Dear Fellow Shareholder,

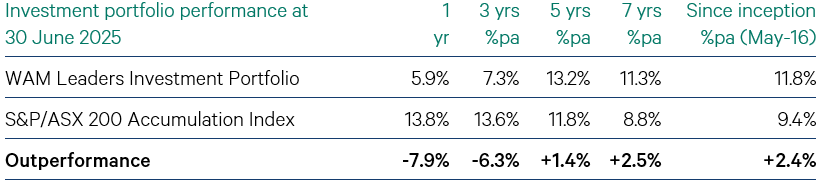

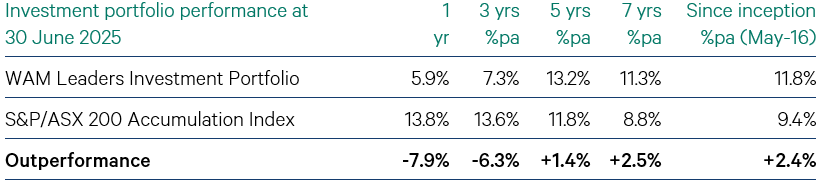

In FY2025, the WAM Leaders (ASX: WLE) investment portfolio was strategically underweight momentum driven stocks, including some Australian banks. This negatively impacted the investment portfolio performance over the 12 months to 30 June 2025, coupled with the sale of The Star Entertainment Group (ASX: SGR). The WAM Leaders investment portfolio increased 5.9%# in the 2025 financial year while the S&P/ASX 200 Accumulation Index rose 13.8%. As a fellow shareholder, I am disappointed in this underperformance.

Many of the dynamics which impacted investment portfolio performance are now contributing positively to performance, as the momentum trade unwinds. In July 2025, the investment portfolio outperformed, increasing 4.0%# while the S&P/ASX 200 Accumulation Index rose 2.4%.

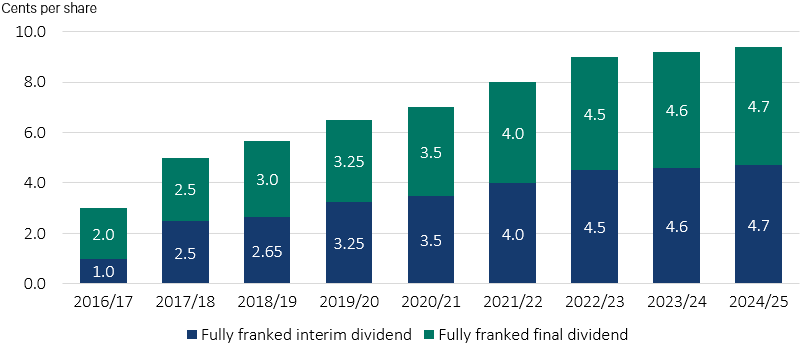

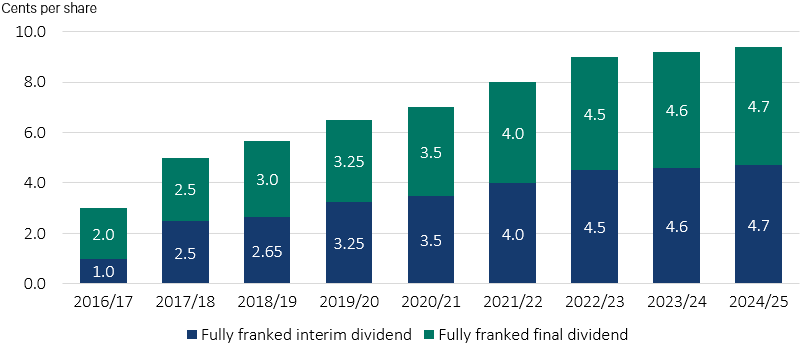

The WAM Leaders Board of Directors declared an increased fully franked full year dividend of 9.4 cents per share, with the fully franked final dividend being 4.7 cents per share. The fully franked full year dividend represents a fully franked dividend yield of 7.1%* and a grossed-up dividend yield of 10.1%* including franking credits. Since inception in May 2016, the Company has delivered 58.05 cents per share in fully franked dividends to shareholders and 82.9 cents per share, including the value of franking credits.

The listed investment company (LIC) structure and historical profits available allows the Company to increase the fully franked full year dividend across market cycles, enabling the Board to pay an increased fully franked full year dividend of 9.4 cents per share.

As we enter the 2026 financial year, we remain confident in Wilson Asset Management's proven investment process and its ability to provide returns to shareholders over the long-term.

Investment portfolio performance

Investment portfolio performance is before expenses, fees, taxes and the impact of capital management initiatives to compare to the relevant index which is before expenses, fees and taxes.

Fully franked dividends since inception

The Company has 2.6 years of dividend coverage, based on the profits reserve of 24.7 cents per share at 30 June 2025, before the payment of the fully franked final dividend of 4.7 cents per share payable on 17 November 2025. Currently, the franking account balance is able to frank the FY2025 final dividend and a portion of the FY2026 interim dividend, assuming the interim dividend is also 4.7 cents per share. If no additional franking is generated through the payment of tax on realised profit, there is a possibility of future dividends being partially franked or unfranked.

Key dividend dates