Geez101

4C is out. Outside of the modest improvement in GTN results look pretty positive to me but i'm not going to second guess how retail will respond.......

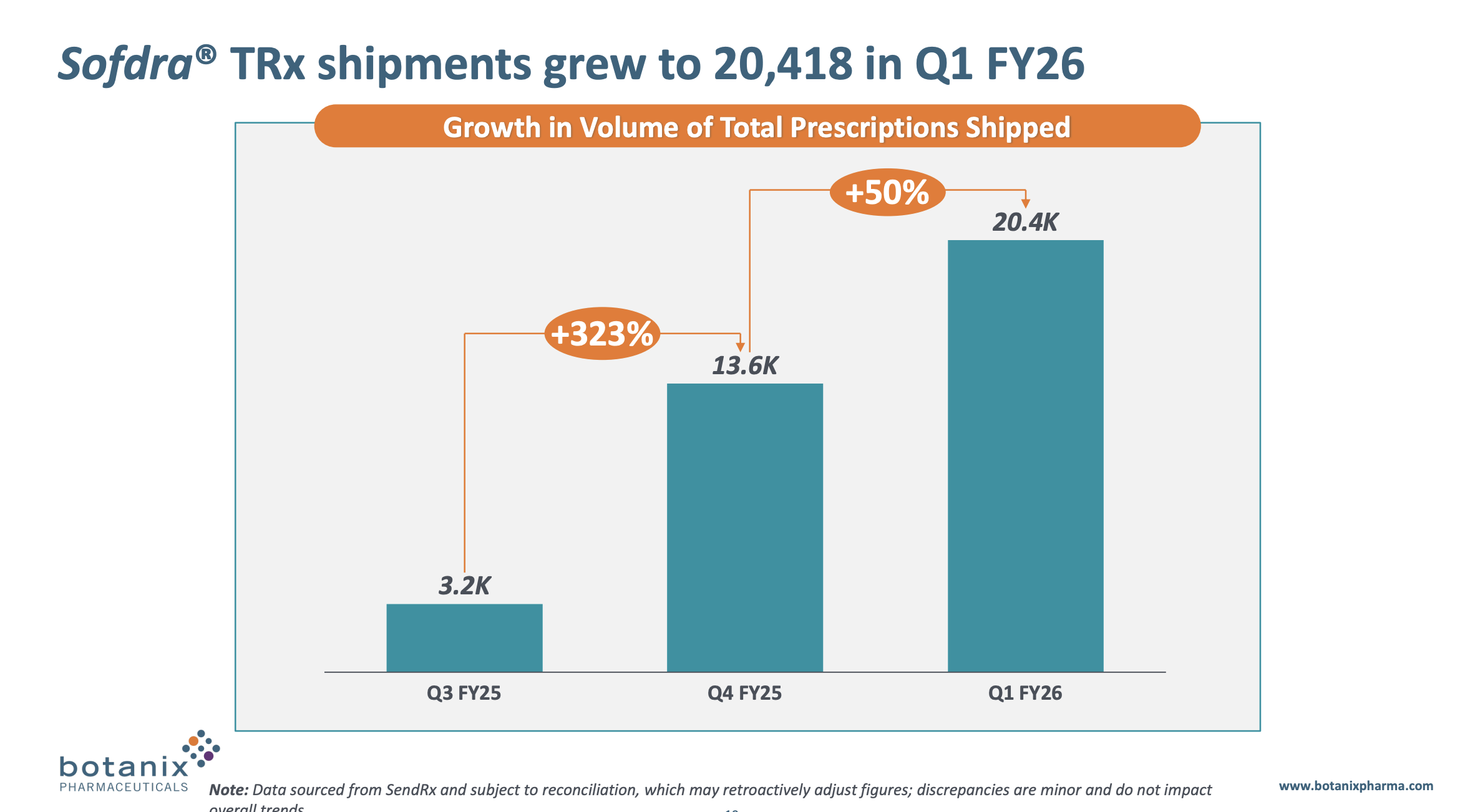

• Total prescriptions shipped grew 50% for the quarter from 13,647 in Q4 FY25 to 20,418 in Q1 FY26

• Sofdra Net Revenue (unaudited) increased from $4.3 million in Q4 FY25 to $7.1 million in Q1 FY26, representing an increase of 65%

• Operating cash outflow improved significantly, decreasing from $28.4 million in Q4 FY25 to $13.1 million in Q1 FY26

• Strong Balance Sheet with cash position of $49.2 million at 30 September 2025 • Sales force was expanded to 50 sales professionals on 20 October 2025

Schwerms

Looks positive overall, i was expecting GTN to come in a bit higher,

First red flag for me having not fully digested this and maybe it's covered in the webinar, they are showing different metrics and not continuing on the monthly trends etc from the last reports.

We don't see retention rate or GTN trend or monthly user additions.

Disc firing from the hip and no longer holding but still very interested in how this goes.

Interested to hear what the webinar was like from those who dialled in

mikebrisy

@Schwerms my detailed write up will have to follow later in the week, as I have overseas visitors staying with me this week.

In brief, the results fell below my "low case" scenario - albeit that is one that yields a valuation of $0.22.

I sold my entire holding this morning during the investor call in $0.155, $0.165, and $0.170 tranches, basically because in 3 out of 10 of my scenarios, $BOT will struggle to ever make any or much money. And in several scenarios further capital is likely to be required,

GTN was a disappointment. I found Howie's explanation to my and others' questions as to why he believes GTN of 30%-40% remains in prospect unconvincing.

Having offered a monthly GTN for June at the last report, he then explained today why only the quarterly number really matters. But even if it advanced from an average in Q4 of 21% to 23% in Q1, I think they will be lucky to hit a future annual average of high 20s%.

Prior to today's result, my model had peak GTN of 35%, so a peak of 29% (my number, not theirs) given that 3Q and 4Q fall back for deductubles, means I'm seeing an annual average more likely of 27% - best case. That's another significant write down of receipts in my model.

TRx at 20,418 was significantly below my low case scenario of 25,000, indicating that existing physicians are not increasing their prescribing rate, and that TRx growth is being driven primarily by new accounts added.

Total prescribers at 2900 was slightly lower than my low case, but close enough, so it confirms the trend of new accounts is driving sales growth, and no increasing account intensity.

Much was made of the 50 reps in Q2 up from 27 reps in Q1. But a law of dimishing returns applies as you build out the coverage to other areas.

I'll do an update on my valuation later, and while there are still scenarios where this business could be worth anywhere from $0.20 to $0.50, I am getting more and more scenarios where it is worth $0.10 to $0.20.

So, the risk profile just doesn't stack up for me anymore. If I were to continue holding, it would be for a different thesis altogether.

@Schwerms - I also agree with your point that this presentation marked a concerted move to reduce transparency of reporting. I think that is so the "narrative" will be given more weight and to buy more time. Howie padded the front of the presentation with an introduction to the company. I think most on the call know this company by now.

I am very grateful to @Geez101 for sharing the EH report, as I was able to read this before the call and compare it with my own models. Anyone reading this report would do well to read the section: "Additional Disclosures". I can get to the EH number ballpark for the next 3-5 years in my high case scenarios, but their research note tends to overlook the fact that dermatological drugs in the US typically get to peak sales in 3-5 years. With the relatively concentrated prescribing base for PAHH, I think we'd likley be looking at more like 3-4 years. So make of their revenue projections what you will!

Therefore, I'll take my losses and head home. Sometimes your investment thesis just doesn't pan out. Today I'm calling it for $BOT.

Disc: Not held in RL; selling in SM

Scoonie

I have to agree with your conclusions mikebrisy

Not an analysis, but some further observations from this mornings tightly managed webinare:

i) From my notes of the last webinar the GTN in June was 23%. Now it is written up in the latest presentation as 21% - and so shows an improvement to 23%. Howie in the webinare clarified as the June “exit GTN being 23%” Right.

ii) In what world do the product manufacturing costs fall 81% in a quarter.

iii) Staff costs fell from $4.5m to $3.5m yet the sales staff went from 27 to 50. The CFO later clarified these sales staff salaries were incorporated in Operational costs. By another Howie accounting miracle the additional 23 sales staff hired assisted operating costs fall from $14.3m to $10.2m.

iv) Howie was asked how they would get GTN to above 40%. Howie’s answer was risibly evasive.

v) Howies was asked about why now we are not being told the breakdown of patients numbers and refills. See answer at (iv)

vi) Howie was asked about ongoing API purchases? Well you didn’t need Howie to answer this one since inventories are at $29m, but see (iv) again.

vii) One hopeful shareholder even asked when BOT would reach profitability. See (iv). Give up and go home.

Howie spoke to the quote in slide 8 about the remarkable speed of delivery of the product. Well why wouldn’t it be a speedy delivery, the guys at dispatch have nothing to do.

And we were told zip as to the why the much hyped direct to consumer model has tanked.

Some 15 months ago Matt Callagham when asked about projected revenues was telling us about the number of hyperhidrosis sufferers in the US, expected percentage of these that would be using the product, the numbers of insurance providers they had signed up, a ball park selling price and saying if you work all that out you “get a very big number”. Well I think he must have been musing on my BOT losses.

When Matt resigned from the Board, BOT stated: “We wish him a very speedy recovery, and both the Board and Matt look forward to his return.” We all hope Matt is now well or recovering but hold no hope for his return to the Board.

Some consolation is, if they did not before all shareholders now have the concept of GTN burned into their brain. Pity Howie with his investor roadshows where investors actually have the time to interrogate Howie and his minions about BOT. Or maybe these will also be strictly 40-minute and dash for the door exercises also.

occy

As much as the company is still in the critical scale-up phase, at current burn rate that is roughly 5 quarters worth of cash even with unused facilities. Now with the extra sales force adding to costs, there is just too much that can go wrong even with increases in sales/revenue and another capital raise is on the horizon unless everything goes swimmingly. I sold out half of my holdings this morning but I suspect after I have time to do a full analysis of this release, I'll be selling the rest and sit on the sidelines for a while to see if they can produce genuine traction in sales, specifically repeat prescription sales, before I contemplate buying back in.

jcmleng

Thanks for all the insights this morning everyone - they made a difference in my decision making process.

Exited my 1.2% position IRL in full this morning at 0.155, taking a 35% hit ... And so, completely cleaned out my portfolio of underperforming US Pharma, removing a chunk of red in the portfolio in the process.

Rather than stressing over the losses, I actually feel a lot of relief exiting AVH and now BOT - the losses sting, but is is the cost of the learning to only invest in what you know best rather than stray away from it.

Discl: No Longer Held IRL and pending sale in SM

edgescape

Ripped the band aid off as well. Get the feeling that growth is like one of those marginal rate curves that flatlines at the end.

Still have NEU, CU6 (free-carried) and ARX to worry about but price action here is a bit more encouraging.

Strawman

I know BOT didn't go the way holders would have liked, but this is a game of odds and the adherence to process and avoidance of theis creep is to be commended. Honestly, it's not easy to have such discipline and I for one dip my hat.

Its an area I personally struggle with.

Onwards and upwards!

Schwerms

The reporting metric games and changes to them were the big one for me... Oh it's this set of numbers we need now, right well what about those metrics you were showing off last time.. oh ok they don't matter ok I'll look over here now. It's all going good? Ok great..

Think I'll make this a primary red flag from now on..

mikebrisy

@Strawman, there are of course lessons to learn, but overall I am very happy with my decision making throughout on $BOT.

The initial thesis encapsulated a very material opportunity. In RL I took a significant position (c. 6-7%), reduced and took profits when the chair sold down early this year, added back when it was way undervalued, and exited when my thesis broke.

My thesis required a big upside, because of the uncertainty. And once that slipped out of reach, I could no longer justify holding it.

My overall loss is modest, thanks to disciplined position sizing, even when I was super-bullish. As indeed I was!

But when the facts change ….

BTW This hasn’t put me off speccy biotechs. In fact, bring on the next one! When you swing at risky plays, you’re going to miss more than occasionally.

Strawman

Well said @mikebrisy

One of the counterintuitive truths of investing is that not taking any risk is risky. At least if one has any aspirations for market beating returns.

occy

I broke one of my own rules with BOT, I doubled my investment on my percentage that I invest in "speccies" within my portfolio. Reading back over my notes this morning over my reasoning, I had $ signs in my eyes, the upside just seemed too great to not take the risk.

My initial investment would actually still have left me in profit as it averaged $0.135, however I doubled down at an average cost of $0.41. I'm not so much angry at myself about the loss monetary wise and understand the reasoning at the time, more so everytime I break a rule it seems to backfire on me. I've framed rules over quite a long period of time and yet my lack of discipline costs me again.

Maybe embarrassing myself by publicly declaring my ill-discipline I might actually learn a lesson for a change.

Strawman

Nothing to be embarrassed about @occy @Arizona

If you want to feel better, just look at some of my mistakes, as well as all the contradictions between what I say and do...

Anyway, I have nothing but respect for anyone who steps into the investing arena and works diligently to hone their craft in the face of risk, uncertainty and our many human shortcomings.

AbelianGrape

@occy and @Arizona

The same story with me, in fact almost the exact same initial and doubled-down prices for me as you @occy. I guess we all let those $ signs flash too big in our minds. Definitely a learning experience!

jcmleng

I was the exact opposite, but still spilt blood. Opened the position at 0.44, but doubled down all the way to 0.1125 with an exit average cost of ~0.24. Roughly half of the units were purchased between the 2 extremes and the selling price of 0.155.

Hence my clear preference to enter once conviction is gotten, then average down, rather than up ...