Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Regenerative medical devices firm $OCC gave an update on progress in the US Market.

Their Key Points

• Orthocell has reached 100 units sales in the US of its flagship nerve repair product, Remplir™, marking a key early adoption milestone in the US$1.6 billion1 US nerve repair market.

• The successful surgical uptake reflects growing momentum in the US rollout, driven by a combination of Orthocell’s concerted medical education and awareness campaign and a specialist distributor network across 25 states covering 40% of the US population.

• The first US sales and surgeries follow the submission of 61 applications to hospital Value Analysis Committees (VAC) in progress, of which 17 have been approved, ahead of schedule. VAC approvals are critical to facilitate access and sales within hospital networks.

• Strong surgeon engagement with >250 engaged from medical education programs and 14 Medical Advisory Board members under contract.

• The growing US surgical uptake will support anticipated growth in adoption in the US during 2026 and inform first surgeries in Canada, targeted to commence in early 2026.

• The Company remains focused on driving rapid market adoption of Remplir™ supported by a strong balance sheet (circa A$50 million in cash and no debt) and ongoing investment in clinical evidence and medical education initiatives.

My Analysis

Progress in the US is the key "thesis-test" for me. So, what can we make of this. Let's break it down.

1. Sales

We've had earlier announcements about inventory moved to the US (2000 units, the 4000 units in total), and we've also had announcements about the number of procedures (first 10 in the Annual Report in August), then >60 procedured in the 6-Nov AGM with report reported in the 8 weeks leading up to the AGM. However, for medical devices, early procedures do not relate to sales. This is becuase it is common practice for novel medical devices to be issue to KOLs for free to evaluate, trial or even hold initial stock. This is so that KOLs build experience, which can then also inform the formal approval processes at hospitals, including the all impoirtant Value Analysis Committees (VACs).

So the evidence of 100 sales indicates that at least some of the 17 hospitals where the VACs have now approved Remplir are placing commercial orders, which would indicate the KOLs/other surgeons have used any initial free-issued material, and are now routinely using the product.

The first VAC approvals appear to have been around July/August (3) , building to 11 by end-Sept, 16 by 6-Nov and 17 today. Now that's early days given that of the 6,000 hospitals in the US, likely some 2,000-3,000 perform relevant surgical procedures, with some 500-1,000 doing regular nerve repair surgeries (the priority for Remplir sales). So, it is a little unwhelming seeing VACs increase from only 16 to 17 in the last month. This is something to continue to monitor in the New Year.

What is 100 units likely to mean in terms of revenue? Well, while at this stage we can be pretty confident we won't get any breakdown from $OCC management, it is likely that after the distributor's cut, $OCC is netting something of the order of A$1000 - $1200 per device. So, let's say they done 100 device sales in the quarter, then that's c. A$0.1m or an annual run rate of A$0.4m.

Of course, we are at the very start of the adoption curve, and it is important to recognise that this is a treatment for which there are competitor products already well-established in the market.

So today's result can only be seen as the starting point, from which further momentum will be measured. It makes clear that there will be a very small US contribution to the 1H FY26 Remplir sales, which will (according to my model)will still be dominated by $3-4m ANZ sales.

2. Engaged Surgeons

On 6-Nov, $OCC reported ">100 Surgeons trained" and ">100 Surgeons engaged".

Today, 6 weeks later, that has become ">250 Surgeons engaged". If we think in order of magniture terms, there are probably something of the order of 1,000 - 1,500 US surgeons who are candidates to use Remplir. So today's report indicates real momentum in growing the awareness of Remplir, from less than 10% penetration to potentially over 20% in a little over one month. This is the concerted effort that $OCC is focused on and it looks like they are making progress.

Many of these surgeons will be established in their use of existing products like Axogen, and will be looking at the data and reports from KOLs to decide on whether to given Remplir a go. Others will be part of the 90%+ who continue to suture as the SoC.

So, it will be interesting to see how that rapdily expanding awareness base converts into sales in Q3 FY26 (i.e. Jan to March). And today's reported 100 units sales baseline, provides a good basis to judge momentum in Q3 when we hear the report in April next year. If a high proportion of the "250" are convinced to give the product a go, then we would see a rapid uptick in sales in Q3. If they are not convinced (either sticking to Axogen etc. or suturing) then we'll see that in more gradual growth. Getting surgeons to change their established practices is not a rapid process.

Whether $OCC is a compelling investment for me or just another struggling regenerative medicine business, is all about what the momentum looks like in the coming quarters. But for sure, the thesis-proving US game is now on, and it should be possible to reach a judgement on this over the next 12 months.

My Key Takeaways

There isn't any information in today's release to justify me changing my position.

The next we should hear is a Group Revenue update, within the first 2 weeks of January (if history is a guide), and today tells us there will be a very small US contribution in that result, unlikely to be broken out.

So my eye is now on the following:

- How good is the overall 3Q Revenue Number (given that we can now guesstimate the small US component) - and what does that tells us about continued penetration and trajectory in ANZ?

- What leading indicators are we updated on for the US in February, when we get a more complete operational update?

- What further newsflow is there about the application in prostate surgery?

Overall, I still see the potential opportunity here, but it is too early to increase my position size. Discipline is required.

Disc: Held

Regenerative medical devices firm $OCC has filed for EU + UK approval for Remplir, expecting the decision in 3Q CY26.

With approvals received and commercial sales underway in ANZ, Singapore, US and Hong Kong, and approvals in Canada and Thailand, and with strong clinical data, it seems a fairly good bet that there will be EU/UK sales contributions starting in FY27.

How material this will be is likely to depend on the periodic reports we get from the US over the coming year. The big question is: can the strong momentum that has been achieved in ANZ be replicated in other markets?

I expect that over the next year, just as in the US and other markets, we will hear further announments on EU+UK distributorships. Orthocell have proven pretty adept and agile with their distributor appointments in order markets, so I expect we'll hear more about this in Q1 and Q2 of CY26.

My Key Takeaway

The global rollout is progressing like clockwork, according to plan. Confirmation of the investment thesis requires evidence of early sales momentum and other leading indicators in the US. For now, I'm ignoring the SP, and will track this patiently over the coming year.

Disc: Held

Regenerative medicine form $OCC have posted a further update on application of its Remplir nerve repair implant by urologists in RARP (robotic-assisted radical prostatecomy) procedures in Australia.

Here is the relevant part of the announcement in full.

• Adoption of Remplir™ among Australian urologists is accelerating, with ~100 surgeries conducted by surgeons nationwide.

• This promising new application for Remplir can potentially reduce post-surgical complications from peripheral nerve injury,representing a globally significant commercial opportunity for the Company.

• Despite advances such as nerve-sparing techniques and robotic-assisted radical prostatectomy (RARP), damage to the peripheral nerves in the neurovascular bundle (NVB) surrounding the prostate remains common — resulting in erectile dysfunction in up to 80% of men and urinary incontinence in up to 35% following surgery.

• Applying Remplir during prostate surgery aligns with its broader role in peripheral nerve protection and repair. In prostatectomy, surgeons are using Remplir to protect the NVB with the aim of supporting improved postoperative nerve function.

• The Company believes thatthe use of Remplirin nerve-sparing RARP presents a significant opportunity to expand its Total Addressable Market in the U.S. from U.S.$1.6 billion to approximately U.S.$2 billion.

• To support a targeted U.S. product launch in the medium term, the Company is setting up a commercialisation advisory board and investing in further research to strengthen the scientific evidence base for this new application of Remplir.

• Initial clinical performance data from nerve-sparing procedures using Remplir across Australia will be released once compiled. Data will support medical education initiatives and provide the scientific foundation for formal product launches in existing approved international markets, with a focus on the U.S.

My Observations and Assessment

When first reported two months ago, the number of procedures was about 40. To have done a further 60 in two months indicates to me that several urologists are trialling this approach. The context is that by my estimate, anywhere from 1,500-3,000 RARPs are performed annually in Australia, with "high volume" surgeons doing more than 100 a year.

To now have 100 cases reported is significant. Given that reported frequency of instances of the major complications of erectile dysfuction (up to 80%) and urinary incontence (up to 35%) are so high, any meaningful "signal" will be readily detectable in a group of 100.

So, what timeframe can we expect progress to be reported? Well, because the effects of the surgery evolve with time, we might see reports along the lines of:

1. Immediate postoperative period: might not be meaningful because for both conditions, there can be short term incidence, typically for incontinence over 0-6 weeks, and for erectile dysfunction over 0 - 3 months.

2. Early Recovery: here we could see some initial signal of a differentiated outcome for both continence and ED over 6 weeks to 3 months,

However, there is no evidence of positive effects of Remplir in it wider uses in the immediate post-operative and early recovery periodss. So there is no reason to expect to see any early "signal" in RARP procedures (in my simple way of thinking about this.)

3. Intermediate Recovery: For continence, significant recovery occurs over the 3 months to 12 months period. A possible signal for successful nerve-sparing could be both the speed of recovery, as well as the plateau level of recovery achieved. For ED, the window for recovery of function is typically longer at 6-18 months, but then continuing thereafer.

The 6-12 month window is where we see the clinically significant advantages in Remplir's wider use, so this is where we might see early data for RARP results.

So What?

It is conceivable that the urologist(s) leading this trial can already see the early effects of a "positive signal", as we are probably getting towards the 6 months timeframe since when the first procedures were performed.

In fact, as they are accelerating procedures, that indicates to me that there must be a "positive signal". I would have thought if there wasn't a clear signal, that would then point to slowing the trial to monitor the results from the initial population (40) over the longer timeframe. I'm not sure how medical ethics applies here in trials conducted off-label.

In any event, if things continue to progress positively, we will likely receive regular updates on patient numbers every few months and we should soon start to receive some updates on clinical performance. For example, by mid March 2026, the first cohort of 40 patients will have all passed the 6-month post-operative milestone, which is meaningful for a potential differentiated "eary recovery" outcome. And by mid-2026 the first patients will be passing the 12-month post-operative milestone.

Implications for the US

As I understand it, Remplir is approved in the US via is FDA 510(k) clearance which essentially states: “A resorbable nerve wrap for protection of peripheral nerves by serving as a barrier to surrounding tissue and aiding the nerve’s natural healing process.” This wording does not restrict the device to upper-limb, lower-limb, trauma, or nerve-transfer surgery. It is a general peripheral nerve wrap. The cavernous NVBs injured during prostatectomy are peripheral autonomic nerves. Therefore, using Remplir to protect hem during RARP is permissible under the current clearance.

What this means is that today, US urologists can already use Remplir "off-label". So, for example, if the Australian trials are published in a peer-reviewed journal some time next year, we would potentially see early adoption within the US, particularly if there is clinical evidence of a significant reduction in incontinence and/or ED. (Of course, if $OCC want to explicitly market the product for this application, then a new 501k would likely be required, and that process (including clinical data collection) would likely take a few years.)

Off-label use is very common in the US for medical devices, and if the community of anywhere from 2,000 - 3,500 urologic surgeons in the US who perform RARP's become aware that they can get significantly improved outcomes for their patients with respect to continence and/or ED, I think you could see the use of the product scale very rapidly indeed.

Why Am I Excited by This?

$OCC are still holding back on sharing more specifics on the wider adoption of Remplir use in the US. I expect we will hear something by way of a trading update early in the New Year, when we have the complete dataset for 2025 (revenue, number of procedures, number of surgeons, number of hospitals approved etc. etc.)

Meanwhile a "next wave" of clinical application is being prepared in Australia. $OCC estimate the market opportunity at US$400 million. And while only a proportion of the RARP's procedures involved might be suitable for Remplir, the big difference is that as of today (as I understand it) nerve-sparing using sheath technologies like Remplir are not currently being used in RARP's. So, basically, it looks like Remplir could have an uncontested run at this market.

In more general nerve repair, there are existing products already in the market. $OCC claims that Remplir has several advantges over these, and we will see over the next year or two, when US surgeons are convinced (as clearly they are being in ANZ).

But without competition from the existing nerve repair devices in RARP, the US market potential could be significant.

The Bottom Line

At this stage, there has been no disclosure on clinical outcomes for RARP applications. Let's be clear-eyed about that.

But I cannot get over the fact that a small group of Australian urologists appear to be accelerating their use of Remplir in RARPs. The only explanation I can come up to explain this, is that they are seeing early evidence of positively differentiated outcomes.

There are still likely to be several months to wait before we get to see clinical data, given the timelines I've set out above. Conceivably, there could be an early paper or conference presentation of either "Immediate Post-Operative Outcomes" or the "Early Recovery" results. Such a publication could emerge in weeks or a few months. So that is definitely something to monitor, and doubtless $OCC would announce it. However, Remplir's action in more general nerve repair points to timelines as being more like 6-months or 12-months.

I see $OCC as an attractive, early stage, med-tech based on Remplir even without the RARP indication. With RARP, there is a further, potential, material revenue driver for which the US market access (FDA approval and supply chain) is already in place.

Yes, there is commercial execution risk here, and there is clinical development risk around the as yet unproven RARP application. But $OCC has established and is growing revenues from ANZ, and in 2025 has progressed a global rollout. So overall, I see this less as a speculative, development bet, and more a commercialisation, rollout bet ... with additional development upside. That's the kind of risk I like to take.

I've add a further 20% to my RL position of $OCC this morning,

Regnerative medicine company $OCC has announced a second, specialist distributorship for Canada, completing 100% market coverage of this market for its nerve repair product, Remplir, which it says is worth US$75m (Note: they've previously said ANZ is worth US$35m, so the procedures must be a lot more pricey in Canada.)

Not really price sensitive, but good news nonetheless.In its first year in ANZ Remplir did about AUD0.4-0.5m. All eyes, however, are on the lucrative US market. Perhaps there might be an interim update at tomorrow's AGM on progress?

Disc: Held (RL 3%)

Another price sensitive (IMO not price sensitive!) update from $OCC.

This time, a distributor appointed for Hong Kong (with the obligatory remark about the connection to the Greater Bay Area market.)

The great news for retail investors (who might still be feeling bruised by missing out of the recent capital raising at $1.30) is that the SP is now back to $1.130, providing a wonderful opportunity to get one over the Instos.

But seriously, I am content to leave my RL position at a modest 3%, until I get to see some more tangible leading indicators of US revenue. That's the main game in town for the next year or two IMO.

Disc: Held

With my focus on another botech yesterday (!!) I barely paid any attention to this announcement from $OCC.

Orthocell has executed a Memorandum of Understanding with Marine Biomedical Pty Ltd, a Western Australian biotech company, to increase its equity stake from 1.7% to 12.0% for a total consideration of AU$1.0 million.

● The AU$1 million dollar investment is contingent upon Orthocell securing exclusive first right of refusal in relation to the global distribution rights to Marine Biomedical’s groundbreaking PearlBone™, a bone substitute product, developed using sustainably sourced pearl shells from the West Australian Kimberley coast.

● PearlBone is an innovative, next-generation biomaterial with promising applications in bone repair and regeneration in the orthopaedic, trauma and reconstructive surgery market.

● This strategic agreement enhances Orthocell’s core regenerative medicine portfolio, providing surgeons with biologically advanced products across nerve, tendon and bone repair, particularly in trauma and reconstructive procedures where multi-tissue regeneration is often required.

● Marine Biomedical is well advanced in its path to US regulatory approval of PearlBone, nearing completion of its pivotal study designed to support a U.S. FDA 510(k) marketing submission in 1Q CY26 to commercially distribute PearlBone into the US$1.6 billion bone substitute market.

● Orthocell and Marine Biomedical will use reasonable endeavours to complete the Formal Agreements by the end of November 2025.

● Following its recent Placement, Orthocell is well funded with over $50m in cash reserves

My Assessment

Clearly, it appears that in addition to its collagen-based platform, for which $OCC already has several commercialised and several more development products, it is continuing to look for opportunities to expand its development portfolio. This latest potetial tie-up is another product of the WA biotech community.

I don't have a particular view on this deal, other than to say, that it goes some way to explaining why $OCC changed their mind and decided to raise more capital. When you have only 2 years of cash, based on a narrow agenda and disciplined execution plan, an incremental $1.0m investment is a big deal and perhaps something you might forego in the interests of preserving capital and maintaining focus. With over $50m in hand, it is a slightly different story.

To be honest, I prefer firms that have a focused approach to execution, particularly when they are pre-cash generative. In my mind $OCC's portfolio was already prefectly formed with respect to relatively mature commercial phase ("Striate"), early commercial ("Remplir") and the existing development portfolio with mutliple potential applications.

So, while I don't have a view on this potential opportunity, it does help the capital raising make further sense.

Disc: Held in RL and SM

$OCC have concluded their $30m institutional placement at $1.30 for 23.076m new shares, adding to the existing 247.863m shares - a dilution of 7%.

I'll overlook the usual irritation that there is no opportunity for retail holders to participate, and that the new shares at $1.30 are offered at lower than my weighted average RL cost of $1.35,

There are in addition some 24m options on issue, as well as 4.65 million retention and performance rights. To these, more are added today: Canaccord Genuity were issued 1.5m options, at strike prices of $1.625 (0.5m) and $1.95 (1.0m) as part fees for being Lead Manager.

As we speculated here earlier, the funds create the capacity for $OCC to accelerate its development on multiple fronts. They've cited the following areas:

- accelerate the US roll out of the Company’s flagship nerve repair product Remplir

- undertake clinical studies to commercialise the use of Remplir in the significant prostate cancer surgery market

- advance commercialisation of pipeline products in tendon and ligament repair

- expand capacity at Orthocell’s existing manufacturing facilities

- invest in new applications and technologies in the regenerative medicine sector.

There is no reference to the Remplir expansion being to new markets (I had speculated Japan and EU/UK), so it will be worthwhile clarifying the approach at the forthcoming AGM. That said, in my view USA and Canada represent more than enough to be getting after, and there is merit in seeing what traction can come from these markets before going even wider.

With well over $50 million in cash now, and FY25 FCF of -$9,2m set to increase now (I expect) in FY26, if the company pushes ahead on all fronts, by my reckoning, the strengthened cash pile should give the firm 3-4 years of runway, by which time operating cashflows from Remplir in North America should be material.

There are arguably only two new elements in the announced program:

1. Expansion of Manufacturing Facilities: I am slightly surprised that expansion of manufacuting facilities has been flagged. With current capacity of around 100,000 units pa, by my reckoning that sufficient capacity for $50m - $100m annual sales, which is still some years off. Of course, this is a relatively capital light business, and it is as well to have expansion plans developed and in progress well before they are needed. For example, if the product goes gangbusters in the US, it would not be a good thing to be caught short!

2. Clinical Studies on use of Remplir in the Prostate Cancer Surgery Market: Following the earlier reported promising results of using Remplir in post-prostate cancer surgery nerve repair, it is no surprise that the company will formally pursue this indication for Remplir in a clinical trial. It will be good to hear more about this in due course.

I also hope we will soon learn more about the product development in tendon and ligament repair, and also the ideas being explored in the R&D program.

My Overall Assessment

While dilution is rarely cheered, it makes sense for the business to ensure it is well-resourced at this pivotal stage in its growth. Its technology platform offers the promise of many valuable products, with both Striate and Remplir already available in multiple markets globally, and building a promising track record, with strong y-o-y revenue growth.

Despite all these moving parts and potential opportunities, for me, the key driver remains what Remplir can achieve in North America. For my thesis to remain intact, I want to see strong revenue in North America, and the two indicators of this will be 1) sustained strong growth trajectory in the now established ANZ markets to indicate the kind of penetration that might be possible and 2) early leading indicators in the US (# surgeons using, # procedures conducted, # account approved, replishment volumes from distributors).

For now, I will continue to HOLD my current position (RL 2.9%) and await evidence of successful execution.

I have been continuing a deep dive into $OCC and will in the coming weeks post some findings, including a better stab at valuation. (I think my current placeholder is probably a bit too optimistic!)

Disc: Held in RL and SM

Orthocell into a trading halt this morning pending a capital raise,

With approx 27m cash and burning 3m / quarter with revenue increasing this one is a bit surprising but I guess strike while the SP is near its peak and get a few more bullets in the chamber seeing as they are trying to pump almost every corner of the globe at once with Remplir..

@mikebrisy what are your thoughts on this?

Regenerative medicine company $OCC reported their 4C today.

TLDR: An OK report. Receipts stepped up materially, however, costs also increased given the front-loading of spend to launch into new markets. Overall, the report was in-line with my thesis. $OCC remains well-funded for the next 2 years on the current trajectory.

My Assessment

To recap, I am looking at 3 criteria to be met before expanding my current 3.2% (RL) holding:

1. Sustained strong momentum for Remplir in ANZ

2. Leading indicators of sales traction in the US

3. Evidence that the business will scale cost efficiently

Given the recent trading update, there is no new info to report on 1. & 2., as I have covered these previously. So my focus is 3.

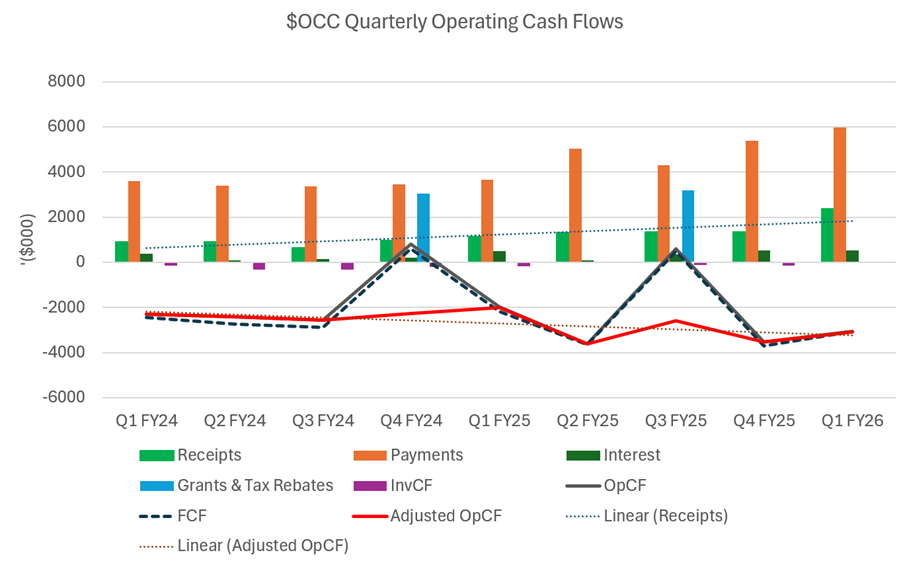

Below, is my usual quarterly cash flow trend report. I’ve included an “Adjusted Operating Cash Flow” in the red line, to reveal the underlying operating performance of the business, omitting the intermittent contribution from Government Grants and Tax Rebates, which distort the signal in the data.

The trend line makes clear that Operating CF is heading in the wrong direction. However, I will explain in the rest of this Straw why I am not concerned about that, at this point.

1. Receipts Growing Strongly

Record receipts of $2.37m (+108% to PCP and +77% QoQ) are a material step up. With revenue of $3.0m in 1Q, and an expected lag between revenue and cash of 1-2 months, it appears likely that Q2 will show a further significant step up.

While most of this will be from ANZ, reports of 1000 + 1000 units sent to US distributors (I assume the first tranche in Q4 and the second tranche in Q1), we could be seeing an initial contribution from the US, however, this isn’t broken out.

While Distributors will have initially stocked, the real question on US trajectory can only be asked when we see how quickly they restock and what the restocking level will be. $OCC have previously indicated that they have 4,000 units in the US market, so that they can respond to demand. (By My guesstimate of the net revenue value to $OCC of 4,000 is c. AUD4m ballpark! So, they are clearly positioning for success.)

2. Several Costs of Market Entry are Front-Loaded

Once distributors are appointed and markets launch, some upfront costs are required ahead of receipts. These include “Marketing, Business Development and Investor Relations” (+69% to pcp) as the distributors are trained and $OCC leads early engagement with KOLs. There’s also developing marketing materials, ads in industry publications, and presentations at regional conferences. After the initial push, more of the ongoing role passes to the distributor, but of course in the US and Canada, there is more territory to cover, so we may see increased levels of spend through FY26.

Then there’s “priming the supply chain” i.e., getting stock into market. While distributors in NZ, Singapore, and Thailand will probably be replenished directly from the WA warehouse, it is clear that $OCC are placing inventory forwards in North America, so that they can effectively service the 16 US and 1 Canadian distributor who have signed up to date. That makes sense, even if it adds some working capital to $OCC’s balance sheet. “Product and Manufacturing Costs” have increased +109% over the PCP – actually, a good result and in-line with the step up in receipts. This indicates to me that $OCC have the supply chain under control.

3. Other Costs have Increased Modestly

R&D is up only 4.8% to PCP. This is modest given that $OCC’s program is across several fronts. Importantly for Remplir, they are continuing the surveillance study to track success rates against the standard of care, and then there is the recently announcement investigator-led work on using Remplir in prostate surgery, which could be an important extension if it takes off. Overall, then, R&D spend seems modest and potentially of high impact.

A final indicator of good cost control is that “Admin, Corporate Cost and Staff Costs (excl R&D)” has only increased by 11% to PCP. This category is always a key indicator for me as to how tightly the ship is being run. Good work.

One major cost increase, that actually stepped up in Q4, is “Lease Costs” (+212% to pcp!). While it is not commented on in the 4C, looking back at the Annual Report this looks like increased leased costs for offices, land, and clean facilities in WA. So, it looks like a one-off step change to support the business growth. One to monitor in future reports, but not of signfiicant concern for now.

The Cash Position Looks Strong

Thanks to an inflow of $1.4m from exercise of options (a financing flow not shown in the chart above), the net cash burn in the Q was only $1.7m. But with cash still at $27m and an underling operating cash burn of $3m per Q, that indicates the business has sufficient cash resources for just over 2 years.

I fully expect to see receipts continue to accelerate in further Qs, while I also expect the rate of cost growth to begin to moderate. And, while I haven’t modelled it out with any confidence, I think that on the current plan, getting to cash breakeven by end of FY27 should be do-able. (My view not $OCC’s!)

Of course, there will be increase costs as there are more territories to add for the US (50%) and more provinces in Canada. I also expect to see regulatory filings in the EU/UK in FY26, with potentially a European launch in FY27. But this should be doable with current cash if we get good traction in North America.

My Overall Assessment

So, overall, I am happy with today’s report. And the market seems to be too (SP +6% at time of writing).

However, my 3 criteria remain open questions, and I need to see more evidence of efficient scaling of the business as it pushes forward on multiple fronts.

Therefore, I am a “Hold” today - and will push back my decision to add more to this position to the Q2 report, unless there is some tangible update on US sales at the AGM in November. Getting products approved in markets and launched is all well and good, but ultimately, the business has to be able to achieve profitable growth. I think the cards are stacked in $OCC’s favour, as the distributor model will favour efficient scaling and the efficacy data will hopefully sell the product on is own, once it is in the market. But I’d like to see more evidence that this is actually happening before adding more capital to this one.

Disc: Held in RL and SM

Stockhead published an article on nerve repair business Orthocell ($OCC) a couple of weeks ago.

Pretty much all of the factual disclosures have been covered in the recent releases. What I found interesting was some of the management commentary around it. Clearly, everyone is pumped both by the reception they are getting in the US and also in the recent clinicals developments in prostate surgery.

With the SP at $1.45 (or c. 23x EV/Revenue forecast for FY26), there is a LOT of success being assumed in the share price. However, from my own research, there are plausible Bull Case scenarios which could make the business still look cheap today.

I've steadily built up to a 3% position, and provided the price doesn't run away, I'm looking to increase that if 1) costs continue to scale reasonably; 2) ANZ momentum is maintained and 3) there are further tangible leading in indicators in the US that experience there will follow ANZ.

Expect the next 4C in about 10 days.

Anyway, for those who prefer to read on here, I've included the full text of the article below.

Orthocell flags rapid ‘hockey stick’ revenue growth in US$1.6 billion US nerve repair market

Health & Biotech 26 Sep 2025 Tim Boreham

Orthocell is shooting early goals with its US Remplir rollout, with 'hockey stick' revenue growth to come. Pic: Getty Images

- Management “couldn’t be happier” with the early US rollout of its flagship device, Remplir

- Revenue should start steadily but then escalate rapidly in ‘hockey stick’ style

- Following Remplir’s surprise adoption in prostate surgery, Orthocell eyes broader indications

Orthocell (ASX:OCC) has flagged rapid “hockey stick” revenue growth as the nerve repair device innovator’s early US commercialisation efforts gain traction at a faster rate than expected.

“This is the calm before the storm,” head of US sales John Walker told an Australian investor forum this week.

In early April the US Food and Drug Administration (FDA) approved the company’s flagship device Remplir, a collagen membrane ‘wrap’ for peripheral nerve repair.

Since then, Orthocell has embarked on a spree of signing up distributors, wooing surgeons and engaging with the hospital system’s powerful gatekeepers.

“We are about to go from ‘zero’ to ‘100’ really really quickly,” Walker says.

Walker has 14 years’ experience in the nerve repair game, mainly with the US$800 million, Nasdaq-listed Axogen.

He played a key role in Axogen’s sales growing from US$3 million to more than US$150 million.

“My message is we have done this before,” Walker says of himself and several other hirings of senior Axogen sales folk.

“We did it by systematically attacking markets. You can’t eat all of the elephant at once.”

Covering the US

Orthocell may not be dining on pachyderm steaks yet, but in the first 120 days the company has established Remplir distribution coverage across 25 states and 40% of the US populace.

“That’s far beyond what we expected in year one – I thought we would do six in six states,” Walker says.

The company has also met more than 100 surgeons and trained them in Remplir usage.

“These include 14 world-class key opinion leaders, the influencers of the nerve world,” Walker says.

“If they say ‘this works’, others follow.”

The company has submitted to 51 hospital value analysis committees, or VACs, with 11 of its entreaties approved.

VACs are the crucial gateway to hospital sales, as they assess the clinical benefit and economics of a product.

Many VACs cover multiple hospitals.

The Cleveland Clinic, for instance, has 15 hospitals in Ohio alone.

Surgeon adoption speaks for itself

Most importantly, Remplir’s actual surgical use is ramping up.

“Over the last few weeks we have had dozens of procedures completed,” says chief operating officer Alex McHenry.

“We expect this sales ramp-up to continue in the December quarter and continue to grow into early 2026.”

While the US will drive Orthocell’s fortunes – a common refrain for a device company – Remplir earlier was approved in Australia, New Zealand and Singapore.

This year, Hong Kong, Thai and Canadian authorities approved the device.

Locally more than 200 surgeons use Remplir, across 165 hospitals.

Orthocell expects to appoint its first distributors in Hong Kong, Canada and Thailand “this quarter and next.”

The company is also preparing marketing applications in Europe and the UK, in view of winning approval next year.

What’s the fuss about?

Orthocell says Remplir is more effective than other nerve repair devices, or the suturing (stitching) method still used in 90% of nerve surgeries.

As a pure collagen product, Remplir ‘mimics’ the outer layer of nerve. The device wraps around the repair site, creating what McHenry dubs a “beautiful bioactive chamber” that enables the nerves to reconnect.

Eventually the wrap is absorbed, leaving the nerves in their natural state.

More than 700,000 nerve procedures are done in the US annually, 90% with suturing.

The success rate from these ‘needle and thread’ operations varies between 50-70%.

This month, a ‘real world’ analysis of 67 Remplir procedures across 49 local patients showed an average 81.1% efficacy.

“We know we can do better [than suturing] and we are showing that we are doing better,” McHenry says.

To date, other conduit devices have been too rigid and thus hard to use, especially for procures connecting a large nerve with a thin nerve.

Prostate surgery: a ‘sleeper’ application

Initially, plastic and orthopaedic surgeons used Remplir to join and protect damaged nerves.

“This is a very versatile product,” McHenry says. “When you put it in surgeons’ hands they say: ‘tell me more’.”

In this vein – or nerve, actually – Orthocell already has stumbled on the hitherto unknown application of prostate cancer surgery.

In Australia, surgeons have used Remplir in about 40 prostatectomies, to protect an underlying bundle of nerves responsible for continence and erectile function.

Despite best practice robotic tumour removal, 80% of patients still experience erectile dysfunction and 35% have incontinence issues.

“This is an exciting emerging treatment that does not require regulatory approval in the US,” McHenry says.

“We are gathering the evidence from the early procedures and will share it with the market shortly.”

Walker says Orthocell also is eyeing expansion into other areas, including oral maxillofacial and spine surgery.

“Anywhere where there’s scar on the nerve, [Remplir] we can be used.”

No royalties, right royal margins

Chairman John Van Der Wielen says Orthocell is in a “great structural position” that is conducive to high margins.

He notes Orthocell has no debt and is not subject to royalty payments, having acquired the royalties from the University of WA.

Royalty payments can be highly dilutive once companies move to profit.

The company also makes its own product at its Perth facility, from a low-cost, porcine-derived material.

Most life science companies outsource to a contract manufacturer, thus losing a large chunk of their margins.

Remplir is lightweight and thus easy to ship. It also does not need to be stored under temperature-controlled conditions and has a three-year shelf life.

Inflexion point

Orthocell reported record revenue of $9.23 million for the year to June 30, up 36%.

Sales derived mainly from non-US sales and Orthocell’s less prominent dental repair product, Striate.

The company also lost $8.5 million (net loss after tax attributable to members), compared with a previous $7.2 million deficit.

Van Der Wielen notes Orthocell’s revenue has grown at an average annual compound rate of 34% over the past three years.

The company is “not too far from heading to profit” as US revenues flow in.

“We are at an inflexion point,” Van Der Wielen says.

“We expect to see revenue rates sustainably increase.

“We are very much focused on the US and couldn’t be happier with the progress and the quality of people we already have employed."

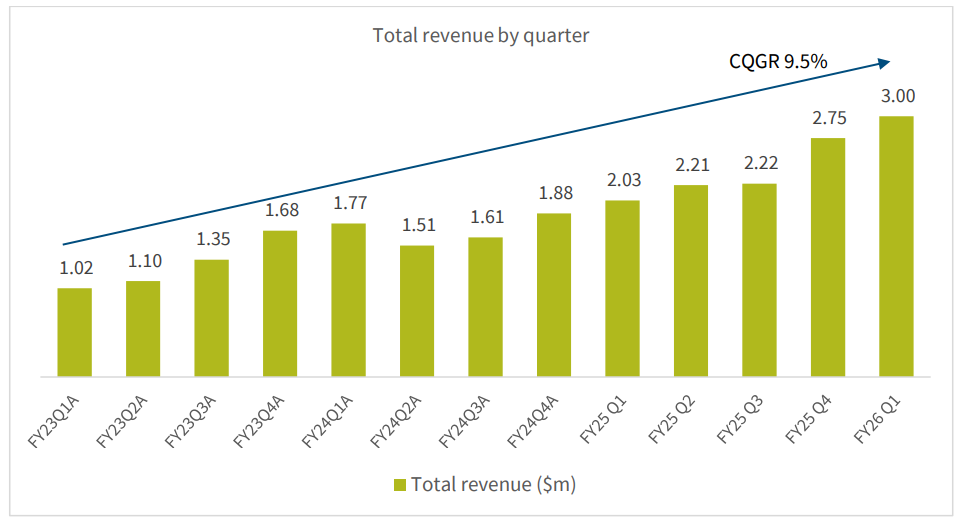

Regenerative medicine company $OCC have announced their 1Q revenue today - a record $3.0m,

Their Summary

• Record revenue of $3.0 million achieved for the quarter ended 30 September 2025, driven primarily by increasing market penetration of nerve repair product Remplir™ in Australia and Singapore.

• September quarter revenue represents a 9.1% increase over the previous quarterly record of $2.7 million for the June 2025 quarter.

• This result is the sixth consecutive quarter of record revenue, with a Compound Quarterly Growth Rate (“CQGR”) of 9.5% since product launches in Q2 FY23.

• Outstanding result does not yet include material revenue from Remplir sales in the US, which are expected to build during the December 2025 Quarter and grow into 2H FY26.

• Highlights of the US commercialisation of Remplir include: o a distributor network that now covers 25+ States and 40% of the US population;

o first US surgeries completed across multiple hospitals, with over 100 surgeons now introduced to the product; and

o over 50+ VAC applications lodged with hospitals; 11 approvals in place and beginning to unlock scale adoption

• The first Canadian distributor was recently appointed, and initial sales from this region are targeted for the December quarter with market adoption expected to grow steadily into 2026.

• Orthocell maintains robust cash reserves of circa $27.0 million and is well-positioned for continued commercial expansion.

• Full Quarterly Activity Report and Appendix 4C to be released by in the next 1-2 weeks.

My Assessment

With Q-o-Q growth of 9.1% and 47.8% to pcp (driven by the large step up in Q4), the first leg of my thesis - growth of Remplir in Australia and Singapore - is looking good.

As for the second leg - the US - given that the US only recorded first sales revenue in July, it is not to be expected that US sales featured materially last quarter. So, the key information is the leading indicators: 50+ VAC applications lodged, 11 approvals in place; over 100 surgeons "introduced to the product".

In itself, these don't necessarily indicate material near-term revenues, as we have no idea how many of the "100 surgeons introduced to the product" will actually use it. However, that 100 surgeons metric is material in the context that currently over 200 surgeons are using the product in the initial markets - concentrated in the ANZ and Singapore. So, that's a good set-up for furture periods, and it will interesting to see if any further information is provided on the number of procedures that have been carried out in the US when the more complete 4C and operational report is issued in a few weeks.

In any event, it puts down an initial datapoint, from which we can judge the market expansion progress in Q2. I'll be most interested in the how the "11 approvals in place" progresses from Q1 to Q2.

The information that really caught my attention was the statement "Orthocell maintains robust cash reserves of circe $27.0M", which is more than I was expecting given the cash and equivalents balance of $28.6m at the EOFY25. It will be interesting to see the 4C to understand why the lower cash burn in the quarter, but this could be due to grants or rebates which tend to be lumpy although these have previously hit the bank account in 3Q and 4Q.

In any event, the apparent cash burn of $1.6m is less than the PCP number of $2.0m, and so we could be seeing the combination of the growing receipts and expense control. Fingers crossed. Anyway, we'll soon see.

My Conclusions

A good update and I'm likely going to add another small tranche to my position, which I aim to build steadily over time. Maybe not today, as we've seen a SP appreciation of 30-40% in the last few weeks, so based on historical volatility and the likely absence of any significant SP cataylysts, I imagine I'll get the chance to add at a better price. Or maybe not,... as these guys do tend to push out good news whenever it arises, and I don't want to be caught short with an underweight position. ;-)

Disc: Held in RL and SM

Regenerative medicine company $OCC has announced the first of what is expected to be a series of distributorships for its nerve repair product Remplir in the Canadian market, with today's announcement covering the provinces of Alberta and British Columbia.

With Canadian regulatory approval having been gained earlier this year in April, the announcement is a little slower than the lightening speed coverage we've seen in the US over the last 6 months. They are expecting imminent launch at a key industry conference in October so, potentially we could see first Canadian procedures performed before year end, depending on how quickly individual hospitals approve the product for use.

My Assessment

While the announcement has been marked as SP sensitive, I don't really see it as such. Clearly the market disagrees with me (at time of writing) with the SP ticking up nicely.

$OCC are progressing steadily in building a network of specialist distributors to obtain rapid coverage of key markets. This will help them achieve a relatively rapid global rollout without having to invest upfront in a large salesforce, albeit they will sacrifice margin to achieve this. It will be interesing to compare this with other firms, like $PNV, who have followed the direct route and as a result taken 5-10 years to get to positive cash generation.

I am maintaining my current position (RL 2.5%) for now, and want to wait until we see the 3Q revenue report, in the next couple of weeks, and the 4C likely in 3 weeks. I want to see 1) continued strong momentum in the existing markets of Australia, NZ, Singapore, and 2) to understand key metrics for early US sales (# procedures performed; # accounts approved; # surgeons having used). I also want to see how the costs are scaling, to confirm the benefits of the indirect model. Subject to Green lights all round, I'll look to step up my position, as $OCC still isn't really on the radar screen yet.

Today's Canada news doesn't influence my plan. In my mind, distributorship announcements were inevitable following the earlier Health Canada approval. What will be relevant is the extent to which Canada follows an "Australia-like" adoption curve.

That said, 2025 is proving to be a pivotal year for market approvals and sales rollout.

I continue to watch $OCC very closely.

Disc: Held in RL and SM

This could be a serious bump in use case. Have not heard it reported before (maybe I have not read widely enough). Prostate surgery is massively common and negative side effects are also massively common, much of it due to nerve injury. If Remplir can potentially reduce some of these side effects (incontinence, erectile dysfunction) it could become commonplace in urological surgery.

Nessy.

Disc - held IRL

Just a quick update from the latest news. Usage is growing fast. 200 doctors using now at 165 different hospitals and great success rates compared to existing technology. I own in RL and Strawman.

A below the radar (not price sensitive) announcement from $OCC this morning, providing an update on US progress,

Summary of the Announcement

Orthocell s advancing the US commercialisation of Remplir™, its flagship peripheral nerve repair device. The US market for this category is estimated at US$1.6 billion.

Commercial Progress in the US

- Early Adoption: 10 US surgeries have now been performed using Remplir™, building surgeon familiarity.

- Hospital Approvals: 36 applications lodged with US hospital Value Assessment Committees (VACs), with 3 approvals granted. VAC approval is essential for broader hospital use.

- Distribution: US distributor network now covers 25 states, with surgeon champions identified to support VAC applications.

- Logistics & Supply: 4,000 Remplir™ units shipped to US logistics partner Uniphar, all manufactured in Western Australia.

Operational Expansion

- Two new US hires, including a regional sales director with direct nerve repair market experience, to support the rollout.

My Assessment

Management are taking every opportunity to keep investors informed of the progress of Remplir in the US. These mini-milestones might normally feature in a quarterly or semiannual update, but we are being kept informed with a constant drip drip of US newsflow.

I imagine the fact that the SP has tracked sideways for the last 8 months may be dirving this. And, furthermore with a market cap of <$300m the shares are not cheap, and the business isn't big enough to be on the radar screen of many.

I do believe management are right to not flag this information as price sensitive. The progress is entirely as you would expect given the steps taken to date, the US market potential, and management's assertions of the competitive weaknesses of the existing standards of care and products from the like of Axogen, Integra and Styker.

The shipment of 4000 units of Remplir to the US is significant. After all, in April this year the CEO reported that total procedures in Australia and Singapore have passed 2000 procedures across 200 surgeons. At that time he indicated a belief that the US offers a 20-30x opportunity (which seems reasonable). Of course, at this stage, the inventory is simply working capital, so news on the number of procedures performed is the key to monitor here.

A further helpful indicator will come in the next couple of weeks, with news on how the product is continuing to gain traction in Australia and Singpore. With 200 surgeons having already used the product in Australia, that's little over 10% penetration of the potential market of surgeons who might use this product (by my BA's estimate), So, if it's a good product, we should still be seeing accelerating penetration and adoption. For me, that remains a key leading indicator to track ahead of use in the US.

Finally, I am not going to get ahead of myself. I am content with my current portfolio weight of 2% for now, and I am following the US progress closely. If the product does experience rapid adoption and displaces not only the incumbent medical devices, but also displaces suturing, then I will be ready to double or treble my exposure to this business. But as we have seen before ample times in medical devices, the ramp up is a slow build as hospital-by-hospital adopts the product, and surgeon-by-surgeon start to use it. One procedure at a time, starting with KOLs and early adoptors, before convincing the majority to adopt a new practice. That's a timescale measured in years, not quarters or months. Patience is required.

This is one I am watching very closely.

Disc: Held in RL and SM

ORTHOCELL ANNOUNCES FIRST US REMPLIR SALES REVENUE:

- Orthocell ha recorded its first US sales revenue from its flagship Remplir product.

- Revenue follows first surgical use of Remplir on June 25 in Ohio and subsequent early surgical cases in Florida sourced from the Company’s network of specialist distributors.

- Orthocell has transitioned from receipt of US FDA 510(k) clearance for Remplir to first revenue generation in just over 3 months.

- Early-stage surgeries conducted in out-patient day surgeries, known as Ambulatory Surgical Centers in the US, play a crucial strategic role in building experience and knowledge amongst the US surgical community in the significant US$1.6 Billion US market.

- Order fulfillment and associated customer invoicing workflow validated.

- Remplir US inventory held and shipped to customers by on-the-ground logistics partner Uniphar.

CEO/MD Paul Anderson: “We are confident our efforts in the US are on track to drive growth in sales of Remplir during the second half of calendar 2025.”

We shall see.

Held IRL

The SP has fallen back over recent months to a more sensible level from its frothy highs and received a bump today on the back of the announcement of the first US surgery using Remplir.

Some concern in online discussion about the length of time from approval to first use and no information on sales. Shows how biotech has long lead times and will be interesting to see sales figures in the 2nd half of the year.

Largest holding in SM and held in RL

$OCC has gone into a trading halt: "the trading halt is requested pending the release of an announcement by the Company regarding a new regulatory approval for Remplir".

This one has caught me by surprise. Based on the chart below, I wasn't expecting to hear anything material for some time.

The next material one I was expecting was EU+UK, but according to the chart below, the application hasn't even been submitted yet. So it can't be that.

What am I missing? Thailand came in about one quarter faster than planned. So might it be Canada? If so, not sure that warrants a trading halt. It it was Canada, that would be quick.

Any StrawPeople have an idea? I am still early on the learning curve with this one. Am I missing something?

OCC received some good media coverage following the FDA approval for Remplir and today announced the first 4 of 10 specialist distributors in the US. Last 4C showed revenue flat but further approvals should boost these figures. SP has pulled back from frothy highs but has shown support around the $1.20 mark.

Orthocell has appointed its first four US distributors of its flagship nerve repair product Remplir™, with first sales expected to follow shortly thereafter.

Distributors are experienced nerve specialists operating in Michigan, Virginia, Colorado and Indiana states.

The Company is targeting to appoint ~10 US distributors by 30 June 2025 in select regions to accelerate the US Remplir rollout and grow sales in the market quickly. These appointments would account for representation in ~25 states.

Distributor model represents the most efficient path to market in the US while also providing a cost effective operating structure for Orthocell. Distributor network to be managed by an in-house team of Sales Directors led by the US Vice President of Sales with a further 4 territory managers to support sales activities.

Recent 4C was boosted by $3M tax refund but outflow of $2.5M. On existing growth path @8% compounding would need another 2+ years for +ve cash flow but Remplir sales should accelerate that rate.

Held in RL and SM

Regenerative medicine company Orthcell ($OCC) today announced their FDA approval for Remplir - its flagship nerve product.

There are a couple of good posts on this business by @PabloEskyBruh and @laoshi - so refer to those for some background, and also an illustration of what this might become in terms of valuation. (I'm rather less bullish than @PabloEskyBruh on the valuation today, simply because I think adoption will be slower as there are well-established, albeit earlier generation technologies in the market. See below.)

There is also the following research report on the business posted on the company website.

Some quick points I like about the business:

- Mutli-product based on the underlying, proprietary technology platform

- Striate: approved in US, EU/UK, ANZ, Canada, Singapore

- Remplir: ANZ, Singapore - and as of today, US

- Other products in development

- Striate is an established dental product manufactured under licence to BioHorizons Implant Systems, in a multi-year deal

- Already revenue generating for two products in multiple markets (1H FY25 Product Sales were $2.4m of total revenue of $4.3m, growing at a rapid clip). Total revenue in FY2 was $6.76m

- $31m cash on the balance sheet at 31-Dec-24; annualised burn rate of $12m at 31-Dec-24. (CEO believes that they will avoid further dilution, and with Remplir approval this now seems likely)

- A notable board (incl. Prof. Fiona Wood and Hon. Kim Beazely) - interestingly Fiona Wood the inventor of ReCell ($AVH) could probably be on any medical devices company board she chose, but this is (I think) her first.

- Individual Insider Ownership of 20% (according to Simply Wall Street)

- US Commercial and Educational leadership established, aiming to sign mutliple distributorships

- Owns a manufacturing with GMP-approved facility in WA, will need to expand as Remplir sales take off.

Because of the multi-product mix, licencing deal and early days for Remplir, I don't have a clear sight on operating economics, but the CEO has said in interviews that:

a) Remplir will achieve Gross MArgins of c. 90% and

b) that across the portfolio, they achieved 75-80%, which makes sense because Striate will be lower marking due to the licencing deal. More work required here.

Valuation

One covering analyst has a PT of $0.97 (although that pre-dates today's announcement, so we should see an upwards revision) and the research report mentioned above from Septmber-24 has a PT of $1.28, which is clearly also stale based on the 1H result and FDA approval.

At time of writing, market cap is about $350m, so let's say an EV of $330. So, if we believe they might hit $8m sales in FY25, then there is a lot of success baked into the price.

However, this is an early stage company, with a strong proprietary technology platform, and existing sales from two products in multiple markets.

So let's consider Remplir in the US alone, where the nerve repair market is estimated to be US$1.6bn of $2.5bn.

Assume Remplir can gain a 5% hold of this market in 5 years at a Gross Margin of 90%, giving FY30 GM of $113m.

Let's then assume a further 50% of Revenue for Operating expense, no debt, and 30%Tax, giving NPAT of $35m

(Note: Under my assumptions 2030 operating expense would be $63m, compared with $8.5m in 2024 - which I think is do-able, as this is quite a capital-light business and, by following a distributor model, they'll not need to build a massive sales force. We'll see! This is critically important in medical devices. $AVH is a business that shows just how long profitability can keep getting pushed out as the sales and marketing organisation is scaled ahead of revenue growth, and $PNV then shows what happens if the rapid growth slows. Lots of execution risk ahead, so beware!!)

Assume SOI rise by 20% over the period to 290m, gives EPS of $0.12.

Apply P/E scenarios of 30, 40 and 50 (because EPS growth in 5 year will be >30% p.a.) and discount back to 2025 gives a range of valuations of ($2.25, $3.00, $3.75).

(Note @PabloEskyBruh has $3,52 - used another approach but, as I said, I am much less aggressive on market penetration.)

Of course, I have not considered global sales, but then again I have also been optimistic (IMO) in assuming that 5% of the US market is captured in 5 years, and there are pre-existing treatments. However, this isn't a fantasy, because the product is proving to have traction in ANZ and Singapore. So, there is a degree of de-risking.

Investment Decision

$OCC has been on my watchlist for about 4 months (thanks StrawPeople) and only yesterday I commented that I was looking to add new early stage biotech positions this year. Little did I realise that the FDA approval would be announced today! (Now that's an announcement I can live with,)

Although Remplir looked pretty low risk for an FDA approval, I decided to hold off until this milestone was achieved, partly because I don't have a high conviction that US market traction will be rapid, and as the SP sailed away from about $0.40 (where it clearly represented good value on a risked basis) to over $1.50 (where I considered it to be well-valued, pre-FDA approval), I have lurked on the sidelines.

It is early days, but today I have taken an initial 1% position in RL, with a a view to adding more on progress and as I deepen my knowledge of this business.

My back-of-the-envelope valuation above tells me that there is no need to rush in on this one. I'd like to see the first decent sales report from the US at 1H FY26.

Disc: Held in RL and SM (order going through, hopefully)

@Strawman any chance of getting Paul Anderson (MD) or John Van Der Wielen (Chair) along. They've done several interviews at the usual outlets, but I think we'd get a lot of value about discussing the product and how they see market traction in the US given the exisiting treatments and the experiences they are getting in ANZ and Singapore. It would be great to get these deeper insights before the US sales reports start coming in, and I think there is a real opportunity here now. (Be forewarned ... I'll be putting a lot on Slido!)

4-March-2025 (Day of FDA Approval for Remplir) - BULL CASE

$3.00 ($2.25 - $3.75)

Note: the range around this is not a full range of scenarios, but simply a sensitivity based on the terminal 2030 P/Es, Actual risk-reward around this has not been evaluated and is likely a lot higher, particularly on the DOWNSIDE.

Method

Let's consider Remplir in the US alone, where the nerve repair market is estimated to be US$1.6bn of $2.5bn.

Assume Remplir can gain a 5% hold of this market in 5 years at a Gross Margin of 90%, giving FY30 GM of $113m.

Let's then assume a further 50% of Revenue for Operating expense, no debt, and 30%Tax, giving NPAT of $35m

(Note: Under my assumptions 2030 operating expense would be $63m, compared with $8.5m in 2024 - which I think is do-able, as this is quite a capital-light business and, by following a distributor model, they'll not need to build a massive sales force. We'll see! This is critically important in medical devices. $AVH is a business that shows just how long profitability can keep getting pushed out as the sales and marketing organisation is scaled ahead of revenue growth, and $PNV then shows what happens if the rapid growth slows. Lots of execution risk ahead, so beware!!)

Assume SOI rise by 20% over the period to 290m, gives EPS of $0.12.

Apply P/E scenarios of 30, 40 and 50 (because EPS growth in 5 year will be >30% p.a.) and discount back to 2025 at 10% gives a range of valuations of ($2.25, $3.00, $3.75).

(Note @PabloEskyBruh has $3,52 - used another approach but, as I said, I am less aggressive on market penetration. But interesting we are in the same ballpark.)

Of course, I have not considered global sales, but then again I have also been optimistic (IMO) in assuming that 5% of the US market is captured in 5 years, as there are pre-existing treatments - albeit arguably not as good.

However, this isn't a fantasy, because the product is getting commercial traction in ANZ and Singapore. So, there is a degree of de-risking.

My valuation is based on Orthocell’s Remplir product achieving a 10% share of the peripheral nerve repair procedure market by end of 2028. It seems that to do so in the US will involve almost wiping out the competitors products, with most surgeons already opting for trusty ol’ sutures over those. There could be some execution risk in first achieving this, and then, to go beyond what their competitors have done — to continue growing by incrementally gaining a higher percentage of those remaining procedures. This seems like effectively a new market. I need to do more research obviously, but I’m interested to know if the US products have initially had more market share and then lost it over the years because the products were so bad. It also raises the concern that the TAM that Orthocell is using is overstated. If so, perhaps I shouldn’t be assigning a growth multiple — because to capture just 10% of those procedures could mean most of the growth has already occurred. These slides below are from the same August 2024 presentation.

Slide above is from an August 2024 investor presentation

This is my reckless back of a beer coaster valuation. Worth a punt I reckon.

Assumptions

- That the TAM is accurate

- That approval process is as quick as it seems to be compared to, say, interventional cardiac devices (#Anteris)

- That Remplir has captured 10% of market by end of 2028

- That operating margin is at least 33.3%

- Dilution of 50% (due to new capital and options). Today’s 250 million shares into 500 million

- P/E multiple if 25 to reflect the industry and growth potential

- That distractions (like dental) get spun off and/or licensed or at least don’t require big reinvestment.

I’ll keep everything is USD until the end because that’s easier

Valuation

200,000 operations x $1,750 sale price of unit / 2 (for wholesale only ) = $175 million revenue

175 million / 3 (for margin) = 58.33

58.33 million x 25 = An end of 2028 market cap of 1.46 billion USD. Discounted back 10% for 3 years gives $1.1 Billion USD.

1.1 billion / 500 million shares give $2.2 US per share today. Or $3.52 Australian.

Equity Mates podcast with Michael Frazis mentions OCC at 28mins (transcript) and an announcement of two new executive US appointments from Axogen who are the incumbent in the field of nerve repair.

Orthocell has appointed two experienced US-based executives, John Walker and Phillip Edmondson, to

drive the market launch and sales of Remplir™ following the expected US FDA approval in the first

quarter of 2025.

John Walker, Vice President - Sales

Mr Walker is a high-performing sales executive with over 25 years’ experience in various senior salesforce

leadership and operational roles in the orthopaedic, primarily peripheral nerve repair, medical device sector.

Most recently, Mr Walker was the Area Vice President and Director of Sales for USA and Europe at Axogen.

Mr Walker was one of the highly awarded leaders at Axogen, leading the growth of nerve repair device sales.

Mr Walker is based in Texas and will commence US launch preparations immediately.

Phillip Edmondson, Vice President - Medical Affairs

Mr Edmondson is an experienced medical affairs and sales executive with over 18 years’ experience in various

senior medical device sales and education roles in the medical device, pharmaceutical, and biologics sectors.

Mr Edmondson was the Senior Medical Affairs Manager and Sales Account Manager at Axogen where he

developed, implemented, and monitored Axogen’s academic program strategy. Mr Edmondson was the

primary liaison with academic institutions, Residency and Fellowship Directors, surgical trainees and key

opinion leaders (KOLs) and received multiple awards and recognition for his outstanding sales growth

performance and leadership. Mr Edmondson is based in Florida and will commence US launch preparations

immediately.

Singapore approval for Remplir. Not really new news as this was expected but suggests that approval in other jurisdictions is likely to be forthcoming. Should be a catalyst for revenue growth over the next 12-18 months.

Orthocell has received regulatory approval from the Health Sciences Authority (HSA) in Singapore, allowing the Company to commence sales of its market leading nerve repair product, Remplir™

Singapore is a strategic regulatory jurisdiction, both as a destination for sophisticated medical treatments in the region and as a regulatory gateway to other substantial ASEAN markets

Orthocell is in advanced discussions with an experienced international medical device distributor ahead of the Singapore market launch anticipated for Q1 CY25

The Company continues to accelerate its regulatory program for other jurisdictions, including the key US market, along with Canada, UK, Europe and other ASEAN markets

Remplir is gaining significant traction with new and existing surgeons in Australia and New Zealand driven by Remplir’s unique qualities that enable the reduction of damaging sutures, creation of an optimal healing microenvironment and facilitation of free gliding within the repair site during the critical healing period.

Singapore is a strategic regulatory market and can be used as a stepping stone to approvals in other ASEAN markets (e.g. Thailand, Malaysia, Vietnam, Indonesia and Philippines).

Orthocell’s global regulatory strategy for Remplir continues to progress, with the Company on track to receive regulatory clearance from the US FDA in 1Q CY25 and applications are planned for Canada, Thailand and EU and UK within the next 6-12 months.

Announcement light on detail but trending in the right direction.

Record revenue of $1.84m has been achieved for the June 24 Quarter, which is up 14.41% from $1.61 million in Q3 FY24 and up 9% from $1.68 million for the same period last year, Q4 FY23.

The continued growth will see record FY24 revenue of $6.72 million, up 30.40% from the previous year (FY23) of $5.15 million, demonstrating clear traction in existing markets.

Company spin

Orthocell aims to secure a 20% market share for Striate+, which would generate approximately AU$50 million in recurring revenue. A similar marketshare for Remplir would generate AU$255 million recurring revenue. Expansion into other markets would see an increase in these projections, demonstrating enormous growth potential for the Company in the immediate future.

Quarterly revenue has grown on average by 9% compounded for the last seven quarters, following Striate+ US and Remplir AUS product launches in November 2022. (9% p/q = 40%p/a compounded)

The reality

Last year's loss before income tax benefit was $9.4M ($6.25M after) on $1.9M from sales and $2.3M from The BioHorizons contract where annual amounts from the lump sum of $23M are transferred to revenue. This will increase to $6.9M for the next three years.

If the sales revenue increases at 30% ( 40% p/a so far off a low base) which is being optimistic then FY25 could see break even on paper. Another licensing agreement for Remplir post approval could change things dramatically (US product registration for Remplir expected in Q1 CY25). Patent life on Striate appx 10 years.

OSX (up 10%) another ASX regenerative microcap announced a big research deal with Singaporean institutions that looks to be in direct competition to OCC’s dental striate product.

Osteopore secures lead role in Clinical-industrial Partnership with National Dental Centre Singapore and A*STAR research institutes through A$19m project, develops next generation jaw implant to access the A$1.26b dental bone graft and membrane market

Orthocell receives new US patent for CelGro®

~ New US divisional patent granted for CelGro®

~ Patent covers the method of manufacture of collagen medical devices and as an aid in the surgical repair of soft tissue injuries

~ CelGro® patents have been previously granted in the US, Canada, Europe, China, Japan, Singapore, Australia and New Zealand

~ CelGro® dental (recently renamed Striate+) approved for use in US, Europe and Australia

~ Global addressable market for CelGro® is in excess of >US$10bn1 and growing.

DISC: I Hold