Have not read @mikebrisy 's notes prior to posting this as I wanted to form an unbiased view. Would be very interesting to see the extent of agreement/disagreement after I post this!

When I read the announcement this morning, I was braced for this to be a shit show ala BOT’s “July PAHH Nightmare” and another 50% haircut. But after listening to the Webinar and digesting the news, while disappointed, I remain bullish and will likely top up.

The webinar is well worth a listen. I have, and continue to find, Jim and David’s communication style to be forthright, clear, logical and sensible. That was again on display today as Jim walked through the Reimbursement drama which hit RECELL sales badly this quarter.

Prior to listening to the preso and digesting the news, my mental checklist was:

- Are the products still performing, medically?

- Has the TAM changed?

- Is the Acute Wound Care Portfolio Strategy still valid?

- Is the headwind temporary or permanent?

- What could management have done to proactively mitigate the issue?

- Do I feel that management could have done more to fix the issue

The Bad News

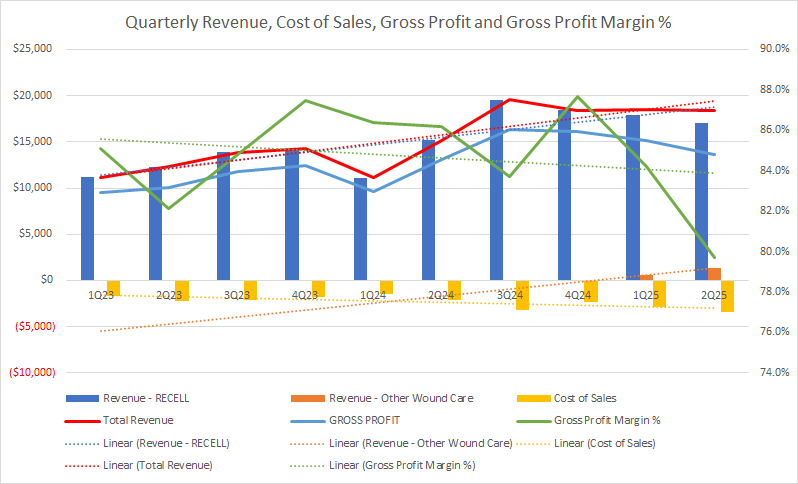

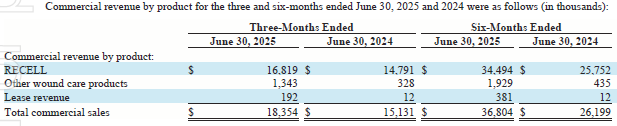

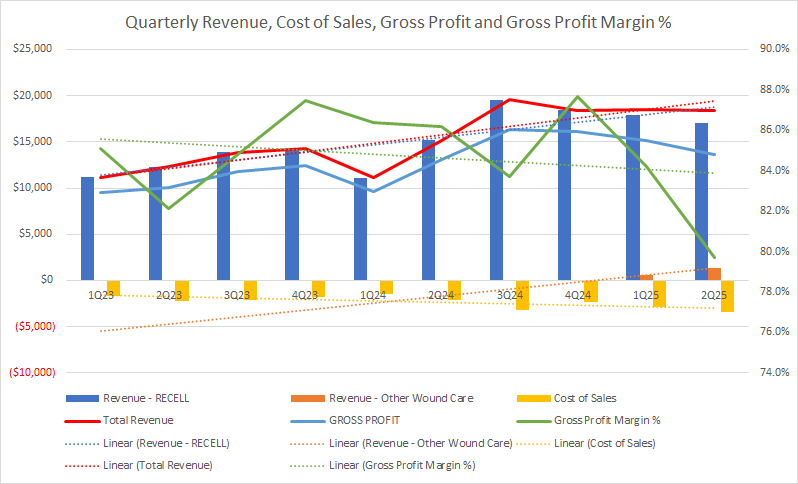

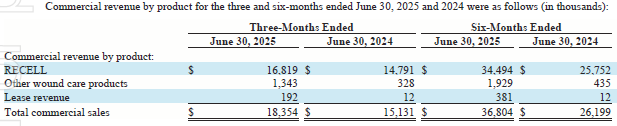

- Revenue was flat QoQ at $18.5m - the market needed to see a rise in 2Q revenue, for that bloody FY25 US$100m revenue target (a cursed number in Pharma, it would seem!) to remain live. Did not happen.

- The FY25 revenue guidance was a whopping ($25m) to $78-$100m, 25% down

- We then had cashflow positive and GAAP Profitability pushed out another 6M and 9M respectively.

- There was a “capital raise” of 400k shares to OrbiMed to pay for the Credit Agreement amendments - at the US share price of ~US5.00 to US5.30, this was a $2.0m to $2.12m hit, not quite small coin

- AND, another FURTHER capital raise was flagged by David - with cash at $15.3m, $11.3m in Receivables vs operating cash burn of $26m per quarter, there does not seem a way to avoid this, as I don’t believe AVH can sell its way in 2HFY25 to avoid this - the ask is too big.

- And so, the shorts got what they expected, and thus should have done well with this outcome.

HOWEVER,

The Positive Takeaways

All the bad news that the shorts hoped for has now manifested, so the anxiety around will they/won’t they make it, raise/no raise, is now mostly resolved (no they won't make, yes they will need to capital raise!) - I see that as a good thing as it feels like it is harder to make big money from a short thesis from here, but would like to see the updated short numbers to validate this thinking

The Claims Processing issue looks to be mostly behind AVH - I found Jim’s explanation very clear. It was another example of US Medicare-related diabolicalness. July and Aug RECELL demand looked good, that is a good sign. Shit happens, nothing anyone could have done about that but react, which management did. This issue will pass, but by when, and the impact on the demand recovery is more uncertain.

The clinical evidence on RECELL from the British Burns Association preso and the cost savings to both hospital and patient, has become significantly more compelling - 36% reduction in length of stay, where 1 day of stay is ~$11k of cost to the patient. This is based on 6,300 real-world patients in real world hospitals, not in clinical trials - this is a huge tick.

I really like the Acute Wound Portfolio strategy with CoHealyx and PermeaDerm gaining traction and the contribution to revenue increasing. These Other Wound Care products contributed 7.39% of total revenue in 2QFY25, up from 0.03% in 1QFY25, providing a bit of a buffer to the drop in RECELL demand. The only direction from here is up, really.

I also like that Recell Go Mini is clearly opening up non-burns trauma and trauma hospitals sales for small wounds - this market wasn’t as clear without Recell Go Mini.

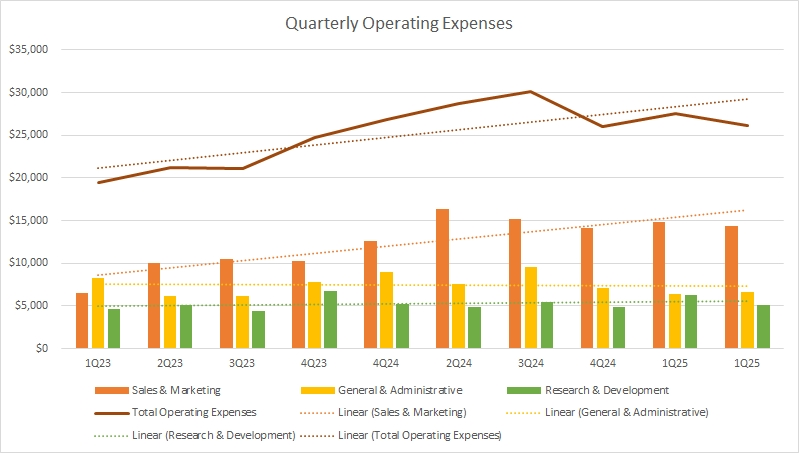

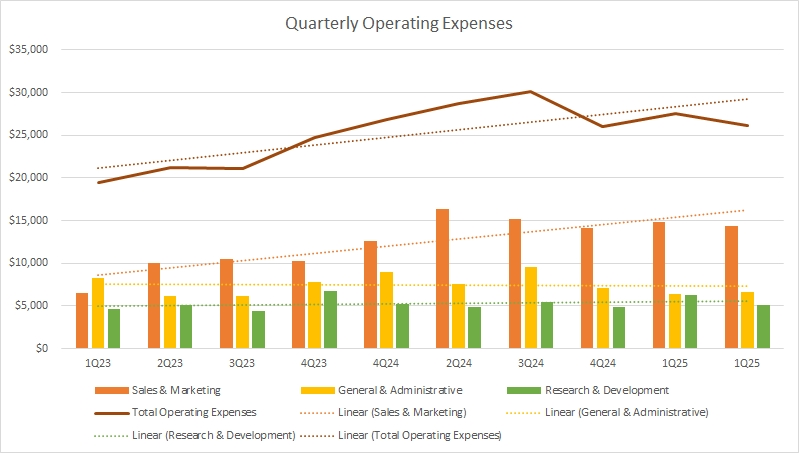

Operating expenses remain flat/falling and appears under control.

OrbiMed taking script instead of cash is a tick of their confidence

All said, yet another curveball has been thrown at AVH, and the impact did/does hurt. But it appears temporary.

I have a much shorter exposure duration to AVH, starting with Jim/David. The rationale for headwinds and missed expectations since I followed AVH have been consistently clearly explained and make sense, so, while I have been disappointed, the explanations have all made sense to me. It is clear that bad things happen in US medical launches, it is far from a straight line, and that is just how it is.

SUMMARY

And so, back to my initial questions to myself:

- Are the products still performing, medically? Hell yeah, and this looks like it is getting increasing attention

- Has the TAM changed? Nope, not at all

- Is the Acute Wound Care Portfolio Strategy still valid? Absolutely - the impact on revenue is now starting to show and can only go upwards

- Is the headwind temporary or permanent? Temporary, mitigating actions have been taken, and we should see the back of it in the coming quarters

- What could management have done to proactively mitigate the issue? Not sure what they could have done differently really - this is not an AVH issue

- Do I feel that management could have done more to fix the issue? I don’t think so

A capital raise feels imminent. I still think it will be circa US30-40m to give AVH 2 full quarters of cash until full revenue kicks in.

Looking at the volume and the “relatively muted” 13.62% drop, and the green candle, which I found totally surprising given the extent of the miss, I read 3 possible things into this:

- the short thesis could have manifested, the short thesis from here is less compelling, so the shorts took their money;

- some selling could have been deliberately absorbed to minimise the price drop in preparation for the imminent capital raise and/or;

- the market consensus was a similar, “Yes, it was shit, but ....” view that I have.

And so, while the AVH price will go nowhere in the short/medium term, I think another peak pessimism level has emerged - hopefully, this is the "last" one.

I remain bullish and will remain very patient for the turnaround to gain momentum. All the ingredients are absolutely in place, particularly the medical evidence. Throughout the webinar, announcements and numbers, have not seen anything that makes me nervous. We just need a clear 3-6M runway of no further curve balls, for revenue traction to be regained!

ACTION

From my current 2.45% allocation, I intend to top up when the price falls under to around $1.20-ish as I do expect it to drift lower further from here, up to my ideal allocation of ~3.0%. If there is a retail portion to the imminent capital raise, I do intend to participate.

Discl: Held IRL and in SM