Pinnacle released their half yearly report last night after close. You can find it here

EPS of 21c up from 16.7c PCP and up from 19.8c last half. Giving a TTM EPS of 40.8c.

PNI dividend increase of 50% on PCP to 17.5c per share fully franked.

FUM is up $4.2B to $93.6B overall despite net institutional outflows of $1.7B. Retail inflows of $2.9B and general market increases kept the FUM on the up. Pinnacle affiliates performance over the last 5 years has been amazing with 77% of funds outperforming their benchmarks. This continued last year and I surmise that the retail inflows is due to investors chasing this performance.

Pinnacles leverage on the share of NPAT continues to increase as the companies incubated "horizon 2" affiliates mature. This is evident as 1H22 affiliate NPAT increased to $137.4m from $118.2m in 1H21, an increase of 18%. Whereas Pinnacles share of this NPAT increased from $31.8m to $39.2m, an increase of 23%.

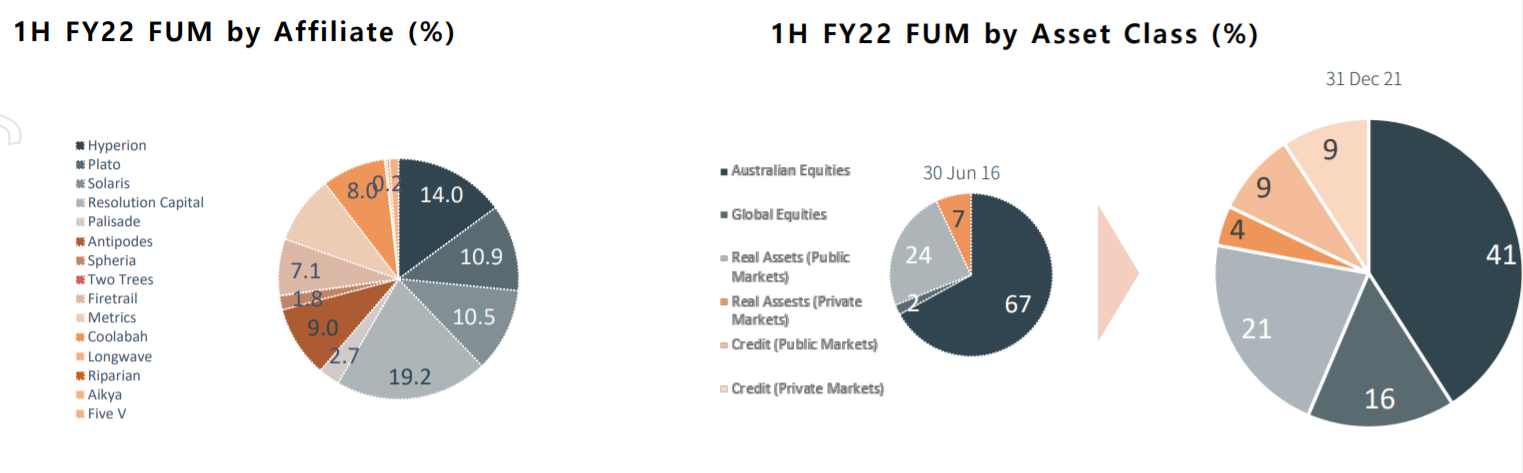

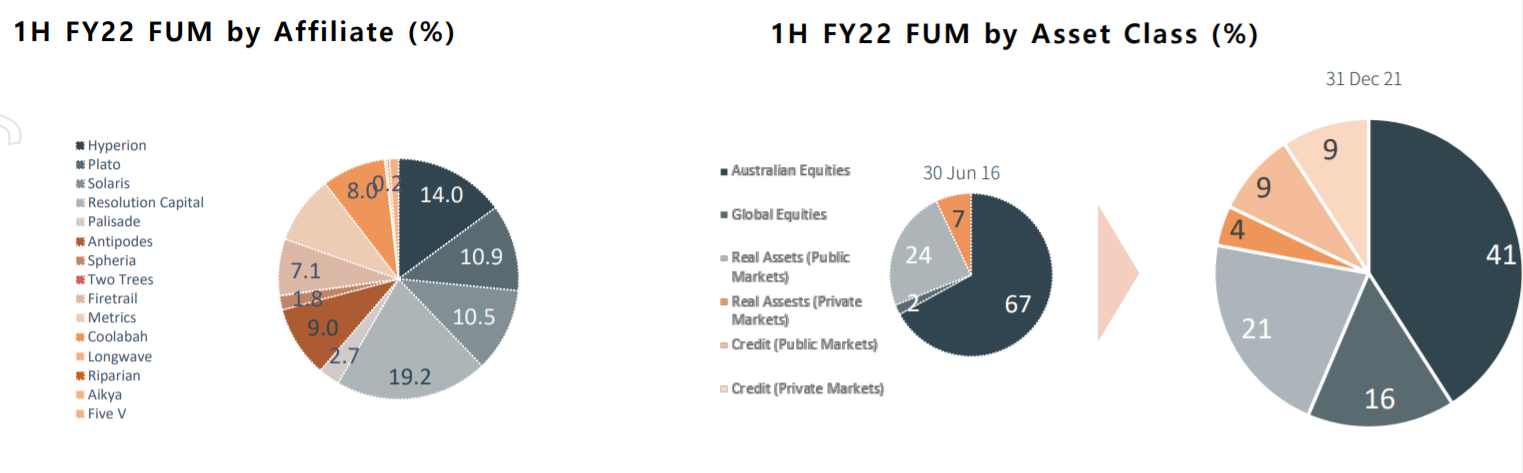

Pinnacle has seen a big pullback in share price in the last 6 months. The share price got too far away from reality especially when it was trading around $19, which was over 50x trailing PE extrapolating last years performance into the future. Now we are sitting at more reasonable multiples and the case to buy more shares is appealing. The big test will be, if this half continues as it has with further sell offs, how well will Pinnacles FUM and affiliate fees hold up. My opinion is that their strategy of broadening asset classes will help them weather any serious downturn. Obviously they will still be impacted by the cycles of financial markets, however i feel their wide variety of assets and strategies will soften the impact. As you can see from below graph management have been intentionally diversifying into an "all weather" portfolio of affiliate managers with varying strategies and asset classes. Their holdings in real assets, credit and value equities should do well if we have an extended inflationary environment.