Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

17 October 2025

$1.35 valuation as a placeholder, because the thesis underpinning my earlier valuation is blown.

There is no analysis supporting this valuation. It is the price I got for my shares this morning.

8 August 2025

I've slashed my valuation based on today's train-wreck revenue number. See today's straw for the details. I'll take a harder look at the valuation after earnings season.

A$2.19 (A$1.88 - A$2.50)

15 May 2025

See today's straw for detail.

A$3.48 ($A2.98 - $3.98)

(I should have rounded to $3.50 ($3.00 - $4.00)... never mind.... leaving it to be consistent with the Forum Post.

Regenerative medicine company $AVH has announced that CEO Jim Corbett is leaving his positions as CEO and Board Member, being replaced as CEO by Chair Cary Vance. The sting in this particular tail is that preliminary 3Q revenue will be approx. $US$17m.

My Assessment

No explanation is given, and there is no message from Jim. He is thanked for his service, in essence.

Let's just recap the last 4Qs of revenue: US$19.5m, US$18.4m, US$18.5m and US$18.4m.

Whatever contribution we have started to see from Permeaderm and CoHealyx, has presumably been swamped by the ongoing woes of the CMS coding debacle for ReCell.

I expressed some scepticism at management's statements last quarter that things were underway to correct this. And I pointed out that once hospitals take it off the order list (because they don't get paid), who's to say when it goes back on the list. And if it ain't on the list, doctors can't reorder it. And, as we know, there are plenty of alternative products with large sales teams and strong clinical data out there. Afterall, the likes of $ARX and $PNV are growing revenue nicely at 15% - 30% p.a., taking share in a category which is still probably growing at high single digits % p.a.

We're not told why Jim is leaving, but I'd speculate that the FALL in revenue is the final straw. At 3Q results guidance will be updated, and I expect it will be ugly.

Lenders OrbiMed are once more relaxing their revenue covenants and are "in discussions" about restructuring future covenants. So, there will be a price to pay for that, revenue growth get's pushed further out, and therefore the potential for needing new capital at some future stage increases. Hitting anything near the projections in my valuation cases seems to be moving ever further out into the future.

And so, while a CEO search is underway, shareholders now have the Chair of an underperforming Board step in as Interim CEO on $0.7m salary, with a guaranteed element of his cash bonus. Nice that for some the returns are guaranteed!

Then there's the ongoing legal investigation into whether Avita and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices. I know these are commonplace in the US and there is no indication that there has been any wrongdoing. But it just does add to the pile of potential issues we'll face in future.

Investment Decision

I took a modest RL speculative position in $AVH earlier this year (2.5% in RL, which I increased on SP weakness to 3.5%). At the time my intention was to signficantly increase the position if the "one stop shop" strategy showed early progress or "run for the hills" if it didn't.

I have stuck to my initial plan. Today, I have turned and run for the hills.

This business continues to make strategies and communicate plans that it cannot execute. I had to have a long think about this on my run this morning, because the CMS coding issue was genuinely something completely outside of the company's control or influence. And yes, once more today's SP probably represents a low point, and therefore a bad time to sell.

But I asked myself, what confidence do I have that the company can get back onto a strong revenue growth trajectory? And my asnwer was that I have no confidence, but at best hope. And hope is not a valid investment thesis. There are too many questions, and I have too many other places in my portfolio I'd rather put the capital in due course.

So, I exited my entire RL position at $1.35 this morning, a painful 23% loss. I should really know better by now!

Disc: Not held.

Not marked as SP sensitive, the market clearly disagrees as the following announcement provides a nice revenue kicker for ReCell in the US in non-burn applications.

Basically, $AVH announced that from October 1, 2025 to September 30, 2026, U.S. hospitals will be eligible for New Technology Add-on Payment (NTAP) reimbursement of up to $4,875 per case when using RECELL to treat acute, non-burn trauma and surgical full-thickness wounds. The NTAP, granted under CMS’s alternative pathway for FDA Breakthrough Devices, highlights RECELL’s clinical value and innovation.

RECELL enables clinicians to create a Spray-On Skin™ cell suspension from a small patient skin sample, reducing donor skin needs compared with standard grafting. A 2024 randomized trial showed RECELL achieved equivalent wound closure outcomes while using 27% less donor skin, lowering donor site complications such as pain, delayed healing, infection risk, and scarring. The new reimbursement is expected to improve hospital access and expand patient use.

My Assessment

Perhaps because the market is awaiting news on the remediation of the CMS coding debacle for RECELL, the company has decided not to flag this as price sensitive. In any event, I didn't have this on my radar screen before today.

The top-up is significant, with the cost of the RECELL component of a 10-20% surface area wound being in the range $6,500-$13,000. However, it is hard to translate this into a potential revenue impact, partly because I don't know what proportion of the sales are eligible. So, afterall, perhaps it is not material at a group revenue level.

Maybe I am drawing too long a bow, but if CMS has granted this priority payment, you'd think they'd have applied themselves to working with their payment contractors to get the re-coding issue sort out. That's the news I am really waiting for, i.e., 1) is the coding issue sorted out and 2) have the hospitals and surgeons that stopped ordering in Q1 and Q2, started again.

I expect we'll have to wait another month or so for that update, when $AVH reports its quarterly.

Don't get me wrong - I'll take today's good news!

Disc: Held in RL and SM

At last!

Today’s CE Mark approval for RECELL GO unlocks AVITA Medical’s long-planned entry into Europe.

Rather than building its own salesforce, AVITA will commercialize the product through third-party distributors, a lower-cost strategy that leverages existing specialist networks. Distribution agreements are already in place across Germany, Austria, Switzerland (via PolyMedics), Benelux, the Nordics, the U.K. and Ireland, with Italy, Spain and Portugal close behind. This coverage secures AVITA a footprint across nearly all major Western European healthcare markets.

The maturity of the sales plans highlights the delay in getting the CE Mark, which CEO Jim Corbett repeatedly blamed in the past on "bureaucratic delays", but which I have previously cited as evidence that the company consistently sets expectations and targets that it then fails to deliver on - albeit several strictly being beyond its control.

The company’s marketing approach outside the US emphasizes ease of adoption. Unlike earlier RECELL versions, RECELL GO requires less training and case support, making it easier for European hospitals to integrate. AVITA expects its distributors to drive uptake through established hospital relationships, with reimbursement supported by national health systems. However, management has cautioned that international revenue contributions in 2025 will be modest, given reliance on distributor-led rollouts and the time needed for value analysis and reimbursement processes. In my view, it will likely be 2027 before revenue contributions outside the US are material.

With CE Mark approval, the company transitions from being a U.S.-centric player to one with a scalable global platform in acute wound care. While near-term sales will be limited, the groundwork is laid for Europe to become a significant revenue stream from 2026 (or 2027?) onward, particularly in high-volume trauma and burn markets.

Referring back to last week's post, this timing could not be better (accepting that it is delayed) given the recent presentation at the Europe Burns Conference on the reduced time in hospital for patients treated by Recell. This will both assist with reimbursement and be a boon to marketing efforts.

My Assessment

This is good news for the medium to longer term prospects for $AVH. In my view, the CE Mark decision was always a question of "when" and not "if".

Following the distributor model is the right thing. $AVH has to steward its cash carefully, and CEO Jim Corbett knows that getting to profitability and postive cashflow is key to creating some investor confidence around this company. He is wise to be focused on that.

While this good news might create some long-absent positive sentiment for this beaten up biotech, the major SP re-rate will await the 3Q result at the end of October, and any news of how sales in the US are progressing, and whether the CMS coding debacle has been resolved and to what extent hospitals are ordering again. For me, that is an vital test of management's credibility, given their detailed descriptions of what went wrong in Q1 and Q2. From my perspective, Q3 and Q4 have to deliver.

I still believe that $AVH's time will come, soon, so I am a HOLD for now.

Disc: Held in RL and SM

Nice Release confirming RECELL results in 36% shorter hospital stays vs traditional skin grafting.

Won’t move the dial on the share price as the market is clearly in show-me-the-revenue mode, but this is pleasing as it makes the real-world evidence-based case to use RECELL that much more compelling for Burns hospitals, trauma centres and surgeons.

The objective would surely be to get to the point where the AVH bods can say to the hospitals “Why on earth are you NOT yet using RECELL”?

- A greater proportion of RECELL-treated patients were discharged directly home, indicating improved recovery trajectories

- Analysis had:

- 741 adults from the Burn Care Quality platform registry

- 247 patients treated with RECELL experienced an average 5.6 day reduction in hospital LOS

- 36% decrease compared to those treated with split thickness skin graft, 494 patients

- Economically impactful:

- Based on an average daily inpatient bed cost of $7,554, use of RECELL is associated with potential per patient cost savings of $42,000, exclusive of procedure and rehabilitation costs

- Reduction in LOS may enable hospitals to treat 13 more patients per bed annually compared to treatment with STSG alone

- In 2023 alone, US burn cases consumed more than 110,000 ICU days, costing in excess of US$676m

Chart Review

The AVH price has drifted downwards as expected and seems to be forming a reasonable base around $1.32 to $1.33, a tad higher than my expected low of ~$1.28, which goes back to the last June 2022 low. Daily volume has stayed flattish, so its all been pretty orderly thus far.

I topped up last week at $1.355, probably a wee bit impatient, but I have one more top up ready to deploy if it gets below $1.30.

Director Top Up

Sorry, forgot to add this.

The top up of 10k shares on market was 15% of his prior holdings of 63,291 ... not much, but this was in isolation, and with his own US$45k coin ... can't be bad!

Discl: Held IRL and in SM

I attended the $AVH webinar this morning. @jcmleng I assume you saw it too?

While there wasn't much new information from last week's results, I found it useful and have 2 additional significant takeaways:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

2. Additional Insights on Cash Position - even though there is every likelohood (based on my analysis) that management misses Q2 2026 cash breakeven, the $30m funding should be ample, unless revenue growth only makes the bottom end of guidance. Some details disclosed by the CFO really helped me to firm up my own model and foreacsts.

In detail then:

1. Existing and new clinical data expected in the next year will really drive US sales, including account conversions.

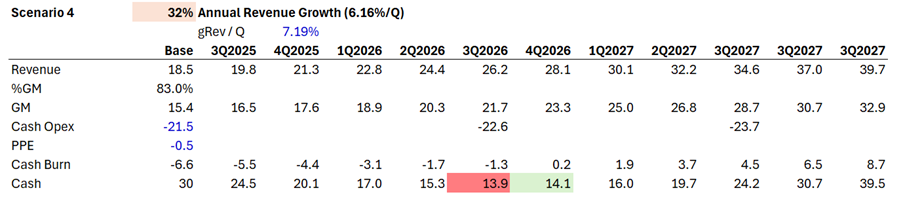

I think it was the best (clearest) summary I've heard Jim give of the products from a surgeon's/patient's perspective, as well as restating the economics.I've dropped a couple of the key slides at the end of this Straw. (If they don't publish a recording of the webinar and if there isnt a transcript, then I can post a link to an audio recording I made if anyone wants it.)

With the focused (i.e. small) clinical studies for Cohealyx (# days better than competing dermal matrices) and Permaderm (cost vs. allograft standard of care) and the recent British Burns Association study on 6300 patient for the -36% less time in hospital for ReCell (to drive burns market penetration up from 20-30% to much higher), the sales reps are going to be armed with compelling data to convert accounts across all levels of burns and trauma acute care. $AVH really could pull off a very potent "one stop shop".

There are significant risks here for $IART and $PNV. $ARX is less exposed (as they have a more diversified product range and have more for internal reconstruction as well as more chronic wound management). Of course, each of these are driving and will be promoting their own clinical data. However, I think $AVH might overall have the edge here.

The emerging $AVH clinical strength combined with the slowing $PNV international sales has significantly undermined any chance I have of a developing a renewed thesis in $PNV. Initially, given 2H stabilising growth in Q2, I was open to taking a fresh look when I get to see the FY financials in a week or two, given that $PNV is now starting to through off cash. But I'm not sure I can have any conviction until I see evidence that Cohealyx doesn't start making headway in the US!

Returning to the $AVH webinar, there were a few positive nuggets (June = highest quarter-end month; July best first-month-in-a-Q in a year) as well as the e-ordering frequency for the large Cohealyx account is a positive (i.e., it wasn't just initial stocking of a new product, the surgeons are using it.) Remember, Cohealyx is only getting started.

2. Additional Insights on Cash Position

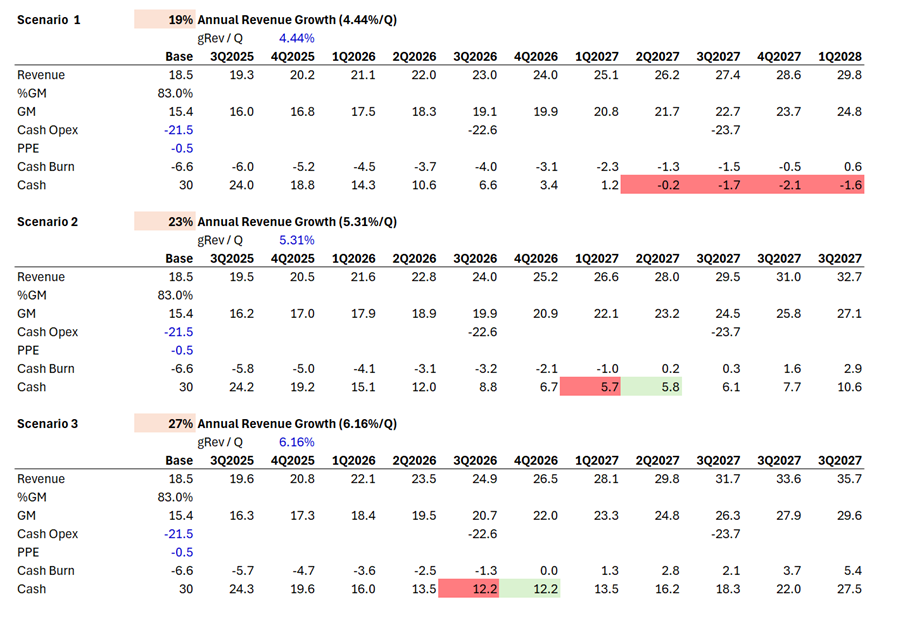

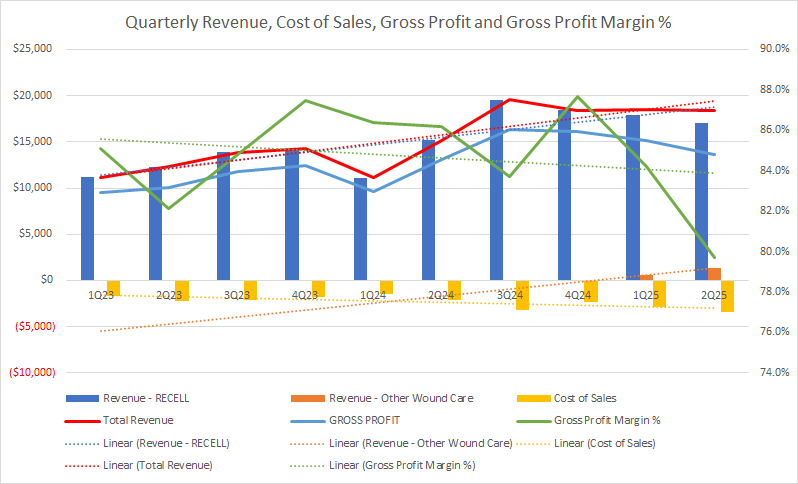

On cash, the CFO gave a nice simple calculation on cash flow as follows:

Rev. $18.5m/Q at %GM 83% (midpoint) = $15.4m as the starting point for last Q.

Cash Expenses: $21.5,/Q - holding steady for the next year, (but I'll then escalate by 5% from Q3 2026 and again by 5% from Q3 2027)

To this, I've added an allowance for investing cash of $0.5m per Q, which is lower than historical, but my sense is that they are really tightening the screws. (CFO was slient on this). For example, putting on ice altogether a go-to-market for vitligo, for which they have FDA approval. That to me is a measure of how focussed they now are.

From this, I've generated a few simple scenarios for quaterly cash burn as follows, with the bottom line of each table shoing cash balance. I've ignored them throwing in $9-10m receivables into the mix, because every business needs working capital!

It is possible that I've been a bit bearish on %GM, but I think that as Cohealyx and Permaderm grow, as licensed products, they will drag down the %GM, as we saw in this Q with the pressure on Recell sales.

The CFO today allowed me to sharpen up my own view, which says they'll make CF break even some time between 4Q 2026 and 1Q 2028.

This confirms my ingoing bias, that they don't leave a lot of fat in their guidance calculations (hence, the set-up for disappointments) .

Now that said, it is entirely possible that revenue growth EXCEEDS the guidance range. If you are bullish on the clinical data and their ability to sell that into their US customers, then a 32% revenue CAGR would not be out of line with this sector, and it pulls CF break even forward by another quarter.

Management are saying they will ge tto CF breakeven earlier than all of these scenarios. So what do I have to believe to trust that? Any of the following will do:

- They are even tighter in screwing down investing capex

- Revenue rebounds more strongly in Q3 2025 and Q4 2025 after the CMS/MACs reimbursement issue is solved

- As Recell rebounds, they get a higher %GM, more like 85% in line with history

- I've not accounted for price rises being pushed through in 2026 and 2027, so this is a material lever (e.g., $PNV pushed through +10% last year, but they are much cheaper per treatment and having more pricing headroom.) i.e. my modelling is unbalanced, as I've put 5% annual inflation on Opex.

OR

- Management are rubbish at giving guidance and will miss this one again.

In any event, a $30m cash position looks good in all but the lowest of the scenarios I've generated.

My Key Takeways

It was good to get a second soak of this information today. I've sharpened my view on their cash flows, and amassing $30m is probably going to be god enough.

For me the upside catalysts in the Q3 2025 report will be:

- Revenue growth rebounds, above guidance midpoint with anecdotes of acceleration

- Confirmation that CMS/MACs remediation is complete

- Progress on recruitment in Cohealyx and Permaderm mini-trials

- Some further quantification on early uptake/ account conversion / re-ordering of Cohealyx, including material orders (e.g., $0.3m per account in a month)

A positive report on the above would - I strongly believe - mark a significant, tangible step forward in the "turnaround". Absence of good news on 3 out of 4 would likely trigger my exit.

Disc: Held in SM and RL

----------------------------------------------------------------

Appendix - 2 Key Slides Explaining the Product Portfolio from the Surgeons/Patient's Perspective

As @jcmleng and I pointed out last week, $AVH is raising capital, given the slippage in their revenue trajectory and the 6 months+ delay to achieving breakeven, based on their current view.

Well, that statement should have been in the past tense... they've raised capital and, at a price of $1.32 per CDI, that's no too much of a discount, given that's almost as low as the SP got on the recent bad news.

At $23m the raise is somewhat lower than we expected, adding 17.2 million ASX CDIs or 3.44 million NASDAQ shares. So with 26.6m shares, that's a dilution of c. 13% - far some ideal, but there you have it.

My valuation basis week included a 20% dilution up to my target date of FY28. Given their share-based compensation running at 1-2% p.a., I'm still in the ballpark PROVIDED they achieve the target of breakeven in Q2 2026. And that's the rub of course with this management team. You really can't pay any attention to their forecasts, and have to form your own view, based on track record.

(I'm don't mean to be unduly negative. All I am saying is that my investment thesis is NOT reliant on management hitting their targets! I discount what they say based on their track record over years.)

Today, SP is up 11-12% on the news, which I guess is market relief that the liquidity risk is eased,... for now.

There will be an investor webinar at 9am, tomorrow. (Link to Register)

I've already posted my question for tomorrow, along the lines of: "What is the basis for your statement "national harmonization expected across all MACs; RECELL demand expected to recover in H2"? What visibility do you have into the engagement between CMS, MACs and the providers on this matter?"

Held in RL and SM

Have not read @mikebrisy 's notes prior to posting this as I wanted to form an unbiased view. Would be very interesting to see the extent of agreement/disagreement after I post this!

When I read the announcement this morning, I was braced for this to be a shit show ala BOT’s “July PAHH Nightmare” and another 50% haircut. But after listening to the Webinar and digesting the news, while disappointed, I remain bullish and will likely top up.

The webinar is well worth a listen. I have, and continue to find, Jim and David’s communication style to be forthright, clear, logical and sensible. That was again on display today as Jim walked through the Reimbursement drama which hit RECELL sales badly this quarter.

Prior to listening to the preso and digesting the news, my mental checklist was:

- Are the products still performing, medically?

- Has the TAM changed?

- Is the Acute Wound Care Portfolio Strategy still valid?

- Is the headwind temporary or permanent?

- What could management have done to proactively mitigate the issue?

- Do I feel that management could have done more to fix the issue

The Bad News

- Revenue was flat QoQ at $18.5m - the market needed to see a rise in 2Q revenue, for that bloody FY25 US$100m revenue target (a cursed number in Pharma, it would seem!) to remain live. Did not happen.

- The FY25 revenue guidance was a whopping ($25m) to $78-$100m, 25% down

- We then had cashflow positive and GAAP Profitability pushed out another 6M and 9M respectively.

- There was a “capital raise” of 400k shares to OrbiMed to pay for the Credit Agreement amendments - at the US share price of ~US5.00 to US5.30, this was a $2.0m to $2.12m hit, not quite small coin

- AND, another FURTHER capital raise was flagged by David - with cash at $15.3m, $11.3m in Receivables vs operating cash burn of $26m per quarter, there does not seem a way to avoid this, as I don’t believe AVH can sell its way in 2HFY25 to avoid this - the ask is too big.

- And so, the shorts got what they expected, and thus should have done well with this outcome.

HOWEVER,

The Positive Takeaways

All the bad news that the shorts hoped for has now manifested, so the anxiety around will they/won’t they make it, raise/no raise, is now mostly resolved (no they won't make, yes they will need to capital raise!) - I see that as a good thing as it feels like it is harder to make big money from a short thesis from here, but would like to see the updated short numbers to validate this thinking

The Claims Processing issue looks to be mostly behind AVH - I found Jim’s explanation very clear. It was another example of US Medicare-related diabolicalness. July and Aug RECELL demand looked good, that is a good sign. Shit happens, nothing anyone could have done about that but react, which management did. This issue will pass, but by when, and the impact on the demand recovery is more uncertain.

The clinical evidence on RECELL from the British Burns Association preso and the cost savings to both hospital and patient, has become significantly more compelling - 36% reduction in length of stay, where 1 day of stay is ~$11k of cost to the patient. This is based on 6,300 real-world patients in real world hospitals, not in clinical trials - this is a huge tick.

I really like the Acute Wound Portfolio strategy with CoHealyx and PermeaDerm gaining traction and the contribution to revenue increasing. These Other Wound Care products contributed 7.39% of total revenue in 2QFY25, up from 0.03% in 1QFY25, providing a bit of a buffer to the drop in RECELL demand. The only direction from here is up, really.

I also like that Recell Go Mini is clearly opening up non-burns trauma and trauma hospitals sales for small wounds - this market wasn’t as clear without Recell Go Mini.

Operating expenses remain flat/falling and appears under control.

OrbiMed taking script instead of cash is a tick of their confidence

All said, yet another curveball has been thrown at AVH, and the impact did/does hurt. But it appears temporary.

I have a much shorter exposure duration to AVH, starting with Jim/David. The rationale for headwinds and missed expectations since I followed AVH have been consistently clearly explained and make sense, so, while I have been disappointed, the explanations have all made sense to me. It is clear that bad things happen in US medical launches, it is far from a straight line, and that is just how it is.

SUMMARY

And so, back to my initial questions to myself:

- Are the products still performing, medically? Hell yeah, and this looks like it is getting increasing attention

- Has the TAM changed? Nope, not at all

- Is the Acute Wound Care Portfolio Strategy still valid? Absolutely - the impact on revenue is now starting to show and can only go upwards

- Is the headwind temporary or permanent? Temporary, mitigating actions have been taken, and we should see the back of it in the coming quarters

- What could management have done to proactively mitigate the issue? Not sure what they could have done differently really - this is not an AVH issue

- Do I feel that management could have done more to fix the issue? I don’t think so

A capital raise feels imminent. I still think it will be circa US30-40m to give AVH 2 full quarters of cash until full revenue kicks in.

Looking at the volume and the “relatively muted” 13.62% drop, and the green candle, which I found totally surprising given the extent of the miss, I read 3 possible things into this:

- the short thesis could have manifested, the short thesis from here is less compelling, so the shorts took their money;

- some selling could have been deliberately absorbed to minimise the price drop in preparation for the imminent capital raise and/or;

- the market consensus was a similar, “Yes, it was shit, but ....” view that I have.

And so, while the AVH price will go nowhere in the short/medium term, I think another peak pessimism level has emerged - hopefully, this is the "last" one.

I remain bullish and will remain very patient for the turnaround to gain momentum. All the ingredients are absolutely in place, particularly the medical evidence. Throughout the webinar, announcements and numbers, have not seen anything that makes me nervous. We just need a clear 3-6M runway of no further curve balls, for revenue traction to be regained!

ACTION

From my current 2.45% allocation, I intend to top up when the price falls under to around $1.20-ish as I do expect it to drift lower further from here, up to my ideal allocation of ~3.0%. If there is a retail portion to the imminent capital raise, I do intend to participate.

Discl: Held IRL and in SM

Mamma Mia! Here We (ReCell)-Go Again

I came to this morning’s 2Q FY2025 earnings call for dermal repair company Avita Medical ($AVH on the ASX; $RCEL on the NASDAQ) with low expectations, and some trepidation. I wasn’t disappointed.

I’ve followed this company for nearly six years. And among all the players in the dermal repair space, $AVH wins my special award for most consistently setting high expectations, missing them, and then confidently explaining why it was either outside management’s control..

So why am I still here? Why (knowing what I know) did I choose in May to allocate precious capital to this serial underperformer? I’ll get to the answer. But first, the results.

$AVH’s “Highlights”

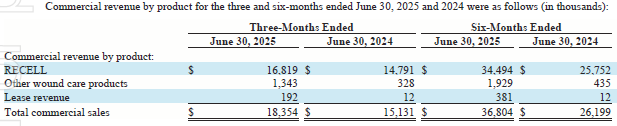

Financial Results

- Commercial Revenue: $18.4 million — up 21% YoY

- Net Loss: $9.9 million (–$0.38/share), improved from a $15.4 million loss (–$0.60/share) YoY

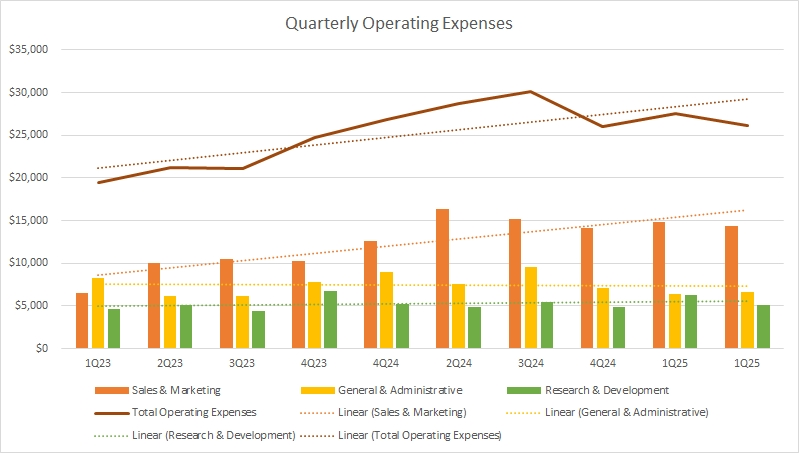

- Operating Expenses: $26.1 million, down from $28.7 million in Q2 2024

Business Update

- Significant revenue headwinds from a temporary reimbursement gap caused by delays in Medicare Administrative Contractor (MAC) payments for the ReCell® System. Multiple MACs began resolving these issues in July, with full resolution expected in Q3.

- Amended credit terms with OrbiMed: lowered revenue covenants and issued common stock in lieu of a cash payment.

- Appointed Michael Tarnoff, MD, FACS (former CEO of Tufts Medical Center and Medtronic/Covidien executive) to the Board.

Clinical Highlights

- Real-world burn registry analysis shows RECELL reduces hospital stays by 36%.

- CMS approves NTAP (New Technology Add-on Payment) for RECELL in trauma wound care.

- Early clinical results for Cohealyx™ show autograft readiness in as little as five days.

- PermeaDerm® featured in 10 U.S. burn conferences, including in a multi-center RCT.

My Analysis: The Heart of the Problem – Revenue

The market reaction (–15% at time of writing) was all about one issue: revenue.

This was a massive miss. Management attributed it to a major disruption in reimbursement stemming from new CMS CPT codes that took effect in January. According to CEO Jim Corbett, implementation by MACs (contractors to CMS) lagged, causing widespread delays in hospital reimbursements, and a cascade effect on ordering behavior.

“This is not a product issue,” Jim said. “It’s a claims processing issue, specifically around how the ReCell procedure is valued and reimbursed.”

Translation: hospitals ordered enthusiastically early in the year, but when reimbursement stopped flowing, reorders dried up. Jim estimates a six-month backlog and a $10 million hit to revenue, more than half of the total $18.4 million reported for the quarter.

More Detail on the MAC Issue

CMS changed the reimbursement model: instead of assigning fixed prices, it delegated pricing decisions to MACs under a “Contractor Pricing” model. This created widespread confusion and an adjudication backlog—not denials, just… silence. Hospitals didn’t get paid. So they stopped ordering.

Jim claims SAVH only realised the extent of the issue in Q2. But while ReCell demand from surgeons remained strong, provider uncertainty “dampened utilisation.” AVH now estimates a $10 million revenue impact in H1, with $5 million lost from just their top 10 accounts.

Efforts to resolve the problem are underway across the industry. Multiple MACs recently announced intentions to resume adjudication. Jim expects a resolution in Q3 and a rebound in demand through Q4.

But This "Bump" Has Material Consequences

- Revenue guidance for FY2025 slashed from $100–106 million to $76–81 million — a ~$25m downgrade.

- Implied revenue growth falls from 55–65% to just 19–27%.

- Loan covenant waiver required from lender OrbiMed, in exchange for 400,000 $AVH shares.

- Cash burn remains an issue: cash and equivalents fell from $25.8m (Q1) to $15.7m at 30 June.

- Breakeven pushed out: previously H2 2025, now Q2 2026.

$AVH must maintain at least $10m cash under its OrbiMed covenant. They can raise ~$5.7m via a 3.8 million share issuance under their current mandate. If revenue rebounds strongly, that may suffice—but further dilution is likely.

Track Record: A History of Overpromising

Throughout my time following $AVH, this has been a company that routinely misses its own targets: product approvals, breakeven timelines, revenue forecasts, loan covenants, you name it. This pattern has continued under Jim Corbett’s leadership since September 2022.

There seems to be a systematic failure to factor in real-world risks, or to differentiate between internal stretch targets and externally-guided expectations. Or maybe they’ve just been extremely unlucky. The CMS-MAC issue is genuinely unusual, but not without precedent.

And so, while I do believe the reimbursement problem will be resolved, I don’t believe the timeline. I’m not confident it’ll be fixed this quarter, or even next. And that uncertainty means more dilution. Fortunately, OrbiMed seems supportive, for now and at a price.

Product Progress: A Glimmer of Hope

However, today’s presentation contained some very encouraging clinical news that could reshape $AVH’s market standing over time, both for ReCell and the newly launched Cohealyx.

ReCell

A new, large-scale real-world study of ReCell shows a 36% reduction in length of stay for burn patients. Based on burn size (TBSA), median LOS savings equated to nearly 6 days, or ~$48,000 in hospital cost savings for a $10–20k treatment.

ReCell is already widely adopted in U.S. burn centers. These new outcomes data are likely to accelerate adoption. $PNV's David Williams has said on mulitple occasions that ReCell complements Novosorb BTM, indicating synergy with dermal substitutes.

Cohealyx

Launched in April, Cohealyx (licensed from Regenity Biosciences) achieved autograft readiness in just 5–7 days in early studies, compared to 2–4 weeks for competitors like Integra’s DRT and Kerecis GraftGuide.

A 40-patient post-market clinical trial (Cohealyx1) is underway, with results expected in 2026.

But the market doesn't appear to be waiting for these results. Early signals are promising, with 25% of U.S. burn centers submitting Cohealyx to their Value Analysis Committees (VACs). July saw $300k in orders from the largest account.

If this trend continues, I expect positive updates in Q3 and meaningful revenue contribution in Q4.

Final Thoughts

Taken at face value, today’s revenue result was dreadful, flat QoQ revenue and declining gross margins due to product mix. Under normal circumstances, management would deserve criticism and $AVH would fail the "moment of truth" I declared when I initiated by position in May of this year.

But this time is different. $AVH had no control - and likely no visibility - over the CMS implementation delays. Still, the consequences were real and severe, and shareholders will bear the cost through dilution and delayed breakeven.

That said, I found Jim’s explanation credible. The reimbursement issue is temporary. What isn’t temporary is the mounting clinical evidence and competitive momentum behind ReCell and Cohealyx.

I remain deeply sceptical of management’s timelines. But I also see a company with a growing product portfolio, US$75m annual run-rate revenue, and a differentiated strategy built around full-spectrum treatment for burns and trauma.

Execution remains the Achilles’ heel. But if reimbursement recovers and Cohealyx gains traction, $AVH may finally begin to fulfil its promise.

Valuation

Today, I ran a quick turn of the handle on my model.

I’ve assumed:

- A further 20% dilution over time.

- That 2025 revenue guidance is missed, albeit narrowly.

- However, I’ve also factored in strong revenue growth from 2026 through 2028, and I acknowledge that management has exercised commendable cost control over the past year.

With these inputs, and applying a 10% discount rate, my model yields 2028 valuations of:

- $4.49 / $5.24 / $5.98 at P/E multiples of 30 / 35 / 40, respectively.

By 2028, I expect today’s reimbursement issues will be firmly in the rear-view mirror—and EPS growth should be significant.

However, given the continued execution risk and repeated underperformance, I’m applying an additional margin of safety - and unusually for me - using a 20% discount rate. That’s the minimum return I want for taking on this risk.

On that basis, my valuation range compresses to:

- $1.88 / $2.19 / $2.50 at the same P/E multiples.

Conclusion and Investment Decision

I’ve always believed that in business, it's often darkest before the dawn. I thought the darkest hour came in May, when I initiated my position in $AVH at a 2.5% portfolio allocation in my RL ASX portfolio.

At that point, I said Q2 would be “make or break” for the company. And based solely on the headline earnings result, I should have exited today.

But I didn't.

And that’s because I believe the only factor driving today’s miss is external, uncontrollable, and temporary. The market understandably focused on the revenue shortfall—but overlooked what I see as compelling new data that positions $AVH to become one of the long-term winners in dermal repair… assuming it doesn’t get acquired first, which I now see as the biggest near-term risk.

Today, I added a further 30% to my RL position. Yes, my total holding is now down 23% on it's cost basis. But my conviction is growing - not shrinking - that this company has a real shot at success.

I just wish management would stop giving forward guidance.

Disc: Held in RL and SM (will top up SM on Monday)

Interesting article on Stockhead today, also covered in The Australian.

The interesting piece from my perspective is the extract I've listed below.

First, it supports my point of view, often repeated here over the last year or so, that competitive intensity in dermal repair is increasing, as we see more product-on-product competition. But it also supports my thesis for why I believe $AVH - as a multiproduct firm, with distinct offerings at all layers of wound covering, epidermal repair and deep dermal repeair - will be advantaged.

They've established a sales and marketing footprint predicated on Recell Go and recell Go Mini, which is growing sufficiently that it should get to breakeven. But then they can sell licensed-in Permeaderm and Cohealyx as icing on the cake, with essentially zero incremental field support costs.

Thus, they can fight for share to take a chunk of the market from the established competitors in the dermal scaffold market, where they are essentially the new entrant. That's not great news for $IART, $PNV, and $ARX, particularly as $AVH pretty much now have full coverage of all the high value burns accounts, so there won't be any delay to the selling pressure kicking in. Oh, and there are comparison studies under way which should read out over the coming year.

To be honest, I am not sure what this market looks like long term anymore, but I think $AVH's SP is beaten up sufficiently that if they get any kind of traction with Cohealyx, they will push through into profitability in the next couple of years, which will see a re-rating.

So, I guess my investment horizon for this one is 2-3 years.

Fun times ahead!

... from the article.

Go low to go high

If Avita’s management is cowed by having so many rivals, it’s not letting on.

“We believe Cohealyx will be the real winner for the company,” chief financial officer David O’Toole says.

“We are going to price it to gain market share”.

O’Toole says rival products typically sell for US$15 ($24) per square centimetre.

“We will sell it for US$10 if [a hospital’s] value analysis committee wants it that low,” he says.

“But we don’t think we have to go that low because it is a superior product.”

Naturelement!

Avita envisages a consignment model, by which product is shipped to the hospitals and then only paid for when used. While not good for the company’s cash flow, the hospital bean counters should love it.

Avita also is undertaking post-market clinical studies to demonstrate the product’s efficacy and economic relevance.

That’s code for “we need data to help hospitals justify buying this stuff”.

Disc: Held in RL and SM

Disc: Held IRL and in SM

SUMMARY

The Not So Good

Revenue looked to have impressively improved 67% vs pcp, but is actually the 2nd consecutive quarter of flat revenue.

If there is no improvement to the 1Q run rate of $18.5m, revenue will end up around $74-75m for FY25, well short of the revenue guidance of $100-106m - this is probably what spooked the market.

Operating Expenses remain high vs pcp and QoQ vs Q4 guidance which said expenses should stabilise around $26m - management attributed this to “typical higher 1Q expenses”, which does make sense, the question is whether expenses will remain elevated in the coming quarters as this will threaten the 4QFY25 GAAP profitability guidance.

Net Loss widened against both pcp and QoQ.

Management has made the call to stop focusing on the Vitiligo indication - too many uncertainties around insurance reimbursement as Recell is only currently reimbursible in a hospital vs Vitiligo which is treated at a Doctor’s clinic - revenue from this indication has not been baked into revenue forecasts, this feels like the right call given the huge opportunity on the burn wound products

Per Dow Newswires, the 1Q results fell short of expectations:

- Net loss ($0.45 per share) vs actual ($0.53 per share)

- Revenue $20.1m vs actual $18.5m, about ~8% below expectations

The Good

Products have not fully launched in 1Q - RecellGo Mini only launched on 1 Feb (announced as "during 1QFY25" in late Dec) and CoHealyx launched on 3 Apr (announced on 3 Apr) - against this backdrop, the market looks like it might have got ahead of itself.

Significant operational changes occurred in 1Q in what management terms a “Launch Readiness Phase” - (1) RecellGo Mini full launch (2) CoHealyx full launch post quarter-end (3) a comprehensive re-organisation of the Sales organisation to align to the product portfolio and expand sales coverage (explained at length during call) - made good management sense (4) PermeaDerm manufacturing integration into Ventura facility. These actions make good sense and are necessary, as management continues to operationally morph AVH from a single RecellGo product to a multi product portfolio.

Higher cash burn is being addressed by a $2.5m/quarter expense savings that have been found through the sales re-organisation - need to see this materialise next quarter.

Overall

It was not a great result vis-a-vis increased expectations arising from the increased FY25 revenue guidance, but once the operational context is baked in, seemed a fair outcome. RecellGo Mini only launched in Feb 2025 and CoHealyx only launched on 3 Apr, post the 1Q results, so revenue from these have not yet flowed in.

I now see the $18.5m quarterly revenue as the “minimum” revenue base, based purely on RecellGo. Annualised, this is ~$74m of the $100m FY25 revenue. For AVH to meet the $100m revenue target, at least $26m needs to come from a combination of RecellGo + CoHealyx + PermeaDerm in the next 3 quarters - this translates to the following run rates:

- Roughly ~$9m per quarter contribution from these 3 products

- Assuming the minimum revenue per case for PermeaDerm $2,000 and Co-Healyx $20,000, the $9m additional quarterly revenue can be met by ~409 cases per quarter, or ~136 cases per month

- The annual FSTD caseload is ~270,000 cases

- This does not seem too onerous to achieve for the rest of FY2025

AVH’s operational readiness for that growth appears to also be in a significantly better place - the actions in 1Q were necessary and reflect an organisation that appears to learn and decisively action, the transition from a single product to multi product environment.

There is nothing to suggest that the anticipated revenue growth will not kick in, in the coming quarters. The 20+% price drop feels overdone against a (8%) shortfall of revenue expectations and the remaining 9M runway ahead, with full launches having occurred.

Thesis remains intact. Patience continues to be required as it is easy to forget that AVH is still morphing from a single product to a multi-product portfolio company - a massive change in strategic direction that needs time to work through/play out.

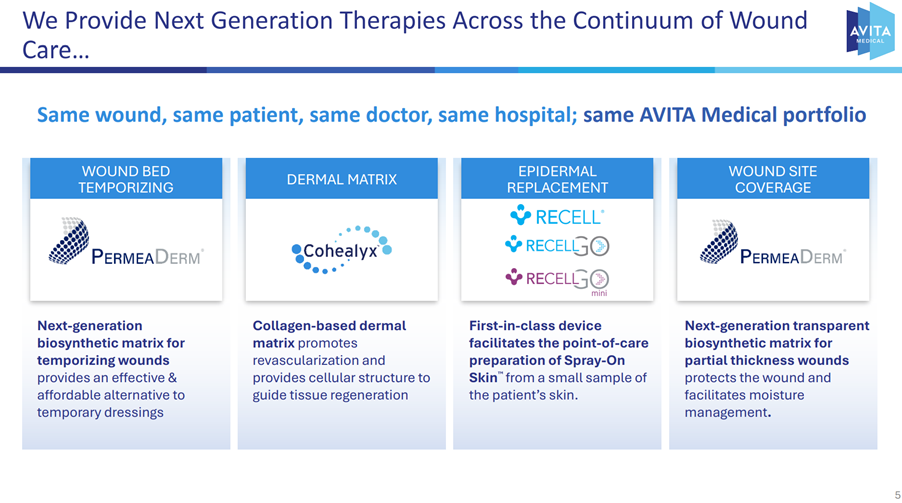

TREND CHARTS

- While 1Q25 revenue has been flat QoQ, it is clearly trending upwards, as is Gross Profit and Gross Profit Margin %

- Cost of Sales has also increased, as would be expected, but at a significantly slower rate of increase vs revenue.

- Total Operating Expenses continues to increase, driven primarily by increases in Sales & Marketing expense, but both have been trending downwards since 3Q24

- G&A and R&D have remained flat trend-wise, with G&A trending downwards

Amidst the market whiplash, this nothing-really-new announcement from AVH is a good reminder that while Trump goes about thrashing the US, one of the companies I own is still delivering against what it said it would do ...

Discl: Held IRL and in SM

AVH Entered into a new Contract Manufacturing Agreement for PermeaDerm® Biosynthetic Wound Matrix, along with an Amendment to its existing Exclusive Distribution Agreement with Stedical Scientific, Inc, effective 17 Mar 2025

Retain 60% of the average sales price from PermeaDerm sales while remitting 40% to Stedical after deducting manufacturing costs. Prior to the amendment, each party retained 50% of the average sales price from the sale of PermeaDerm.

------

Very positive move which makes a lot of sense:

- PermeaDerm has essentially morphed into a royalty-per-quantity-sold arrangement as AVH will now 100% control the end-to-end of PermeaDerm, from sales, distribution to the manufacturing supply chain - great move given how significantly PermeaDerm will increase AVH's TAM

- Optimises capacity at AVH’s manufacturing facilities - unclear of startup cost impact but as there was no mention, assuming that it is either immaterial or shared cost

- Manufacturing cost is 100% recovered from Stedical before remitting Stedical's share of revenue - may be some small accounting upside in the broader manufacturing cost recovery

- Increases revenue from 50% to 60% - that extra 10% revenue should drip straight to the bottomline as there is virtually no marginal cost for selling & distributing PermeaDerm

Remain very happy and bullish with how AVH management has continued to steadily and deliberately morph AVH from a single product to a multi-product company around a Recell Core, with a significantly expanded TAM.

Disc: Held IRL and in SM

AVH held the usual a-few-days-later Investor preso, this morning, following the results announcement. Picked up a few additional notes, mostly from the questions.

Discl: Held IRL and in SM

UPDATED TAM

I asked for, and got this updated TAM slide which provides a breakdown of the ~$2.0b additional TAM from FTSD indications.

- Excludes chronic wounds our of Indication - no intent to enter that market - do not believe that this is the best therapy for these wounds as have not studied it.

- Left with ~270k annual full-skin thickness traumatic and surgical wounds which (1) is a surgical wound (2) is an acute wound and (3) we can close it with combination of CoHealyx, RECELL and PermeaDerm

- Market is huge, in about 350-400 hospitals, adding $2b more of TAM to make combined TAM of Burns + FTSD wounds = $3.5b TAM

- Go from Burns Only TAM of ~$500m to Burns + Surgery + Trauma TAM of $3.5b

- Broader product line from the original single product RECELL to RECELL Go + RECELL Mini + CoHealyx + PermeaDerm

- Same wound, same patient, same doctor, same hospital - have seat at the sellig table, all the time

CURRENT MARKET SHARE

Currently, essentially selling to ALL 120k Burn Centres to some degree. Difficult to estimate market share as there is no direct competitor but suspect it is in the region of 20-25% - lots of upside ahead

In close to 200 new trauma hospital accounts, about 50% of trauma hospitals since the launch of the new FTSD indication - account size are not equal, some really big, some really small - depends on where located, the population around the hospital, type of wounds.

Big emphasis though, is to sell the portfolio of products - focus on product mix, deeper contributor to heal acute injuries

CASH SUFFICIENCY

Orbimed, debt provider, in for the long haul, complete supporter, sees the business growing.

Original 2023 revenue covenants were established with a very different AVH. FY2025 revenue guidance is below the trailing 12M revenue covenants with OrbiMed - mutually agreed to amend revenue covenants to that they are no longer a hindrance to the business and is aligned to the projected growth

No immediate risk of not meeting the revenue covenants and needing to repay back the debt, hence, see no reason to raise additional capital ahead of FCF in 2HFY25

COMPETITORS

PermeaDerm - many, but few have the features and benefits that PermeaDrm has - enough of these that being price competitive matters - happy to price appropriately to gain share as 50% revenue flows straight to the bottomline on any price, to demonstrate clinical advantages/increase adoption

CoHealyx - many, dermal matrices, ~20, key competitors include Integral Life Sciences, Caris, Polynovo (overlap on some cases) some more common than others, have same arrangement as PermaDerm, allows for same pricing flexibility BUT 5-year exclusivity term, and upon completion of CoHealyx1 study, share of revenue increases 10% to 60% or on 1 Jan 2026, not incentivised to get premium price, but to get adoption. Clinical data says Cohealyx is superior, hospitals put a lot into dermal matric inventory - win on clinical benefit, price, and on consignment model/working capital management.

FY2025 GUIDANCE

Based on current portfolio of products - does not bake in any new products in development.

My combo of notes and thoughts from the results presentation early morning Fri. Very happy shareholder!

Discl: Held IRL and in SM

SUMMARY

No surprises with Q4 results as the shortfall of $3-4m revenue and the pushing back of GAAP profitability by 1 quarter to 4QFY2025 had already been flagged to the market in early January.

Conversion to RECELL GO going well - 83% of total unit volume now converted.

Big jump in FY2025 revenue guidance of $100 to $106m, YoY growth of between 55% to 65% - the ability to achieve this will depend on the performance of CoHealyx and RECELL Go Mini - there is clearly a huge TAM opportunity, but will need to see actual revenue in 1QFY25 to understand the revenue momentum and trajectory.

Very little is baked in for international sales but nothing will happen in this space until EU CE Certification is received, currently expected mid-2025 - appears to be minimal downside risk but good upside if the certification comes in earlier or “on time”.

Operating expenses have been guided to be fixed around ~$26m per quarter, based on 4QFY24 expenses, normalised after a 3Q spike in one-off expenses, and there being no planned increases of headcount or operating expenses - any incremental revenue from FY2024 will essentially drop straight to bottomline as the earning of this revenue requires no additional operating cost.

FY2024 was a good transformational year as AVH decisively executed the strategic an operational pivot from single to multi-products while continuing to achieve 29% YoY revenue growth and the various FDA approvals occurred as management guided.

Apart from the purchasing-related Q4 revenue shortfall which hurt the AVH share price, management continues to march forward as it said it would.

Do not see much risk of capital raising in FY2025 as AVH prefers debt, has long-term debt facilities lined up, expenses have flatlined, and is steadily generating more cash from operations as revenue expands and accelerates in FY2025

Management has a simple and clearly articulated strategy and game plan for FY2025 - FY2025 is shaping up to be the year where AVH performance really accelerates and achieves GAAP profitability, driven by RECELL GO Mini and CoHealyx product launches from a significantly more established RECELL GO platform.

There is clearly ongoing risk that GAAP profitability will not be achieved in FY2025. It is achievable given expected flat expenses (~$104m) and expected expansion of revenue (~$100-106m), but planets do need to align throughout the year. AVH will remain vulnerable to hiccups, any or all which could dent the share price again.However, any delays will likely only be a timing issue as the trajectory and plan to profitability is clear and imminent.

Q4 RESULTS

Revenue $18.4m, $3-4m lower than forecast

- Key customers deferred buying to preserve cash - timing difference, not due to a lack of demand or other commercial operations issues

- Now have better understanding of customer end-of-year buying patterns

- January purchasing activities now back to normal

4Q Margins 87.7%, recovering from 83.7% in 3Q

Q4 operating expenses have stepped down $4.1m, from elevated levels in 3Q t0 $26.1m - No plans for headcount increases, other operating expenses in FY2025 and no planned expansion of commercial/sales organisation in the next 18-24M

Conversion to RCELL GO going well

All Burns accounts and 70% of trauma accounts have transitioned - 83% of total unit volume

FY24 RESULT

Revenue increased 30% YoY driven by:

- Accelerated transition to RECELL GO,

- Deeper penetration within both existing customer accounts and new accounts targeting full-thickness skin defects in trauma centers

FY24 margin was 85.9%, at the higher end of the 85-86% gross margin guidance

Operating expenses increased from $86.5m to $111.8m, primarily due to costs from the expansion of the sales & marketing organisation

At 31 Dec 24, $35.9m in cash, cash equivalents and marketable securities - sufficient cash reserves to fund operations for the next 12 months.

FY25 GUIDANCE/EXPECTATIONS

Commercial revenue for the full-year 2025 is expected to be in the range of $100 to $106 million, reflecting growth of approximately 55% to 65% over the full-year 2024

- RECELL GO Mini and CoHealyx will contribute substantially to this revenue growth following launches in Feb and Apr 2025, respectively

- Modest international revenue is baked into revenue guidance as timing of CE approval is uncertain - previous indication for approval was Oct 2024, there are no technical challenges, no revisions or materials that are pending, just dealing with an unpredictable process

$26.1m Q4 expenses is expected to be a consistent baseline for FY25 quarterly expenses

Expect to generate free cash flow in the second half of 2025 and reach GAAP profitability during Q4 2025

Expect use of cash to further decline over the next 3 quarters

Gross Margin for RECELL will stay in the 85-87% range, but margins overall will inevitably go down because of the distribution arrangements for CoHealyx and PermDerm (50-50 shared), as CoHealyx and PermDerm revenue becomes more significant,

- Because of expected flatline operating expenses, all incremental Gross Margin essentially drops to the bottomline as no additional cost is expected to generate this revenue

Revenue Growth profile for FY2025, in response to an analyst question:

- Q1 - up sequentially, driven by RECELL GO Mini launch, PermaDerm gaining momentum

- Q2 - up sequentially

- Q3 and Q4 - CoHealyx impact will back end, plenty of gunpowder to keep revenue line growing, strong cadence during the year

- Burns - approximately 1,000 burn cases per month, these last 2 quarters

STRATEGY & TAM UPDATE

Since 2023, AVH have evolved from a single product company to a multi-product leader in therapeutic acute wound care

Focus on treating event-driven trauma and surgical wounds, full thickness skin defect (FTSD) indications - victims of severe and unpredictable events/trauma

FY24 was a transformative year in terms of expanding the TAM:

- 2 years ago, TAM for single-product RECELL was $500m per annum for burns wounds only

- 18M ago, FDA approval for FTSD indications expanded AVH’s market for RECELL to the trauma centre market - roughly 272,000 wound procedures annually could be eligible for RECELL Treatment, 122,000 traumatic wounds, 12,500 annual surgical wounds and 136,000 annual surgical resections and excisions for cancer

- Based on the increase in the potential revenue per patient from the addition of CoHealyx and PermDerm alongside RECELL, the TAM for AVH has now expanded to ~$3.5b per annum for therapeutic burns care across both burn and trauma centres, in the US alone - the numbers presented do not line up nicely with $3.5b - have asked for a slide to break this down for the Aussie presentation next week

- 120+ Burn Centres TAM = ~$1.5b

- RECELL: $500m

- PermaDerm: $100m

- CoHealyx: $1.0b

- Trauma Centres FTSD TAM = ~$2.9b

- CoHealyx: $1.35b

- PermaDerm: $135m

- RECELL: $1.5b

Strategy and focus for FY2025 is thus clear:

- Expand RECELL GO adoption

- Rollout RECELL GO Mini, focussing on trauma centres in 1QFY2025 (Feb 2025) - potential to expand the trauma centre market by 270,000 full thickness acute wounds annually

- NOT targeting chronic wounds or chronic centres

- Launch CoHealyx commercially in April 2025

- Continue to rollout PermaDerm

- Expect CE certification by mid-2025 which then opens up Europe and Australia markets

CoHealyx Plan Update

Embarking on a post market clinical study called “CoHealyx1” - ~40 patients enrolment, 26 weeks, 20 sites in real world settings

- A “OPC” objective criteria study design - objective is to benchmark Cohealyx performance against published data from alternative dermal matrices under controlled conditions

- Expect to demonstrate key outcomes (1) accelerated 7 days to graft readiness and (2) shorter overall time to wound closure vs alternative dermal matrices - 1st case in mid-Jan 2025, before the study commenced is already proving these outcomes - see slide in presentation pack.

- Study has 2 use cases (1) CoHealyx alone (2) CoHealyx with RECELL

- Expect study data to support 1 April launch of CoHealyx

1 April 2025 - full commercial launch for large wounds across 120 burn centres

- RFID tagging to simplify hospital adoption of consumption on a consignment model

- CoHealyx will be priced below current market leaders and will be positioned as a “value offering”

- CoHealyx can be used independent of RECELL

Expecting VAC approvals to be faster by ensuring:

- VAC sees pre-clinical data as it is published

- VAC sees post-market case studies in real-time

- Price point is set where it saves hospitals $

- Hospitals do not hold inventory - consignment model will be much appreciated

OTHER POINTS

RECELL GO Mini addresses a key gap in RECELL GO which is intended for wounds up to 1920sq cm or 10% of Total Body Surface Area (TBSA) - most traumatic wounds are under 480sqcm’s or 2.5% of TBSA - this “wastage” of using full RECELL GO to treat smaller wounds was a key feedback item from customers

RECELL GO Mini uses the same equipment as the RECELL GO full, so transition to the Mini is seamless

Another yeah baby moment for AVH.

The approval was not unexpected at all, but it is still very nice when things actually happen when management say they expect it to happen.

Pieces have fallen nicely in place for revenue to flow in nicely for the rest of FY25 - may that now actually happen in reality!

Discl: Held IRL and in SM

Good to wake up to some positive company news instead of the doom & gloom around market crashes, Trump/Musk fights etc ...

Still some ways to go before revenue flows through, from around 2QFY2025, but its a good and required step forward.

No new news from today's webinar but management provided more detailed insights on various topics as management typically focuses on strategy evolution, operational insights etc, rather than the previously-released financials. This follow up webinar is always worth attending as I find I am able to better digest the commentary.

I like that everything that has happened, and is happening, with AVH, makes simple and sound sense. Planets are really aligning very, very, nicely with lots of milestones to look forward in the coming quarters to as AVH continues commercial expansion, which looks set to accelerate from hereon.

Discl: Held IRL and in SM

Vision and Mission

Been a while since I last reviewed this, but it is clear now that AVH has fully transformed from a single product RECELL company to become the “leading global regenerative tissue company by addressing a broad continuum of clinical needs”

IP and Regulatory moat for Recell is a minimum 3-5 years - caused thinking on what doctors and patients need around Recell for the same wound.

“Same Doctor, same Patient, same Wound” is a really good encapsulation of AVH’s strategy pivot - AVH is no longer a single product company

Defining the Standard in Wound Care & Skin Regeneration, PermeaDerm Impact

Have not seen this slide before which reinforces the point that PermeaDerm is actually potentially used 2x in a burn treatment - temporarily, then to cover the wound

VAC Approvals for PermeaDerm - Jim made the point that VAC approvals for PermeaDerm are significantly easier than for RecellGo - it is a dressing, which the VAC sees a lot of, and is significantly less complex than RecellGo, and so, is not a big obstacle at all

TAM Expanded to ~US$2b

Potential Revenue expansion per Patient with AVH’s Burn Continuum strategy - the slide documents the excitement verbalised during the previous investor call.

TAM is calculated from the number of Recell-eligible burns treatment per year, which AVH estimates is ~35,000

- Recell-only TAM was ~US$455m ($13,000 x 35,000 cases)

- Recell + PermeaDerm + Cohealyx TAM rises to ~US$1.925m ($55,000 x 35,000 cases)

- This is a significant TAM expansion, once Cohealyx comes onboard

Current ~20% penetration in the market - can see a clear pathway to 40-50% in the next 1-2 years based on increase usage at top burn centres, but how long it will take to get to this will become clearer in the next 1- 2 quarters

Recell Platform

Good summary slide which differentiates RecellGo and RecellMini - the move away from “old Recell” into this single RecellGo platform makes it significantly easier to understand the product differentiation, and the components of the Platform

The Processing devices can be used 200x vs the single use Preparation Kits

Expecting to fully complete the conversion of existing customers to Recell Go by end Q32024 - priority was given to the bigger burn and trauma centres as they wanted to get onboard early, have bigger consumption etc.

Essentially, a biopsy of skin approximately the size of a credit card is the input to develop spray on skin that can potentially cover 2,200sqcm, a 80:1 ratio - that puts the benefit of Recell in good perspective.

International Expansion

Overall approach is to ensure international expansion is “contribution positive” - hence the approach to not invest heavily but instead to use 3rd party distributors

Will take time to develop, but confident it WILL develop

Japan

- Distributor has only pursued burns indication - AVH is working on an alternative strategy for FSTD indications.

- 1st year has been focused on inventory build out and to establish the distribution framework

- Utilisation from here will reflect actual case utilisation.

- Does not sound like management expects too much from Japan at this stage

Europe

- CE Mark still has 2 more hoops to cross - (1) technical review, expected this month (2) 1-2 month Admin process that flows. Approval is expected 1QFY2025 but it all depends on the Regulatory body which does not have a statutory requirement on review timeframes

- Already ready to ship inventory today, startup is expected to be a swift 1 week from when approval is obtained

- Will be for Burns and FSTD indications

- Contribution from Europe will be much more valuable than Japan given bigger population and more countries

Australia: Announcement today of appointment of the Australian distributor

Manufacturing Facility Update

Completed transformation of the 1960’s Ventura manufacturing facility to a modern one, which expands capacity 10x, from the current 8,000 units to 80,000 units per annum.Do not expect any need for capacity increases for the next 3-5 years

Other change is that AVH is no longer required to hold stock for Barda which frees up inventory

Built a service centre to address repairs, re-qualification of kits etc

FINANCIALS

Operating Cost Outlook

Very few headcount increases are planned for FY2025, no further increase in Sales Team in the next 18-24M.

G&A 3Q24 contained one-off expenses (recruitment, severance costs etc), Q2FY24 G&A is more representative of the cost going forward.

R&D expenses expected to be flat for the next 12M - makes sense as AVH operationally digests the current suite of products.

Revenue Covenants

31 Mar 2025 - trailing 12M revenue of $75m - only need to generate US$17m of revenue in 1QFY25 to meet this, not an issue

30 Jun 2025 - US$99m, easier to meet with current significant Q-on-Q revenue growth trajectory

Cash Reserves

Clear management view that the $4m cash reserves will be sufficient to take AVH to cash flow positive by 3QFY2025

Cash use in Q3 was lowest during this commercialisation phase, expecting cash use to be at similar levels in Q4FY2024 - revenue expansion will then generate sufficient cash

My notes and views from today's Results call. I always get a lot out of the AVH calls as management does a really good job at providing the operational context, observations and detailed explanations, which makes it easy to follow the narrative.

SUMMARY

Overall

Very comfortable with the results - 3Q was a big quarter of not only revenue, but also good, sensible sales-related positioning

Pivot to convert existing install base to RecellGo vs previous focus on getting through VACs made good management sense.

Very excited at the addition of Cohealyx to the continuum and how that could potentially drive a big uptick in revenue - continues AVH’s morphing from a single product company to a “burns solution” company, all centred around and further embedding Recell - this strategy really optimises the use of the Sales organisation to chase incremental, almost no-effort, revenue.

Next 6M and FY25 overall will be full of milestones and activity as revenue momentum accelerates with new approvals imminent and products coming on stream.

Positives

- Continued strong revenue growth from Q2 - 29+ consecutive quarters of growth

- Deliberate pivot in the Quarter to focus on, and accelerate, the conversion to the RecellGo conversion so that the benefits of RecellGo can be reaped by both patient and clinicians

- Entered into multi-year development & distribution agreement for exclusive rights to market, sell, and distribute Cohealyx™, an AVITA Medical branded collagen-based dermal matrix - this fills up the Dermal Replacement/Matrices gap in the AVH Burns & FSTD Wound Care Continuum

- The introduction of Cohealyx into the AVH product mix appears significant as it is looking to drive ~3x more spend in the burns per-treatment spend from the current RecellGo + PermeaDerm offering of between US$8.5k to US$17.5k to between US$28k to US$55k - multiplying this increased spend to the 35k annual AVH-eligible burns case sees an additional ~US$1.5b potentially added to the TAM in the US alone

- Good/on track progress on (1) Recell Mini FDA approval (2) publishing of Vitiligo study findings (3) overseas market startup (4) expansion of manufacturing facilities

- FY2025 is looking very exciting with (1) Recell Go Mini startup (2) PermeaDerm expansion (3) Cohealyx approval and startup (4) CE Mark Approval to drive overseas expansion

- No change to management guidance of GAAP profitability and Cash flow Positive by 3QFY2025

Not So Good/Watch Areas

- Pivot on RecellGo conversion impacted progress on the VAC approvals - 23 accounts approved vs planned 40-50 this Quarter - management said this was a deliberate choice in the use of Sales time

- Delays encountered in (1) CE mark approval from Sep 24 to 1QFY25, delaying entry to Europe and Australia, minimal impact to FY25 profitability targets

- Rise in expenses - was a bit concerned with the trajectory of this in FY24 at first glance, but expect this to level off from here based on management comments plus expected significant boost in revenue once the FY25 drivers kick in progressively during FY25

Position Size

Now a 4.17% position, which is where I wanted it to be.

No further action other than to remain vigilant for buying opportunities if prices dip below $3.00 on market weakness.

Chart Review

Price has run up strongly in the past 2 weeks from ~$3.00 to peak at $3.80, breather is thus expected.

Has broken past resistance level ~$3.23 and the significant 200 SMA, both of which have held despite today’s pullback - expect this to provide some degree of support in the near-term.

OPERATIONAL HIGHLIGHTS

Deliberate Pivot to RecellGo Platform (RGo) Conversion.

Made deliberate decision to accelerate the conversion of existing customers on to RGo to enable revenue growth and set foundation for long-term scalability.

Accelerate benefits of (1) Significant workflow efficiencies (2) Shortens anaesthesia time (3) Reduce operating theatre time (4) Accelerates patient healing.

Transitioned ~75% of installed base to RGo within 4M of FDA approval, indicating operational agility.

VAC Approvals Impacted

This pivot has come at expense of slower Value Add Community (VAC) approvals - 23 new accounts vs planned 40-50 this Quarter - less VAC’s was a deliberate choice in the use of Sales time.

Now ~300 accounts for Full Skin Thickness Defect (FTSD) accounts, more than double from a year ago.

RGo is expected to make closing new accounts easier.

Q4, 60 accounts in VAC process, expect 30-40 to close in Q4.

VACs are wanting to see evaluation cases as part of the approval process - have not proactively prepared for this request.

As an indicator of adoption, only 1 hospital required VAC approval specifically for RGo.

Addition of Dermal Matrix Product, Cohealyx to Burn Wound Management Continuum

On July 31, 2024, entered into a multi-year development and distribution agreement with Regenity Biosciences that provides AVITA Medical with the exclusive rights to market, sell, and distribute Cohealyx™, an AVITA Medical branded collagen-based dermal matrix.

Submitted FDA approval end-Sept, expecting FDA clearance by end-Dec 2024.

Cohealyx promotes generation of vascularised tissue, takes 5-15 days, and prepares the wound for grafting - this looks like a direct competitor to PNV’s Novosorb BTM.

Cohealyx will be used as a combination of RGo + PermeaDerm (PD) and Cohealyx as a comprehensive solution for FSTD wounds - improve patient experience and streamline clinician workflow in a 2-step treatment process:

- Step 1 - Apply Cohealyx to promote vascularisation of tissue

- Step 2 - meshed split thickness skin graft is used to prepare spray-on skin using RG, which is then sprayed on top of meshed skin graft

- Uses significantly less skin than traditional skin graft and enables more definitive skin closure

- PermeaDerm, a transparent dressing, is then applied over the Recell skin graft to optimise wound protection and moisture management

Cohealyx Changes Business Model and Expands AVH Market Potential

For 10-20% of burns patients, treatment is expected to utilise (1) 1-2 RGo kits (2) 1 application of PD and (3) 1 application of Cohealyx.

Current per-treatment spend for RGo + PD between $8.5k to $17.5k - this increases to between $28k to $55k for RGo + PD + Cohealyx.

CoHealyx increases the pre-treatment spend by 3-fold, applying the increase spend to the ~35k Recell-eligible burns cases per annum, TAM is US$1.5b in the US alone - will meaningfully enhance market penetration and strengthen market position in FSTD and Burns markets.

Plans for a post approval, post clinical study using the combined 3 solutions vs other Dermal Matrix-solutions - enrolment in 1QFY25, expense will be required for the study in 1HFY25. Intent is to prove the time-to-graft benefit from 3 elements:

- Cohealyx gets to ready-for-graft without infection, more rapidly, in days

- This speeds up the faster-to-close process

- This then speeds up the out-of-hospital days

RGo Mini Update

Fills the smaller wound gap with the offering, expands AVH reach as it addresses the up-to-480sqcm wound vs RGo’s scope of up to 1920 sqcm wounds.

Use the same multi-use RCGo device but with smaller disposal cartridge.

On track for approval by year end, launch in 1QFY2025, rollout plan:

- Training 1st half of 1QFY25

- Rollout during 1QFY25 - practical customer utilisation will be 2nd half of 1QFY25

- Targeted at Trauma Centres which is where FSTD cases are - would have added well over 200 accounts since FSTD approval in 2023

In terms of expectations for adoption, in the study for FDA approval, there were zero study cases which were over 500sqcm - RGoMini was developed to better fit patient needs.Market is the same, but expect adoption will be quicker as it is the same RGo use on a smaller sized wound.

International Expansion, CE Mark Approval Delayed

- CE mark approval was expected in Sep 2024, now delayed to 1QFY2025 - this will enable expansion to Europe and Australia.

- In final stages of review, with a 1-2 month mostly admin process - impacted by current regulatory backlog.

- Impact is not significant as Profitability goals in FY25 are are dependent on overseas revenue.

- 3rd party distributors are looking forward to RGo as less training and startup is required which will help with faster customer adoption.

Vitiligo Study

- Studies have been submitted to major medical medical publications, expect to be published late 2024/early 2025

- Foundational to get commercial insurers onboard - this is expected in 2HFY25

- Not guiding to a a significant vitiligo contribution in FY2025 as this is looking to be a FY2026 impact instead

Manufacturing Capacity to Meet FY2025 Demand

- Completed Project early in the Quarter to revamp Ventura manufacturing facility - this has expanded capacity by 10x

- Included the creation of a service centre for durables

- No supply shortages encountered during period of fast revenue expansion

3QFY2025 FINANCIAL RESULTS

Commercial revenue of $19.5 million, an increase of approximately 44% compared to the same period in 2023.

Gross profit margin of 83.7% - this was expected due to ongoing RGo engineering and validation of the RGo durable and disposal cartridges - temporary, expecting GM to be between 85-86% for FY24.

Operating expenses US$30.2m.

- Sales & Marketing expenses up US$4.4m - employee-related costs following Sales Org expansion in 2QFY23 and 1QFY24

- G&A increased US$3.5m, mostly due to employee-benefits

- R&D costs increase US$1.0m, employee costs of medical liaison team

US$44.4m cash & cash equivalent vs US$89.1m as at 31 Dec 2023 - Q3 was the lowest use of cash in this phase of commercial expansion - current low rate of cash utilisation expected to continue in 4Q.

On November 7, 2024, amended the credit agreement with OrbiMed in a mutually beneficial arrangement, forgoing access to an additional $50 million in funding in exchange for removal of the 12-month trailing revenue covenant for the period ending December 31, 2024 - reiterated comment that there was no previous intention to draw down the $50m funding.

Built on success of strong 2Q - outpaced performance by 29% , 44% YoY.

OUTLOOK

4QFY2024

US22.3m to $24.3m - a QoQ improvement of between 14-25%, a YoY improvement of 58-72% - aligns to full year FY24 guidance.

FY2025 Guidance

No change to guidance of GAAP Profitability and CashFlow +ve by 3QFY2025 - huge focus on crossover to profitability.

Expecting to add very little durable operational cost from hereon - no significant org growth for the next 18-24M.

Positive revenue trajectory to continue into FY2025 with FY2025 Growth Drivers:

- RGo - increase usage of Recell in accounts

- RGoMini from Jan 2025

- PermeaDerm - collecting clinical evidence, accelerate use in FY2025

- Cohealyx - limited launch in 1QFY25, gather clinical data collection, full launch in 2QFY25

Recell drives the majority of revenue today - Cohealyx and PD will become substantial revenue contributors over coming Quarters.

Going forward GM mix change:

- Gross profit of a combination of RGo, PD and Cohealyx will be less than RGo alone

- Not adding to operating expense

- Cohealyx addition to operating margin will be substantial

Notes on today's AVH 2QFY24 Investor Webinar, and then I think I am done with AVH for this Q!

TLDR SUMMARY

Nothing new as most of the content was released as part of the 2QFY24 results last week

What was very useful, however, was the detailed insights and colour to (1) the step change introduced by the RecellGo devices and the impact of this (2) the position behind the New Account numbers - a bigger than run-rate jump is expected in Q3 (3) approach to the globalisation strategy (4) positioning of Regnity in the Continuum of Wound Care strategy and the product selection process and (5) update on how profitability will play out.

Clear reiteration that with the current growth trajectory with RecellGo, there is sufficient cash to get to profitability without having to draw down on $25m of upcoming debt tranches.

Even if AVH meets the lower end of revenue growth guidance it still expects to reach the break-even goals as AVH is now setup for sequential QoQ growth.

Very apparent that Jeff and David are still very sore with the drop in the 1QFY24 results and the impact this will have on FY2024 - declaring that it really was “self-inflicted” and they have owned that. But AVH is now poised for growth and “is in a good place to make this happen”.

My thesis is absolutely playing out and am very bullish as the various pieces for sustainable growth previously discussed are now in place. It is now all about delivering against the playing field that AVH has created in the coming quarters ....