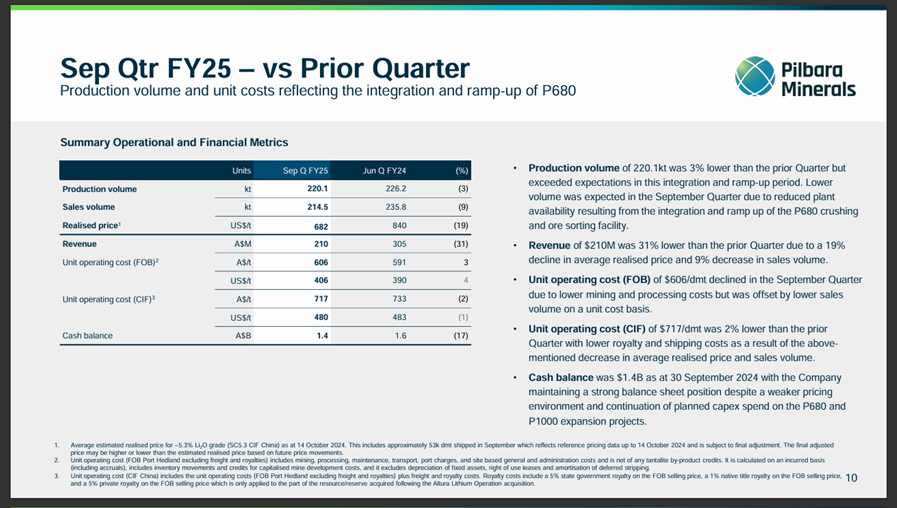

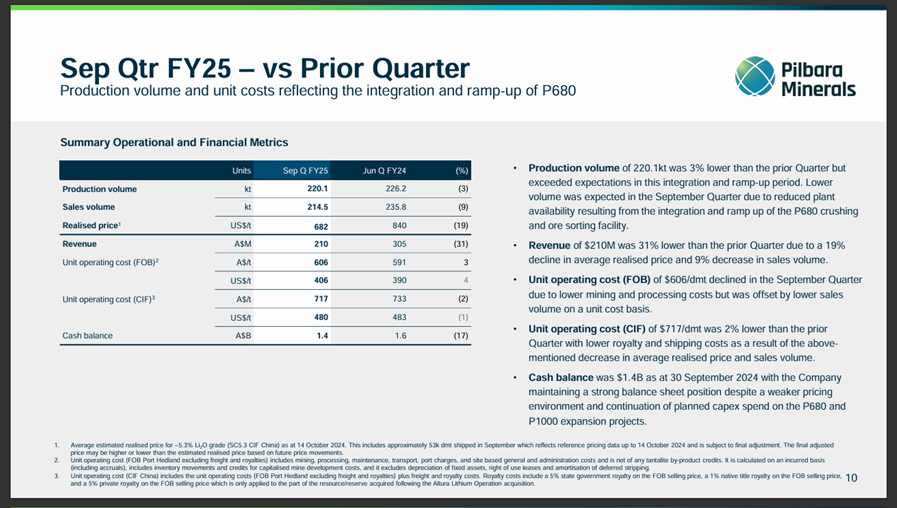

Unsurprisingly the quarterly figures are down on prior quarter due to sales volume and price, but what is very strong given the hole Lithium prices are in is that they are still profitable, and reasonably so. Realised price was just under A$1,000/t and CIF operating costs were A$717/t.

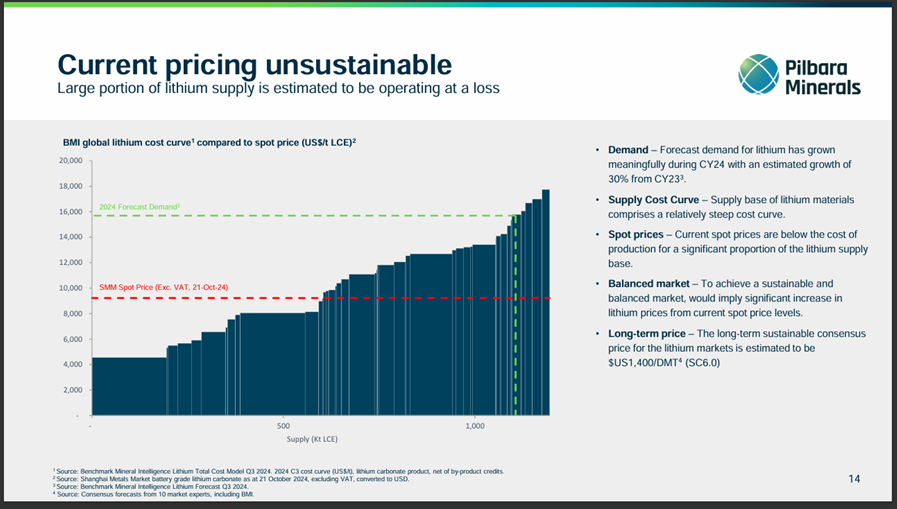

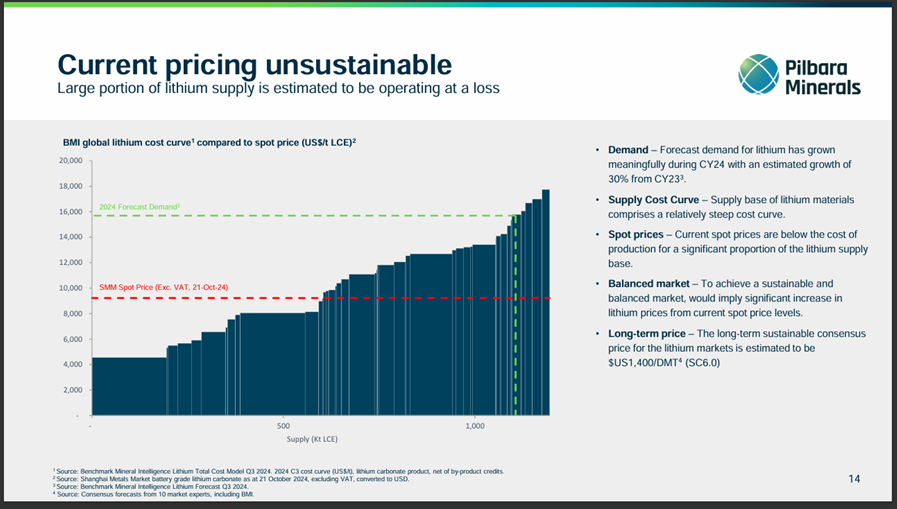

Pilbara Minerals is not the lowest cost producer but it is sitting comfortably in the half of producers that are profitable at current prices. Over half of Lithium being produced is at a loss and assuming that eventually prices move up the cost curve to the margin producer where supply matches demand then a price around US$1,400/dmt or close to double the current price is a point of equilibrium as this slide shows:

I don’t expect PLS will see prices near US$1,400/t any time soon or possibly ever given the supply and demand dynamics are shifting in both cost and quantity. The important point for my investment theses is that PLS is in the top half of the class and likely to stay there and remain profitable through the cycle.

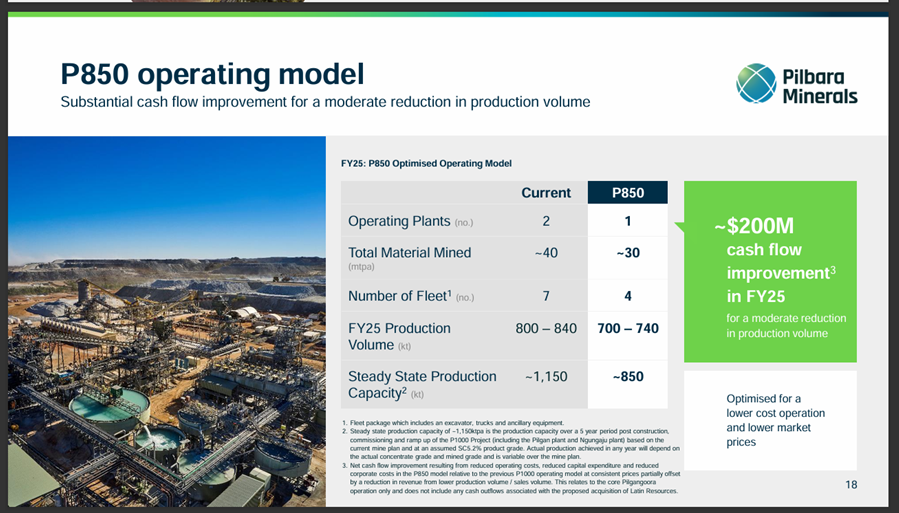

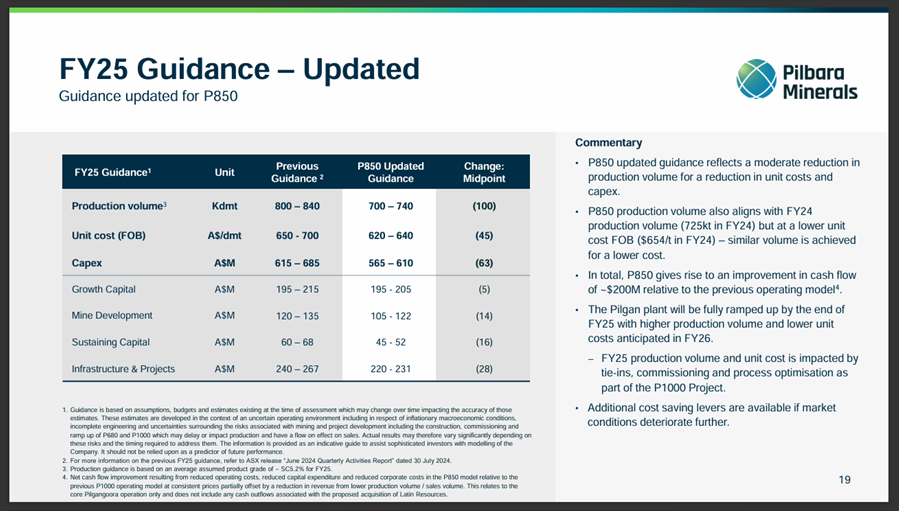

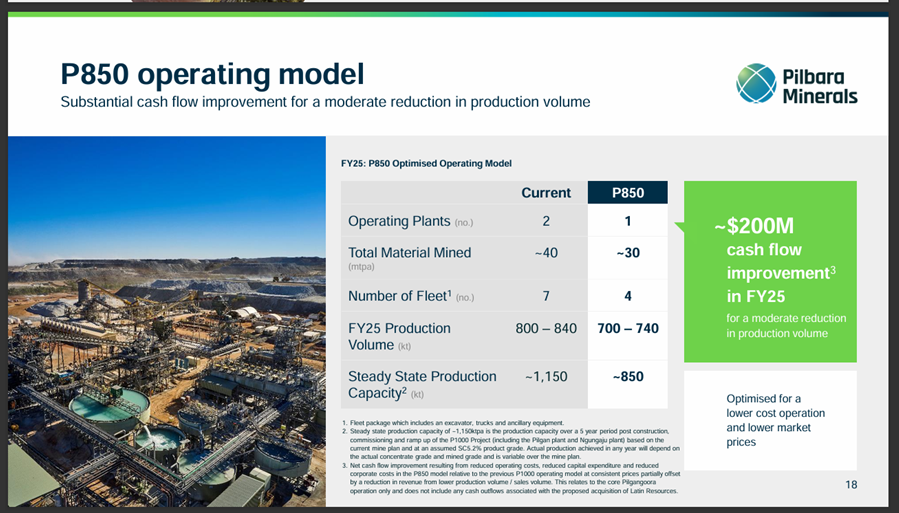

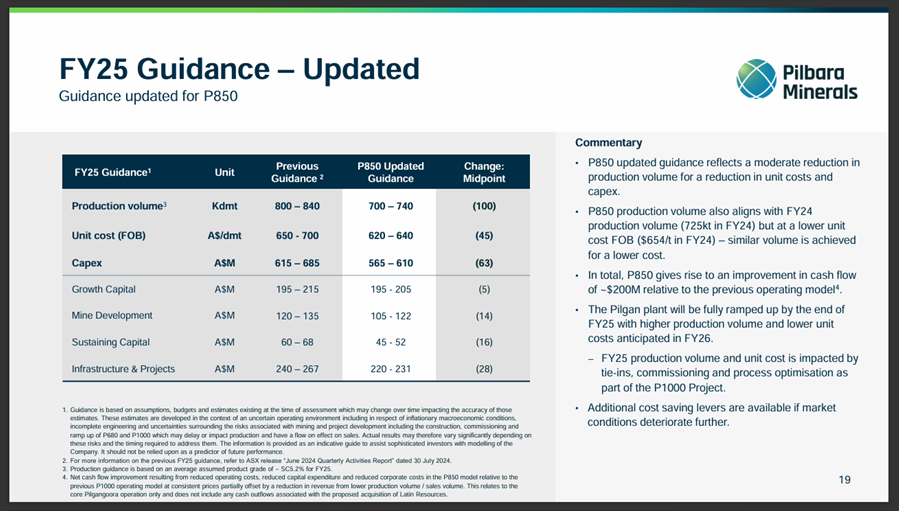

On this point, the recent investment in capex recently is driving costs down and they are optimising operations at Pilgangoora. The “P850” operating model has taken the lead with the Ngungaju plant being mothballed, which is reducing volume but increasing cashflow:

Noting the P850 production is being expanded with the P1000 Project, so capacity increases are coming but per guidance below, it’s one step backwards on volume to get cost reductions before they can take two steps forward with volume increases and cost decreases:

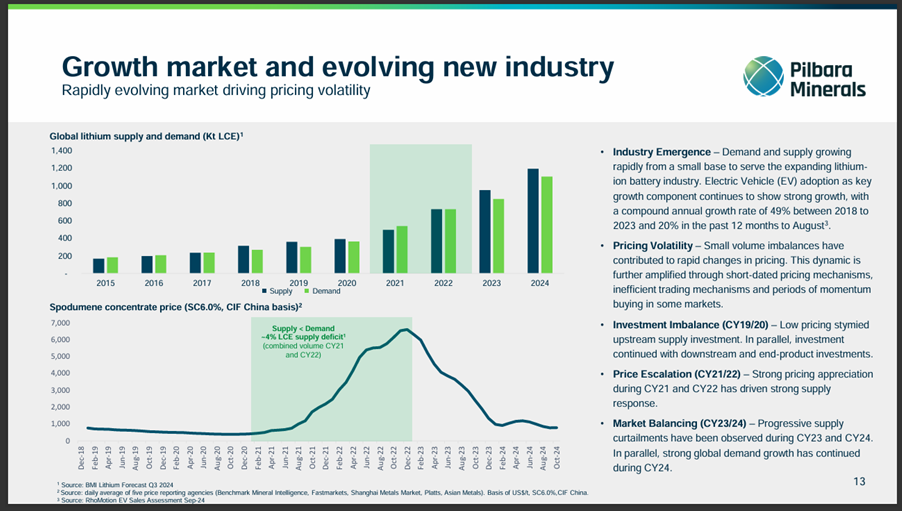

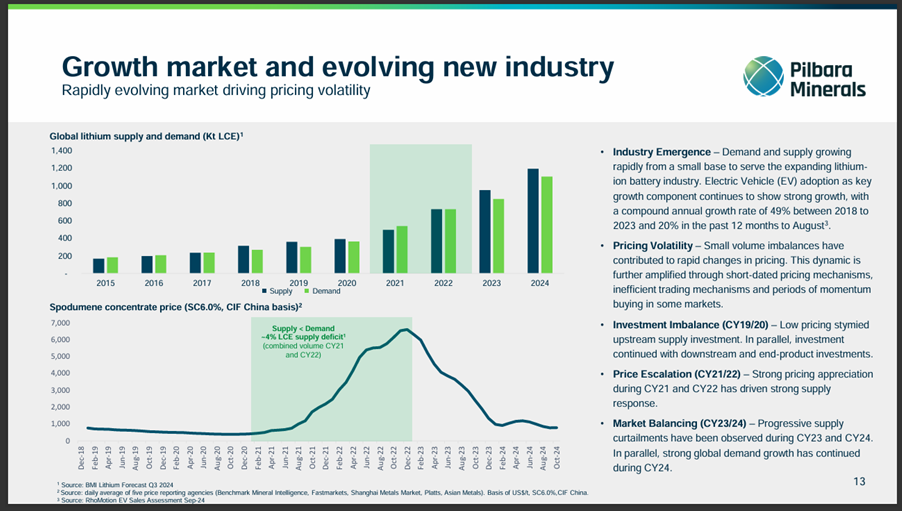

It is worth checking the presentation out yourself, but this slide I also found interesting. What struck me is the gap between supply and demand for Lithium has been minor (around 10% eyeballing it), yet the price movement has been insane. I accept that we are seeing a radical change in the demand opportunity for Lithium, but the relatively small imbalance of supply and demand is surprising in the context of the price move.

Other things in play for PLS currently is the impending close of the deal to acquire Brazilian lithium explorer Latin Resources for $630m. They are also in a JV in South Korea for a POSCO chemical processing plan (vertical integration option) and poor Calix (CXL, which I also own) is getting smashed today because PLS is deferring the next phase of the demonstration plant they are working on, looking for more supportive market conditions OR a government handout!

I am happy that my thesis holding nicely and still has some time to play out. It’s only a half position, but I would be happy to increase if a general market pull back offered another opportunity around $2.50.

Disc: I own RL