Pinned straw:

5th August 2025: Diggers & Dealers Investor Presentation [29 pages]

Slides from that presso are below in this straw.

Also today (5th Aug): Results from Initial Metallurgy Testwork at Lakeview

And yesterday (4th Aug): Mulwarrie Resource Update

And last week (30th July): Quarterly Activities/Appendix 5B Cash Flow Report

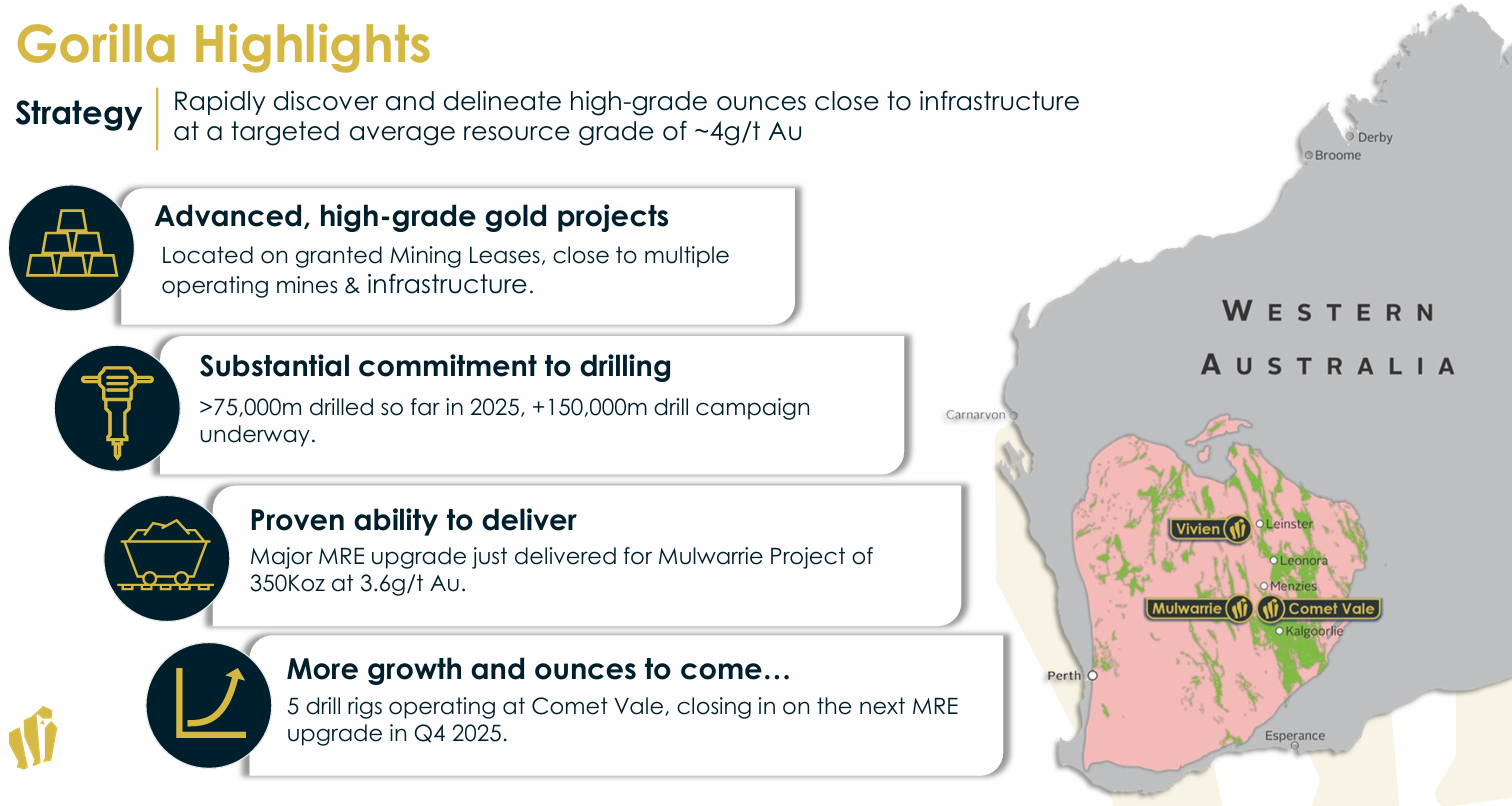

So, I've provided a price target (77 cents/share) and a brief overview of Gorilla Gold Mines (GG8) (formerly known as Labyrinth Resources Ltd) in my "Val" for GG8 here.

This straw is to provide a little more colour around their Board & Management, their skin in the game, more info on the locations of GG8's major WA gold projects particularly in relation to other gold producing mills (owned by other companies), and just how active GG8 have been so far and what their immediate plans are from here.

Warning: This is a pre-revenue company; they do not currently produce any gold; they are an explorer and maybe-wanna-be-project-developer, so there WILL be CRs along the way and it's much higher risk than an established gold producer. "Investing" in this one is more akin to gambling, and I'm betting that they find more gold and increase their own value while also making themselves more attractive as either a takeover target or a company with valuable assets that their neighbours might be interested in acquiring. I don't think GG8 will be progressing any of their projects through to production - my own opinion rather than fact - because I think they are a true exploration company run by geologists who are in it for the hunt - they love finding viable gold deposits and proving them up, selling them off, and then moving on and doing it all again.

That's the basis of my position in GG8 - they are a very active gold explorer run by very competent geologists who are finding more gold and adding value. It's an exciting gold play with money I can afford to lose if it all falls apart, but based on what they've found already, I doubt that they are going to go broke, the worst outcome scenario in my opinion is that they keep raising capital and diluting existing shareholders without finding enough gold to take them to that next level where they can sell off projects at good profits or be taken over themeselves. These sort of companies can keep mining shareholder wallets for years without ever providing a positive shareholder return, but that sort of outcome tends to come more from companies who don't do enough drilling and/or don't have good enough ground to start with. GG8 clearly have very good ground based on what they've already discovered there, and they are certainly very active with their drilling, so that's why I say they're one of the better explorers.

So I'm going to share some of the better (or more important, IMO) slides from today's 29 page D&D presentation in Kalgoorlie, without repeating stuff that I've already included in my "Val" for GG8.

Firstly, here's their Board & Management:

Simon Lawson was MD & Executive Chairman of Spartan (formerly Gascoyne Resources) prior to Spartan being acquired by Ramelius (RMS) recently, and Simon has now been appointed as Non-Executive Director (NED) and Deputy Chair of Ramelius Resources (see here). Simon is also a NED of Gorilla Gold (GG8) and their Technical Director (see here). Mr Lawson is a professional geoscientist with more than 16 years operational experience spanning multiple commodities and jurisdictions and was a founding member of Northern Star Resources (ASX:NST) that over his 6 years with the company transformed a small Western Australian gold mine into a multi-billion dollar global gold mining heavyweight. He also spent 3 years as the MD of Firefly Resources Ltd, a junior exploration company that merged with Spartan in November 2021. Prior to that Mr Lawson was Chief Geologist and alternate Resident Manager for TSX-listed Superior Gold (TSX.V:SGD) at Plutonic Gold Mine after selling the mine to the Canadian group out of Northern Star Resources in 2016-17. In his 12 months with Superior the 27-year-old Plutonic operation produced more than $20m free cashflow from month one through a combination of cost reduction, operational focus and commercial dealings. The man has some serious gold sector experience, particularly in management and exploration.

Alex Hewlett is a qualified geologist who is highly skilled at project identification and acquisition. Previously Chairman of Spectrum Metals Limited, Mr Hewlett oversaw its growth from mid-2018 through to Spectrum being taken over by Ramelius Resources (RMS) in early 2020. More recently, Mr Hewlett led the identification and acquisition of Tabba Tabba (from GAM owned by RCF) for Wildcat Resources Limited and the acquisition and development of the Mt Ida project (from Ora Banda) for Delta Lithium Limited.

Charles Hughes is GG8's CEO, and is a professional geologist with 17 years of experience in the resources industry, during which time he has held executive positions at Delta Lithium and senior management positions at Bellevue Gold, Northern Star and Saracen Minerals (which was Australia's 4th largest gold miner prior to being acquired by NST, now Australia's largest gold miner). Mr Hughes is highly skilled at identifying growth opportunities, developing and leading aggressive resource growth and development strategies, and delivering results. More recently, Mr Hughes has overseen more than 400km of drilling across multiple development projects in the last 3 years with Delta Lithium defining >40Mt of Li2O resource and >750koz of high grade gold resources as well as driving mining permitting, and mining and processing feasibility studies.

Matt Crowe, GG8's Exploration Manager, is an experienced exploration geologist with 20 years’ experience working for major and junior companies across a broad range of commodities in the Western Australian resources industry; including Principal Geologist at BHP, and Chief Operating Officer/Exploration Manager at Dreadnought Resources. He has extensive experience leading both greenfields and brownfields exploration teams which included discoveries in copper, gold, nickel, iron ore, rare earths and niobium. In 2023 he was co-recipient of AMEC’s Prospector Award for the Yin REE discovery which involved a period of rapid exploration and resource definition following the initial discovery.

Much of that can be found here: https://gorillagold8.com/directors-management/ but I've supplemented some of that info with some cross-referencing with other gold company websites, Commsec data and some LinkedIn profiles.

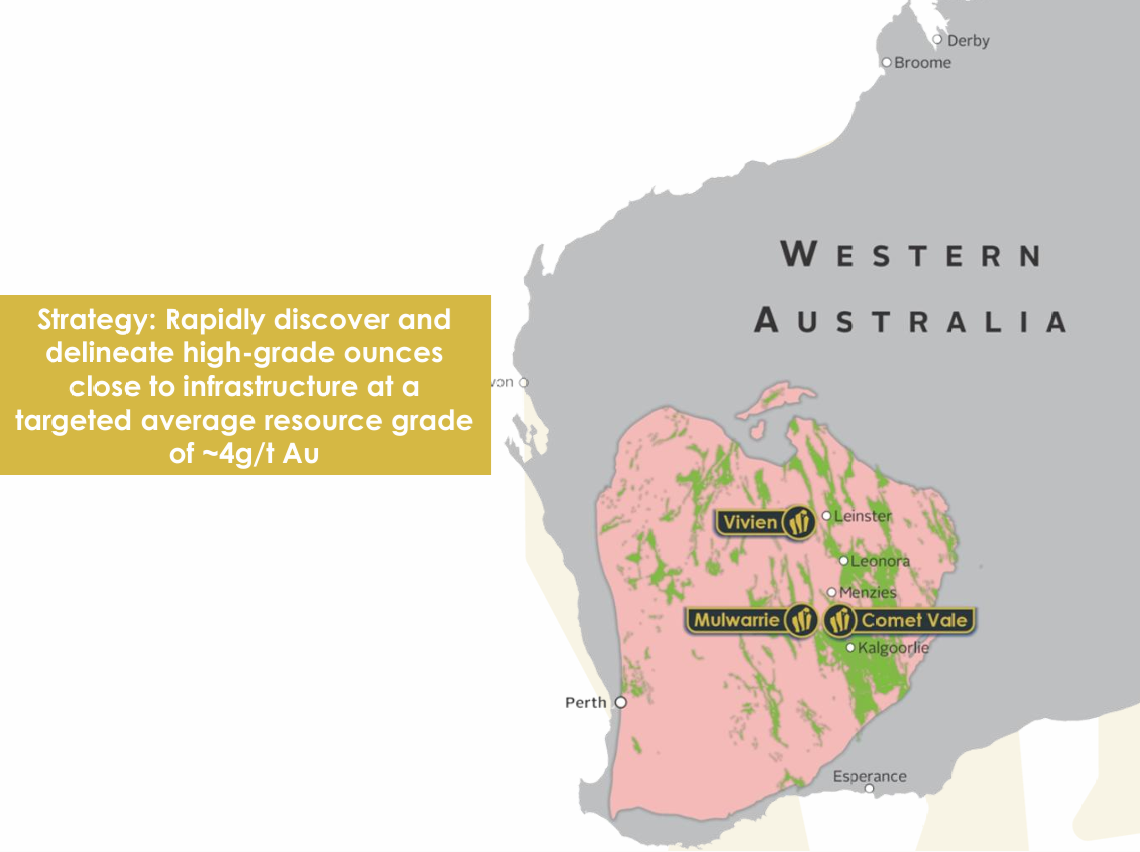

Next, the overview:

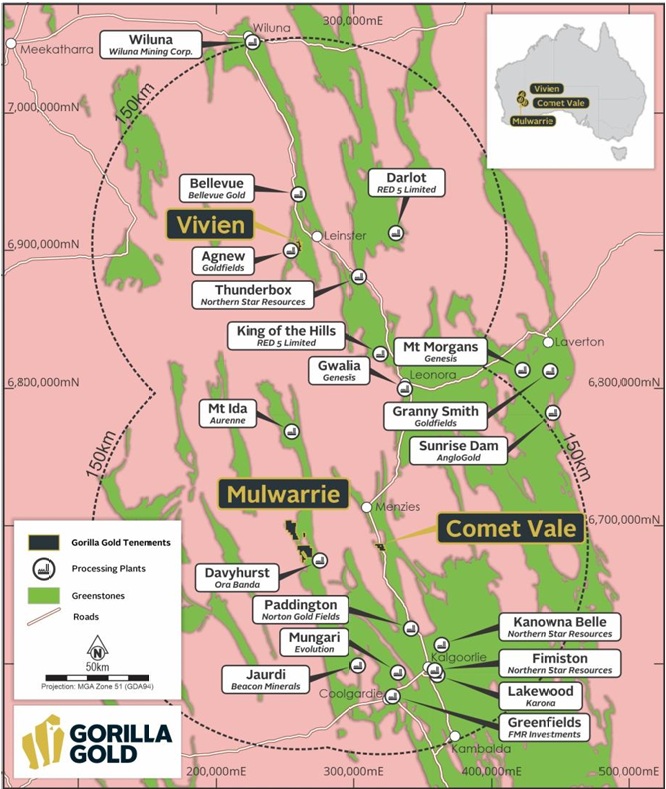

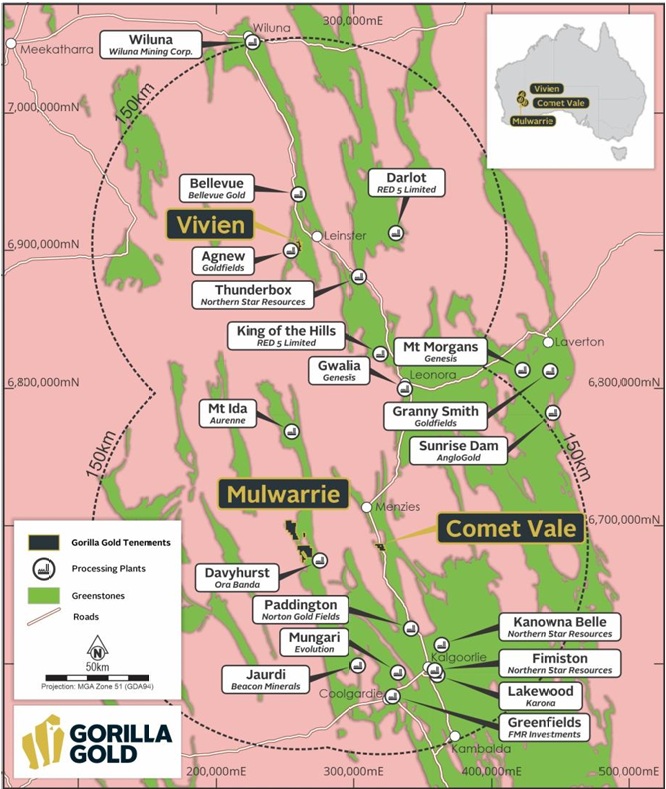

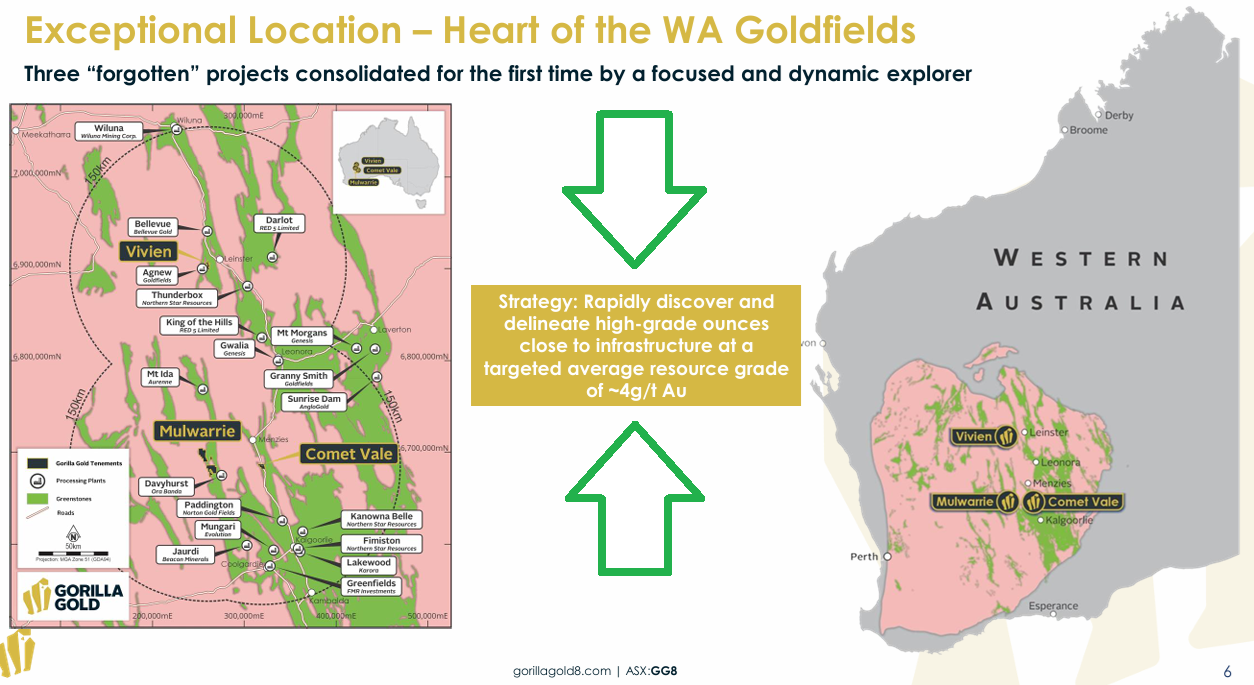

They also have a project in Canada, but they are entirely focused on their WA Goldfields assets at this point in time, and with good reason - look at where they are:

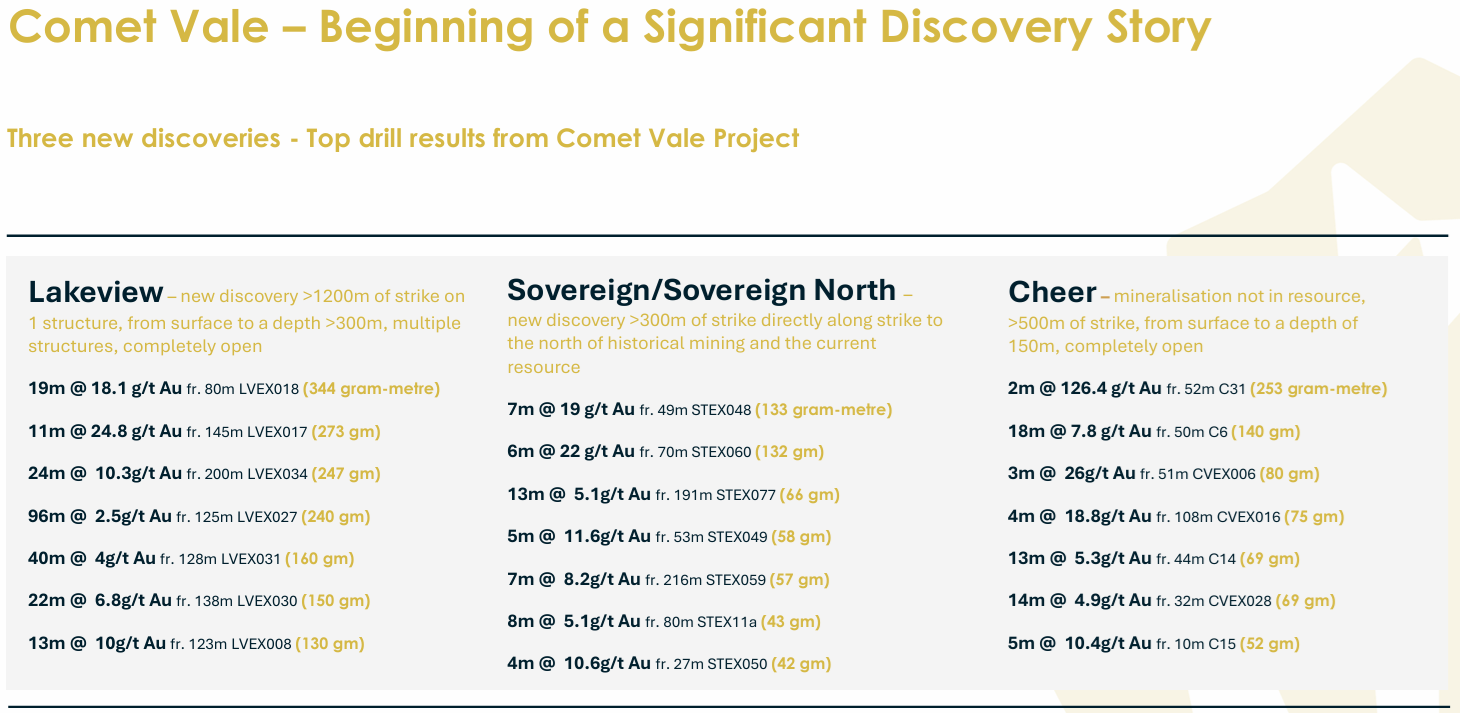

And the grades of gold that they're finding:

More on that in a minute - and also plenty of details of that in my "Val" for GG8.

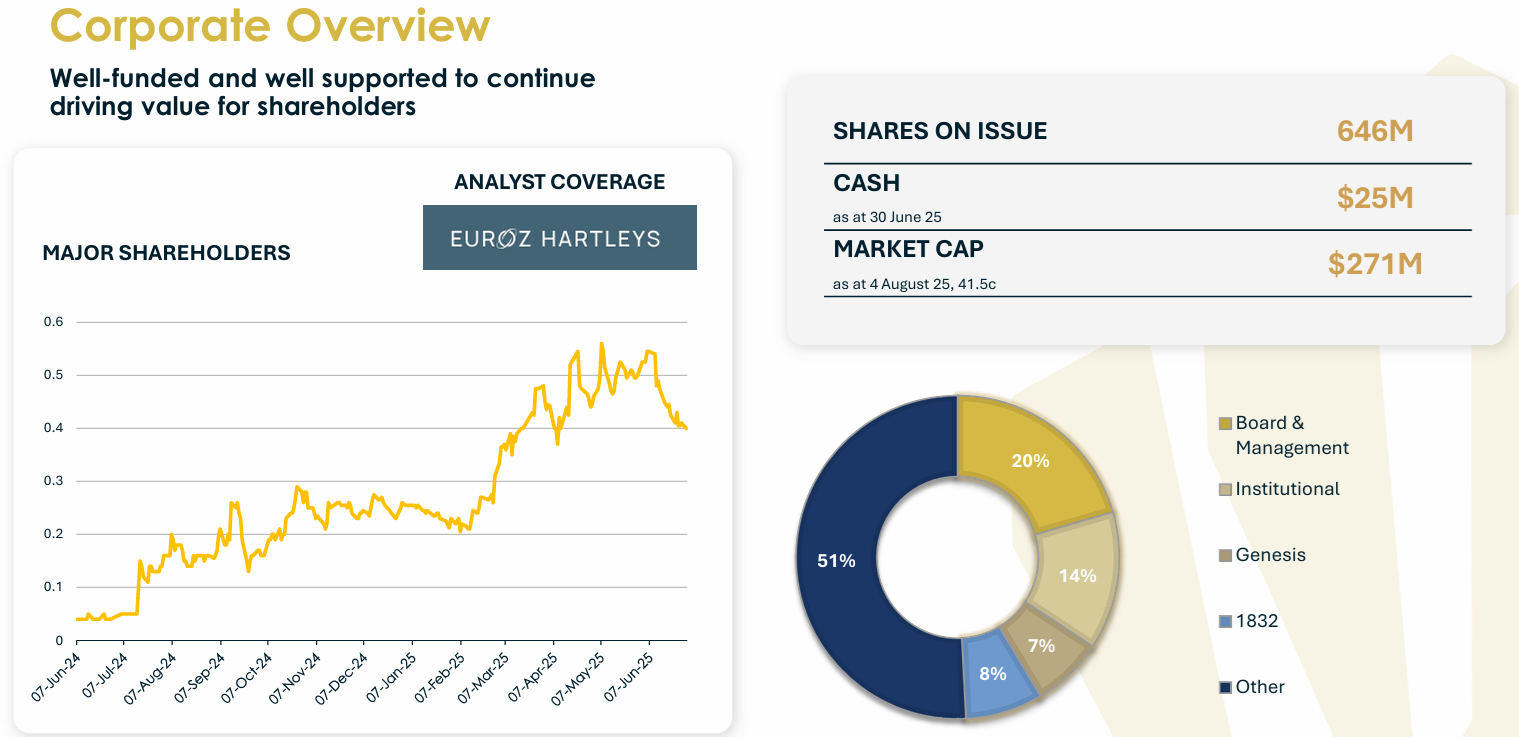

But firstly have a look at their ownership structure below. 20% owned by their Board and Management - that's substantial skin in the game - and 7% owned by Genesis Minerals (GMD) which is probably the best growth story among all of Australia's current gold producers (and yes, I do hold GMD shares).

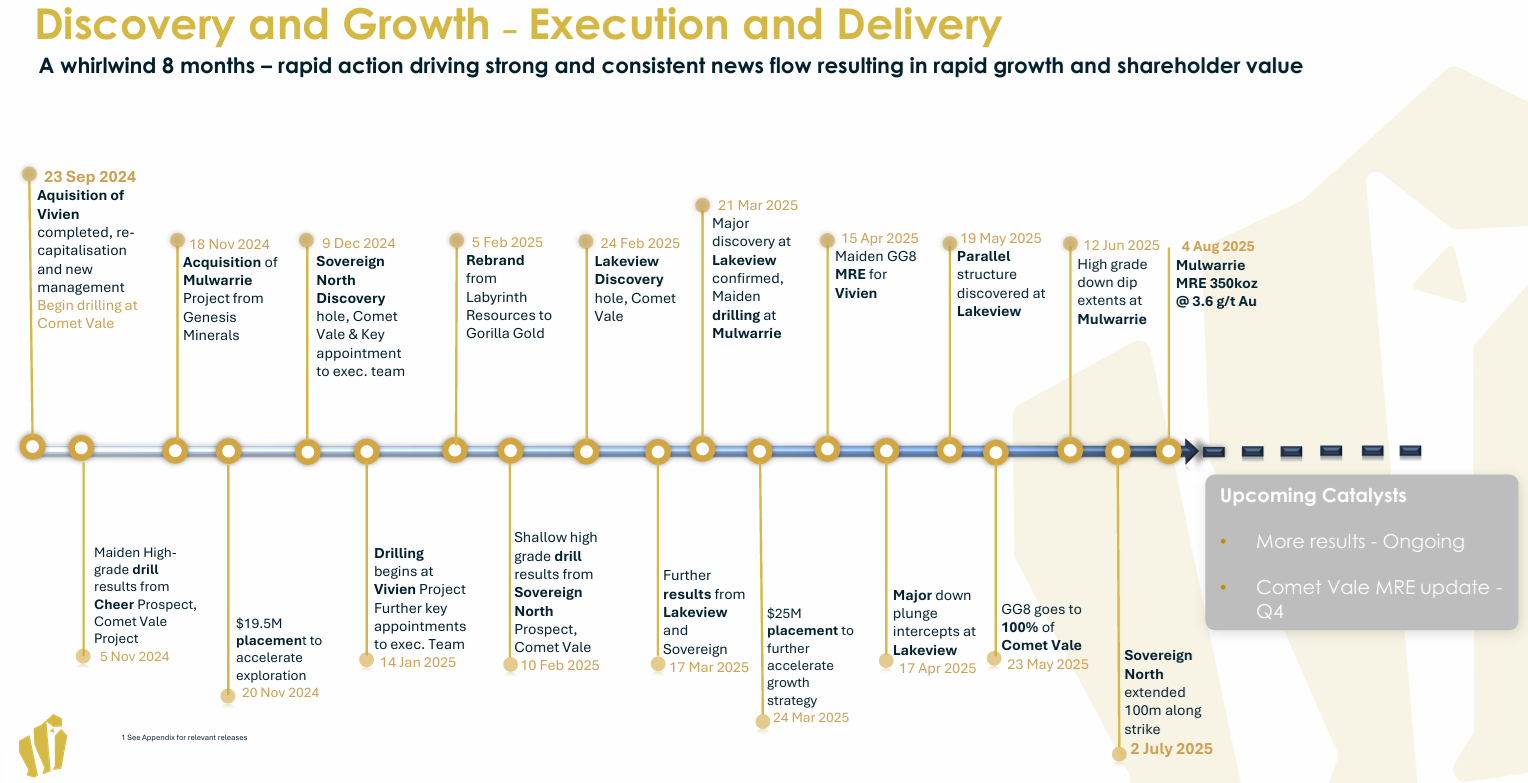

And their market cap is still sub-$300m. Next - what they have already achieved and the timeline they achieved it in:

A quick overview of some of their better recent gold hits at just one of their projects, Comet Vale:

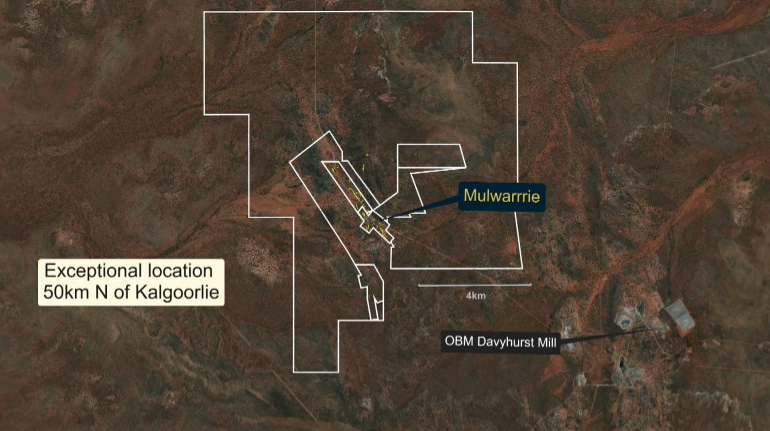

Below is a satellite image of Comet Vale with their tenements and gold hits marked on it, and then below that is the same thing with their Mulwarrie project, which is just 60km west of Comet Vale.

Here's just how busy they've been and will continue to be:

In Summary:

For more: https://gorillagold8.com/

Disclosure: Holding.

Bear77

That area map I just included in that straw came out very small. Just trying two other formats (.JPEG & .BMP instead of .PNG) to see if they are any larger and more readable:

So the JPEG file (above) is the best format - coz the .BMP file came out too small like the original .PNG one did in the post.

I've now replaced that image in the post with the larger .JPEG file.

Darlot and KOTH (King Of The Hills) are both shown in the upper half of that map as being owned by Red 5 Ltd, however Red 5 merged with Silver Lake Resources in mid-2024 and changed their name to Vault Minerals Ltd (VAU), so Darlot and KOTH are now owned by Vault (VAU), Otherwise the map seems to up to date. The reason I wanted to include it was to show just how many active gold mills and active gold mines are within close proximity to GG8's Vivien, Mulwarrie and Comet Vale gold projects.

In future I'll know to convert these maps to JPEG files so they display larger and show detail. You couldn't read the mine owners' names in the original version. Below is what the same image as a .BMP file and then a .PNG file look like:

Just a heads up for any of you that want to post this sort of content - all three images look identical (and are the same size) when you are creating the Valuation, Straw or Forum Post, it's only after you save the content and then view it that the sizes and readability changes. JPEG files retain their size and readability.

Bear77

I've just watched the actual video of the GG8 Presso @ D&D this past week; well worth the watch for those who are interested in a gold explorer who are SERIOUS about exploring, as evidenced by how much drilling they are doing every quarter and the results those drill cores are returning, which are very impressive:

Aug 5, 2025: 2025 | Gorilla Gold Mines Ltd - Charles Hughes, Chief Executive Officer

Disc: Held.

tomsmithidg

@Bear77 , what sort of timeframe would you expect for these guys to go from an explorer to a producer? Do you think they are set up to produce, or find and sell off? Is there a company that you would consider comparable that has gone from explorer to producer for evaluation purposes?

Bear77

I honestly don't actually expect GG8 to become gold producers @tomsmithidg - I believe they are a team of geo's that love the hunt and finding gold, and they'll sell off projects and keep doing the exploring and the finding and the proving out of deposits.

They are termed developers because they have 3 projects that contain mineable gold and they are developing those projects in terms of progressing the understanding of the deposits - through drilling and assays - through to declaring and increasing Resource estimates and converting as much of that as possible into Ore Reserves - so adding value through the drill bit.

I reckon that's one of the reasons why GMD (Genesis Minerals) are on the "Subs" list with 7.4% of GG8, where they can easily buy enough shares on market to move to 10.1% to block a takeover attempt if they needed to - I reckon Ral at GMD would like the optionality of adding Comet Vale and possibly even Mulwarrie to GMD's asset register, as they are they're not too far away from Leonora - they're between Kalgoorlie and Leonora but have a look at how close Comet Vale is to Genesis' Aphrodite and Bardoc assets (which includes Zoroastrian):

Source: https://www.proactiveinvestors.com.au/companies/news/219145/bardoc-gold-raises-1203-million-to-fast-track-gold-focused-strategy-219145.html [26-April-2019]

Note: Bardoc Gold, whose main projects back in April 2019 are shown on that map above with the red stars, and the one below (in 2020), was acquired by St Barbara (SBM) and then those were among the assets that Genesis aquired from St Barbara in mid-2023, so they're Genesis' assets now.

The following map was taken from the Bardoc Gold PFS presentation in early 2020 before SBM acquired them - showing their projects' proximity to Kalgoorlie:

Source: Page 5 of https://announcements.asx.com.au/asxpdf/20200330/pdf/44gj3f67yy630d.pdf

The following map from Genesis' website today shows how the Genesis gold projects stretch not only from Leonora to Laverton but also down to just above Kalgoorlie.

Below is GG8's map of Comet Vale and Mulwarrie:

Source: https://gorillagold8.com/project/comet-vale/

You can see that Genesis' Gwalia mill (@ Leonora) is at the top of that map, around 120km north of Comet Vale, but Genesis already own their Bardoc Gold assets alongside Comet Vale.

Now after Comet Vale and Mulwarrie, GG8's third most advanced project is Vivien which might NOT be on Ral's radar (at GMD), despite it technically being in the Shire of Leonora, about 14 km west of Leinster and approximately 6 km from the Agnew Gold Mine.

The Agnew Gold Mine (6km from Vivien) is shown in the top left corner of the following map of GMD's current tenements:

So I'm guessing Vivien is approx. 120 to 125 km (as the crow flies) from GMD's Leonora Mill, and even closer to (like around 80 to 85 km from) Vault's KOTH mill - remembering that many people expect GMD to make a move on VAU and gain control of that KOTH mill at some stage, although that's been the expectation for a couple of years and it hasn't happened yet.

That map above is from GMD's website today but is out of date as it doesn't show the tenements they recently acquired from Focus (FML), as shown below in a map taken from Genesis' D&D presso last week:

That one is down to just 50km radius circles around each of their two operating mills, but I think that Genesis' longer term aspirations extend beyond that.

Anyway, Genesis may or may not want to buy/own Vivien, but they do intend to make money if GG8 gets acquired by somebody else hence their current position as GG8's 3rd largest shareholders. And they would very likely prefer to have Comet Vale in their hands than let one of their competitors get their hands on it. My own thoughts are that Comet Vale ends up in Genesis' hands sooner or later and possibly Genesis may just buy all of GG8 to get Comet Vale (and Mulwarrie) if GG8 aren't interested in selling off Comet Vale and/or Mulwarrie in a separate transaction or two.

Remember also that Simon Lawson is on the GG8 Board as their technical director and he's the dude that turned Gascoyne into Spartan and got it merged with RMS and is now in charge of exploration at RMS - he does the second half of RMS' D&D Presso - well worth watching: D&D 2025 | Ramelius Resources - Mark Zeptner, MD & CEO and Simon Lawson, Deputy Chair.

I don't mind if Gorilla Gold take Comet Vale or Mulwarrie through to production, but I think it's far more likely that Comet Vale gets acquired by GMD or someone else and Mulwarrie's natural owners are really Ora Banda (OBM) whose Davyhurst gold mill is right next to GG8's Mulwarrie project. Alternatively, if OBM had spare milling capacity at Davyhurst, they might consider toll-treating ore from GG8's Mulwarrie gold project.

There's a reasonable amount of that going around these days - it's how HRZ are generating income - toll treatment agreements with various mills until they get Black Swan modified, operational and ramped up, which wouldn't happen before the end of calendar 2026 I'd reckon.

But the TL;DR summary is that no, I don't think GG8 are particularly interested in taking any of these projects through to production, at least not in the sense of building their own mill when there are multiple mills within trucking distance of their gold projects, and there are multiple producers with gold projects within spitting distance of theirs.

They could - Comet Vale looks like it would support a mill - but I just don't think that's what these guys are about - they want to keep finding gold - more than they want to be gold producers, in my opinion. I could be wrong. Either way they look good to me. High risk, but one of the better explorers. Most of their money is going to into exploration, and that's what you want from a gold explorer, especially when they're finding so much gold.

As far as your other question about comparable companies @tomsmithidg - none come to mind, purely because GG8 have so many prospects and they're progressing multiple prospects at the same time, so they're acting like explorers who are proving out their projects to sell off rather than acting like a company who wants to become a gold producer ASAP. In my experience, those companies that really wanted to be producers would focus almost exclusively on their very best prospect which in GG8's case would be Comet Vale at this stage, and some people might think they are doing that, but they're still drilling at Mulwarrie and they're still progressing Vivien at the same time. Genesis was sort of like that but they did a lot of M&A to grow rapidly and they did want to be major producers and that was their stated goal from the start. Most explorers want to get through to producer status ASAP so they can start to self-fund their further exploration efforts, and perhaps I'm totally misreading GG8 and that is indeed their plan, and if so they'd be plenty of comps around to point to, but building a mill takes a huge amount of effort and a lot of money so getting from explorer to producer - unless you go via the toll treating method - is both time-consuming and expensive - and really takes a lot of the focus away from exploration during that period - and I just get the strong feeling that GG8 are about the hunt. And so far they've proved to be very good at it.

There are multiple ways to make money in the gold game, and I reckon GG8 are very good at what they do and they're creating value - and can continue to create major shareholder value without every producing any gold, just by proving up deposits and selling them off to people who need or want more ounces for their existing mills.

PortfolioPlus

Excellent summary of the likely outcomes @Bear77 and very logical that you follow the interests and strengths of the company leaders. Hasn’t history shown that the skillsets of explorers are not necessarily a good match for mine developers and mine operators. Besides specialists are more knowledgable in their chosen field than generalists. The role of a brilliant geo is exactly that. Full stop.

And when you study Genesis, Raleigh is surrounded by a strong board and senior management who can think strategically and commercially about existing plant utilisation and ore transportation. For mine, as you have laid out (and boy, those maps certainly confirm it), Comet Vale’s future is pre ordained and GG8 will continue with ‘a hunting we will go’.

Bear77

Too right @PortfolioPlus - Exploration Geo's that are actually good at it are a rare breed and Simon Lawson has led a team of them at Spartan who are going to find a LOT of gold across Ramelius' tenements now in my opinion. I reckon the teams that are best at finding gold should ideally stick to that pursuit and not have to do what they consider the more boring stuff that comes with actually mining the stuff. Lawson also being the technical director at Gorilla Gold is a big plus, but he's not the only exploration Geo there, and GG8's track record in recent months is outstanding, and their MO seems clear to me.

Source: Page 6 of their 2025 Diggers and Dealers Presentation last week.

Disc: Holding.