Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This morning CEO Adreas Fouras presented a webcast update on 4DX's recent $150m capital raise. Around 15 minutes was spent on the presentation and 25 minutes on questions.

Some Points:

- Emphasized the advantages and superiority of CT:VQ over current nuclear pharma imaging.

- Size of CT:VQ market - $US1m in US and $2.6b globally. Said 4DX expects to get 100% of this currently nuclear market.

- 4DX has contracts with 15% of the top 20 US hospitals and actively quoting 45% of them.

- CT:QV 4DX looking at getting $US500 reimbursement at a cost of around $4 each, a 99% Gross Margin.

- “Pipeline bursting with opportunity” – CEO words. Though focus is on the CT:QV opportunity.

- Recent capital raise led to a dilution of only 3.8%

Q&A:

- Future opportunities? Said 4DX are doing much research and spoke of where there is blood flow there is 4DX imaging opportunity. CEO talked of pulmonary angiograms as the near-term opportunity and said had a market size 4x CT:VQ.

- Veterans Affairs has been slow to uptake 4DX products, however 4DX are working on and assistance from Phillips is useful. Similar with DoD, slow but "they like the technology".

- Concerning the share price and analyst reports valuing 4DX at $3:00? CEO said the assumption in these reports were for much slower adoption of CT:VQ. CEO expects will have 100% of the lung market in less than 10 years. Andreas drew on the obvious comparison with PME.

- Why raise the capital when had stated late last year can get to breakeven without raising cash? Andreas said this remains true, however can now push the company harder and faster. Plus said the share price and circumstances presented an opportunity to raise more capital.

- Said TGA (Australia) CT:VQ approval should happen by the end of this calendar year. (was not clear on Europe).

Andreas himself looked well with a haircut and beard trim and wasn’t the disheveled and slightly irritable person he appeared earlier in 2025. He showed no hint of arrogance at the 13x 4DX share price appreciation in the last 5 months. Him and his immediate family now being worth around $400m. Was very matter of fact about the job he and his 130 staff have ahead of them.

Appears to be a lot to be positive about 4DX, even at a market cap of nearly $2.5b. Its anyone’s guess where 4DX will be in 5 years time.

Salary?

4DX $3.93. Opened at $4 now up 10%

Good vibes here..

After the COB today Cyclopharm (ASX:CYC) lodged the following with the ASX:

Cyclopharm with their Technigas product are in a fight to the death with 4DX with its recently FDA approved and US reimbursable CT:VQ™ technology.

Regal Funds Management has 11% of CYC. Looking like another Opthea moment for Phil.

WEBINAR DETAILS:

Webinar details, tomorrow 12:00 pm Date: Wednesday, 17 September 2025 Time: 12:00 pm – 12:45 pm AEST

For CEO and founder of 4DMedical(ASX:4DX), Andreas Fouras the latest share price run must be a welcome and long awaited vindication of his life’s work.

As at the 30/6/25 he has through his interest in Velocimery Consulting Pty Ltd 65.7m shares in 4DX or 16% of the company. Worth today around $110m.

His personal holding outside of Velocimetry appears to be much smaller, at around 6m director options.

According to the FY25 annual report Helen Fouras (presumably his wife) has voting power in Velocimetry Consulting Pty Ltd of “above 50%”. Whilst Andreas has voting power “above 20%”.

I hope Andreas has been, and continues to be nice to his Mrs.

Seems just like the rest of us, Andreas is only one fat-arse comment away from career and financial ruin.

Update: 5 September 2025

I have withdrawn my SM $4DX valuation. I am keeping the illustration here, below, unchanged for transparency and my own learning.

The reason is that in seeking to independently verify management's $1.1bn market sizing claim for NUC:VQ in the US, I am finding several observations that cause me to lose confidence:

- The market is likely significantly smaller, if I exclude sources that trace back to $4DX or the reference they've cited.

- Primary source analysis of US CMS databases confirms @Chagsy's observation that the procedure count decline in NUC:VQ and which can be confirmed as a US-market wide trend as reported over the period 2004-16 in the JAMA article I cited earlier, can be observed to continue over the period 2020-24. The decline is material and appears to be ongoing.

- An initial market size analysis driven by publicly-reimbursed procedure counts and reimbursement rates, and scaled for likely public-private splits and rates, leads to a conservative estimate of US$230m (AUD354) and a more balanced estimate of US$365m (AUD561m).

Again, the above numbers might also contain errors, but at least I have transparency of them to primary source data of procedures actually report. I am not reliant on some consultant's TAM report.

Thus, there is a potentially material error in my illustration of the potential value of $4DX that is attributable exclusively to CT:VQ displacing NUC:VQ.

As I have not completed my market deep dive, nor assessed the other value drivers for $4DX, I do not at this time have a valuation update to replace those posted yesterday. However, from the above notes, you can see the numbers will be very different.

Again, I want to emphasise that my analysis was solely focused on the NUC:VQ opportunity. There is a lot more to $4DX than that. It's just that I don't have a number for that yet!

Meanwhile, the SP soars upwards relentlessly, +25% today at the time of writing. (HC rules!)

And, as ever, this is not advice and you must do your own research.

Disc: Held, but I will be taking some profits in RL today (I'll let it run on SM for fun!)

---------------------------------------

Original Straw: 4 September 2025

Having realised I didn't allocate nearly enough capital to $4DX 5 weeks ago, even though I had a reasonable idea it was about to hit a transformational milestone, the question obviously arises "when should I be prepared to allocate more"?

It is of course important to not get caught up in the market reaction and hype and I find no better antidote than diving into ... yes, you guessed it ... a spreadsheet.

There's massive uncertainty around this business, but equally, there are some pretty solid facts to ground the valuation on. So, in this Straw, I'll layout how I've made some estimates of valuation.

In this case, I've reverted to a DCF, because the economics of the business are really quite simple, and I will go with that.

1. The Market

Quite simply, CT:VQ will over time replace NUC:VQ. It is as effective, much cheaper and more accessible. (I haven't assessed second order effects such as, the potential to increase the demand for CT facilities, which seems logically to folllow. @Scoonie already having flagged the negative impact on demand for nuclear medicine facilties.)

$4DX have estimated their TAM as 1.1bn in the US and 1.5 bn in RoW.

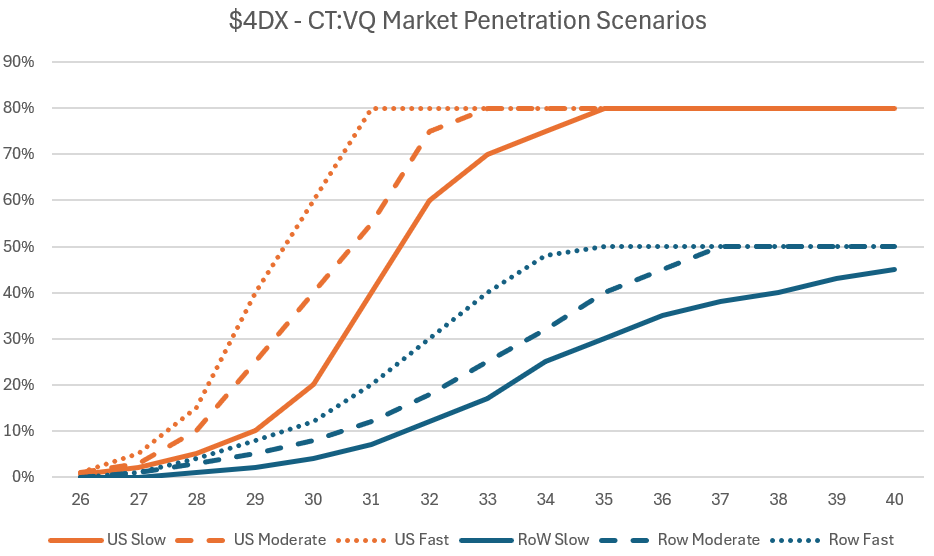

So, I will run three adoption scenarios, Slow, Moderate, Fast, where in the US 80% of the NUQ:VQ market is displaced, and in Row only 50% is replaced, as a lagging rate.

Rather than describe each scenario, here's what they look like in terms of market penetration.

Obviously, there are scenarios where the maximum penetration achieved is significantly lower. However, based on the data presented, this is really looking like a true technology replacement modality. Nonetheless the residual 20% in the US and 50% in RoW present some conservatism in the long run numers that drive the NPV.

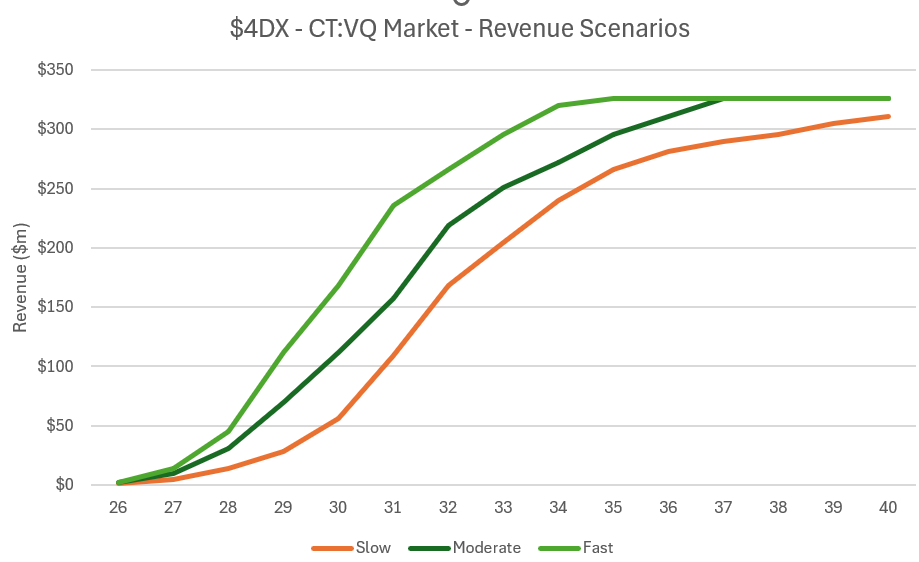

2. Revenue

Calculating revenue is then simply the TAM x % market market penetration x Gross to Net.

I've assumed a GTN of 20%.

How reasonable is this?

Well in medical devices there are several possible supply chains:

$4DX - Hospital - Patient

$4DX - HMO - Hospital - Patient

$4DX - PACS Vendor HMO - Hospital - Patient

$4DX - Equipment Vendor - HMO - Hospital - Patient

Depending on the model the manufacturer ($4DX) can end up with anything from 10% to 40% of the revenue, skewed to the lower end.

However, $4DX is a breathrough technology, there is no alternative using CT methodology, and the modality offers significant advantages over the standard of care.

Therefore, in the direct sales model, $4DX should be able to keep 30+% of the $650 per scan, and even in the distributed chains, it should be able to negotiate better than the market norms.

So, I think 20% GTN is a reasonable assumption.

The resulting revenues are shown below:

3. Costs

I'm essentially assuming COGS are $0 (actually $4 per $650 scan). No a biggie for this guesstimate.

3.1 Opex

Opex is currently running at about $48m p.a. - that's a lot - although they have recently implemented some cost savings, to significantly reduce the burn rate.

However, I think they need to step up US sales and marketing, so I am going to step them back up to $50m in FY26 and inflate at 5% p.a.

3.2 Capex

Most of the develop costs appear to be expensed, however, I am going to put in $5m capex p.a., escalating at 5% p.a..

Other Assumptions

I have ascribed not value to $4DX's other products, other than the base $5m revenue from 2025, which is assumed to contine.

SOI - I assume capital will be raised soon to bring FY26 SOI to 500m, and thereafter to grow at 1% p.a.

WACC - 10% (sensitivity run at 15% discount rate)

Tax - 30%

DCF model run to 2040, with continuing value growth of 3% p.a.

4. Valuation Outputs

(in parenthesis I've added a sensitivity with a 15% discount rate)

Scenario1: Slow = $1.26 ($0.44)

Scenario 2: Moderate = $1.64 ($0.69)

Scenario 3: Fast = $1.92 ($0.91)

Conclusions

These are just one set of illustrations for what this business might do in the success case.

However, the potential is exciting enough that when the current froth blows off, I'll consider adding more around $0.70.

In terms of my SM valuation, I will put in the "Slow" senario of $1.26, and for the range around this I will put $0.50 - $2.00, as guesstimates.

Disc: Held in SM and RL

Two days after receiving its 501 FDA approval CMS has agreed Medicare/Medicaid reimbursement for CT:VQ at US$650 on top of the providers standard chest CT payment.

I can't remember when I last saw a reimbursement approval come through so quickly - it usually takes months, and sometimes over a year ... or years!

Even for $4DX this is phenomenal - I think it took about 6 months for CT:LVAS.

I have no doubt this is because CT:VQ is a breakthrough disagnostic that is much cheaper and more accessible than the existing standard of care.

I wonder to what extend this will turbocharge commercialisation. It will certainly make $4Dx's channel partners sit up and pay attention, and I think it will give Andreas the confidence to make sure $4DX gets a decent share of the pie in the distribution and sales agreements. (I just hope he kept some powder dry in the $PME and Philips negotiations!!)

Pass the popcorn!

Below are my notes and comment from webinar:

CT:VQ™ market is around 1m scans a year in the US and a value of around $1b.

Superior technology to the current radiopharma procedures in:

- No contrast agents – ie either radioactive dust or injectables into bloodstream

- Clearer image

- More accessible with 14,500 existing scanners in US

- Better workflow

- Better patient experience

- Lower cost.

Questions: Costs and Sales pricing:

Was cagey, but said expected $600 per procedure, about the same as their LVAS product and it costs about $4 each (said this with a straight face). Said a share of this will need to go to the hospitals. $300m of sales would be just the beginning

(Importantly said this was the first time 4DX was selling a product that was a replacement product, not something new). Said product was ready for rollout.

Conversion to paying customers:

Had never given a free trial for any 4DX product where the practice did not end up paying.

Medicaid Reimbursement: Said confident will have by the end of the year.

VA and DoD progress: said had a team in Washington. Spoke of the value of their XV LVAS product and gave example of DoD burns pit scans versus a biopsy. Their existing scan cost around $1k (?) versus $30k for a biopsy.

Asked about PME partnerships: refused to comment, but did say product was technically compatible

CME approvals; Said focus of on the US where 40% of the market and 50% of the profits are.

It is interesting the changes in Department of Health and Human Services (Robert Kennedy) and how the US healthcare landscape is changing. Today announcement from PNV in response to New York Times press speculation. It would seem PNV is on the right side of the muted changes with a low cost product. Similarly the same thing seems to apply with 4DX and their offerings. (Contrast this with BOT and its old school management whose major skills and experience appear to be in rorting the US insurance and government reimbursement system. And just how they appear to have come unstuck, for that and other reasons.

Andreas was his in a black T shirt and looking his usual disheveled self. His demeanor was slightly more upbeat than his previous webinars over the years and he took questions. He said that he and his team will working around the clock to make this work. Looks good to me and I think you can be reasonably sure Andreas is working for you the shareholder and will not be spending his evenings rooting whores and snorting lines of cocaine. Share price is off post his presentation, so f&%$ed if I know what I got wrong.

Good news and a few weeks earlier than I expected - FDA approval for the CT:VQ technology.

Their Highlights

• 4DMedical’s ventilation-perfusion product, CT:VQ™, receives U.S. Food and Drug Administration (FDA) 510(k) clearance

• FDA submission for CT:VQ™ was supported by a compelling clinical validation package across multiple lung conditions

• CT:VQ™ is the world’s first and only non-contrast, CT-based ventilation-perfusion imaging technology

• With over one million nuclear VQ scans performed annually in the U.S., CT:VQ has an initial addressable market of USD $1.1 billion

• 4DMedical believes it can rapidly capture a significant part of this market, and over time expects to displace 100% of all nuclear VQ scans

• Potential to grow the current ventilation-perfusion market into new applications in disease monitoring and screening, due to the wide availability of CT infrastructure globally

• 4DMedical will hold an investor webinar tomorrow, Tuesday 2 September 2025 at 11am AEST

My Assessment

This is major good news, and singificantly enhances $4DX's clinical offering.

(I'm on the $RUL call at the moment, so will write more later. I have put a further small offer in at $0.65, but I expect the SP will blast past that. I don't want to go crazy, however, and their will be a pull back over the months ahead, most likely!)

Disc: Held in RL and SM

Lung imaging software firm $4DX has announced its FY25 results.

Their highlights

• Operating revenue for FY2025 was $5.9m, up 56% vs FY2024, with gross margins >90%

• Underlying SaaS revenue for FY2025 up 95% vs FY2024

• Cost reduction program initiated in Q3 FY2025 has delivered $6.5m in annualised savings and focused resources on revenue generation

Secured $10m strategic investment from Pro Medicus (ASX:PME), a leading global medical imaging software company

• CT:VQ™ FDA 510(k) submission filed in May 2025 and progressing towards clearance within anticipated timelines

• Announced the signing of a Reseller Agreement with Philips under which 4DMedical’s combined product suite was added to Philips’ product catalogue in Q3 FY2025

• Accelerating commercial progress in the U.S. with new contracts signed at key reference sites (UChicago Medicine and UCSD Health) and renewals at Cleveland Clinic, Stanford University and University of Michigan

• Contract wins in Australia included Integral Diagnostics (ASX:IDX), QScan and Perth Radiological Clinic (PRC)

• 4DMedical is now delivering SaaS products at 388 sites globally, up 60% YoY, and produced over 74,000 structural and functional scans in Q4 FY2025, up 35% QoQ and 105% YoY

My Assessment

Quick high level thoughts only: I'm expecting that FY25 and early FY26 will prove to be a pivotal period for $4DX. Should the 501K for CT:VQ be granted in a few week's time, then that will be a significant catalyst.

Of course it is very early days and $4DX is seriously burning cash, hence the timely assistance from $PME was important, and no doubt allowed $PME to extract a good deal.

In the 4 weeks since I took an initial speculative 0.5% RL position, it has grown to a 1.0% position. Part of me thinks I should be bold and increase ahead of the 501k decision, given their track record on 501s over the last few years has been pretty good.

That said, it is not cheap, and it will clearly be giving a lot of value away in its deals with Phillips, $PME. and others. However, good distribution deals accelerate the GTM and we have seen elsewhere, that these imaging companies can burn a lot of cash over many years as they try to grow via a direct strategy (e.g., $M7T and $VHT).

Patience required here, and I will take a risk averse approach initially, but increase with continued progress. The good news is that the SP is quite volatile, so picking your days to buy can make quite a difference.

Disc: Held in RL and SM

Chump change on favourable terms for Pro Medicus. Let's see if 4D Medical can make anything meaningful of this for the viability of their business.

-----

4DMedical secures $10m strategic investment from Pro Medicus

31 July 2025

Highlights

• Pro Medicus (ASX:PME), a leading global medical imaging software company, has invested $10m into 4DMedical

• This strategic investment will provide 4DMedical with the growth capital to accelerate its commercial pipeline for existing products while advancing CT:VQ™ towards regulatory clearance in the U.S.

• The investment is structured as a hybrid debt and equity loan that is non-dilutive if 4DMedical’s share price is rangebound, while also creating upside alignment between Pro Medicus and 4DMedical’s shareholders if the share price performs strongly over the two-year term

• The agreement also provides Pro Medicus with the option of distributing 4DMedical products on terms consistent with other distribution arrangements

11 June 2025 Highlights • Olympus Corporation, one of the world’s largest medical device companies, launches a new campaign for SeleCT™ Screening across the United States

• SeleCT™ Screening uses 4DMedical’s lung density analysis technology on existing CT scans to identify candidates for the Olympus Spiration™ Valve System

• Full market release by Olympus creates large-scale U.S. deployment of 4DMedical’s AI-based lung imaging for therapeutic screening

The share price is not reflecting the CEOs cheerie confidence! ...normal ..hehe

see how this opens..

30.0¢

Change

0.000(0.00%)

Mkt cap !

$139.6M

4DX on the move!

https://hotcopper.com.au/threads/ann-4dmedical-files-fda-submission-for-ctvq.8597580/

4DMedical files FDA 510(k) submission for CT:VQ™, a non-contrast CT-based lung imaging software product for assessing both ventilation (V) and perfusion (Q) in the lungs

• CT:VQ™ represents a revolution in ventilation perfusion imaging, solving key clinical and logistical limitations across all forms of nuclear ventilation perfusion imaging

• Compelling clinical validation package, demonstrating equivalence (or superiority) to SPECT ventilation perfusion across multiple lung conditions

• 4DMedical expects to capture 100% of the one million nuclear ventilation perfusion scans performed annually

• CT:VQ™ is expected to align with the Company’s existing CT LVAS™ CPT code (USD $650), supporting rapid clinical adoption

• Provides the potential to grow the current ventilation perfusion market into new applications in disease monitoring and screening, due to the wide availability of CT infrastructure

• When including days spent with the applicant, the average time for FDA 510(k) decision is approximately 120 days

• 4DMedical will hold an investor webinar tomorrow, Tuesday 27 May 2025 at 11am AEST

Investor Webinar 4DMedical will hold an investor webinar tomorrow, Tuesday 27 May 2025 at 11am AEST, where Dr Andreas Fouras will provide further information, and host a Q&A session, in relation to CT:VQ™. Please register in advance using the following links: Phone registration: https://s1.c-conf.com/diamondpass/10047546-qpjld5.html Webcast: https://ccmediaframe.com/?id=a2ozxVzA After registering, you will receive a confirmation email containing information about joining the webinar or dial-in details for those who would prefer to join by telephone.

Last

30.5¢

Change

0.045(17.3%)

Mkt cap !

$137.4M

Commencing now for anyone interested.

Title: 4DMedical Ltd - Webinar Date: 11:00am AEST, Tuesday 1 October 2024Link:

Click here to join the webcast on the event date.https://event.choruscall.com/mediaframe/webcast.html?webcastid=spqX9wlZ&securityString=aquvig6KqoaoVEiRUFQ2xqZH

This message is automatically generated. Do not respond to this email.

Ord Minnett report for 4DX. Going to be 2026 before FCF it seems. Tricky one for me. Price target double todays actual.......

4DX broker report May 2024.pdf

Nessy

Boy, this company sure knows how to kill off any momentum built up in the share price with a capital raising.

This is the second we have had within a few months.

The terms are generous to the institutional buyers not not great for existing shareholders (big discount to the prevailing market price of ~18%, 1 free attaching option with every 2 shares). Existing shareholders don't get an SPP btw.

The acquisition is of US-based Imbio, which is an early stage company which is touted as a "leader" in cardiothoracic imaging. Seems alright, but is this a case of juggling too many balls too early?

The SPP and Placement combined raised $45 million (before costs) and is being deployed to strengthen and accelerate the Company’s commercialisation strategy.

Life support for of $1.1M - 4DX will have to grow profitability eventually though.....

We are extremely excited to have been awarded the $1.1 million CTCM funding announced today. Combining both functional components of airflow and blood flow into a single analytical process represents a dramatic advancement in respiratory healthcare, providing the ideal test for phenotyping, early detection and evaluation of specific treatment responses for high-impact lung diseases such as Chronic Obstructive Pulmonary Disease (COPD), Cystic Fibrosis, pulmonary hypertension and pulmonary embolism.

A total of 28,044,096 fully paid ordinary shares New Shares will be issued to SPP applicants at an issue price of $0.89 per New Share. The New Shares issued will represent 8.1% of 4DMedical’s issued capital and will rank equally with existing shares on issue from their date of issue.

The New Shares issued under the SPP are expected to be allotted on Wednesday, 31 May 2023 and are

expected to commence trading on ASX on Thursday, 1 June 2023. The total funds raised, comprising the Placement ($20m) and SPP ($25m), amount to $45m (before costs).

Proceeds raised under the Placement and SPP will be used primarily to accelerate commercialisation of 4DMedical's respiratory imaging software and significantly strengthen the Company's balance sheet. Funds raised leave the Company with a cash balance of approximately $79.6m after costs as at 31 March 2023 on a proforma basis

Fouras - CEO (2012) circa 23% voting power.

1 Month ago 4DMedical (ASX:4DX) signs first US hospital SaaS contract https://youtu.be/ef8j0lr2JUI

Dr Andreas Fouras

Chief Executive Officer,Managing Director (Since 2012)

Bio

Dr Fouras is the founder, Managing Director and Chief Executive Officer (CEO) of the Group. He is also the Groups Chief Technology Officer being the inventor of its core XV Technology, maintaining a direct role in its evolution and development. Andreas career in academic research has a foundation gained within the Department of Mechanical and Aerospace Engineering at Monash University in Melbourne, Australia. This research into wind tunnel quantification garnered recognition as a young leader in the scientific discipline of fluid dynamics, developing a number of new approaches to the imaging of gas and liquid flow. Following completion of a Masters degree by research and a Doctorate (PhD), Andreas rapidly rose to the position of Professor of Mechanical and Aerospace Engineering and Director of the Laboratory for Dynamic Imaging.

He received accolades from a wide range of premier research bodies including the National Health and Medical Research Council (NHMRC) and the American Asthma Foundation. Andreas applied a novel concept to clinical use through the development of XV Technology, uniquely measuring airflow within the breathing lungs at every stage of the breath, providing both high spatial and temporal resolution at very low dose.

This research has been documented in over 100 peer reviewed publications and resulted in 72 patent applications with 40 granted. In December 2012, Andreas founded 4DMedical resulting from a deeply held personal and professional desire for his work to reach and positively influence as many people afflicted by respiratory compromise as possible, through global clinical translation.

Andreas leadership is evidenced as a commissioned officer in the Australian Army (Infantry) and through the prestigious Australian Davos Connections Australian Leadership Award for 2013. The focus of Andreas substantial intellect and energy is now concentrated upon applying business acumen, drive and innovation to the successful commercialisation of 4DMedicals technologies. Andreas is a member of the Medical Advisory Committee.

THE BUSINESS

4D medical is a medical technology company that specializes

in developing and commercializing medical imaging software and visualization

tools. The company's flagship product is its imaging platform, called VX technology,

which uses advanced imaging techniques to create a four-dimensional image of a

patient's lungs in real-time.

This technology allows doctors and healthcare professionals to better

diagnose and manage respiratory diseases, such as asthma and chronic

obstructive pulmonary disease (COPD). VX technology provides a more detailed

and comprehensive view of a patient's lungs, enabling doctors to detect and

monitor changes in lung function that may indicate the progression of a disease

or the effectiveness of a treatment.

4D medical offering consists of the following:

1) XV LVAS -Software used to analyse ventilation efficacy of lungs using X-ray hardware. This product has been released commercially.

2) CT LVAS -Software used to analyse ventilation efficacy of lungs using CT hardware. This product has been released commercially.

3) XV Scanner – Is 4DMedial’s prototype lung scanner, base don X-ray diagnostics. The scanner can perform imaging, with a fraction of radiation exposure compared to conventional X-ray hardware, and significantly shorter patient turnover times. Target market – Paediatric hospitals (where X-ray exposure is a critical consideration), and veterans affairs hospitals. Where high throughput / productivity is required.

4) CT:VQ – Software used for ventilation / perfusion analytics. Currently under development.

ADDRESSIBLE MARKET

In the United States alone, 74 million respiratory diagnostic procedures are undertaken every year at a value of $13.7 Billion USD. Worldwide, 378 million diagnostic tests are performed annually.

In particular, Veteran’s Affairs presents a significant opportunity, with an estimated 3.5 million (out of 19.2 million) veterans being exposed to toxins from burn pits. It is possible that all 3.5 million veterans will need to be screened on a regular basis, with the US PACT Act appropriating $280 Billion USD over the next ten years for exposed veterans. News article here.

At a cost of $171 USD per scan (Agreed pricing with DoD and VA), assuming 1 million scans per annum from Veterans Affairs alone, the 4DX potential revenue is in excess of $250 M AUD per annum. Globally, the addressable market is 10+ billion dollars.

The number of Paediatric and military Hospitals in the US is 200 and 50 respectively. These hospitals are the target market for the XV Scanner.

COMPETITIVE ADVANTAGE

XV Technology has the following advantages:

· Improved insights from imaging, leading to better clinical outcomes.

· Faster, more efficient testing, using existing hardware.

· The only non-invasive technology that can detect burn pit exposure lung damage, using existing X-ray hardware, currently available.

· Lower cost compared to existing technologies.

· Equipment agnostic.

· Management claim 4-D X-ray scanning is being legislated under US PACT ACT– this may be true, but unable to confirm this at the time of writing.

KEY PEOPLE

Founder - Dr Fouras, who owns about 20% of business.

Advisor - Dr Sam Hupert - Founder and CEO of Pro Medicus -

owns about $1 M in 4DX shares. Great back ground in medical imaging software,

and proven experience in execution.

Advisor - Dr David Shulkin - Former Secretary of US Dept. of

Veterans Affairs. He worked with current Deputy Under Secretary of Health,

Veterans Affairs; among others in Veterans Affairs.

COMMERCIALISATION ACHIEVEMENTS TO DATE

1) June 28, 2022 - Signed commercial, 3 year, contract with Australian radiology network, I-MED. XV Technology currently rolled out to 30 I-MED sites (up from 27 at year end 2022). Expect this to growth to 100 sites nationally.

2) October 19, 2022 – XV LVAS application for Category III CPT code accepted by US AMA. These codes are a set of temporary codes for new / emerging technologies, and is the pathway towards Category I codes, which allows US insurance reimbursements.

3) April 5, 2023 – Signs five year SAAS contract with University of Miami Hospital. ($200-300k AUD per annum.

4) April 13, 2023 – Dr David Shulkin joins advisory board.

5) May 1, 2023 – First veterans affairs scan under commercial arrangement.

6) May 5, 2023 – US Dept. of Defence contract – commercial pilot.

MANAGEMENT GOALS

Management have advised goals / milestones are as follows:

1) News on VQ trial results imminent (within weeks). Management advise the initial data / results are looking great.

2) Prioritise US Veterans Affairs and US Defence opportunities. DoD pilot contract expected to end by August, with management already in discussions regarding expansion into a wider commercial agreement post August.

3) Guiding for significant progress with Veterans Affairs + DoD in relation to screening opportunities.

4) Achieve Category I CPT code within 2 years (enables insurance reimbursement). This step requires further clinical trials. Management reports 12 prepares are in progress (up from 4 papers 12 months prior).

5) Guiding to hit profitability within 24 months, with growth beyond the US to be self-funded.

RISKS

4D Medical is burning $8 million cash per quarter. It has approximately 2 years of cash runway to reach cashflow positive position. The key risks are:

1) Delay, failure to execute Veterans Affairs / Defence Health opportunity. 4D Medical is focussing on this opportunity to achieve the sustainable revenue scale they need. Given the pilot contract will end around August, failure to extend this pilot in 2023 would be a red flag.

2) Key personnel – Should any of the three key people leave, this would be a big red flag, as these key personnel hold the key networks / relationships 4D Medical need to convert near term opportunities.

3) Regulatory clearance / hurdles may delay the adoption cycle, and increase development costs.

4) Delay in achieving Category CPT I code within two years will inhibit growth beyond VA / Defence health.

5) Competitors may disrupt. impede 4D Medical’s progress.

VALUATION

Number of shares on Issue: 358 000 000 (incl options) - Excl/ SPP.

Share price as at 11/5/23: 95 cents

Market Capitalisation: $340 M.

Cash: $56 M

EV: $284 M

Guidance for gross margins: circa 85%

Assume Veterans affairs contracts result in $150 Million AUD revenue per annum in FY 2026. Assuming operating costs of $120 million per annum, and $20 M NPAT. This equates to EPS of 5.6 cents per share. At a PER of 35 (assuming 20-30% revenue growth at this scale), I come up with a valuation of $1.95 per share.

Discounting this share price at 20% (high risk), and including a 20% margin of safety, I come up with a valuation of 94 cents per share.

POTENTIAL UPSIDES:

1) Broader adoption across US war veterans (potential $100 M upside).

2) Adoption by US dept. of defence to screen existing defence force pre and post deployment ($50 M upside)

3) Broader adoption for long COVID, industrial disease health claim paediatrics (???).

4) Adoption beyond the US and ANZ.

POTENTIAL DOWNSIDES

1) VA and DoD slow to adopt technology, reducing revenue stream & delaying profitability – medium / high probability.

2) New technology enters market – disrupts XV technology – low probability.

3) Clinical trial results delayed / poor results delay CAT I reimbursement – medium probability.

4D Medical has signed a 5 year contract with University of Miami Hospital to provide XV LVAS software services. XV LVAS software is applied to X-ray scanners already in use at medical facilities.

This is following a clinical trial. with Miami researchers publishing results from their trials a a recent American Thoracic Society conference. The contract is effective immediately.

Early days, but it is proof the product is marketable and builds on its recent contract for using the software on existing CT scanners with I-MED.

I recall (don't quote me), that revenue is around $150 per scan. Each surgeon has about 700 cases per annum. That is about $100 k revenue per surgeon (assuming 1 scan per patient), and there are 4000 surgeons in the US. So that is a TAM of about $400 M USD per annum.....

DISC - HOLD tiny position........

4D Medical reported successful results of Vanderbilt 'burn pit' clinical trial.

Results: XV Technology confirmed diagnosis of constrictive bronchiolitis with less than 0.001% uncertainty. The only alternative to XV Technology for a reliable diagnosis is expensive and risky biopsies.

Market Potential:

1) US PACT Act provides USD $280 billion in additional healthcare benefits to veterans exposed to burn pits and other harmful toxins.

2) US Veterans Health Administration to provide toxic exposure screening to each of the 9 million US Veterans enrolled in the VHA heatlhcare program.

3) 4DX pricing structure with VHA is $171 USD per scan.......

DISC: I hold a small position in 4DX.

Capital Raising Presentation

Applications are due Monday 29th March for those that are holding.

Have a feeling the Friday FOMO rally was due to people reading the recent announcement with the DoD in the USA and maybe securing as much shares as possible so they get their full allocation from the raise.

I've put in my SPP application already. I heard the $40m for the institutional and sophs was fully raised.

Disc: I hold

4DMEDICAL SECURES STREAMLINED ACCESS TO U.S. DEPARTMENT OF DEFENSE & VETERANS AFFAIRS CONTRACTS

4DMedical Limited (ASX: 4DX, “4DMedical” or the “Company”), a medical technology company focused on commercialising its patented respiratory imaging platform, is pleased to announce that it has been granted a streamlined process for securing contracts with the U.S. Department of Defense (DoD) and Veterans Affairs (VA) through NASA’s Solutions for Enterprise-Wide Procurement (SEWP) program.

This access will allow DoD and VA affiliated healthcare facilities to contract with 4DMedical to integrate and use 4DMedical’s proprietary XV Lung Ventilation Analysis Software (XV LVAS™) to deliver valuable insights of lung health. Revenue will be generated as the Company secures supply contracts from each facility adopting the technology.

The DoD is the largest government agency in the U.S. with 2.15 million active-duty service members and over 730,000 civilian personnel. In addition, the VA healthcare system represents the largest integrated healthcare system in the U.S., providing life-long care and services to eligible military veterans and their families. The VA operates 1,255 healthcare facilities, including 170 medical centres and 1,074 outpatient clinics, offering a variety of care to over 9 million veterans enrolled in the VA healthcare program.

As part of the arrangement, 4DMedical has negotiated a fixed price for its XV LVAS offering at DoD and VA facilities without requiring separate reimbursement. This will streamline commercial engagements with these facilities by having a pre-agreed pricing structure.

08-Oct-2020: 4DMedical Goldman Sachs Healthcare Forum Presentation

The COVID-19 pandemic should be giving a company like 4DX a decent boost, i.e. providing them with a strong tailwind, considering they specialise in digital four-dimensional lung imaging and data interpretation. They rose +14.11% today on the back of this presentation at the Goldman Sachs Healthcare Forum.

Introduction to 4DMedical

- Founded in 2012, 4DMedical Limited is a Melbourne-based software technology company focused on creating a step change in the capacity of physicians to diagnose and manage patients with diseases of the lung

- The respiratory diagnostic sector represents a global market of over US$31 billion per annum, with over 377 million respiratory diagnostics tests performed each year

- 4DMedical is focused on commercialising its four-dimensional XV lung imaging technology, which utilises proven, patented algorithms to convert X-ray images into quantitative scan data

- Unlike existing respiratory diagnostic procedures, 4DMedical’s proprietary XV technology provides a non-invasive way of understanding regional lung motion and airflow in real-time

- With FDA clearance in place, 4DMedical’s major focus is on US market commercialisation of its XV Technology

- Australian TGA approval for XV Lung Ventilation Analysis Software (LVAS) allows 4DMedical to gain local traction quickly through leveraging existing industry knowledge and relationships

- The SaaS business model offers hospitals access to the technology without the traditional issues of hardware integration, capex, additional staff or re-training

- 4DMedical’s advancement in respiratory diagnostic technology is expected to result in improved patient experiences, earlier intervention leading to improved healthcare outcomes, with reduced costs of care

[I'm not a shareholder, but they look interesting. I would need to do more work before investing, such as establishing whether they have a credible path to profitability within a reasonable and realistic timeframe.]