Regenerative medicine company $OCC reported their 4C today.

4C Report.

TLDR: An OK report. Receipts stepped up materially, however, costs also increased given the front-loading of spend to launch into new markets. Overall, the report was in-line with my thesis. $OCC remains well-funded for the next 2 years on the current trajectory.

My Assessment

To recap, I am looking at 3 criteria to be met before expanding my current 3.2% (RL) holding:

1. Sustained strong momentum for Remplir in ANZ

2. Leading indicators of sales traction in the US

3. Evidence that the business will scale cost efficiently

Given the recent trading update, there is no new info to report on 1. & 2., as I have covered these previously. So my focus is 3.

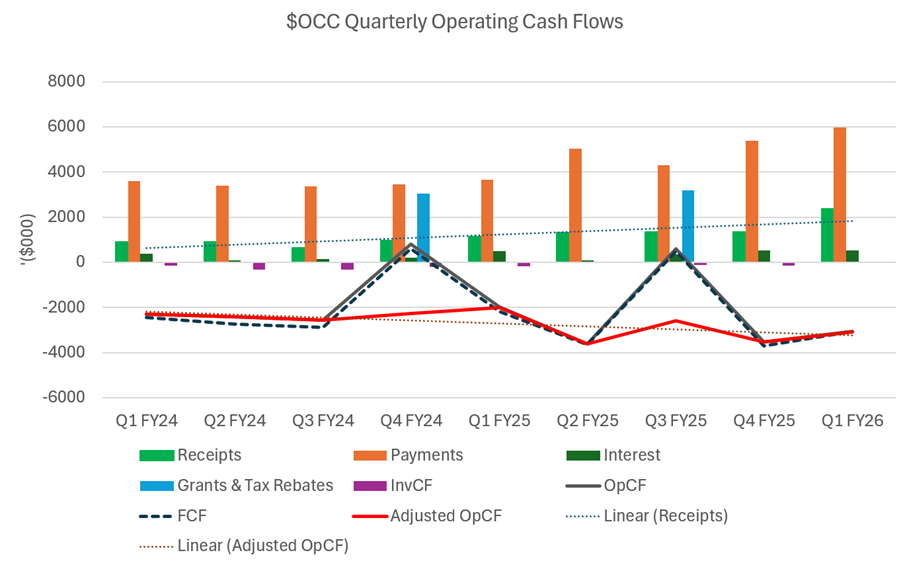

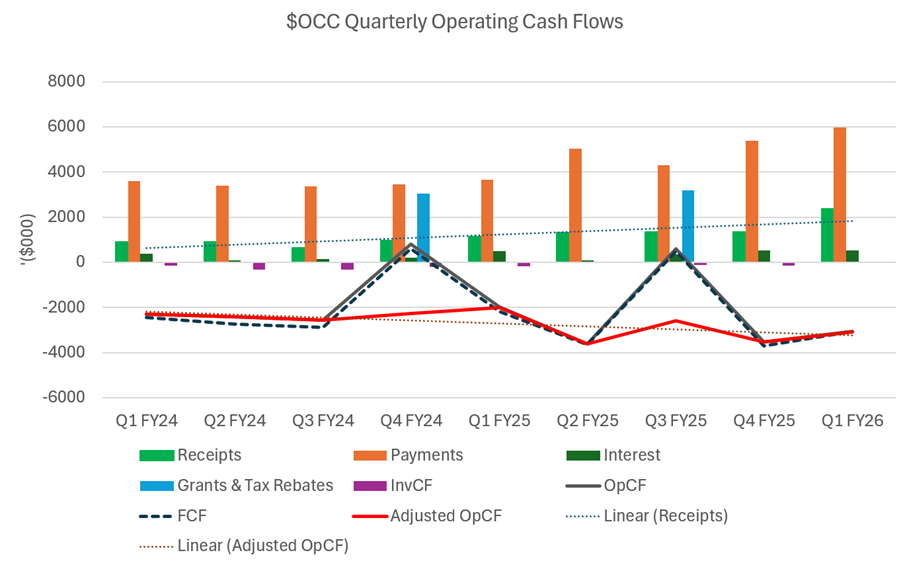

Below, is my usual quarterly cash flow trend report. I’ve included an “Adjusted Operating Cash Flow” in the red line, to reveal the underlying operating performance of the business, omitting the intermittent contribution from Government Grants and Tax Rebates, which distort the signal in the data.

The trend line makes clear that Operating CF is heading in the wrong direction. However, I will explain in the rest of this Straw why I am not concerned about that, at this point.

1. Receipts Growing Strongly

Record receipts of $2.37m (+108% to PCP and +77% QoQ) are a material step up. With revenue of $3.0m in 1Q, and an expected lag between revenue and cash of 1-2 months, it appears likely that Q2 will show a further significant step up.

While most of this will be from ANZ, reports of 1000 + 1000 units sent to US distributors (I assume the first tranche in Q4 and the second tranche in Q1), we could be seeing an initial contribution from the US, however, this isn’t broken out.

While Distributors will have initially stocked, the real question on US trajectory can only be asked when we see how quickly they restock and what the restocking level will be. $OCC have previously indicated that they have 4,000 units in the US market, so that they can respond to demand. (By My guesstimate of the net revenue value to $OCC of 4,000 is c. AUD4m ballpark! So, they are clearly positioning for success.)

2. Several Costs of Market Entry are Front-Loaded

Once distributors are appointed and markets launch, some upfront costs are required ahead of receipts. These include “Marketing, Business Development and Investor Relations” (+69% to pcp) as the distributors are trained and $OCC leads early engagement with KOLs. There’s also developing marketing materials, ads in industry publications, and presentations at regional conferences. After the initial push, more of the ongoing role passes to the distributor, but of course in the US and Canada, there is more territory to cover, so we may see increased levels of spend through FY26.

Then there’s “priming the supply chain” i.e., getting stock into market. While distributors in NZ, Singapore, and Thailand will probably be replenished directly from the WA warehouse, it is clear that $OCC are placing inventory forwards in North America, so that they can effectively service the 16 US and 1 Canadian distributor who have signed up to date. That makes sense, even if it adds some working capital to $OCC’s balance sheet. “Product and Manufacturing Costs” have increased +109% over the PCP – actually, a good result and in-line with the step up in receipts. This indicates to me that $OCC have the supply chain under control.

3. Other Costs have Increased Modestly

R&D is up only 4.8% to PCP. This is modest given that $OCC’s program is across several fronts. Importantly for Remplir, they are continuing the surveillance study to track success rates against the standard of care, and then there is the recently announcement investigator-led work on using Remplir in prostate surgery, which could be an important extension if it takes off. Overall, then, R&D spend seems modest and potentially of high impact.

A final indicator of good cost control is that “Admin, Corporate Cost and Staff Costs (excl R&D)” has only increased by 11% to PCP. This category is always a key indicator for me as to how tightly the ship is being run. Good work.

One major cost increase, that actually stepped up in Q4, is “Lease Costs” (+212% to pcp!). While it is not commented on in the 4C, looking back at the Annual Report this looks like increased leased costs for offices, land, and clean facilities in WA. So, it looks like a one-off step change to support the business growth. One to monitor in future reports, but not of signfiicant concern for now.

The Cash Position Looks Strong

Thanks to an inflow of $1.4m from exercise of options (a financing flow not shown in the chart above), the net cash burn in the Q was only $1.7m. But with cash still at $27m and an underling operating cash burn of $3m per Q, that indicates the business has sufficient cash resources for just over 2 years.

I fully expect to see receipts continue to accelerate in further Qs, while I also expect the rate of cost growth to begin to moderate. And, while I haven’t modelled it out with any confidence, I think that on the current plan, getting to cash breakeven by end of FY27 should be do-able. (My view not $OCC’s!)

Of course, there will be increase costs as there are more territories to add for the US (50%) and more provinces in Canada. I also expect to see regulatory filings in the EU/UK in FY26, with potentially a European launch in FY27. But this should be doable with current cash if we get good traction in North America.

My Overall Assessment

So, overall, I am happy with today’s report. And the market seems to be too (SP +6% at time of writing).

However, my 3 criteria remain open questions, and I need to see more evidence of efficient scaling of the business as it pushes forward on multiple fronts.

Therefore, I am a “Hold” today - and will push back my decision to add more to this position to the Q2 report, unless there is some tangible update on US sales at the AGM in November. Getting products approved in markets and launched is all well and good, but ultimately, the business has to be able to achieve profitable growth. I think the cards are stacked in $OCC’s favour, as the distributor model will favour efficient scaling and the efficacy data will hopefully sell the product on is own, once it is in the market. But I’d like to see more evidence that this is actually happening before adding more capital to this one.

Disc: Held in RL and SM