Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

While several of us in the community are still traumatised by the June "Nightmare on ..." it is worth bracing ourselves for what I expect to be a $BOT Trading Update next week, ahead of the 4C towards the end of the month.

@jcmleng covered the August Canaccord Genuity Conference, and I thought as part of my own preparation, I'd share some extracts from the Canaccord Genuity Analyst Report following that conference (published 1 September 2025, but I've only read it today).

While the presentation gave no new disclosures, which was also the case at the more recent Wainwright Investment Conference (in early September), there was a "fireside chat" format, and so some insights were gleaned from that, which I've highlighted in bold below.

TLDR: I am reasonably aligned with CG. Their valuation of $0.27 compares with mine of $0.35, and I believe the depressed SP at the moment reflects a loss of trust, so that void left by shareholders who fled with their "night terrors" was not been replaced with new believers. If the next update is half decent on scripts, GTN, and revenue, that could be a significant step towards rehabilitation.

Extracts from Canaccord Genity Report (1/9/25)

Summary

"We maintain our BUY rating and $0.27 PT on Botanix Pharmaceuticals. BOT remains in a holding pattern as investors wait to re-establish trust with the expectations around Sofdra traction, particularly as it relates to script volume and gross-to-net yield improvements. We would caution investors not to place too much focus on single data points, however. Our fireside chat with management at Canaccord Genuity's 45th Annual Boston Growth Conference suggested to us that the 30 sales reps now in field are continuing to convert patients at the expected rate. We have therefore maintained our script volume growth and assess the ability for Botanix to meet these numbers as reasonable. There are calculable reasons as to why the gross-to-net yield can sit at ~25-30% within a ~18-month time frame; we have moderated this over FY26e and FY27e to 26-32% (from 29-33%) to reflect this. We view revenue expectations being met through either volume growth or gross-to-net improvement as alternate commercial strategies, rather than preferring either one - with the caveat that we expect profitability to rema intact for 2Q27e. We, and the market, keenly await a trading update in October."

"FY25 summary. Revenue: Total revenue of A$5.8m was largely pre-reported, noting ~A $5.0m directly relates to sales of Sofdra in the US (the remaining attributed to royalties from Ecclock sales in Japan). Sofdra sales reflected ~16,689 total prescriptions (TRx) sold since Jan-25. At a gross price of ~A$1,500 per script (per month), gross revenue sits at A$25.2m, reflecting ~20% average gross-to-net yield across the period. OpEx and earnings: Total OpEx of A$94.1m was 10% ahead of forecasts (CGe: A$85.6m), noting cash OpEx (excl. SBPs) of A$73.5m was only ~4.9% ahead of forecasts (CGe: A$70.8m). Loss from operations therefore sat at A$86.4m (CGe: A$83.4m, -3.5%). Cashflow: operating cash outflow of A$78.6m was driven by a large WC outflow for inventory build (~A$27m) as well as inflows related to R&D tax incentive (A$1.5m) and interest income (A$1.9m) sitting ~$4m ahead of forecasts (CGe: A$82.6m outflow). As reported in the 4C, Botanix closed FY25 with $65.0m in cash, having raised $40m in equity in April-25 and established a US$30m (A$48m) debt facility with Kreos Capital, of which A$31m was drawn down."

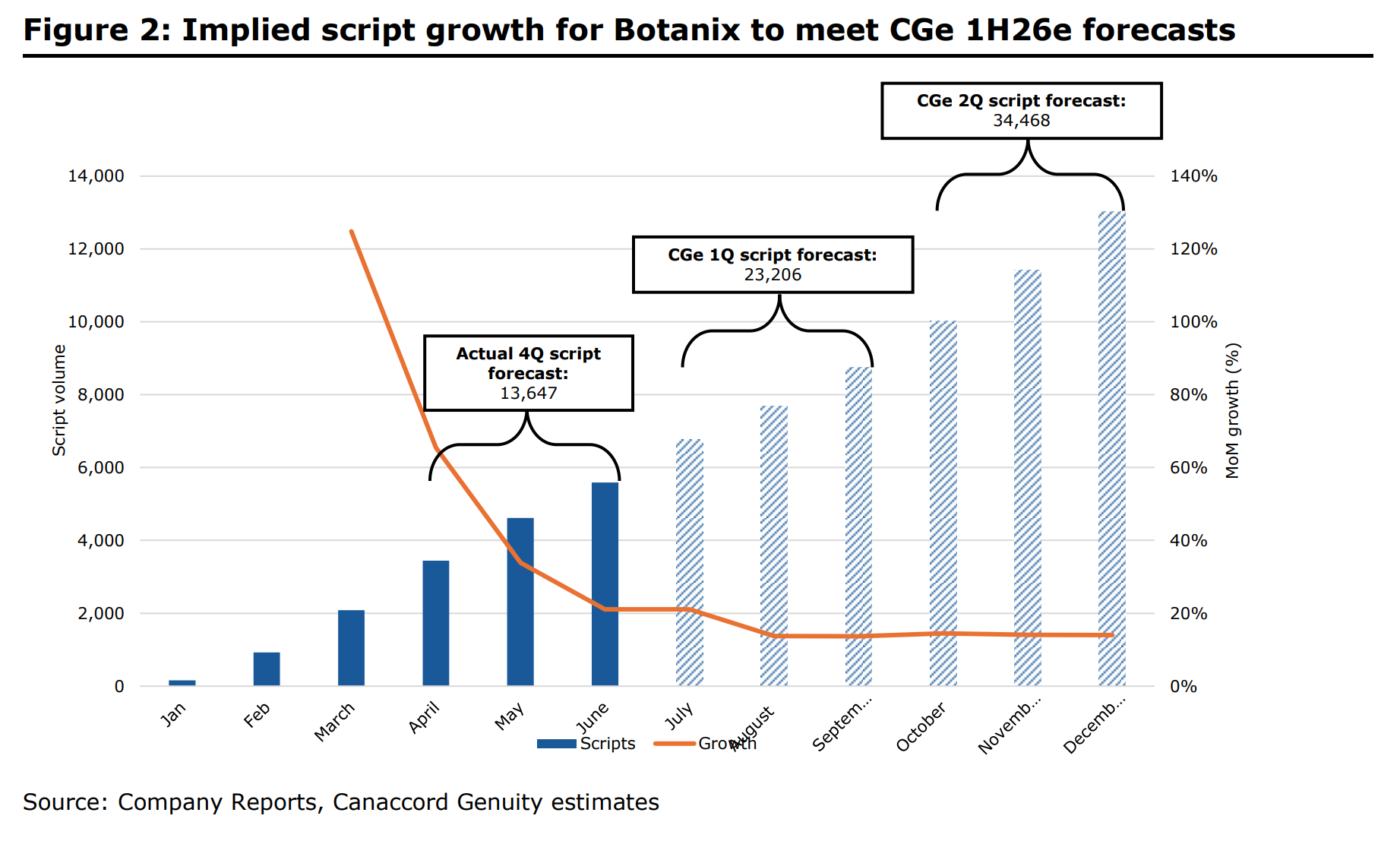

"Forecasts and outlook. Our main model adjustments include: a) moderating GTN yield in FY26e from 29% to 26% (A$6m topline), b) adjusting expenses, accounting for a larger SBP expense, c) inventory (noting no inventory build is expected in 1H26e), d) removal of additional debt drawdown. We see the next two quarters as paramount to Botanix reestablishing trust with the market. We expect Botanix to provide a 1Q trading update in Oct-25. For context, we forecast 1H26e net revenue of A$23.2m. The A$23.2m is predicated on two factors: 1) on the basis that June-July growth is the same as May-June growth (~21%); we forecast ~14% MoM growth in script volumes is required to reach our 1H26e number which needs to be coupled with... 2) an improvement in gross-to-net yield. As a reminder, as of June, GTN yield sat at 23%; we need to see GTN head ≥26% (remember 2H of a CY is a stronger GTN period). "

"Valuation. Our diluted 12-month price target of $0.27 is informed by our DCF model (WACC: 10.3%, Tg: 2.5%) and cross-checked against ASX-listed and global comps (median FY+1 EV/Rev: 3.2x), as well as dermatology deal values (median EV/Rev multiple: 3.4x), which sits broadly in line (4.0x) based on FY27e CGe net revenue: A$140m. More importantly, across the forecast period (FY26-FY28e), we believe Botanix has the capacity to build into a peer comparable EV/EBITDA multiple of 8.0-11.0x, with our PT in line with FY28e EV/EBITDA at 7.5x."

My Assessment

Who knows what 1Q revenue will look like, as multiple factors are at play:

1) seasonality (+ or -)

2) evolution of GTN (+)

3) maturing market penetration (-) and

4) expanding sales force and territories (+)

5) increasing prescriber experience in prescribing ... initial cohort entering their second 6-month period. (likely + but could be -)

Revenue is the key unknown, because costs are controllable and management have demonstrated that they know they have to show an improved control of expenses.

I think the CG numbers above are a good reference to check 1Q against. They could be a little bullish, because of the delay in getting new reps up to speed, but as I've shown above that is only one of several factors.

In my assessment, there is a significant margin of safety between today's SP and any reasonable valuation on fundamentals. The discount is really a management credibility one, and as CG state, $BOT will need two solid quarters of execution to start to repair that.

When we get the next management briefing, I will be very interested to hear about the prescribing behaviour in the more established accounts. How that trends will be an important indicator of where we end up in terms of revenue plateau.

At the start of the year, I followed the Chairman by selling 25% of my RL holding at $0.465 (and sold some in SM too). At the time, I feared I was being a wally, given my valuation at the time. But I was unnerved by Vince's sale. It turns out that was a good decision (for Vince and me!)

But in recent weeks, when the SP hit $0.125, I bought those shares back in RL (and also added again in SM) because things would have to go really badly for the business to have that value. Unfortunately, in that case I was on my own with the Directors and Insiders not sharing my enthusiasm.

Management have been very tight-lipped during the last Q. Maybe they were rightly beaten up for all the loose talk early in the year about revenue expectations for FY26, and perhaps the Board resolved "Shut the f*** up and let the results do the talking."

Well, not long until we see what the revenue trajectory is looking like.

(I have to remind myself that I'm sweating more not because I need the product, but because its just warming up in QLD as we head towards the Summer.)

Disc: Held in RL and SM

$BOT held a short 4C-focused webinar, keeping strictly to reporting on the quarter.

There were really four big takeaways for me:

Sales and Marketing

The expansion of the Sales Force from 27 to 33 and then 50 (+17 training in 1Q FY26, selling from 2Q FY26), reps is being funded through a reallocation of the overall sales and marketing budget (whatever that was). So management are saying that it isn't leading to a net cost increase.

As I have commented earlier, Howie reiterated that this is rational resource allocation, given how easy it is proving to "activate" physicans. He said that adding more reps is going to be the fastest way to get to breakeven, so they're doing that.

We also said that the digital channel is working, but by inference, achieves a low ROI.

So, they are working as fast as they can to reach all (or 90%) of the 4,000 - 5,000 prescribinbg Derms.

In terms of my valuation, that a positive, as it means I might be able to dial back the high-cost sensitivities I ran. (I will look at that later today, once I've gone through the 4C).

Cash Burn Will Stablise Quickly

In addition to reallocating funds within the sales and marketing budget, the made a big splash in 4Q on buying enought active agent (API) to support iunventory for 1H FY26. In fact, I think they said they won't be buying an more API in 1K FY26. That will help stablise cash outflows for the next two quarters, all the while we'll see cash receipts ramping quickly.

They have the Cash to Get to Breakeven and Won't need to Raise Capital

Vince put the CFO on the spot to answer that question. The CFO was careful with his words and didn't say they won't raise capital, but implied they wouldn't "if they hit their revenue targets".

I mean, what else can a CFO say. He's the numbers guy and clearly they have a set of revenue and cost budgets that get them to profitability without further capital. But he doesn't control the operation or the revenue, so I guess a cautious CFO would only be able to say what he said. That's as good as we can hope for.

100% Focus on Sofdra

There were clearly questions about development of other products and licensing. Vince made it clear that spending on other product development is on ice, and that there is some BD on prospecting for products to license in. But he made it clear that management's sole focus is making a success of Sofdra and getting to profitability. Good.

Conclusion

Happy with my analysis last week and over the weekend on this one, and I think this investment now just needs patience so that over each quarter we can see how scripts and GTN trend. These guys seem to have the cost side of the equation under control, and they are clearly focused on wanting to get to profitability as soon as possible.

Reaffirming my HOLD decision from last week.

Disc: Held in RL and SM

In this Straw I set out details of the valuation I posted last night. I know Monday's webinar may well quickly date what I write here. However, it is a line in the sand because it sets out the basis for why I continue to HOLD $BOT. And that was a decision I needed to take today. If Monday brings new information, so be it.

SUMMARY

This Straw presents a valuation analysis of Botanix Pharmaceuticals ($BOT) based on the first six months of SOFDRA sales. Using updated data from the 8th July 2025 company webinar (The “Nightmare on Hyperhidrosis Street”), I built a scenario-based revenue model projecting to FY28 and applied forward P/E multiples to derive a valuation discounted to FY25.

Key components of the model include:

- Market Penetration: Three uptake scenarios (70%, 85%, 100%) based on prescribing dermatologist adoption over 24 months, with consideration of potential GP involvement and expansion of the specialist base over time.

- Refill Dynamics: Volume driven by average new scripts per prescriber and monthly patient churn. Churn is conservatively set at 18.5%, with sensitivities at 16% and 20%.

- Gross-to-Net Revenue: Gross sales per refill is AUD 1,500. A gross-to-net (GTN) ratio of 32% is assumed on average, reflecting early-year deductible effects and expected improvements in reimbursement management.

- Cost Structure:

- Sales & Marketing: Based on sales force headcount and dermatology industry benchmarks (AUD 462k per rep), with sensitivities up to AUD 20 million additional spend.

- COGS: Assumed at 7% of gross refill revenue.

- Other Expenses: Adjusted from the FY25 interim results, net of sales and marketing.

Twelve scenarios are modelled, combining varying assumptions for prescriber activity, churn, GTN, and S&M cost. The base case (P/E = 25) yields a valuation range of $0.22–$0.90, with a central (p50) estimate of $0.35. Even in worst-case scenarios, valuations remain above the current share price of $0.16- $0.18.

Using an alternative methd of applying an M&A revenue multiple of 5x FY28 revenues and discounting back yields valuations of $0.24 to $0.42. (Average is $0.33)

I conclude that despite recent market pessimism, SOFDRA retains strong risk-reward potential, and management has a reasonable timeframe to demonstrate longer-term value generation through platform exploitation and licensing.

INTRODUCTION

My basic approach is to model scenarios for revenue to the end of FY28, estimate the NPAT at that stage and apply a range of P/E ratios at that point, discounting back to end of FY25.

Revenues are driven off modelling total refills per month, using the detailed monthly history provided in the “The Webinar” (aka “Nightmare on Hyperhidrosis Street”, 8th July).

The structure of the analysis is as follows:

1. The Revenue Model

1.1 Market Penetration

1.2 Refill Volumes

1.3 Average Number of Scripts Per Subscriber Per Month

1.4 Patient Churn

1.5 Gross to Net

1.6 So What Revenue Do I Expect

2. The Rest of the Financials – A “Ball Park” Estimate

2.1 Sales & Marketing Expense

2.2 COGS

2.3 Expenses

2.4 Getting to NPAT and EPS

3. Valuation

4. Model Outputs Discussion

4.1 Discussion

4.2 M&A Valuation

5. “A Nightmare on Hyperhidrosis Street 2 – The Revenge of the Applicator”

6. So, What About My Thesis?

------------------------------------------------------------------------------------------------------------

1. The Revenue Model

1.1 Market Penetration

The market is large with some 3.7m seeking treatment in a Dermatologists office out of an estimated market potential of 10m.

The key volume drivers are therefore:

· How many dermatologists (Derms.) are prescribing Sofdra

· Number of new scripts written per month

· How many refills each patient gets

We know there are around 4,000-5,000 Derms. who see patients with PAHh and will therefore assume 4,500 as 100% of the prescribing base.

The market penetration scenario assumptions are:

· Maximum penetration achieved over 24 months

· Penetrations of 70%, 85% and 100% modelled.

This is justified because very rapid penetration (51%) was achieved inless than 6 months. However, ultimate penetrations of 70%, 85% and 100% might at first glance appear unreasonably high. However, there are three further factors to consider:

First, the actual Derm base is 10,000-12,000, so if the product gains market acceptance, there is the possibility that the specialist prescribing base expands.

Second, the experience for the other anticholinergic in the market (Qbrexa) is that over time, some GPs will prescribe refills, or potentially write a script for a patient who has tried the drug but them come off it (for example, at first they couldn’t get the health fund to pay). Apparently, this has been written as acceptable by some health funds (Note: verification of this is required.)

Finally, the upside case (100% of 4,500) also allows for the potential that there are actually 5,000 prescribing dermatologists to begin with.

In short, while 100% penetration is unlikely, there is the potential for the prescriber base to grow over time.

A peak in number of prescribers is assumed to occur in 24 months from launch. The three modelled uptake scenarios are shown below. These scenarios are consistent with the observed fact that in the US dermatology treatments tend to reach plateau sales in the 3rd year.

Exhibit 1: Modelled Prescriber Uptake Scenarios

1.2 Refill volumes

Scenarios are generated for the number of refills issued by month. The assumptions in this model are:

· Existing patients obtain refills, subject to a Monthly Churn Rate (% Churn).

· Active Monthly Prescibers write “n” Scripts per Month

From this simple model, the number of refills in any month is simply:

TRx(n) = Total (Re)fills issued in Month “n” = TRx(n-1) . [1 - % Churn] + NRx(n)

where

NRx(n) = number of new scripts (i.e. new patients, including returning patients) written in the month.

In turn we can find NRx(n) from the Total Number of Prescribers (n) x # Scripts per Subscriber Per month.

So, we have two key variables we now have to understand:

· Number of new Scripts written on average per Prescriber

· % Monthly Churn.

I’ll next look at each of these in turn.

1.3 Average Number of Scripts Per Subscriber Per Month

Here we turn to the data from the first 6 months from The “Webinar”, and perform the analysis shown in Exhibit 2 below:

Exhibit 2: Model Calibration – New Scripts and Churn

Source: The figures in blue are from the “Webinar”.

I’ve estimated the New Scripts in each month (the Churn model is described in the next section). From this, we can calculate how many new scripts were written per Prescriber in each month.

Interestingly, the number started very high, which indicates that early prescribers might have already “warmed up” by having been engaged over the prior 3-6 months as part of the Patient Experience Program. In any event, $BOT presumably had a kernel of super-prescribers and KOLs ready to go at launch.

In previous Straws, we’ve also spoken on this forum about whether a potential “bolus effect” exists. The would be from highly motivated patients aware of the products approval and actively seeking it after launch.

So, the rapid fall-off in the Average Number of Scripts per Prescriber per Month is unsurprising. In fact, we expect it.

A source of error in this analysis is the Churn model leading to an estimate of the number of patient “Lapsing” each month. I’ve played around with different “% Churn" values, and the overall observation is robust.

Scripts per Prescriber per month falls rapidly over the first 6 months, although appear to be levelling off. This is reasonable if the initial population of "super-prescribers" gets diluted by the more general population and/or if the “bolus” effect dissipates rapidly in the early months after launch.

Now, the key question is how this number changes over time.

There is evidence from other drug launched in dermatology, that indicates that the prescribers initially prescribe at a low level, and that this grows by 2-3x over the next 12 months.

Whether this proves to be the case for SOFDRA is one of the big value drivers and uncertainties. At this stage it is unknown.

Note also that I am ignoring the prevalence of the condition at this stage. It doesn’t matter, because the results of the model represent a very low proportion of the prevalent population, so Sofdra will not be limited by the number of patients seeking treatment.

Conservatively, I have generated the following 3 scenarios, which I hold as independent to the number of prescribers:

Exhibit 3: Scenarios for New Scripts Per Subscriber Per Month

I have clearly excluded the scenario that the product “flops”, and clinicians reduce their prescribing over time. This scenario cannot be ruled out, and could occur under two situations.

· Clinical Data doesn’t support continued use (for whatever reason)

· A superior treatment emerges.

I’ve ruled out the first case because of the clinical trial data published by the JAAD, but also the experience in Japan, which showed consistent growth over the first three years in the market. While the product is only partially effective, it appears to be well tolerated and delivers a sufficient benefit to be meaningful to a reasonable proportion of patients who try it.

At this stage, it is unclear whether a superior product will emerge in the near future.

Note: This sensitivity most significantly impacts the valuation.

1.4 % Monthly Churn

The Webinar covered a lot of information about adherence and number of refills. I’ve developed a basic monthly churn model, simply because it is the easiest way to fit the data provided for the first 6 months, and then to project forward.

If 18.5% of patients churn off the drug each month and don’t return, we get the following profile:

· 3.46 total fills from February to June (i.e.2.46 refills)

· Only 11% of patients remain at the end of the first year

· 4.94 fills over the first year

The first point fits the data presented by Howie in the webinar.

On the second point, no-one knows how many patients will come back for another script at the start of the second year. However, 11% seems a conservative approach. Perhaps more will if a significant proportion of reimbursed patients perceive value from the product. So, there is a significant potential upside that I have not considered, as I am choosing a cautious approach in absence of data.

The % Monthly Churn model is flawed. For example, we know a proportion of patients are not going for auto-refills, and are maybe only trying 1 or 2 refills, before abandoning the treatment. However, I am basically comfortable with the model as a rough estimate, given that:

1. It predicts well the average number of refills for the February patients over a 5-month period

2. It aligns with managements enthusiasm that the product is performing well above the norms for dermatological products, which have of an average of 2 fills per patient (i.e., only 1 refill).

I will run two sensitivities on this parameter at % Churn levels of 16% and 20%, noting that at a 20% monthly churn, only 9% of patients are still using the product in the 12th month after first prescription.

This is an area of high uncertainty, and based on performance over the first 6 months and management’s statement about the February Scripts, there is a possible material upside risk to this factor. Rather than introduce further model complexities, this will be something to revisit over time.

1.5 Gross-To-Net (GTN)

$BOT appear to be achieving Gross Sales of AUD1,500 per refill. So with modelling the volume of scripts well-defined, the next big parameter is GTN, in order to achieve net revenue. Management believe they will ultimately achieve a GTN of 30% to 40%.

The exit rate for June was 23%, improving at about 2% per month. Given that Q1 and Q2 are the high deductible season, recovery to the mid-range seems likely.

Secondly, I expect management to tighten the copay policy in Year 2, and also for optimisation of Pre-authorisation of Scripts over time to improve GTN over time.

Analysis from studies of other drugs in sectors like derm. shows that Q1 and Q2 are typically hit by the high-deductible period, with stable revenues in Q3 and Q4,

I have therefore derived the following assumptions based on other studies (note: at this stage $BOT management haven’t said much about this):

· GTN continues to improve at 2% per month, reaching 35% by end of calendar 2025.

· Thereafter, every year, there is a Q1 hit to 72.5% of the Q4 value, and in Q2 88% of the Q4 value, with full recovery by Q3.

We don’t yet know what the Q1 and Q2 annual deductible hits will be. However, the chosen values seem reasonable given experience elsewhere.

The net effect of the 35% assumption, and the annual resets lead to an average annual GTN of 32%. (Note: this is down from my original valuation of 50% - a bit hit to value!)

I have not run any scenarios or sensitivities on GTN. Who knows, perhaps average annual GTN is only 28% or maybe it is 36% - these are now relatively small uncertainties compared with others discussed here! So, I’ll settle with 32% as a reasonably conservative but not unduly pessimistic number. Exhibit 4 shows the GTN over time.

Exhibit 4 GTN over Time

This concludes the revenue model assumptions.

1.6 So What Revenues Do I Expect

According to my model, Sofdra will generate peak revenues of anywhere between $AUD137 and AU$240m by FY28 (or US$90m – US$160m).

That’s very materially down from upside cases I was projecting of anywhere from US$200m to US$600m only a few months ago. (Sad face emoji)

Of course, it is possible that in every assumption I’ve made in this model I’ve suffer from a negative bias induced by the “Nightmare …” and there are certainly upsides I’ve chosen not to consider, particularly around GTN optimisation and, more materially, increasing prescription rates over time.

But rather than “fudge” my model, I’ll run with what it's telling me and – if warranted over time – I'll make adjustments in the light of evidence.

2. THE REST OF THE FINANCIALS

With a high range of uncertainty around the revenue model, I have kept the rest of the financial modelling simple. I’ve also not spent any time trying to get a sensible number for FY25 simply because it is a transition year, with several non-recurring factors:

· Platform build

· Launch preparation

· Onboarding of Sales and Marketing Staff

· Launch inventory build

I want to emphasise this because I will not judge this model by how well it predicts the FY25 Full Year result. I’ve spent zero effort trying to do that because it has no bearing on the company value in the medium term - even though it may well drive the market.

The major uncertainty is the spend on Sales and Marketing. So my approach here, is to take the Expenses from the 1H FY25 Accounts, back out the Sales and Marketing element, and build a simple sales and marketing cost model.

2.1 Sales and Marketing Expense

I will estimate the total Sales and Marketing Expense as follows:

S&M Expense = Sales Force Headcount x Benchmark value

This is a crude but well-established method in pharma to derive total S&M Expense from the size of the field force, with the benchmark picking up all related and overhead costs.

Reasonable benchmarks in Dermatology are anywhere from $USD 300 k per FTE to $500 k per FTE, which turns into AUD 462 k to AUD 770 k.

We know that $BOT have hired an “A” team of derma industry veterans. And “first product” businesses usually pay over the odds. This will be offset by the fact that some of the expenses covered by the benchmark are already “hidden” in other lines of the Accounts – given the AASB/IRFS model applied in Australia.

Therefore, the approach to be followed is as follows:

· Assume AUD 462 k per FTE

· Run high case sensitivities of AUD$10m, $15m, and $20m (for a 50 strong field force, these sensitivities are equivalent to AUD200k, 300k and 400k per head – so they should cover the potential outcomes).

These sensitivities are also important because we don’t know how much digital marketing spend has been thrown at the business.

Most of the platform build will be included in the 1H FY25 accounts, So we don’t need to worry about that. However, it is clear to me from the Webinar that $BOT are not yet spending big on digital marketing, and as I’ve written previously, that they are seeing the highest ROI on investing in the good old door-knocking salesforce.

Why is this the case? Well, it appears the physicians are easily “activated.” So rational resource allocation is to get your reps in front of all the 4,000-5,000 target derms. asap! Which is what management appear to be doing.

For the model, Sales and marketing is built up as follows:

· FY25: 27 Reps (FY25 is not refined as it's immaterial to valuation)

· FY26: 50 Reps

· FY27: 60 Reps – they go from 90% coverage to expand the base in targeted areas.

And so the Sales & Marketing expense then follows.

2.2 COGS

I’ve assumed a flat 7% of Gross Refill Value is assumed. i.e., 0.07 x AUD1500 = AUD105 per refill

This is on the high side to allow for Tariff impacts (assuming Tarrifs apply to COGS and not Sales!)

An error in the model is that inventory needs to be made 3-6 months ahead of sales, but this is not material given all the other assumptions, so I’ve ignore working capital.

2.3 Total Expenses

Expenses are estimated as follows:

· The expense base at 1H FY25 Accounts (4D) as starting point: AUD 32m x 2 = AUD 64m

· Strip out Sales and Marketing, so it doesn’t get double-counted: -AUD 17.7m

· Expense Base = AUD 47m + Sales and Marketing.

I’ve assumed interest is included in here, and may have under-estimated charges for the expanded debt facility.

2.4 Getting to NPAT and EPS

PBT = Net Revenue – COGS – Expenses

Tax rate assumed at 25%, as there will be benefit from carried forward tax losses.

NPAT = PBT * (1-Tax)

Shares on Issue: Management are using a fair amount of share-based compensation, so I assume 3% dilution p,a,

3. VALUATION

The model generates FY28 NPAT for 12 scenarios, combining the various factors covered.

P/E Ratio – This is the second big driver for the change to my valuation. The change in this valuation over my pervious valuation is that SOFDRA does not appear likely to be a blockbuster. It looks like it will be moderately successful and reaches maturity in FY28, and is not rolled out beyond the US. (The economics are not attractive.)

Growth from FY28 onwards will then depend on whether – over the next three years (not tomorrow!) – management can bring other undervalued dermatology drugs onto the platform.

I’m not sure they’ll succeed and so the P/E ratio scenarios I will apply in FY28 are 20, 25 and 30.

If you think $BOT is “Sofrda and done”, then eventually it will get bought out at some multiple.

So, I’ve taken FY28 EPS and discounted back for 3 years to end of FY25 at10%

Bingo.

This is still betting on management experience and skill in dermatology, and it gives them a reasonable time horizon to either do platform deals or licence in new molecules. If I didn’t believe in management, then P/E scenarios of 15 and 20 would probably be more appropriate. This risk is not explicitly modelled, but that’s because I believe management will find a way to create more value over time.

The detailed inputs and key outputs are listed in Exhibit 5.

Exhibit 5: Model Scenarios and Outputs

The table above shows the outputs from the various scenarios. I’ve not really had the time to think about the scenarios probabilistically, but if I had, the distribution of valuations would be as shown in the Exhibit 6.

Exhibit 6: $BOT Valuation Results

At my refence P/E of 25, I get a valuation range using my usual p50% (p10% - p90%) notation, of $0.35 ($0.22 - $0.90) in roundabout terms.

At my p50% level, the range generated by my P/E values (20, 25, 30) are $0.27 to $0.41

My conclusion is that the market has indeed over-reacted to the “Nightmare on Hyperhidrosis Street”. Even in my lowest case analysis, I can’t get below $0.17. And yet that’s where we are today at $0.16 to $0.18.

While my previous very bullish view on $BOT has been materially deflated (sigh), I think the market has got this one wrong. Standing here today, you’d probably need to give me $0.60-$0.70 to get me to part with my shares.

4. Discussion of Valuation and Model Outcomes

4.1 Discussion

Depending on how you compose your scenarios, you can generate either more valuation results at the low end or more at the high end of Exhibit 6.

So, picking a number is indeed a fools game. I’m not sure of the value of doing more analysis on this, simply because the spread of valuations starts squarely at today’s market price and are solidly risked to the upside. IF YOU BELIEVE MY ASSUMPTIONS.

It is true that I could easily generate valuations down to $0.10 or lower, but equally, I can easily still get valuations north of $1.00 – in both cases using reasonable assumptions.

But based on what I believe to be reasonable assumptions, I am a solid HOLD on $BOT given by 4% RL position.

4.2 M&A Valuation

If we assume that by FY27 it becomes clear that $BOT is nothing other than “US Sofdra and Done”, then it won’t make sense as an ongoing entity and will get acquired.

To test the valuation, I’ll apply a modest 5 x FY28 revenues, and discount back.

Doing this I get a range of valuations of $0.24 to $0.42. Funnily enought, the midpoint of $0.33 is eerily close to my bottom-up $0.35 p50% at P/E = 25. (Honest, I haven't had time to fudge the models!)

5. “A Nightmare on Hyperhidrosis Street 2 – The Revenge of the Applicator”

So, why another “comprehensive” webinar on Monday?

I think management HAVE to do this because the 4C is doing to drop on Monday. Revenue and Cash will be bugger all, and cash burn will be scarey. And so management has to help the market make sense of the cost base. If they don’t do that, half the analysts will predict that $BOT runs out of money pretty soon.

And I don’t think they will run out of cash. For example, I’ve plotted the financials below for one of my more central case scenarios in Exhibit 7. $BOT can get close to breakeven in FY26 and is strongly cash generative in FY27.

Exhibit 7: Modelled $BOT Financials (Scenario 6)

Even in the case where I’ve layered on $20m of excess sales and marketing costs, with the lowest monthly prescription case (Scenario 12), there’s probably enough liquidity to get through to positive cash flow in FY27, just.

Exhibit 8: Modelled $BOT Financials inHigh Cash Burn / Lower Revenue Case (Scenario 12)

Of course, I’m also hoping for some more insights about rollout. After all, there’s been another 4 weeks of data, so hopefully there’ll be an update on scripts and prescribers.

6. So. What about My Thesis?

The whole point of doing all this work was find out if my investment thesis is intact or not. And?

My investment in $BOT was initially predicated on the view that the market was seriously mis-pricing development and execution risk. Development risk mispriced, because we knew the product works based on experience in Japan and the promising US clinical trial data (now published in JAAD). Execution risk overblown because 1) there is huge unmet need in the market, 2) the management team have a strong track record in dermatology launches and 3) the existing anticholinergic product in the market has well-defined deficiencies, and is being managed by a lightweight company trying to juggle multiple products.

I bought $BOT between $0.325 and $0.47 in the belief that this business was worth anywhere from $1.00 to $2.00.

Wind forward to today, and while physicians are getting onboard, prescription rates are underwhelming, and conversion to net revenue is less than (I) expected. Added to that, the company is rapidly scaling up sales and marketing spending.

So, the market is in the doldrums, seeing this business as worth $0.16 - $0.18. But I think it would be worth anywhere from $0.20 to $0.90. That’s a serious haircut to what I thought, but still an interesting investment. And it is early days.

So, my thesis while seriously diminished, is not broken. I’m happy to see how this story continues to unfold.

At this stage, I’m not sweating.

Disc: Held in RL(4%) and SM

Heads-up $BOT holders, management are holding a "webinar to provide a comprehensive update on the Company’s Quarterly Activity Report and 4c Cash Flow Report. The webinar will include an update on the increasing launch momentum for Sofdra™ (sofpironium) topical gel, 12.45% and how Botanix’s cash position will support Sofdra through to profitability."

Monday 28th July, 9am.

Be there or be square!!

Given the SP reaction to the last sxxx show, this is hardly a surprise**. But it probably an indication that management believe the market reaction to the result was badly wrong. And they will take steps to give assurances that they are not going to run out of money before geting to profitability.

(** Actually, I listen back to the recording several times over, and there was a lot of good information provided by Howie, which I've been able to build into my model.)

My Valuation Update

I have been beavering away on my detailed digestion of the last webinar. Now the pressure is on for me to complete the work today, and during trading tomorrow to decide my investment strategy.

What is emerging from my analysis so far, is that there are a wide range of scenarios for how Sofdra will play out. Certainly, many aspects of the first 5-6 months data are promising. One example is the rapid penetration of the key prescriber base, which really does look like a best-practice launch rollout.

Less impressive are the scripts per prescriber. How this evolves is a key value driver and a key uncertainty. For sure, it is perfectly normal that prescribing frequency is low in the early months, and it often picks up through the 6-18 month timeframe, based on market response and clinical feedback and competition (low here).

The market was clearly shocked by the GTN numbers. My research on this indicates that in the second half, we will see GTN increase significantly, and this will drive net revenues significantly.

Apologies for the teaser, but I am still working through my various scenarios. I'm still seeing plausible cases that hit my current valuation, but the risk-reward has shift downwards, significantly. And based on the data so far, there are plausible scenarios where this business doesn't amount to anything.

So my investment decision is going to come down to how I assess the various scenarios (sorry, that's a statement of the blindingly obvious). I'm flipping at the moment between viewing that the market got this about right. ($0.2 - $0.3, risked valuation) through to no, no, no, its a complete over-reaction ($0.6 to $1.0). So, I better get my head down!

At this stage, I am on the fence as to whether my investment thesis is intact or not.

One thing I do tend to agree with in the webinar announcement,... Sofdra sales ramp appears highly likely to get to cash flow positive based on existing cash reserves. So that is one source of anxiety I am feeling better about. But only one.

Apparently (according to The Australian) US Investment Bank HC Wainwright, have initiated coverage of $BOT at $2.00.

HC Wainwright are a leading deal maker in the US in the small and mid-cap space, however, their SP recommendations have a reputation for being aggressive. Biotech is one of their focused sectors. Take from that what you will.

(Patiently waiting for the next sales update...)

Disc: Held

"$BOT today announced that Mr Matthew Callahan has stepped down as a Director, effective immediately, to attend to a medical issue. The Board thanks Matt for his significant contributions to the Company’s evolution to date. Botanix is now a well-resourced, sustainable and rapidly growing commercial organization. We wish him a very speedy recovery, and both the Board and Matt look forward to his return."

This is sad news. @Strawman, Matt's been generous giving us his time over the last couple of years. If you have his email, perhaps consider wishing him all the best from the Community?

As I expected. here's the full text. They'll try and argue that the same product is not available elsewhere. We'll need to see the text of the EO to see if that cuts it!

Botanix responds to US pharmaceutical pricing announcement

Philadelphia PA and Phoenix AZ 12 May 2025:

Clinical dermatology company, Botanix Pharmaceuticals Ltd (ASX: BOT, “Botanix” or “the Company”), is responding to the reported announcement by President Trump on Telegram of a proposed executive order in relation to “Prescription Drug and Pharmaceutical Prices” (“US Announcement”).

Botanix is aware from the US Announcement that Mr Trump is proposing to issue an executive order that is focused on reducing costs of pharmaceuticals by instituting a “most favored nation’s policy” whereby the US will pay the same price as the nation that pays the lowest price for a drug, anywhere in the world.

Botanix obviously has not seen the executive order the subject of the US Announcement, but based on the information in the US Announcement makes the following comments:

• SofdraTM (sofpironium) topical gel, 12.45% is only approved in the USA and is not marketed in any other jurisdiction worldwide by Botanix or any other party;

• EcclockTM gel 5% is a product that contains sofpironium bromide which is marketed in Japan by Botanix’s partner, Kaken Pharmaceutical Company, however it is a different concentration and formulation than Sofdra, and was tested in different clinical studies and populations than Sofdra; and

• Neither Ecclock nor any other 5% concentration of sofpironium bromide gel are approved for sale in the USA and Sofdra is also not approved for sale in Japan.

Based on the limited information currently available in relation to the US Announcement and in light of the above, Botanix does not consider that it is likely that it will be subject to price reductions based on sales of Sofdra outside the USA, as there are none. Botanix will review the proposed executive order when it becomes available.

Release authorised by Vince Ippolito Executive Chairman

Good discussion with Matt just now, which I think clarified a few points which will help us all interpret the newsflow and data over the coming months and reporting periods.

- The target derm market is the 4,000-5,000 medico-derms, and within this they'll focus on the high prescribers. (Implication: so let's not do any modelling based on 11,000-12,000)

- Pure telehealth remains an unknown as to its relative performance, so over future reports I'll be listening carefully to what they are learning. This is really important for future growth, because if the platform is successful, it is an easy route to add value to already commercialised products.

- The early trends are continuing, but don't over-react to indidividual weeks that fall below this trend. Afterall we've already seen on in the initial results (the week of a major dermatology conference).

- Net revenue per refill sounding more like US$400, than US$450 which most are modelling. Possibly due to higher co-pay requirements driven by the requirements of inidividual patients plans.

- Refills at 6-11 p.a. dramatically reduce the number of patients to hit US$100m FY26 sales, versus analyst forecasts and industry normal (1.8 refills). Basically, as other here have modelled, if they continue to add c, 2,000 new patient per month at close to 100% refill rate, there is a LOT of revenue upside. Apart from doing "what ifs" it is too early to narrow the uncertainty, but that's what we have to track in future reports.

- Management and Board pretty much 100% focused at this time on Sofdra. If we see the SP start to recognise a materially higher potential FY26, then entirely possible that they exploit an opportunity to get more capital, to licence in new products, although I note that they favour back-ended deals and are willing to use debt, reserving cash to invest in Sofdra growth.

Everything else pretty consistent with what they've said before, and Matt understandably being very careful not to make new disclosures outside of a proper market release.

So far, $BOT is executing well.

Disc: Held

I've been trying to understand if there are any drivers of the strong $BOT SP action we've seen in recent days.

Clearly, the market is on tenterhooks wondering what disclosures management will make about early sales at the Half Year report, at the end of this month. So my thought was that market watchers are accessing information on early sales or customer responses.

I found the following in my search:

- Report of a Euroz Hartley report on the news-wires

- Some customer reviews on the web (reddit and drugs,com).

TLDR: Euroz Hartley conclude early signs are that Sofdra is effective compared to its alternative with minimal side effects.

My own search of reviews is inconclusive, because I'm not sure how much of what I am reading is real!

As the EH report only came out in the last few days, that might be the source of the increase buying pressure.

--------------------------

1. Report of a Euroz Hartley report on the news-wires

(Not: I have not read the report)

Sales Traction from Botanix Pharmaceuticals' Prescription Gel Launch May Drive Stock Re-rating, Euroz Hartleys Says

February 10, 2025 at 01:53 am EST

(MT Newswires) -- Sales traction from Botanix Pharmaceuticals' (ASX:BOT) full commercial launch of Sofdra, its prescription treatment for excessive underarm sweating, could lead to a potential stock rating above its price target, according to a Monday note by Euroz Harlteys.On Jan. 31, the company said that the full commercial launch of Sofdra is officially underway, with sales professionals set to hit the field within the next week.

Early patient feedback from social media and online sources shows that Sofdra is effective compared to its alternatives, with minimal side effects, with patients receiving full insurance coverage, Euroz said.

The feedback is positive for BOT and raises Euroz's confidence in the company's ongoing commercial rollout.

Euroz maintained Botanix Pharmaceuticals' buy rating and its AU$0.55 price target.

Shares of the company rose 7% at market close.

2. Some customer reviews on the web.

I had a look on Reddit and also at user reviews on Drugs.com.

Hardly meaningful samples, and in either case, beware that anyone can write anything!

My assessment: I am suspicious of the Drugs.com reviews, which are all 10/10 and unreservedly positive. This is inconsistent with the data from the clincal trials. There are also several from September, which was prior to the start of the patient experience program, so I don't know where these patients were getting their product from.

Against, the same benchmark, the Reddit reviews look more like I was expecting to see.

I will continue to monitor these and other channels, but I can't independently either vouch for or contradict the Euroz Hartley assessment. There are other sources including various closed Facebook Groups as well as Tic Tok, that I have not looked at yet. Can't see much on either X or Insta.

2.1 Reddit

Review 1

"I’m a week or so into using it.

Sadly it’s not proving to be a silver bullet for me. Definitely minimizes it, but have had several breakthrough incidents thus far when body temp increases or I consume caffeine. Roughly the same effect as Qbrexza wipes were for me.

Onto DermaDry, which I grabbed during their Black Friday sale. Still on sale now, at 25% off."

Review 2

"SOFDRA is by far the best thing one can try. whichever folks or company has created this solution needs to be thanked a million. Thankyou Thankyou Thankyou"

Review 3

"I sweat a lot so it’s hard to tell but maybe a 10-20% reduction so far with no noticeable side effects. This is my third night applying Sofdra."

Review 4

"I have done 3 Sofdra applications so far. I think I’m noticing a decrease in underarm sweating, but not significant. Hopeful it’ll continue decreasing. I have been getting headaches all week. Not sure if that’s related or a coincidence."

2.2 Drugs.com

20 reviews, suspiciously all 10/10 and very positive.

January 24, 2025

"Had a good experience. No complaints as it works well and just had a slight dry mouth - nothing compared to other treatments. I like that it is easy to carry around too. Cost me nothing and no insurance hassle."

10 / 10

February 10, 2025

"Got Sofdra last week and very happy with it. No side effects for me. Cost zero."

10 / 10

January 4, 2025

"My friend recommended Sofdra to me. She tried it first and liked it. It is my first week. I had some mild dry mouth at first, but nothing else. I like how effective it is and simple to use. I tried a few drugs before: Qbrexza and Drysol. Sofdra is so much better."

10 / 10

January 13, 2025

"Found out about Sofdra from the HH Society website. Have tried it now for a week, and over the last 3 to 5 days, I have noticed a substantial decrease in my HH symptoms. It feels great to finally be able to show my face in public, knowing I don't have my sweat patches anymore."

10 / 10

February 1, 2025

"I used different medication in the past from Drysol, Qbresza, and Botox. Sofdra is really a game changer for me. First, it simply works and with far fewer side effects. Yes, I still have mild dry mouth, but this is nothing compared to redness and dizziness from other medications."

10/ 10

September 8, 2024

"Found out about Sofdra recently. I think it is new to the market. Did some research and tried it. After many years on different treatments, Sofdra is a game changer. Easy application and have no side effects. Very positive impact. Insurance covers it. I will continue to use it. I understand they can mail it to me too, my doctor said."

10 / 10

February 1, 2025

"I used different medication in the past from Drysol, Qbresza, and Botox. Sofdra is really a game changer for me. First, it simply works and with far fewer side effects. Yes, I still have mild dry mouth, but this is nothing compared to redness and dizziness from other medications."

10 / 10

September 8, 2024

"Could not believe how well this worked. As a sufferer of HH, I was over how much Botox would hurt and the time it took to attend appointments. Simple and easy to apply before bed, thankful that insurance covers this product."

10 / 10

September 12, 2024

"Tried a few alternatives over the years, but nothing comes close to the results from this new treatment. Simple to apply, and the reoccurring subscription and delivery were easily covered by insurance. Much happier."

10 / 10

February 6, 2025

"I like it. Works well and costs nothing with insurance. Some slight dry mouth the first few days only. Much better than wipes and Botox. Easy to use, and they delivered it."

10 / 10

January 1, 2025

"I tried Sofdra this week. Worked well for me. Will continue to use it. Insurance covered it."

10 / 10

January 10, 2025

"Found out about Sofdra from Hyperhidrosis Society email. Works really well for me. Had slight dry mouth before going to bed, but nothing compared to Qbresza. Signed up for 6 months."

10 / 10

December 18, 2024

"Tried yesterday. Simple cream but so effective. No side effects. Will continue to use it."

10 / 10

January 20, 2025

"Had a positive experience with Sofdra. It was a while since I did not experience side effects from using other treatments. Good job for the Sofdra team. It cost me nothing, too."

10 / 10

January 6, 2025

"Game changer - I’ve only been using for a week, but I would highly recommend it to anyone struggling with HH - yet to have a breakthrough episode."

10 / 10

September 6, 2024

"Just found it a new treatment. The best. No side effects and really easy to use."

10 / 10

September 6, 2024

"Great experience."

10 / 10

September 8, 2024

"The doctor told me about it. Spoke to my insurance, and it was covered. Really no side effects and worked like magic (easy to apply!). After many years trying different stuff, Sofdra is the way to go."

10 / 10

January 13, 2025

"Was not sure what to think of it, but Sofdra is a big improvement over Qbresza. I have similar effects like Botox, but this is just easier on my body. Good to have something new."

10 / 10

September 20, 2024

"Did some research and tried Sofdra. Tried a number of things before Drysol and Botox. Sofdra works the best and is easy to use."

10 / 10

September 21, 2024

"Super excited about this new novel treatment for underarm sweating!"

10 / 10

Disc: Held in RL and SM

$BOT announced their 4C this morning

Their Headlines

• First Sofdra™ prescriptions were issued in December as part of the Patient Experience Program, with 100% refill follow up in January, proving up the telehealth and closed fulfilment systems

• Full commercial launch of Sofdra with the field sales force is now underway to be followed by the expanded digital program

• All sales professionals who will drive adoption of Sofdra in dermatology offices are now trained and certified and will be in the field next week

• The Patient Experience Program was successfully completed and was highly rated by participants, providing useful refinements of the telemedicine communication and fulfilment systems

• Botanix has now finalised contractual terms with all of the key US commercial payers (insurers) which reflect the target financial and patient access restrictions previously communicated

• Botanix has also completed all of the requirements for US government payer programs, with the consequence that from March 2025, Sofdra will be available for an additional ~80 million lives

• Q1 CY2025 will represent the first commercial quarter of revenue from Sofdra with full field and digital launch deployed and Q2 CY2025 is expected to reflect a significant ramp in revenue following that launch

• Cash position of A$48.36 million at December 2024 quarter end, with no debt

My Assessment

It is definitely worth reading the full release, as it is packed with insights from the Patient Experience Program.

Overall, it looks like everything progressed well, proving up the telehealth channel including prescription, fulfillment, Even the first patients from the December have received their refills in January, with no payor issues.

So the online DTC channel is now going live to the wider cohort of prioritised potential patients, as planned,

The sales force of 27 is trained, and gets unleashed on dermatologists next week. So that will be the second leg of the strategy underway. (It sounds like they've been able to recruit a high quality sales force!)

The release is careful to avoid any quantification of patient numbers or scripts, but it sounds like a more complete update will be provided in a few weeks time at the HY Report.

"Botanix will be providing guidance to the market in relation to leading indicators that will be reported, in our half yearly update in February, which will enable shareholders and stakeholders to follow the development of the Sofdra opportunity from quarter to quarter, as sales increase."

Overall - from my reading - everything seems to be going to plan.

Disc: Held in RL and SM

$BOT have issued a release confirming that initial prescriptions of Sofdra have been delivered via the patient experience program run in conjunction with IHhS.

Their Headlines

• Patient Experience Program underway with first prescriptions issued and Sofdra delivered to patients

• Inventory build and logistics infrastructure testing completed to support full commercial launch in Q1 2025

• Marketing and sales materials developed, tested and refined

• Sales force engaged and preparing for launch meeting in late January, followed by digital program expansion

My Assessment

Basically, this is a communication saying everything is going according to plan.

My view is that the first significant information will come after 1Q 2025, when we see data on the number of prescriptions in what will be a partial quarter after full launch, with hopefully some information on refill rates from early patients.

Still, this is good news, and good that management are keeping the market informed that everything is progressing as planned. Of particular note are 1) that supply chain is prepared and able to flex according to demand and 2) that insurer reimbursement is working as planned. These are both important elements of execution risk showing an initial "green light". Early days, of course, but nonetheless positive.

Disc: Held in RL and SM

$BOT have posted the presentation for their Commercial Webinar later this morning at 10:30am.

Good clarity on the timeline and how different US market segments will be accessed.

The Feb-25 HY report should give comprehensive (??) feedback from the Patient Experience trial, as well as the initial progress on IHhS (18,000) and Targeted Patient Lists (1 million).

The Feb report will be very significant, as it will provide decent real world commercial sales data from which forecasts will be updated. I expect there will be huge divergence that early in the s-curve, given the conservatism of current forecasts! That is, unless the product bombs!

Very much looking forward to the next 6 months.

Disc: Held in RL and SM

So $BOT announced today they are going to hold a "Commercial Day Webinar" on 17th September.

Apparently, the market values the statement "to provide a comprehensive update on its commercial launch plans and market insights for Sofdra™" at $0.05 per share or $90m. Go figure.

(I'm not complaining, as I believe that once the market starts to get a 2-3 year view of the sales profile, there's plenty to more to come. However, the reaction to this "news" gives some insights into the potential choppiness of the ride ahead.)

Happy weekend all.

Disc: Held in RL (8.3%) and SM

As @Strawman made special efforts to feed the "spreadsheet jockeys" on the call this morning, I thought it only fair to respond in kind.

Matt referred to the potential that Sofdra really takes off, being a case not at all considered in the E&P and EH valuations of $0.47 and $0.55. So I thought I'd have a go a putting some dimensions around that.

Assumptions (details shown in the spreadsheet below)

- Assume sales build to peak over 5 years according to the profile given

- 5% of diagnosed market captured in yr 5

- 2.5% of undiagnosed market capture in yr 5

- 12 scripts per year at 50% persistency (absolute, not progressive/cumulative)

- %GM 76%; SG&A grows at 20%; R&D at 10% of revenue; nominal DD&A (capital light)

- No debt

- SOI grow at 2.5% per annum

- P/E in 2029 of 50 (which is modest if this baby takes off)

Crank the handled and discount back at WACC of 10% and you get a valuation of $12bn, today.

In this scenario, they are writing 2m scripts p.a. in 2029. That's just double the rate in Japan after 3 years. With excellent marketing and execution, that's not inconceivable.

To be clear, this IS NOT my valuation. I am happy to leave my valuation at a "modest" $1.20.

The point is that if we see a strong revenue trajectory in 2Q25, 3Q25 and 4Q25, then this indicates the order of maghnitude change that could possible emerge - which is probably more in line with where Howie and Vince are thinking.

For sure, there is a lot amount of execution risk. But this kind of upside potential means that this morning I've added a further 20% to my RL holding at $0.335, and will align SM accordingly. I want to place a bigger bet here.

I wasn't around to get on the $PNV bus pre-revenue, but I'm damned sure that I'm on this one with a solid position.

I'll write a separate straw with some reflections on the SM meeting later today.

Disc: Held in RL (7%) and SM

$70m at $0.30 for 233.333m shares - a dilution of c. 15%.

No SPP as suspected.

Use of funds focused on Sofdra.

Thanks to the loyal shareholders.

While it’s easy to be disgruntled, the big picture is that not too far down the track, this business is likely to be worth a lot more.

Overall, I do want this business to have a strong balance sheet, but I still don’t understand why they didn’t raise a few days down the track.

Will look at the price action at the open and see if I can sneak in some more. Unlikely though.

$BOT has announced approval of Sofdra.

(Just seen the ASX announcement come through as I board flight for 2 weeks holiday.)

$BOT into a trading halt pending announcement of FDA Approval for Sofdra.

Looks like a pre-emptive strike to prevent any leaks ahead of them issuing an ASX announcement.

Watch this space.

Disc: Held in RL and SM

Just over a month ago Euroz Hartley published a short term price target for $BOT of $0.33, predicated on their assessment of the typical run-up in SP ahead of an FDA decision. Sure enough, with days to go, SP has passed this target standing today at $0.345.

I have absolutely no interest in short-term trading, as I am placing a 90% risked bet that this will be a much more valuable proposition. Much more over time. That said, it is interesting to watch the volumes and prices.

Last week's "non-announcement" appears to have given the market a little nudge, reminding the hot money out there about the impending FDA decision.

In the success case, on fundamental grounds, I expect the SP to go a lot higher. However, if there is a negative decision, this baby has pumped up enough that any correction will likely be hard indeed.

At time or writing there are still slightly higher volumes in the "BUY" queue (9m) than the "SELL" queue (7m), but things have evened up a little from this morning. But today marks the 3rd conseuctive day of higher than normal volumes.

tick-tick-tick

Disc: Held in RL and SM

$BOT have sent existing shareholders and everyone on their mailing list the updated Euroz Hartley report following last weeks Commercial. It is a thorough and well-written report, so I have put screenshot below in this straw.

Its gives a valuation of $0.33, and clearly seems to encourage the pre-FDA SP uplift short term trade. (Not for me)

I prefer to focus on the long term investment proposition in the success case.

Before reading, be aware the EH supported $BOT in the recent capital raise. It is also likely based on my reading of the disclaimer they have been engaged by $BOT as their defence adviser. EH have been paid by $BOT in shares for the advisory services they've provided. So although EH have certified that this is their own opionion, it is clear that it has been prepared benefiting from the EH collaboration with $BOT management and board.

So when I read it, I read it more as the view of $BOT management than of an independent analyst. So, I wanted to make that clear up front.

You can read the report yourself, but I wanted to highlight a few points.

FDA Approval

The imply a CoS of FDA approval in June as 90%

Benchmarking ASX FDA Knockbacks Leading to CLRs

They compare recent ASX companies that received a knockback at FDA approval (listed in Fig 3. on page 4). Of the 7, 5 were finally approved, one withdrawn, and one under review.

However, what is important, is that none of the sample group received knock-backs purely for label/patient information data. All were some combination of safety, efficacy of manufacutring, with one (later approved) not providing details.

%BOT's CRL was was labelling and patient information. The corrected labelling led to 100% compliance in the human factors study.

Therefore I think 90% is a reasonable CoS, and perhaps given $BOT reports of having high confidence of approval following engagement with the FDA in recent weeks, it is hard to understand the basis for a rejection. Should a rejection occur it would be a shock.

Revenue Profile

Figure 8 on Page 7 provide revenue projections. The growth curve looks reasonable. However, to my eye it looks conservative give the gap in the market that SOFDRA addresses. The projection is to only penetrate 1.0% of the market by 2033 - 9 years after launch.

As ever, the drug will only suit some sufferers, and not everyone will respond. In any event there is certainly upside to this if the drug is well-received by the market.

Cautioning my own enthusiasm, I note that the analysis has considered the progress of the drug in Japan in developing their projections. $BOT reported that Kaken have sold 350,000 units in the last 12 months in Japan. The valuation forecast projects the US taking 5 years to get to this. So following launch (assuming approval) it will be instructive to follow the early US profile compared with the experience in Japan. There has to be a bull case to do much better than the EH profile.

Valuation

Of EH's valuation of $0.33, $0.26 comes from SOFDRA and $0.06 from the development portfolio.

My Quick Valuation - Bull Case - SOFDRA is approved in June with minor risk adjustment

I think the EH sales profile is a prudent forecast, and I base my valuation solely on SOFDRA.

On the basis that $BOT achieve an EBIT in 2029 of US$104m, carrying no debt, and applying tax at 30% and USD:AUD 0.67 give 2029 NPAT of A$109m.

With 1,575m SOI, although $BOT will be highly cash generative quite soon, I'll allow some dilution due to share based compensation, so assume SOI of 1,800 in 2029.

That gives a 2029 EPS of $0.061.

I'll deal with the uncertainty via the P/E ratio, ranging from 25 to 45 - probably very conservative for a high growth pharma company.

I'll add a risk premium to the WACC, and discount at 12%.

My unrisked valuation range is: $0.88 to $0.1.56 (but including a margin of safety in the risk premium)

So, now I am going to apply my 90% CoS, and assume that in the 10% failure case

- There is a net 5% chance that there is a subsequence approval on what ever the residual issues are, and that the profile gets pushed out by another year, leading to a further discount and a further dilution of 10%.

- There is a net 5% chance that the drug is withdrawn amd the value of the business is $0.06 of the development portfolio.

Boiling all this up together, and I get a risked valuation of: $1.13

What do I have to believe: 1) SOFDRA gets approved some time in the next year, 2) the telemarketing strategy is successful, 3) the product gets some traction over 9 years with 1% of the potential market.

Not a long bow to draw for a Bull Case.

Now at the start of this straw, I speculated that EH are $BOT's defence advisor. If their valuation is truly $0.33 that clearly cannot be true, because as my analysis shows, if you believe the forecast, and had deep pockets, you'd happily put in a takeover offer today of $0.50 to $0.60. The board should send any acquirer away for anything south of $0.60 or even $1.00 IMHO, given the upside which I haven't even attempted to assess.

So there is a lot of risking being applied to the EH analysis, unless I am missing something!

(I note that my fellow $BOT bull @Nnyck777 is at $1.92 ... I'm slowly getting there :-)

Disc: Held in RL and SM

I attended the $BOT Commercial Webinar today.

Obviously, everything hinges on the FDA decision slated for late June. However, that aside, the presentation gives a good indication as to just how advanced they are with their innovative, direct-to-cutomer via telehealth approach.

I have no experience of comparable case studies using this launch approach to be able to critically assess it. However, the team have approached all the Tier 1 payors, and seem to be getting a positive response. Manufacturing and supply chain is all set up.

Today's SP response continues a steady trend of buyers moving in following the confirmation a few months ago that their resubmission to the FDA represented a "Complete Response". That of course does not prejudge the approval decision, but the market is starting to position itself for an approval (as I indicated it would last year).

Clearly, an acquisition (i.e., being acquired) is very much on these folks mind ... a lot of the team has been there before.

Potentially a big upside here. Over to you, FDA. Let the countdown continue.

Happy to hold for a binary outcome, as the CoS looks high. But FDA approval is never a slam dunk.

Disc: Held in RL and SM

$BOT have issued their 4C.

Highlights

Cash holdings actually increased, thanks to exercise of options.

We're now two months away from the expected FDA decision on Sofdra - one way or another that will be a major SP catalyst, with anything but an approval a major surprise.

Accordingly, $BOT are making good progress in preparations for launch. They've focused activities on the US payers (insurers) and report"

"The Company has now engaged players that account for 80% of covered lives in the US and is pleased with the feedback regarding pricing and the relative absence of obstacles for patients to access Sofdra following planned approval."

So, if the approval is straighforward and goes as expected, then FY25 is going to be an important year!

Disc: Held in RL and SM

$BOT announcing this morning that the resubmission for Sofdra has been accepted by FDA as a "complete response" and that the timeline from resubmission in December to the approval decision is 6-months. So the decision is slated for June.

This is somewhat of a non-announcement, as that is what has been communicated previously and also what is understood by the market.

However, it is clear that $BOT are being careful to disclose everything around this key milestone to keep investors informed.

I also think it might address speculation by some that the FDA decision may come sooner.

@Nnyck777 posted a summary of the Euroz Harley report on $BOT earlier this year. I tried my usual trick of Googling "Botanix Pharmaceuticals Analyst reports" and bingo, scored the link to the April 2023 report (I don't know if there has been any update) buried somewhere on the Botanix website.

I don't think it has previously been posted on SM so I thought I'd share it for those who are looking at trying to value $BOT.

Note the disclosure that the analyst owns $BOT shares and that Euroz Hartley has been involved in providing corporate advice, raising equity and has been paid for its services in $BOT equity. So clearly they have a lot of interest in the SP of $BOT, so the research has to be viewed with that in mind.

Ahead of developing my own view in the New Year, I was interested to see the market penetration and revenue build profile assumptions. It is curious to see the forecasts have Sofdra very significantly expanding the addressible market, given its price premium to existing treatments. I think understanding this further is important.

The 6-9 month timing delay of the FDA setback is not necessarily that material to the revenue build projection in CY24 assuming a July launch if they position themselve aggressively ahead of FDA approval, which they appear to be doing. Also, given the ability for sales and marketing to target the relatively small number of dispensing dermatologists, the build profile through 2025-26-27 is actually quite pedestrian IF the product proves to be a hit with patients. So maybe, there is an element of risking in the build? Definitely room for some scenario thinking!

The target SP in this report is $0.28, and with the passage of 9 months since the report and a delay of 6-9 months due to the FDA setback, its still probably a reasonable price target today, if you accept the numbers. As I said, I will have a go at this in the New Year, so I am not giving a view on this at this stage.

Disc: Held in RL and SM

$BOT report that they have resubmitted the NDA for Sofdra to the FDA.

The original timeline they were targetting when they first received the setback from the FDA in September was for resubmission in early Q1 CY24 aiming for FDA approval in mid-CY24, with immediate commercial launch thereafter.

Along that process and since that time we've received two positive updates.

First, on 4-Dec following meeting with the FDA where the agency confirmed that $BOT's approach to update the labelling and patient use instruction are acceptable.

Second, on 14-Dec $BOT announced completion fo the Human Factors study, importantly stating that ALL patients in the trial successfully "prepared and applied Sofdra in accordance with the revised IFU".

CEO Howie McKibbon said "Our focus now is firmly on preparation for commercialisation as we work with FDA towards Sofdra approval by midyear.”

My Analysis

Unless I am missing something, FDA approval of Sofdra is entirely derisked. (That said surprises do happen!) Provide that centre for the HF study was validated (surely it must be), then a 100% compliance result should remove any questions regarding adequacy of the instructions. I don't think it can be clearer than that.

So, today the clock starts on the FDA's 6-month review timeline. Given everything we've learned Sofdra should get approval in late June 2024, with almost immediate launch.

There has been a mild positive market response today, simply because $BOT is doing what it said it would do, and the emerging news is entirely positive.

They've certainly moved along apace. Even though there is a clear sequence in which things should happen, activities are clearly being driven assuming success. That approach will be applied to the commercial / launch activities as well.

I've added 50% to my position this morning in RL, although overall it is still a small holding for me (1.6%). I'm on holiday now, but will do some proper valuation modelling of $BOT in the new year. Approval and early sales within CY24 means there is a lot of potential upside ahead and I think the risk-reward probably justifies a significantly larger position.

According to Med Esthetics, the US market for treatment of axilliary hyperhidrosis reached $500m last year. Given the attractiveness of the gel applicator over injections (which is the second line of treat for those who do not respond well to other topical applications) if $BOT can capture 20% of the market, i.e., revenue of $100m, then its current EV of c. $240m could easily re-rerate to 2x or 3x or more.

For now, I don't think the SP is going anywhere until the next FDA milestone unless $BOT starts to pick up some more analyst coverage. According to Tradingview.com there is one analyst covering it with a price target of $0.3000. (Do any StrawPeople have that research?)

Anyway, it looks like having quite a low risk profile for a drug company at its stage of development.

Disc: Held in RL and SM.

Botanix has successfully completed the planned human factors validation study assessing revised Instructions for Use (IFU) for Sofdra

• All HF Study participants successfully prepared and applied Sofdra in accordance with the revised IFU

• Botanix will now prepare to resubmit the Sofdra new drug application to FDA, including the revised IFU, human factors validation study report, and other requested materials

• Submission of the final component requested for FDA approval of Sofdra remains on track for early Q1 CY2024, targeting FDA approval in mid-CY2024

My Analysis

This is an unequivocal and clear statement. All participants in the study successfully followed the instructions. 100%. No ands or buts.

Of course, the FDA will have to review the updated NDA dossier and see if they agree, but it sounds pretty clear.

This removes the sole remaining impediment to getting Sofdra approved. We just have to wait for the FDA review process to complete.

Good news.

Disc: Held in RL and SM

$BOT have issued the above announcement following their feedback meeting with the FDA following the failure to receive approval for Sofdra based on the need to clarify patient instructions.

The purpose of the meeting was to better understand the FDA decision and, more importantly, to confirm that the planned changes to be included in the resubmission address the issues. FDA indicated that the proposed changes will be "acceptable for the planned resubmission of the Sofdra NDA package." While that is not the same as saying that the proposed changes will be approved (they can't say that), it is a positive indication that this final hurdle towards approval will be cleared.

The next step is for $BOT to implement the changes and then test them in a "human factors study'. The new patient information and results of the study will then be resubmitted to the FDA early in the new year, with a decision by mid-year.

Predictably, the SP has bounced, now sitting only 12.5% below its recent high just before the FDA setback.

Disc: Held in RL and SM

$BOT is in a trading halt pending announcement of a capital raising.

Despite earlier assurances to the contrary, the 6-12m delay to the FDA approval of Sofdra was always going to strain remaining cash, so in my view it was a matter of when and not if.

Disc: Held in RL and SM

$BOT are holding their AGM today.

The AGM Presentation has no material new information, but it is a good overview of where they are at. Next milestone is meeting before year end to get FDA guidance on the labelling/PIL feedback that has delayed approval of SOFDRA until mid-CY24.

Presentation has further details on the sales and marketing strategy, including details on sales force, geographic focus and telehealth strategy (recent partnership with UpScriptHealth annoucned separately).

Disc: Held in RL and SM

I wanted to better understand the precedence around the FDA letter holding up approval of sofpironium bromide gel based on labelling and patient information deficiencies.

I found an interesting reference on the subject in JAMA (Sacks et al. (2014) JAMA 311(4) 378-384). The article is a little too dated for my liking, but the information in Table 5 is interesting. (below)

Of 151 drugs not approved in their first cycle, 71 were subsequently approved following resubmission, with 80 not approved during the lifetime of the study.

What is more interesting is that only 4 drugs (2.6%) were not approved first time for labelling alone, and all 4 of these were subsequently approved.

Although the median delay in the study was 435 days this includes the entire population which is dominated by drugs with safey, efficiacy, chemistry, manufacturing and controls issues, many of which would have required further clinical trials. There's no data on the delay for labelling ony.