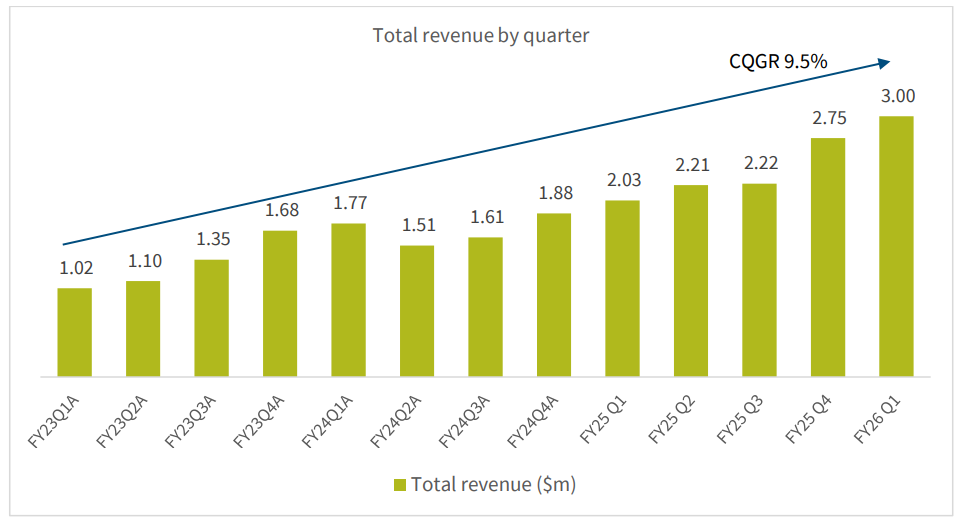

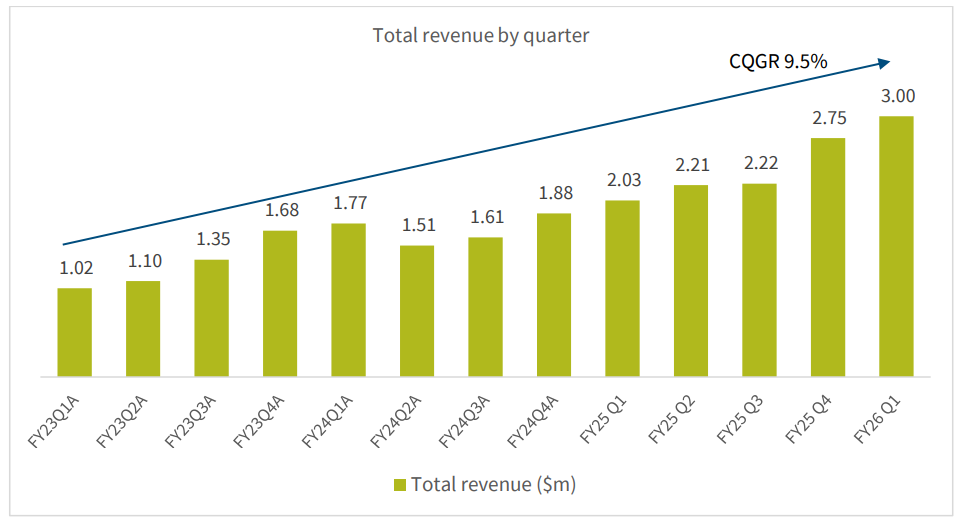

Regenerative medicine company $OCC have announced their 1Q revenue today - a record $3.0m,

ASX Announcement

Their Summary

• Record revenue of $3.0 million achieved for the quarter ended 30 September 2025, driven primarily by increasing market penetration of nerve repair product Remplir™ in Australia and Singapore.

• September quarter revenue represents a 9.1% increase over the previous quarterly record of $2.7 million for the June 2025 quarter.

• This result is the sixth consecutive quarter of record revenue, with a Compound Quarterly Growth Rate (“CQGR”) of 9.5% since product launches in Q2 FY23.

• Outstanding result does not yet include material revenue from Remplir sales in the US, which are expected to build during the December 2025 Quarter and grow into 2H FY26.

• Highlights of the US commercialisation of Remplir include: o a distributor network that now covers 25+ States and 40% of the US population;

o first US surgeries completed across multiple hospitals, with over 100 surgeons now introduced to the product; and

o over 50+ VAC applications lodged with hospitals; 11 approvals in place and beginning to unlock scale adoption

• The first Canadian distributor was recently appointed, and initial sales from this region are targeted for the December quarter with market adoption expected to grow steadily into 2026.

• Orthocell maintains robust cash reserves of circa $27.0 million and is well-positioned for continued commercial expansion.

• Full Quarterly Activity Report and Appendix 4C to be released by in the next 1-2 weeks.

My Assessment

With Q-o-Q growth of 9.1% and 47.8% to pcp (driven by the large step up in Q4), the first leg of my thesis - growth of Remplir in Australia and Singapore - is looking good.

As for the second leg - the US - given that the US only recorded first sales revenue in July, it is not to be expected that US sales featured materially last quarter. So, the key information is the leading indicators: 50+ VAC applications lodged, 11 approvals in place; over 100 surgeons "introduced to the product".

In itself, these don't necessarily indicate material near-term revenues, as we have no idea how many of the "100 surgeons introduced to the product" will actually use it. However, that 100 surgeons metric is material in the context that currently over 200 surgeons are using the product in the initial markets - concentrated in the ANZ and Singapore. So, that's a good set-up for furture periods, and it will interesting to see if any further information is provided on the number of procedures that have been carried out in the US when the more complete 4C and operational report is issued in a few weeks.

In any event, it puts down an initial datapoint, from which we can judge the market expansion progress in Q2. I'll be most interested in the how the "11 approvals in place" progresses from Q1 to Q2.

The information that really caught my attention was the statement "Orthocell maintains robust cash reserves of circe $27.0M", which is more than I was expecting given the cash and equivalents balance of $28.6m at the EOFY25. It will be interesting to see the 4C to understand why the lower cash burn in the quarter, but this could be due to grants or rebates which tend to be lumpy although these have previously hit the bank account in 3Q and 4Q.

In any event, the apparent cash burn of $1.6m is less than the PCP number of $2.0m, and so we could be seeing the combination of the growing receipts and expense control. Fingers crossed. Anyway, we'll soon see.

My Conclusions

A good update and I'm likely going to add another small tranche to my position, which I aim to build steadily over time. Maybe not today, as we've seen a SP appreciation of 30-40% in the last few weeks, so based on historical volatility and the likely absence of any significant SP cataylysts, I imagine I'll get the chance to add at a better price. Or maybe not,... as these guys do tend to push out good news whenever it arises, and I don't want to be caught short with an underweight position. ;-)

Disc: Held in RL and SM