Pinned straw:

@Slideup I am naturally cautious. Once upon a time (after their Strawman interview well over a year ago) management insisted that they would expect to achieve free cash flow consistently/regularly going forward most quarters -- a forecast which turned out to be badly wrong. It is not that I don't take them for their word, but once bitten....

I do agree though. There appears to have been a clear attempt to decrease costs. If they have achieved that (Q1 and Q2 will provide some insight), the only catch is if it comes at the expense of growth/expansion. Obviously this is critical -- the business needs to continue growing. I think management were forced into this for for two reasons: they had a disappointing year (revenue wise) in FY25; but also they probably clued on that the business model wouldn't survive -- simply wasn't sustainable to keep tracking along how they were.

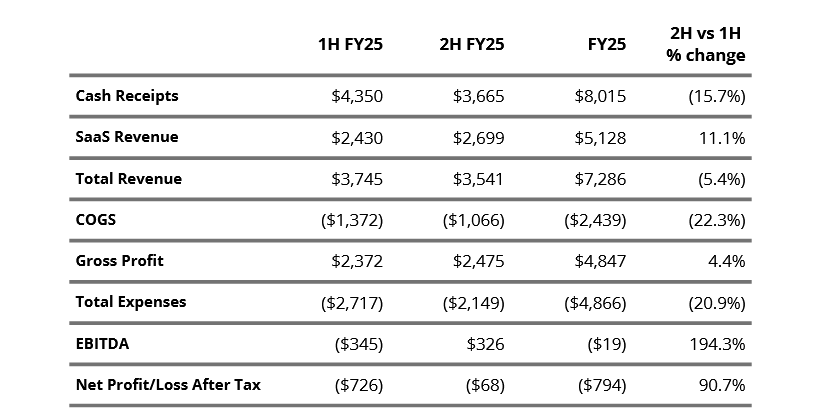

In FY25, admin expenses, employee and contractor costs, direct software costs and marketing costs all decreased YoY. If we see stability for these costs into FY26 like you mention, the result will be a business that is profitable, or very close to -- provided they don't lose any significant contracts and continue to make small wins. SaaS revenue in excess of 5m for FY25, with standard revenue dropping 11% to 7.3m. If we see 10-15% growth to the latter in FY26, we should see revenue hit more than 8m and a profitable business (a long time coming).

I will update my valuation shortly, but for both a slower growth model, and a realistic bull case, the share price is cheap at these levels. Particularly when you consider you are getting in return a business that has a strong foothold at the fed gov level.