Discl: Held IRL

SUMMARY

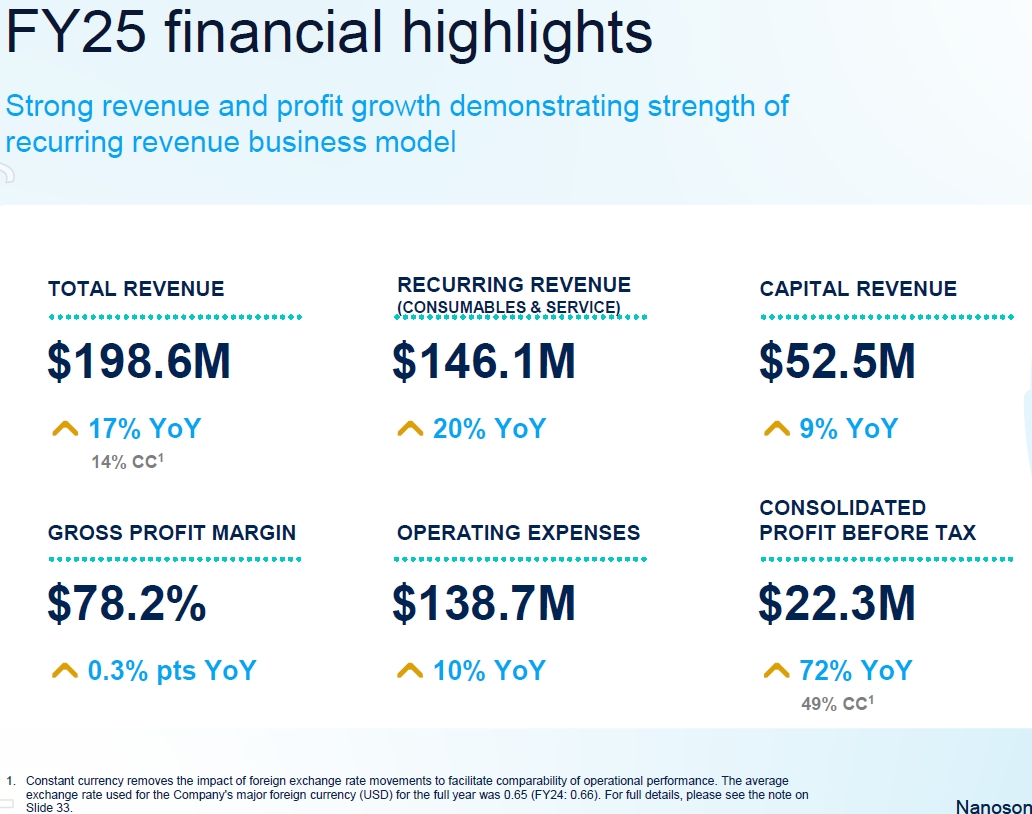

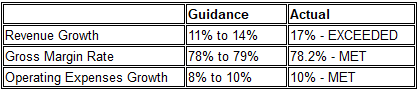

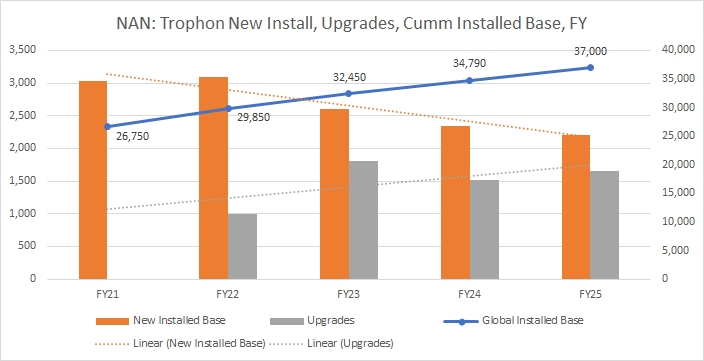

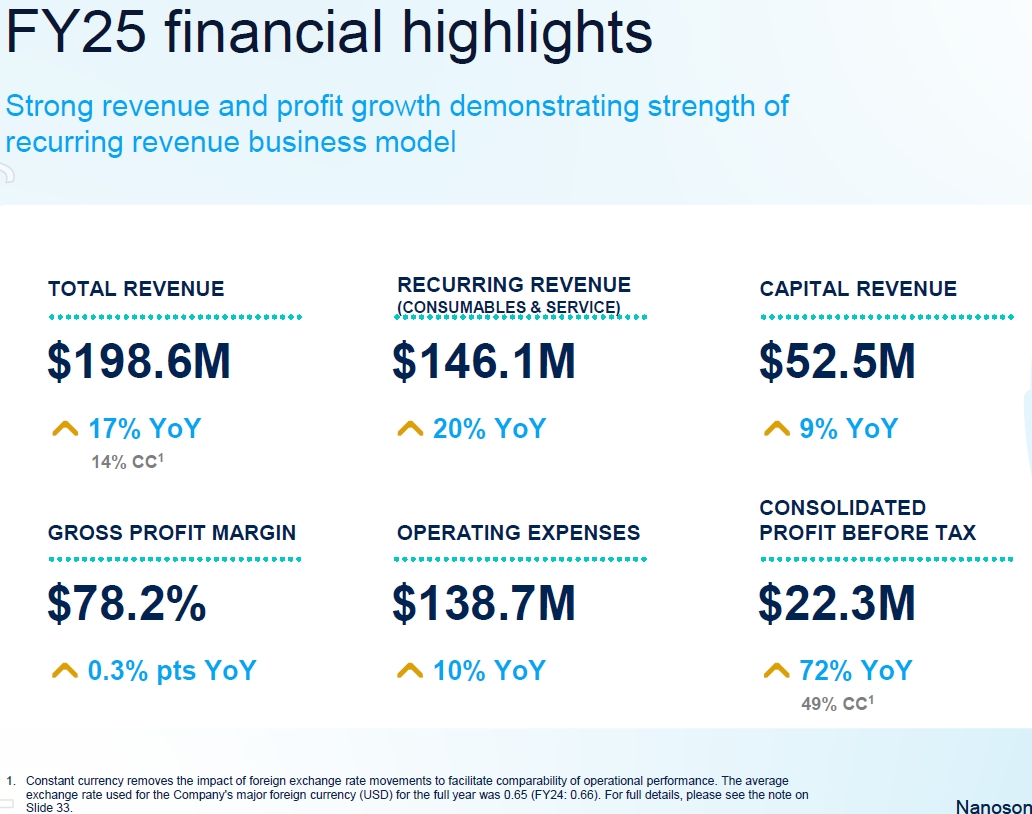

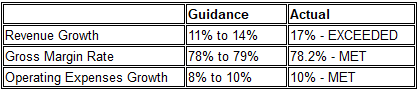

Solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

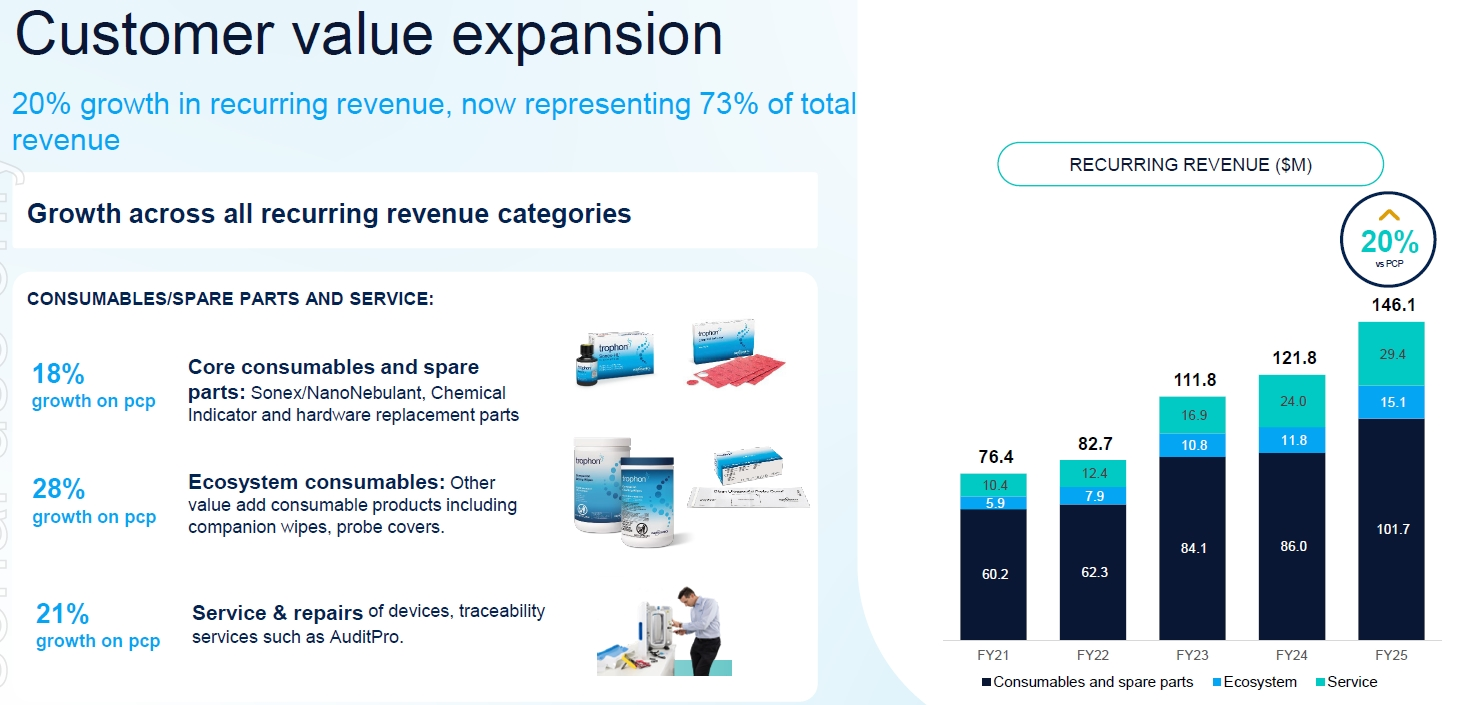

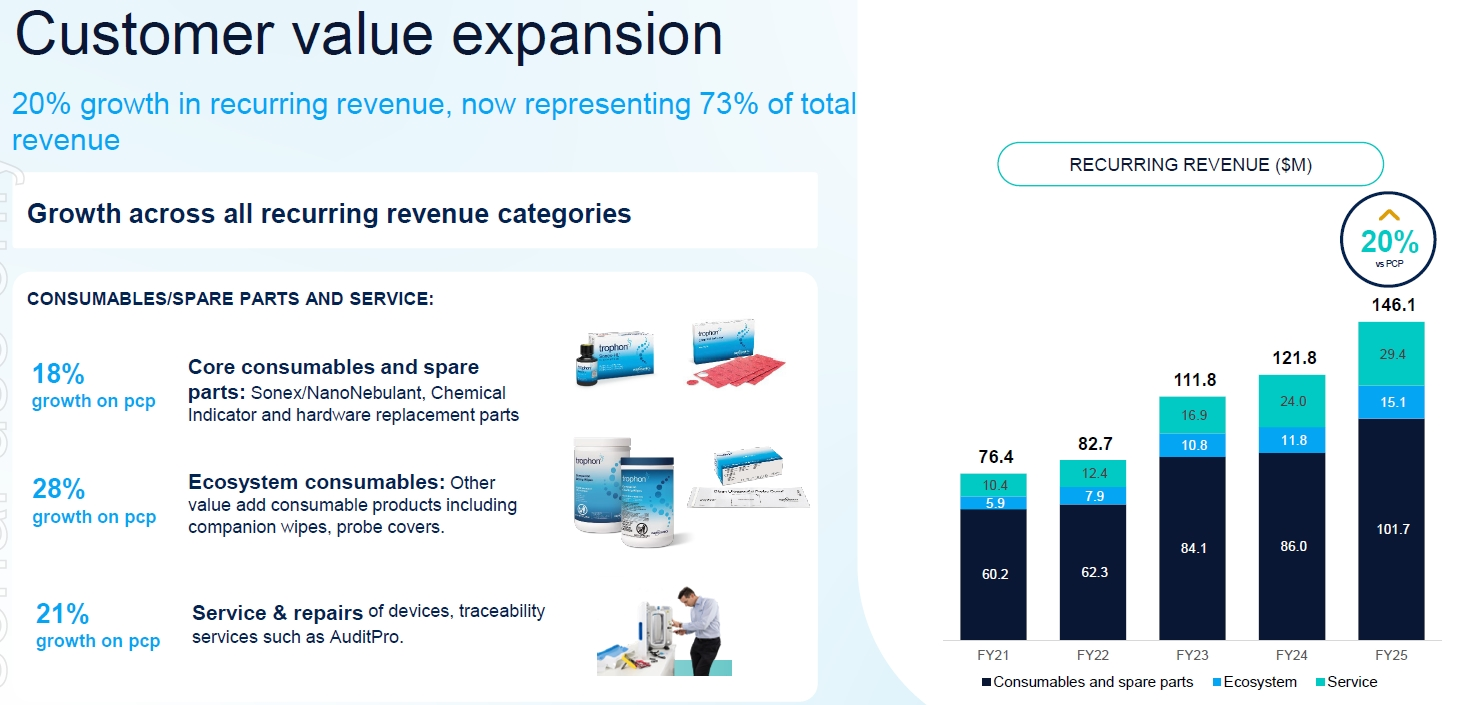

17% YoY Revenue increase was driven by 20% YoY increase in Consumables and Service Recurring revenue and 9% Capital Sales revenue - the regaining of revenue momentum in 1HFY25 was very much sustained in 2H, leading to the good overall FY25 result.

Operating leverage is now increasingly evident, especially in Consumables and Service recurring revenue.

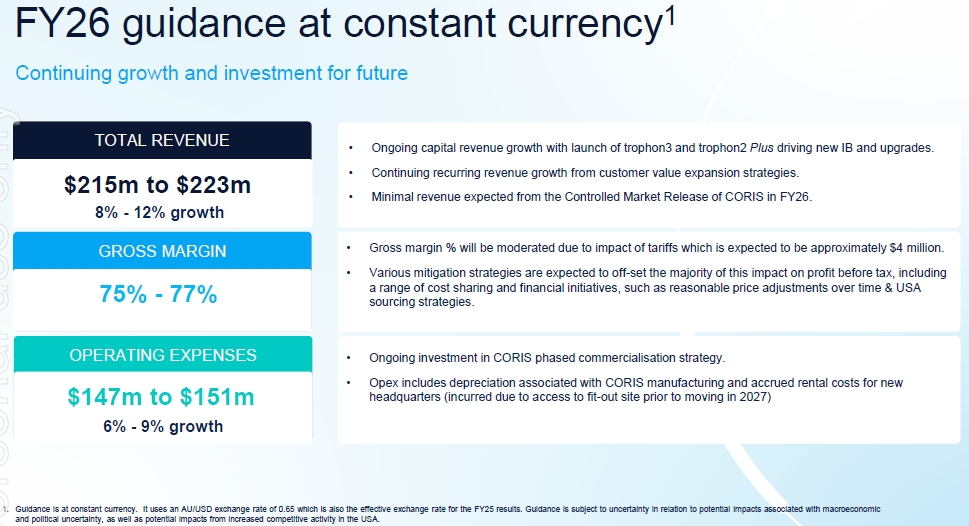

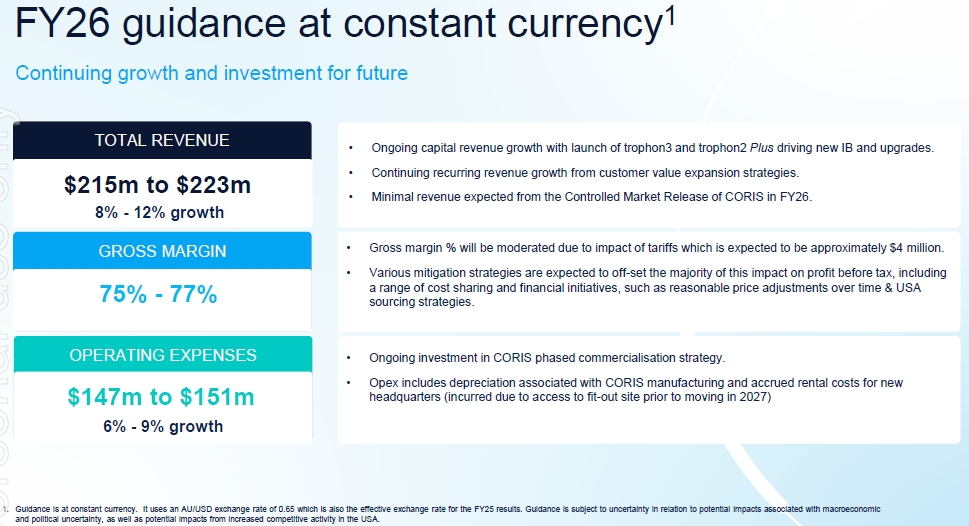

FY26 is guided to be “more of the same as FY25” - with upgrades to Trophon 3 being the focus in 1HFY26, followed by software upgrades to Trophon 2+ in 2HFY26, and the continuing of momentum from Trophon Consumables and Service recurring revenue.

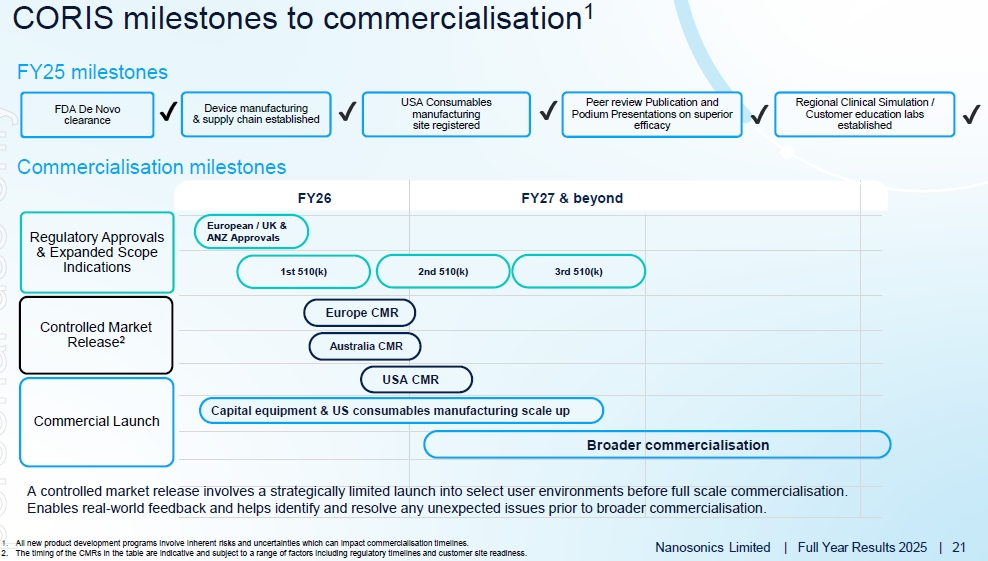

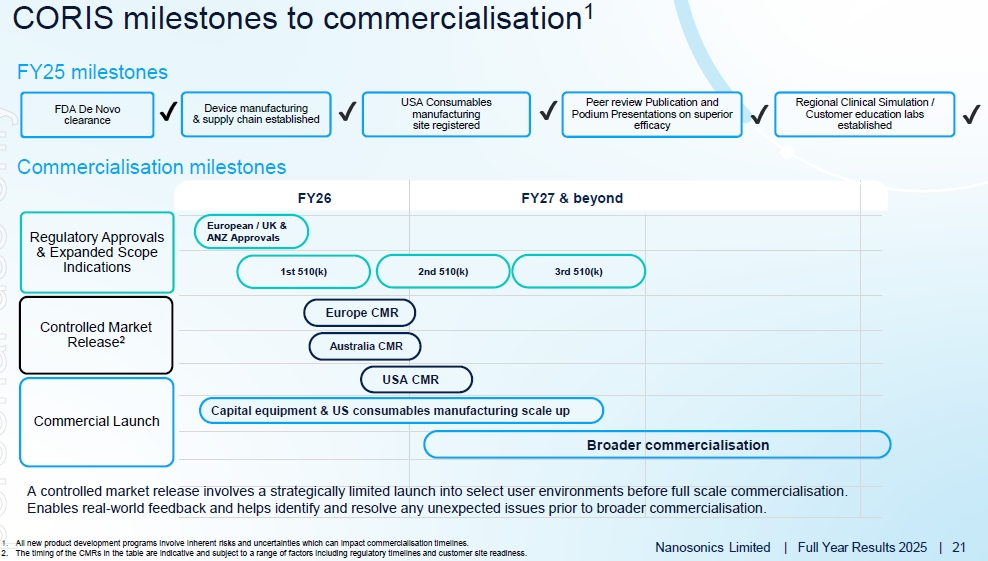

FY26 growth is with very minimal Coris contribution as NAN focuses on bring Coris to market, set up the operational supply chains, submitting 501k indication expansions to broaden the use of Coris to “all flexible end scopes” right throughout FY26.

The real kicker will come in FY27 where both Trophon and Coris should be firing all cylinders, creating a significant step up in NAN’s economics.

Key Risks to Watch Out For

- Trump and his bloody tariffs - the full impact of the tariffs, including the effectiveness of management mitigation actions, including the startup of the US manufacturing facility, will be experienced in FY26

- Issues with 501k Indication Expansion applications - nothing is approved, until it is approved

- Hiccups with the Controlled Market Release of Coris

- Slower than expected momentum in the uptake of Trophon 3 upgrades (in 1HFY26) and Trophon 2+ upgrades (in 2HFY26)

Have added my notes against the key preso slides from this morning’s call if anyone wants the detail. I really like the slide pack because, for me, it very clearly and logically tells the story of FY25 and has lots of insights as to how management expects FY26 to play out.

Overall

My bullishness in the longer-term outlook of NAN went up a notch today. I do not expect any significant movements in the NAN share price in FY26, if any, probably a sideways with an upside bias, and patience will absolutely be required for the full Coris commercial release to play out.

Action To Take

Accumulate on price weakness under ~$4.00 from hereon to position for FY2027.

Chart Review

The NAN price chart looks really nice - textbook retracement to about 60% since March 2024. This sets it up nicely for upwards price movements from here, with support coming from the 200 MA line and the medium-term uptrend line.

DETAILED NOTES

A solid 2HFY25 and FY25 result, meeting and exceeding guidance provided at the 1HFY25 results.

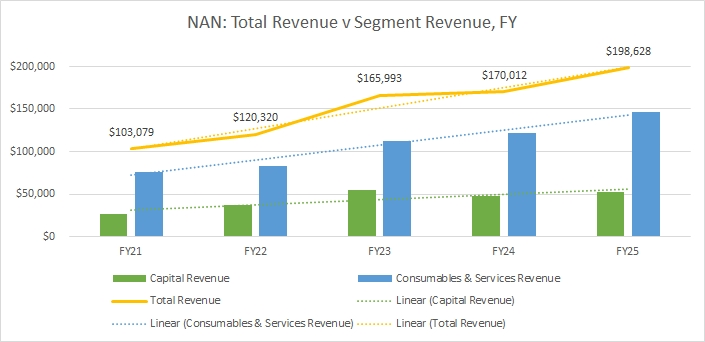

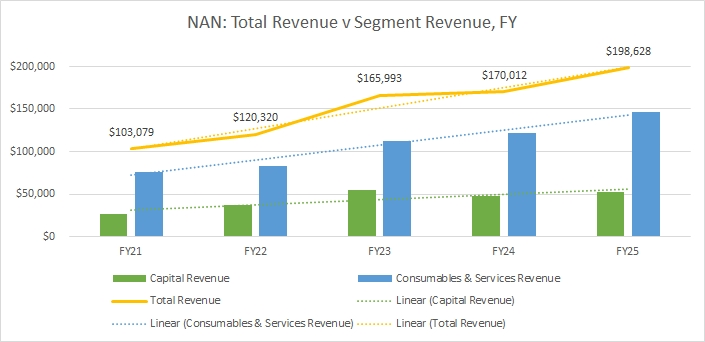

Installed base of 37,000 Trophon units is driving strong recurring revenue growth through customer value expansion - recurring revenue up 20% YoY - includes a small 3% price increase but is mostly volume-drive growth

FY25 delivered new installed base of 2,210 units & Upgrades of 1,660 units - driving capital revenue up 9% YoY to 52.5m

Growth in revenue and installed base was across all regions.

Trophon New Installed Base has been on the decline, Upgrades are increasing. Expecting to see both improve with Trophon 2+ and Trophon 3 in the next FY

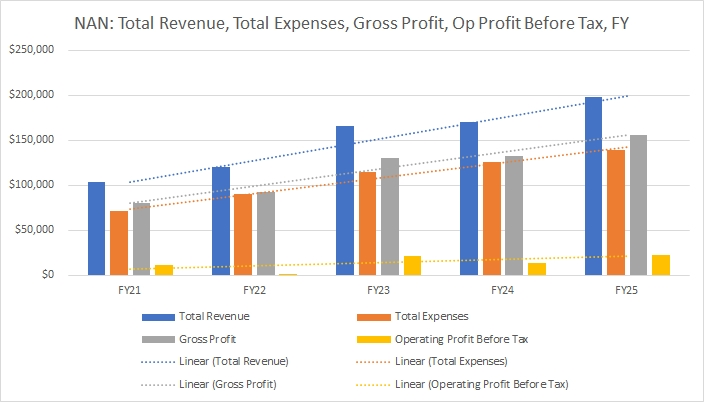

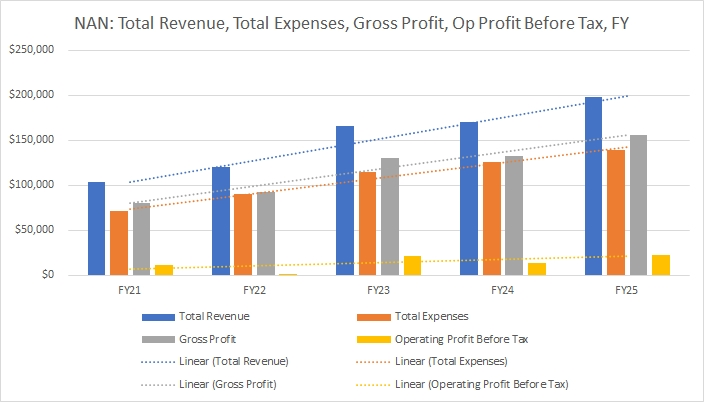

Operating leverage is showing with the increasing widening of the gap between revenue and expenses in the chart below

All components of recurring revenue are firing nicely - multiple drivers for Trophon which are highly profitable and generate good cash flow.

Core Consumables reflect the impact of a 3% pricing increase but growth was primarily volume driven.

Services revenue was up 21%, remains very promising - this was what got me excited as a 3rd recurring revenue stream when I last looked at NAN in June 2025 and topped up as a result.

Good all round operational achievements in FY25

Manufacturing facility established in Indianapolis, US for Coris and Trophon consumables

ERP implementation has completed

Cloud infrastructure established to support the integration to the DIFON platform for Trophon 2+ and Trophon 3

Really good to see ISO27001 cyber security re-certification achieved - this provides good confidence around NAN’s cyber security posture.

FINANCIALS

- Operating Expenses are falling as a percentage of revenue

- Admin expenses grew 19% but this included ERP investment which must be expensed in the year incurred - this ERP-related expense will not recur in FY26

- R&D expenses fell as a percentage of revenue by 2% to 17% - management has guided for “this trend to continue”

- Gross profit margin up 0.3% YoY to 78.2%

Tariff Impact

- Tariff impact was $0.5m, mitigated by high inventory levels already in the US

- FY26 tariff impact is expected to be circa $4m, expected to cause a drag on FY26 gross profit margin - guided to be between 75% to 77%

- Actions taken include sourcing from the US, price adjustments

Cash Position, M&A

- $32.0m cash generated in FY25, $161.6m cash balance, no debt

- Keeping a very open mind on M&A opportunities to put the available cash to best use, but acquisition must make sense

- Expect Coris to open the door to explore more M&A opportunities as the need will arise to build a Trophon-like ecosystem of consumables around Coris

- But focus in the coming year will be fully on bringing Coris to market

CORIS UPDATE

- Pursuing 510k scope indications to expand the use of Coris beyond initial De Novo approval for endoscope's to all flexible end scopes

- In parallel, pursuing regulatory approval in Europe and Australia

- Customers understand the need and the problems with the current cleaning methodology of cleaning and the resulting increase in adverse events from the risk of contamination - lots of ongoing education occurring

- Good slide which shows the multiple Coris revenue streams which other than the initial capital sale, are mostly recurring - very exciting

- Higher cleaning cycles per Coris machine (vs Trophon) are expected - lots of upside potential for recurring revenue to take off with Coris

- Did not announce the pricing for a Coris cleaning cycle - data point of $11 to $37 for CURRENT manual cleaning was given - hints point to something “around $10” ...

- EBIT margin for Coris consumables is likely to be “a little bit better than Trophon”

- Expecting the Coris model to be the same as Trophon - “more weighted to consumables”

New Manufacturing Facilities/Office in Macquarie Park

- Capex requirements to fit out new manufacturing facility/offices as lease for current premises runs out in 1QFY2026 and cannot be renewed

- Capex will straddle over FY26/FY27 for move in FY2027 - expected to be $10-$12m in total across FY26 and FY27, to be depreciated over 10 years

- Leasing costs will commence in April 2026 when access to the new premises is gained - expected to be circa $600-700k in FY26

FY26 GUIDANCE

- Revenue 8-12% growth, includes expected “reasonable” price adjustments

- Minimal Coris revenue baked into FY26, focus is to get Coris to the Controlled Market Release stage - will learn from this stage to better understand and quantify the FY27 impacts

- Not currently seeing major issues with hospital capital budget issues of 12M ago and not seeing any change in patient volumes going through hospitals - these observations is baked into the guidance

- Gross margin to fall from 78.2% to between 75% to 77% due to expected tariff impacts

- Minimal revenue from Coris which would only be in “Controlled Market Release” mode throughout FY2026 - this will set up FY2027 very, very nicely

- Continue to expect Opex to grow less than revenue

- Higher depreciation of around $2m was flagged for the fit out of the manufacturing facilities in the US

- R&D expenses as a % of revenue expected to fall in the ROM of 2% in FY26

- FY25 R&D cost was majority internal cost - bio scientists, clinical staff etc, not just engineering personnel

- Committed to ongoing internal innovation

- FY26 R&D will be focused on the broader Coris indications and Coris-related R&D

- Capex was guided to be circa $10m (FY25 was $9m) - 50% for the Facilities fit out, 50% will be the normal Capex run rate