Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

21 October 2025

$0.18 ($0.08 - $0.50)

Method 1

Updated valuation based on reductions to GTN and low case TRx trajectory indicating reducd peak revenue (Scenarios of AUD90 m - $AUD200 m in FY28).

Other assumptions: single formulation; dispensing via dermatologists only; US only; no indications beyond PAHH; no telemarketing contribution; no new products.

Disclaimer: Valuation is highly uncertain as based on projections of only 9 months of sales data from a single product company. Do not use as a basis for your investment decision. (Always true, but especially today!)

Method 2

$0.16 market price realised on 20 October 2025.

24 July 2025

$0.35 ($0.22 - $0.90)

Full valuation update following new model based on 8th July Webinar.

See Straw for full description of valuation.

Disclaimer: Valuation is highly uncertain as based on projections of only 6 months of sales data from a single product company. Do not use as a basis for your investment decision. (Always true, but especially today!)

15 April 2025

$1.10 ($0.80 - $1.40)

I'm not doing a model update as we are still in the world of pretty wide uncertainty, and so I've just done a little rounding of my numbers to get rid of the spurious accuracy.

However, the update is to prevent this valuation getting stale.

Based on today's Webinar and the plan to accelerate sales and marketing scale-up, as well as the sales trajectory in the early weeks, I am feeling very comfortable with the lower end of the valuation range, per my alternative analysis last week.

So this is no longer a Bull Case (as indicated below), as the Bear scenario is essentially de-risked. The product has translated to the US. Yay.

The next key valuation catalyst will be the FY25 report and how the sales trajectory has responded to increased investment, That's said, I imagine earlier market updates are likely.

21 May 2024 - Bull Case (SOFDRA now approved)

Updating the valuation based on the 14th May assumptions, now with Sofdra approved, as follows.

SOI now 1,575+233, and allowing for further dilution due to share options to 2029, giving assumed 2029 SOI=2,000m

No change to 2029 EPS, debt free, and tax rate

Eliminate FDA failure cases and resubmission scenarios

Retain 12% discount rate to reflect market uptake risk.

2029 EPS now $0.055

Gives 2029 values for P/Es 25 & 45 of $1.36 - $2.45

Discount back at 12% to 2024 gives $0.77 - $1.39

Add back in value of $70m cash of capital raised = $0.035/share

Valuation range: $0.81 - $1.43

Central Case $1.12

Which kinda explains the limited SP movement today, versus what might have been expected, given that my pre-approval, undiliuted SP was $1.13.

----------------------------------------------

14 May 2024 - Bull Case

See today's Straw for full justification.

On the basis that $BOT achieve an EBIT in 2029 of US$104m, carrying no debt, and applying tax at 30% and USD:AUD 0.67 give 2029 NPAT of A$109m.

With 1,575m SOI, although $BOT will be highly cash generative quite soon, I'll allow some dilution due to share based compensation, so assume SOI of 1,800 in 2029.

That gives a 2029 EPS of $0.061.

I'll deal with the uncertainty via the P/E ratio, ranging from 25 to 45 - probably very conservative for a high growth pharma company.

I'll add a risk premium to the WACC, and discount at 12%.

My unrisked valuation range is: $0.88 to $0.1.56 (but including a margin of safety in the risk premium)

So, now I am going to apply my 90% CoS, and assume that in the 10% failure case

- There is a net 5% chance that there is a subsequent approval on whatever the residual issues are, and that the profile gets pushed out by another year, leading to a further discount and a further dilution of 10%.

- There is a net 5% chance that the drug is withdrawn amd the value of the business is $0.06 of the development portfolio.

Boiling all this up together, and I get a risked valuation of: $1.13

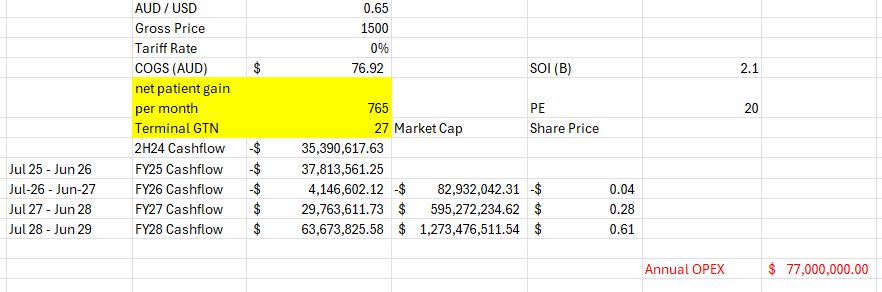

Just wanted to update my previous model based on the most recent 4C data to confirm what at first glance looked ugly.

Despite the confusing change in metrics I have come up with the following, could be right or wrong..

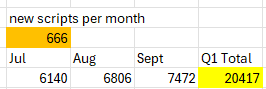

From the 4C, There were 20417 total units shipped in Q1,

** only thing that may skew this is August potentially was low due to the holidays or whatever goes on over there, the pharma data on HC seemed to support this from the bloomberg terminal or where ever it comes from, this is possibly what got it pumped down to 10c recently.

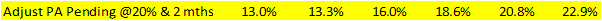

** In the below table:

-- Yellow, total units shipped,

-- July units = historical June units (which they gave previously of 5474 or thereabouts) + X

-- August = July + X

-- Sept = Aug + X

Goal seek X for when Q1 Total = 20417: 666 net additions per month.

Previous posts I was thinking that 1000 / month would be a good base with increased sales force / prescriber productivity etc but missed this by 40% and also the GTN is in the shocker.

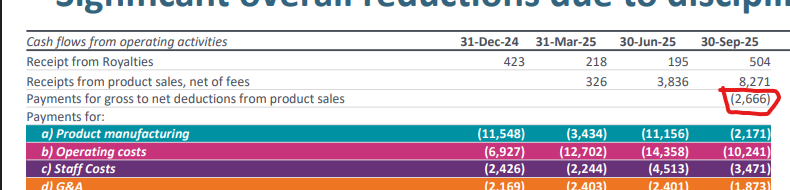

Also this little expense line has been fleshed out of somewhere, not sure what it fell under previously but makes the net revenue $5.6m?

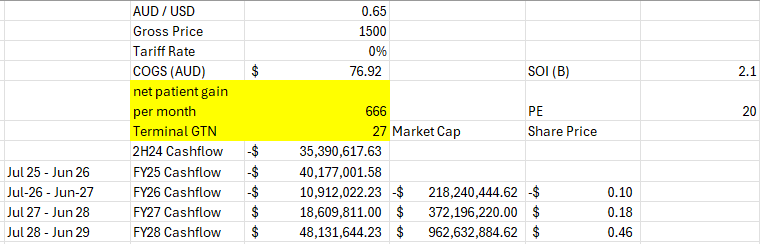

anyway, based on the old model with updated numbers...

COGS I possibly have low at 77 / unit AUD but who knows with what they are reporting.

no COGS until Jan 2026.

-40m loss this FY probably more if winter and high deductible season hit hard.

-11m loss the following year

maybe an 18m profit the year after before tax.

I guess there is a chance the new reps get some growth firing but that net patient gain I have deduced from the numbers provided is ugly to me as is the GTN. my theory about the GTN and PA units must have been incorrect.

Hard to figure it out when they have taken away the script breakdown between free, reimbursed, PA etc.

again that was the only red flag I needed this morning to unload what I had left, they changed the metrics because if it actually is 666 per month average net patient gain of the quarter it stinks more than the tales of $400-450 USD Net / unit.

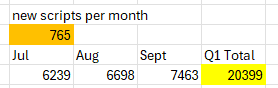

As a side note, suppose August was a shitter of a month due to holidays etc

If I set August in the previous table to be 60% of the scrips added in July and then goal seek for scripts / month, brings the average up to 765 but with a pretty average August.

Still makes for ugly reading considering where it was hoped to be going.

hope it makes sense, can't see too many positives after having looked a bit deeper.

Maybe my OPEX is a bit high, but the COGS is murky at best to me

Maybe my GTN at 27% is a bit low, but its really flattening out month by month

As always any comments welcome hope this may be of use to anyone still holding and on the fence, to me there are much better options out there than to wait and see if they can do it because the performance so far has been underwhelming.

Botanix Webinar – Monday 20 October:

Registration Information Philadelphia PA and Phoenix AZ 16 October 2025:

Commercial dermatology company, Botanix Pharmaceuticals Limited (ABN 70 009 109 755) (ASX:BOT, “Botanix” or “the Company”), announces that it will host a webinar to provide a comprehensive update on the Company’s Quarterly Activity Report and 4C Quarterly Cash Flow Report.

Executive Chairman Vince Ippolito, Chief Executive Officer Dr Howie McKibbon and US Chief Financial Officer Chris Lesovitz will include an update on the launch momentum for Sofdra® (sofpironium) topical gel, 12.45%.

The webinar will be held on Monday, 20 October 2025, at 11.00 am AEDT (Sydney/Melbourne)/8.00 am AWST (Perth).

Interested participants must register before the webinar using the link below. Dialin details will be sent in return.

Date: 20 October 2025 Time: 11.00 am AEDT (Sydney/Melbourne), 8.00 am AWST (Perth) To register: https://us06web.zoom.us/webinar/register/WN_-oGtp6viSHG5NwrKmitAsw Dial in details: Will be sent to you directly upon registration

While several of us in the community are still traumatised by the June "Nightmare on ..." it is worth bracing ourselves for what I expect to be a $BOT Trading Update next week, ahead of the 4C towards the end of the month.

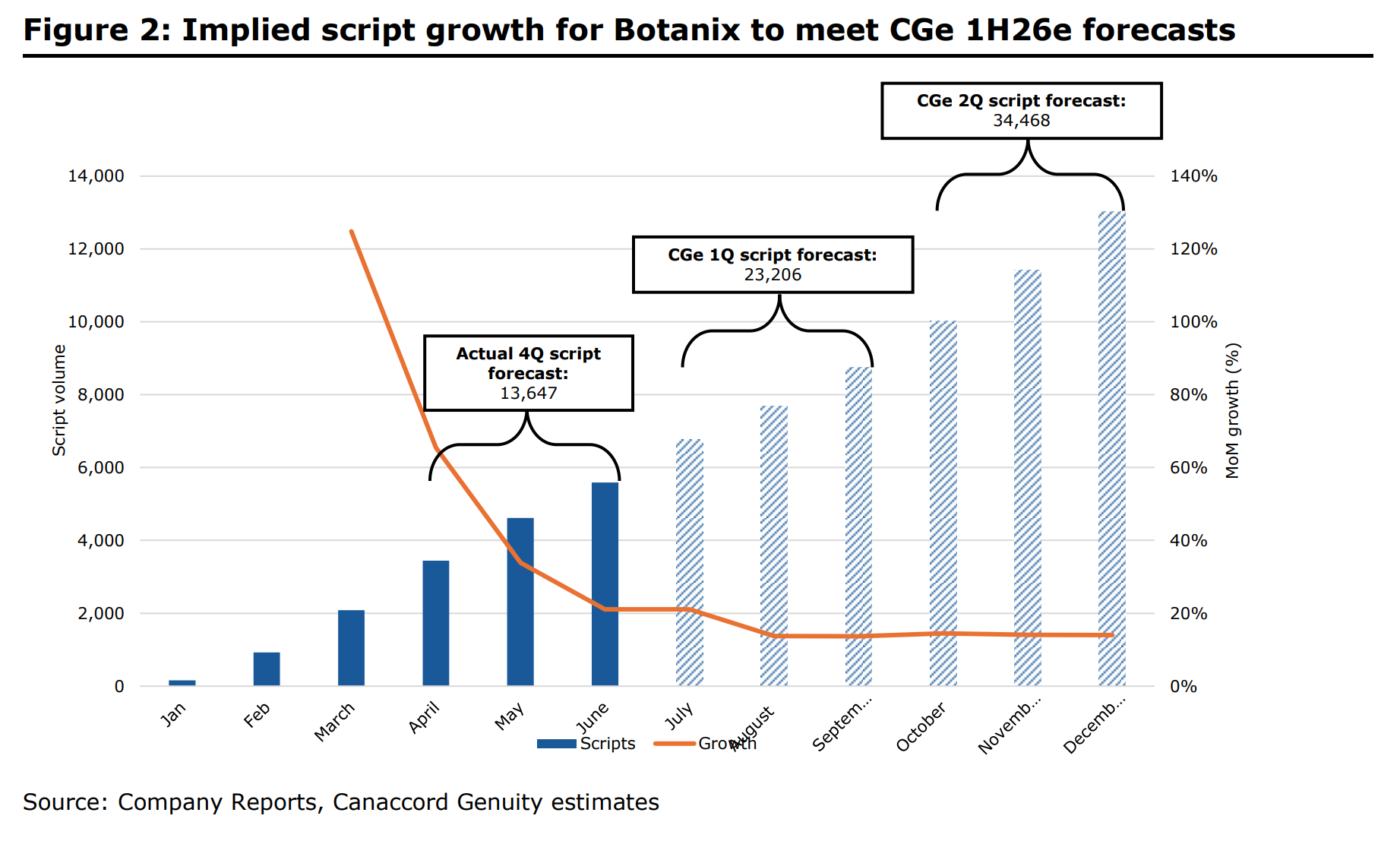

@jcmleng covered the August Canaccord Genuity Conference, and I thought as part of my own preparation, I'd share some extracts from the Canaccord Genuity Analyst Report following that conference (published 1 September 2025, but I've only read it today).

While the presentation gave no new disclosures, which was also the case at the more recent Wainwright Investment Conference (in early September), there was a "fireside chat" format, and so some insights were gleaned from that, which I've highlighted in bold below.

TLDR: I am reasonably aligned with CG. Their valuation of $0.27 compares with mine of $0.35, and I believe the depressed SP at the moment reflects a loss of trust, so that void left by shareholders who fled with their "night terrors" was not been replaced with new believers. If the next update is half decent on scripts, GTN, and revenue, that could be a significant step towards rehabilitation.

Extracts from Canaccord Genity Report (1/9/25)

Summary

"We maintain our BUY rating and $0.27 PT on Botanix Pharmaceuticals. BOT remains in a holding pattern as investors wait to re-establish trust with the expectations around Sofdra traction, particularly as it relates to script volume and gross-to-net yield improvements. We would caution investors not to place too much focus on single data points, however. Our fireside chat with management at Canaccord Genuity's 45th Annual Boston Growth Conference suggested to us that the 30 sales reps now in field are continuing to convert patients at the expected rate. We have therefore maintained our script volume growth and assess the ability for Botanix to meet these numbers as reasonable. There are calculable reasons as to why the gross-to-net yield can sit at ~25-30% within a ~18-month time frame; we have moderated this over FY26e and FY27e to 26-32% (from 29-33%) to reflect this. We view revenue expectations being met through either volume growth or gross-to-net improvement as alternate commercial strategies, rather than preferring either one - with the caveat that we expect profitability to rema intact for 2Q27e. We, and the market, keenly await a trading update in October."

"FY25 summary. Revenue: Total revenue of A$5.8m was largely pre-reported, noting ~A $5.0m directly relates to sales of Sofdra in the US (the remaining attributed to royalties from Ecclock sales in Japan). Sofdra sales reflected ~16,689 total prescriptions (TRx) sold since Jan-25. At a gross price of ~A$1,500 per script (per month), gross revenue sits at A$25.2m, reflecting ~20% average gross-to-net yield across the period. OpEx and earnings: Total OpEx of A$94.1m was 10% ahead of forecasts (CGe: A$85.6m), noting cash OpEx (excl. SBPs) of A$73.5m was only ~4.9% ahead of forecasts (CGe: A$70.8m). Loss from operations therefore sat at A$86.4m (CGe: A$83.4m, -3.5%). Cashflow: operating cash outflow of A$78.6m was driven by a large WC outflow for inventory build (~A$27m) as well as inflows related to R&D tax incentive (A$1.5m) and interest income (A$1.9m) sitting ~$4m ahead of forecasts (CGe: A$82.6m outflow). As reported in the 4C, Botanix closed FY25 with $65.0m in cash, having raised $40m in equity in April-25 and established a US$30m (A$48m) debt facility with Kreos Capital, of which A$31m was drawn down."

"Forecasts and outlook. Our main model adjustments include: a) moderating GTN yield in FY26e from 29% to 26% (A$6m topline), b) adjusting expenses, accounting for a larger SBP expense, c) inventory (noting no inventory build is expected in 1H26e), d) removal of additional debt drawdown. We see the next two quarters as paramount to Botanix reestablishing trust with the market. We expect Botanix to provide a 1Q trading update in Oct-25. For context, we forecast 1H26e net revenue of A$23.2m. The A$23.2m is predicated on two factors: 1) on the basis that June-July growth is the same as May-June growth (~21%); we forecast ~14% MoM growth in script volumes is required to reach our 1H26e number which needs to be coupled with... 2) an improvement in gross-to-net yield. As a reminder, as of June, GTN yield sat at 23%; we need to see GTN head ≥26% (remember 2H of a CY is a stronger GTN period). "

"Valuation. Our diluted 12-month price target of $0.27 is informed by our DCF model (WACC: 10.3%, Tg: 2.5%) and cross-checked against ASX-listed and global comps (median FY+1 EV/Rev: 3.2x), as well as dermatology deal values (median EV/Rev multiple: 3.4x), which sits broadly in line (4.0x) based on FY27e CGe net revenue: A$140m. More importantly, across the forecast period (FY26-FY28e), we believe Botanix has the capacity to build into a peer comparable EV/EBITDA multiple of 8.0-11.0x, with our PT in line with FY28e EV/EBITDA at 7.5x."

My Assessment

Who knows what 1Q revenue will look like, as multiple factors are at play:

1) seasonality (+ or -)

2) evolution of GTN (+)

3) maturing market penetration (-) and

4) expanding sales force and territories (+)

5) increasing prescriber experience in prescribing ... initial cohort entering their second 6-month period. (likely + but could be -)

Revenue is the key unknown, because costs are controllable and management have demonstrated that they know they have to show an improved control of expenses.

I think the CG numbers above are a good reference to check 1Q against. They could be a little bullish, because of the delay in getting new reps up to speed, but as I've shown above that is only one of several factors.

In my assessment, there is a significant margin of safety between today's SP and any reasonable valuation on fundamentals. The discount is really a management credibility one, and as CG state, $BOT will need two solid quarters of execution to start to repair that.

When we get the next management briefing, I will be very interested to hear about the prescribing behaviour in the more established accounts. How that trends will be an important indicator of where we end up in terms of revenue plateau.

At the start of the year, I followed the Chairman by selling 25% of my RL holding at $0.465 (and sold some in SM too). At the time, I feared I was being a wally, given my valuation at the time. But I was unnerved by Vince's sale. It turns out that was a good decision (for Vince and me!)

But in recent weeks, when the SP hit $0.125, I bought those shares back in RL (and also added again in SM) because things would have to go really badly for the business to have that value. Unfortunately, in that case I was on my own with the Directors and Insiders not sharing my enthusiasm.

Management have been very tight-lipped during the last Q. Maybe they were rightly beaten up for all the loose talk early in the year about revenue expectations for FY26, and perhaps the Board resolved "Shut the f*** up and let the results do the talking."

Well, not long until we see what the revenue trajectory is looking like.

(I have to remind myself that I'm sweating more not because I need the product, but because its just warming up in QLD as we head towards the Summer.)

Disc: Held in RL and SM

Not huge news but should bring in a little royalty revenue, when its up and running....

Approval for Marketing Authorization for ECCLOCK gel 5% in Korea

for Treatment of Primary Axillary Hyperhidrosis

Kaken Pharmaceutical Co., Ltd. (“Kaken”, head office: Bunkyo-ku, Tokyo; President and

Representative Director, Hiroyuki Horiuchi) announced that Dong-Wha Pharm. Co., Ltd.

(“Dong Wha”, head office: Seoul; Co-CEOs, Jun Ha Yoo and In Ho Yoon) has obtained

approval from MFDS: Ministry of Food and Drug Safety for the marketing authorization in

Korea of ECCLOCK gel 5%, a topical formulation drug for primary axillary hyperhidrosis

(generic name: sofpironium bromide; product name in Japan: ECCLOCKⓇ).

In June 2023, Kaken and Dong Wha entered into an agreement under which Kaken granted

Dong Wha the exclusive right for the development and commercialization of the product in

Korea based on its rights to sub-license in certain Asian countries granted by Botanix SB, Inc.

(head office: Pennsylvania, USA), and Dong Wha had applied for marketing authorization for

Sofpironium Bromide. Dong Wha plans to launch the product at the earliest possible timing.

About Dong Wha

Dong Wha is a Korean pharmaceutical company, listed on the Korean Stock Exchange

(000020.KS), with strong capabilities in research and development, manufacturing and

marketing and has been providing superior pharmaceutical products in Korea since its

foundation in 1897. For more information, please visit https://www.dong-wha.co.kr/.

Amidst all the excitement last week, I just realised that BOT dropped its FY25 Appendix 4E and Annual Report at about 5.20pm on Friday 30 June 2025.

This was surprising as (1) there was no preso or webinar, just a straight drop of the 4E (2) it was as late as they come - after trading hours on the last day of reporting season?

Looked at FY2024, and it seems this is normal for BOT - last day drop, no preso (there was a webinar 2 weeks later to update on Sofdra). This being my first year as a BOT investor, is this normal, what I would call "tardiness"??

Discl: Held IRL and in SM

Had a quick glance through the BOT Cannacord Genuity Preso which was released on 12 Aug 2025. It was a good summary refresher of the BOT story for me being relatively new to BOT.

What caught my eye, though, was the few slides on the "fulfilment platform" - see extracts below.

- It was interesting to see the re-positioning of the fulfilment platform as a means to improve GTN yield, expediting fulfilment etc.

- There were 18 content slides in the pack. The fulfilment platform appeared in 5 of the 18 slides, about 27% of the pack - a very decent amount of airtime, I thought.

- This positioning is almost exactly how Matt O'Callahan positioned the platform in the SM meeting - how Matt described it, and how it is positioned in this slide pack makes total sense to me - its a differentiator and will make a difference, but there is no "formal" or tangible" dependence on it to drive growth/uptake

- Quite a sharp contrast to the deafening slience on the platform in the last 2 updates, starting with "The Nightmare"

Given this airtime, this does not sound like a capability that is dead/shafted/pushed to the side ... could this be the start of the platform revival instead, I wonder?

Discl: Held IRL and in SM

Am methodically working through all the posts on BOT since "The Nightmare" of early July to take stock and review my conviction on BOT and action to take. There are lots and lots of very valuable insights ...

Upfront apologies for what feels like a dumb question to me, being rather new to BOT, but it keeps popping up in my head as I work through the posts on BOT:

"What is the utopia target or targets, implicitly or explicitly, that the market is expecting from BOT which caused the huge disappointment following the July "The Nightmare" announcement ie, oh crap, given current trajectory, I think target x is going to be missed/delayed/short ...

Is it $100m top line revenue in CY2026? Or cash flow positive in CY2026? Both? Or something else? I had $100 top line revenue in CY2026 as a goal that I think popped up in the Matt SM interview.

The reason for asking is that it feels like a lot of the analysis seems to be trying to establish if BOT can still get to "something" but I am not clear what that "something" is.

Or should I just ignore that "something" and work bottom up to determine if the investment case still makes sense, given current trajectory, which is how I framed my thesis. Sofdra is going to change lives, there is a huge TAM, and BOT is well positioned to go after that TAM in the coming months/years ... onward and upward?

Discl: Held IRL and in SM

$BOT held a short 4C-focused webinar, keeping strictly to reporting on the quarter.

There were really four big takeaways for me:

Sales and Marketing

The expansion of the Sales Force from 27 to 33 and then 50 (+17 training in 1Q FY26, selling from 2Q FY26), reps is being funded through a reallocation of the overall sales and marketing budget (whatever that was). So management are saying that it isn't leading to a net cost increase.

As I have commented earlier, Howie reiterated that this is rational resource allocation, given how easy it is proving to "activate" physicans. He said that adding more reps is going to be the fastest way to get to breakeven, so they're doing that.

We also said that the digital channel is working, but by inference, achieves a low ROI.

So, they are working as fast as they can to reach all (or 90%) of the 4,000 - 5,000 prescribinbg Derms.

In terms of my valuation, that a positive, as it means I might be able to dial back the high-cost sensitivities I ran. (I will look at that later today, once I've gone through the 4C).

Cash Burn Will Stablise Quickly

In addition to reallocating funds within the sales and marketing budget, the made a big splash in 4Q on buying enought active agent (API) to support iunventory for 1H FY26. In fact, I think they said they won't be buying an more API in 1K FY26. That will help stablise cash outflows for the next two quarters, all the while we'll see cash receipts ramping quickly.

They have the Cash to Get to Breakeven and Won't need to Raise Capital

Vince put the CFO on the spot to answer that question. The CFO was careful with his words and didn't say they won't raise capital, but implied they wouldn't "if they hit their revenue targets".

I mean, what else can a CFO say. He's the numbers guy and clearly they have a set of revenue and cost budgets that get them to profitability without further capital. But he doesn't control the operation or the revenue, so I guess a cautious CFO would only be able to say what he said. That's as good as we can hope for.

100% Focus on Sofdra

There were clearly questions about development of other products and licensing. Vince made it clear that spending on other product development is on ice, and that there is some BD on prospecting for products to license in. But he made it clear that management's sole focus is making a success of Sofdra and getting to profitability. Good.

Conclusion

Happy with my analysis last week and over the weekend on this one, and I think this investment now just needs patience so that over each quarter we can see how scripts and GTN trend. These guys seem to have the cost side of the equation under control, and they are clearly focused on wanting to get to profitability as soon as possible.

Reaffirming my HOLD decision from last week.

Disc: Held in RL and SM

In this Straw I set out details of the valuation I posted last night. I know Monday's webinar may well quickly date what I write here. However, it is a line in the sand because it sets out the basis for why I continue to HOLD $BOT. And that was a decision I needed to take today. If Monday brings new information, so be it.

SUMMARY

This Straw presents a valuation analysis of Botanix Pharmaceuticals ($BOT) based on the first six months of SOFDRA sales. Using updated data from the 8th July 2025 company webinar (The “Nightmare on Hyperhidrosis Street”), I built a scenario-based revenue model projecting to FY28 and applied forward P/E multiples to derive a valuation discounted to FY25.

Key components of the model include:

- Market Penetration: Three uptake scenarios (70%, 85%, 100%) based on prescribing dermatologist adoption over 24 months, with consideration of potential GP involvement and expansion of the specialist base over time.

- Refill Dynamics: Volume driven by average new scripts per prescriber and monthly patient churn. Churn is conservatively set at 18.5%, with sensitivities at 16% and 20%.

- Gross-to-Net Revenue: Gross sales per refill is AUD 1,500. A gross-to-net (GTN) ratio of 32% is assumed on average, reflecting early-year deductible effects and expected improvements in reimbursement management.

- Cost Structure:

- Sales & Marketing: Based on sales force headcount and dermatology industry benchmarks (AUD 462k per rep), with sensitivities up to AUD 20 million additional spend.

- COGS: Assumed at 7% of gross refill revenue.

- Other Expenses: Adjusted from the FY25 interim results, net of sales and marketing.

Twelve scenarios are modelled, combining varying assumptions for prescriber activity, churn, GTN, and S&M cost. The base case (P/E = 25) yields a valuation range of $0.22–$0.90, with a central (p50) estimate of $0.35. Even in worst-case scenarios, valuations remain above the current share price of $0.16- $0.18.

Using an alternative methd of applying an M&A revenue multiple of 5x FY28 revenues and discounting back yields valuations of $0.24 to $0.42. (Average is $0.33)

I conclude that despite recent market pessimism, SOFDRA retains strong risk-reward potential, and management has a reasonable timeframe to demonstrate longer-term value generation through platform exploitation and licensing.

INTRODUCTION

My basic approach is to model scenarios for revenue to the end of FY28, estimate the NPAT at that stage and apply a range of P/E ratios at that point, discounting back to end of FY25.

Revenues are driven off modelling total refills per month, using the detailed monthly history provided in the “The Webinar” (aka “Nightmare on Hyperhidrosis Street”, 8th July).

The structure of the analysis is as follows:

1. The Revenue Model

1.1 Market Penetration

1.2 Refill Volumes

1.3 Average Number of Scripts Per Subscriber Per Month

1.4 Patient Churn

1.5 Gross to Net

1.6 So What Revenue Do I Expect

2. The Rest of the Financials – A “Ball Park” Estimate

2.1 Sales & Marketing Expense

2.2 COGS

2.3 Expenses

2.4 Getting to NPAT and EPS

3. Valuation

4. Model Outputs Discussion

4.1 Discussion

4.2 M&A Valuation

5. “A Nightmare on Hyperhidrosis Street 2 – The Revenge of the Applicator”

6. So, What About My Thesis?

------------------------------------------------------------------------------------------------------------

1. The Revenue Model

1.1 Market Penetration

The market is large with some 3.7m seeking treatment in a Dermatologists office out of an estimated market potential of 10m.

The key volume drivers are therefore:

· How many dermatologists (Derms.) are prescribing Sofdra

· Number of new scripts written per month

· How many refills each patient gets

We know there are around 4,000-5,000 Derms. who see patients with PAHh and will therefore assume 4,500 as 100% of the prescribing base.

The market penetration scenario assumptions are:

· Maximum penetration achieved over 24 months

· Penetrations of 70%, 85% and 100% modelled.

This is justified because very rapid penetration (51%) was achieved inless than 6 months. However, ultimate penetrations of 70%, 85% and 100% might at first glance appear unreasonably high. However, there are three further factors to consider:

First, the actual Derm base is 10,000-12,000, so if the product gains market acceptance, there is the possibility that the specialist prescribing base expands.

Second, the experience for the other anticholinergic in the market (Qbrexa) is that over time, some GPs will prescribe refills, or potentially write a script for a patient who has tried the drug but them come off it (for example, at first they couldn’t get the health fund to pay). Apparently, this has been written as acceptable by some health funds (Note: verification of this is required.)

Finally, the upside case (100% of 4,500) also allows for the potential that there are actually 5,000 prescribing dermatologists to begin with.

In short, while 100% penetration is unlikely, there is the potential for the prescriber base to grow over time.

A peak in number of prescribers is assumed to occur in 24 months from launch. The three modelled uptake scenarios are shown below. These scenarios are consistent with the observed fact that in the US dermatology treatments tend to reach plateau sales in the 3rd year.

Exhibit 1: Modelled Prescriber Uptake Scenarios

1.2 Refill volumes

Scenarios are generated for the number of refills issued by month. The assumptions in this model are:

· Existing patients obtain refills, subject to a Monthly Churn Rate (% Churn).

· Active Monthly Prescibers write “n” Scripts per Month

From this simple model, the number of refills in any month is simply:

TRx(n) = Total (Re)fills issued in Month “n” = TRx(n-1) . [1 - % Churn] + NRx(n)

where

NRx(n) = number of new scripts (i.e. new patients, including returning patients) written in the month.

In turn we can find NRx(n) from the Total Number of Prescribers (n) x # Scripts per Subscriber Per month.

So, we have two key variables we now have to understand:

· Number of new Scripts written on average per Prescriber

· % Monthly Churn.

I’ll next look at each of these in turn.

1.3 Average Number of Scripts Per Subscriber Per Month

Here we turn to the data from the first 6 months from The “Webinar”, and perform the analysis shown in Exhibit 2 below:

Exhibit 2: Model Calibration – New Scripts and Churn

Source: The figures in blue are from the “Webinar”.

I’ve estimated the New Scripts in each month (the Churn model is described in the next section). From this, we can calculate how many new scripts were written per Prescriber in each month.

Interestingly, the number started very high, which indicates that early prescribers might have already “warmed up” by having been engaged over the prior 3-6 months as part of the Patient Experience Program. In any event, $BOT presumably had a kernel of super-prescribers and KOLs ready to go at launch.

In previous Straws, we’ve also spoken on this forum about whether a potential “bolus effect” exists. The would be from highly motivated patients aware of the products approval and actively seeking it after launch.

So, the rapid fall-off in the Average Number of Scripts per Prescriber per Month is unsurprising. In fact, we expect it.

A source of error in this analysis is the Churn model leading to an estimate of the number of patient “Lapsing” each month. I’ve played around with different “% Churn" values, and the overall observation is robust.

Scripts per Prescriber per month falls rapidly over the first 6 months, although appear to be levelling off. This is reasonable if the initial population of "super-prescribers" gets diluted by the more general population and/or if the “bolus” effect dissipates rapidly in the early months after launch.

Now, the key question is how this number changes over time.

There is evidence from other drug launched in dermatology, that indicates that the prescribers initially prescribe at a low level, and that this grows by 2-3x over the next 12 months.

Whether this proves to be the case for SOFDRA is one of the big value drivers and uncertainties. At this stage it is unknown.

Note also that I am ignoring the prevalence of the condition at this stage. It doesn’t matter, because the results of the model represent a very low proportion of the prevalent population, so Sofdra will not be limited by the number of patients seeking treatment.

Conservatively, I have generated the following 3 scenarios, which I hold as independent to the number of prescribers:

Exhibit 3: Scenarios for New Scripts Per Subscriber Per Month

I have clearly excluded the scenario that the product “flops”, and clinicians reduce their prescribing over time. This scenario cannot be ruled out, and could occur under two situations.

· Clinical Data doesn’t support continued use (for whatever reason)

· A superior treatment emerges.

I’ve ruled out the first case because of the clinical trial data published by the JAAD, but also the experience in Japan, which showed consistent growth over the first three years in the market. While the product is only partially effective, it appears to be well tolerated and delivers a sufficient benefit to be meaningful to a reasonable proportion of patients who try it.

At this stage, it is unclear whether a superior product will emerge in the near future.

Note: This sensitivity most significantly impacts the valuation.

1.4 % Monthly Churn

The Webinar covered a lot of information about adherence and number of refills. I’ve developed a basic monthly churn model, simply because it is the easiest way to fit the data provided for the first 6 months, and then to project forward.

If 18.5% of patients churn off the drug each month and don’t return, we get the following profile:

· 3.46 total fills from February to June (i.e.2.46 refills)

· Only 11% of patients remain at the end of the first year

· 4.94 fills over the first year

The first point fits the data presented by Howie in the webinar.

On the second point, no-one knows how many patients will come back for another script at the start of the second year. However, 11% seems a conservative approach. Perhaps more will if a significant proportion of reimbursed patients perceive value from the product. So, there is a significant potential upside that I have not considered, as I am choosing a cautious approach in absence of data.

The % Monthly Churn model is flawed. For example, we know a proportion of patients are not going for auto-refills, and are maybe only trying 1 or 2 refills, before abandoning the treatment. However, I am basically comfortable with the model as a rough estimate, given that:

1. It predicts well the average number of refills for the February patients over a 5-month period

2. It aligns with managements enthusiasm that the product is performing well above the norms for dermatological products, which have of an average of 2 fills per patient (i.e., only 1 refill).

I will run two sensitivities on this parameter at % Churn levels of 16% and 20%, noting that at a 20% monthly churn, only 9% of patients are still using the product in the 12th month after first prescription.

This is an area of high uncertainty, and based on performance over the first 6 months and management’s statement about the February Scripts, there is a possible material upside risk to this factor. Rather than introduce further model complexities, this will be something to revisit over time.

1.5 Gross-To-Net (GTN)

$BOT appear to be achieving Gross Sales of AUD1,500 per refill. So with modelling the volume of scripts well-defined, the next big parameter is GTN, in order to achieve net revenue. Management believe they will ultimately achieve a GTN of 30% to 40%.

The exit rate for June was 23%, improving at about 2% per month. Given that Q1 and Q2 are the high deductible season, recovery to the mid-range seems likely.

Secondly, I expect management to tighten the copay policy in Year 2, and also for optimisation of Pre-authorisation of Scripts over time to improve GTN over time.

Analysis from studies of other drugs in sectors like derm. shows that Q1 and Q2 are typically hit by the high-deductible period, with stable revenues in Q3 and Q4,

I have therefore derived the following assumptions based on other studies (note: at this stage $BOT management haven’t said much about this):

· GTN continues to improve at 2% per month, reaching 35% by end of calendar 2025.

· Thereafter, every year, there is a Q1 hit to 72.5% of the Q4 value, and in Q2 88% of the Q4 value, with full recovery by Q3.

We don’t yet know what the Q1 and Q2 annual deductible hits will be. However, the chosen values seem reasonable given experience elsewhere.

The net effect of the 35% assumption, and the annual resets lead to an average annual GTN of 32%. (Note: this is down from my original valuation of 50% - a bit hit to value!)

I have not run any scenarios or sensitivities on GTN. Who knows, perhaps average annual GTN is only 28% or maybe it is 36% - these are now relatively small uncertainties compared with others discussed here! So, I’ll settle with 32% as a reasonably conservative but not unduly pessimistic number. Exhibit 4 shows the GTN over time.

Exhibit 4 GTN over Time

This concludes the revenue model assumptions.

1.6 So What Revenues Do I Expect

According to my model, Sofdra will generate peak revenues of anywhere between $AUD137 and AU$240m by FY28 (or US$90m – US$160m).

That’s very materially down from upside cases I was projecting of anywhere from US$200m to US$600m only a few months ago. (Sad face emoji)

Of course, it is possible that in every assumption I’ve made in this model I’ve suffer from a negative bias induced by the “Nightmare …” and there are certainly upsides I’ve chosen not to consider, particularly around GTN optimisation and, more materially, increasing prescription rates over time.

But rather than “fudge” my model, I’ll run with what it's telling me and – if warranted over time – I'll make adjustments in the light of evidence.

2. THE REST OF THE FINANCIALS

With a high range of uncertainty around the revenue model, I have kept the rest of the financial modelling simple. I’ve also not spent any time trying to get a sensible number for FY25 simply because it is a transition year, with several non-recurring factors:

· Platform build

· Launch preparation

· Onboarding of Sales and Marketing Staff

· Launch inventory build

I want to emphasise this because I will not judge this model by how well it predicts the FY25 Full Year result. I’ve spent zero effort trying to do that because it has no bearing on the company value in the medium term - even though it may well drive the market.

The major uncertainty is the spend on Sales and Marketing. So my approach here, is to take the Expenses from the 1H FY25 Accounts, back out the Sales and Marketing element, and build a simple sales and marketing cost model.

2.1 Sales and Marketing Expense

I will estimate the total Sales and Marketing Expense as follows:

S&M Expense = Sales Force Headcount x Benchmark value

This is a crude but well-established method in pharma to derive total S&M Expense from the size of the field force, with the benchmark picking up all related and overhead costs.

Reasonable benchmarks in Dermatology are anywhere from $USD 300 k per FTE to $500 k per FTE, which turns into AUD 462 k to AUD 770 k.

We know that $BOT have hired an “A” team of derma industry veterans. And “first product” businesses usually pay over the odds. This will be offset by the fact that some of the expenses covered by the benchmark are already “hidden” in other lines of the Accounts – given the AASB/IRFS model applied in Australia.

Therefore, the approach to be followed is as follows:

· Assume AUD 462 k per FTE

· Run high case sensitivities of AUD$10m, $15m, and $20m (for a 50 strong field force, these sensitivities are equivalent to AUD200k, 300k and 400k per head – so they should cover the potential outcomes).

These sensitivities are also important because we don’t know how much digital marketing spend has been thrown at the business.

Most of the platform build will be included in the 1H FY25 accounts, So we don’t need to worry about that. However, it is clear to me from the Webinar that $BOT are not yet spending big on digital marketing, and as I’ve written previously, that they are seeing the highest ROI on investing in the good old door-knocking salesforce.

Why is this the case? Well, it appears the physicians are easily “activated.” So rational resource allocation is to get your reps in front of all the 4,000-5,000 target derms. asap! Which is what management appear to be doing.

For the model, Sales and marketing is built up as follows:

· FY25: 27 Reps (FY25 is not refined as it's immaterial to valuation)

· FY26: 50 Reps

· FY27: 60 Reps – they go from 90% coverage to expand the base in targeted areas.

And so the Sales & Marketing expense then follows.

2.2 COGS

I’ve assumed a flat 7% of Gross Refill Value is assumed. i.e., 0.07 x AUD1500 = AUD105 per refill

This is on the high side to allow for Tariff impacts (assuming Tarrifs apply to COGS and not Sales!)

An error in the model is that inventory needs to be made 3-6 months ahead of sales, but this is not material given all the other assumptions, so I’ve ignore working capital.

2.3 Total Expenses

Expenses are estimated as follows:

· The expense base at 1H FY25 Accounts (4D) as starting point: AUD 32m x 2 = AUD 64m

· Strip out Sales and Marketing, so it doesn’t get double-counted: -AUD 17.7m

· Expense Base = AUD 47m + Sales and Marketing.

I’ve assumed interest is included in here, and may have under-estimated charges for the expanded debt facility.

2.4 Getting to NPAT and EPS

PBT = Net Revenue – COGS – Expenses

Tax rate assumed at 25%, as there will be benefit from carried forward tax losses.

NPAT = PBT * (1-Tax)

Shares on Issue: Management are using a fair amount of share-based compensation, so I assume 3% dilution p,a,

3. VALUATION

The model generates FY28 NPAT for 12 scenarios, combining the various factors covered.

P/E Ratio – This is the second big driver for the change to my valuation. The change in this valuation over my pervious valuation is that SOFDRA does not appear likely to be a blockbuster. It looks like it will be moderately successful and reaches maturity in FY28, and is not rolled out beyond the US. (The economics are not attractive.)

Growth from FY28 onwards will then depend on whether – over the next three years (not tomorrow!) – management can bring other undervalued dermatology drugs onto the platform.

I’m not sure they’ll succeed and so the P/E ratio scenarios I will apply in FY28 are 20, 25 and 30.

If you think $BOT is “Sofrda and done”, then eventually it will get bought out at some multiple.

So, I’ve taken FY28 EPS and discounted back for 3 years to end of FY25 at10%

Bingo.

This is still betting on management experience and skill in dermatology, and it gives them a reasonable time horizon to either do platform deals or licence in new molecules. If I didn’t believe in management, then P/E scenarios of 15 and 20 would probably be more appropriate. This risk is not explicitly modelled, but that’s because I believe management will find a way to create more value over time.

The detailed inputs and key outputs are listed in Exhibit 5.

Exhibit 5: Model Scenarios and Outputs

The table above shows the outputs from the various scenarios. I’ve not really had the time to think about the scenarios probabilistically, but if I had, the distribution of valuations would be as shown in the Exhibit 6.

Exhibit 6: $BOT Valuation Results

At my refence P/E of 25, I get a valuation range using my usual p50% (p10% - p90%) notation, of $0.35 ($0.22 - $0.90) in roundabout terms.

At my p50% level, the range generated by my P/E values (20, 25, 30) are $0.27 to $0.41

My conclusion is that the market has indeed over-reacted to the “Nightmare on Hyperhidrosis Street”. Even in my lowest case analysis, I can’t get below $0.17. And yet that’s where we are today at $0.16 to $0.18.

While my previous very bullish view on $BOT has been materially deflated (sigh), I think the market has got this one wrong. Standing here today, you’d probably need to give me $0.60-$0.70 to get me to part with my shares.

4. Discussion of Valuation and Model Outcomes

4.1 Discussion

Depending on how you compose your scenarios, you can generate either more valuation results at the low end or more at the high end of Exhibit 6.

So, picking a number is indeed a fools game. I’m not sure of the value of doing more analysis on this, simply because the spread of valuations starts squarely at today’s market price and are solidly risked to the upside. IF YOU BELIEVE MY ASSUMPTIONS.

It is true that I could easily generate valuations down to $0.10 or lower, but equally, I can easily still get valuations north of $1.00 – in both cases using reasonable assumptions.

But based on what I believe to be reasonable assumptions, I am a solid HOLD on $BOT given by 4% RL position.

4.2 M&A Valuation

If we assume that by FY27 it becomes clear that $BOT is nothing other than “US Sofdra and Done”, then it won’t make sense as an ongoing entity and will get acquired.

To test the valuation, I’ll apply a modest 5 x FY28 revenues, and discount back.

Doing this I get a range of valuations of $0.24 to $0.42. Funnily enought, the midpoint of $0.33 is eerily close to my bottom-up $0.35 p50% at P/E = 25. (Honest, I haven't had time to fudge the models!)

5. “A Nightmare on Hyperhidrosis Street 2 – The Revenge of the Applicator”

So, why another “comprehensive” webinar on Monday?

I think management HAVE to do this because the 4C is doing to drop on Monday. Revenue and Cash will be bugger all, and cash burn will be scarey. And so management has to help the market make sense of the cost base. If they don’t do that, half the analysts will predict that $BOT runs out of money pretty soon.

And I don’t think they will run out of cash. For example, I’ve plotted the financials below for one of my more central case scenarios in Exhibit 7. $BOT can get close to breakeven in FY26 and is strongly cash generative in FY27.

Exhibit 7: Modelled $BOT Financials (Scenario 6)

Even in the case where I’ve layered on $20m of excess sales and marketing costs, with the lowest monthly prescription case (Scenario 12), there’s probably enough liquidity to get through to positive cash flow in FY27, just.

Exhibit 8: Modelled $BOT Financials inHigh Cash Burn / Lower Revenue Case (Scenario 12)

Of course, I’m also hoping for some more insights about rollout. After all, there’s been another 4 weeks of data, so hopefully there’ll be an update on scripts and prescribers.

6. So. What about My Thesis?

The whole point of doing all this work was find out if my investment thesis is intact or not. And?

My investment in $BOT was initially predicated on the view that the market was seriously mis-pricing development and execution risk. Development risk mispriced, because we knew the product works based on experience in Japan and the promising US clinical trial data (now published in JAAD). Execution risk overblown because 1) there is huge unmet need in the market, 2) the management team have a strong track record in dermatology launches and 3) the existing anticholinergic product in the market has well-defined deficiencies, and is being managed by a lightweight company trying to juggle multiple products.

I bought $BOT between $0.325 and $0.47 in the belief that this business was worth anywhere from $1.00 to $2.00.

Wind forward to today, and while physicians are getting onboard, prescription rates are underwhelming, and conversion to net revenue is less than (I) expected. Added to that, the company is rapidly scaling up sales and marketing spending.

So, the market is in the doldrums, seeing this business as worth $0.16 - $0.18. But I think it would be worth anywhere from $0.20 to $0.90. That’s a serious haircut to what I thought, but still an interesting investment. And it is early days.

So, my thesis while seriously diminished, is not broken. I’m happy to see how this story continues to unfold.

At this stage, I’m not sweating.

Disc: Held in RL(4%) and SM

Heads-up $BOT holders, management are holding a "webinar to provide a comprehensive update on the Company’s Quarterly Activity Report and 4c Cash Flow Report. The webinar will include an update on the increasing launch momentum for Sofdra™ (sofpironium) topical gel, 12.45% and how Botanix’s cash position will support Sofdra through to profitability."

Monday 28th July, 9am.

Be there or be square!!

Given the SP reaction to the last sxxx show, this is hardly a surprise**. But it probably an indication that management believe the market reaction to the result was badly wrong. And they will take steps to give assurances that they are not going to run out of money before geting to profitability.

(** Actually, I listen back to the recording several times over, and there was a lot of good information provided by Howie, which I've been able to build into my model.)

My Valuation Update

I have been beavering away on my detailed digestion of the last webinar. Now the pressure is on for me to complete the work today, and during trading tomorrow to decide my investment strategy.

What is emerging from my analysis so far, is that there are a wide range of scenarios for how Sofdra will play out. Certainly, many aspects of the first 5-6 months data are promising. One example is the rapid penetration of the key prescriber base, which really does look like a best-practice launch rollout.

Less impressive are the scripts per prescriber. How this evolves is a key value driver and a key uncertainty. For sure, it is perfectly normal that prescribing frequency is low in the early months, and it often picks up through the 6-18 month timeframe, based on market response and clinical feedback and competition (low here).

The market was clearly shocked by the GTN numbers. My research on this indicates that in the second half, we will see GTN increase significantly, and this will drive net revenues significantly.

Apologies for the teaser, but I am still working through my various scenarios. I'm still seeing plausible cases that hit my current valuation, but the risk-reward has shift downwards, significantly. And based on the data so far, there are plausible scenarios where this business doesn't amount to anything.

So my investment decision is going to come down to how I assess the various scenarios (sorry, that's a statement of the blindingly obvious). I'm flipping at the moment between viewing that the market got this about right. ($0.2 - $0.3, risked valuation) through to no, no, no, its a complete over-reaction ($0.6 to $1.0). So, I better get my head down!

At this stage, I am on the fence as to whether my investment thesis is intact or not.

One thing I do tend to agree with in the webinar announcement,... Sofdra sales ramp appears highly likely to get to cash flow positive based on existing cash reserves. So that is one source of anxiety I am feeling better about. But only one.

Have had some time to analyse the presentation and come up with the best way to monitor upcoming progress,

I feel The simplest metric to track is the net increase in users per month after the churn along with the gross to net. This was reported as the Tx / month.

Short version, it probably still isn't as bad as it looked and has been sold down heavily, won't be a 6 month success story but even on the lower end case things will be ok in 12-18 months time and they could be close to a profit, main takeaway is cash on hand after the raise and factoring in the debt facility a raise shouldnt be needed.

Welcome anyone's thoughts/comments on this.

As noted in a separate post, when you remove the free units and factor in the PA units that get retrospective approval it isn't as bad as it looks. The high deductible dip in the given example didn't seem to be as bad in the year after the launch but that remains to be seen, I have put a dip in year 1 post launch but not year 2.

Another thing to note is the adherance rates, it was 79% overall and 95% for people in the auto refills,

The 79% adherance rate on the surface looks low but it is most likely related to the free units being shipped each month (mid 20%, assuming these aren't eligible for refills and these account for most of the discontinuing users.

If this assessment is correct, the actual adherence rate is still quite reasonable.

All this being said below are 3 cases to consider, both with an example for GTN of 30 and 35.

All have annual opex of 80m to allow for the extra reps, COGS as noted below, and the bodor royalty is 5% of net sales.

*need to confirm the opex in the quarterly, might still be hard to tell with the foray into digital that didn't go well but should be a good indicator at least.

Case 1:

Maintain the net addition of 1150 users on average per month as has been the case so far, GTN tracks to 33%, with a dip being overserved in high deductible season.

Not sure if the bigger table will be readable, but COH bottoms out at 70m, with a cashflow positive month in June 2026.

Case 1b:

GTN peaks at 30 with 1150 / month

Case 2:

Net Addition of users gets up to 1500 / month with the addition of more sales reps and an S curve effect with prescribers becoming more productive.

Cashflow positive August 2026, COH bottoms at 60mil.

Case 2b: GTN peaks at 30 with 1500 / month

Case 3:

Growth underwhelms and has peaked at 1150, continues to add at 750 / month with additional reps.

Case 3b: GTN peaks at 30 with 750 / month

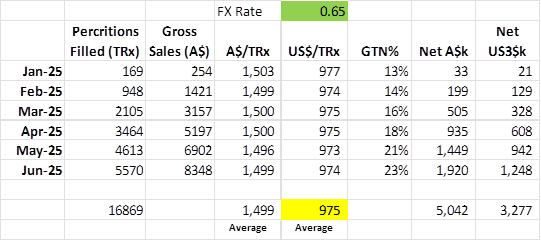

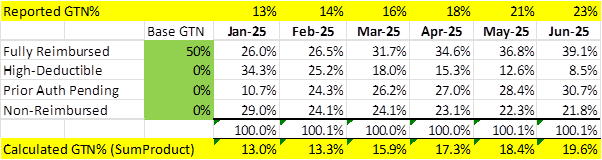

This is just a start in re-understanding BOT…

I am starting with understanding GTN both % and $. I think we can learn something useful from yesterdays presentation about this, unlike the other important disappointment regarding patient and prescription numbers which has a lot of fog to lift.

So what is the Gross Sales per script.

Matt had indicated that the Gross sale price was between US$500 and US$1,000 but closer to US$1,000. So US$750 to US$1,000

Based on the presentation the Gross Sales per customer is US$975, this is an average but one with very little variability – suspicious? maybe, or just a fact from initial launch and single distribution channel (welcome input on how these prices are agreed with insurers from anyone who knows, or there is something wrong with my calc).

So what is the GTN% profile and likely Net.

Initially Investors were told to expect approximately US$450 per prescription as net revenue. This was talked back recently to US$400, but analyst EUROZ still had the US$450 per prescription back in May.

Assuming they knew the gross price of US$975 at the time (which is reasonable given insurer negotiations were mostly done), that would be an average GTN% of 46.2% at US$450 net sales. They would have taken into account some element of deductibles would eat into a fully reimbursed margin, so we can probably assume that Fully Reimbursed GTN% is over 46.2%.

The subsequent talk down to US$400 (41.0% GTN), was probably in response to early indication on higher deductible impact and the sales approach effect of Non-Reimbursed sales or sales prior to authorisation ending up not being authorised.

The presentation sets out the types of reimbursement status that impact GTN. It also shows the weight but not what the GTN% of each group was. So here is my attempt to unravel the confusion on what each group represents in terms of GTN:

Full Reimbursed Units: These are full margin, highest GTN% sales which should only be offset by patient rebates (co-pay coverage), which on slide 10 is 50%. I am assuming the “Managed Care Rebates” of 21% are not included or any wholesale costs due to cutting that out. So may be 50% GTN% for these sales.

High-Deductible Units: BOT will cover the deductible for patients, which added to the other out of pocket coverage is the total price. Hence, I expect these are all 0% GTN%

PA Pending Units: This is messy, BOT would get nothing until they receive authorization, which they say 70% get approved, so 30% they get nothing ever and presumably stop (or become non-reimbursed). The rest may start to be reimbursable later, I assume those issued prior to authorisation don’t get reimbursed later. So at best they get 70% of the Full Reimbursed, but with a delayed – so I don’t think we see revenue until later and at a lower average GTN%.

Non-Reimbursed Units: They should just call these “Free Samples”…

So let’s assume a 50% GTN% for only Fully Reimbursed and zero for everything else and see how it lines up with the reported GTN%. Below you will see it starts on the money but a gap opens up to be 3-4% low by June.

So I played around with the % for Prior Authorisation Pending and delayed the impact by a few months and got a good fit at 2 months delay and average GTN% of 20%.

While not conclusive, it indicates to me that the GTN% for Fully Reimbursed sales is likely around 50% (from both this calc and the inference from the US$450 expected net on extrapolated gross US$975).

Given it is very early days, I think we can expect the weight of PA Pending and Non-Reimbursed to drop steadily as a total %, also the High deductible will be seasonal. So GTN% should improve, but how quickly and to what steady state I am unsure. To get to a US$400 net per script, they would need to get to an average of just over 80% of scripts being Fully Reimbursed as an example.

Conclusion

1. I am comfortable that GTN% will improve steadily, the rate of growth in patients will impact this significantly. Faster growth will hold GTN% back given the low base, but as the patient base matures we will see much higher Fully Reimbursed % and so higher GTN%

2. A 50% GTN% for Fully Reimbursed scrips seems to be reasonable given the current distribution model. Hence this is a cap, but a high cap, so we may see 30-40% GTN% in the next year, but over 40% will be a way off and challenging.

3. It is also clear that as much as we as investors are struggling to understand the economics of the business, those in the company are also challenged…

Disc: I own RL+SM

Sums it up this was chaotic and 50% falls doesn’t make sense. Oversold territory.

https://stocksdownunder.com/botanix-pharmaceuticals-asxbot-crash/

The language of this is interesting and positive sounding ...

Discl: Held IRL and in SM

Some research from via the IHHS, FWIW. Nb: I am yet to read all links, myself.

From the IHHS website: https://www.sweathelp.org/home/news-blog/562-pearls-from-the-latest-hyperhidrosis-research.html

Hot Topics in 2025: Summer School Is in Session!

School’s out, but we’re still hitting the science pages! Consider this your hyperhidrosis journal club—bringing you pearls from the latest published research on hyperhidrosis.

Sofdra™

So far this year, key articles have been published in medical journals about the newest hyperhidrosis treatment on the market: Sofdra—a topical gel also known as sofpironium bromide.

Importantly, three of our co-founders and members of the Board of Directors published pooled safety and efficacy data on Sofdra in the Journal of the American Academy of Dermatology, based on two randomized, double-blind, controlled clinical trials. The combined trials included 353 people in the treatment groups and 348 in the control (placebo) groups. Patients as young as nine years old participated, but most were adults who had suffered from underarm excessive sweating for about 14 years. Analysis of the combined results, say the authors, shows “statistically significant and clinically meaningful” improvements in underarm excessive sweating (primary axillary hyperhidrosis) from Sofdra treatment, based on both patient-reported outcomes and objective sweat measurements.

Using a recognized scale for measuring excessive sweating severity (the Hyperhidrosis Disease Severity Scale), the data shows that more than 56% of patients had a 2-point improvement in their underarm sweating severity when using Sofdra, compared to 37% using the placebo. In terms of measured sweat volume (how much sweat output a person had), patients using Sofdra experienced a 138mg decrease in sweating, while those using the placebo decreased their sweating by 114mg. The authors note that, while the placebo (a gel without Sofdra’s active ingredient) gave patients some results in terms of patient-reported outcomes and reduced sweating, this was expected because the gel “has emollient properties and can affect skin function. Additionally, patients with hyperhidrosis experience anxiety about their sweating, and this anxiety could trigger further sweating whereas the hope of receiving treatment could reduce anxiety and anxiety-produced sweating.”

No serious side effects from Sofdra were reported. The most common side effects were dry mouth, underarm pain, blurred vision, dilated pupils of the eyes, underarm redness, and swelling and irritation of underarm skin.

In other Sofdra news, in a letter to the editors of the journal Annals of Medicine and Surgery, eight authors reiterate the usefulness of Sofdra to treat underarm excessive sweating noting its targeted nature (localized to the skin of the underarms), its effectiveness, and its more limited side effects (as compared to those of oral medications.) Their call to action is that more people should be made aware of this treatment option and that it should be made more affordable and accessible. Cost effectiveness studies of Sofdra compared to other treatments, they say, could be especially helpful.

Apparently (according to The Australian) US Investment Bank HC Wainwright, have initiated coverage of $BOT at $2.00.

HC Wainwright are a leading deal maker in the US in the small and mid-cap space, however, their SP recommendations have a reputation for being aggressive. Biotech is one of their focused sectors. Take from that what you will.

(Patiently waiting for the next sales update...)

Disc: Held

Botanix Signs Debt Facility with Kreos Capital

Key highlights

• Botanix has worked with Kreos Capital to establish a ~A$48 million (US$30 million) debt facility

• The new debt facility will be available to Botanix for working capital purposes for the

commercialisation of Sofdra™, as well as other platform expansion opportunities

• Following the recent A$40M capital raising and cash on hand at the end of the last quarter

(~A$28M)

So now there will be no need for a credit raising and therefore no dilution to existing shareholders, but it also means that Botanix must be moving a reasonable amount of stock as Kreos would have had a look at the books and liked what they saw.

Im not sure if this update from Simply Wall St has had an effect on BOT share price today. Down circa 5% this morning.

I can't see any further detail on the reasoning.

"$BOT today announced that Mr Matthew Callahan has stepped down as a Director, effective immediately, to attend to a medical issue. The Board thanks Matt for his significant contributions to the Company’s evolution to date. Botanix is now a well-resourced, sustainable and rapidly growing commercial organization. We wish him a very speedy recovery, and both the Board and Matt look forward to his return."

This is sad news. @Strawman, Matt's been generous giving us his time over the last couple of years. If you have his email, perhaps consider wishing him all the best from the Community?

As I expected. here's the full text. They'll try and argue that the same product is not available elsewhere. We'll need to see the text of the EO to see if that cuts it!

Botanix responds to US pharmaceutical pricing announcement

Philadelphia PA and Phoenix AZ 12 May 2025:

Clinical dermatology company, Botanix Pharmaceuticals Ltd (ASX: BOT, “Botanix” or “the Company”), is responding to the reported announcement by President Trump on Telegram of a proposed executive order in relation to “Prescription Drug and Pharmaceutical Prices” (“US Announcement”).

Botanix is aware from the US Announcement that Mr Trump is proposing to issue an executive order that is focused on reducing costs of pharmaceuticals by instituting a “most favored nation’s policy” whereby the US will pay the same price as the nation that pays the lowest price for a drug, anywhere in the world.

Botanix obviously has not seen the executive order the subject of the US Announcement, but based on the information in the US Announcement makes the following comments:

• SofdraTM (sofpironium) topical gel, 12.45% is only approved in the USA and is not marketed in any other jurisdiction worldwide by Botanix or any other party;

• EcclockTM gel 5% is a product that contains sofpironium bromide which is marketed in Japan by Botanix’s partner, Kaken Pharmaceutical Company, however it is a different concentration and formulation than Sofdra, and was tested in different clinical studies and populations than Sofdra; and

• Neither Ecclock nor any other 5% concentration of sofpironium bromide gel are approved for sale in the USA and Sofdra is also not approved for sale in Japan.

Based on the limited information currently available in relation to the US Announcement and in light of the above, Botanix does not consider that it is likely that it will be subject to price reductions based on sales of Sofdra outside the USA, as there are none. Botanix will review the proposed executive order when it becomes available.

Release authorised by Vince Ippolito Executive Chairman

BOT is down 16% this morning. Seems as though the following breaking news is the issue:

Trump Seeks to Align US Drug Costs With Cheapest Ones Abroad

Looks like Howy's bus to Rortsville has just got a puncture. Will take some time to figure out what are the implications of all this, but not good news for BOT, NEU and thousands of other US sales dependent drug companies.

Some notes below on competitor products to Sofdra, potentially good options, but look to most likely be limited by insurance coverage due to being classed as cosmetic treatments and also requiring repeat dermatologist trips for application.

Not Thesis breakers but I don't want to see anything coming up that will be nibbling away at the patient base with a more accessible, more effective solution.

- Brella Sweat Patch

This is being put out by a private entity (CANDESANT)so not too much data on it, they raised $35m USD in funding to advance commercialisation in 2023, requires a Dermatologist trip and looks to cost about $350-550 USD to have it done, results similar to botox and is good for about 3-4 months. Considered cosmetic so limited insurance coverage.

How it works:

The Brella SweatControl Patch consists of a sodium sheet with an adhesive backing. When the Patch is applied to the underarm, the sodium comes in contact with the water in your sweat, generating heat. The heat precisely targets your underarm sweat glands to significantly reduce sweat production.

Pros:

- lasts quite a long time as does underarm botox

- don't have to apply it every day

- side affect profile minimal

Cons:

- Expensive every 3-4 months

- Requires a dermatologist office trip each time

- early stages of commercialisation, so note widely available yet.

https://www.mybrella.com/

2: Dermata Xyngari with Daxxify

Dermata have a sponge type material of sorts (Xyngari) which when applied to the skin creates microchannels where whatever the sponge is infused with can go through the top layer (very rough explanation)

They think they can use this with a brand of Botox (Daxxify) for mostly a pain free botox application to the underarms to treat hyperhidrosis. The botox trial for HH have good results but the cost and pain is an issue. Daxxify is a bit more expensive than normal botox but lasts a bit longer.

Dermata are listed NASDAQ: DRMA, tiny market cap.

https://www.dermatarx.com/new-index

They are doing a phase 2A trial, referenced in the link below from Jan 2025.

https://ir.dermatarx.com/news-events/press-releases/detail/75/dermata-and-revance-enter-clinical-trial-collaboration.

Pros:

- lasts as long as normal botox potentially a bit longer

- mostly pain-free application

Cons:

Similar to above, most likely cost and repeated doctor office trips + yet to be commercialised. Assuming phase 2 and 3 trial this could still take a while.

The Dermata offering is interesting by itself but then again if it was going to shoot the lights out for HH one would expect the Brella sweat patch to already be making waves.

The pipeline they have in general is interesting as the Xyngari applicator appears to be effective for multiple things, the HH application looks like a small side effort compared to the other options they are looking at.

Good discussion with Matt just now, which I think clarified a few points which will help us all interpret the newsflow and data over the coming months and reporting periods.

- The target derm market is the 4,000-5,000 medico-derms, and within this they'll focus on the high prescribers. (Implication: so let's not do any modelling based on 11,000-12,000)

- Pure telehealth remains an unknown as to its relative performance, so over future reports I'll be listening carefully to what they are learning. This is really important for future growth, because if the platform is successful, it is an easy route to add value to already commercialised products.

- The early trends are continuing, but don't over-react to indidividual weeks that fall below this trend. Afterall we've already seen on in the initial results (the week of a major dermatology conference).

- Net revenue per refill sounding more like US$400, than US$450 which most are modelling. Possibly due to higher co-pay requirements driven by the requirements of inidividual patients plans.

- Refills at 6-11 p.a. dramatically reduce the number of patients to hit US$100m FY26 sales, versus analyst forecasts and industry normal (1.8 refills). Basically, as other here have modelled, if they continue to add c, 2,000 new patient per month at close to 100% refill rate, there is a LOT of revenue upside. Apart from doing "what ifs" it is too early to narrow the uncertainty, but that's what we have to track in future reports.

- Management and Board pretty much 100% focused at this time on Sofdra. If we see the SP start to recognise a materially higher potential FY26, then entirely possible that they exploit an opportunity to get more capital, to licence in new products, although I note that they favour back-ended deals and are willing to use debt, reserving cash to invest in Sofdra growth.

Everything else pretty consistent with what they've said before, and Matt understandably being very careful not to make new disclosures outside of a proper market release.

So far, $BOT is executing well.

Disc: Held

Matt Callahan on Euroz Hartleys, finding the front Podcast, 28th March 2025.

Bear in mind that this is a Euroz Hartleys sales job. At the same time, it does give some depth to Matts history. His resume does sound extensive.

BOT doesnt come up till approximately 1:06 and does not go very deep on BOT, however worth a listen for a bit of depth on the Matt Callahan story, ahead of his upcoming Strawman interview.

For this brand new episode of Finding the Front we are so fortunate to have biotech and life sciences veteran Matt Callahan on the show. Matt is a Philadelphia based, Australian born life sciences entrepreneur, with a track record of building and exiting numerous life sciences companies in pain, oncology, dermatology, cell therapies, animal health and regenerative medicine.

He starts the show off on the front foot answering the question of Donald Trumps impact going forward on the US Biotech and Life Science sector showcasing his thoughts for aspiring investors.

Matt has accumulated 25 years legal, life sciences, IP and investment management experience and is Founder and Executive Director of ASX listed Botanix Pharmaceuticals, Co-founder and Director of Respirion Pharmaceuticals Pty Ltd and was also a Co-founder of life science companies Dimerix Bioscience Ltd, Mirata Pharmaceuticals LLC and Orthocell Ltd, as well as the Bill Gates backed climate tech company, Rumin8 Pty Ltd.

Matt is such a great communicator and provides some deep insights into being an entrepreneur, the world of life sciences, FDA approval, the phases of a company and distribution. This really is a captivating chat.

Following on from the Cap raise and launch data released below is some Analysis of the path to $200mUSD Annual Revenue,

- Week on Week patient number growth is going at approx 13%, only a small data set

- New prescribers growing well forming a strong base, quick google search shows it looks safe to assume there are at least 10,000 dermatologists active in the US so there should be decent growth in individual prescribers to come.

- Addition of 20% extra sales staff to drive dermatologist adoption.

There is still a pretty wide window for where this can land, the questions to try and answer are:

- How long can they sustain WoW patient growth? This is currrently 2,280 new patients per month as of the 1st week of April.

- Assuming no Bolas affect here and continuing at a WoW growth of 10% (have averaged 13% for the first 9 weeks of launch) it looks pretty safe to assume before the EoFY we could be tracking at new patients per week of 1000 or equivalent to 4,380 / month. If the new sales staff increase uptake this could happen a bit quicker. (10% WoW growth would have this happening end of May)

Weekly New patients acquired:

- If we were to get to this rate of approx 4,300 new patients per month running for 12 months through the next FY with patients already acquired or expected to in this FY this would land at $200m USD revenue for the coming FY.

- This is not factoring in any benefit from the digital campaign and assuming no further growth in user acquisitions per month once we reach that 4300 / month mark.

- Refills are noted as 100% but this most likely will reduce down as we have discussed previously but it sounds like the onus is on the user to cancel rather than to keep them coming. Also a note from the webinar, when the patient is coming up to the end of the 12month mark, SendRX contact the prescribing dermatologist to reming them to arrange for another appointment and renew the scripts, It wasn't mentioned in the webinar but I suppose they could possibly be directed to the telehealth avenue at this point as well.

The target market from the slides was noted to be 3,700,000 patients that have already sought help from a Dermatologist.

- 61,800 concurrent users would give 1.7% market penetration

- As a side note if that level of users was hit from end of next FY, the forward looking revenue assuming no churn issues and not factoring additonal users would be tracking for $333m USD

Table below shows monthly users acquired and cumulative monthly users --> sales.

New users capped at 4380 to factor in any churn and to assume a safe peak monthly acquisition rate.

The Wildcards:

- Acquiring any % of the 6.3m people with HH that have not sought help through a dermatologist

- any small% of these users is a huge benefit to the revenue stream and not accounted for in the figures above.

- Off-label prescription

- Qbrexza has some talk online about have being prescribed off label, hands, feet, groin, head, any off label prescriptions for Sofdra are a benefit that hasn't been factored into the forecast sales, the mechanism is largely the same and some affect should be seen in these areas. There was a question in the Cap raise webinar about if this could potentially be suitable for menopausal women experiencing sweating issues.

$200m USD annual revenue would be inline with the FY2028 forecast from Euroz below and would imply 143m AUD profit. 143, with 1,950m SOI --> 7.3C EPS. pick a PE for final SP.

The Euroz 2029 Operating income of $134m USD --> 206.7m AUD would be approx 10.6c EPS to follow conservatively the year after on similar growth rates the FY2030 or 2031 could be achievable.

Still a wide range for where this can land sales wise but extrapolating out the early numbers and plotting out what looks to be conservative monthly customer acquisitions I will be watching this closely and updating the numbers and trajectory as the data keeps coming. Very encouraged by the early data and to see what the digital channel does once fully activated.

Any input welcome as always, still a shame the launch slipped a few months but good to see it is finally happening with positive signs.

Disc: Held IRL and SM

Might be cleaner in a new straw rather than the cap raise one.

Interesting, especially with the digital not really turned on.

If they can add 100 people per month (seems doable based on the small data sample) and with that data so far being derms only.

On track for rolling annual revenue of $200mUSD by June, at the current run rate $129m USD earnings for FY25/26.

Interesting to see how much this $40 raise can amplify sales when they fine tune the platform.

Didn't pick up anything that turned me off in the webinar, looks like an experience team doing what needs to be done

Although I am still shitty the launch timing was slow and interesting to hear the digital hasn't really started even though it was in for start of March. Or did I not hear that correctly.

BOT | Investor Webinar

Tuesday 15 April at 11am AEST / 9am AWST

https://investorpa.com/announcement-pdf/20250415/127442.pdf

They don't give much notice, but there you go.

Mix are the agency charged with hiring the BOT sales team. It appears BOT are adding extra staff over and above those hired earlier this year.

https://www.linkedin.com/in/cassie-vick-9219859/recent-activity/all/

From Linkedin:

"We hired outstanding talent for the Botanix sales team, including some of the

most credentialed individuals in dermatology, with 79 President Club wins

between them. "In only two months, they have shown the impact a highly motivated team can make