My thoughts following the release of the Cogstate quarterly update and investor call:

- Financial results were basically within guidance

- One exception was operating cash which was strong at US$9.2m, versus guidance of $5m+

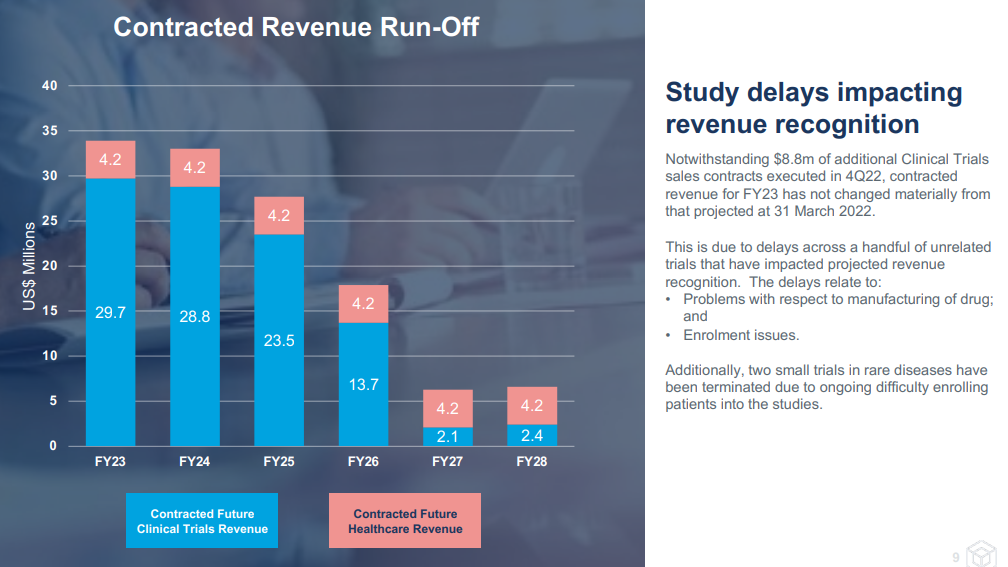

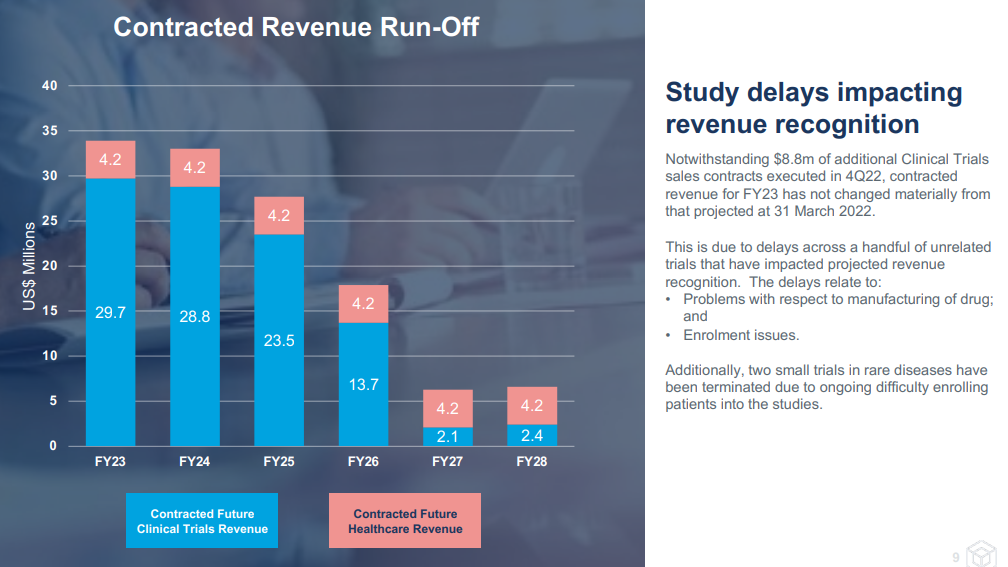

- The one knock on the update was slowing sales in the quarter. For the first time since I’ve been watching them they didn’t fill the top of the sales funnel as quickly as revenue flowed out the bottom. Brad acknowledged that but said there was “no trend to talk to” and “expect to see a stronger Sep qtr”. Of the $8.8m sales in the qtr, approximately half should be recognised in FY23

- Alzheimers clinical trials are becoming an ever greater proportion of trial sales (84.2% in FY22 versus 65.3% in FY21)

- Seeing some delays in trials, which they attributed to delays in drug manufacture and recruitment of cohorts). They confirmed in Q&A that postponed trials delays not only revenue recognition but also cashflow as contract schedules are linked to milestones rather than dates.

- Noted near term readouts of phase III trials for Eisai and Roche (both CY22) and Lilly (mid 2023)

- Healthcare deal with Eisai will benefit from a successful phase III trial

- Noted that clinical trials are increasingly adding decentralised elements, which Cogstate are well positioned to support. Decentralised trials are cheaper overall but they believe Cogstate will get a larger proportion of the trial budget.

- When asked about margins they stated they were optimised for the current revenue base but should see further operating leverage on higher revenues. Also said a successful phase III trial would be beneficial for this as it would result in higher Healthcare revenue, which lends itself to more of a pure software sale rather than Clinical Trials, which are a mix of software and services.

- Proposed use of free cash flow – looking at acquisitions but they would need to be complementary to existing business and not add significantly to cost base. Otherwise there may be an opportunity to return some to shareholders.

- They didn’t mention the recent discussions throwing doubt on amyloid research published back in 2006 that Nnyck777 mentioned a few days ago (I did ask but they didn’t take that question).

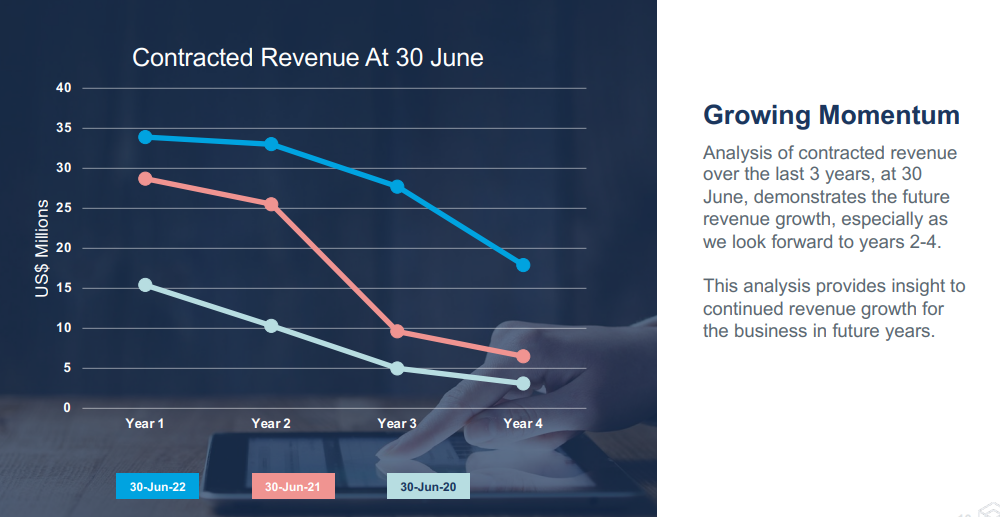

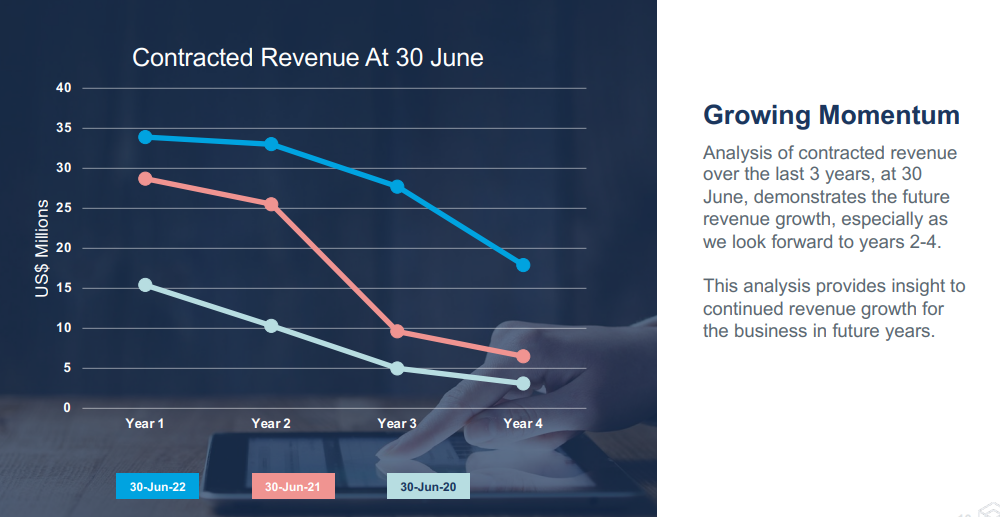

Overall, I think it's a strong result showing that they are growing, are delivering operational leverage as they grow and some near term catalysts that would be very positive should they occur. The one thing that gives slight pause is the slowdown in contracted sales and I'll be watching the next quarterly closely to ensure it's a blip and not a trend.

[Held]