@Schwerms I am not sure. Consider the cash flow picture below - I will describe adjustments I've made to cut through noise and non-recurring items.

For context, their closing cash at the end of FY25 was $28.6m, having raised some $18m in the year to fund the US launch.

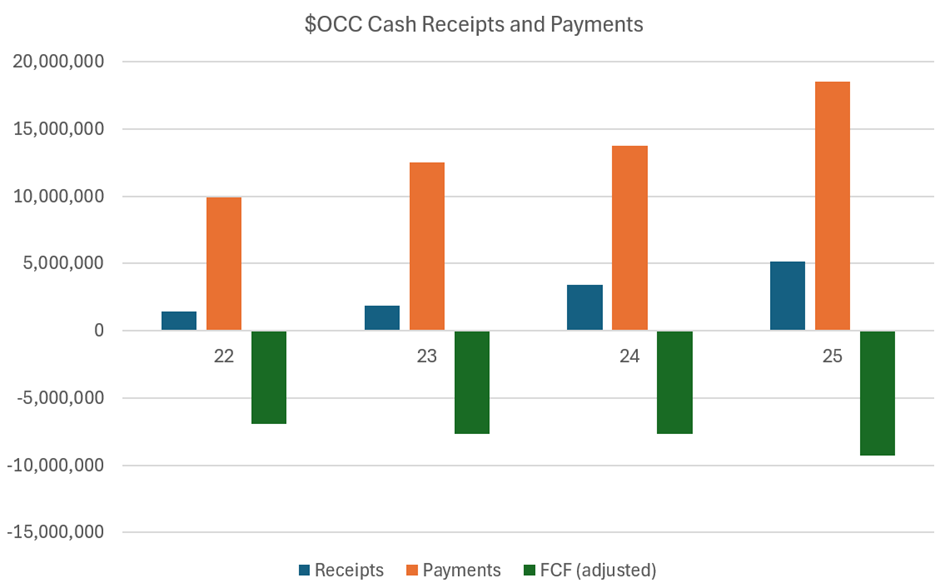

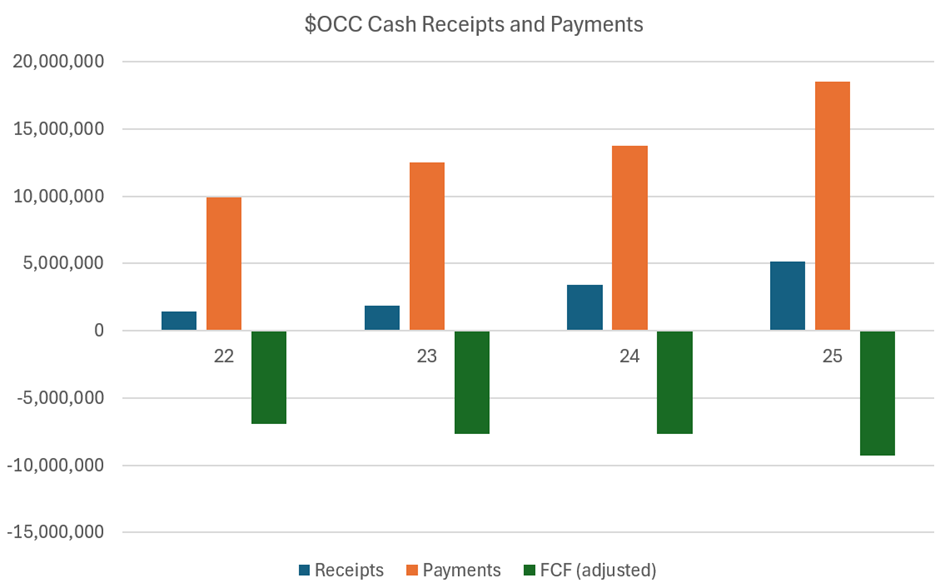

In the picture below I have plotted receipts (blue) and payments (orange) omitting other components from the cash flow statement, like grants and rebates. Importantly, I have also omitted the FY23 upfront payment for the exclusive global distribution deal Striate ($21.5m) in my calculation of Receipts.

I have also excluded the one-off Striate "contract receipt" from my Free Cash Flow ("adjusted") number, to get a better view of the trend within the operating business.

Now I can explain WHY I am being cautious. With a cash burn of the order of $9-10m per year and increasing, the $29m closing cash could conceivably get them through 2+ years.

HOWEVER, what is not clear to me is just how much cash will be mopped up by inventory and marketing. They now have many geographies and many distributorships, and I don't think they've disclosed the terms of their distributorships. The norm is for the distributors to take title to the product (after all they are getting a healthy margin!) but with a new product in a new market, I don't know if any incentives have been structured in the deals to encourage early US uptake.

That's why I am so keen to see the next couple of quarterly reports, as I don't consider that I have any feeling for how this business is scaling.

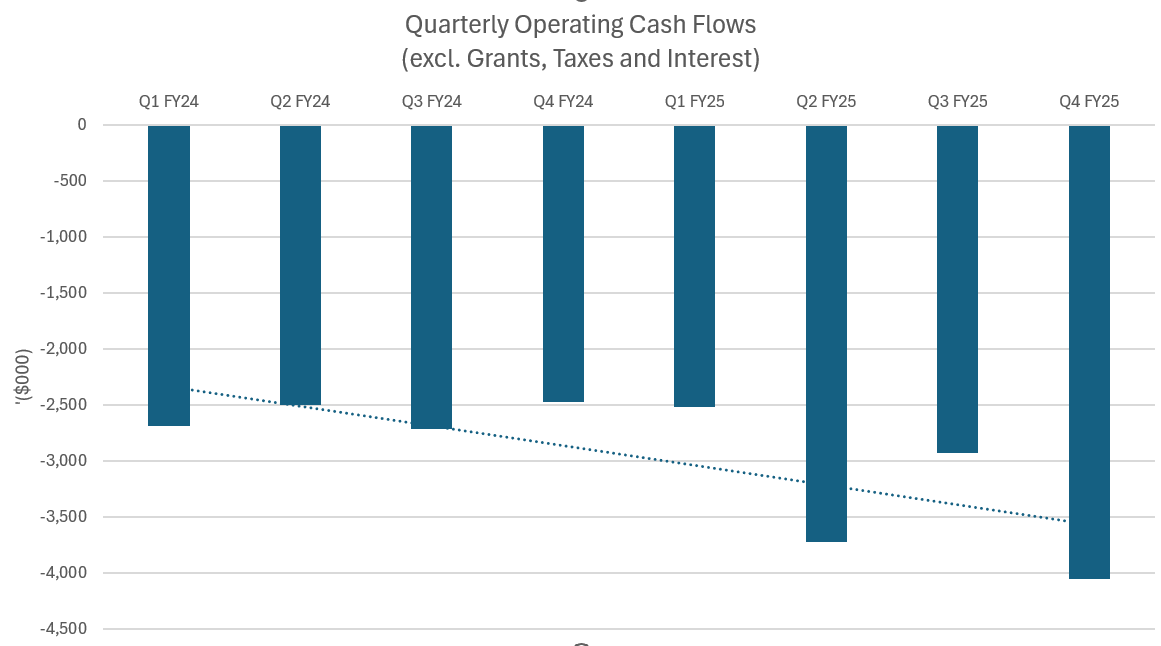

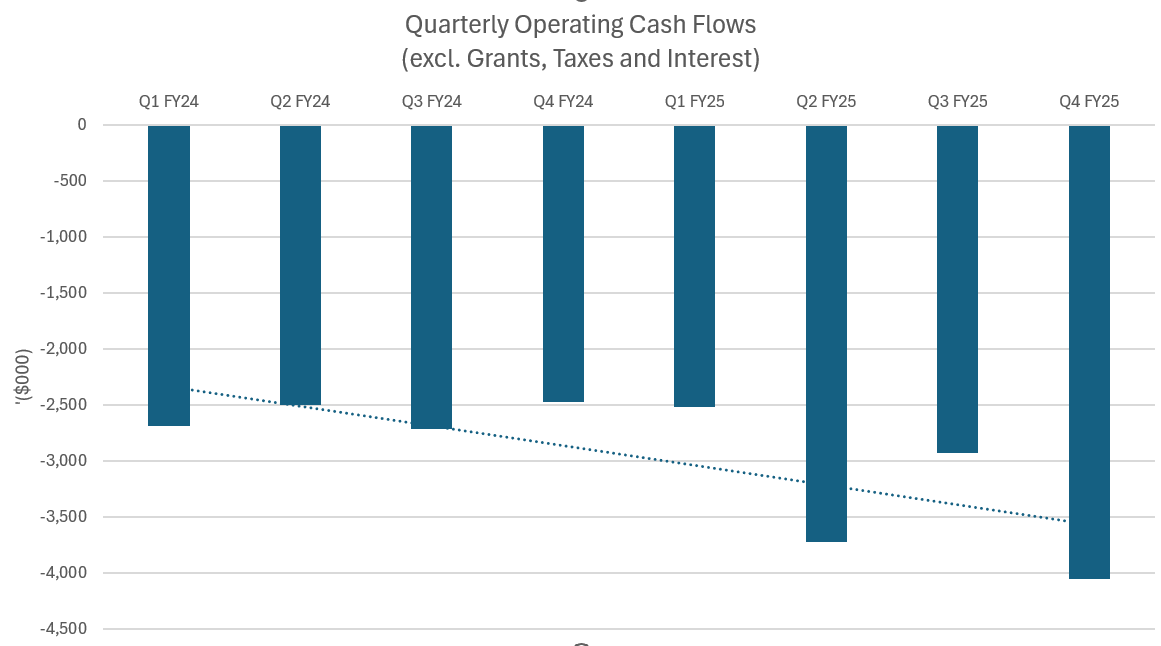

Zooming in now to a quarterly resolution, I've plotted the Operating Cashflows again excluding Grants, Taxes and Interest to understand the trends in the scaling of the operation.

As you can see, despite the uptick coming from top-line growth, the trend in operating cashflow is increasingly negative. I can't make a call on whether they will need to raise cash again until I see how that trend starts to evolve.

Having focused on cash burn, my thesis doesn't rest on that. If the product continues to show superior efficiacy in its category, then I will be happy for them to burn some cash (even if they have to raise another $20-30m) given that they are following a rapid global rollout via a multi-distributor model.

However, my thesis does rely on two factors:

1) Continued strong traction in ANZ and Singapore

2) Early success indicators of uptake in the US, indicating a similar trajectory (of course in a much bigger market).

As long as those remain strong, then in my view we are potentially on to a winner.

Subject to that being the case, I will increase my holding (provided the SP remains modest) once I have increased confidence in the operating economics. As it stands today, there is too much uncertainty for me to take a bigger position today.

Hope that helps!

Disc: Held in RL and SM