the current state of output.

A second person briefed on the matter said affiliated refineries in nearby Yichun had been informed of the closure. The first person added the company was still in talks with government agencies to secure a renewal but was preparing for the halt to last months. The people asked not to be named as they are not authorized to speak publicly.

CATL’s permit trouble and suspension come as Beijing cracks down on overcapacity across a host of industries and increases scrutiny of mining operations. For an industry that has been plagued by a glut for more than two years, however, the pause in output from a significant link in the supply chain will be a boon.

CATL saw revenue from its battery mineral resources business plummet 29% in 2024, a drop that underscores challenges facing the Chinese company’s upstream investments including a precipitous decline in lithium prices. These were originally intended as a way of securing supply and managing costs, and CATL had aggressively pursued mining stakes, even overseas.

The most-active lithium carbonate futures contract touched more than 80,000 yuan ($11,128) in July on the Guangzhou Futures Exchange, which moved to rein in speculative trades afterward. The material surged around 9% last week to change hands at 75,000 yuan on Friday.

— With assistance from Jackie Cai and Chunying Zhang

(Adds detail on mining permit in paragraph two and five, CATL background in paragraph seven.)

Drones Hover Over CATL Mine as Lithium Market Anxiety Rises - Bloomberg

Drones Hover Over CATL Mine as Lithium Market Anxiety Rises

By Annie Lee and Alfred Cang

August 8, 2025 at 7:53 PM GMT+10

Takeaways by Bloomberg AIHide

- Traders have been flying drones over a lithium mine run by Contemporary Amperex Technology Co. Ltd. to gauge the state of the operation.

- The lithium sector has been experiencing extreme volatility amid uncertainty over production disruptions and rising government scrutiny.

- The mine is awaiting an extension to its mining paperwork to continue working beyond the weekend, according to traders and the company's statement to investors.

Traders have been flying drones over a lithium mine run by battery giant Contemporary Amperex Technology Co. Ltd. in the hope of gauging the state of the operation days before a key permit expires, a symptom of the acute supply anxiety that has gripped the market.

The lithium sector has been buffeted in recent weeks by extreme volatility in the spot, futures and equity markets amid uncertainty over production disruptions and rising government scrutiny. Major supply concerns include CATL’s Jianxiawo mine, forecast to account for about 3% of the world’s mined production. It is awaiting an extension to its mining paperwork if it is to continue working beyond this weekend.

Drones have been hovering above the mine to monitor its conveyor belts and potentially catch a change in its operations, according to two traders who attended a conference held this week in Yichun, China’s lithium mining hub in Jiangxi province.

Lithium Swings Amid Supply Anxiety

Prices of the battery material see heightened volatility in recent weeks

Source: Guangzhou Futures Exchange

Yichun emerged as a battery-metal hub through the boom years. Traders and analysts have been closely watching activity in and around the city, plus efforts to regulate producers there as Beijing pledges to crack down on excess supply across industries.

Read More: China’s Lithium City Shows the High Price of a Fortress Economy

The most-active lithium futures in China hit more than 80,000 yuan ($11,128) in July on the Guangzhou Futures Exchange, though it later moved to cool speculative trading. This week the material has surged around 9% to change hands at 75,000 yuan on Friday.

CATL did not immediately comment on queries emailed by Bloomberg.

The Chinese company told investors last week it had submitted an application to extend the permit. It added that the mine was operating normally.

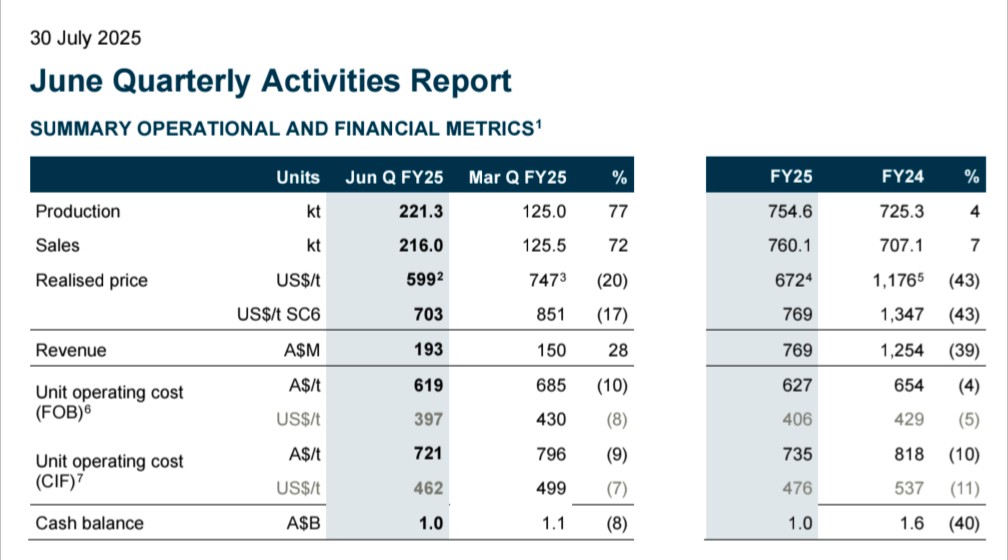

This is a really strong result IMO. Management are delivering on everything that is under their control. Costs down, production up, strong cash balance. Even at these unsustainably low prices, they are profitable. Cash balance only fell due to capex spent on increasing production further.

Also very positive is a large increase in reserves, as well as improved quality

They are guiding for further increases in production, with further decreases in unit operating cost. Getting very close to Greenbushes, which is widely regarded as the best lithium mine in the world

The current market cap of $5.5 billion doesn't look that cheap. But if you subtract the $1 billion cash and model a long-term lithium price that would incentivise production (I am no expert, but most estimates are at least in the range of US$1000 to $1200), then things start looking pretty good.

I am happy to hold onto my small-moderate position

For those long suffering investors in $PLS, at least management is showing faith in a personal and financial way.

I've got to say as an investor IRL, I can take some solace in the fact that Pilbara Minerals is striving to be the best, low-cost option in the market, even as the share price tanks and the potential for some of the smaller, capital/cash constrained companies start to capitulate.

From the Australian Resource & Investment website:

PLS boss buys $1 million in shares

By Dylan Brown

Pilbara Minerals (PLS) chief executive officer Dale Henderson has again backed his company on the open market, spending $1.01 million on shares.

According to ASX filings released on Monday, Henderson acquired 755,000 PLS shares at $1.34 each last week. The purchase follows a $1.1 million buy-up in December, when he acquired 500,000 shares at $2.23 apiece.

The move comes amid a continued lithium downturn, but Henderson’s investment appears to reflect his long-term faith in the company’s strategy and broader outlook.

“Lithium is still a young and rapidly evolving market, fuelled by technological breakthroughs, government policies, and the global shift toward cleaner energy, so short-term pricing volatility is to be expected,” Henderson told Australian Mining.

“We’re currently witnessing a rebalancing of the market with production curtailments across the sector. Pricing at its current level is unprofitable and unsustainable for the majority of raw material producers, which could potentially lead to even further cuts in production.”

The purchases coincide with PLS’ transition from a growth to optimisation phase as it ramps up its P1000 expansion project at the Pilgangoora operation in Western Australia.

“Construction of the P1000 expansion project was completed in January, marking the end of a transformational two-year investment cycle,” Henderson said.

“Ramp up is now complete and we’re entering the optimisation phase of the project with a focus on achieving higher production volumes and lower unit cost.”

The expansion lifts nameplate capacity at Pilgangoora to around one million tonnes per annum, positioning PLS for greater efficiencies when the market rebounds.

“We’re preparing our operation and business for this future state by preserving our current position and maintaining our options for future growth,” Henderson said.

Henderson’s repeated share purchases send a strong signal of confidence as PLS looks to ride out current headwinds and maintain its position as global lithium leader.

Must be feeling brave today - considering the other widow-maker trade - been on par with those calling time on CBA's unstoppable rally over the past 12 months!!

By that I'm talking about anyone trying to pick the bottom in the Australian Lithium sector (namely the two Aussie pureplay majors - Pilbara Minerals (PLS) & upcoming major Liontown Resources (LTR)). [Exposure to the cheapest & best quality mine Greenbushes would be nice - but don't fancy the idea of being a minority shareholder in JV with Tianqi through IGO, or being in the Kwinana lithium refining in Perth & trying to compete with the Chinese].

While I confess I moved too early in accumulating initial positions in both PLS & LTR - I do believe the punishment doled out to the sector has shown incredible short-termism & factoring in a very sustained dire outlook for the sector at large.

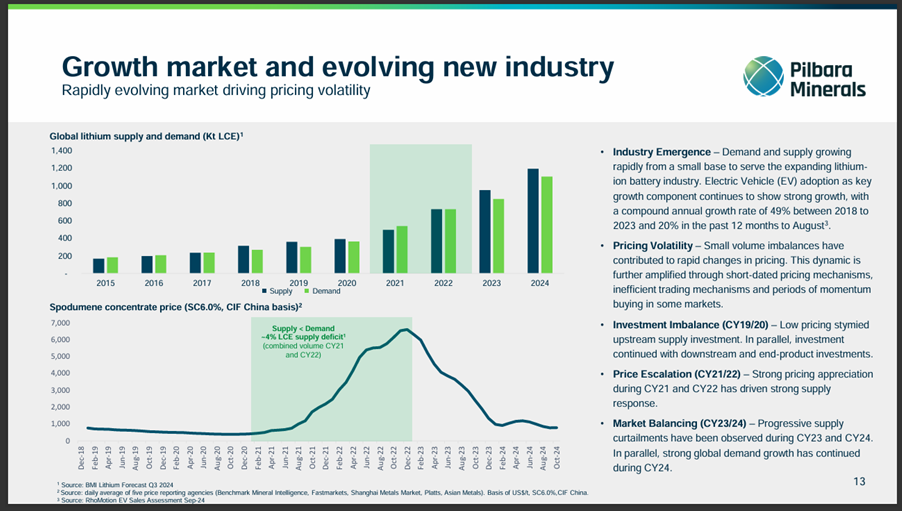

While no one can say for sure when demand will catch up with the current lithium supply & refining over-capacity - it is clear the growth rates in EVs & BESS (stationary energy storage) sectors & expert demand forecasts continue to be extraordinary. Lithium prices have been well below incentive prices for quite sometime now, and we have & should continue to see supply cutbacks (probably overall slower supply growth, but no where near enough to keep up with the rapidly expanding demand.

One has to note this against what is likely be a relatively elastic supply price response to any meaningful & sustained price kick - so not expecting any kind of massive run up in prices like we witnessed in 2022. Rather I do expect a slow & steady recovery in pricing to a level that incentivises some lower-cost lithium supply additions over time, but not enough to open the floodgates.

I think the incredible tech advancements we're seeing in battery tech (particularly Solid State batteries) will help overcome issues like range anxiety, I while Trump might be able to repel some Chinese auto supply from the US market - I really don't believe he can or will derail the increasing international uptake in EV & BESS.

So my predictions:

1) A short-term bump of up to 20% off recent lows in higher-quality Lithium stocks (seems to be happening in China's market today also), after what has been a likely been overdone negativity on the real impact of Trump's tariff threats (more likely to just divert supply to other markets & perhaps slow growth down slightly rather than stop it altogether) - as well as likely stimulus measures to be announced at this week's Chinese National People Congress.

2) A medium-term broadening recovery in Lithium pricing from later this year & into a more positive outlook in 2026 and beyond. Personally I think more supply has been curtailed (or predicted supply that will not come on) than currently modelled, and I believe demand will continue to grow at strong rates driven by increasing EV & BESS adoption as well as potential game--changing catalysts such as mastering Solid State batteries that can take drivers over 1000kms without recharging.

Anyways - full disclosure - I am not a lithium sector expert!

Just been following it closely & steadily accumulating a position in PLS & LTR, in anticipation of the current heavy negativity towards the sector beginning to lift as the boom/bust commodity cycle runs its course & green shoots emerge.

FWIW a quick summary roundup from various broker reports on PLS in the past 24hrs

Citi:

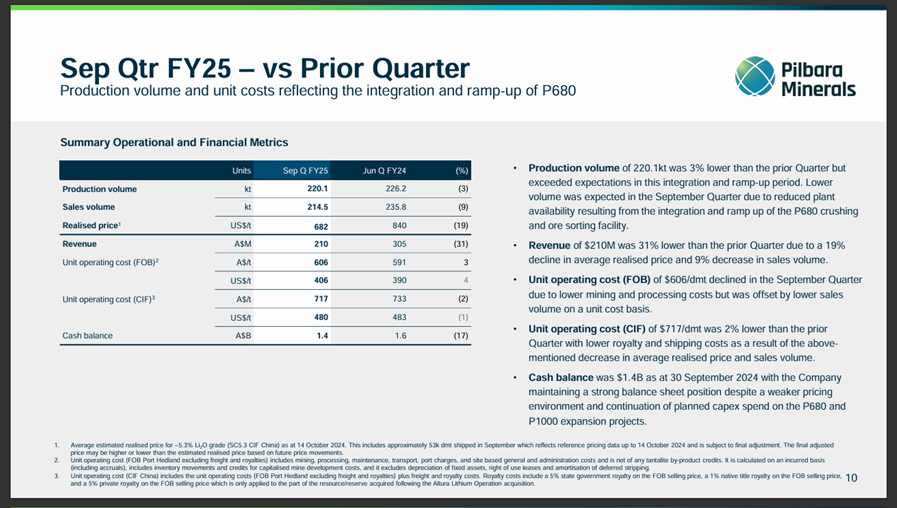

SepQ: curtailing Ngungaju upgrades sentiment and FY25 cash flow

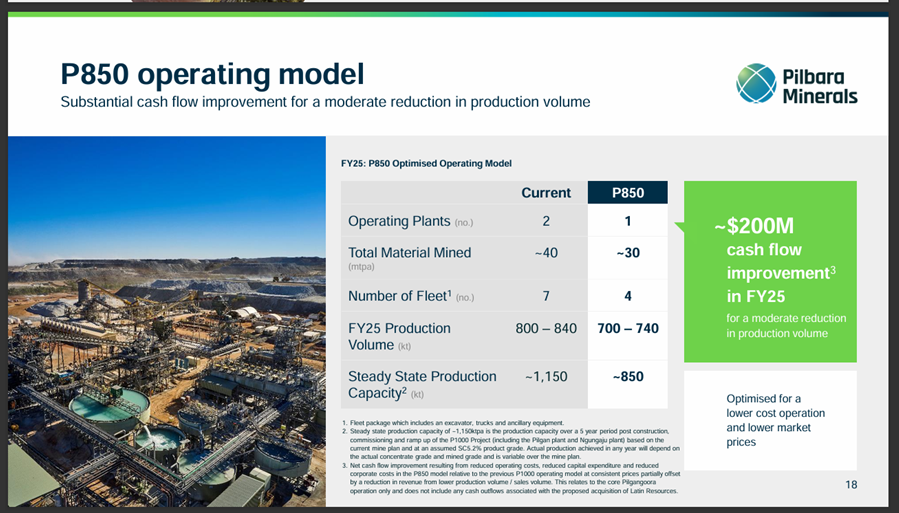

UBS: Sell 12m PT$2.35

Supply leaving (but it wasn't supposed to be PLS first)

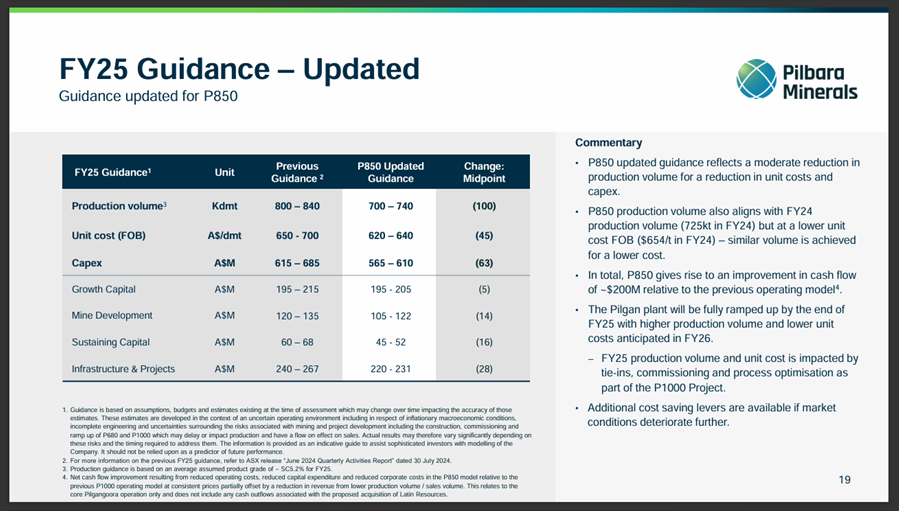

PLS has reported strong Sep-Q production and sales of 220kt and 215kt respectively, ~10% ahead of expectations. Costs are tracking well as it ramps up and the realised price was weak as expected at US$683/t (vs US$872/t for IGO). However, the real news was that PLS will put the Ngungaju plant onto care and maintenance from December, downgrading FY25 production by ~100kt and reducing the FY26 outlook to P850 (UBSe 185kt) pending an improved outlook for market balance/prices. The updated FY25 guidance comes with A$63m shaved off capex and expectations for FOB costs to be A$45/t lower at A$620-640/t. PLS suggest this improves cashflow by ~A$200m at US$700/t spodumene. We are happy to remain slightly above on production and below on costs given PLS's excellent operating performance. We await more supply to exit the market. Our NPV based Price Target of A$2.35/sh remains unchanged and we retain a Sell rating

JP Morgan: Neutral Dec25 PT $3

SepQ24: Turning off Ngungaju, but remains another medium-term option should markets turn; retain Neutral

Key takeaways from the SepQ24 quarterly: 1) PLS has placed the higher cost Ngungaju plant into care and maintenance, citing the weak lithium market outlook with a 150-200ktpa impact on medium-term production, and providing further optionality on matching production to market growth (in addition to LRS Salinas and P2000), 2) FY25 production (-100kt), cost (-$45/t FOB) and capex (-$63m) guidance have all been moved lower, 3) the quarterly result was solid, with production/sales volumes beating our forecasts by 13% and 16%, flowing through to a 12% beat on the cost line, and despite realised pricing missing our numbers by 9%, the higher volumes saw revenues net out in line. Our FY25 earnings fall to -$53m (from -$19m) and our NPV is down 2%. We view the stock as fair value at current levels (1x P/NPV), and retain our Neutral rating

CLSA: Outperform PT$3.20

Strategic cost optimisation and growth planning drive upgrade

Playing the cycle smartly, PLS is optimising operations while preserving future optionality. The strategic move to P850, placing Ngungaju into C&M, should deliver up to A$200m in CF benefits while maintaining restart flexibility for the upturn. With growth capex completing late FY25 and steady-state 850ktpa production expected in FY26, PLS is now showing stronger operational discipline and strategic timing. We upgrade to O-PF and lift our TP from A$2.90 to A$3.20 seeing value in PLS’s medium-term production optionality and counter-cyclical strategy

Goldman Sachs: Not Rated

Pilbara Minerals Ltd. (PLS.AX): 1QFY25: Lithium production guidance cut with smaller plant into care & maintenance on cost management

We estimate revised unit cost guidance implies previously expected plant costs at ~A$870-1,120/t (where we continue to model the separate plants, with Ngungaju costs ~US$200/t higher than Pilgan), with the C&M decision likely only partly relating to plant unit costs, in our view, where turning off the plant also enables other significant cost savings such as a significant reduction in mining fleet on stopping work in the Southern pit while the Central/Eastern pits continue largely as planned (we expect combined mining and stripping costs to fall to ~A$10/t), while also deferring other planned capital spend. PLS expect to be able to ramp the plant back up in ~4 months when market conditions improve (we factor in a restart of Ngungaju in mid-CY26 on our price outlook)

RBC: Outperform PT $3.10

Our view: A strong 1Q was overshadowed by the decision to place Ngungaju on care-and-maintenance (C&M). While we are cognisant of minor near-term FCF benefits from curtailing production in light of spot prices, given Ngungaju's asset quality (mid-cost curve asset) and PLS's balance sheet strength, we think placing the asset on C&M was too conservative. We see other operations having higher risk of curtailment. Further to our first-take (link), incorporating 1Q and assuming Ngungaju is on C&M until 2028, sees FCF increase marginally in FY25E, but notable EPS/EBITDA reductions over FY26-28E. Our price target reduces 20c to A$3.10. Outperform retained

Macquarie:

Key Points

• PLS's 1QFY25 production, sales and cost beats were overshadowed by the decision to cut FY25 production guidance by 12% by placing Ngungaju C&M

• Whilst management believe the Ngungaju suspension saves ~A$200m in FY25 cash flow, the key question is when/if the plant returns to full operability

• We adjust production and costs in line with PLS's new guidance and model a FY28 Ngungaju restart aligning with our view on market rebalance

What we liked: Better grades and recoveries; Value over volume

What we didn't like: Realised pricing

What was interesting: Posco JV production

Morgan Stanley: Equal-Weight PT$3

Ngungaju turning off – not so bad after all

Although results benefitted from higher grades, which will eventually fall, near-term Ngangaju closure is accretive to valuation, reducing capital requirements, improving recoveries + reducing mining complexity. But, Li price still challenged with limited reasons to add exposure. Stay EW

BoFA:

PLS Sir, can we have some more?

DISC: Small Position Held in RL & SM

Unsurprisingly the quarterly figures are down on prior quarter due to sales volume and price, but what is very strong given the hole Lithium prices are in is that they are still profitable, and reasonably so. Realised price was just under A$1,000/t and CIF operating costs were A$717/t.

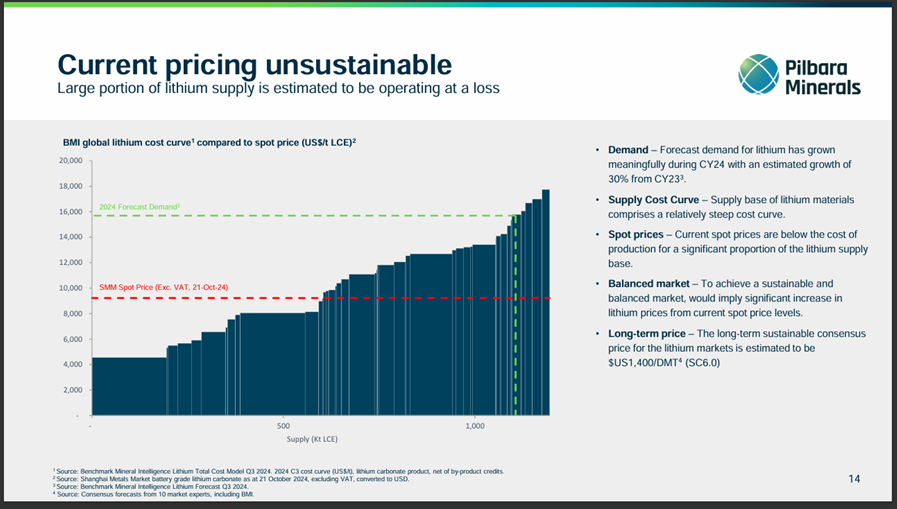

Pilbara Minerals is not the lowest cost producer but it is sitting comfortably in the half of producers that are profitable at current prices. Over half of Lithium being produced is at a loss and assuming that eventually prices move up the cost curve to the margin producer where supply matches demand then a price around US$1,400/dmt or close to double the current price is a point of equilibrium as this slide shows:

I don’t expect PLS will see prices near US$1,400/t any time soon or possibly ever given the supply and demand dynamics are shifting in both cost and quantity. The important point for my investment theses is that PLS is in the top half of the class and likely to stay there and remain profitable through the cycle.

On this point, the recent investment in capex recently is driving costs down and they are optimising operations at Pilgangoora. The “P850” operating model has taken the lead with the Ngungaju plant being mothballed, which is reducing volume but increasing cashflow:

Noting the P850 production is being expanded with the P1000 Project, so capacity increases are coming but per guidance below, it’s one step backwards on volume to get cost reductions before they can take two steps forward with volume increases and cost decreases:

It is worth checking the presentation out yourself, but this slide I also found interesting. What struck me is the gap between supply and demand for Lithium has been minor (around 10% eyeballing it), yet the price movement has been insane. I accept that we are seeing a radical change in the demand opportunity for Lithium, but the relatively small imbalance of supply and demand is surprising in the context of the price move.

Other things in play for PLS currently is the impending close of the deal to acquire Brazilian lithium explorer Latin Resources for $630m. They are also in a JV in South Korea for a POSCO chemical processing plan (vertical integration option) and poor Calix (CXL, which I also own) is getting smashed today because PLS is deferring the next phase of the demonstration plant they are working on, looking for more supportive market conditions OR a government handout!

I am happy that my thesis holding nicely and still has some time to play out. It’s only a half position, but I would be happy to increase if a general market pull back offered another opportunity around $2.50.

Disc: I own RL

PLS announced a "Disclosure of equity derivative positions".

From the announcement:

Pilbara Minerals is releasing this letter to ensure full transparency, however has no reason to believe that the information, of itself, is materially price sensitive and is not aware of any additional information of relevance.

The announcement details a number of call and put options entered into by Ganfeng Lithium, a Chinese lithium producer.

I assume this doesn't really mean much, otherwise it would be marked price sensitive, but I'm still curious to understand more about why it's been released at all.

I understand the overall structure - Ganfeng have limited their downside and upside within a certain price range - and while the overall position is large, at 105 million shares, it's still under 5%.

Further from the announcement:

Guidance Note 20: Equity Derivatives (GN20) issued by the Australian Takeovers Panel... provides that the non-disclosure of equity derivative positions, including short equity derivative positions that offset long positions, may give rise to unacceptable circumstances.

I'm guessing "unacceptable circumstances" actually means something to those in the know? One thought I had was that this could flag some price volatility around the strike price of the options? If any members have experience or thoughts I'd be interested to hear your take.

Interesting Money of Mine interview with a Singaporean based fund manager YJ Lee from Arcane Capital. Interview covers in particular Lithium and silver.

Why the Lithium Market Has Bottomed with YJ Lee (youtube.com)

If not able to watch, the points I found interesting were:

Lithium

Market is underestimating the extent to which supply is coming off due to low Li prices.

Markert is underestimating the future demand for Lithium. Just as the market wildly over estimated demand 2 years ago. YJ Lee points to as well as EV demand, demand from e-trucks which are using 10 times the lithium of a car and rising stationary battery usage. He thinks the market has missed both. (YJ says already 85% of taxi fleet in China is EVs)

Cheap solar cells have made solar power at certain times very cheap, this in turn makes battery storage more economic.

Poor spodumene grades are coming out of Africa – much in only around 3 to 3.5% Li. YJ postulates that this has not been fully appreciated in Li production estimates.

Chinese lepidolite mines can be both high and low cost. (Prevailing western mining journalism keeps telling us they are all high cost).

Western tariffs on Chinese cars will be relatively ineffectual. Big markets already in Middle East and Asia + cracks in EU with Norway saying doesn’t want to put tariffs on EVs. RoW just want cheap cars. Vertical integration of BYD: makes EVs, batteries and has own car export vessels. Is building 7 more that can take 7,000 cars each.

YJ Lee calls now the lithium market bottom.

Silver

New generation of solar cells are more energy conversion efficient, however use more silver.

YJ Lee argues the silver ETF market may get a speculative kick on the back of industrial demand driving up prices and speculators following.

Silver supply is relatively inelastic. Unlike Lithium which is widespread from James Bay in Canada, to Africa to brines in South America to Chinese lepidolites to the deserts of WA. Bloody everywhere. (It is interesting Mike Henry was asked around 2 years ago why BHP had not got into Li mining. His response was there is not a deposit on the planet large enough to get them interested)

YJ is trying to get off the ground a Green Metals Fund, so he is of course breathlessly pumping up his own tyres. Who really knows what the real situation is.

Possibly the only truth is there are more people demanding more and less people willing to work to get it. Get long productive Australia (PLS, WHC, MIN, DVP, GMD).

Since I just posted the two AFR articles on Pilbara's $560 million takeover offer for Latin Resources I'd figured FWIW I'd see what some of the brokers were saying (note most of these (except RBC) were published before yesterdays conf call and market open)...

Morgan Stanley: Underweight PT $2.70

Today's counter cyclical transaction makes sense. However, for PLS we remain concerned about medium-term recoveries and costs, the contract structures and prices achieved (lower vs. peers), and the ramp-up of the downstream conversion plants alongside weakening Chinese EV sales (-10% MoM in July)

JP Morgan: Neutral PT $2.80

PLS have announced today the acquisition of ASX-listed Latin Resources (LRS) in an all-scrip deal. At PLS’ last close price of $2.85/sh, the offer implies 20cps for LRS’ shareholders, a 67% premium to LRS’ last close. LRS own the Salinas lithium development project in Brazil, with a preliminary study indicating stage 1 production potential of 405kt of SC5 and 123ktpa of SC3 production coming online in 2026 for capex of US$253m. Stepping into a new jurisdiction could be challenging, although the LRS MD will be retained on a consulting basis by PLS for 12mths to assist with the transition. Another growth option (in addition to P2000), presents options in terms of sequencing additional capacity into a market that appears to be oversupplied on our S/D market assumptions over the remainder of the decade

Macquarie:

PLS inorganic strategy makes sense: PLS looking to add resource off Pilgangoora tenure is an intelligent move as it grows the company without incrementally adding tonnes to the market. It also arguably is timed appropriately with lithium prices in the doldrums and the retention of balance sheet flexibility important at this point of the cycle

Macquarie aren't providing a rating or PT - and note they "are currently on research restrictions" - digging into their disclosures section ...

Macquarie is currently providing investment banking services to Pilbara Minerals Ltd for which it expects to receive or intends to seek compensation

Macquarie is currently providing investment banking services to Latin Resources Ltd for which it expects to receive or intends to seek compensation

UBS: Sell PT $2.50

While LRS talks to 2026 first production, we're not convinced the market needs the supply and how soon it will come. Deal completion is expected late this calendar year with the Scheme meeting likely in mid-Nov 24. The 100% scrip consideration leaves net cash intact at A$1.6bn ahead of new project funding (debt/gov financing and strategic/ offtake options). However, we remain concerned an over-supplied lithium market will weigh on prices for 1-3yrs ahead and remain unchanged Sell rated at A$2.50/sh

CLSA: Hold PT $2.90

We believe the deal lacks short-term accretiveness, but if timed with a market bottom, which is likely near, and the asset meets its potential, it could offer significant long-term upside. We update our model accordingly and lower our target price from A$3.10 to A$2.90

RBC: Outperform PT $3.90 (up from $3.80)

PLS is offering A20¢ps (all scrip) for LRS. The rationale for the acquisition is to incorporate the 100% LRS-owned Salina project into the portfolio; diversifying the asset base counter cyclically. Based on a recent significant increase in Resources (and pending DFS), our estimates suggest a value accretive acquisition, but near-term earnings/FCF dilution. Further to our first take, we incorporate the Salinas development project in our NAV. Adjusting for the transaction has reduced our FY25e/26e EPS by 6-7%, but increased our price target 3% to A$3.90/sh. We retain our Outperform rating

DISC: Held (very small position) in RL

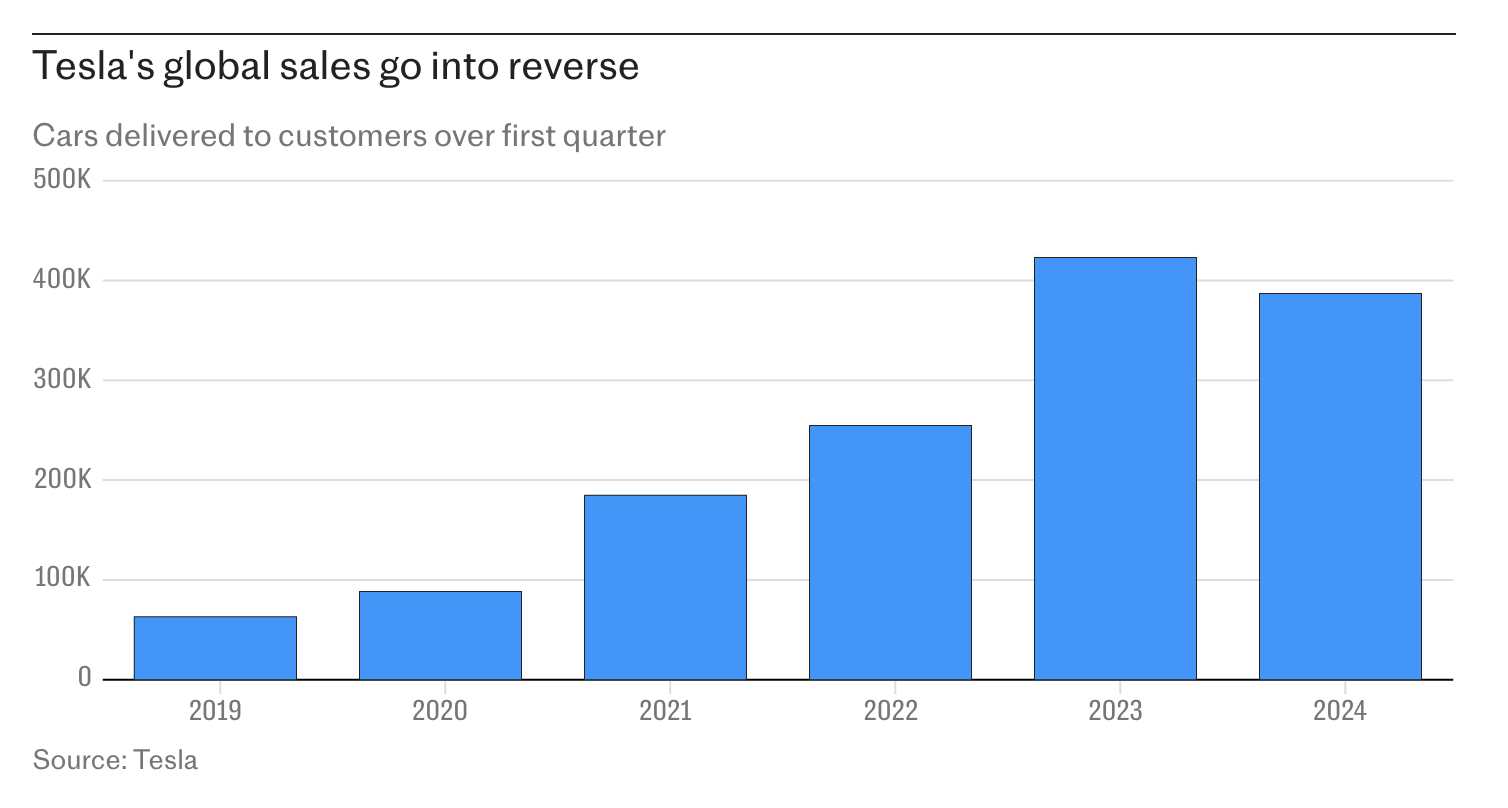

The AFR posted an article online yesterday titled "The carnage in the EV industry is only getting started".

It's syndicated from The Telegraph in the UK, and opens with some pretty bearish statements on the future of the EV industry:

Profits at the German auto giant Mercedes plunged last Friday as sales of its slick new range of electric vehicles went into freefall.

Porsche abandoned its sales targets for battery-powered cars amid waning demand from customers. Ford is losing nearly $US50,000 ($A76,000) on every EV it sells, while Tesla’s profits dropped 45 per cent. Meanwhile, battery manufacturers such as Germany’s Varta are getting wiped out.

It has become clear that the EV industry is on the brink of collapse. Hundreds of billions of euros, dollars and pounds have been pumped into this industry by political leaders and the subsidy junkies that surround them – and it is surely time they were held to account for the vast quantities of taxpayer cash that has been wasted.

Mostly the article seems to be complaining about "the billions" wasted on EVs, which I assume is a reference to public policy. It's light on details (lucky the AFR has posted it as an opinion piece!).

"Profits at the German auto giant Mercedes plunged on Friday as sales of its slick new range of electric vehicles (EVs) went into freefall." Looking at the latest results from Mercedes, EV sales are down, but only 6% YoY. Free cash flow is down, but "free fall" doesn't line up with the battery-electric vehicle results.

A graph is included titled "Tesla sales go into reverse"

Which is true - they are down for 2024! Or was 2023 an anomaly?

I don't follow vehicle manufacturers closely, and I think it's fair to say there are headwinds for vehicle manufacturers in general. But this article doesn't really bring any convincing arguments to support the theory that EVs are a failed experiment (though individual manufacturers might struggle)

My thesis around PLS is:

- many products are just far better when they are electrified, including vehicles

- battery-electric is a proven technology and will continue to be popular

- lithium will remain a critical part of battery manufacturing, and eventually we will move into the recovery phase of the cycle

I'm writing this as a reminder to myself: ignore the noise!

14-April-2024: I received a link to the following article today in an email from Roger Montgomery's investment management company:

https://rogermontgomery.com/pilbara-minerals-the-asxs-most-shorted-stock-yet-poised-for-long-term-success/ [19-March-2024]

[Not behind a paywall]

PILBARA MINERALS: THE ASX’S MOST SHORTED STOCK, YET POISED FOR LONG-TERM SUCCESS?

As a low-cost and long-life spodumene producer (spodumene is a raw material used to produce lithium for batteries in your phone, e-bike and electric vehicles (EVs)), Pilbara Minerals (ASX:PLS) is one of the highest quality single commodity miners on the ASX. The share price has been punished recently, with the spodumene price falling from over U.S.$8,000 per tonne to below U.S.$1,000 per tonne in just over 12 months.

This was driven by slowing demand as governments around the world wound back their subsidies for EVs, and the higher cost of living began to take a toll on consumers. A large oversupply had emerged as commodity producers ramped up supply, a logical response to high spodumene prices that were far above production costs for even the newest and most inefficient operators.

Given the tough operating environment, Pilbara Minerals management behaviour has showcased a measured and conservative approach to surviving the price cycle. The company has a strong net cash position of over $1.5 billion, built up from high prices in previous years and prudent deployment of capital. With cash costs of production of AU$691 per tonne, the company has been able to maintain profitable operations throughout this difficult period as higher-cost rivals suspend or close operations to reduce cash burn.

The company’s production expansion projects, P680 and P1000, are well progressed and have a two-fold effect. Increased production volume will go some way in offsetting falls in realised price, while increasing economies of scale decrease the unit cost of production per tonne. Current annual production is 620kt and will increase 60 per cent to 1 million tonnes beyond FY25.

The company has also partnered up for mid-stream and downstream projects, which have the potential to increase future returns to shareholders. A mid-stream joint venture operation with Calix Ltd, an environmental technology company, is progressing with the objective of decarbonising the processing of spodumene. A large South Korean steel company, POSCO, is the downstream project partner that has started the commissioning of a lithium hydroxide plant, producing the finished product used in batteries and EVs.

With such strong fundamentals providing solid downside protection while simultaneously setting a platform for significant upside, the Australian Eagle Asset Management team have gradually built up a position in Pilbara Minerals in the past few months. As the most shorted stock on the ASX, the share price could rise significantly when the spodumene price inevitably recovers, forcing short sellers to close their positions.

While the team cannot claim any expertise in forecasting spodumene prices, we remain confident, given its current strong balance sheet and low cost of production, that Pilbara Minerals will be one of the long-term winners of the future as the world moves away from fossil fuels and accelerates towards renewable energy.

---

The Montgomery Fund and the Montgomery [Private] Fund owns shares in Pilbara Minerals. This blog was prepared 18 March 2024 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Pilbara Minerals, you should seek financial advice.

---

By Daniel Chan

Daniel Chan joined Australian Eagle Asset Management in 2014 as an Investment Analyst, and beyond the usual realms of financial modelling, Daniel is also responsible for writing research papers for portfolio stocks as well as stocks within the ASX 100. He is also responsible for the implementation of the Australian Eagle investment philosophy across the portfolio and bringing to the team’s attention any company inflection points that may assist with the purchase or sale of these stocks.

---

I always read these sort of bullish reports from the POV that the writers either holds shares themselves or the company they work for does, or else it's a paid report on behalf of the company being reported on. That said, you can often still find useful pieces of information in these reports that do help to form an independent view - it's just always best to use multiple sources of info rather than just one, especially when that one is expected to paint the company in the best possible light.

That said, I can't argue that Pilbara Minerals (PLS), as Australia's most shorted company, with more than 20% of their SOI being shorted - see here: ShortMan - Short position graph for PLS ...is primed for a northbound SP spike IF the shorters are wrong and there is a short squeeze.

The argument behind shorting PLS appears to be more around shorting lithium, and PLS being the largest and easiest ASX-listed pure-lithium play to short.

My own thoughts on that are that PLS is the strongest pure lithium player in Australia (possible the World) and they're in a very strong (net cash) position with a huge pile of cash to tide them over even if prices stay below their cost of production for a decent chunk of time, and if I was going to short a lithium company, PLS would not be my first choice. [I never short any companies by the way, that was just a hypothetical]

Another analyst, Gaurav Sodhi from Intelligent Investor has also been bullish on PLS, although he has recently (in early March) changed his "Buy" call on PLS to a "Hold".

The Intelligent Investor Australian Equity Income Fund (Managed Fund) (ASX:INIF), the Intelligent Investor Ethical Share Fund (Managed Fund) (ASX:INES), and the Intelligent Investor Australian Equity Growth Fund (Managed Fund) (ASX:IIGF) all own shares in Pilbara Minerals Limited (PLS).

Here's a link to Gaurav's latest thoughts on PLS - may be behind a paywall:

Pilbara Minerals: Interim result 2024 - Intelligent Investor [01-Mar-2024]

I don't hold PLS - as I'm not ready to have direct exposure to a pure lithium play. I don't understand the supply/demand dynamics and environment in lithium enough to be comfortable with that exposure, however I do hold MinRes (MIN) shares in multiple portfolios (including here) and they do have some lithium assets - but it's not all they do - they are also diversified across iron ore, mining services, and investing.

But back to PLS. The company's management have done well. They've acquired good assets at cheap prices and then worked them hard and built up a very healthy warchest of cash while investing billions back into their own business to lower their own costs and set themselves up very nicely for the future. They also developed a sort of lithium auction system that should allow them to rapidly benefit from higher lithium prices when they come, rather than having locked in all of their future production at set prices for years as many other lithium miners have done. Excellent foresight and planning, superb execution from a quality management team; there's a lot to like about Pilbara Minerals.

If and when I want pure lithium exposure, this is the company I would be looking to get it through.

Here's just the start of Gaurav's March article on PLS:

Pilbara Minerals: Interim result 2024

Amid lower prices, this result was a flex.

We all knew this was coming. Amid tumbling lithium prices, Pilbara Minerals’ margins, profits and cash flow all crashed.

Net profits for the period fell from $1.2bn to $220m; operating margins crumbled from 83% to 55%. This was because received lithium prices went from almost US$5,000 a tonne to US$1,645.

Despite those dramatic falls, this result was a demonstration of how good Pilbara’s wholly-owned asset is.

The fact that the miner still made operating margins of over 50% and operating cash flows of over $500m for the half year neatly illustrates why we upgraded Pilbara amid grim pessimism (see Pilbara Minerals: luck and lithium).

Of course, lithium prices are lower now, so those margins will be crunched again, but no one else in the industry is making much cash. Here we have proof, if we needed any more, that Pilbara is the best hard rock lithium asset in the world.

Pilbara is doing what low-cost mines ought to do: maximising output.

For more, see here: https://www.intelligentinvestor.com.au/recommendations/pilbara-minerals-interim-result-2024/153340

Key takeaways:

Revenue: $757 M (down 65% on PCP)

Profit: $213 M (down 82% on PCP)

EPS: 7.25 cents (down 82% on PCP)

Trading on forward PER of around 25......................

Current share price includes a premium for a recovery in Spodumene prices........

From the Australian ...

Only Wodgina and Greenbushes are profitable at the current spot price

Pilgangoora is above the cost curve and appears this is what is driving the shorts.

From money of mine podcast.

https://www.youtube.com/@MoneyofMine

AustralianSuper builds stake in lithium miner Pilbara Minerals

Australia’s largest pension fund on Thursday emerged as a 5.1% stakeholder in Pilbara Minerals after snapping up shares now worth A$558 million ($371 million) at a time of heightened interest in the country’s lithium miners

The only shareholder with a larger stake in Pilbara Minerals is a subsidiary of Ganfeng Lithium Group, which owns 5.7%, according to LSEG data

A stock exchange filing, required as AustralianSuper‘s stake now makes it a “substantial shareholder”, showed the A$300 billion fund had built its position since July, picking up more shares in September and October as Pilbara‘s share price dropped

Lithium stocks have been battered as prices for hard rock lithium, or spodumene, have slumped 70% over the past year. Pilbara Minerals is the most shorted stock on the Australian Stock Exchange, ASX data shows, which has sent its shares down 21% over the past year

However, buyers are betting the plunge in lithium prices will be short-lived as supply shortages for battery makers reemerge

AustralianSuper declined to comment

The pension giant has become a more activist investor, leading opposition to a high-profile $10.6 billion bid for Australia’s top power retailer Origin Energy

Its move into Pilbara Minerals comes at the same time as mining magnates have snapped up stakes in takeover battles for some of Pilbara‘s rivals

Gina Rinehart, Australia’s richest person, spoiled Albemarle’s ALB.N A$6.6 billion bid for Liontown Resources LTR.AX

Pilbara‘s shares closed 2.3% higher on Thursday

Production relatively flat @ 144.2 kT

Sales up 6%

Revenue down 42% on prior quarter, as Lithium Hydroxide prices collapse.

Realised price per Tonne down 31% on prior quarter.

Looks to be trading on a forward PER of 15, assuming they maintain current realised price. The problem is Spodumene prices have fallen a further 20% over the past month.

IMO, there appears to be more downside than upside at present.

Estimated NTA as at December 31: $2.9 BN ($0.94/share)

Gross margins sitting at around 60%.

Offtake prices have collapsed and are presently $2240 USD per tonne of Spodumene

Predictions for commodity prices are impossible to make, but assuming this is a new normal, and a PER of around 11, I come up with $2.90

Now voting power: 6.19%

Guess JP Morgan & affiliates are shorting PLS.

PLS most shorted stock on the ASX

Tantalite production decreased in Q4 FY23 with 7,224 lbs produced relative to 8,575 lbs in Q3 FY23. For the full year FY23 period, the Group recorded 620.1k dmt of concentrate production, 64% higher than FY22 and at the top end of production guidance. The increase in production for the full year was driven by a combination of product grade strategy and improvements in productivity.

Share price reaction ; $4.95 up ~7% this arvo

supported by a $20mill Govt Grant . Executed April 2023

ASX +security code Security description PLS, ORDINARY FULLY PAID

Number of +securities to be quoted 168,678

Issue date 04/04/2023

Looks ok ..But the resource price must stand -up. ( Chart here )

- Release Date: 27/04/23 18:38 ( noted released outside trading hrs )

- Summary: March 2023 Quarterly Activities Presentation

- Price Sensitive: Yes

- Download Document 896.61KB

below MIN vs the Li Carb' Price: ........the red -line incase yur colored blind"

So Li Carb chart to test the bottom of the price "pit" then bounce out / bottom out.

Market Cap ($M): 11,872

Return on invested capital: is good

Free cash flow: ablility to pay a fully franked dividend is ok

@west it gets better…the sell rating with an upgrade from 3.15 to 3.40 has now (allegedly) been changed to neutral and a new price target of 4.70. All in the space of a few days. Oh my, it’s a comedy show unless you are paying for advice then, you wouldn’t know what to think.

For those interested the Quarterly Investor Conference Call from PLS is below. It provides a nice summary of the present and future opportunities and challenges as the company sees them.

I think it’s worth a listen for holders, non-holders and those who may be considering a holding.

What I found interesting is listening to some of the questions raised by GS, UBS, JPM etc and comparing them to the questions Andrew raises in the Strawman Interviews. Obviously, it’s not a like for like comparison but, it’s just interesting to see the difference (ie what I see as a short term focus almost looking for a gotcha moment) in the questions from the larger investment houses v Andrew’s more people focused in depth review of the people running the show and what they are doing to grow and develop.

https://www.webcasts.com.au/13125/player/index.php?player_id=20349&skip_stats=1

Add the potential dividend (assume interim, full, interim) back to their 3.40 (12m) price target and you are already getting back to yesterdays price. So one could hedge their bets.

The UBS valuations are priced on catastrophic drops in Lithium. With Liontown announcing today an increase in construction costs developers could be under further cost pressures to get production going. Will UBS redo their PLS price prediction?

So while the producers clean up developers face upward cost pressures to start producing.

This reminds me so much of the FMG v investment bank battles during their growth. These investment - advisory companies are stuck in the days where they think Retail holders can not access news themselves.

At $3.40 assuming just last quarter results x 4 (and no dividend payout) PLS could have $6B in the bank!

So UBS would like their clients to think that PLS should then only be valued at 10B?

I am not good at forecasting so I am happy to run off the present data. I will leave the guess work to the large investment and advisory financial companies.

The day after PLS quarterly results - oh my! Smells of desperation needing to get this update out today.

I think this article is important because it highlights that the world when it comes to EVs and thus Li requirements is greater than just China and the USA. So when we are talking about EVs and lithium demand it’s important to not just rely on information that suggests potential slow down or uptakes in China or the US due to XXX. Let’s not forget China “makes and sells” not just for their own consumption but, the world!

https://europe.autonews.com/automakers/chinas-ev-exports-surge-record-european-demand

PLS continue to clean up holding these auctions. When one considers the cash being delivered by this company and 1) it’s not at full capacity, 2) a majority of present earnings have been locked in at “significantly” lower earnings it’s valuation of 4.55 just does not add up.

I understand the “it’s a commodity stock” but just how many so called tech stocks earning no money, with the dream of a solution, and a fanciful unlimited TAM continue to bleed cash are priced “significantly higher” on a relative basis even after big pull backs.

Lithium isn’t going anywhere and PLS a “producer” earning a bucket load of cash is right in the mix. I can’t help but think we have seen this story played out again and again (think FMG).

Maybe it’s a mix of “it’s a commodity” or “the price of Li has to retreat” or “looking for the spec explorer rather than the actual producer to get the life changing multiple expansion” or the so called investment company reports released “referring to lower valuations” whilst they accumulate in the background (does this really happen - ha ha).

If one looks past the “noise” and analyses the “numbers” I can’t help but think PLS is a future BHP, RIO or FMG if it isn’t already.

Note: I hold iRL.

PLS 12th BMX Auction.

US$8,299/DMT

PLS Share price $$4.55

Participating interests in the JV will be 55% Pilbara Minerals and 45% Calix, with each party funding their share of operating and capital costs and Calix licensing their patented technology and calcination knowhow into the JV

Latest BMX auction results.

16/11/22 $7805 dmt

There has been a steady increase in price month on month

About a year ago, 26/10/21, the price was $2350

I’m sure this rate of increase is unsustainable but have no idea when it will slow or reverse.

Backs up yesterday’s announcement to start paying dividends from FCF, 20-30% payout from a cash balance of 1.375b

Held

"Battery Material Exchange" equates to a price of ~US$7,708/dmt (SC6.0, CIF China basis).

PLS price reaction up 1% to $4.94 (The Fed raised the federal funds rate by 75 bps to the 3%-3.25% range)

Above: YTD Growth returns (Chart shows the NHC coal ahead - but will unwind when a dark swan swims in)

Above: 5yr Growth returns

qualified buyers with a total of 22 bids received online during the 30-minute auction window. equates to a price of ~US$7,708/dmt (SC6.0, CIF China basis).

Thought I'd post here instead of CXO as PLS is a current producer

Wonder if demand destruction for EVs could be on the horizon? And how much of the EV hype is driven by the current Biden administration and other western govs round the world. I usually don't pay much attention to Zerohedge but this is a good article.

Lithium prices hit new record as EV affordability concerns mount

$1.2 Bill Revenue plus 577% , $814.5Mill EBITDA, $561.8Mill NPAT

That is it dig up the dirt and ship it around and you get paid,

PowerPoint Presentation (markitdigital.com)