Just wanted to update my previous model based on the most recent 4C data to confirm what at first glance looked ugly.

Despite the confusing change in metrics I have come up with the following, could be right or wrong..

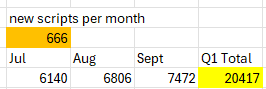

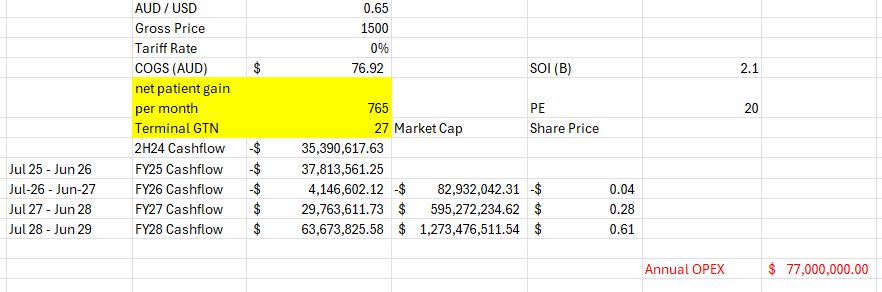

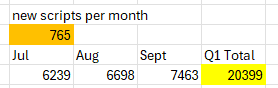

From the 4C, There were 20417 total units shipped in Q1,

** only thing that may skew this is August potentially was low due to the holidays or whatever goes on over there, the pharma data on HC seemed to support this from the bloomberg terminal or where ever it comes from, this is possibly what got it pumped down to 10c recently.

** In the below table:

-- Yellow, total units shipped,

-- July units = historical June units (which they gave previously of 5474 or thereabouts) + X

-- August = July + X

-- Sept = Aug + X

Goal seek X for when Q1 Total = 20417: 666 net additions per month.

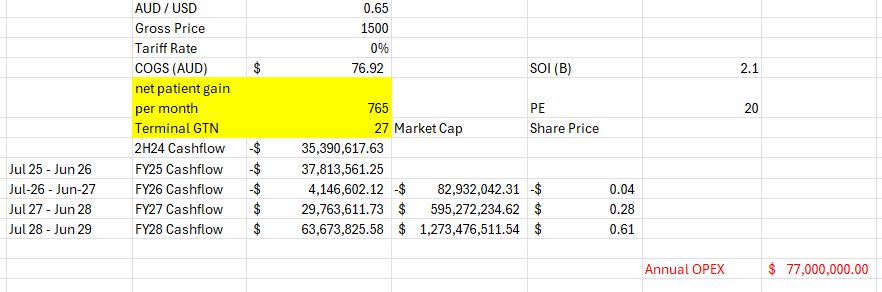

Previous posts I was thinking that 1000 / month would be a good base with increased sales force / prescriber productivity etc but missed this by 40% and also the GTN is in the shocker.

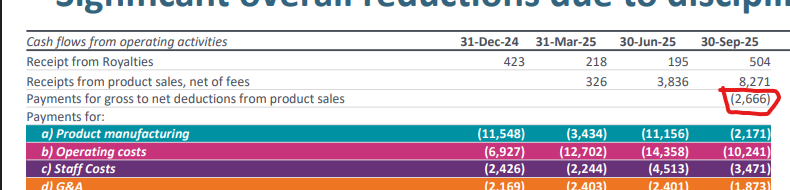

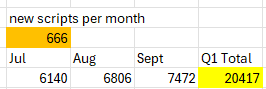

Also this little expense line has been fleshed out of somewhere, not sure what it fell under previously but makes the net revenue $5.6m?

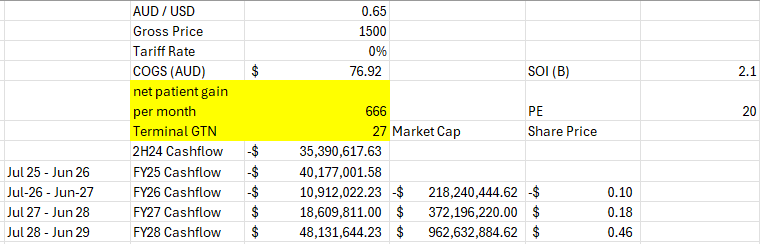

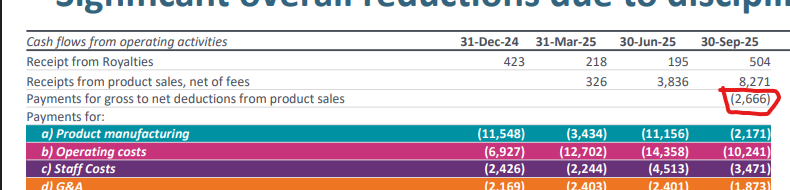

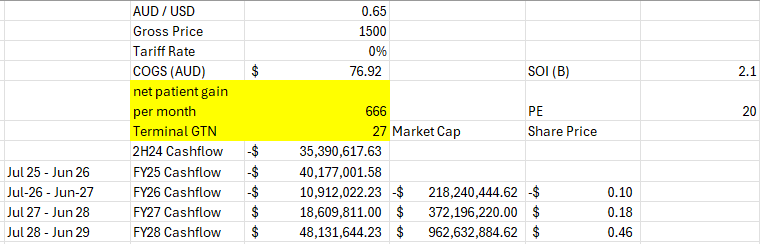

anyway, based on the old model with updated numbers...

COGS I possibly have low at 77 / unit AUD but who knows with what they are reporting.

no COGS until Jan 2026.

-40m loss this FY probably more if winter and high deductible season hit hard.

-11m loss the following year

maybe an 18m profit the year after before tax.

I guess there is a chance the new reps get some growth firing but that net patient gain I have deduced from the numbers provided is ugly to me as is the GTN. my theory about the GTN and PA units must have been incorrect.

Hard to figure it out when they have taken away the script breakdown between free, reimbursed, PA etc.

again that was the only red flag I needed this morning to unload what I had left, they changed the metrics because if it actually is 666 per month average net patient gain of the quarter it stinks more than the tales of $400-450 USD Net / unit.

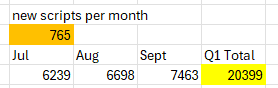

As a side note, suppose August was a shitter of a month due to holidays etc

If I set August in the previous table to be 60% of the scrips added in July and then goal seek for scripts / month, brings the average up to 765 but with a pretty average August.

Still makes for ugly reading considering where it was hoped to be going.

hope it makes sense, can't see too many positives after having looked a bit deeper.

Maybe my OPEX is a bit high, but the COGS is murky at best to me

Maybe my GTN at 27% is a bit low, but its really flattening out month by month

As always any comments welcome hope this may be of use to anyone still holding and on the fence, to me there are much better options out there than to wait and see if they can do it because the performance so far has been underwhelming.