It's been a rough run for SciDev over the last 12 months, at least in terms of the share price which has effectively been cut in half. And, sure, watching revenue drop 5% while costs are bulked up isnt going to do the bottom line any favours either.

But if you think that this was merely a speed bump resultant from a few project delays, and that the longer term growth potential remains, well, it *could* be an opportunity.

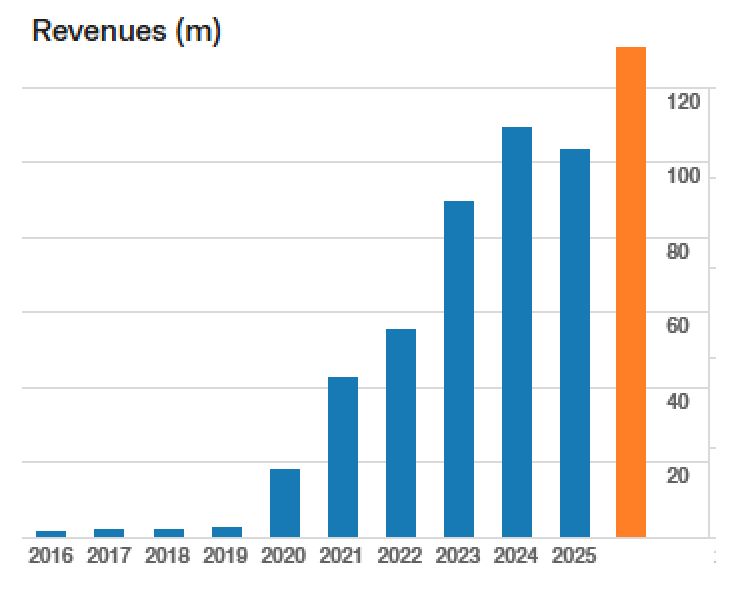

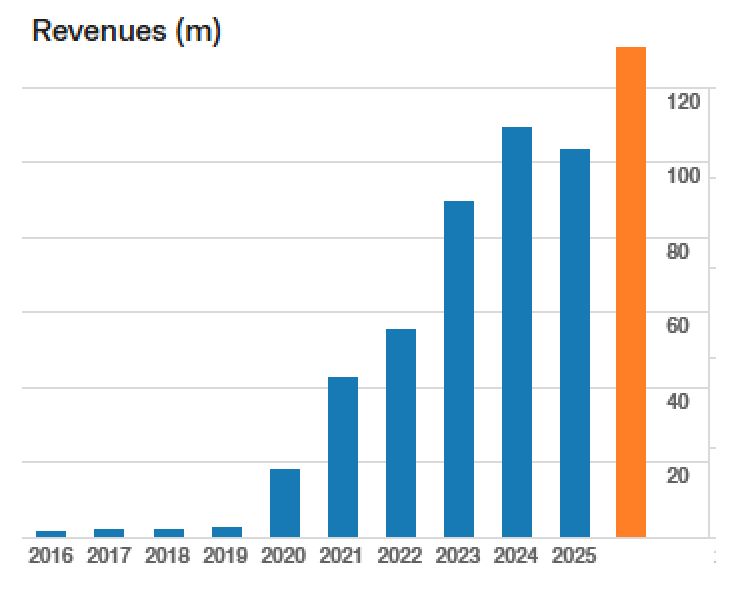

Zooming out, revenues have effectively doubled in the last 3 years, and are set to grow a further 20-40% this year -- a figure Sean said they had confidence in because of the some of the delays in FY25 clearing.

At the mid point of FY26 guidance, the revenue picture looks like this:

They now have some important local reference sites in the US and Europe which was previously an impediment to winning work (i led the question there, but Sean really seemed to emphasise the importance of this). And they have a bulked up team to help drive continued momentum, and for which it seems there isnt much further investment needed. Indeed, he mentioned the operational leverage potential a number of times.

Also encouraging to see them remain cash flow positive and bulk up the balance sheet. And it was really good to see them walk away from a European water tech acquisition that they believed would have been highly accretive from a portfolio perspective, but too dilutive given the share price weakness. I though that was a good tell in terms of capital discipline and shareholder focus.

In my experience, small Aussie businesses dealing with very large customers often get pushed around, and contract wins can be sporadic and easily deferred, which can make for a bit of lumpiness -- which always scares the market. But business is never linear, and so I tend to be pretty sanguine about such things. Again, so long as the bigger opportunity remains in tact. The trouble is, it's easy to tell yourself that when there really could be more structural problems at play...

It's hard to get a sense of what a net or operating margin might look like at scale, but I dont think 5% net is an overly bold guess. Sean was a little coy here, but if we go with that in order to get a rough forward and normlised PE, and assume they hit the low end of guidance, well the PE is 10x. If you prefer, the trailing P/S is 0.6x or the forward is around 0.5x. Which hardly seems excessive.

No position as yet, but i'm a sucker for a stock that's been beaten up and where the core business remains in decent shape.

Anyway, the transcript is here: SDV Transcript.pdf and the recording is on the Meetings page.

Here is the chatGPT summary:

Here’s a concise bullet-point summary of the interview with Sean Halpin, CEO of SciDev (ASX: SDV):

Financial Performance & FY25 Results

- FY25 revenue was down 5% to $103.4m, mainly due to delayed contract execution pushing revenue into FY26, not lost business.

- Despite softer top-line results, margins improved, and SciDev remained cashflow positive with a stronger year-end cash position.

Strategic Highlights

- Secured multi-year contracts in mining using MaxiFlox technology.

- Achieved 46% YoY sales growth in proprietary chemicals for US oilfields.

- Made significant PFAS treatment progress, winning first revenue-generating contracts in Europe and North America.

- Building a pipeline in Europe via partnerships (e.g. Swedish Hydro) to avoid heavy upfront investment.

PFAS Opportunity

- US Department of Defense (DoD): secured contracts giving access to five PFAS-contaminated sites, providing critical reference points.

- Europe: targeting multiple sub-markets with a mix of direct contracts (e.g. UK) and channel partners (e.g. Nordics).

- Management views PFAS remediation as a huge long-term growth driver.

Margins & Pricing

- Achieved higher-than-expected gross margins on Swedish projects due to efficient manufacturing partnerships and upfront deposits.

- US PFAS contracts priced leaner to gain reference sites, but none are loss-making.

Operational Capacity

- Operating a hub-and-spoke model: core design and engineering in Sydney with local delivery teams offshore.

- Running lean operations but has invested in regional boots on the ground and increased sales resources to support growth.

Acquisition Strategy

- Walked away from a highly accretive European water-tech acquisition because funding it at a lower share price would have been too dilutive.

- Demonstrates capital discipline; prefers organic growth, but remains open to future M&A if conditions are right.

Outlook & Growth Drivers

- Provided FY26 revenue guidance of $120m–$140m (20%–40% growth), underpinned by:

- Delayed FY25 contracts rolling into FY26.

- Expanding international PFAS opportunities.

- Growing order book and strengthened business development capability.

- Sees significant operating leverage across divisions; expects margin expansion as scale builds.

Culture & R&D

- Strong focus on culture and internal development to retain top talent and build future leaders.

- R&D skewed towards product development and optimisation rather than pure research — constant incremental innovation to improve solutions.