Pinned straw:

The more I think about this one, the better it looks.

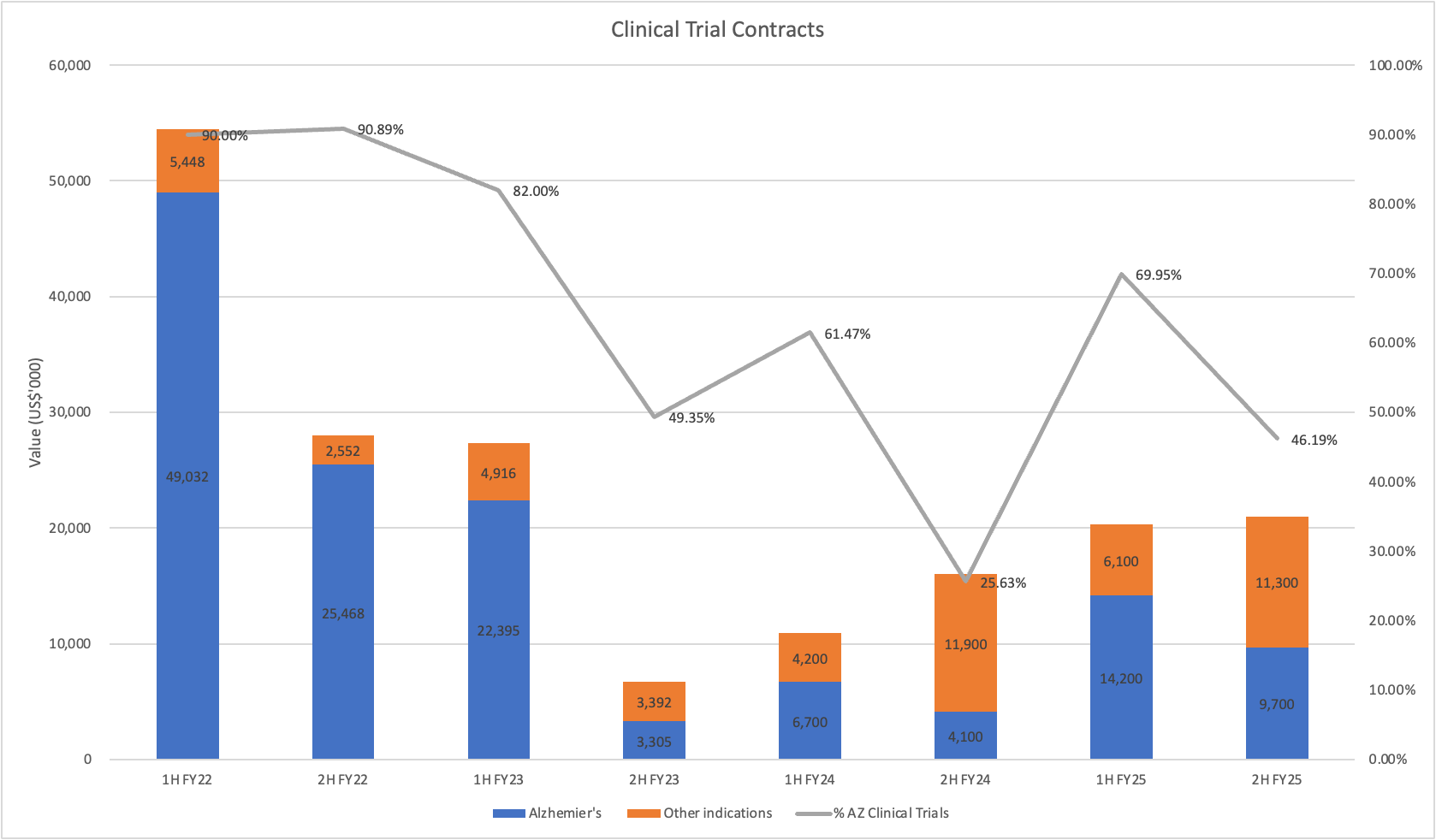

They've been running into the headwind of a lack of new Phase 3 Alzhemier's Disease (AD) trial starts for the past two years. Mainly from large pharma companies switching focus to getting approvals over designing new trials. All the while the company delivered record revenue, profits and a maiden dividend. The company has done this by broadening its offerings into non-AD work, and its partnership with Medidata.

Brad spelled out in no uncertain terms that this trend will reverse in FY26 due to their visibility of the AD trial pipeline. That's the type of lumpiness I can get on board with! One phase 3 win will underwrite growth for the next few years. Multiples, and strong growth will be all but assured.

Trailing EV/E is 21.8, or if you're an annualisoooooor like me and double the 2H FY25 it comes down to 17.7. Not expensive at all for a company that's growing well, with a new partnership that's only just underway and with a strong headwind that's about to reverse.

Like I mentioned in an earlier post on this thread - Roche is kicking off 3x Phase 3 AD trials in the next 6-12 months. And they've hired Cogstate to help recruit these patients, as confirmed in the interview. Winning one or more of these is where the near-term opportunity lies for Cogstate.

Great interview as always @Strawman , I really enjoyed this one.

I’ll let you guys in on why I asked the question about the Roche study pre-screening (TRAVELLER) potential patients for future Alzheimer’s Disease (AD) Phase 3 trials.

Brad confirmed Cogstate’s involvement on TRAVELLER. The observant investors may have already picked this up, since CGS’s proprietary “International Shopping List Test” is listed as an endpoint on clinicaltrials.gov.

Roche is running two Phase 3 AD trials with the drug Trontinemab - TRONTIER 1 and 2 - scheduled to begin on 2025-10-27 and run for three years. As of now, there’s nothing explicitly linking Cogstate to these trials.

Roche also plans to run a third Phase 3 AD trial targeting pre-clinical AD patients. These are individuals not yet showing cognitive symptoms but considered at risk of developing AD. The goal is to see if Trontinemab can be used preventatively.

While Brad appreciated my question, he was very careful in answering it and essentially batted it away to line leg (cricket analogy for deflecting). To me, that speaks volumes.