@BoredSaint , the easiest way would just be to put the query into something like Perplexity e.g.: "Please calculated the volume weighted share price average of shares for CAT on the ASX for the last 5 trading days and then apply a 2% discount to that price"

Which for the last 5 days would give you:

The current 5-day volume weighted average price (VWAP) for shares of Catapult Group International (CAT) on the ASX is A$6.9590. Applying a 2% discount to this price, the result is approximately A$6.82.

Calculation

- 5-day VWAP: A$6.9590

- 2% discount: 6.9590×0.98=6.819

- 6.9590×0.98=6.819 (rounded to A$6.82)

The adjusted VWAP for CAT (ASX) with a 2% discount is therefore A$6.82.

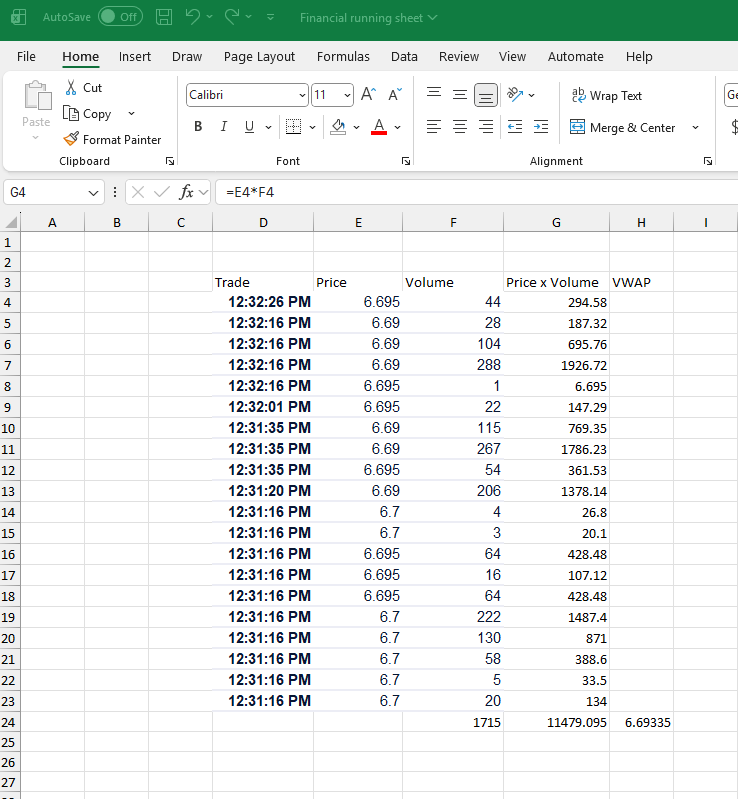

Alternatively you could actually create the calculation in a spreadsheet, and cut and paste all the trading data from your trading platform into the columns each day and get the real VWAP.

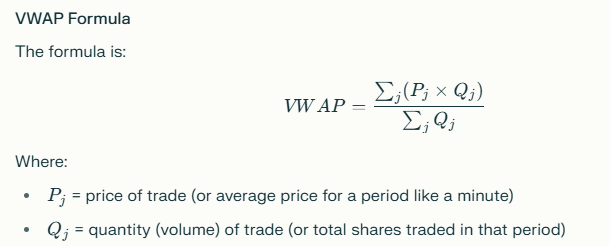

VWAP, or Volume Weighted Average Price, is calculated by dividing the total dollar value of all trades (price multiplied by volume for each trade) by the total trading volume over the selected period.

So above I've just cut and past some trades today for CAT, Column G is calculated as indicated by Price multiplied by Volume of each trade. Then you 'Autosum' at the bottom of each column and the VWAP is calculated by dividing the totals of the G4 column by the total of the F column (=G24/F24).

But if you're happy with the $6.68 price, then I wouldn't worry about it, as it will either be that price or lower.