Pinned straw:

$ACAD 2Q Earnings Report

Now for a more detailed analysis of the DAYBUE result and what it means for $NEU.

DAYBUE 2Q Revenue

DAYBUE revenue of US$96.1m was up 14% on the PCP and 14% Q-o-Q.

1H sales therefore are $180.7m.

FY Guidance of $380 – 405m is unchanged, although it will be reviewed (narrowed) at Q3.

US Sales

That the PCP and Q-o-Q % growth numbers are the same is a manifestation of two factors: 1) seasonal decline in Q1, now showing constently over two years and a feature of many US pharma products given the cyclicality of reimbursements and – more importantly for DAYBUE – 2) sales “pull forward” in Q4 taking some sales out of Q1. While this shocked the market in the first year of sales (even fuelling a short thesis that tanked $NEU SP), the pattern is now established and, I think, reasonably-well understood.

Unique active patients in the quarter rose to 987 from 954m, up 33, continuing the trend seen from Q4 to Q1 of 954 from 920.

Management said that sales have moved from "stabilisation back into growth", and Commercial VP Tom Garner said that they expect to see sales to “continue to accelerate”.

There have been several drivers, as follows:

- Persistency is strong. 12 month persistency if >50% and, for the first time, an 18 month persistency number of >45% was announced.

- Stability of the patient base is improving, with >70% of patient now having been on the drug for >12 months (up from 65% last quarter).

- The sales force expansion of +30% was completed in May, and they are now all in the field expanding the reach to community health care professions (HCPs), who cover 65% of the prevalent patient base. This sales force expansion has only impacted part of the period, and is therefore likely to be the key driver of management’s confidence that sales will accelerate.

- 900 HCPs have now written a DAYBUE Script, with 75% of new referrals coming from outside of the Centres of Excellence (CoE), which were the initial focus. $ACAD are actively transferring learnings of management of DAYBUE, which is now coming from the CoEs, and actively supporting the transfer of this knowledge across the prescribing base. There is increased confidence in titration strategies and GI management.

Overall, management sound pretty upbeat about the outlook, for the following reasons:

- Little over 30% of the patients diagnosed with Rett Syndrome have tried DAYBUE, and there being no other treatment.

- There are increased referrals from community HCPs who cover 65% of the patient base, and they will reach more of this segment via the expanded sales force. Early signs are that this sales strategy is working.

- Whereas HCPs in CoEs were easy to activate, the Community HCPs who rarely see a Rett patient need more support before they will prescribe. Thus management are confident that they will see accelerating scripts from this majority segment of the market over time as they continue to focus on it.

- Persistency data is holding up and providing a stable base of patients who have been on the drug from over a year. This is providing data and confidence around the longer term management of the medication.

- Discontinuations have remained well below 10% in the quarter.

- $ACAD have now launched the DTC channel in July, and sales reps are reporting patient enquiries to HCPs as a result, indicating that this will effective in reaching more of the prevalent population and also drive sale force productivity.

Progress Outside the US.

In the EU, “named patient supply” is available through $ACADs partner Clinigen. Some EU jurisdictions allow early access for patients when recommended by their physician, which is allowing $ACAD to make sales in the EU ahead of the drug being approved. There was no indication how significant these sales are. However, I imagine if will be very low numbers of patients.

Early access is also available in Israel and selected other countries via another distributor.

It will be interesting to see how this progresses. There is an active international support community for Rett, and the wider community is aware of the product’s availability in the US and it is reasonably to expect that over time, more and more will try and get their hands on it. Particularly, those able to pay.

My Analysis of the Revenue vs. Guidance

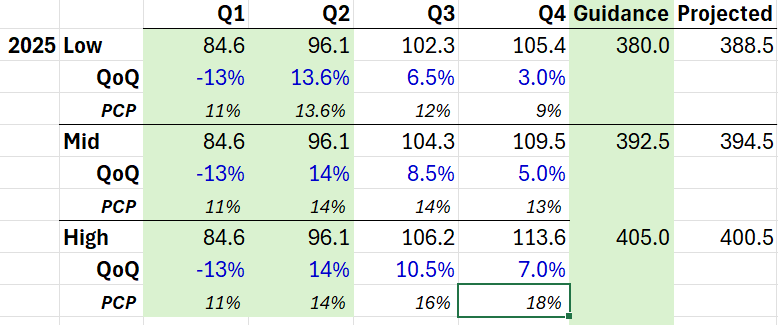

I now discuss my analysis of progress towards the FY number by reference to the extract below from my revenue model.

The "Projected" column are my calculations - and not management numbers.

Numbers shared green are actuals on the left and the guidance on the right.

I list both the % to PCP and QoQ numbers. You can see the sharp Q1 drop, which then drives the recovery in Q2 and the high Q2 QoQ result.

I’ve modelled three scenarios.

Low: In this case DAYBUE fails to achieve (in my interpretation) what management describe as “acceleration”. I assume the QoQ growth rates are no different than that achieved in 2024. In this pessimistic case, DAYBUE sales comfortably clear the low point of guidance ($388.5m vs. 380.0m)

Mid: In this case, DAYBUE sales achieve 200bps acceleration in QoQ % growth compared with the rate achieve in 2024, and the result is $394.5m, just ahead of the $392.5m guidance midpoint. In this scenarios, annual growth rate remains reasonable steady for the rest of the year.

High: In my bullish case, 400bps improvement in QoQ sales growth is achieved, leading to a gradual acceleration is the annual growth rate. Pretty bullish IMHO. In this case, 2025 revenue will be $400.5, below the upper end of guidance.

Overall, based on management’s statements this morning, I’d assign probabilities to these three scenarios as 10%, 70% and 20% respectively. Which means that my expense 2025 DAYBUE revenue is $395m - just a smidge over guidance midpoint.

And that’s which I think management have been right to leave guidance unchanged.

Implications for 2026 and Beyond

Clearly, improved % growth numbers, a strategy to cover more of the prevalent population and evidence that $ACAD are making traction in penetrating the broader market, together with a stabilisation of the longer term patient base all bode well for peak revenues. I’ve haven’t update my long term revenue model and won’t do this until the FY results are in and we have guidance for 2026. However, I now have higher confidence the US peak sales will likely exceed US$500m, probably ending in the range US$500-600m.

Implications for Neuren

I’ll leave it for CEO Jon to update his numbers for the FY. I don’t expect any change from last time, given that he will simply restate the royalites based off guidance.

However, I do expect his tone to be more positive. At 1Q he was very positive, but I’m not sure the audience necessarily brought into his enthusiasm. He’ll rightly say “told you so” so, but that is not in Jon’s nature. So, I expect he'll restate his messages, just with renewed enthusiasm.

Longer term, the $500m North America revenue milestone payment is almost certainly off the table for 2026 (it was never on im my view), but back on the table with high likelihood in my view for 2027. But I’ll revisit this at the end of the year.

Overall

A good result. As good as anyone could reasonably have hoped for,

I remain very impressed both with $ACAD's new CEO Catherine Owen and VP Commercial Tom Garner. Both are relatively new in the role, the former since Sept 2024, and the latter since December. There is a confidence and clarity in their communication that the previous management team failed to achieve (and which I have raged about in earlier straws).

Then again, we have to remember that the early days of novel drug launches are challenging. In rare diseases (in which I have zero experience), even more so. It takes time to understand how best to engage with HCPs, how to feed learning from patients and HCPs back into the sales force, particularly with a challenging drug like DAYBUE, where there are real issues to manage in its administration (titration, GI management). And so we have to remember that we are only two years into this product being in the market. (Let's also remember this lesson when we think about some other pharma companies with new products in the market,... ;-)! )

So perhaps the vastly improved clarity of communication is the combination both of 1) time in the market and 2) an uplifted management team. Whatever the mix, the fog around DAYBUE is clearing, and the outlook is looking more positive.

Day-Blue Skies ahead!