Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I am catching up on some of the results that came in last week and one of the ones that surprised me was 8CO, as @Rocket6 wrote about a few months back this one has been a long disappointing investment that has failed to convert revenue into profit.

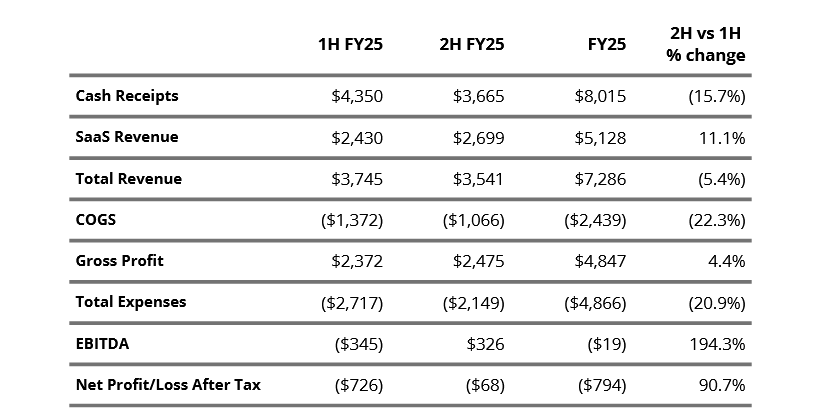

What jumped out to me was this table and the significant improvement in costs in the 2H. They have reduced corporate and staff costs from around $2.3M/qr to $1.7-9/qr and I think they are going to maintain this rate. So they need to bring in 7-8m revenue to cover this cost base. As always with these guys its their ability to convert the government ERP program into active users, which is still slow, but the pipeline is moving. If they can maintain this costbase and maintain the onboarding rate this should be approaching the transition into profitability.

There is still a lot of potential here, with the captive govERP users that can be converted and with card hero contributing 466K in Fy25 and plenty of future upside if they can win a few tenders. This is the first result for 12 months or so that I can see the way forward for them. I also like that this one has gone from being a relatively highly commented stock on strawman to now being mostly ignored and pretty much all of the recent action has been sells.

In general 8CO has been a dissapointing investment to date. They are running around 12-18 months behind where I thought they would be in terms of the federal government rollout. I still don't have a good reason on why the implementations are so slow, I'm guessing it must be largely on the customer side as otherwise I can't see why they wouldn't be throwing all of their resources (limited as they are now) at accelerating it. Many of these departments only have a few hundred employees so maybe this is part of it.

I was disappointed at the quarterly as I did expect this to be a strong cash build quarter and for them to only generate $1K positive cashflow is underwhelming. This is two quarters in a row now that they have run their balance sheet to an inch of its life. While I don't think this is great, I am taking it as a positive in that they can control spending and manage their own operations within their revenue forecasts. I am still in the camp that doesn't think they will do a cap raise. I think if it was on the cards they would have done it by now.

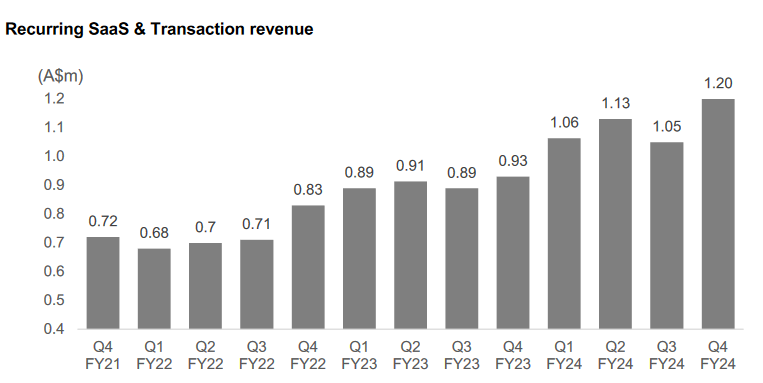

Overall 8CO is moving steadily forward as this chart shows. SaaS revenue is now $5m annualised entering Fy25 (includes the 2k odd users who went live after June 30). There is another $2m min recurring revenue sitting in their committed pipeline, when they actually pull their finger out and get the pipeline moving.

Positives from the quarter - Cardhero is operating at cashflow positive so while it is only $400K annualised, this is no longer a drag on the rest of the business and its rate of change over FY24 is pretty positive going forward. When I originally invested in 8CO I thought Cardhero would have taken off quickly. I was defiantely wrong on that, but better late than never.

Everything else in the quarterly was a bit same same, muddling along.

I have been thinking about 8CO today and about how management have communicated to shareholders and whether i have placed too much trust in them. Have they been deceptive on the growth framing or have I been overly positive in my interpretations of their guidance? I went back and looked at what they said was coming from a year ago when they had what looked like at the time a large break out quarter.

Q4 23 CEO statement and Outlook

FY2023 and in particular the recent quarter has been momentous for 8common as we posted record operating results across the board. More importantly, we recorded positive operating and group net cash-flow as the business works towards profitability. Whilst it remains premature to be able to give forecasts, the $12.4 million in contracts closed during FY23 and robust pipeline places the Company in a very encouraging position.”

The growth of users on our platforms is anticipated to increase our ARPU over FY24 and beyond, delivering material revenue growth for the Company and driving profitability and further positive cash flows for the group.

Q1 and Q2 CEO statement and outlook 24

The Company continues to expand its presence amongst government, not for profit and large enterprises. As more entities progress to the on-boarding phase of Expense8 under the GovERP program, we anticipate user numbers to continue to grow in coming quarters. With a growing proportion of users on our platforms from within Federal government is anticipated to grow our ARPU over FY24 and beyond, delivering material revenue growth for the Company and driving the business towards sustainable positive cashflow.

We are completing 1H FY24 with strong growth and new mandates to sustain momentum in to the second half of FY24. The continued growth in our SaaS & transaction revenue, which is up over 100% over the past 2 years, reflects the growing scale of our business within Federal & State Governments as well as large enterprises. With over $8m in revenue generated in the past four quarters (an increase of 51% on previous 4 quarters) and upwards of 54,000 users currently in Phase 0 or onboarding Expense8 stages we expect the SaaS revenue to continue to grow. Importantly, we returned to positive cashflow during the quarter as we worked on initiatives to reduce the timing mismatch that we had previously flagged between client onboarding expenses and cash receipts.

Q3 24

The Company has clear line of sight towards sustainable positive cashflow and profitability. Active management of infrastructure costs combined with growing SaaS revenue point towards a positive cashflow and profitable Q4 of FY2024 and underpin a momentum into FY2025.

Q4 (current Q) Q outlook

We are pleased with the strong Q4 finish to the year which has set us up nicely for FY25. Our focus on customer success and new implementations drove record SaaS revenue and cash receipts which delivered operational profitability for the quarter. Both expense8 and Cardhero are well positioned for continued growth given the demand for our solutions and our positioning given the blue chip client base. We have begun FY25 on strong footing as SaaS revenue is poised to grow given the recent implementations and strong pipeline of opportunities in the near term. Operational efficiencies and strategic initiatives have also contributed to strengthening our financial performance. We have turned an important corner and look forward to delivering on our goal towards positive cashflow and profitability in FY25.

As i read through these I can't really find anything wrong with what they have said and delivered against, maybe they implied operating cashflow was closer than it was but nothing overly problematic. I look back at my old valuation of 25c and it is clearly wrong, but I can't see how 3.5c is fair value either. The business is steadily moving in the right direction, just slower than I anticipated. I look at this business today and see and $8m market cap that is selling for <1 x revenue or 1.5 x recurring rev, has scant cash in the bank but the security of the director loan that will prevent any forced bankruptcy from lack of cashflow.

I compare this to Change financial (recent Wini writeup), a same same but different fintech business. I was able to listen to the quarterly update today, and it is a good looking business that is growing revenue at 30-40% and should do $14m revenue this year and be EBITDA positive, it is selling for around 4-5 times revenue.

I'm not implying that CCA is overvalued more that 8CO is asymmetrically cheap.

I had been waiting for for the 8CO quarterly as a few warning signs had started to appear over the last few months. In general I was happy with what they produced, not spectacular but solid forward progress. All they key metrics moving upwards, even though progress is far slower than I been expected from a year or two ago. Cardhero was a positive with an 1yr extension and a new contract signed. Still low revenue but not a right off.

They are back to positive cashflow, even if it was only $6K, but this would have been negative if the late payments from Q1 hadn't have fallen in Q2, but then Q1 would have been cashflow negative of $0.5-0.7M. So overall they are still a bit behind where I would like their cash generation relative to expenses to be. They will also get some more implementation revenue from the new entities (Fair work, Commonwealth Ombudsmen and Maurray Darling authority) that have signed up. So I still consider cashflow to be manageable for them. They have $814K cash left and the undrawn $1.5m director loan available, so a cap raise is not on the immediate horizon which is good, but I don't think the market will consider them out of the woods yet.

I still find it incredibly difficult to follow how many active users they have in the GovERP program. The below guide from Q1 and Q2. It looks like they have 3K new live users and 1K additional onboarding to result in a net loss of 4K from users not yet engaged. Seems straightforward but then in the text we have this statement that they have 8K live users- So why aren't these captured as part of the total live users current at 24th Jan 2024.

There has also been no net change in total number of users in there metric table apart from the 2K reduction due to the churn in the state government inactive accounts from a year ago. It seems unlikely that user churn is occurring as they have flagged this previously when it has occurred.

I still think the risk reward profile here is compelling, especially at the current price of 6c. When those 54,000 in progress users become live over the next 6-12 months they will generate an additional $2.5m annual revenue, which should enable positive cashflow to be maintained. At this stage there is no indication that the opening up the ERP program to competitors is having an effect on pipeline but it is still early days.

A bit of a disappointing media release from the government about the shared services model for the public service. It looks like they are ditching it in favor of a more open tender system. I had dismissed this as a likely risk as nothing had been mentioned after the last federal election.

8CO had signed a 3yr +3yr extension contract in July 2021 to provide the travel management and expense software (Expense8) as a common corporate platform for the majority of the public service - the non-corporate entities were mandated to use it, while the corporate entities could opt in to use it. In total this was going to be around 180K users.

So from the media release I no longer expect the 3yr extension to be taken up by the government in July 2024 and competition to potentially increase. Although by all accounts the software is well built and well liked so they do have first mover advantage now and a solid footprint to maintain and expand from.

This media release could also be behind the recent increased use of 3rd party tier-1 contractors to accelerate the speed of on-boarding. It also makes the recent focus achieving the 'Protected status" security clearance more interesting, at the time I thought it seemed a bit odd to spend time and money on that given the slow rollout and balance sheet. In the context of the media release it may be a way to stay the preferred supplier in addition to being ready to expand into the defense department when a tender is opened.

Its hard to know if this release is targeted at 8CO or whether their are other service providers in the shared services model that haven't worked out as well. The rollout of Expense8 has been far slower than I had expected, given that we are 2.5yrs into the initial 3 yr contract and only 40K users have gone live, I could see an internal review being critical of the sole provider design.

Disappointing news but doesn't really change my thesis, which is hinged on the rollout continuing and achieving the 180K or thereabouts live government users, and maintaining an ARPU level of > $50. But given the market isn't particularly happy with 8CO currently I think we will find new all time SP lows.

The pipeline of users for the GovERP program continues to increase with todays annoucement of the Veteran affairs department signing up 2600 users for $895K. This contract is $460K implementation revenue and then $140K/yr SaaS revenue for a 3 yr term. It brings the total GovERP work up to $5.5m. This contract also brings them closer to the defence department, which they have talked about targeting after the GovERP program is completed, This implementation revenue should be received in 2H FY23 and 1H FY24, with the SaaS revenue occurring in a years time. The market is worried about their cash reserves, but I think this, and the previously announced GovERP implementation revenue should let them avoid the need for a cap raise. I am hoping to see low cash burn (<$400K) in the upcoming quarterly.

I have been keeping an eye on these numbers and the rollout of users is slower than I would like but the pipeline is moving - live users are only up 2000 from October 2022. I'm not exactly sure how this process works, so it is possible that we get big movement events of users between onboarding to live user according to scheduled dates. From todays annoncement it looks like it takes around a year to go from not yet engaged to Live.

26/4/2023 (161,000 user pipeline)

25/1/2023 (155,000 user pipeline)

30-11-2022 (120,000 user pipline)

More good news for 8CO with a further $2.1 million implementation contract announced on Dec 24th. This will bring another 5300 users onto the GovERP platform. It looks like it is 6 entities with the main one being The Department of climate change, energy, environment and water and the inclusion of others onto the Service delivery office of the Department of Finance. Overall very good news and continuing signs of a happy customer.

At the end of Nov 22 they had 31000 live users and another 14K being onboarded. After a slowish initial rollout it looks like the onboarding process is starting to speed up. In the announced contract they are expected the $2.1M implementation revenue to be recorded in FY23, while the SaaS revenue starts accumulating in 1H24.

The ARPU of the government users has also been increasing steadily overt he last year and is now running at $53 ($20 for non-government users). SaaS revenue in FY23 should exceed $1.6-2m just from the existing government users and probably another $3.2M from the non-government clients. Its easy to see how the government revenue will become the main revenue source over the coming years when the full 130K users are onboarded.

I tuned into the Automic Tech Opps 2022 presentation that had Nic Lim (Executive Chairman) giving a 30 minute interview style presentation a few days ago. He gave a broad overview of what 8CO have been doing and it is worth a watch when/if? they put the recording up. Gave me more confidence in my view that this is undervalued at current price.

Overall nothing new was said that can't be teased out of the quarterlies, but did give good commetary around where they are heading. Expecting to be cashflow positive in the near future and moving to be profitable in the near term. He was very aware of dilution and strongly stated that they have no plans to raise any capital and said that they do not require it to reach profitability. They are also not currently looking for aquisitions but open to it if they right technology comes along.

Gave some good background of how the Fed government rollout is going and why they are so well positioned to get this work. Was really excited about how they currently have only onboarded 20-30K users and still need to onboard 150K (or so working from memory). The ARPU is still trending up for the Gov users and this is higher than non-gov mainly as they are more embedded and they use more of the add on services.

The big new future gazing opportunity (that I haven't heard them mention before) for growth is to get into the Defence forces (I think he said 300K user potential?), and this is a longer term priority for them and they seem confident that they have the technology that is suitable and secure enough to get into this area but did highlight the slow process that getting government contracts entails.

Its a funny market and highlights how unpopular small tech companies are at the moment. 8CO has clearly set out how they are growing and executing to that plan, but the market says meh!

The announcement this morning can only be described as good news --> another 575K added to the Gov ERP contract ($2M total contract rollout now). Even though the number itself is not huge it further embeds them into the federal government bureacracy (was a potential risk that this would be rolled back with change of government), reinforces that the exisitng rollout is going well, with the first 7 entities now live, adding 3000 users to the platform. To me the potential here is huge, when the full 110000-150000 users across the 158 government entities are on the platform. Currently 20000 users, at ARPU of $47 ($53 pre covid), up from $43 in the last quarterly. I do expect the ARPU number will reduce when all the users are added due to not everyone travelling and swiping the corporate card as frequently as the early users.

I am looking forward to the upcoming CEO interview on strawmen.

A nice update from 8CO on how the buisness is tracking for the 4th quarter numbers-

Expense8

- $820-830K (up 14-15% from Q3-$714K)

- 181K users now on platform --> up 4K from Q3 22

- 3.6 & 5.6K trips recorded in April and May --> May the highest number since Covid and confirms the sense I get that professional travel is returning strongly.

- ARPU at $18 vs $20-25 pre pandemic and continuingto improve was $16 in Q3

- Total revenue for Quarter guided for $1.6m up 50% from Q3

CardHero went live in May and first transactions recorded revenue will start to flow in FY23

Everything is tracking in the rright direction and on these numbers and they should be back to cashflow positive for the quarter.

I thought this was a pretty positive annoucement. A 2nd NDIS provider signing up to CardHERO and Expense8 for an 3 year term + 2yr extension option. I am guessing the muted market response is due to the contract only being worth $165K.

I agree that alone this contract isn't game changing but I think it is very positive and further validates what the company has been saying about there CardHERO strategy. The positives I see from this deal is that now we have a 2nd organisation (that from what I can tell are not linked to Life without Borders) that sees value in using this finance management software over an inhouse (cheaper but timecost) or alternative solution (none tailored for this purpose that I am aware off). If CardHERO generates revenue of $12/month (Expense8 -$36/yr currently) doing some rough numbers this organisation probably has a headcount of somewhere between 20-40. For an organisation of this size to see that paying for CardHERO is a good use of their funds supports the earlier assessment that the value proposition from CardHero is that it lets the carers spend their contact time in more effective ways with their clients than expense documentation.

From doing a very rough check from the governments website on how many NDIS providers there are I get a ballpark of around 25-35000 organisations, but some of these are duplicate offices etc. So while this contract is relatively small, it doesn't take that many of these small organisations to sign up to move the revenue needle in a positive way and given the nature of these types of software buisnesses, after a certain point this revenue drops to the profit line.

I first came across this company through a straw from @wini and thought it looked interesting, but wasn't totally confident of the impacts of Covid, and was always reluctant to buy on the enthusiasm of a good annoucement. I have just used the recent pullback to buy into this in RL. I am not confident of putting a valuation on it as it will depend on CardHero uptake and rollout, but I am confident enough that if it works out like I think it will then it will be worth much more than $0.17.

I think their expense8 software is a pretty nice package and is and will continue to be a solid earning channel for the company that enables it to maintain positive (or thereabouts) cash flow. This channel is still being impacted by covid restrictions, lack of travel trips etc. but It does seem to be popular with government departments as evidenced by the recent contract wins and lack of churn once a contract is won. Pre-covid ARPU was $25 and now it is $17, but total users are increasing and I think this number will continue to drift back up as movement increases this year.

The exciting thing for me about 8CO is there new product CardHero, which has just gone live this quarter with non-profit Life Without Barriers (LWB), who are part of the NDIS network. A while back I read an interview with the CEO about how this product was built in partnership with LWB and what the value proposition for them was (see excerp below). This got me interested in the company initially, I have used the recent sell off to buy in RL. What I like about CardHero is the benefit to the client and the higher ARPU which is $12/month ($144/yr vs $17-25/yr for expense 8). I have copied a portion of the interview below as it gave me a lot fo confidence that this product will be a winner and likely to lead to rollout beyond LWB in the future.

************************************************

Source- CEO interview with Alan Kohler Eureka report (April 2021)

Virtually no churn.

Yeah, virtually no churn. It was all ARPU and that's primarily because a good chunk of our revenue is fixed. It’s platform fees or it’s annual fees for use of the system, but there is a proportion that's transactional and that obviously had a dip, there was less travel therefore there was less trips in our system, there was less credit card usage. Right now we've got that back up to a bit over $17 and we can see that trending back up, so that's the sort of ARPU at the moment for Expense8. With CardHero, we've got the first deal signed and all that has been released. That's for 3,500 cards and it's approximately $500,000 per year is the revenue on that contract. So it works out to be I think about $10.90 per card per month, is the ARPU, so that’s a hundred and…

Per month?

Per month.

Right, what’s that, five or six times the ARPU, is that right?

Yeah, correct. Yeah. It's a much higher ARPU in this space

And is Life Without Barriers happy with that?

Yeah, they are. What we're building is very sophisticated, very complex. And what it does is not just Life Without Barriers, but the not-for-profit space in general, their focus is the hour of care and maximising the hour of care is an important phrase for them.

Explain that hour of care. What do you mean?

If you've got people in a share house, there's typically three, four, five people who are living in this house and there are carers and there's almost always a carer on duty in the house and their job is to care for the individuals. I guess the concept is they want to make sure that they're spending as much of that time that they’re with the people with disabilities actually caring for them and not doing administration and trying to find receipts for the money they spent for the client that they've got. So they're very focused on that. That’s $12 a month, this is half an hour’s worth of carer time of which we're going to save a lot more than that by taking away a huge administration burden and then letting them focus on looking after the people with disabilities.

How many clients did you say you have for Expense8?

Expense8, depending on how you cut it exactly, but we've got over 150 government agencies using the solution, and then a lot of large corporates. It's just under 200 individual customers using Expense8, and about 157,000 users. (173K@ $17/user Q2 2022)

Is there any reason why all of those customers won't convert to CardHero?

Look, I don't know if it makes sense for every single customer but it certainly does for a lot of the customers to use it. We've had a lot of good discussions with our existing customer base. As you can see it's a large starting point, which is fantastic. And probably the other important thing to note is we have 157,000 users of our system. So they're the people within these government agencies and corporates who have a credit card, or who spend money on the company's behalf regularly enough to then get a credit card. Only about 10 per cent of people in a company get a credit card normally, so 90 per cent of people don't get a credit card, they spend their own money and get that money back and that's a great target market for CardHero. So those people who are spending money right now, the companies and the agencies, they know it's not a good way to treat employees and you have to spend the money now, if you take a flight. If I came down to see you in Melbourne, the flights, the accommodation, just for a day, is sort of $5-700, you've then got to apply to the company to get that money back, get that approved, wait for the next pay run. You can be waiting a month to get your money back. With these CardHero cards in hand you can put the money on the card beforehand, and not have to go through that process.

Is the card labelled CardHero or is it labelled a Visa card or something?

It's a CardHero card. It is backed by MasterCard, through EML, so it’s our design.

I presume most of the companies that they dish out corporate credit cards to 10 per cent of the employees, because they don't trust the other 90 per cent. Is there some greater safety in your CardHero that will give them comfort and confidence to do that?

Yeah, a hundred percent. You're right. It may not even be trust, but there's a liability on those cards and it's either mistakes, or unfortunately, there is fraud in this world, but yeah, you can't give a card to every single person. Our cards will inherently have no value on them and I'm talking like in the corporate space now, it's a slightly different use case to the not-for-profits. These cards will have zero dollars, so I can give it to every person in my company and it sits there with no dollars on it. If I try and tap it, nothing will happen. There's no money on it. It's kind of like a gift card. If you walk into a supermarket and get a gift card, there's no value on it until you walk up to the checkout and load up $50 or whatever it is that you want to give to somebody, it's very similar to that.

What will happen then is you can request money to be put on the card. I can say “Alan, I'm coming to Melbourne I need $500 for the flights, accommodation, taxis”, and I can itemise that through the system, which already does all of this by the way. I can request all that and you, as my manager can say, “yep, I approve that” and then money will be instantly transferred onto my card. That's the first step is I can't spend it unless there's a pre-approved event on that. I can't get drunk at night and accidentally tap it on the wrong thing, pull out the wrong card. I can't make a mistake.

The event is pre-approved as well, is it, not just the amount?

Correct.

Oh, is that right? So you can only tap it at whatever it is, the place that's approved?

Yeah. You can really narrow it down and look, every customer has slightly different use cases, but, you know, the classic example is I need a new laptop. It's going to cost me $3,000. I can approve that and say, you've got $3,000 to spend. You can only spend it at JB Hi-Fi because that's our preferred computer seller for whatever reason and you've got five days to spend it. If you don’t spend it, I'll take the money back.

****************************************************************

Post a valuation or endorse another member's valuation.