PNI’s SP has been all over the place recently. I view it as a quality company that is dependant to some extent on market performance. If the market is optimistic, funds flow in to their fund management subsidiaries boosting returns. When the tide goes out, well things could turn around rapidly. As such its SP can be volatile: tariffs are the end of the world price 1/2s; oh, actually everything is great and AI will turbocharge productivity and earnings, SP doubles. Sort of.

here’s the latest from Morningstar.

Pinnacle Investment Earnings: Market Enamored With Presently Strong Flow Momentum

Analyst Note

Shaun Ler,

Published on Aug 06, 2025

Pinnacle reported a 49% increase in fiscal 2025 net profit to AUD 134 million. Funds under management, or FUM, grew 63% to AUD 179 billion during the year, with around 25% from acquisitions.

Why it matters: Earnings were supported by numerous acquisitions but still fell short of our forecast due to higher expenses, lower fee margins, and reduced profit share. However, Pinnacle received considerably stronger-than-expected inflows toward fiscal 2025's end, which benefits future earnings.

- The inflows come with a cost, though, with more spent on distribution, technology, and personnel, causing margins to expand less than expected. Meanwhile, Pinnacle attributed fee margin compression to unfavorable mix shift, but we believe competition also played a role.

- Flows were very strong toward the end of fiscal 2025. New boutique Life Cycle secured significant mandate wins, while the higher-margin international channel also attracted better-than-expected flows. The earnings impact from these developments should manifest in fiscal 2026.

The bottom line: We raise our fair value estimate for narrow-moat Pinnacle by 7% to AUD 16 per share. A larger FUM at fiscal 2025's end and stronger flows lifted our projected FUM for fiscal 2030 to AUD 331 billion, from AUD 301 billion previously, and EPS growth to 15% per year, from 12% before.

- Shares remain overvalued. We believe the market underestimates several risks, including potential redemptions from subperforming boutiques, normalization of flows as the tariff relief rally fades, and margin erosion from investments in wages and distribution to drive growth.

- To justify current prices, we'd need to assume EPS grows at around 22% per year for the next five years—versus our 15% forecast and the five-year average of 28%; or reduce our cost of capital to around 6.5% from 9.0%, which we believe don't sufficiently factor in competitive and cyclical risks

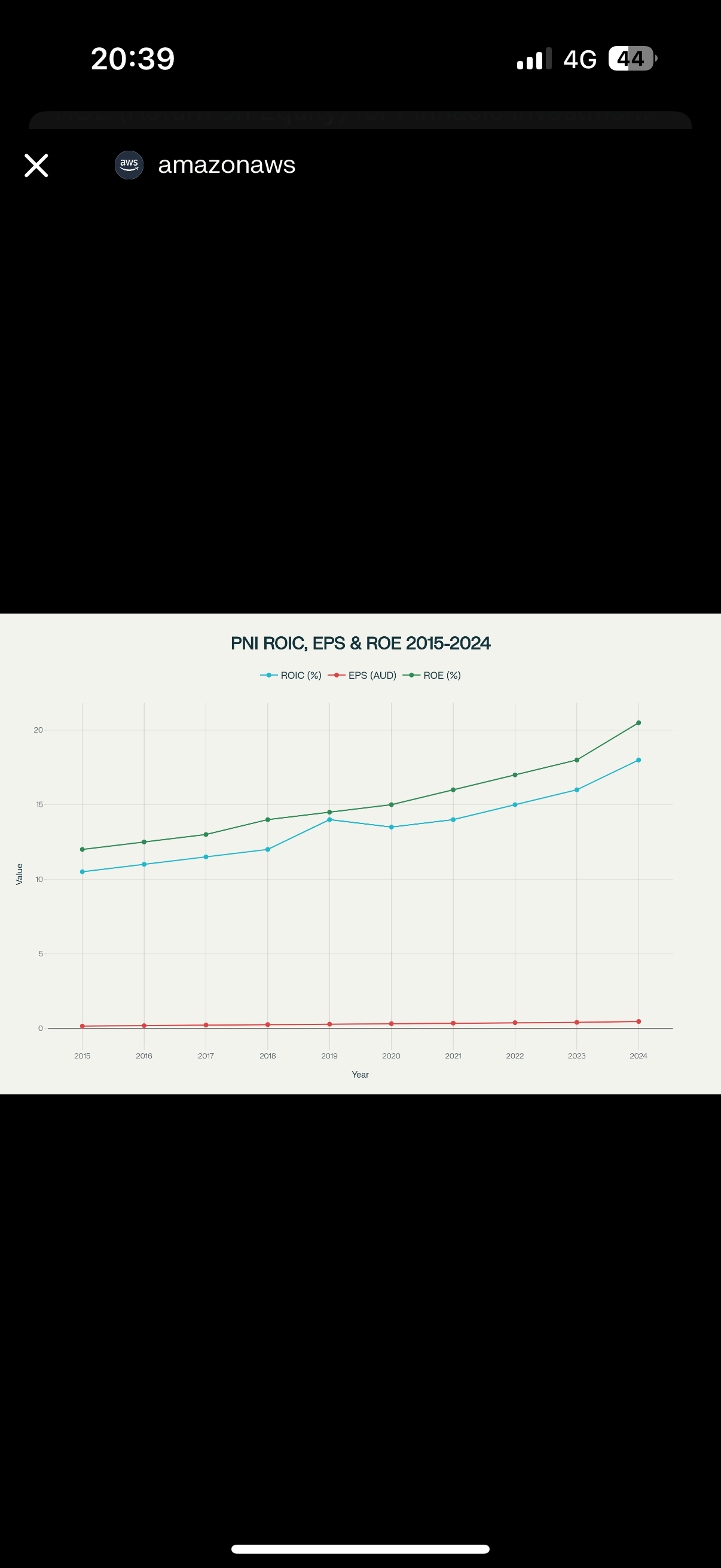

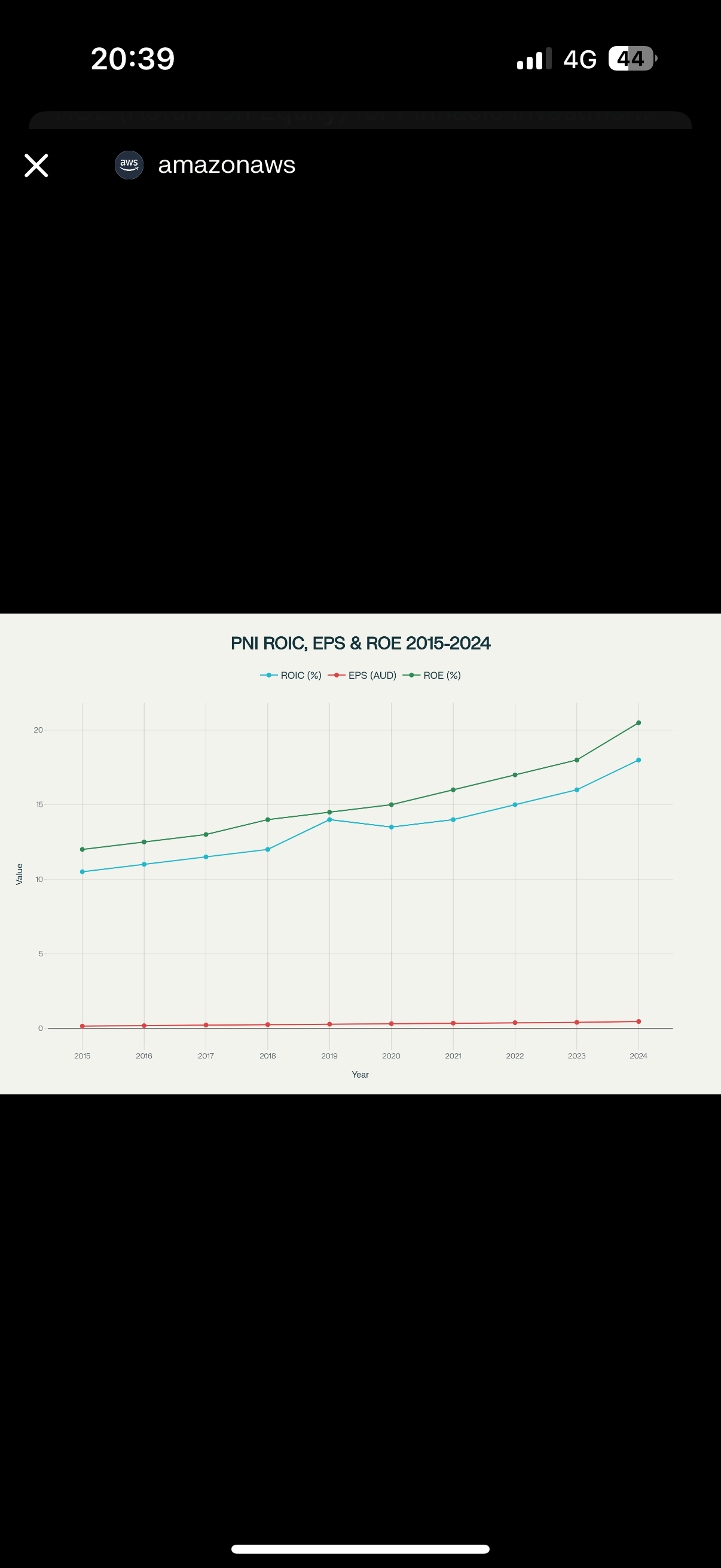

My rationale for holding is that over the long term they have great metrics:

Apologies for screenshot, I’m on my phone.

Key Highlights:

• ROIC (%) has shown a generally positive trend over the past decade, peaking in the latest year as operational profitability increased.

• EPS (AUD) has climbed steadily, reflecting sustained earnings growth, with significant jumps in the past two years aligning with strong reported financials.

• ROE (%) averages around 14–15% over the decade, with recent results near 20% indicating improved efficiency and profitability

(from perplexity)

Thesis contd:

I full anticipate that in a downturn the SP will underperform. It might be a great stock to trade for these reasons but it’s more of a bottom drawer holding for me as over the long term……..you know the rest.

And im pretty lazy.