Pinned straw:

@mushroompanda gave a good overview of Cogstate—agree it’s worth keeping on the watchlist and appears to be gaining some traction.

A few recent signals have caught my eye:

- They’ve announced an Investor Day for November—Hard to imagine a company putting on a 5-hour session if they weren’t feeling optimistic about what's ahead.

- There’s increased IR activity: holding investor webinars (they’re up on the website) and, for the first time in ages, I’ve started hearing Cogstate mentioned in financial media.

Director buying: Brad just bought $87.5 on market. Not huge given he already has about $10.6m in equity (plus options and performance shares), but equally—why bother unless he’s confident in the outlook? Could be a soft signal to retail punters, but he’s never really struck me as a classic promoter—or I guess cynically it’s part of the new IR push.

So, is Cogstate finally getting ready to grow into its promise?

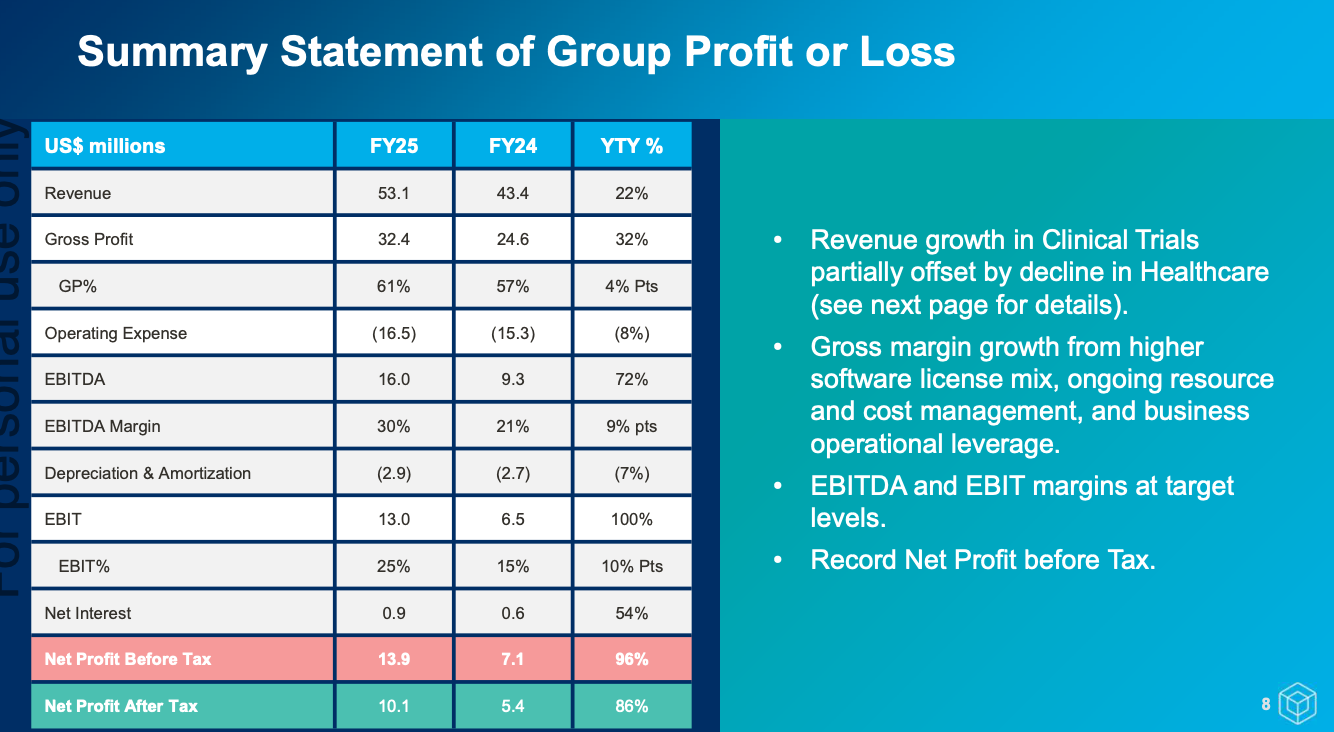

- Financials are good (if a bit lumpy).

- Feels like there’s a real effort to “sell” the story to the investment community right now.

- Liquidity potential barrier for larger investors—averaged about $130K traded per day over the last 12 months, including buybacks.

- Product usage is expanding beyond Alzheimer’s trials, makes business more robust.

- The CGS data set is valuable —chance of renewed M&A possibilities?

- Brad’s been around ~19 years. How much longer will he stick it out?

@Strawman at the last meeting, Brad was pretty flat, it would be good to get an update meeting if possible, see if his outlook has brightened.

Held for ~5 years, small position, topped up after results.

Was planning to sell after this report season if no clear path ahead emerged, I’m satisfied with the results & commentary so back to holding for another year.