Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

PNI’s SP has been all over the place recently. I view it as a quality company that is dependant to some extent on market performance. If the market is optimistic, funds flow in to their fund management subsidiaries boosting returns. When the tide goes out, well things could turn around rapidly. As such its SP can be volatile: tariffs are the end of the world price 1/2s; oh, actually everything is great and AI will turbocharge productivity and earnings, SP doubles. Sort of.

here’s the latest from Morningstar.

Pinnacle Investment Earnings: Market Enamored With Presently Strong Flow Momentum

Analyst Note

Shaun Ler,

Published on Aug 06, 2025

Pinnacle reported a 49% increase in fiscal 2025 net profit to AUD 134 million. Funds under management, or FUM, grew 63% to AUD 179 billion during the year, with around 25% from acquisitions.

Why it matters: Earnings were supported by numerous acquisitions but still fell short of our forecast due to higher expenses, lower fee margins, and reduced profit share. However, Pinnacle received considerably stronger-than-expected inflows toward fiscal 2025's end, which benefits future earnings.

- The inflows come with a cost, though, with more spent on distribution, technology, and personnel, causing margins to expand less than expected. Meanwhile, Pinnacle attributed fee margin compression to unfavorable mix shift, but we believe competition also played a role.

- Flows were very strong toward the end of fiscal 2025. New boutique Life Cycle secured significant mandate wins, while the higher-margin international channel also attracted better-than-expected flows. The earnings impact from these developments should manifest in fiscal 2026.

The bottom line: We raise our fair value estimate for narrow-moat Pinnacle by 7% to AUD 16 per share. A larger FUM at fiscal 2025's end and stronger flows lifted our projected FUM for fiscal 2030 to AUD 331 billion, from AUD 301 billion previously, and EPS growth to 15% per year, from 12% before.

- Shares remain overvalued. We believe the market underestimates several risks, including potential redemptions from subperforming boutiques, normalization of flows as the tariff relief rally fades, and margin erosion from investments in wages and distribution to drive growth.

- To justify current prices, we'd need to assume EPS grows at around 22% per year for the next five years—versus our 15% forecast and the five-year average of 28%; or reduce our cost of capital to around 6.5% from 9.0%, which we believe don't sufficiently factor in competitive and cyclical risks

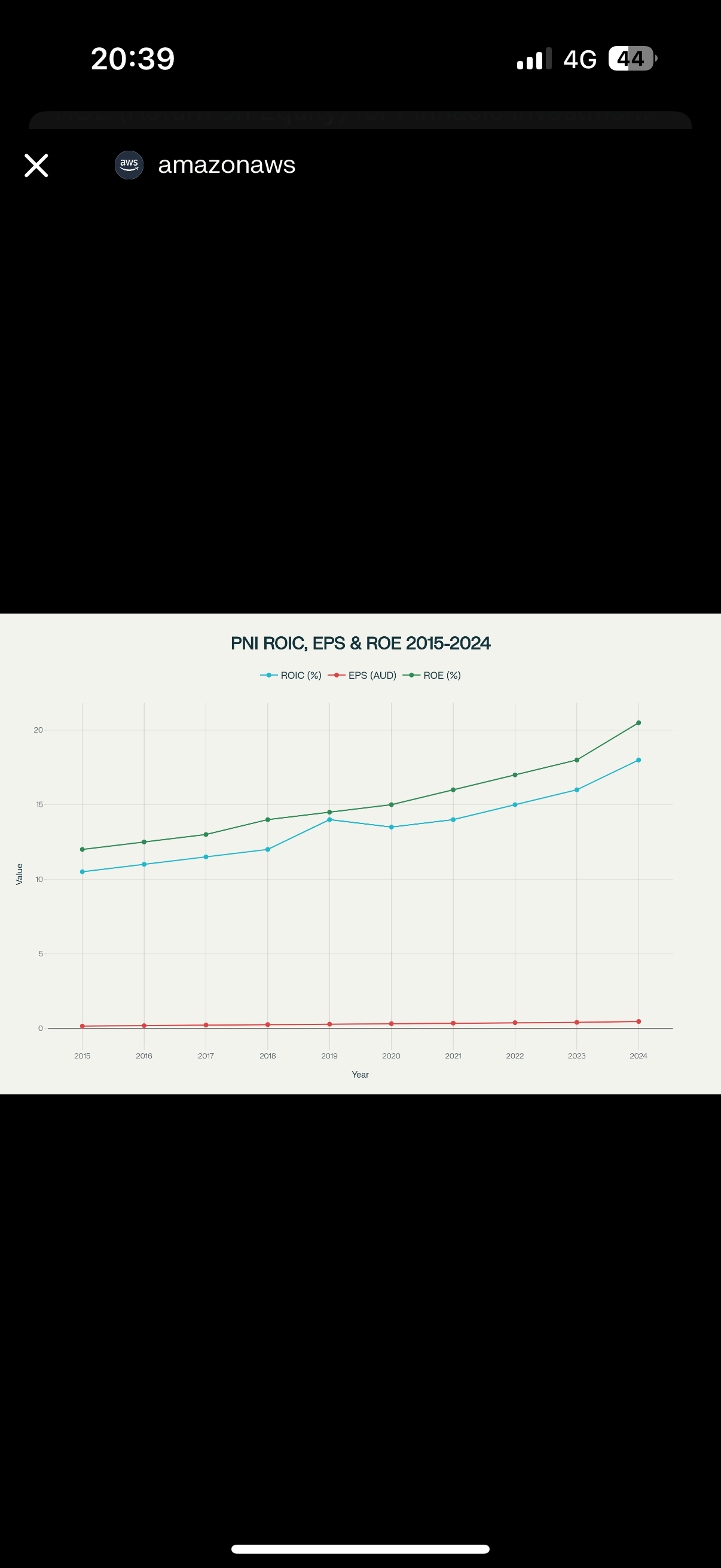

My rationale for holding is that over the long term they have great metrics:

Apologies for screenshot, I’m on my phone.

Key Highlights:

• ROIC (%) has shown a generally positive trend over the past decade, peaking in the latest year as operational profitability increased.

• EPS (AUD) has climbed steadily, reflecting sustained earnings growth, with significant jumps in the past two years aligning with strong reported financials.

• ROE (%) averages around 14–15% over the decade, with recent results near 20% indicating improved efficiency and profitability

(from perplexity)

Thesis contd:

I full anticipate that in a downturn the SP will underperform. It might be a great stock to trade for these reasons but it’s more of a bottom drawer holding for me as over the long term……..you know the rest.

And im pretty lazy.

Not overly material to PNI but note Hyperion loss and just general info how hard it is there for active managers - even those that are performing given pressure on fees. The lavish decades are over.

Big super mergers create havoc for fundies as mandates get yanked

Funds management firms are increasingly on edge about large customers yanking money from them – and rightly so.

The rationalisation and mandate losses sweeping through the local funds management sector are causing a shakeout and hollowing out of the industry. These forces aren’t abating and the heightened fee pressure is set to leave the industry looking markedly different by the decade’s end.

It’s clear the days of fund managers raking in easy money ended long ago. And with the number of mandates being awarded across the industry dramatically shrinking, pressure is only intensifying this year, meaning further firms will decide shutting their doors is the better option.

The growth of the retirement fund sector has come at the same time as many of those funds have merged, creating havoc for external money managers.

The merger of CareSuper and Spirit Super – which created a $53 billion fund – is the latest pressure point. It is this month sending shockwaves through parts of the domestic investment management industry. The combined group has conducted an audit of many of the firms it hires to manage its Australian equities portfolios, deciding to cull several from its roster.

While some firms have escaped being cut, many of their mandates are set to be reviewed in coming months and further names will likely be shed, multiple people briefed on these matters said.

Already Hyperion Asset Management has lost its place in the CareSuper equities stable, reflecting a mandate worth almost $408 million. Tyndall Asset Management – which managed almost $469 million at June 30 for Spirit – has also lost out in the wash-up of the merger.

Earlier this month, Sydney-based small cap boutique Celeste Funds Management decided to call time on its entire business after 27 years, citing the loss of a mandate. Celeste was among firms managing money for Spirit Super, and was obviously not immune to the pressure enveloping the industry. The latest accounts for Celeste’s small companies fund showed its operating profit more than halved to $1.3 million in the six months ended December 31, compared to the prior corresponding period.

While the total pool of money being managed across Australia isn’t necessarily changing, what’s clear is the industry’s composition is. Part of the rationale at industry funds for having fewer managers with bigger mandates is that the fees typically decline when they top $1 billion.

The shift, however, is stifling diversity in the market, seeing more money shift to cheaper and passive investment styles and concentrating further funds in the ASX’s largest stocks, including Commonwealth Bank.

“I don’t think (fund) members are being well served by this,” one fund manager told this column on the basis of anonymity. The fund manager does not manage money on behalf of Care/Spirit Super.

Other firms that managed money for the merged industry funds as at June 30 – and may be anxious about mandate decisions -– include DNR Capital, Schroder Investment Management and Ubique Asset Management.

Last year, it was Cbus causing unrest in the sector, when it consolidated several mandates and handed as much as $1 billion to an existing manager. The funds landed with Magellan Financial’s Airlie Funds Management.

Peter Cooper’s eponymous Cooper Investors suffered a string of mandate losses, including in the latter half of 2024 and this year, amid personnel changes and performance issues in some of its funds.

Industry funds from Rest Super to HESTA and Team Super – and separately Perpetual’s wealth unit – either pulled mandates or reduced the size of those with Cooper Investors over the past 10 months.

Alongside the fee pressure, fund managers are also having to explain their decisions and any dip in performance in detail. Of course, some level of consolidation where performance has disappointed and managers can’t offer consistently above-benchmark returns or a real point of difference, is welcome. But what’s happening here goes well beyond that.

This month’s mandate losses have caused huge transition flows through the ASX as funds are transferred elsewhere. Heavy trading volumes in stocks including appliance group Breville and engineering firm Downer EDI in the past 10 days, have piqued the interest of those watching the flows and seeking to ascertain where the money is headed.

If the current trend is anything to go by, further bloodshed is likely.

Mercer this year predicted the nation’s compulsory retirement savings sector would shrink from 89 players to just 32 over the next decade.

Local fund managers are navigating a host of negative factors that can collide and easily spell the end of their firm. Among those are mergers of industry funds, the rise of exchange-traded funds and passive investing, the decline in the number of financial planners in Australia and industry funds taking more of their investment management in-house.

Then there is the prudential regulator’s annual performance test that has some funds very closely tracking indices for fear of failing the metrics.

A report by data and insights firm Rainmaker exemplifies how much tougher funds management firms are having to fight for fewer mandates.

It found the number of mandates awarded by investment managers and not-for-profit funds roughly halved to 70 in the 12 months to December 31, from the prior year. In 2010, there were more than 700 mandates awarded over the 12 months. By 2014, the figure stood at about 400.

The results do need to be interpreted with caution, however, given the data is self-reported by funds and incorporates mandates beyond equities.

Compliance and regulation costs, scale benefits and seeking out lower fees for members are among the factors driving industry fund mergers.

Already this year, Qantas Super has folded into Australian Retirement Trust and further tie-ups are anticipated, albeit at a slower rate than the past five years. Mergers have characterised that period, in part as the prudential regulator strongly urged smaller funds to combine. Media Super, for example, became part of Cbus in 2022. Australian Retirement Trust was formed through the merger of Sunsuper and QSuper.

The mergers come as funds and a smattering of family offices are also managing more money in-house rather than awarding mandates to local fund managers. The results of that trend will also need to be measured over time. One outlier is Hostplus, which hasn’t joined the internalisation push.

Casualties in the funds management industry already include quant fund Redpoint Investment Management, small cap investor NovaPort Capital, and boutique Ethical Partners Funds Management.

Consolidation has also played a role with Antipodes Partners snapping up Maple-Brown Abbott, Yarra Capital Management acquiring Nikko Asset Management’s Australian business and Regal Partners buying firms including VGI and PM Capital. And ASX-listed Platinum Asset Management – which is in the crosshairs of a potential merger with L1 Capital – may be subject to a transaction if terms can be struck.

While it appears dramatic, what’s happening in the fund management sector is not that dissimilar to global trends that are playing out.

European analysis by EY in March put the wealth and asset management industries at “an inflection point” due to years of disruption and reinvention. It noted that while firms had traversed multiple financial crises and lingering geopolitical instability, proving an ability to adapt, the challenges ahead were shaping up as more complex and unforgiving.

Pinnacle capital raising $400m to buy up offshore funds

The $4.4 billion funds firm is issuing at least $400 million of new equity to buy stocks in two offshore fund managers and make investments in existing funds within its stable, a move aimed at satisfying lofty growth expectations.

“The Pinnacle model works just as well overseas as in Australia, and that opens up enormous expansion opportunities for us,” Pinnacle’s founder and chief executive Ian Macoun said on Wednesday.

Pinnacle will tap institutional investors for $400 million of fresh equity and will target an additional $25 million via a share purchase plan. New shares under the SPP will be issued at $20.30 capped at $30k per investor. The SPP, which is expected to close on 12 December, follows the completion last week of a $400 million equity raising through an institutional share placement.

Of the funds raised, $143 million will be used to buy a 25 per cent stake in London-based wealth manager Pacific Asset Management and 22.5 per cent in US-based private asset manager VSS Holdings. Pinnacle will allocate around $75 million to seed new funds strategies for existing fund managers while $182 million will be used on existing growth opportunities.

In February, assets managed by Pinnacle affiliates surpassed $100 billion. As a result of the two new investments, total assets will reach $145.9 billion.

Some investors have queried the high price paid for the stake in VSS.

The $US50.8 million ($76.6 million) investment values the business at $US225 million, 23 per cent of its total funds under management.

“You’re never going to get a bargain with very high-quality, high-growth managers,” Mr Macoun said. “We pay a fair price, and we can add value to them with our distribution. They’re able to grow faster than they otherwise would have so it ends up being cheap.”

Lakehouse capital has revealed that they are not participating in the SPP due to a full position sizing already.

Looks like a price arbitrage as at current market.

Some price targets but not sure of the reco:

Pinnacle Target Price Cut 4.1% to A$11.70/Share by Wilsons

Pinnacle Investment Target Price Raised 2.2% to A$9.20/Share by Ord Minnett

Also Ethical partners reduced their holding last week.

Despite that and the recent market update shares rallied yesterday.

Hard to predict

Held

Pinnacle's share of performance fees lower than last year (just 2m short) and explains the falling share price

Pinnacle Investment Management Group Limited (Pinnacle) advises that nine Affiliates have crystallized performance fees for the financial year ended 30 June 2023 (FY23) totalling approximately $58.0 million at 100% gross in aggregate, of which $54.8 million crystallized in the second half of the financial year (2H FY23).

For the financial year ended 30 June 2022 (FY22), these fees were $57.8 million at 100% gross in aggregate, from ten Affiliates. Pinnacle’s net share of these performance fees, after tax payable by the Affiliates on this revenue, is in the order of $14.6 million, of which $13.6 million was earned in 2H FY23. For FY22, Pinnacle’s net share of performance fees, after tax payable by the Affiliates on this revenue, was $16.6 million. Within the Affiliates, there are now 24 diverse strategies with the potential to produce significant performance fees each year (up from 22 as at 31 December 2022). Of those 24, 13 strategies delivered this financial year

Fund management is a tough biz when the stocks you own doesn't entirely go your way.

[held]

The intra-day low today was a decent spot to add to positions. It could be tough sledding over FY23, but the shares look attractive enough over a longer timeframe.

Price target from Macquarie from 10.92 to 11.78 (3 Aug 22)

Also lots of other price targets from other brokers ranging from 12-14

Price target from Macquarie (raised 10%) from 9.72 (8th July 22)