Discl: Held IRL and in SM, and staying In

SUMMARY

As the Earnings call was progressing, the following were the impressions that I wrote down and took away:

- Relentless and furious peddling with EML2.0 transformation occurring on multiple fronts - there is significant complexity to confront and fix everywhere management turns

- Management is continue to chew gum while it sprints - the analysts on the call appear to clearly get this focus on restructure

- Flat Customer Revenue has been offset by significant improvement in Interest/Treasury Income - FY25 EBITDA guidance was met

- Anthony Hynes summed it best at the end with a quote he says he uses with his wife: “I am a work-in-progress. Stick with me, the best will still be”

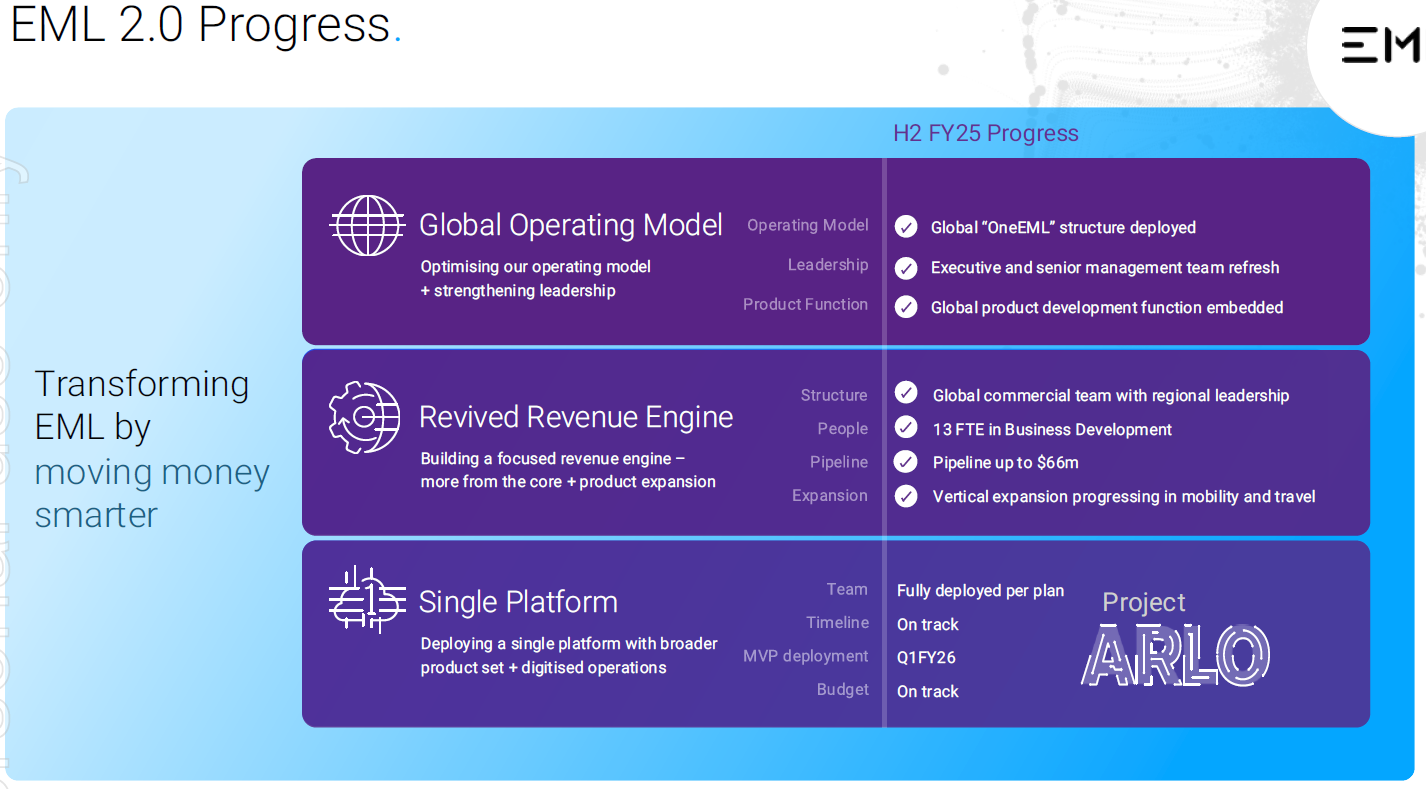

Having managed and been a part of many an organisation’s Transformation journey’s, I totally get the necessary pain that EML2.0 is bringing to the EML organisation, both in the actual work needed for the transformation AND in parallel, the need to still keep the business running and growing. EML 2.0 is a wholesale clean out and change - the people have been cleaned out, the systems and processes rebuilt, the culture changed. It is brutal.

I have very high confidence in EML2.0 as one key thing stands out - the very public and strong drive for that Transformation by the Exec Chairman himself, who, is also a major shareholder on his own coin. The language that he uses is the sort of brutality that any Transformation PMO wants by their side, and this is him being polite in public. That sort of ownership is pure manna from Transformation Heaven ...

And so, I will have a lot of toothpaste remaining to squeeze out of my EML toothpaste tube, to give management the next 1-2 years that it needs to fully transform and transition, before the growth trajectory of old takes off.

Chart Review

With the meh-like results, and despite the analysts sounding generally congratulatory in the call Q&A, I expected the price to be belted to the tune of maybe ~5%, given how unforgiving and short term the market is these days. So, was very surprised to see EML close unchanged, albeit with a long down wick in today’s candle. This provides an immediate data point, at least for now, that the market understands where EML is and where it is heading - that is hugely positive.

I do expect the price to drift sideways/downwards - I will be looking to top up if the price retraces to say, 80c-ish, to position further average down and position for 2HFY26, where the real action will begin.

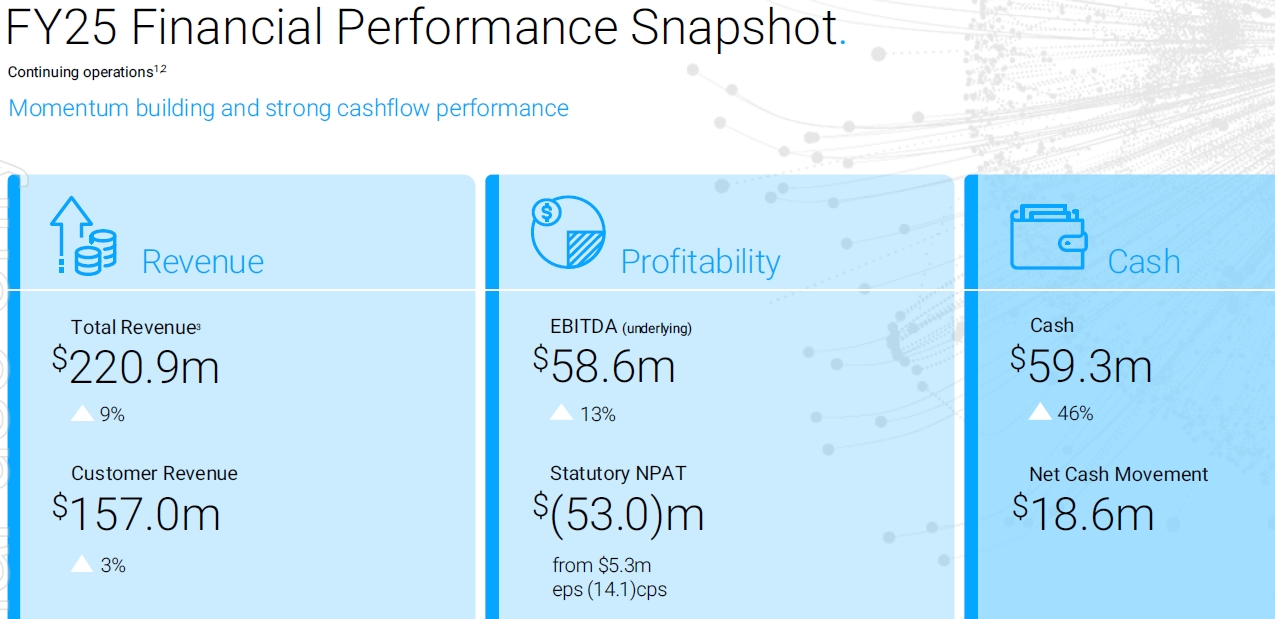

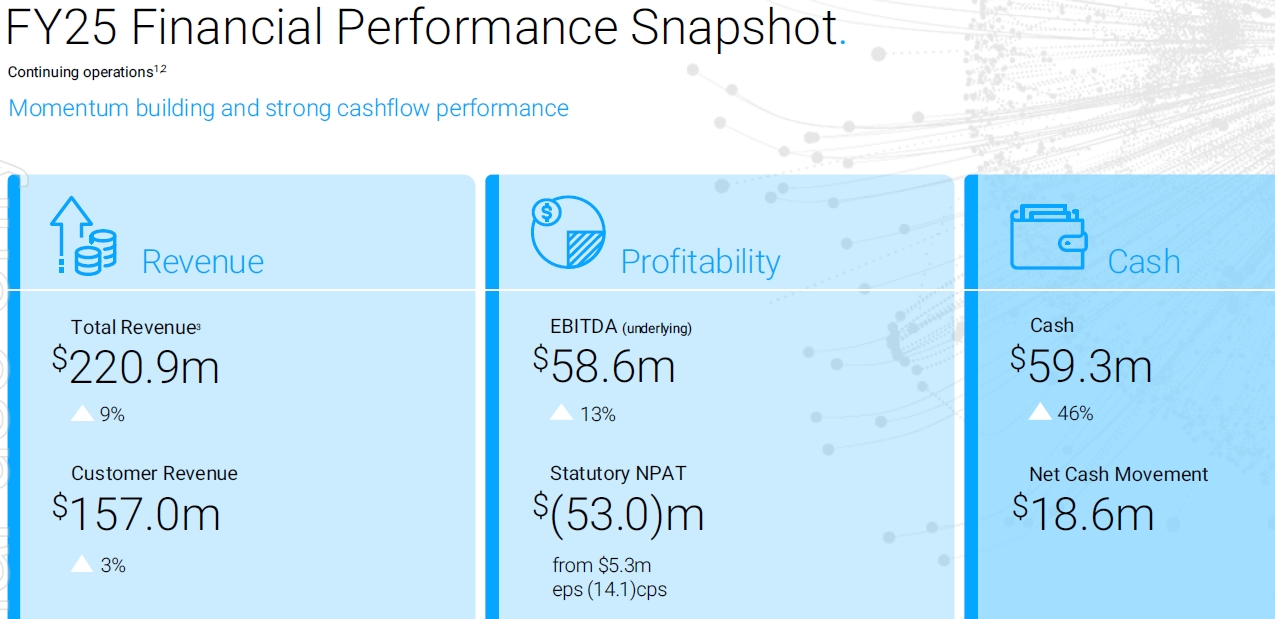

FINANCIAL PERFORMANCE

In absolute terms, the EML FY25 results were “Meh-to-OK-ish”. But in the context of massive organisation transformation, it was very pleasing.

- Revenue grew 9% YoY to $220.9m

- Underlying EBITDA was $58.6m, meeting guidance of $54-$60m towards the top, up 13% YoY

- Modest 3% growth in customer revenue

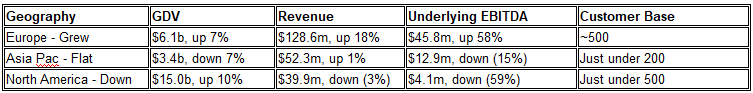

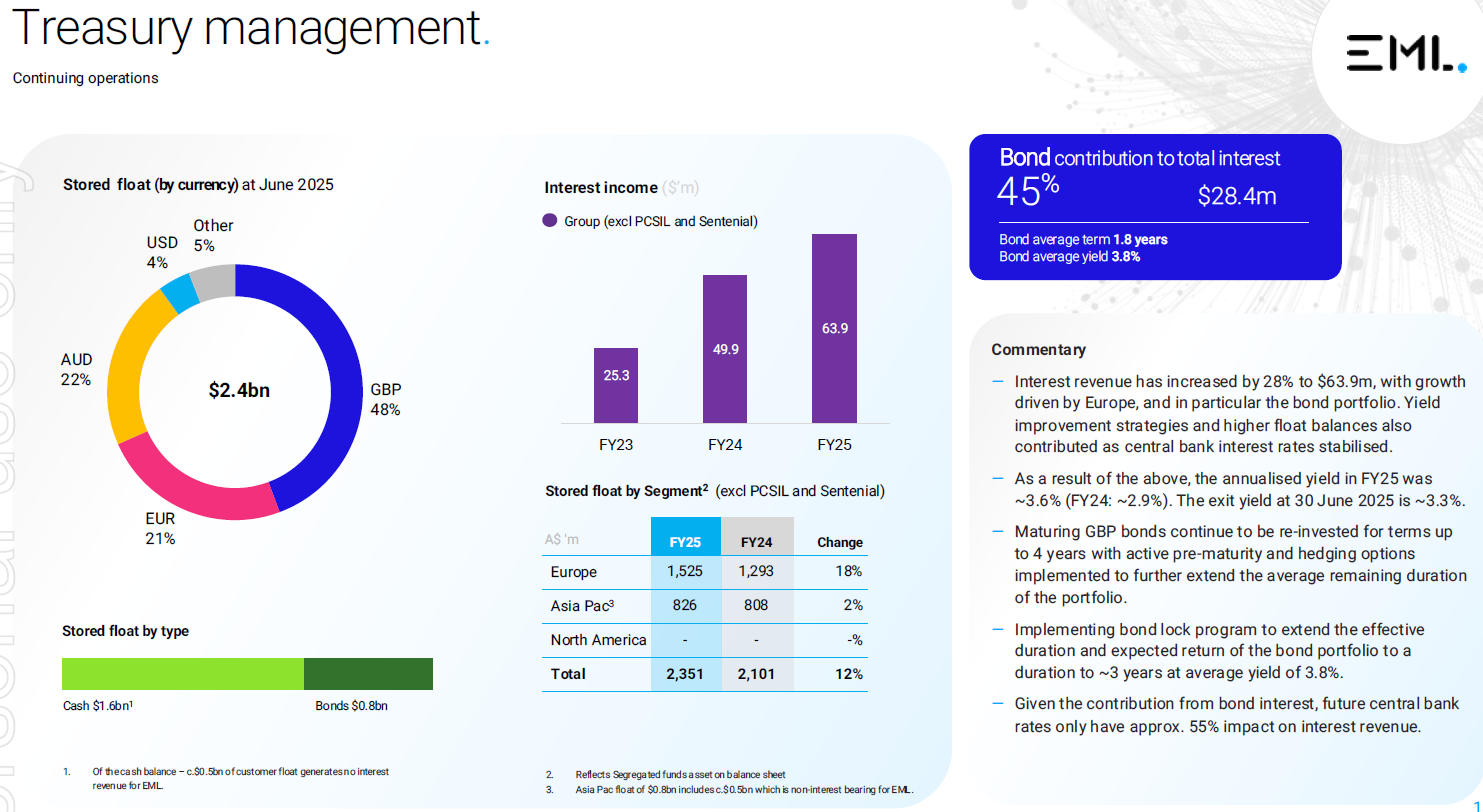

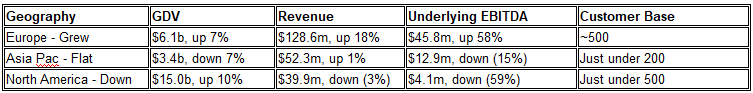

- Higher interest revenue, jumping 28% - driven by yield improvement strategies, higher central bank rates and higher float FY25 annualised yield was ~3.6% (FY24: ~2.9%), exit yield ~3.3% at FY25

- Partly offset by overhead cost increases - up 1% HoH, up 8% YoY

- Underlying Gross Margins were sustained at 75%, underlying EBITDA margin

- Statutory NPAT took a big hit from the ~$35m Shine Class Action settlement

- Cash increased $18.6m YoY , which resulted in cash of $59.3m. Up 46% YoY

- Cash conversion ratio of 72%, generating $16.7m net cash from operations, higher than normal

- Further $55m borrowing capacity

Other FY25 key achievements that provide evidence of a bit more than green shoots:

- 8 top 30 contracts were renewed, including 2 in the top 5

- 27 new clients secured

- Bond yields fixed on ~45% of the float for 3 years locked in at 3.8% - very positive given the lower trajectory of interest rates

- Class action settled - no more uncertainty about the size of the settlement of ~$35m

- Pipeline up to $66m vs target of $60m (from a start of zero pipeline in Dec 2024)

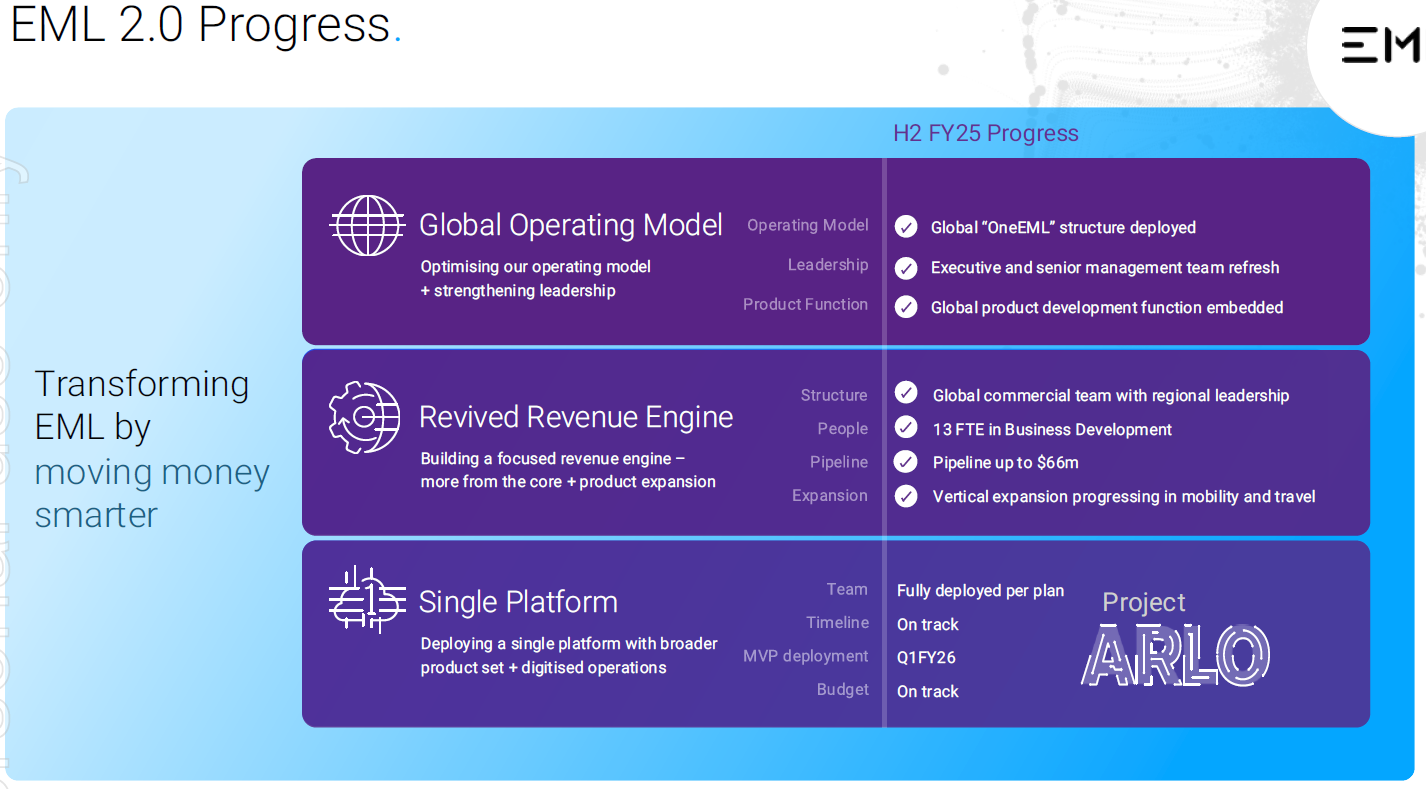

Geographic Segments

Treasury Management

Interest income has grown nicely in the last 3 years

Future central bank rates only have approximately 55% impact on interest revenue

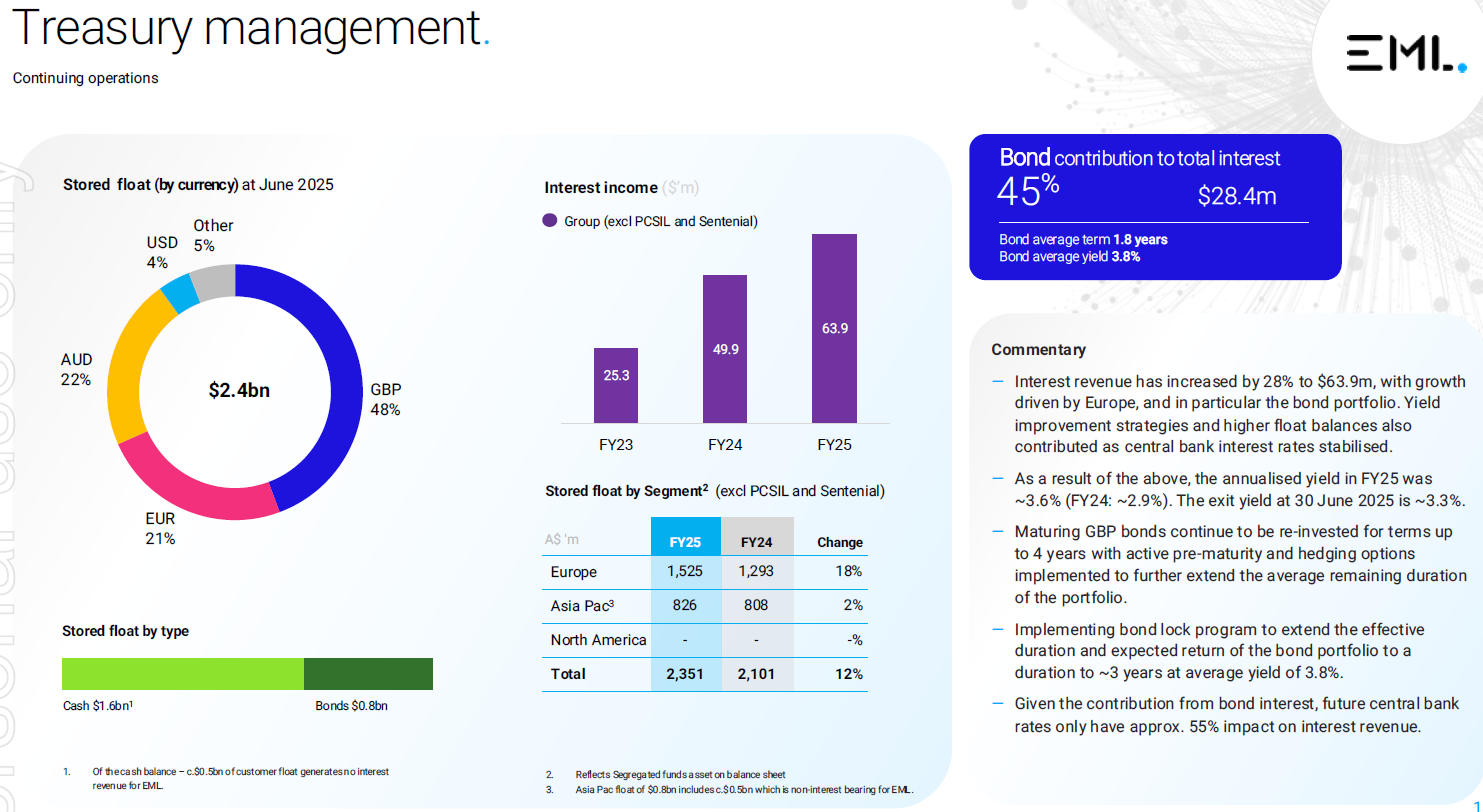

EML 2.0 Update

Comments by Anthony around the Transformation Journey shows the breadth, depth and intensity of the Transformation

- “Wholesale refresh of People, Process, Technology and Culture” - “if you started before 2024, you must be no good”

- “Doing more with our Core” - focused effort, moving hard

- “No corner of our business is being untouched by EML 2.0”

- “Often we turn more rocks and fine more rocks - getting rid of rocks and deadwood”

- Key risk is the inability of the organisation to fully digest and absorb this change - it requires a high level of multi-tasking

- Project Arlo objective is to combine 3 platforms into 1 - once in a lifetime fix - On Track

- Key constraint is on the customer-end - how to lift and shift customers to the new platform around customer constraints

FY26 OUTLOOK

- FY26 is a “Bridge Year”

- Started the year with new signings, starting to see growth in revenue - key is to win and onboard quickly

- Expect cost base to be flat

- Target pipeline to $90m by end-Dec 2025

- Expect to go back to 10-12% Market Growth CAGR over a multi-year period through to 2028, starting with back-end of FY2026

- Unable to provide the are at which the pipeline will translate to revenue - pipeline was zero to start with and so, there is no data to support a conversion metric

- Will get a better sense of conversion dynamics by end CY2025 and will update in early CY2026