Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I’m attending the investor day tomorrow.

If anyone else is going, I’ll be the one with an orange Crumpler backpack and not looking very corporate!

Not expecting there will be heaps of people but who knows.

Cogstate seems to be executing well with an ever increasing pipeline and expanding into new disease domains. Margins may compress in the short term as they tool up to enable this:

Business Update

All results in US$, unless stated

Cogstate Limited (ASX:CGS), has today released a business update ahead of its Annual General Meeting of

shareholders, which will take place at 11am AEDT today.

Market Conditions

The demand for Cogstate services continues to grow, reflecting both growth in the market for R&D in central nervous

systems diseases as well as growth in market share by Cogstate.

Each of the last four quarters (from 2Q25 to 1Q26) has set a new record for the number of sales opportunities

identified by Cogstate, with those opportunities in the September quarter (1Q26) 72% higher than 1Q25.

The growth in sales opportunities identified reflects an expansion of both the Cogstate customer base and entry into

new indications. Cogstate management continues to carefully monitor win-rate from the associated increase in

proposals volume and is assessing the full impact of new channel partnerships, with further updates to be provided

throughout the course of the year.

Clinical Trials Sales Contracts

For the September quarter (1Q26), Cogstate executed $21.4 million of sales contracts, which is the second highest

quarterly result in Cogstate’s history. The quarterly sales contracts represent an increase of 88% compared to the

$11.4 million of sales contracts executed in the previous corresponding quarter (1Q25).

The following table shows the reduced concentration of the value of sales contracts executed in 1Q26, delivering on

Cogstate’s growth strategy, compared to the full FY25 year – noting that 1Q26 data will not necessarily be reflective

of the full FY26 year:

Indication

FY25

Sales Contracts

by Value

1Q26

Sales Contracts

by Value

Alzheimer’s disease 56% 33%

Rare disease 19% 19%

Narcolepsy 6% 11%

Depression 5% 17%

Parkinson’s disease 4% 2%

Schizophrenia 2% 14%

Other 8% 4%

| Page 1Financial Outlook 1H26

Subject to sales contracts executed up to 31 December 2025, and 1H26 revenue yield from those, revenue for the

December half year period (1H26) is expected to be:

• Approximately 18% - 20% better than the previous corresponding half (1H25 $23.9m); and

• Closely align with the most recent June half year period (2H25 $29.1m).

In respect of margins for the December half year period, we reconfirm guidance provided with the release of the

FY25 results in August, specifically:

• Continuing to invest for growth: Both direct costs and operating costs will increase from FY25 to FY26 as

Cogstate invests for growth:

o Additional science resources to support expansion into psychiatry and mood disorders;

o Additional resources based in the Asia-Pacific region to support a growing customer base there;

o Continued increase in expenditure related to data engineering to bring more automated data insights

to Cogstate customers; and

o Engineering expenses associated with development of AI tools.

• Potential margin impact of growth initiatives: Subject to revenue growth in FY26, the increase in

expenditure may result in a small decrease in margins (0-3 percentage points).

Due to the volume and value of sales opportunities outstanding presently, it is not possible to provide accurate full

year FY26 guidance at this stage.

Held IRL

Super impressive meeting today with $CGS CEO Brad O'Connor's (not Cooper) kindly hosted by @Strawman as usual.

I also like the symmetry of a franked dividend hitting my bank account while Brad offered a really upbeat outlook for Cogstate as the seem to navigate brilliantly towards an AI future with powerful partnerships.

Seems Brad was also impressed with the level of SM expertise and even offered @mushroompanda a job after a particularly probing question.

I really enjoyed today's chat with Cogstate's Brad O'Connor (not Cooper!! as I mistakenly said.. ugh)

The recording in on the Meetings page and the transcript is here: Cogstate Transcript.pdf

A couple of things that stood out to me:

- I REALLY liked the assertion that they are staying focused on their core competency -- a narrow but deep moat, as Brad put it. Doing too much, too soon is just too often a capital killing move for small caps.

- It's clear that their offering is gaining increasing awareness and adoption by the big firms. As i say all the time, the social proof element is super critical for disruptors to properly exploit the opportunity in front of them.

- It was really interesting to hear him say that the R&D phase is actually still critical, if even dominant relative to the challenge of scaling (not that they are ignoring that at all). His reference to AI here seemed grounded and reasonable, and the partnerships being leveraged here made a lot of sense.

- Brad essentially spelled out what we investors should focus on -- the lead indicator of contract wins. Which, i suppose, it's somewhat obvious, but reading between the lines I wonder if he was essentially saying "we're expecting to win a bunch of work in the coming period"

- I thought his comments on takeovers, the company's initial listing and their increased IR efforts were all rather candid and reasonable. Most often you get more generic responses to those kinds of questions.

- The developing operating leverage is hard to miss, and testament to how well they are scaling. In fact, it is remarkable that their revenue has grown to the degree it has while they actually cut staff -- and significantly so.

- This wasnt discussed, but a PE of 37 actually doesnt seem too excessive at all *if* they can indeed double their revenues in the coming years and sustain (or even extend) their margins.

Also, big shout out to @mushroompanda who's question Brad called "remarkably insightful". Looks like you've got a job offer out that one too!

Anyway, here's the AI summary of the meeting:

- What Cogstate does (problem → solution)

- Core problem in CNS trials: highly subjective clinician-administered cognitive endpoints at global scale create noise that can mask drug signal. Cogstate’s mission is signal over noise.

- Solutions span: validated digital cognitive tests, trial design expertise, investigator training/certification, algorithmic data monitoring, human review of recorded assessments, and robust stats/reporting—all to reduce error.

- Economics of “getting endpoints right”

- A single Phase 3 Alzheimer’s trial can cost ~US$1B; Cogstate’s endpoint quality services are ~US$30–40m, a small fraction of total but critical to success and regulatory acceptance.

- AI & the next phase of clinical trials

- Trials are changing fast (1–3 years, conservatively “3–5”). Cogstate is applying small, purpose-built models over proprietary data rather than relying on generic LLMs.

- New AI model (shipping “next month”) flags assessment-administration errors from audio recordings, moving human review from ~60 minutes to ~10 minutes—and ultimately to full automation and 100% review coverage. North Star: real-time prevention and, longer-term, AI avatar administration (multilingual, consistent, error-free).

- Efficiency evidence: headcount down from ~200 to ~160 since COVID while revenue climbed from ~US$30m to ~US$50m, due to automation and data-analytics leverage.

- Build vs partner (tech strategy)

- Two years ago Cogstate shifted from fully in-house dev to a hybrid model with global engineering partner UST (~30k engineers). They run 12-week innovation cycles, tapping UST’s AI/data leaders, while Cogstate focuses on proprietary datasets and domain problems. Deliverables include avatar patients/caregivers for training/certification and internal productivity tools (e.g., AI-drafted RFI/RFP responses).

- Medidata partnership (scale unlock)

- Medidata is the dominant eClinical/EDC platform (acquired by Dassault Systèmes in 2019, ~US$5B deal). Historically light in CNS due to service intensity needed. Cogstate wraps CNS services around Medidata’s platform so Medidata can push into CNS; Cogstate gains reach and scale. Expect impact to show more in FY26 than FY25. Shareholder day (Nov 7, Melbourne) will feature Medidata’s COO Joe Schmidt and an ex-Lilly exec to discuss the partnership.

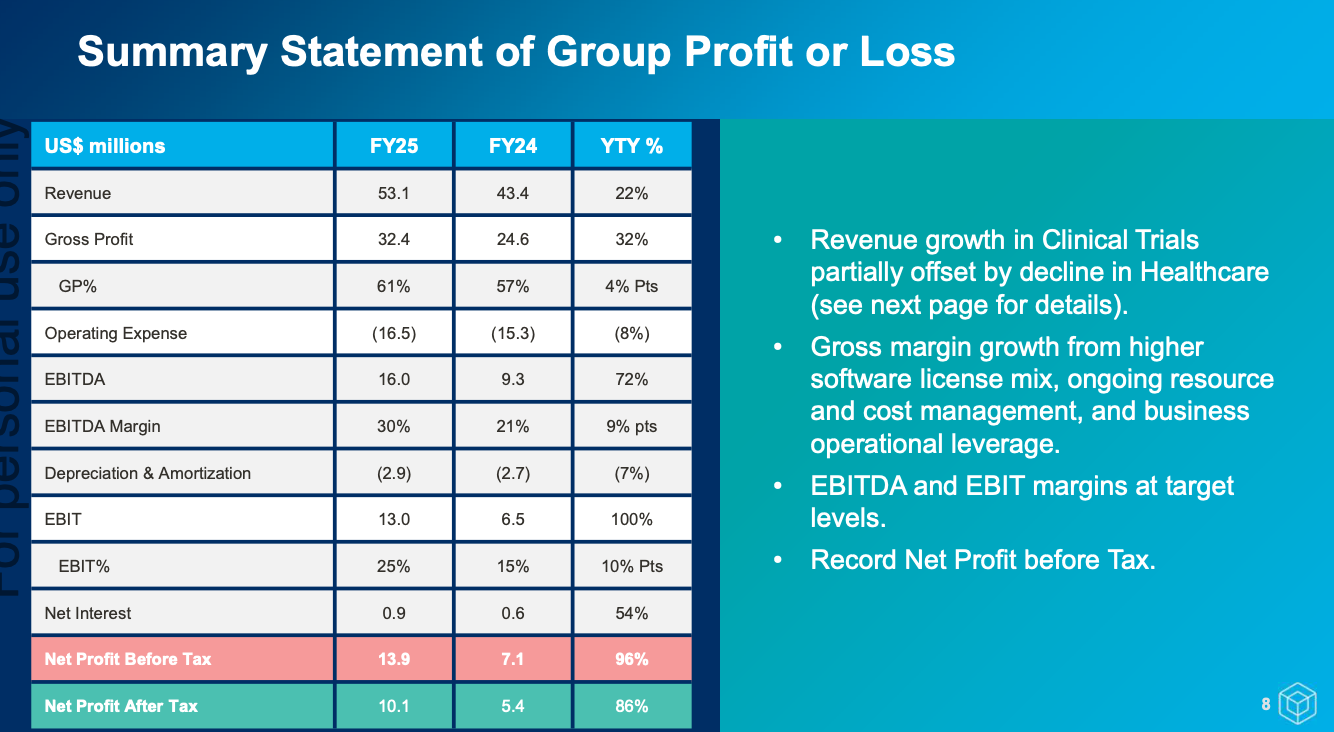

- Financial profile & capital allocation (as discussed)

- Recent year revenue ~US$50m; indicative margins: ~60% gross, ~30% EBITDA, ~25% EBIT. Cash ~US$36m at 30 June; ~US$5m buyback in the last 12 months. Board challenges management to speed up R&D, but management prefers rapid, measured experiments with customer validation.

- Targets/aspirations: lift license revenue from ~24% to ~30% (supporting ~65% gross margin), drive operating leverage to potentially ~40% EBITDA at scale; path to US$100m revenue with better opex leverage.

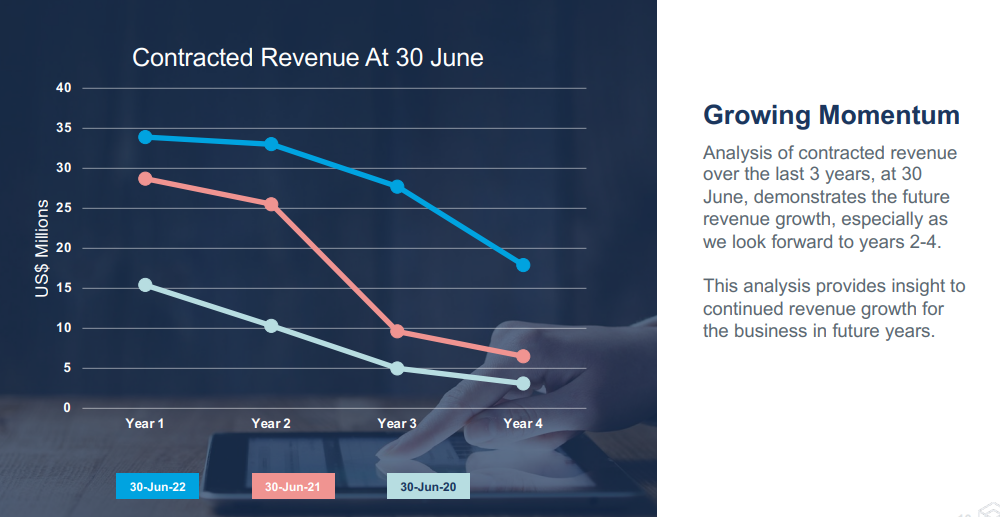

- Bookings vs revenue (key metric)

- Sales contracts (bookings) are the lead indicator. FY22 bookings were US$82m vs ~US$40m revenue; but in FY23–FY25, total bookings were below revenue. Management aims to reverse this in FY26 (back to bookings > revenue) as growth re-accelerates.

- Revenue lumpiness

- Mix shift in FY25 toward more, smaller, diverse studies (faster revenue recognition) made results less lumpy; however, lumpiness may return in FY26 with visibility on larger Phase 3 Alzheimer’s programs.

- Competition

- Two main head-to-head players in CNS trial endpoints/services: Sign Health and Clario (both PE-owned, broader offerings, larger scale). Cogstate is the smaller, deeper specialist (“inch wide, mile deep”). Potential IPOs for peers depend on market windows.

- Geography & APAC strategy

- Majority of customers/revenue from US and Europe. Growing interest in APAC, particularly China (drug discovery, out-licensing post-Phase 2). Cogstate assessing whether to expand boots on the ground in the region.

- Consumer/GP product (status)

- Prior primary-care push with a partner (ACI) did not gain traction (Alzheimer’s prescribing is specialist-led). Cogstate re-acquired the IP (no cash returned; fewer future payments owed). Options under review: direct-to-consumer assessments, or a white-label with large payers/associations (e.g., Kaiser, Alzheimer’s Association) where Cogstate offers tools (possibly free) in exchange for dataset access to power insights and prevention—still undecided.

- Alzheimer’s pipeline direction

- Expect shift from treating dementia patients to pre-dementia populations (e.g., 50-somethings with risk markers), moving the system from sick-care to health-care (prevention & early management). Near-term data readouts could reshape AD R&D for the better.

- Q&A highlights

- Michael #1 (lumpiness trend & Medidata): Brad said FY25 looked less lumpy due to more small/varied studies; lumpiness could return in FY26 with larger trials; reiterated need to grow bookings and broaden indications beyond AD.

- Michael #2 (Roche “TRAVELER” pre-screening): Brad called it “remarkably insightful”, confirmed Cogstate’s digital assessments are being used alongside blood biomarkers to identify community patients for future AD trials; joked Michael could “hit me up if you’re looking for a job.”

- IR activity: Cogstate admits it had been “a bit st**” at IR; now stepping up because the business is at a scale where wider communication makes sense. Shareholder Day Nov 7 flagged.

- Takeover chatter: On a past approach, there was diligence and a price but it wasn’t announcement-ready; acquirer ultimately did not proceed; disclosure came after market talk. On Medidata (hypothetical) acquiring Cogstate: board is open to value-creating M&A, but the company is not run for sale and is focused on capturing upcoming growth.

- What to watch (management’s own list)

- Bookings growth (sales contracts > revenue again in FY26).

- Early Medidata contribution through FY26–FY28 (share gains).

- Progress to US$100m revenue with license-mix expansion and margin uplift (opex leverage).

- AD trial landscape and movement toward pre-dementia populations.

This is just a quick look-see in preparation for our meeting tomorrow:

For those not familiar with the company:

Cogstate Limited (CGS), an ASX-listed company, is the neuroscience technology company optimising brain health assessments to advance the development of new medicines and to enable earlier clinical insights in healthcare. Cogstate technologies provide computerised cognitive tests across a growing list of domains and support electronic clinical outcome assessment (eCOA) solutions to replace costly and error-prone paper assessments with real-time data capture.

To me, Cogstate looks like a picks-and-shovels play in the development of new drugs to treat an increasingly broad spectrum of neurological conditions and brain malfunctions.

One thing I haven’t been able to get a firm grip on is Cogstate’s competitors - are there any who go head-to-head? I can see that there are some other companies with potential offerings in the space, but do they actually compete with CGS in the sense of the user picks one or the other? If there is a direct competitor,, who are they and what share of the global market have they got compared to CGS?

Also, what regions does CGS currently draw its revenue from, and what regions does it see as contributing the most in FY26-28?

Will stick those questions into Slido and see what we can learn.

Discl: Held in RL.

It was a great set of results for FY25. Though much of it was pre-announced in an earlier trading update, so there were no surprises. 2H was significantly stronger with $27.9m revenue and $8.1m EBIT. A notable shift from prior years is the growing share of smaller clinical trial wins, which provide faster turnarounds and earlier revenue recognition.

In the past, Cogstate has hinted that channel partnerships (with groups like ERT or Clario) could help drive sales. It now looks like they’ve found the real deal in Medidata - a major electronic data capture company with 4,000+ staff and roughly 800 salespeople. The partnership is still in its infancy: the sales team only began ramping up in February 2025, yet proposals involving Medidata already represent around 20% of Cogstate’s pipeline. With Medidata’s far deeper reach into clinical trials, Cogstate is accessing a broader range of opportunities than it could on its own. Management has made it clear this is only the beginning, with expectations of further pipeline growth and contract wins as the joint approach matures.

We’re also beginning to see the benefits of the April 2024 licensing amendment with Japanese pharma giant Eisai, which returned global rights to Cogstate’s assessment technology. That technology is now being used to help pharma companies pre-screen patients for clinical trials - an application that generated $1.2m in FY25 revenue, with more opportunities of this kind already in the pipeline.

It’s been a tough stock to hold over the years, largely because Cogstate has been so reliant on a small number of large phase 3 Alzheimer’s trials. The scarcity of these large deals, combined with their inherent lumpiness and the impact of patient recruitment delays, has led to significant year-to-year swings in the company’s performance.

All of a sudden, the outlook looks much brighter. The business is diversifying beyond Alzheimer’s into areas like rare disease, sleep disorders, and Parkinson’s - smaller trials that are quicker to secure and faster to recognise revenue from, smoothing out the historic lumpiness. Medidata is now driving meaningful RFP flow and opening doors into new indications. Cogstate has also began monetising its consumer-facing technologies for patient recruitment, with scope to expand into further use cases. Importantly, the upside from large phase 3 Alzheimer’s trials remains intact, with a number of big pharma companies currently progressing phase 2 programs.

Management have suggested revenue growth is once again expected in FY26, but with the shortened sales cycles and revenue recognition, no specific numbers have been given. Also expect a modest margin decline (~0-3 percentage points on EBITDA/EBIT) due to increase investments. They’re off to a strong start with $14.1m of contract revenue banked since June 30. A maiden $0.02/share fully franked dividend was also declared.

One could make the case that it’s a very reasonably priced company with an EV/E of 15x (annualise 2H performance), that’s more self-reliant than it has previously been (broader beyond AD, stronger channel-partner leverage, and a faster cadence of smaller contracts), with some tremendous tailwinds (pursuit of AD treatments, pharma chasing earlier stages of AD that require more sensitive endpoints, etc). Ultimately, this is only for investors that have belief in the long-term tailwinds and willing to ride the bumps and grinds - this is not your grandad’s SaaS company adding incremental ARR every year.

For those that may have missed this last week - Cogstate (CGS) came out with a fairly decent guidance upgrade last week.

So if we take the mid-point of $13m PBT should give us earnings of about $9.1m (30% tax rate).

There is circa 169 million shares in issues which then provides about $0.054 EPS.

At current SP = ~$1.71 / 0.054 = a PE of roughly 32.

With CGS returning to growth this seems fairly on point, but you'd expect/want to see this continue into FY26.

Will be an interesting annual report to review.

Feel free to jump in and add to the above.

Cogstate SP up 15.6% today.

I can't see any announcements or reports. I'm wondering if I've missed anything.

Anyone?

Cogstate attracted my attention because of my background in psychology and psychometric testing. My past business Voice Project was focused on developing tools to assess organisational culture and leadership, which overlaps to a significant extent the processes and challenges of cognitive assessment.

I’m late to the Cogstate party on Strawman, with 19 members currently holding Cogstate. Much of what I write here won’t be new to many readers. Nevertheless, some may find value in my notes and valuation.

TLDR: I see a wide range of possible futures for Cogstate. Overall I think it is currently fairly priced and a Watch/Hold.

Bull case

- Preventing and managing cognitive decline is an increasing focus in aging societies.

- If cognitive assessment can become as common as cholesterol testing, and Cogstate establishes itself as market leader, then the sky is the limit.

- For now, Cogstate is riding the wave of clinical trials for big pharma, with 95% of revenue coming from clinical trials, mainly for development of Alzheimers drugs. This research area is expected to grow around 12% pa over the medium term.

- Revenue growth for FY25 is likely to be around 10%.

- A focus on operational efficiency generates a healthy net margin around 15%.

- Cogstate has no debt and over US$30m in cash. No dividends have been paid but roughly 50% of recent FCF has been directed to share buybacks.

- A bull case could see 10% revenue CAGR over next 5 years and growing margin to 20%. With a terminal PE around 30 and allowing for 10% dilution, we’d see 23% pa ROI. Discounting at 10% we get a fair price around $2.30.

Bear case

- It’s tempting to think of Cogstate as a technology subscription business. However it is mainly a services business. Technology licensing is <20% of revenue. The rest comes from clinicians conducting assessments or training/monitoring others to do assessments. The CEO Brad has said he sees his competition not as cognitive assessment developers but instead they are clinical research organisations (CROs).

- Cogstate’s current reliance on stage 3 clinical trials from big pharma results in lumpy revenue.

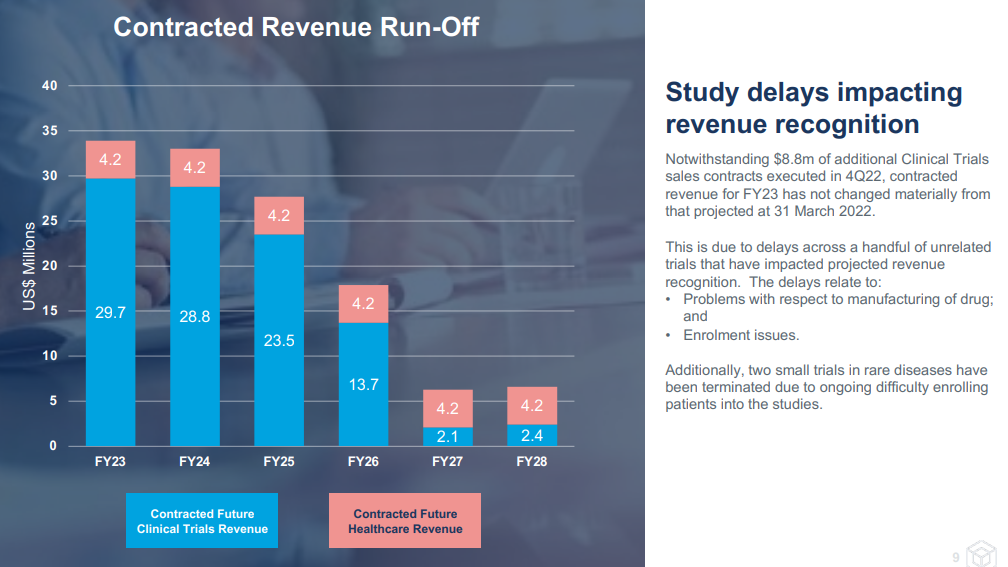

- Recent sales contracts have been below recognised revenue. And the last 2 years of sales contracts have been below the previous 3 years of sales contracts. Given sales contracts impact revenue over the following 5+ years, both of these forces create a significant headwind for short-term revenue growth. Barring a quick and significant increase in sales contracts, FY26 revenue is likely to plateau or decline.

- Cogstate is sitting on a PE around 20, high for a company that might not be growing in the near future.

- A bear case could see revenue flatline over next 5 years and margins contracting to 10%. With a terminal PE around 15 and allowing for 10% dilution, I see roughly -10% pa ROI. Discounting at 10% we get a fair price around $0.40.

Base case

- My base case assumes revenue is flat in FY26 but, on the back of improving sales, steadily improves to achieve a 5-year CAGR around 5%. With FY29 revenue around $85m, maintenance of current 15% net margin and PE of 20, I get a current fair price around $1.00. When I factor in the asymmetrical bull vs bear cases then I get a fair price of around $1.30, which is right around the price at time of writing.

- So for me, Cogstate is a Watch/Hold. I don’t currently own but may dip in if they can lift sales contracts to at least 10% above recognised revenue.

From the economist.

I’ve been aware of the lower risk of Alzheimers in those who have had a shingles vaccine for some years . In fact, that was a major reason I paid for the vaccine a few years back (it is now free for >50 year olds). But this review really fleshes out that theory.

Initially, I thought it was a thesis buster given this will impact the beta amyloid theory and all the current crop of drugs. Having slept on it, I realise it may well be a positive: more research, more cognitive assessments, more business for Cogstate. Interested in others thoughts:

n the summer of 2024 several groups of scientists published a curious finding: people vaccinated against shingles were less likely to develop dementia than their unvaccinated peers. Two of the papers came from the lab of Pascal Geldsetzer at Stanford University. Analysing medical records from Britain and Australia, the researchers concluded that around a fifth of dementia diagnoses could be averted through the original shingles vaccine, which contains live varicella-zoster virus. Two other studies, one by GSK, a pharmaceutical company, and another by a group of academics in Britain, also reported that a newer “recombinant” vaccine, which is more effective at preventing shingles than the live version, appeared to confer even greater protection against dementia.

For years, most research into Alzheimer’s disease—the most common cause of dementia—has been laser-focused on two proteins, known as amyloid and tau. These build up in the brains of people with the disease, forming plaques and tangles that prevent neurons from functioning properly. Most scientists assumed that these proteins are the primary cause of Alzheimer’s disease. But the shingles studies published in 2024, along with a host of new papers, add weight to an alternative decades-old idea—that viruses trigger the disease. Per this theory, plaques and tangles of proteins could, instead, be the body’s response to an underlying viral infection. If that is true, then eliminating the virus could prevent or treat Alzheimer’s.

Ruth Itzhaki, formerly of Manchester University and now a visiting professor at the University of Oxford, has championed this idea for almost 40 years. The bulk of her work has focused on herpes simplex virus 1 (HSV1), best known for giving people cold sores, which infects around 70% of people, most without symptoms. The virus normally lives outside the brain, where it can lie dormant for years. It is flare-ups that can lead to cold sores.

In rare cases, the virus can also lead to massive inflammation in the same brain areas that are most affected by Alzheimer’s. In experiments conducted in the early 2000s, Professor Itzhaki found that if she infected lab-grown human brain cells with HSV1, amyloid levels inside the cells increased dramatically. That led her to suspect a causal connection.

For decades she struggled to get her ideas accepted by the rest of the scientific community. “It was considered a left-field, crazy hypothesis,” says Or Shemesh, who researches viruses and Alzheimer’s at the Hebrew University of Jerusalem. Most scientists were focused on the role of amyloid and tau, assuming that they were the primary cause of the disease. Critics argued that the virus theory was hard to reconcile with the fact that Alzheimer’s has a strong genetic basis or occurs in almost all people with Down’s syndrome.

But growing disillusionment with the leading hypothesis for the cause of Alzheimer’s has led scientists to cast around for alternatives, such as viruses. Over many decades, for example, tens of billions of dollars have been poured into efforts to develop treatments to reduce the levels of amyloid and tau in the brain but the results have been underwhelming—existing amyloid-targeting drugs only have a modest effect on the disease. The discovery that pathogens can trigger other neurological diseases, such as the connection between Epstein-Barr virus and multiple sclerosis, has made the link yet more plausible.

In a bid to push forward Professor Itzhaki’s theory, a group of 25 scientists and entrepreneurs from around the world have assembled themselves into the Alzheimer’s Pathobiome Initiative (AlzPI). Their mission is to provide formal proof that infection plays a central role in triggering the disease. In recent years their work detailing how viruses trigger the build up of proteins linked to Alzheimer’s has been published in top scientific journals.

One new idea, supported by some AlzPI members, is that amyloid and tau may actually be the brain’s first line of defence against pathogens. These proteins are sticky, so they can grab hold of viruses or bacteria to slow their spread before more sophisticated immune responses kick in, says William Eimer at Harvard University. In small quantities, therefore, the proteins seem to boost brain health. The presence of active HSV1 or other pathogens, however, may send the immune system into overdrive, causing the proteins to stick to each other and create the plaques and tangles that damage neurons in Alzheimer’s.

Genetics seem to influence this process, answering some criticisms. The high incidence of the disease in those with Down’s syndrome, for example, might be explained by the fact that their bodies produce more of the protein that is, under certain conditions, converted into amyloid. Some of the AlzPI scientists theorise that this larger potential supply of amyloid could facilitate the formation of plaques in response to a virus. People with Down’s are also more prone to infection.

What’s more, in 1997 Professor Itzhaki found that people with a genetic variant known to increase Alzheimer’s risk, ApoE4, were only more likely to get the disease if they also had HSV1 in their brain. In 2020 a group of French scientists showed that repeated activations of the virus, seemingly harmless in people without ApoE4, more than tripled the chance of developing Alzheimer’s in those with it.

Researchers at Tufts University, working with Professor Itzhaki, have probed why such reactivation occurs. In 2022 they found that infection with a second pathogen, the shingles virus, could awaken the dormant HSV1 and trigger the accumulation of plaques and tangles. This may explain why shingles vaccination appears to be protective against dementia. In another study published in January, the Tufts researchers also showed that a traumatic brain injury—a known risk factor for Alzheimer’s—could also rouse HSV1 and start the aggregation of proteins in brain cells grown in a dish.

The viral theory has promising implications for treatment. Current therapies for Alzheimer’s, which attempt to reduce levels of amyloid in brain cells, merely work to slow the progression of the disease. If viruses are a trigger, though, then vaccination or antiviral drugs could prevent future cases. Such treatments could also slow or halt the progression of Alzheimer’s in those who already have the disease. None of this requires major breakthroughs. Antivirals for the cold-sore pathogen already exist and are off-patent. And the shingles vaccine is now routinely offered to elderly people in many countries.

Many researchers have trawled through medical records to look for links between antivirals and reductions in dementia diagnoses. These sorts of retrospective analyses are often tricky to interpret, as people who take medications or get vaccinations tend to be more health-conscious in general, making them less likely to develop diseases such as Alzheimer’s. But some of the results are promising. One study published in 2018 found that for older people in Taiwan who had cold sores, taking an antiviral cut the risk of dementia by 90%. Several subsequent analyses of medical data from other countries found more modest protective effects of antivirals, typically between 25 and 50%.

The first double-blinded randomised clinical trial to test the effectiveness of antivirals against dementia is now under way. A group of researchers mostly based at Columbia University are testing whether valacyclovir, an antiviral used against HSV1, can slow down cognitive decline in people with early stage Alzheimer’s. Between 2018 and 2024, the researchers recruited 120 patients and treated half with the antiviral. They expect to publish their findings later this year. John Hardy, whose research forms the basis of the dominant amyloid theory of Alzheimer’s, and who has been a critic of the virus theory, says that a positive result in this trial would begin to convince him otherwise. If Dr Geldsetzer and his team can secure the funding, a similar trial of the shingles vaccine may soon follow.

Around 32m people around the world are living with Alzheimer’s disease. If antiviral treatments can indeed slow, delay or prevent even a small subset of these cases, the impact could be tremendous. ■

Well Cogstate (CGS) delivered on a pretty decent 1H if you ask me. Here's a quick rundown.

Key Highlights:

- Record Revenue: $23.9 million, up 19% compared to the previous corresponding period (PCP).

- New Sales Contracts: $20.3 million executed, up 147% on PCP.

- Future Contracted Revenue Backlog: $99.1 million at 31 December 2024.

- EBIT: $4.8 million, up 167% on PCP.

- Cash Balance: $34.2 million at 31 December 2024.

Segment Results:

- Clinical Trials: Revenue up 27% to $22.7 million, gross margin improved to 61%.

- Healthcare: Revenue down 44% to $1.2 million, gross margin remained at 77%.

Outlook for 2H25:

- Consistent Revenue: Expected to be consistent with 1H25.

- Margins: No significant changes planned, so margins should remain consistent.

- Operating Cash Flow: Expected to be consistent with 1H25, excluding additional tax payment

All in all, fairly in line with what they advised in late January, which does place them on a PE of roughly 17-18x at current SP at opening today. Market appears to like it with them up about 11% at time of writing.

Looks like they've returned/returning(?) to growth, which should be commenced given they amended their contract with Eisai back in April of last year, which allowed them to pursue more opportunities outside of this partnership.

Big fan of CGS and the Management Team here, haven't taken a thorough look at them for a while, but will on the back of these results and with hopefully more positive news to come after full year release.

Held.

Cogstate is expecting a fairly decent first half

Unaudited revenue jumped 18% YoY to $23.9M, driven by a 27% surge in Clinical Trials revenue, now 95% of total revenue. Sales contracts for Clinical Trials hit $20.3M, with Alzheimer’s programs being a standout, more than doubling compared to 1H24.

CGS said efficiency gains are showing, with headcount slightly down while revenues grow. Although gross profit margins and EBIT margins remain about the same as the preceding quarter, they are up a lot from the pcp..

The balance sheet looks healthy: cash at $34.2M (up from $30.1M in June), no debt, and an ongoing share buyback.

Cogstate is scaling up via partnerships, which contributed 36% of sales opportunities in 1H25, while continuing to expand outside Alzheimer’s into other indications like cancer and rare diseases.

The PE based on the TTM is roughly 18x. Not terrible if they can sustain sales momentum and unlock more operating leverage.

I’m still a holder but thinking my thesis is busted or at least a little bent out of shape.

@nerdag - you were an early and vocal naysayer. Do you have any updates to how things are shaping up?

thx

c

The share price has taken yet another whack after the release of their FY report. Strangely enough, if you provided me the below figures last year and asked if I would be happy to see these at the conclusion of FY24, my answer would have been yes.

- Net income of 5.4m for the year, a 57% increase on last year’s 3.6m (all figures US unless I state AUD)

- Free cash flow of 3.3m, well up on last year, which was negative.

- EPS of 3.15c, an increase on last year’s 2.02c.

- 30.1m cash in hand, up on last year’s 28.6m, with almost 10m in trade and other receivables. In short, total assets have grown from 38m to 43m.

Importantly, we saw some improvement on a not-so-strong H1. Clinical trials revenue increased to 21.5m (vs 17.9m in H1), but healthcare contribution wasn’t as strong with a 700k difference. Operating expenses were essentially flat, and with that EBIT increased from 1.8m to 4.7m, with net profit more than doubling.

Okay, what's the problem?

- Contracted future revenue decreased…AGAIN. This now stands at 101m, although was previously 132m same time last year.

- Across the year, revenue grew from 40.5m (FY23) to 43.4m -- single digit growth. The risk is this company turns into a ‘gunna’ company – we are almost there or we are well-positioned to capitalise on…

Looking forward, FY25 future revenue sits between 28-29m. At a guess, Cogstate will add another 25-30% on top of this (based on previous years). To speculate, this could put next year's revenue at around 37-38m without any significant wins, which will see them move backwards on an already disappointing FY24.

At a current market cap of 177m, they are profitable with a revenue multiple of just under 3x and a P/E of under 35. They also have 30m burning a hole in their pocket. There is an argument that the current price is quite attractive using traditional metrics. But despite expectations tapering, Cogstate is still priced to grow. I had a play with my DCF. Let’s say FCF was to grow 1m per year for the next few years – I reach a company value of just under 90m (US) and a share price of under 80c (AUD). If we change this to 4m FCF next year, increasing by 2m a year thereafter – I arrive at a more modest company value of 120m (US) and a share price of 1.05c (AUD), basically where the share price stands today.

The thesis here is a classic picks and shovels play relevant to the growing Alzheimer's market. That remains firmly intact, even if it has taken some bruising the last 12-24 months. That said, it was easier to justify Cogstate’s valuation when their growth was >40%. Ultimately, we need to see reasonable growth to make the current valuation appear fairly priced, let alone attractive. The million-dollar question relates to what sort of growth Cogstate will see over the next few years.

Future growth is largely dependent on securing early stage (phases 1 and 2) trials from large pharma and then staying the journey through the stages of development. The good news is there were multiple phase 2 trials (with new customers) executed during FY24, in addition to the recent execution of a main contract for a phase 3 trial. Despite my attempts to be positive, my conviction has certainly taken a hit over the last 18 months and I plan to do some hard thinking over the next few weeks. Does anyone agree, disagree? Curious as to the thoughts of others.

Been pretty quiet for CGS. One bad surprise overnight though:

The share price of Eisai, a Japanese drugmaker, plummeted after a surprise decision by European regulators on Friday not to approve lecanemab, an Alzheimer’s treatment it developed with Biogen, an American counterpart. The European Medicines Agency cited the danger of serious side effects, including brain swelling. The drug has been approved in America and Japan. Eisai said the ema’s decision would disappoint Europe’s 6.9m Alzheimer’s sufferers.

Board Ownership

Inside Ownership Ordinary Shares %CGS Issued Net Value at $1.15

Brad O’Connor 4,438,102 2.6% $5,103,817

Martyn Myer 23,614,566 13.83% $27,156,751

Richard van den Broek 4,458,500 2.61% $5,127,275

Richard Mohs 67,000 0.04% $77,050

Ingrid Player 134,098 0.08% $154,213

Kim Wenn 12,586 0.01% $14,474

Total 32,724,852 19.16% $37,633,580

Market Cap at current price $1.15 is $196.4m

Board Bio’s

Brad O’Connor - Chief Executive Officer

Brad O’Connor has been Managing Director and Chief Executive Officer of Cogstate Limited since December 2005. He has responsibility for Cogstate’s overall strategic direction and day-to-day operations as well as development of expansion opportunities outside of the core clinical trials business. Prior to taking the position of CEO at Cogstate, Mr O’Connor joined Cogstate as Chief Financial Officer and Company Secretary in May 2004. Prior to that, he held senior positions at Spherion Group, Australian Wine Exchange and Price waterhouse Coopers. Mr O’Connor is a chartered accountant who holds a Bachelor of Business degree.

Martyn Myer AO - Chairman

Mr Myer is Chair of the Doherty Institute at the University of Melbourne and the boards of the Australian Chamber Orchestra and Watertrust Australia Limited. He previously served as Deputy Chancellor of the Council of the University of Melbourne, President of The Myer Foundation, one of two principle Myer Family philanthropic funds, President of the Howard Florey Institute of Experimental Physiology and Medicine and was a director of The Florey Institute of Neuroscience and Mental Health, where he participated in the transition of the Institute’s research focus towards diagnostic and therapeutic neuroscience, including a focus on degenerative brain diseases.

Richard van den Broek - Independent Non-Executive Director

Mr van den Broek (Graduate of Harvard University, CFA) is founder and managing partner of HSMR Advisors LLC, a U.S. based fund manager with an investment emphasis on small and mid-cap biotech public companies. From 2000 through 2003 he was a Partner at Cooper Hill Partners, LLC, an investment fund focused on the healthcare sector. Prior to that Mr. van den Broek had a ten year career as a biotech analyst, starting at Oppenheimer & Co., then Merrill Lynch, and finally at Hambrecht & Quist.

Richard Mohs - Independent Non-Executive Director

Dr. Mohs retired from Eli Lilly in 2015, where he held several leadership positions including Vice President for Neuroscience Early Clinical Development and Leader of the Global Alzheimer’s Drug Development Team. Before joining Eli Lilly in 2002, Dr. Mohs spent 23 years with the Mount Sinai School of Medicine in NY where he was Professor in the Department of Psychiatry and Associate Chief of Staff for Research at the Bronx Veterans Affairs Medical Center. Dr. Mohs received a Ph.D. in psychology from Stanford University and completed postdoctoral training in pharmacology at the Stanford University Medical School. He is the author or co-author of over 350 scientific papers, including those describing clinical trials that lead to the approval, in the US and other countries, of cholinergic drug treatments for Alzheimer’s disease. Dr. Mohs is currently Chief Scientific Officer for the Global Alzheimer’s Platform (GAP) Foundation, a patient-centered, non-profit organization devoted to enhancing the speed and quality with which new treatments for Alzheimer’s disease are developed. He also serves as a consultant to academic institutions, foundations and biopharmaceutical companies, and is a member of the Board of Governors for the Alzheimer’s Drug Discovery Foundation.

Ingrid Player - Independent Non-Executive Director

Ms Player brings deep healthcare sector experience and strong commercial expertise to the Board of Cogstate. She has held senior executive roles with Healthscope Ltd, a leading private healthcare provider in Australia, including the former positions of Group Executive – Legal, Governance and Sustainability, and General Counsel and Company Secretary from 2005 until 2019. Ms Player also has considerable international commercial and regulatory experience that spans different markets and industries, which she gained in private legal practice in Australia and in The Netherlands. Ms Player holds a Bachelor of Economics & Bachelor of Laws (Hons) from Monash University. She is a graduate member of the Australian Institute of Company Directors and Fellow of the Governance Institute of Australia.

Kim Wenn -Independent Non-Executive Director

Ms Wenn brings extensive technology experience and strong commercial expertise to the Board of Cogstate, with over 30 years experience in innovation roles. Until July 2018, Kim held the role of Chief Information Officer at Tabcorp Holdings, an ASX50 listed company where Kim led a team of 1,200 technology experts to drive strategic direction through digital transformation. Kim’s experience includes, among other things, business strategy, governance and change management—with a focus on digital disruption. Ms Wenn holds a Bachelor of Computer Science from Monash University and completed an Advanced Management Program from Harvard University. She is a graduate member of the Australian Institute of Company Directors.

Cogstate has renegotiated the terms of its license agreement with Eisai -- in essence, Eisai no longer has exclusive rights to distribute Cogstate's digital assessment technology. The catch is that Cogstate will forgo $15m in future minimum royalties (although the main impact wont be felt until FY28).

This allows Cogstate to "progress exploratory plans regarding alternative distribution approaches for our digital cognitive assessment technologies"

Clearly the board reckons this will lead to superior outcomes, and have apparently already formulated some exploratory plans. Importantly, all payments to date will be retained and the relationship with Eisai (which owns 6.8% of CGS).

I take this as mildly good news. You wouldn't bother unless you thought it would result in more income (although hubris can sometimes misinform!)

ASX announcement here

Didn't know that Cogstate was part of the ASX300 as I thought the rule was trading the top 300 shares.

Or they've made a new rule none of us knows about.

Anyway it is there if anyone wants to try their luck.

Just watched the video from the recent meeting.

I felt reassured that the confidence implied by the continued share buy back was real. At least in the short-medium term. The likelihood of larger contracts from the 3 new big pharma companies to contract their services was clearly something that Brad thought (and the Board) would have a very high likelihood of bringing increased revenues in teh future.

The expansion of Cognigram into the yearly health check in the US is really interesting. Brad raised the point that there is a big gap between identifying a decline and there being any actionable steps. This may not matter. The old "show me the incentives...." quote comes to mind. If there is a positive financial impact for the primary healthcare provider, they will want to use the test. If there is also a perceived benefit from the patient, they will want the test. This might be all that matters. Be interesting to see how that evolves.

That got me thinking - they should have a free app you can download and test yourself at home. Turns out they do - it's called Lila - you can test yourself and track your results over time, I just downloaded and will give it a burn tomorrow. I'm surprised this has never come up before - presumably it hasn't got much traction as yet.

Overall, I felt considerably reassured about heir capital management, which was my main concern with how the business is tracking.

Held.

Cogstate (CGS) reported this morning with a fairly underwhelming set of results for 1H24.

Much of their reporting is against PCP numbers rather than 2H23, as they typically have a strong 2H than 1H during the FY (according to the release).

- Revenue growth has slowed and was actually down from 2H23 ($20.2m vs. $20.9m) through a reduction in Clinic Trials Revenue

- Revenue was up 3% from the PCP

- Concerning, contracted future revenue is down to 123.7 million, this was 146.7 for 1H23.

- Positively costs were down 9% on PCP and 6% on 2H23 numbers, due to lower salary, and a reduction in FT workforce (aka layoffs)

- Cash flow from operating activities (excluding "passthrough" - someone please explain to me what this is) was at $0.5m mil

- Net Cash on hand sites at a nice $24.4m

- The company has and (IMO, strangely) continues to buy-back shares, see excerpt below:

"The Board of Directors has resolved to commence a further on-market share buy-back of up to 5 million of Cogstate’s issued ordinary shares over the next 12 months (“Share Buyback”). Under the previous share buyback which commenced on 28 February 2023 and was closed on 4 December 2023, 3,753,218 ordinary shares were acquired on-market, for a total cost of A$5,589,131. The new Share Buyback program reflects the Cogstate Board’s maintained belief in the business’ future commercial prospects, the business’ strong capital position, and supports the Board’s ambition to improve returns for shareholders. The timing and number of shares to be purchased under the Share Buyback will depend on the prevailing share price, market conditions and the capital position and requirements over the next 12 months..."

Let me get this right, (1) growth is slowly and in some cases reversing, (2) contracted revenue is going backwards, and (3) staff count has or is reduced... Yet the Board remains confident of the company's future commercial prospects? How or why is the Board confident this growth will return? Might be a question for Brad on the upcoming Meeting...

FY24 Guidance (or lack of): "Customer engagement on new clinic trials expected to remain strong... Expect improved clinical trials sales bookings in 2H24 compared with 1H24, as increased sales pipeline activity starts to deliver. The revenue impact of the expected sales bookings remains sensitive to timing of contract execution." "No specific guidance is provided."

Make of that what you will.

Overall not good, confused regarding the Board's position on the Share buybacks which makes me ponder their capital management. Looking forward to the Meeting.

Held, but confused - probably not a good sign.

UPDATE - Feb 2023

*all figures in US dollars unless otherwise stated*

Readjusting some of my forecasts in preparation for Cogstate's upcoming H1 report. My 2023 forecasts were well off, primarily due to delays with closing out contracts. I forecasted 10m FCF; instead they were in the negatives (gulp). That said, management have suggested these issues are no longer current, and with some additional cost savings expected, I am hoping to see improvements to cash flow.

I am dropping my FCF forecast (for FY24) to 8.5m. I am also increasing my discount rate to 10%. Cogstate's buyback has seen shares decrease to around 171m -- call it 172m to be conservative. As for future cash flow forecasts, I have dialled these back somewhat to provide more safety in my valuation: 11.5m in FY25, 13.5m in FY26 and 15.5m in 2027.

Noting the above, I reach a company value of 246m. Divide this by shares outstanding and I reach a valuation of US$1.10, or 1.70 converted to AUD. Provided Cogstate continues to grow strongly, I think shares are attractively priced. If you remove growth to cash flows though, all of a sudden a share price of 50c would appear expensive. We NEED to see growth going forward and another year of contract delays or similar won't cut it. I am not suggesting this is likely, but the bear case is always something to keep in mind.

UPDATE - September 2022

*all figures in US dollars unless otherwise stated*

As @Noddy74 indicated a few weeks ago, Cogstate's share price was battered after the release of their FY22 results. As @Noddy74 outlined, FY23's outlook was likely a key reason for this, with management advising of delays to a number of clinical trials. FCF also decreased to 8m (was 14m in FY21), so this was likely a contributor too.

Looking back at my previous valuation, I conservatively estimated that FY22 FCF would be 4.5m -- intentionally providing a huge margin of safety given the lofty valuation at the time.

While FY22 FCF did indeed decrease, it nearly doubled my estimation coming in at 8m for the year. In addition, profit increased from 5m to 7m, cash on hand increased handsomely to 29m, while CapEx costs decreased to -1.6m (previously 1.77m). Clinical trials margins also increased to 60%, up from 54%. Did I mention they have no debt?

I am not buying the business for next year's FCF; I own Cogstate because I think FCF in FY25 and onwards will be much higher than it is today. @Noddy74 touches on revenue backlog in his Straw -- so refer to that for more detail -- but this is not a business with structural concerns; quite the opposite. As the below demonstrates, revenue backlog for FY24 and to a lesser extent FY25 are almost that of FY23. And this is base case -- progress or further development on the Alzheimer front will likely have a serious (positive) impact on future cash receipts.

I forecast FY23 FCF of 10.5m, with this rising to 13.5m in FY24. Similar to my last valuation, I am giving myself plenty of breathing room with what I consider conservative FCF increases. Using a discount rate of 8.4%, I reach a company value of 325m; divide this by shares outstanding (173m) and I reach a current valuation of $1.85.

Cogstate is currently high on my 'top up' list.

_______________________________________________

*all figures in US dollars unless otherwise stated*

FY22 projected revenue: 42m

FY21 revenue: 32.6m

FY20 revenue: 22.7m

Gross margin: 53%

Net profit margin: 16%

Within my DCF I used FCF projections with a discount rate of 8.4%. The company had a cracker of a year last year, achieving 16m in FCF. Q1 and Q2 figures in FY22 suggest CGS’ FCF has dropped (-0.27m and 1.55m respectively). I have forecast 4.5m FCF in FY22, with 2m+ yearly increments recorded thereafter (conservative yes, particularly if the Eisai deal starts to gain traction, but best to be on the safe side noting lumpy results). This gives me a CV of 154m – divide this by shares outstanding and I reach a valuation of 0.90c (or approx. AU1.30c, although the continued drop in the AU dollar doesn't help).

I suspect CGS net profit margins will drop slightly within FY22 results, down to approximately 14%. This is based on the calculation that FY22 profit comes in at around 5.8-6m, which would represent a slight profit increase on FY21 figures.

Let me know if I have missed something in the above calculations.

Now, while my DCF doesn’t exactly provide confidence that current levels are cheap, maybe its true to say that high quality healthcare stocks will always trade at a premium – so to wait for it to reach

That said, there are some negatives too. There has been lots of insider selling in the last 12 months and I am of the belief that the CEO salary is far too high. And with increased costs impacting their FCF in FY22, a bear case can possibly be made.

Disc: held

I've stopped following Cogstate, but I thought the following opinion piece will be of interest to many investors here in light of Biogen pulling the plug on aducanumab.

TLDR: The monetary incentive for Eisai to profit from sales of Leqembi could have the effect of prompting mass withdrawal from a phase 3 trial designed to show it prevents cognitive decline, which will have the unintended effect of preventing it from reaching full approval for a healthy population as the scientific evidence of efficacy won't have been demonstrated. Lecanemab is already approved where cognitive decline is demonstrated.

The relevant point here is that if the same mistake happens again, the FDA accelerated approvals framework that Cogstate relies upon to chase new trials in the pipeline, becomes vulnerable to tightening, especially if the Democrats remain in the White House. Under the likely Republican candidate, it won't even register as an issue.

This one from Cogstate (CGS) flew under the radar today - Notice of Initial Substantial Holder.

Anacacia Capital has picked up a lazy 10,424,974 shares amounting to 6.1% of CGS over the last 4 months (if I have read this correctly).

This probably explains the ~14% jump in SP today, albeit off a low base and low volume. Prior to today's pop, CGS was circling around 12-month lows, and points which have not been seen too often since circa 2021.

There hasn't been much (price sensitive) news regarding the company for some time, but it has been buying back shares since Feb 2023, amounting to a total of 3.753 million shares bought back for a total consideration of the best part of $5.6 million.

This has been a bit quiet ever since the whole takeover debacle early last year, @Noddy74 did a ripper job summarising it here. It's essentially been trading sideways since, while the overall market has trended up since then, CGS hasn't. I would hazard a guess Mr. Market is looking for some positive news to reinstate confidence.

As a previous top-10 SM stock, could we see a return to the rankings?

I was about to ask @Strawman to see if we can get the CEO Brad on to get his thoughts on business progress but it looks like this is already penned in for the 26th February; I'm looking forward to hearing from him to get an update.

Currently HOLD here, and IRL - but, will be paying close attention to their half yearly report (22nd Feb).

Not a huge surprise, but good news nevertheless.

Hopefully in the eyes of pharma companies and biotechs this helps de-risk the development of future Alzheimer’s treatments, and in turn increase the demand for Cogstate’s clinical trial products and services. This is the main bull case of the FDA approval for CGS.

Apart from the financial strain to the US government (US$26.5k per year for the treatment), other key concerns involve the strain of the demand to the medical system. PET scans, genetic tests, neurologists, the laborious administration by intravenous infusion every 2 weeks, and so forth.

Cogstate may stand to benefit in a couple of ways. One is the likely follow up clinical trials for Leqembi, and other likely FDA approval candidates, to use less laborious administration of the drug. Perhaps longer intervals or subcutaneous injections instead of infusion.

Two, in order to qualify for Leqembi, prospective patients will need to have cognitive tests completed and submitted to centralised registries. A low-touch digital test would help ease the load on the medical system by opening up the pool of healthcare professionals that can administer them. No doubt Eisai and Cogstate are hoping their upcoming digital apps will play a large role in this.

Esiai consumer cognitive test “NouKnow”, expanding usage into 2023

“TOKYO, June 22, 2023 - (JCN Newswire) - Eisai Co., Ltd. announced today that brain health checks utilizing "NouKNOW" (pronounced "NOH-NOH"), Eisai's digital tool for self-assessment of cognitive function, will continue to be promoted as part of the FY2023 dementia examination project, conducted by Bunkyo City, Tokyo.”

“Eisai has concluded regional cooperation agreements with local governments, medical associations, and other organizations throughout Japan, and is promoting efforts to realize a Dementia-Inclusive Society (167 locations in 45 prefectures as of March 31, 2023). In addition, Eisai is collaborating with 46 other local governments including Bunkyo City (in FY2022) on dementia-related projects, providing opportunities for brain health assessments tailored to local issues and promoting initiatives to establish a pathway to subsequent medical care and support.”

Leqembi (Lecanemab) just approved by FDA.

Likely full approval for Eisai’s Leqembi next month after FDA decision this Friday. Predicted CMS coverage. Anticipated sales of US $7billion by 2030.

Cogstate (ASX:CGS) into the S&P/ASX All Technology Index – Effective Prior to the Open on June 19, 2023

Nabtrade didn't post the announcement until after 5pm today.

Seems some others may have known earlier and might explain why CGS finished up 10% on the day.

S&P Dow Jones Indices Announces June 2023.pdf

Held on SM and IRL

Cogstate has issued FY23 NPAT guidance of between US$0.6-1.6 million (FY22 was US$7.5m, FY21 was US$5.2m)

Further revenue delays and one-off restructure costs (redundancies) of $600k seem to be the issue, with revenue expected to be 9-12% below FY22, and EBITDA margins expected at 9-12% of revenue (formerly guided for 12-15%).

They had also previously said to expect positive operating cash flow, but that's now looking to be US$1m either side of breakeven in H2, following -US$0.2m in H1 (they still have close to $30m in cash).

Restructure costs will be absorbed prior to June 30, and going forward they expect to save US$2.6m annually. The question is, of course, whether they can fulfil their growth ambitions with a smaller workforce (thumb sucking, it looks like the savings represents about 18% of employee and admin expenses). CEO Brad O'Connor reckons that with technology investments and efficiency gains, the business will be appropriately resourced to handle the expected revenue growth. Moreover, these issues of FY23 are "isolated factors that do not impact our medium- and long-term [potential]"

As of yesterday's close, shares were on a forward EV/EBITDA of around 40 so we certainly need to see growth resume if shares are going to do well from here. That being said, the margins can swing around a bit here and revenue can be lumpy -- originally they were guiding for EBITDA margins of 27-29% of revenue -- so if revenue delays abate and trading conditions improve, things could change quickly.

Full announcement here

CGS not waiting and cutting costs. guidance appears for 2h to be running at similar rates to the disappointing FH. the cost cutting will give CGS extra breathing room until demand reappears. an interesting feature is the benefit run rate nearly $3m and costs of implementation under $1m, 3X is quite high usually they are around 1X. if true good return on spend. CGS in waiting mode by the looks of it.

See my straw in Telix about Lantheus

https://strawman.com/reports/TLX/edgescape?view-straw=22592

Hopefully there isn't much overlap.

[held]

For those of you interested in Donenemab by Eli Lilly: see below. Certainly looks like a better treatment option as less frequent dosing.

https://endpts.com/lillys-alzheimers-drug-donanemab-succeeds-in-phase-iii-trial/

Seems to be good news. Hopefully this will lead to further studies and eventually turbocharge general healthcare use of Cogstate (the latter not being my central thesis).

[Held]

Q3 10.9m sales (+18% PCP) in line with expectations, made up of 6.7m of Contracted Future Revenue (CFR) was recognised and 3.4m in Clinical Trial sales contracts. This brought CFR down to 140.0m from 146.7m and 4Q23 realisation of 9.1m will see them finish the year at around US$40m sales as expected.

They noted capital market conditions (ie soft) delaying biotechnology companies sales, just over half last year. Also flagged the Alzheimer’s disease trial reviews in June and July – see the article @Nnyck777 linked a few days ago on Esai facing FDA scrutiny on death of a patient in the study.

Disc: Own.

Esai will face increasing FDA scrutiny on June 9th over the death of a patient in a Lecanamab extension study.

Possible stricter drug labeling may be needed for patients with certain genetic markers. This would go a step beyond avoiding prescriptions in patients on blood thinners. The amyloid stripping nature of the drug my thin and weaken blood vessel walls in vulnerable patients leading to brain bleeds.

Never straight forward in the Alzheimer’s drug world.

Came across this on my walk, US micro "guru" Ian Cassel talking about the turmoil in CGS share rpice, he is still a big holder.

interesting starts around 46 minute mark.

as an aside, soem of the US interviewers i find really annoying, nothing on SM!

disc held

https://microcapclub.com/2023/03/the-business-brew-podcast-with-ian-cassel/?utm_source=MicroCapClub&utm_campaign=55e93b5beb-RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_2ffd571424-55e93b5beb-164930521

good to see director buying on this dip. Brad OC plus Myer director +$50k each on market is my reading.

7/3/23 Half year results release notes (in US$)

· Sales for the half down 15% PCP and 11% HOH and NPAT only $60k Vs $4.1m PCP as operating leverage reversed on enrolment delays impacting revenue and growth investments increasing Opex.

· Future Contracted Revenue continued to grow, increasing by $7.7m in the half and by $13.9m Vs PCP, so $27.3m of contracts were added to offset those billed in the period. This is 50% lower than PCP which was an unusually large increase, it is in line with the previous half, so contract growth seems solid and steady, but not growing.

· Contribution margin from Clinical Trials (85% of revenue) dropped to 46% from 57% last half and 62% PCP. Drop due to lower sales to cover fixed cost, higher direct costs to support clinical trials in other countries (Japan) and lower software licence mix.

· Operating expense up 15% in the half, due sales (business dev) and marketing costs up.

· Share buyback plan: A$13m in shares which is about 5% of the shares on offer currently.

· Guidance: Clinical Trials FY23 sales down 6-9%, contributions improving in second half to 52-55% range. Healthcare consistent with H1. EBITDA 12-15%, EBIT 6-8%, positive Op Cash.

· Price drop partly justified by poor result and FY23 outlook but significantly over done by trading action to do with undisclosed take over talks which fell through.

Conclusion: FY23 is going to be a backward step on the previous 2 years of growth, but this seems to mostly be timing and a victim of comparatives. Future Contracted Revenue continues to grow and margins setbacks relate to market expansion for future growth investments. The Clinical Trials business provides a stable revenue and cash flow base with a long runway of secured revenue on which to build. The Healthcare business is scaling and offers additional future growth opportunities.

Valuation Range: $1.50 – $2.45 (FY27 Revenue $63m Vs $100m on 55% GM)

Revenue Note: Clinical Trials dominate revenue currently, with 82% of sales contracts relate to Alzheimer’s in HQ FY23 as does 87% of contracted future revenue. Healthcare revenue is from early stage partnering with Eisai in Japan, Hong Kong and Taiwan with Thailand & Korea in first year. US opportunity is underway with FDA approval for Cognigram (another partnership with Eisai).

Disc: I bought on the drop and now hold.

Despite the share price falling by nearly 50% since the close on Friday last week, my view is very little has changed about the company on a fundamental level.

The guidance downgrade issued was essentially the result of delays in clinical trials by Cogstate’s customers - either from slower-than-expected enrolment of patients or delays in timelines. The vast majority of companies working in the clinical trials space face the same risks. It’s part of parcel of being in the industry and should be expected to happen from time to time. More importantly, none of the contracts have been cancelled and contracted revenues are sitting at record levels. As per my previous straw, contracted revenues for the next few years are tracking materially higher than today and this is the leading indicator for future revenue. EBITDA and EBIT numbers are going to be crunched this year as operating leverage goes into reverse - but again, I don’t think anyone that’s followed the story would be surprised by that. The company has plenty of cash, looking to remain profitable, and can easily ride out the bumps.

The likely reason for the share price volatility is someone caught hold of the corporate control discussions between a third-party and Cogstate and purchased large volumes of stock throughout early-mid February. When the takeover was called off - and the party also caught wind of this - they became a forced seller and started dumping heavy volumes on the next trading day and has continued since. The Galaxy Brain has lost 30%+ of capital within a week on this trade, and may attract regulatory or criminal investigations.

One can argue, management could have handled the corporate control situation better. Perhaps halted the stock when increased volume of purchasing was obvious - that is, the confidential discussions were no longer confidential. Perhaps they could have disclosed the discussions once access to due diligence was granted. It’s neither here nor there, and doesn’t change my view on the quality of management. Of course if management is found to have been negligent in keeping the discussions confidential, then my views will change.

The share price closed at $1.18 on Friday. Prices not seen since before the FDA accelerated approvals of Aducanumab (Biogen) and Lecanemab (Eisai/Biogen). A time in the midst of a dark winter of AZ treatment development, when no new AZ treatments had been approved for almost two decades. When there was a high level of uncertainly whether Cogstate’s customers will continue to fund clinical trials if the current set of monoclonal antibody treatments struck out. Some 20 months on, we’re given another chance to purchase stock at this price. In my opinion, we’re given the chance because someone screwed up majorly trading on inside information, and is now a forced seller.

When there is a high level of uncertainly and incomplete information, this is when one’s resolve, conviction and understanding is tested. None of these can be borrowed from other investors, and during times of peak uncertainty, we’re all on our own.

I added substantially to my RL holdings on Friday, and could potentially add more in the coming days.

The share price could have further to fall from here. I’m wrong a lot. Please do your own research. Thought it would be fun to publicly document during a time of high uncertainty. It’ll be fun to look back to see whether I took the correct action or if I had completely misjudged the situation.

"The Company has recently been in discussions with a third party in relation to a potential control transaction with respect to the Company. These discussions substantially commenced in late December 2022, with access to due diligence granted in late January 2023. At all times, the Company considered that the discussions were and remained confidential, non-binding, incomplete and insufficiently definite to warrant disclosure. On 18 February 2023, it was determined that the potential transaction would not proceed, and accordingly, all such discussions have ceased."

So there was a non-binding, unsolicited takeover offer with due diligence occurring over a month ago which was not considered of material significance? And then the potential third party backs out without so much as a whimper?

This strikes me as very odd to stay quiet in the current M&A market where value is being sought out and then publicly announced at the earliest opportunity so as stoke the fires of a bidding war. Instead we have closed doors and an announcement of the suitor stepping away well after the fact.

There's more questions than answers in this response, and the 25% drop is well deserved.

Yeah, that sure seems to have come out of nowhere. Over lunch I did a bit of news reading to see if anything came up. This is all I get from the past few days:

- Fructose might be the cause of Alzheimer's (https://www.sciencealert.com/group-of-scientists-propose-a-new-driver-of-alzheimers-disease-fructose)

- Viruses (and maybe bacteria) might be the cause of Alzheimer's, and the article mentions lecanemab and how it's not that effective (https://www.theguardian.com/society/2023/feb/19/could-alzheimers-be-caused-by-an-infection)

- Another drug approach for dealing with amyloid plaque and its precursors (as I understand it), and it also mentions lecanemab in less-than-glowing terms (https://scitechdaily.com/groundbreaking-new-treatment-developed-for-alzheimers-disease/)

Maybe I missed something, but none of this seems that new. My understanding of the field is that we are still a long way away from a real knowledge of the cause and progress of the disease at a neurological level, and it seems to me that new hypotheses come up often.

So maybe the news is something to do with their 1H23 results.

(Disc: held in RL)

Not sure @Solvetheriddle but it feels to me like someone knows something. If not, then that is some seriously undisciplined buying and selling over the past couple of weeks.

Anyway, I think it highlights an interesting thought, which is the danger of buying these seemingly unjustified sharp drops. Most of the time it will be nothing and turn out to be a good buy, but the assymetry of when there is actually a skeleton means you only need to get caught out once for every handful of times it turns out to be nothing.

I was tempted yesterday at $2 but steered clear in the end after think about the above.

Anyone have any idea why CGS has fallen so quickly. i realise that it also went up a lot. only asx announcement is that AEF are sellers, which if redemptions, could be a buy oppty. may be worth waiting for the dust to settle on this one, unless you are privy to what is going on.

https://endpts.com/smooth-and-very-much-on-track-eisai-reports-first-shipments-of-leqembi/

“Eisai and Biogen began shipping out doses of their newly approved Alzheimer’s drug Leqembi ahead of schedule last month, according to Eisai’s US chairman and CEO Ivan Cheung.

If all goes according to plan, the chief executive hopes to achieve full approval and expand access to Leqembi later this year, he said on the company’s recent quarterly call with investors.

Leqembi won an accelerated approval back in January for use in patients with mild cognitive impairment from Alzheimer’s who have confirmed presence of amyloid beta pathology prior to treatment. It’s a second chance in Alzheimer’s for Eisai and Biogen, whose controversial predecessor Aduhelm suffered a commercial flop following its accelerated approval in 2021.”

D.Dolby

at 25th January 2023:

MC : $346Mill , closed at $2.00 a share

Annual report 2022

AGM 4th Nov 2022

CGS removal:

Noted Sector: Industry Group: Health Care Equipment & Services

Listed on 13 February 2004

............................................................................................................................

at 30/8/22 profitable:

FY22 Financial Results & Business Outlook

EBITDA**: $13,009,201 $5,711,737 $7,297,464 up 127.8%

2022 EPS growth up 40%

Return (inc div) 1yr: 1.50% 3yr: 101.21% pa 5yr: 9.23% pa

Need to check the Outlook for 2022 / 23:

In respect of forecast earnings, Cogstate continues to target EBIT margins in the range of 20% - 24% over the coming years. Based on current revenue forecast, FY23 EBIT margins are expected to be at the bottom end of that range. Target EBITDA range is 27% - 29% of revenue.

A further update will be provided at the company’s AGM on Friday 4 November 2022.

..........................................................................................................

https://www.cogstate.com/clinical-trials/therapeutic-focus-areas/parkinsons-disease/?cn-reloaded=1

As seen on Linked in another large area of research with new plasma drug treatment trials for Parkinson’s. Cogstate is involved in clinical drug trials to test for cognitive impairment for this disease. Another large market opportunity.

https://www.nytimes.com/2023/01/06/health/alzheimers-drug-leqembi-lecanemab.html

Interesting article suggesting with this approval Lecanemab is likely to be given Medicare approval.

I thought this was a very interesting addition to labelling:

“The Leqembi label says the drug should be used only for patients in early and mild stages of Alzheimer’s disease, matching the status of patients in the clinical trials of the drug. It instructs doctors not to treat patients without doing tests to confirm that they have one of the hallmarks of Alzheimer’s: a buildup of the protein amyloid, which Leqembi (like Aduhelm) attacks.”

Which cognitive tests are not stated. Perhaps an Opportunity for Cogstate here.

FDA has granted accelerated approval for Lecanamab.

This drug provides hope for treatment of Alzheimer’s rather than just purely treatment of disease symptoms. Patients appear to have a reduction in Amyloid plaque vs placebo. Based on the amyloid plaque theory this should reduce cognitive decline.

This likely hales the first of many new treatments for Alzheimer’s to hit the market. Suggesting a healthy level of future clinical trial work for Cogstate. Whether this extends to at home or community cognitive testing is yet to be seen. Overall good news for the company.

Two data points for digestion.

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(22)02480-1/fulltext

This passage is particularly salient:

"After such a long and fruitless wait for a successful therapy for Alzheimer's disease, a phase 3 trial showing efficacy on clinical outcomes is welcome news. However, a 0·45-point difference on the CDR-SB, an 18-point scale, might not be clinically meaningful. A 2019 study suggested that the minimal clinically important difference for the CDR-SB was 0·98 for people with mild cognitive impairment and presumed Alzheimer's aetiology, and 1·63 for those with mild Alzheimer's disease. Furthermore, development of ARIA—seen in one in five patients taking lecanemab—could potentially lead to unmasking, introducing bias."

Noting that these trials are showing improvement relative to placebo, for there to be any wide scale government funding should the drugs make it to market, monoclonal antibodies are going to need to show significant improvement relative to treatment as usual.

A quick Medline scan finds no head to head studies of monoclonals vs cholinesterase inhibitors +/- NMDA antagonists (unsurprising given they are not yet in widespread use), but the following article gives some food for thought.

https://doi.org/10.7759/cureus.31065

Leaving aside the aducanumab and FDA accelerated approvals controversy (and I rate Lancet well above Cureus for independence), I suspect that unless monoclonals demonstrate a significant magnitude of improvement, irrespective of the assessment tool used, the risk of the drug class being a big flop, on efficacy, safety and cost-benefit measures, is a material risk to Cogstate.

Conclusion: For Cogstate's core business, I'd want to know that contracted forward revenue is watertight in the event big pharma pulls the pin and writes off the entire drug class on efficacy, safety or cost benefit grounds. You'd also want a good margin of safety with any forward projections in case contracted revenue suddenly drops off a cliff.

If anybody knows the finer details of Cogstate's contract terms and can disclose, I am sure that there would be plenty of members here who would love to know.

Disc: Not held

it seems the 2 deaths are likely attributable to drug interactions rather than a direct effect of lecanamab.

for me the major point about this study is that it opens the door a little for other trials. This is the first, robust phase 3 trial with positive results that confirms that the amyloid plaque theory is valid. As to whether the (admittedly modest) benefit is worth the risk or cost is not partly relevant to the thesis of Cogstate. It means that there will now be a concerted push by drug companies to improve on this initial success we are likely to see a significant expansion in new drugs in this space all requiring trials. This is the point

Heralded Alzheimer’s drug works — but safety concerns loom

Eisai and Biogen share clinical trial data confirming that lecanemab slows mental decline amid reports of potentially related deaths.

30 November 2022

People involved in a clinical trial of the experimental Alzheimer’s drug lecanemab had their brains scanned to see whether the treatment was clearing away toxic protein plaques.Credit: US Department of Energy/Science Photo Library

Researchers have got a first look at phase III clinical trial data for a much lauded experimental Alzheimer’s drug — and although the data support it having a moderate cognitive benefit for people, scientists worry about its safety.