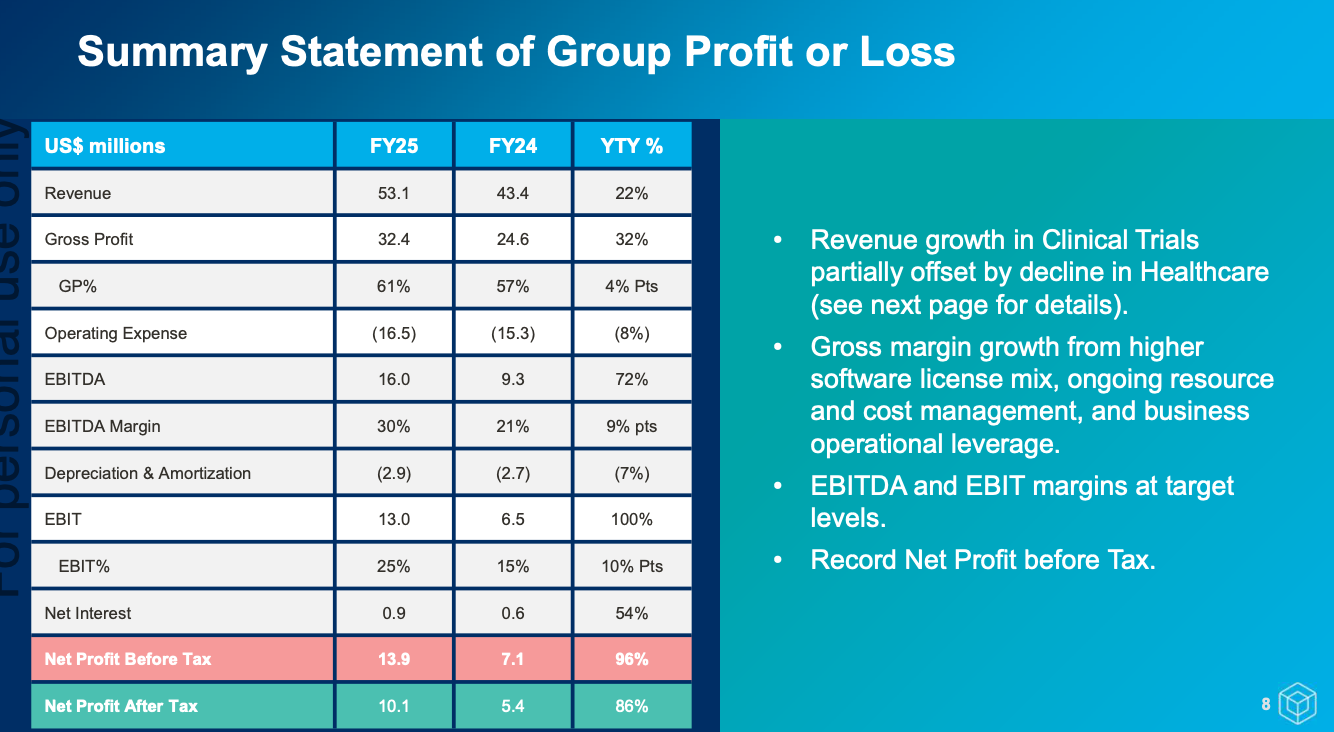

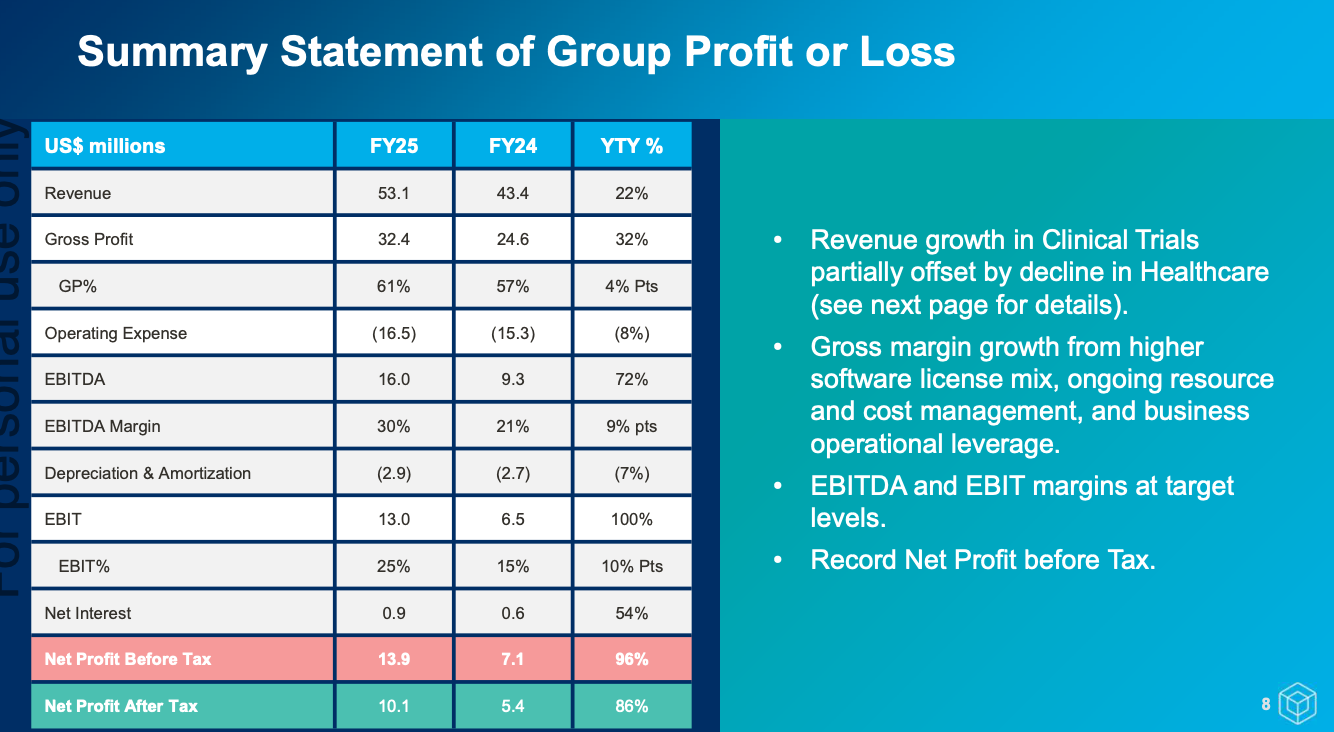

It was a great set of results for FY25. Though much of it was pre-announced in an earlier trading update, so there were no surprises. 2H was significantly stronger with $27.9m revenue and $8.1m EBIT. A notable shift from prior years is the growing share of smaller clinical trial wins, which provide faster turnarounds and earlier revenue recognition.

In the past, Cogstate has hinted that channel partnerships (with groups like ERT or Clario) could help drive sales. It now looks like they’ve found the real deal in Medidata - a major electronic data capture company with 4,000+ staff and roughly 800 salespeople. The partnership is still in its infancy: the sales team only began ramping up in February 2025, yet proposals involving Medidata already represent around 20% of Cogstate’s pipeline. With Medidata’s far deeper reach into clinical trials, Cogstate is accessing a broader range of opportunities than it could on its own. Management has made it clear this is only the beginning, with expectations of further pipeline growth and contract wins as the joint approach matures.

We’re also beginning to see the benefits of the April 2024 licensing amendment with Japanese pharma giant Eisai, which returned global rights to Cogstate’s assessment technology. That technology is now being used to help pharma companies pre-screen patients for clinical trials - an application that generated $1.2m in FY25 revenue, with more opportunities of this kind already in the pipeline.

It’s been a tough stock to hold over the years, largely because Cogstate has been so reliant on a small number of large phase 3 Alzheimer’s trials. The scarcity of these large deals, combined with their inherent lumpiness and the impact of patient recruitment delays, has led to significant year-to-year swings in the company’s performance.

All of a sudden, the outlook looks much brighter. The business is diversifying beyond Alzheimer’s into areas like rare disease, sleep disorders, and Parkinson’s - smaller trials that are quicker to secure and faster to recognise revenue from, smoothing out the historic lumpiness. Medidata is now driving meaningful RFP flow and opening doors into new indications. Cogstate has also began monetising its consumer-facing technologies for patient recruitment, with scope to expand into further use cases. Importantly, the upside from large phase 3 Alzheimer’s trials remains intact, with a number of big pharma companies currently progressing phase 2 programs.

Management have suggested revenue growth is once again expected in FY26, but with the shortened sales cycles and revenue recognition, no specific numbers have been given. Also expect a modest margin decline (~0-3 percentage points on EBITDA/EBIT) due to increase investments. They’re off to a strong start with $14.1m of contract revenue banked since June 30. A maiden $0.02/share fully franked dividend was also declared.

One could make the case that it’s a very reasonably priced company with an EV/E of 15x (annualise 2H performance), that’s more self-reliant than it has previously been (broader beyond AD, stronger channel-partner leverage, and a faster cadence of smaller contracts), with some tremendous tailwinds (pursuit of AD treatments, pharma chasing earlier stages of AD that require more sensitive endpoints, etc). Ultimately, this is only for investors that have belief in the long-term tailwinds and willing to ride the bumps and grinds - this is not your grandad’s SaaS company adding incremental ARR every year.