Pinned straw:

Update: 5 September 2025

I have withdrawn my SM $4DX valuation. I am keeping the illustration here, below, unchanged for transparency and my own learning.

The reason is that in seeking to independently verify management's $1.1bn market sizing claim for NUC:VQ in the US, I am finding several observations that cause me to lose confidence:

- The market is likely significantly smaller, if I exclude sources that trace back to $4DX or the reference they've cited.

- Primary source analysis of US CMS databases confirms @Chagsy's observation that the procedure count decline in NUC:VQ and which can be confirmed as a US-market wide trend as reported over the period 2004-16 in the JAMA article I cited earlier, can be observed to continue over the period 2020-24. The decline is material and appears to be ongoing.

- An initial market size analysis driven by publicly-reimbursed procedure counts and reimbursement rates, and scaled for likely public-private splits and rates, leads to a conservative estimate of US$230m (AUD354) and a more balanced estimate of US$365m (AUD561m).

Again, the above numbers might also contain errors, but at least I have transparency of them to primary source data of procedures actually report. I am not reliant on some consultant's TAM report.

Thus, there is a potentially material error in my illustration of the potential value of $4DX that is attributable exclusively to CT:VQ displacing NUC:VQ.

As I have not completed my market deep dive, nor assessed the other value drivers for $4DX, I do not at this time have a valuation update to replace those posted yesterday. However, from the above notes, you can see the numbers will be very different.

Again, I want to emphasise that my analysis was solely focused on the NUC:VQ opportunity. There is a lot more to $4DX than that. It's just that I don't have a number for that yet!

Meanwhile, the SP soars upwards relentlessly, +25% today at the time of writing. (HC rules!)

And, as ever, this is not advice and you must do your own research.

Disc: Held, but I will be taking some profits in RL today (I'll let it run on SM for fun!)

---------------------------------------

Original Straw: 4 September 2025

Having realised I didn't allocate nearly enough capital to $4DX 5 weeks ago, even though I had a reasonable idea it was about to hit a transformational milestone, the question obviously arises "when should I be prepared to allocate more"?

It is of course important to not get caught up in the market reaction and hype and I find no better antidote than diving into ... yes, you guessed it ... a spreadsheet.

There's massive uncertainty around this business, but equally, there are some pretty solid facts to ground the valuation on. So, in this Straw, I'll layout how I've made some estimates of valuation.

In this case, I've reverted to a DCF, because the economics of the business are really quite simple, and I will go with that.

1. The Market

Quite simply, CT:VQ will over time replace NUC:VQ. It is as effective, much cheaper and more accessible. (I haven't assessed second order effects such as, the potential to increase the demand for CT facilities, which seems logically to folllow. @Scoonie already having flagged the negative impact on demand for nuclear medicine facilties.)

$4DX have estimated their TAM as 1.1bn in the US and 1.5 bn in RoW.

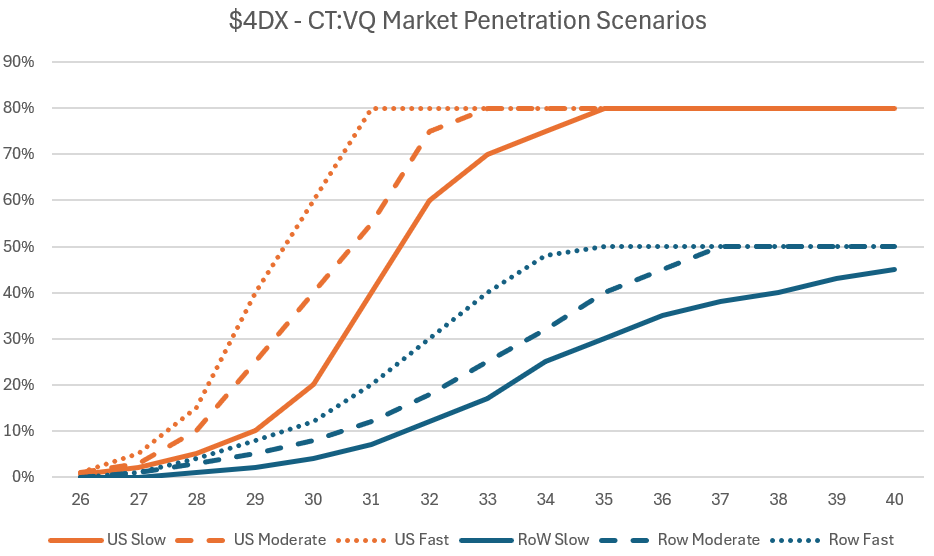

So, I will run three adoption scenarios, Slow, Moderate, Fast, where in the US 80% of the NUQ:VQ market is displaced, and in Row only 50% is replaced, as a lagging rate.

Rather than describe each scenario, here's what they look like in terms of market penetration.

Obviously, there are scenarios where the maximum penetration achieved is significantly lower. However, based on the data presented, this is really looking like a true technology replacement modality. Nonetheless the residual 20% in the US and 50% in RoW present some conservatism in the long run numers that drive the NPV.

2. Revenue

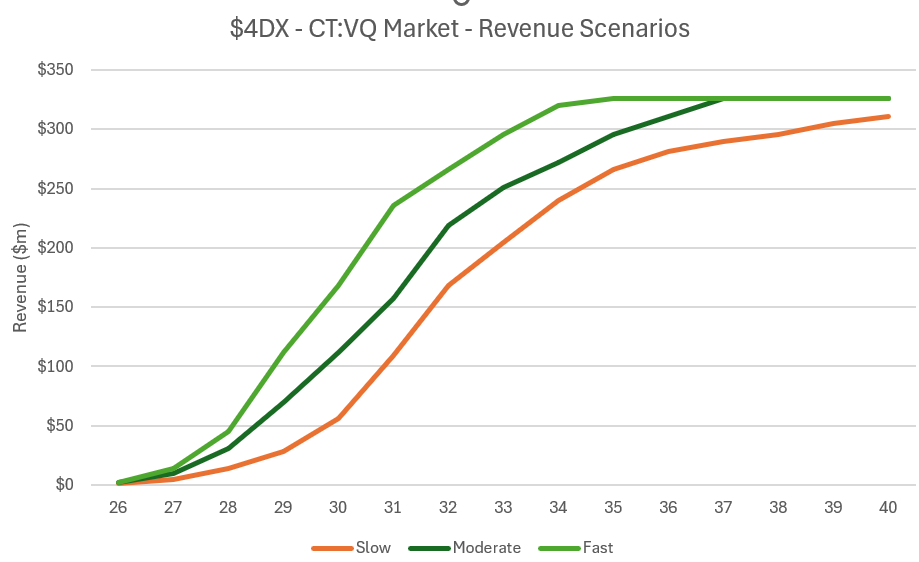

Calculating revenue is then simply the TAM x % market market penetration x Gross to Net.

I've assumed a GTN of 20%.

How reasonable is this?

Well in medical devices there are several possible supply chains:

$4DX - Hospital - Patient

$4DX - HMO - Hospital - Patient

$4DX - PACS Vendor HMO - Hospital - Patient

$4DX - Equipment Vendor - HMO - Hospital - Patient

Depending on the model the manufacturer ($4DX) can end up with anything from 10% to 40% of the revenue, skewed to the lower end.

However, $4DX is a breathrough technology, there is no alternative using CT methodology, and the modality offers significant advantages over the standard of care.

Therefore, in the direct sales model, $4DX should be able to keep 30+% of the $650 per scan, and even in the distributed chains, it should be able to negotiate better than the market norms.

So, I think 20% GTN is a reasonable assumption.

The resulting revenues are shown below:

3. Costs

I'm essentially assuming COGS are $0 (actually $4 per $650 scan). No a biggie for this guesstimate.

3.1 Opex

Opex is currently running at about $48m p.a. - that's a lot - although they have recently implemented some cost savings, to significantly reduce the burn rate.

However, I think they need to step up US sales and marketing, so I am going to step them back up to $50m in FY26 and inflate at 5% p.a.

3.2 Capex

Most of the develop costs appear to be expensed, however, I am going to put in $5m capex p.a., escalating at 5% p.a..

Other Assumptions

I have ascribed not value to $4DX's other products, other than the base $5m revenue from 2025, which is assumed to contine.

SOI - I assume capital will be raised soon to bring FY26 SOI to 500m, and thereafter to grow at 1% p.a.

WACC - 10% (sensitivity run at 15% discount rate)

Tax - 30%

DCF model run to 2040, with continuing value growth of 3% p.a.

4. Valuation Outputs

(in parenthesis I've added a sensitivity with a 15% discount rate)

Scenario1: Slow = $1.26 ($0.44)

Scenario 2: Moderate = $1.64 ($0.69)

Scenario 3: Fast = $1.92 ($0.91)

Conclusions

These are just one set of illustrations for what this business might do in the success case.

However, the potential is exciting enough that when the current froth blows off, I'll consider adding more around $0.70.

In terms of my SM valuation, I will put in the "Slow" senario of $1.26, and for the range around this I will put $0.50 - $2.00, as guesstimates.

Disc: Held in SM and RL

Stevie_B

Thanks @mikebrisy for sharing your thinking behind your valuation of $4DX.

On a similar note I see that the good folk at Morningstar have a fair value SP estimate of $0.82

Disc - Held in SM and not nearly enough IRL but looking to add more on any significant pull back

Stevie_B

Morningstar has now revised their fair value estimate to a rather bullish $2.30…

$4DX Morningstar 9 Sep 2025.PDF

Would be interested to hear your perspective on this latest valuation @mikebrisy

mikebrisy

@Stevie_B as far as I know, Morningstar’s quantitative reports are generated automatically. I don’t pay them any attention. The language of that report reads like gobbledygook to me. Their model is driven by proprietary algorithms that blend fundamentals, moats, sector analysis, and share-price performance, but I’ve never dug into the detail.

That said, to me it does feel like $4DX’s time has come. The global lung imaging market is huge: perhaps US$40–50bn when you scale up from the ~US$20bn US market. If 4DX captures even 1%, that implies peak revenues of ~US$0.4bn per percentage point, at potentially high FCF margins.

But TAM figures include everything across all diagnostic modalities: payer slice, hospital, facilities, technicians, clinicians, and software. 4DX’s realistic share is a fraction of that (5–10% at best). And with such a short commercial track record, it’s impossible to model the scale or timing of its revenue ramp with confidence.

The Volpara comparison

When Volpara was scaling, similar TAM maths could be made against the US$9–15bn US breast imaging market. In practice, revenue per scan was modest, investment in tech and sales remained high, and revenue only climbed from $5m in 2019 to $35m in 2023. By then it was handling >30%+ of US mammograms. It was acquired at a ~$300m market cap, down from a ~$600m peak (I recall) in 2019.

The point: hype cycles matter. Six years ago the market valued $VHT much higher than at exit. $4DX is not Volpara, but the lesson is clear.

So where does that leave me?

Morningstar may or may not be “wrong.” What matters is execution. Without rapid, material contracts, froth will come off the share price. Hence my modest position and desire for a margin of safety. At $2.38 I thought it toppy; at $1.595 (now) it looks less so. The price could fall further if profit-taking continues or rise sharply if new deals land in short order.

In the long run, 4DX could be worth multiples of that if it executes flawlessly, or far less if it doesn’t. Right now, I’m convinced it’s worth more than $0.50, maybe $1.20 with solid execution. Beyond that, the scenarios widen. The only certainty is volatility.

Bottom line: the “fair” price of $4DX today? I don’t know. And neither does anyone else (I’d argue). All we can observe is what those buying and selling in the market today are prepared to pay. And of course we have no idea as to their motivations, many of which will be totally unrelated to the “fair” value of the business in the long term.

Disc: Held in RL and SM

thunderhead

I concur. Their quant reports are dispensible. Their fundamental analysis is good, though their estimates of intrinsic value especially for high growth names can be way off.

thunderhead

It is motoring towards your best case valuation @mikebrisy.

What a quick multi-bagger in the order of a few weeks!

thunderhead

It is motoring towards your best case valuation @mikebrisy.

What a quick multi-bagger in the order of a few weeks!

mikebrisy

@thunderhead Yes, my RL position has already "spiffy popped" on two consecutive days. Never had that happen to me before, let alone for something I've only owned for 5-6 weeks.

To me, it underscores the value of having a long watchlist,... companies you know enough about that, when something fundamental changes, you can move quickly. I've tracked $4DX for a long time, as part of my general interest in medical imaging (have held $VHT and $M7T, for example. Not $PME.)

That said, there is so much execution success now built into the share price, I can't get there anymore on fundamentals. (My upper SP limit was based on a TAM that I think might be significantly lower than stated. If I was to run a valuation today based on CT:VQ displacing NUC:VQ, the numbers would be A LOT lower.

i honestly believe that we are now just seeing FOMO and momentum kicking in, not fundamentals.

But, hey, lets see where it goes. I've already redployed 2X of my cost base into $AIM, $BRG and $CAT in RL.

thunderhead

Yes, it’s incredible. The chequered history of the company made me hesistant to add when the price was ostensibly attractive relative to the potential - Sam’s investment was a big vote of confidence and a strong signal looking back, but I did not have the confidence to act on it.

Price is the only thing that ultimately pays us all, and this has worked out way better than I could have ever imagined. The 1week rate of change must be literally off the charts here.

I have not seen or experienced anything like it before, and I am someone who got off $PLTR in the US before it went on to add 8 bags on my exit price in a year!)

mikebrisy

I am working on other things now, so I won't write up my full market analysis from yesterday. But in essence, the revised TAM estimates I posted yesterday for US NUC:VQ were based of a deep analysis of the Medicare/Medicaid codes on the CMS databases in the US, and then using these to estimate the broader market.

The JAMA paper I shared yesterday showed how dramatically NUC:VQ has lost share to CTPA screening (per @Chagsy's personal anecdote) from 2004-2016.

Well, the chart below shows the decline of NUC:VQ has continued from 2020-2024, most recently at -10% pa (The brief peak in 2021 was due to a temporary shortage of the iodine contrast agent which is used in the CTPA procedure, creating a temporary demand blip for NUC:VQ.)

So, that leads me to wonder if the TAM that $4DX are citing is based on a very broadly scoped market research report based on medical screening using old data? I don't know what methodology the report used.

To get reliable TAMs you have to download the CMS procedure database and other databases (e.g. for reimbursement rates) which are publically accessible, and identify all the relevant codes (just like Medicare codes here in Australia) but it is not clear to me what methodology the market research was based on.

Of course, CT:VQ vs. NUC:VQ is just the recent announcement. Perhaps the market is assessing that the broader set of technologies are going to succeed, and that CT:VQ is going to also displace other modalities. For example. the Gold Standard for PE is CTPA, and $4DX haven't said anything about whether CT:VQ compares favourably against CTPA. CTPA focuses on lung structure (so it can detect PE) whereas CT:VQ maps lung function, and can infer detection of PE, but you'd need to have a head-to-head study run to compare the two. Maybe that's next? Or maybe they've already done it, and it doesn't stack uo?

I am very interested in $4DX now as a longer term opportunity, so the time has now come to deepen my knowledge about this area, and to be patient so that I buy and sell at times that are likely to deliver strong long term returns. I imagine sitting on a small position on the sidelines until the current froth blows off.

Afterall, even long term winners like $PME have experienced volatility. It got up to $1.60 in 2006 only to be back at $0.18 in 2011. And the gamechanger acquisition of Visage happened in 2009, in the middle of this! I don't mean to try and draw an equivalence between $PME and $4DX (which is what several clowns are doing on HC at the moment), but in medtech, there is no need to be in a hurry! Voaltility gives real option value.

Scoonie

mikebrisy great posts that gets to the pointy end of it. 4DX deserves to run on the news this week - but this much? 4DMedical today trading at $1.71, gives it a m/cap of around $800m. It is hard to believe this is down just to retail investor ratbaggery? It can’t be all down to just this week’s announcements and the Sam Hubert / PME pixie dust? Maybe there is more to it and there are some smart(er) fund managers diving in now.

Assuming this is the case, then mikebrisy I agree the 4DX valuation case cannot rely on CT:VQ™ displacing nuclear :QV alone. Because leaving aside the 4DX niche XV product/s, the current price on a US market of just $1.1b – or maybe less, is hard to make it all stack up. (Even if you throw in RoW).

On Andreas’s webinar on Tuesday he laid doggo on the potential to displace legacy CT:VQ. Doing away with the need for an IV contrast agent is a very powerful technical advantage - but this point or the potential of, was skipped over. With the overall market around 9 times that of the nuclear: QV alone, then you could argue 4DX even today is not overpriced.

This could be the only instance I have ever witnessed of a CEO underselling his company. I wish this wasn’t all so hard. If it wasn’t Scoonie would be on Merewether Beach now sucking back Bundys and cokes.

mikebrisy

@Scoonie I hear you.

But the iodine contrast agent is only contraindicated in a small proportion of the population, so can it really support CT:VQ displacing CTPA? I am not medically qualified, but I doubt it.

To remove doubt, we would have to see a head-to-head study of CT:VQ against CTPA. The moment positive results from that are reported, then I am back in with 5X my position, even at $1.50.

But you make a good point, There is probably smart money joining most of the dots around the technology portfolio, and calling time to get on this bus, and I am being distracted by the FWs on HC and their rocket emojis.

I have retained enough of a RL position (and am going to hold on to it, come what may), so that if in 10 years this does go to $100, I don't suffer from SPRP (@Strawman $PME Regret Psychosis).

Strawman

haha @mikebrisy -- definitely worth avoiding if you can!

btw, I've been lucky enough to experience a few "spiffy pops", but never so quickly. well done sir!

OxyBBear

I don't suffer from SPRP @Strawman $PME Regret Psychosis).

@mikebrisy Good one! I solld half my holding in 4DX but like you I intend to hold the balance and see what comes of it as the balance of my holding is a free carry plus the sale of my PME shares still scars me.

Just out of interest I had a look at my hstorical PME holding and I sold the following shares which makes me weep.

1,000 PME at $28.22

800 PME at $34.00

1,000 @ $41.39

700 @ $62.00

thunderhead

By the bye, I offloaded my entire position in the morning. The sell doesn’t look too bad, atleast not until tomorrow I guess :)

mikebrisy

@OxyBBear ,... another day, another "spiffy pop".

But seriously, this is a reminder that even before last week's approval of CT:VQ, $4DX has a suite of advanced lung diagnostic software tools, developed and with regutalory approvals gained over recent years, and which are now starting to gain traction. The focus up until now has been getting the technologies tested and accepted in the leading research and teaching hospitals, and developing KOL support. So, now, to see uptake in government screening programs is very encouraging indeed.

I think we are entering a period of perhaps a year or two, where it is going to be very difficult to value $4DX. Global TAM numbers are very large (depending on what you put in scope), and the FY25 revenue base is very low, so that growth rates will potentially look eye-watering for a few years, IF the company can execute commercially. And of course, as long as commercial terms remain confidential, then it is hard to evaluate them.

But just to take today's announcement as an example, I estimate (with assistance from my BA) that the global market for lung cancer screening is somewhere between US$0.7 - 1.5bn annually, and is growing quite rapdily, as more countries adopt screening programs as the infrastructure build out matures, and screening technologies improve, And while you'd think we're smoking less, and that's true in many developed markets, it is not globally the case. Furthermore, the largest rate of increase in lung cancer deaths has been in populations that have never smoked. It seems that poor air quality is becoming increasingly important as a contributing factor, particularly in urbanising Asia. Sadly, deaths from lung cancer nearly doubled from 1.06 million in 1990 to 2.04 million in 2019.

This is a completely separate market from that we covered in last week's discussions. So even 5% of this market is a meaningful revenue contribution for $4DX, at high margin. (I have absolutely no idea if 5% is too high or too low!)

The rate of newsflow is quite something. Can they follow up with near term commercials deals in the US, on the CT:VQ tech? That's what I'm looking for next.

OxyBBear

@mikebrisy Your knowledge when it comes to med/bio tech well surpasses mine so it is alway good to get your perspective.

I agree that 4DX is going to be very hard to value which is why I have an increasing FOMO if I sell as I have already taken some profits which in hindsight was the wrong decision.

mikebrisy

@OxyBBear we each have to form our own view on value and risk.

The thought process I went through last week, and which continues today, was/is as follows:

- I believe it is almost certainly worth more than $0.50 (>90%), and it might be worth more than $1.20. But I have a much lower level of confidence in my projections of revenue, than I normally have.

- I was offered $1.26 last week, when my cost based (RL) was $0.285 (yes, I know that's anchoring)

- I sold about half my position and decided to let the rest run, come what may, for the long term

- So, today, it is $2.30, and I can either feel really bad about the 50% I sold, or really happy about the 50% I held on to.

- As an optimistic person, I choose the latter.

Unlike, most of my other holdings, where I believe (rightly or wrongly!!) that I have a good handle on the range of reasonable valuations, I can't say the same about $4DX because it is just too early and things are changing very quickly.

So, I am letting the market tell me what its worth, even though if you press me, I believe based on fundamentals, it is worth less than $2.30 based on its long term fundamentals.

But, in the queue at the moment there are 679 buyers for 5.112m shares and only 191 sellers for 1.755m shares. So, if the market insists of driving up the SP, then I am not going to rage at it and say "you're wrong, its only worth X", because I am not convinced I even know what X is".

And so, when it falls back to $1.00, I'll still be happy, because I sold a bunch at $1.26, I have psychologically hedged my position.

edgescape

Wow I never thought this would go over $2.

If I still had it now I'll be in profit :(

Next thing you know they will mention that 4DX is a better way of detecting lung cancer.