Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Dear Fellow Shareholder,

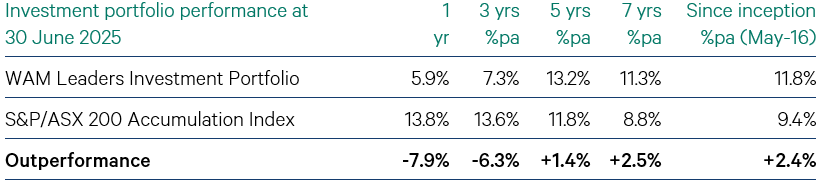

In FY2025, the WAM Leaders (ASX: WLE) investment portfolio was strategically underweight momentum driven stocks, including some Australian banks. This negatively impacted the investment portfolio performance over the 12 months to 30 June 2025, coupled with the sale of The Star Entertainment Group (ASX: SGR). The WAM Leaders investment portfolio increased 5.9%# in the 2025 financial year while the S&P/ASX 200 Accumulation Index rose 13.8%. As a fellow shareholder, I am disappointed in this underperformance.

Many of the dynamics which impacted investment portfolio performance are now contributing positively to performance, as the momentum trade unwinds. In July 2025, the investment portfolio outperformed, increasing 4.0%# while the S&P/ASX 200 Accumulation Index rose 2.4%.

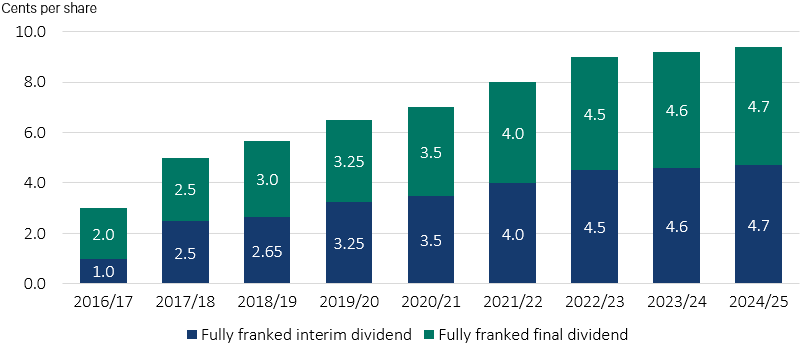

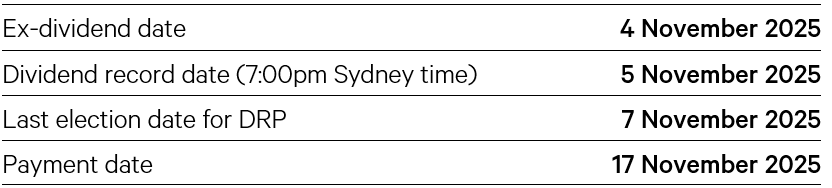

The WAM Leaders Board of Directors declared an increased fully franked full year dividend of 9.4 cents per share, with the fully franked final dividend being 4.7 cents per share. The fully franked full year dividend represents a fully franked dividend yield of 7.1%* and a grossed-up dividend yield of 10.1%* including franking credits. Since inception in May 2016, the Company has delivered 58.05 cents per share in fully franked dividends to shareholders and 82.9 cents per share, including the value of franking credits.

The listed investment company (LIC) structure and historical profits available allows the Company to increase the fully franked full year dividend across market cycles, enabling the Board to pay an increased fully franked full year dividend of 9.4 cents per share.

As we enter the 2026 financial year, we remain confident in Wilson Asset Management's proven investment process and its ability to provide returns to shareholders over the long-term.

Investment portfolio performance

Investment portfolio performance is before expenses, fees, taxes and the impact of capital management initiatives to compare to the relevant index which is before expenses, fees and taxes.

Fully franked dividends since inception

The Company has 2.6 years of dividend coverage, based on the profits reserve of 24.7 cents per share at 30 June 2025, before the payment of the fully franked final dividend of 4.7 cents per share payable on 17 November 2025. Currently, the franking account balance is able to frank the FY2025 final dividend and a portion of the FY2026 interim dividend, assuming the interim dividend is also 4.7 cents per share. If no additional franking is generated through the payment of tax on realised profit, there is a possibility of future dividends being partially franked or unfranked.

Key dividend dates

Scroll down for latest update.

April 30th 2019 Pre-Tax NTA: $1.2039 (ex-div).

April 30th 2019 Post-Tax NTA: $1.1769 (ex-div).

6 months on:

October 31st 2019 Pre-Tax NTA: $1.2522 (ex-div).

October 31st 2019 Post-Tax NTA: $1.2264 (ex-div).

October 31st NTA after tax but before tax on unrealised gains: $1.2471 (ex-div). NTA increase of just over 4% in 6 months, so around 8% pa (annualised). SP has been rising steadily since June. I hold WLE shares.

November 30, 2019: Pre-tax NTA for WLE was $1.3016, and the share price has remained 3 to 4 cents below that level for the past couple of weeks (to December 27th 2019). I spoke to Matt Haupt and Oscar Oberg during the November roadshow when they visited Adelaide and Oscar (who manages WAM, WAA, WAX & WMI, but not WLE or WGB, which are managed by Matt and Catriona) told me that he has been buying WLE and WGB shares himself ahead of his own LICs because they were both trading at discounts to their NTA and his LICs were trading either at premiums or at NTA - or close enough to NTA as to clearly NOT be bargains. He told me that just like Geoff Wilson himself, he (Oscar) likes to buy $1 worth of assets for less than $1, and you can still do that with WLE and WGB. I hold both of them.

22-June-2020: Update: WLE pre-tax NTA was $1.15 on May 30, 2020. Share price was $1.08 then, and is now a little lower at $1.065. WLE had 15.6 cps in their profit reserve - enough for 2.5 years of dividends. Cash = 8.9%. After WAM Global (WGB), WAM Leaders (WLE) has the next best discount to NTA of the 6 LICs currently managed by Wilson Asset Management (aka WAM Funds). Their flagship fund, WAM Capital (WAM) is trading at an NTA-premium of over 20% and WAM Research (WAX) has a NTA-premium in their SP that is between 35% and 40%, which is huge! I'm not going to pay those sort of premiums, particularly for WAM Capital (WAM) which has less than one half-year dividend in their profit reserve. WAX has a much better profit reserve but a they're also at a much higher premium-to-NTA.

The best value is currently WGB, then WLE, then WMI. I now hold all three (I sold my WAM today, and bought some WMI and more WGB - I already had a decent position in WLE).

BAF is also very interesting, and will be even more interesting when it becomes WAM Alternatives instead of Blue Sky Alternatives Access Fund - and their ticker code gets changed - probably to WAL (because WAA and WAF are both taken already). I also hold BAF shares.

Update: 21-Dec-2020: WLE's pre-tax NTA as at 30-Nov-2020 was $1.2896, so $1.29 is my new valuation for them. I do NOT currently hold WLE shares, having taken profits after the gap between the NTA and the SP closed up. In other words, I bought them at a substantial discount to NTA, then sold them at close to NTA, when the NTA was actually significantly higher as well. WLE's top 20 holdings (in alphabetical order) at 30-Nov-2020 were: ANZ, BHP, CBA, CSL, FMG, IAG, NAB, OZL, QAN, QBE, RHC, RIO, S32, SCG, SGR, STO, TCL, TLS, WBC, WOW.

18-Mar-2021: Update: 28-Feb-2021 before tax NTA = $1.37. After tax NTA = $1.31. Share price at the end of Feb was $1.43, and is now $1.52 (on 18-Mar-2021), so WLE has moved from a small discount to NTA to now being priced with a small premium to NTA in the share price. Nothing like the rediculous premium that WAX is trading at (+38.7% premium to NTA at end of Feb) or the more modest premiums of WAM (+14%) or WMI (+16.8%), but still at a small premium. Even WAM Global (WGB) was trading at a small premium (of +4.8%) to NTA at the end of Feb, and I can't think of any other globally focussed LIC (an ASX-listed investment company that invests in companies outside of Australia) that is currently trading at an NTA premium, so that's quite a feat!

In fact, the only LIC that WAM Funds manage that was NOT trading at a premium to NTA at the end of Feb 2021 was WAM Alternative Assets (WMA), which had a before tax NTA of $1.10 and closed the month at $0.995, being a 9.5% discount to NTA, which is a lot less than the big discount they were trading at prior to WAM Funds taking over the management, and that was fairly recent, so in time they may also end up trading at an NTA premium as well. However, they also might not, because of the very nature of the assets they hold, and the market's perception of the margin of error that may need to be factored in to their valuations of those assets. A lot of WMA's assets aren't trading daily on an exchange like company shares are, so the valuations are a little harder to work out, and for that reason it is quite possible that a 10% discount - or thereabouts - might be as good as it gets. We shall see.

But back to WLE - WAM Leaders - Matt and John (and their team) are doing a great job with this fund, and the share price reflects the underlying portfolio performance. It's all good. Wish I was still holding them actually...

04-Aug-2024: Update:

WLE will probably release their July report tomorrow (Monday 5th August 2024) however I'll take a stab and say their before-tax NTA is probably worth around $1.39, based on their NTA at the end of June (see here: WLE-June-2024-Investment-Update.PDF) of 133.60 cents ($1.336) plus the market (the ASX200 index or XJO.asx) rose +4.17% in July (from 7,768 close on June 30th to 8,092 close on July 31st), so 133.60 cents + 4.17% = 139.17 cents or $1.39.

WLE is now my largest position in my largest real money portfolio, with 100,000 WLE shares held in that portfolio, bought at $1.27 two Friday's ago, 26-July-2024. I like their dividend yield and the fact that they've outperformed their benchmark index over 3 years, 5 years, 7 years and since inception (before fees), and have paid more in dividends than people would have received by investing a similar amount in an ASX200 tracker (ETF). They also have a healthy profit reserve with more than 3 years' worth of dividends in there. They have also raised their dividends every single year since inception. The dividend yield at my buy price of $1.27 (and they closed on Friday only half a cent above that, at $1.275) is 7.24% plus franking, so over 10% when grossed up to include those franking credits. This is based on WLE paying a 4.6 cps final div, the same as their interim div, so 9.2 cps/year.

WLE have underperformed the index over the past year, hence the premium to NTA came out of their share price and they have traded at a small discount to NTA, which is why I have been attracted to them now, that and the dividend yield. But they have outperformed over all periods from 3 years upwards and their profit reserve allows them to maintain or even increase dividends even when they have a bad year.

So, the reasons I'm back in are:

- The dividend yield of over 7%, or 10% grossed up, and all fully franked dividends.

- The discount to NTA. It's small, but it's better than paying a premium.

- The exposure to large caps that I don't follow closely, so happy to offload that part of my market exposure to Matt Haupt at WAM Funds as he has a track record of beating the index and building up good profits and paying out top notch dividends.

I also hold WGB (their global LIC) for (a) global sharemarket exposure with active management and (b) good rising dividends, fully franked, with an even healthier profit reserve that covers over 5 years worth of div's: See here: WGB-June-2024-Investment-Update.PDF.

So - basically both bought at discounts to NTA (/NAV), both paying good above-market fully franked and rising dividends (WLE's yield is higher than WGB's yield however) and both give me exposure to market exposure that are not my forte - i.e. Australian large caps and overseas listed companies.

I do not hold any other LICs. In terms of WAM Funds other LICs, I don't like paying premiums to NTA, plus WAM Capital (WAM) has bugger all in their profit reserve so will continue to struggle to maintain their dividends let alone grow them - they haven't raised their dividends since 2018 (so have only managed to maintain it at the same level for the past 6 years) - and WAX have run out of franking credits and had to reduce their franking percentage.

So that's why I like WLE right now.

https://www.asx.com.au/investors/investment-tools-and-resources/asx-on-demand

WAM Leaders: Investing in large cap companies with compelling fundamentals

Recorded in July, posted to YouTube two days ago, on Friday 2nd August 2024.

14-Nov-2024: Update:

WAM Global (WGB) LIC October 2024 Report

Being overweight Resources and underweight the big Banks hurt WLE's NTA in October, which finished the month at 136.29 cps, 5 cents lower than the 141.55 cps they closed September at. That means that with a $1.37 share price at close of trade on October 31st, there was no discount-to-NTA in their share price as there had been for the previous few months.

The NTA drop isn't welcome, but their positioning is one of the reasons I hold them - I do want them to be overweight resources and underweight banks, so the NTA drop wasn't unexpected.

They are currently my second largest real money portfolio position (behind LYL) outside of my SMSF, due to that dividend yield - circled in green above - however they go ex-dividend on Monday (18th Nov) for their 4.6 cps FF div to be paid on 28th Nov, so I expect their share price to fall next week.

I'll likely be rotating some money out of WLE and into some direct shares either next week or soon-ish afterwards, depending on what their SP does. If they drop by substantially more than the grossed up value of that dividend then I'll probably wait before selling any; I'm not fussed having money tied up in WLE (or their stablemate WGB) because it's like an ETF except with active management and higher fees, and they've raised their dividend every single year since the fund's inception (WGB is a different exposure - to global shares, but they also have a good dividend history).

Here's WLE's dividend history:

...and with over 32 cents/share in their profit reserve, I expect WLE to continue that trend regardless of their actual portfolio performance. That's one of the main advantages of a LIC (listed investment company): their profit reserves and their ability to bank some profits and smooth their dividends using those reserves, and maintain or even increase dividends in times of poor potfolio performance.

Disc: Holding for the large cap exposure - with less exposure to the banks and more to resources - and also for the income.

11-Sep-2024: WAM Leaders pre-announced their results and dividends last month - see here: WAM Leaders increases fully franked full year dividend [26-Aug-2024]

Here's their 2024 Annual Report.

Here's the reason they are my largest position currently in my largest real-money portfolio:

That and one other fact: That they have enough in their profit reserve to keep increasing those dividends for another 3 years at least (PR = 31 cps).

Today they released this: WAM Leaders FY2024 Full Year Results Q&A Recording.PDF

WLE closed today unchanged at $1.29, after trading up to $1.315 during the day. Their end-of-August NTA was $1.37/share (as shown above). So they're still available at a discount to their underlying net asset value (NAV, a.k.a. NTA - Net Tangible Assets). Not a huge discount but a discount nonetheless.

Website: https://wilsonassetmanagement.com.au/listed-investment-companies/wam-leaders/

Disclosure: WAM Leaders is currently my largest position; I hold 100,000 WLE shares. They are in my "income portfolio", the largest one I manage.

People often think that a LIC like this only does well when the market does well, but sometimes it can be a little counterintuitive, because when the market is doing well, everybody considers themselves an investing expert and wants to invest directly in companies themselves, and when things get rocky, people either go to cash or they stick their money into ETFs or LICs which means they are outsourcing that portfolio management for that portion of their investable capital.

Sometimes reliable dividend paying LICs can move to a premium in more turbulent market conditions when self-funded retirees and other people that need to maintain an income stream (like me at the moment) want to lock in that income stream.

26-Aug-2024: WAM Leaders increases fully franked full year dividend (.PDF file)

This one is currently my largest real money position (100,000 shares). As I expected, WLE declared a 4.6 cps dividend, in line with their large profit reserve and the fact that they've increased their dividends every single year since inception, and I expected them to do it again, and they did.

I hold WLE for two reasons. The first is income, with that dividend yield of over 7%, which is over 10% grossed up (so including the value of the franking credits; all their divs are fully franked). The second is large cap exposure.

I tend to not follow large caps too closely as there are already too many professional fund managers and analysts and brokers and journo's and all the rest following our largest companies, so what insight am I going to have over them? To make money I need to be right when others are wrong, so buying at a good price when the person(s) selling to me are thinking that they are making a good move by selling at that price.

Sometimes both are right, as in it makes sense for me to buy at that price, for me, and it makes sense for them to sell at that price, for them and their circumstances.

However most of the time, in simple terms, someone is getting the better end of that deal. And when it comes to large caps, I don't feel I have an edge with most of those companies, so I don't bother. I either steer clear of most of them or I outsource that to an ETF (or two) or to a large-cap LIC that is paying better-than-market dividends and has a history of outperforming the index.

WLE have some shorter term underperformance but their portfolio (before expenses, fees, taxes, etc.) has outperformed the index over 3 year, 5 years, 7 years, and since inception (which was May 2016). Those outperformance numbers are +2.2%, +5.2%, +4.3% and +3.6% respectively, so not massive outperformance, but a bit here and a bit there and it all adds up. Even after fees.

The main advantage is they had 29.5 cps in their profit reserve @ June 30, so they can pay this 4.6 cps divy (declared today, as I expected), another 9.3 cps next year (interim & final divs combined), then 9.4 cps the following year, then 9.5 cps the following year (that's for FY27) - and still have money left in that profit reserve - and that's if they do NOT make ANY profits between now and then, and of course they will make further profits, but it's a very healthy profit reserve when they have another 3 years' worth of divs already covered, even with modest increases to those divs every year, after they pay the one they declared today.

I only hold two LICs - WLE and WGB (WAM Leaders and WAM Global) who both have dedicated investment teams with lead portfolio managers who are not responsible for any other LICs - just the one LIC for each of them - and in Matt Haupt's case also the WAM Leaders open-ended fund as well, which has exactly the same strategy - so holds the same companies. I was able to buy both at discounts to their NTA, they both pay great dividends, they both have very healthy profit reserves that guarantee future dividends even if they seriously underperform during the next couple of years, and they both provide me with exposure to companies I'm not comfortable to invest in directly myself in a lot of cases because I consider them to mostly be outside of my sphere of competence (wheelhouse).

The downside risks are (1) that we get a global downturn or a sharemarket crash for any reason, and/or (2) one or both of those LICs underperform and drag the share price lower as their NTA falls. However, I want sharemarket exposure and one of those risks is going to be present whichever way I choose to get that exposure, even via ETFs, and the other risk is one I'm willing to take based on the two LICs' lead portfolio managers' track records and investment styles.

Catriona Burns and her team at WGB had already pre-declared their FY24 final dividend, to be paid in November, and it's going to be 6 cps, fully franked, which puts them on a 5.4% fully franked yield (or over 7.5% grossed up) based on their closing share price today of $2.22, which is just above what I paid for my WGB. That's a good yield for a global shares LIC listed on the ASX - and the franking credits are all from tax paid on trading profits as they obviously don't get any franking credits from their investee companies - as none of them are listed here in Australia or pay Australian tax. So it's rare to get good dividends from an ASX-listed Global LIC, but to have them fully franked as well is particularly unusual - but good! I no complain!

But back to WLE - who reported today. It won't always be my largest real-money investment, but it is today. LYL is second. GNG is third. WGB is fourth. RMS is fifth (across two portfolios, and they reported today and they increased their dividend by +150% and that was just one of many highlights). There are a few other gold companies coming up behind those ones in terms of postion sizes.

It might seem like I am overly focused on dividends here, but what I'm really trying to achieve is TSRs and TSRs include both dividends and capital gains/losses, and the dividends are often a lot easier to predict than the capital gains, especially with LICs that have good profit reserves. So, yeah, I'm back in two LICs for now. But my strategy can quickly change when new opportunities present themselves.

https://wilsonassetmanagement.com.au/listed-investment-companies/wam-leaders/

14-Jan-2021: In the cover letter accompanying their December 2020 Investment Update or "LIC Snapshot" as they now call it, Geoff Wilson (from WAM Funds) said today:

Dear Fellow Shareholder,

We are pleased to announce the December 2020 Investment Update for our listed investment companies.

Markets rallied in the final month of a very turbulent year. The Trump Presidency is coming to a disgraceful end with the storming of the United States Capitol building and a second impeachment of the outgoing President, while a new strain of the coronavirus and rising case numbers in the US and Europe weigh on healthcare systems. The vaccine roll-out and the US stimulus package approval supported equity markets in December.

The S&P 500 Index rose by 3.7%, the NASDAQ Composite Index 5.7%, the UK FTSE 100 Index 3.1%, the Euro Stoxx 600 Index 2.5%, Japan’s TOPIX Index 2.8% and China’s CSI 300 Index 5.1% in local terms, while the MSCI World Index (AUD) declined 0.5% for the month. In Australia, a coronavirus outbreak in Sydney and localised lockdowns during the month caused concern among investors ahead of the summer holiday period. The Australian dollar rose 9.7% against the US dollar in 2020, underpinned by rising commodity prices, with iron ore reaching a nine-year high in December. The S&P/ASX All Ordinaries Accumulation Index rose 1.8% for the month.

Our listed investment companies' 2020 performance

We are pleased to deliver strong absolute and relative investment portfolio performance during the challenging social, economic and financial landscape that we witnessed this year. Our six equity-focused listed investment companies’ (LIC) investment portfolios outperformed* their respective benchmarks in the 2020 calendar year and the 2021 financial year to date.

Supported by strong risk-adjusted outperformance and profits reserves available, WAM Leaders Limited (ASX: WLE) and WAM Global Limited (ASX: WGB) announced FY2021 fully franked interim dividend guidance of 3.5 cents per share and 5.0 cents per share respectively.

Based on their 13 January 2021 share prices, these represent annualised grossed-up fully franked dividend yields of 7.5%# for WAM Leaders and 6.0%# for WAM Global.

WAM Leaders has 24.3 cents per share in profits reserve**, representing 3.5 years of dividend coverage for shareholders. WAM Global has 43.0 cents per share in profits reserve**, representing 4.3 years of dividend coverage for shareholders. We look forward to sharing the interim results for all seven of our LICs in the coming weeks.

* Investment portfolio performance and index returns are before expenses, fees and taxes.

# Grossed-up dividend yield includes the benefit of franking credits and is based on a tax rate of 30.0%.

** The profits reserve is before the fully franked interim dividend guidance.

--- end of excerpt --- You can access their full December 2020 report here.

[I currently hold WGB and WMI, and I have held WAM, WMA (previously BAF), WAA, WAX and WLE previously, and may do so again in the future.]

19-Nov-2019: November 2019 Shareholder Presentation

Note: This Presentation is related to the WAM Group (WAM Funds) + FG (Future Generation) Funds November 2019 Australian Roadshow (which I'll be attending here in Adelaide next Wednesday) and covers all of WAM Group's 6 LICs: WAM Global (WGB), WAM Leaders (WLE), WAM Capital (WAM), WAM Research (WAX), WAM Microcap (WMI) and WAM Active (WAA).

This one is for the Sydney leg of the roadshow, which includes their AGMs, but similar Presentations will be made at all of the venues they attend during the roadshow over the next couple of weeks.

WLE (WAM Leaders) is one of six LICs (Listed Investment Companies) managed by Wilson Asset Management Group (WAMG). WLE focusses on larger companies, predominantly in the ASX100, and most of their positions are in the ASX50.

They are currently (as at Friday 17th May 2019) trading at a 10% discount to their April 30th pre-tax NTA - which was $1.23. WLE closed on Friday at $1.105. It would be reasonable to expect a little bit of a rise today (Monday 20th May 2019) considering Labor has just lost the unlosable Federal Election, partly on the back of their policy of changing the refundability of franking credits for a large number of Australians. With the Libs now set to retain government, that issue has been put to bed for at least another 3 years (and quite probably longer), and WAMG's founder and CIO, Geoff Wilson, who is also the Chairman of WLE, was a very vocal opponent of Labor's failed policy on franking credit changes. He was the first to coin the phrase "Retirement Tax" which was picked up by most of the opponents to the policy and most of the independents and minor party senators who in most cases also pledged to vote against the changes should Labor win the election and try to introduce legislation to bring into effect their poorly thought out and badly structured policy (a little editorial licence here thank you, those views expressed here are not necessarily those of Strawman.com owners or staff or even necessarily the views of the majority of Strawman users, although I suspect that most people who hold dividend paying shares would prefer the status quo). Anyway, bank shares might have a little bounce today, as might Telstra and other stocks viewed as "yield" or "income" stocks. WLE, ARG, AFI, MLT and some of the larger LICs who hold bank shares and other large cap income stocks might also do reasonably well on the back of Labor's defeat. WLE look good here as long as you can buy them below their last reported NTA, and, as I said, they closed Friday at around 10% below their last reported NTA (net tangible asset backing).