Pinned straw:

BGH Capital increased their holding a couple % points in Webjet Group.

Some background, because I wanted to understand where BGH were coming from. In 2020, they bought a 55% stake in TripADeal, joining the founders.

AFR, ' If Tripadeal, which made a $4.4 million net profit in 2018-19, was valued at anything like the 15 to 25 times earnings multiples at which listed competitors such as Flight Centre and Webjet traded before the pandemic, then BGH's 55 per cent stake could represent a $30 million to $50 million investment.'

They sold a 51% stake in TripADeal in 2022 to Qantas for $110m. June 2024 Qantas bought the remaining 49% for $211m. At the time, they expected bookings (TTV) of $450m for the year. Company valued at $431m June last year. Webjet did $1.3B in bookings or TTV in FY25. Now I'm not saying at all that Webjet is worth what ever the multiple that Qantas paid for TripADeal, but I do think its undervalued and BGH has a track record in the space.

Adding to my SM portfolio. Still holding IRL. Short term catalyst is another offer from BGH.

Follow up,

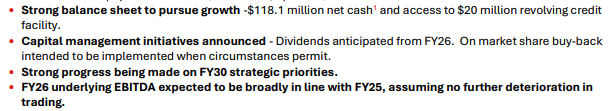

Share buy-back of up to $25 million and looking to use available franking credits for special dividends above the target pay out ratio for dividends of 40-60% of underlying NPAT.

Also announced the acquisition of an online business travel company called Locomote for $17 million. Speed to market versus in-house build was quoted as the reason to acquire.

I think I will continue to hold. I like the acquisition to chase growth and is well aligned to the core business. I think the cash generation is strong, that with support a ok dividend plus increasing EPS with the share buy-back.

For the P/E multiple to go up, I think the market might wait until management show they can execute and achieve profitable growth because right now, they're literally saying earnings will be flat.

ChatGPT:

Metric FY26 Forecast Notes

Underlying NPAT ~$19.8 m MarketScreener analysts

Dividend @ 40% payout ~$7.9 m Equals ~$0.0201/share

Dividend @ 60% payout ~$11.9 m Equals ~$0.0303/share

Estimated yield @ $0.92 2.2%–3.3%