While several of us in the community are still traumatised by the June "Nightmare on ..." it is worth bracing ourselves for what I expect to be a $BOT Trading Update next week, ahead of the 4C towards the end of the month.

@jcmleng covered the August Canaccord Genuity Conference, and I thought as part of my own preparation, I'd share some extracts from the Canaccord Genuity Analyst Report following that conference (published 1 September 2025, but I've only read it today).

While the presentation gave no new disclosures, which was also the case at the more recent Wainwright Investment Conference (in early September), there was a "fireside chat" format, and so some insights were gleaned from that, which I've highlighted in bold below.

TLDR: I am reasonably aligned with CG. Their valuation of $0.27 compares with mine of $0.35, and I believe the depressed SP at the moment reflects a loss of trust, so that void left by shareholders who fled with their "night terrors" was not been replaced with new believers. If the next update is half decent on scripts, GTN, and revenue, that could be a significant step towards rehabilitation.

Extracts from Canaccord Genity Report (1/9/25)

Summary

"We maintain our BUY rating and $0.27 PT on Botanix Pharmaceuticals. BOT remains in a holding pattern as investors wait to re-establish trust with the expectations around Sofdra traction, particularly as it relates to script volume and gross-to-net yield improvements. We would caution investors not to place too much focus on single data points, however. Our fireside chat with management at Canaccord Genuity's 45th Annual Boston Growth Conference suggested to us that the 30 sales reps now in field are continuing to convert patients at the expected rate. We have therefore maintained our script volume growth and assess the ability for Botanix to meet these numbers as reasonable. There are calculable reasons as to why the gross-to-net yield can sit at ~25-30% within a ~18-month time frame; we have moderated this over FY26e and FY27e to 26-32% (from 29-33%) to reflect this. We view revenue expectations being met through either volume growth or gross-to-net improvement as alternate commercial strategies, rather than preferring either one - with the caveat that we expect profitability to rema intact for 2Q27e. We, and the market, keenly await a trading update in October."

"FY25 summary. Revenue: Total revenue of A$5.8m was largely pre-reported, noting ~A $5.0m directly relates to sales of Sofdra in the US (the remaining attributed to royalties from Ecclock sales in Japan). Sofdra sales reflected ~16,689 total prescriptions (TRx) sold since Jan-25. At a gross price of ~A$1,500 per script (per month), gross revenue sits at A$25.2m, reflecting ~20% average gross-to-net yield across the period. OpEx and earnings: Total OpEx of A$94.1m was 10% ahead of forecasts (CGe: A$85.6m), noting cash OpEx (excl. SBPs) of A$73.5m was only ~4.9% ahead of forecasts (CGe: A$70.8m). Loss from operations therefore sat at A$86.4m (CGe: A$83.4m, -3.5%). Cashflow: operating cash outflow of A$78.6m was driven by a large WC outflow for inventory build (~A$27m) as well as inflows related to R&D tax incentive (A$1.5m) and interest income (A$1.9m) sitting ~$4m ahead of forecasts (CGe: A$82.6m outflow). As reported in the 4C, Botanix closed FY25 with $65.0m in cash, having raised $40m in equity in April-25 and established a US$30m (A$48m) debt facility with Kreos Capital, of which A$31m was drawn down."

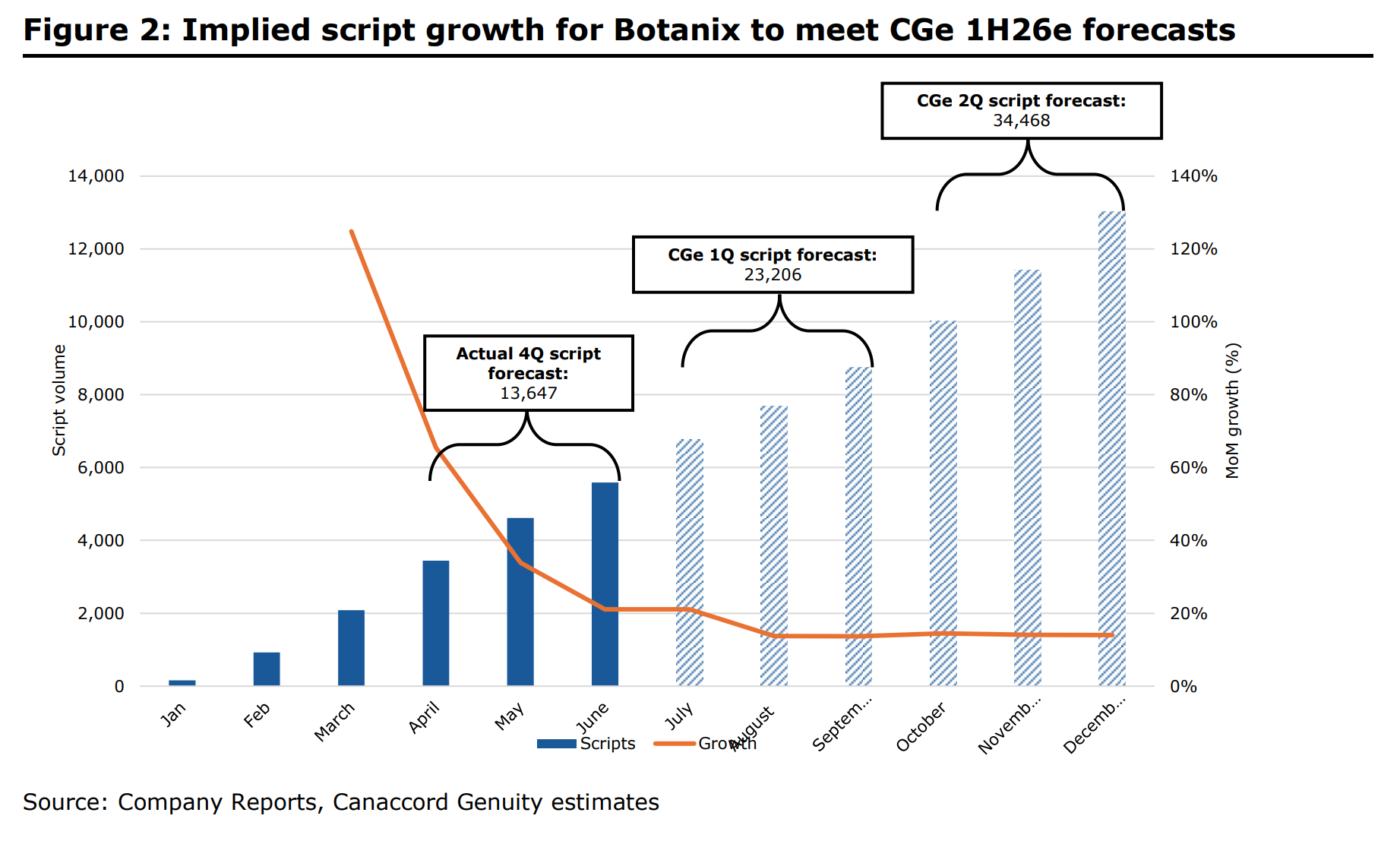

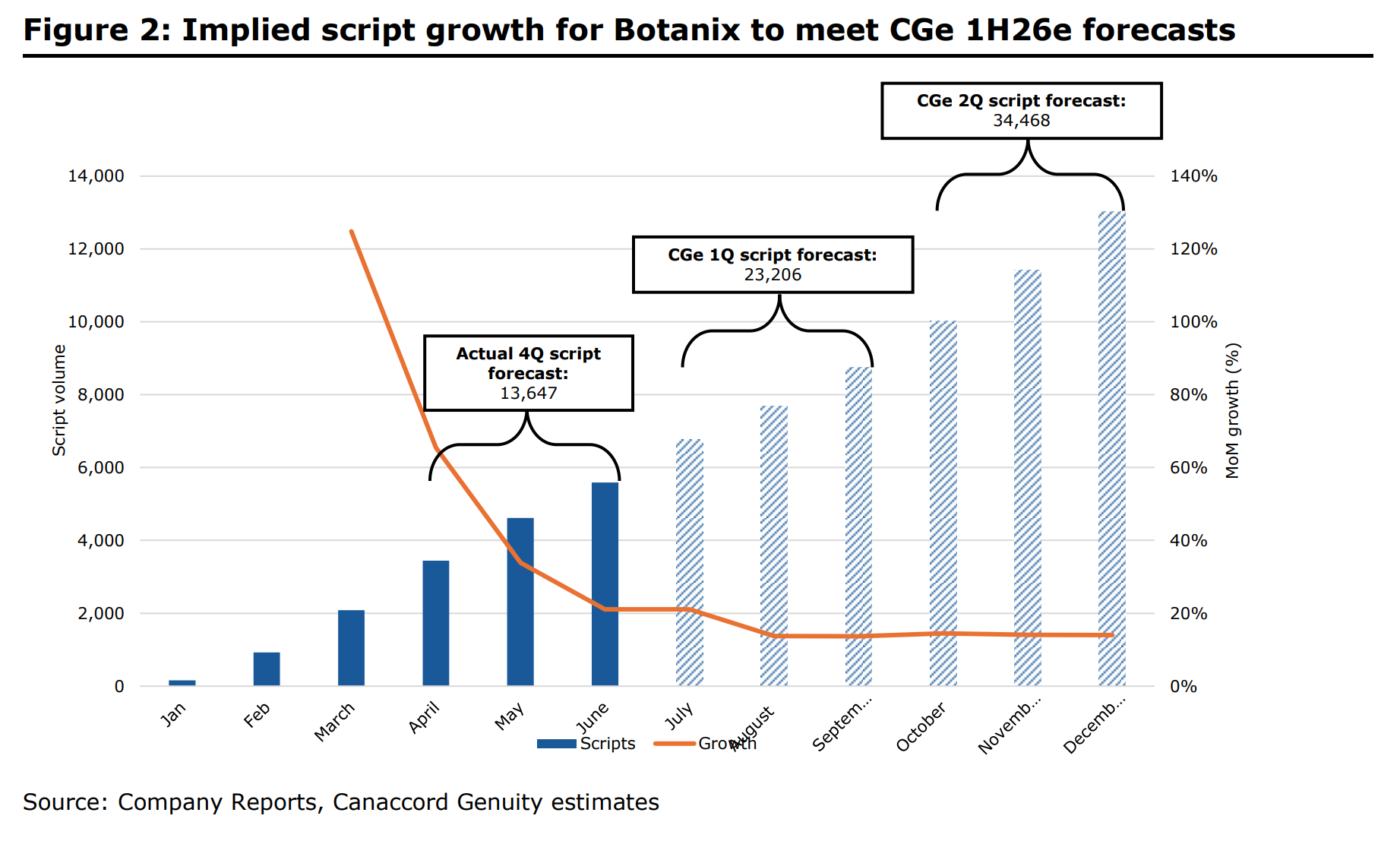

"Forecasts and outlook. Our main model adjustments include: a) moderating GTN yield in FY26e from 29% to 26% (A$6m topline), b) adjusting expenses, accounting for a larger SBP expense, c) inventory (noting no inventory build is expected in 1H26e), d) removal of additional debt drawdown. We see the next two quarters as paramount to Botanix reestablishing trust with the market. We expect Botanix to provide a 1Q trading update in Oct-25. For context, we forecast 1H26e net revenue of A$23.2m. The A$23.2m is predicated on two factors: 1) on the basis that June-July growth is the same as May-June growth (~21%); we forecast ~14% MoM growth in script volumes is required to reach our 1H26e number which needs to be coupled with... 2) an improvement in gross-to-net yield. As a reminder, as of June, GTN yield sat at 23%; we need to see GTN head ≥26% (remember 2H of a CY is a stronger GTN period). "

"Valuation. Our diluted 12-month price target of $0.27 is informed by our DCF model (WACC: 10.3%, Tg: 2.5%) and cross-checked against ASX-listed and global comps (median FY+1 EV/Rev: 3.2x), as well as dermatology deal values (median EV/Rev multiple: 3.4x), which sits broadly in line (4.0x) based on FY27e CGe net revenue: A$140m. More importantly, across the forecast period (FY26-FY28e), we believe Botanix has the capacity to build into a peer comparable EV/EBITDA multiple of 8.0-11.0x, with our PT in line with FY28e EV/EBITDA at 7.5x."

My Assessment

Who knows what 1Q revenue will look like, as multiple factors are at play:

1) seasonality (+ or -)

2) evolution of GTN (+)

3) maturing market penetration (-) and

4) expanding sales force and territories (+)

5) increasing prescriber experience in prescribing ... initial cohort entering their second 6-month period. (likely + but could be -)

Revenue is the key unknown, because costs are controllable and management have demonstrated that they know they have to show an improved control of expenses.

I think the CG numbers above are a good reference to check 1Q against. They could be a little bullish, because of the delay in getting new reps up to speed, but as I've shown above that is only one of several factors.

In my assessment, there is a significant margin of safety between today's SP and any reasonable valuation on fundamentals. The discount is really a management credibility one, and as CG state, $BOT will need two solid quarters of execution to start to repair that.

When we get the next management briefing, I will be very interested to hear about the prescribing behaviour in the more established accounts. How that trends will be an important indicator of where we end up in terms of revenue plateau.

At the start of the year, I followed the Chairman by selling 25% of my RL holding at $0.465 (and sold some in SM too). At the time, I feared I was being a wally, given my valuation at the time. But I was unnerved by Vince's sale. It turns out that was a good decision (for Vince and me!)

But in recent weeks, when the SP hit $0.125, I bought those shares back in RL (and also added again in SM) because things would have to go really badly for the business to have that value. Unfortunately, in that case I was on my own with the Directors and Insiders not sharing my enthusiasm.

Management have been very tight-lipped during the last Q. Maybe they were rightly beaten up for all the loose talk early in the year about revenue expectations for FY26, and perhaps the Board resolved "Shut the f*** up and let the results do the talking."

Well, not long until we see what the revenue trajectory is looking like.

(I have to remind myself that I'm sweating more not because I need the product, but because its just warming up in QLD as we head towards the Summer.)

Disc: Held in RL and SM