The AFR posted an article online yesterday titled "The carnage in the EV industry is only getting started".

It's syndicated from The Telegraph in the UK, and opens with some pretty bearish statements on the future of the EV industry:

Profits at the German auto giant Mercedes plunged last Friday as sales of its slick new range of electric vehicles went into freefall.

Porsche abandoned its sales targets for battery-powered cars amid waning demand from customers. Ford is losing nearly $US50,000 ($A76,000) on every EV it sells, while Tesla’s profits dropped 45 per cent. Meanwhile, battery manufacturers such as Germany’s Varta are getting wiped out.

It has become clear that the EV industry is on the brink of collapse. Hundreds of billions of euros, dollars and pounds have been pumped into this industry by political leaders and the subsidy junkies that surround them – and it is surely time they were held to account for the vast quantities of taxpayer cash that has been wasted.

Mostly the article seems to be complaining about "the billions" wasted on EVs, which I assume is a reference to public policy. It's light on details (lucky the AFR has posted it as an opinion piece!).

"Profits at the German auto giant Mercedes plunged on Friday as sales of its slick new range of electric vehicles (EVs) went into freefall." Looking at the latest results from Mercedes, EV sales are down, but only 6% YoY. Free cash flow is down, but "free fall" doesn't line up with the battery-electric vehicle results.

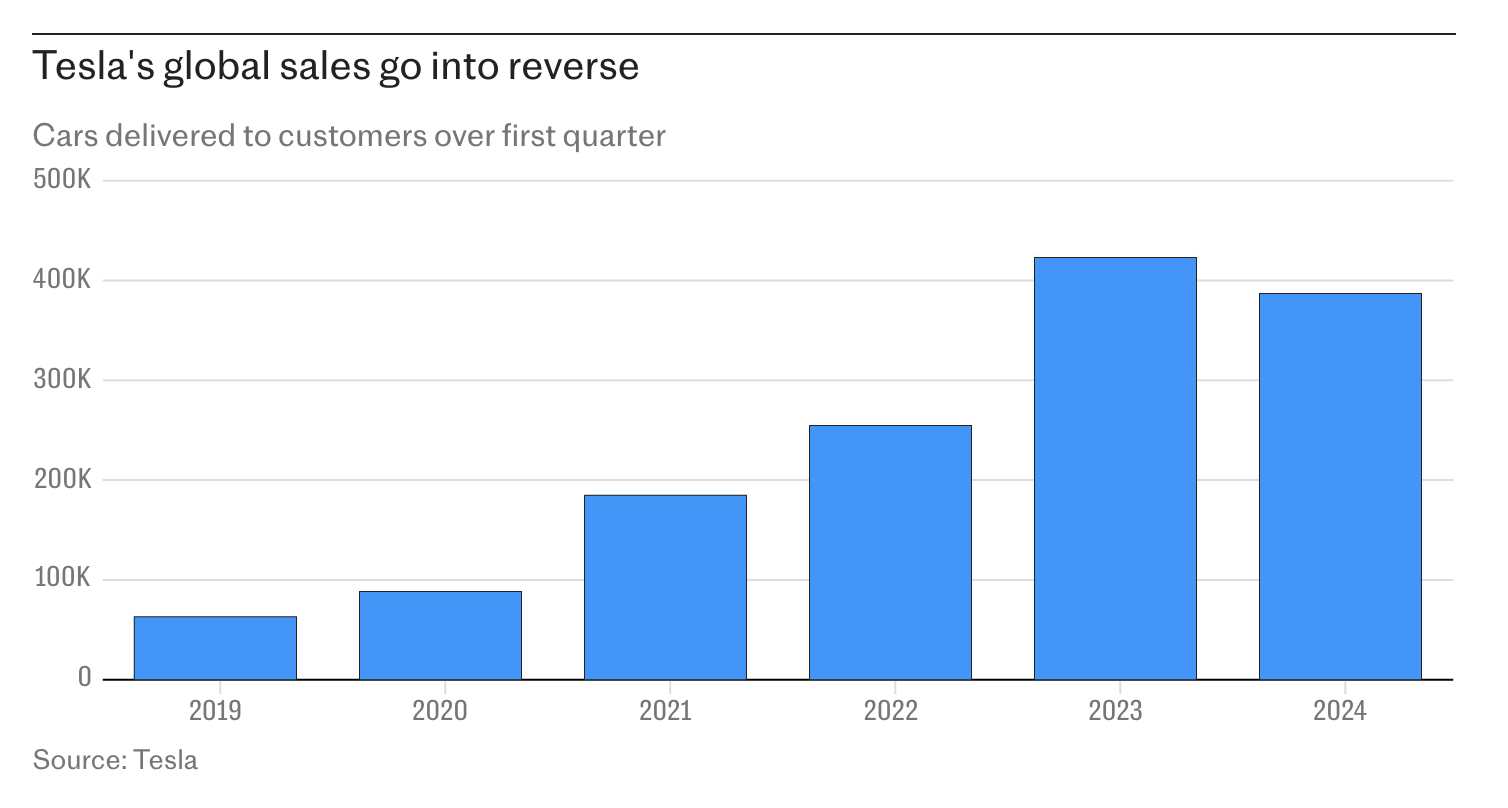

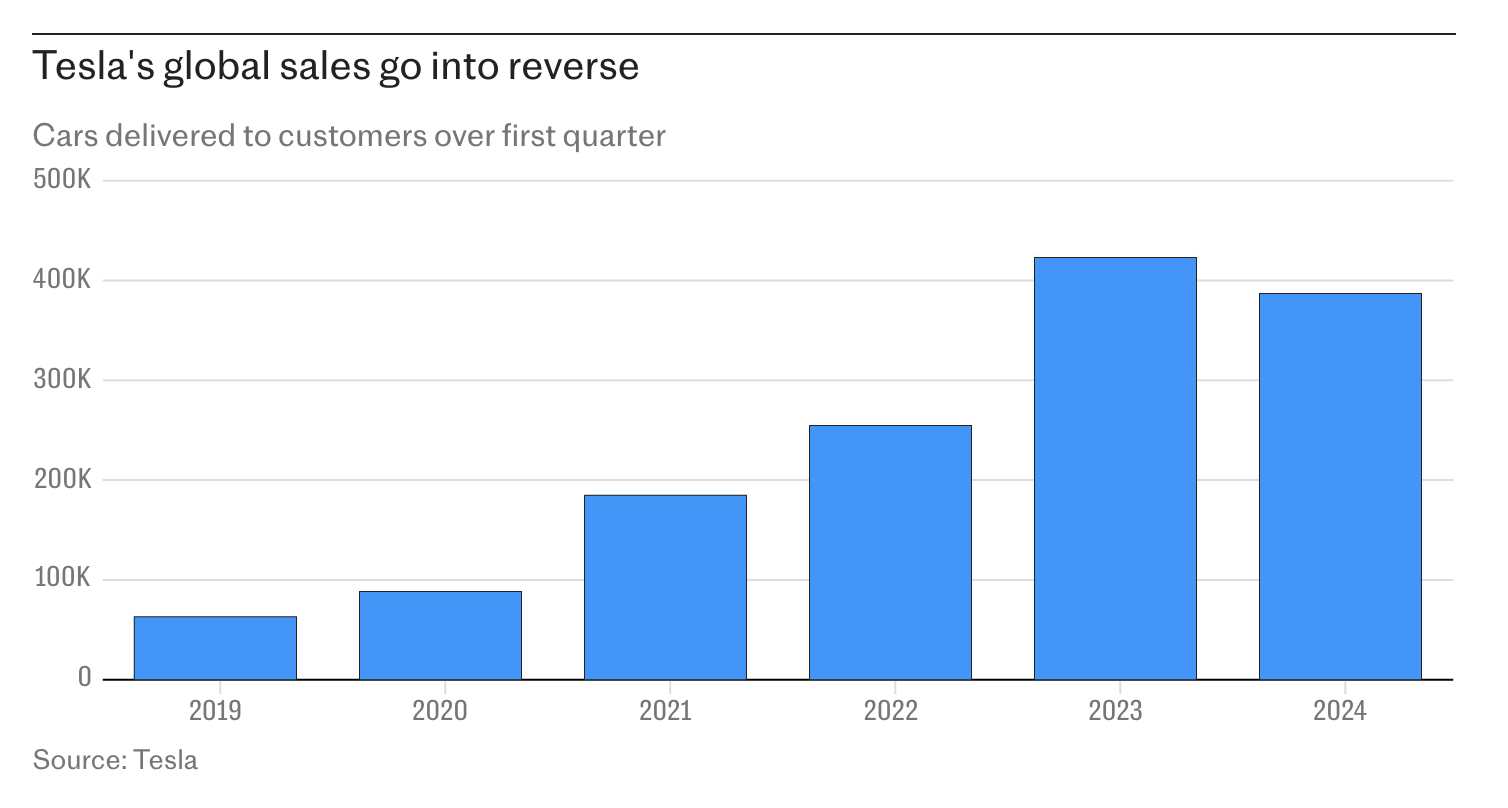

A graph is included titled "Tesla sales go into reverse"

Which is true - they are down for 2024! Or was 2023 an anomaly?

I don't follow vehicle manufacturers closely, and I think it's fair to say there are headwinds for vehicle manufacturers in general. But this article doesn't really bring any convincing arguments to support the theory that EVs are a failed experiment (though individual manufacturers might struggle)

My thesis around PLS is:

- many products are just far better when they are electrified, including vehicles

- battery-electric is a proven technology and will continue to be popular

- lithium will remain a critical part of battery manufacturing, and eventually we will move into the recovery phase of the cycle

I'm writing this as a reminder to myself: ignore the noise!