Discl: Held IRL 0.67% and in SM

Part 1 of a few parts as I deep dived on HZR.

SUMMARY

HZR owns the IP to the Hazer Process and is developing and commercialising this technology

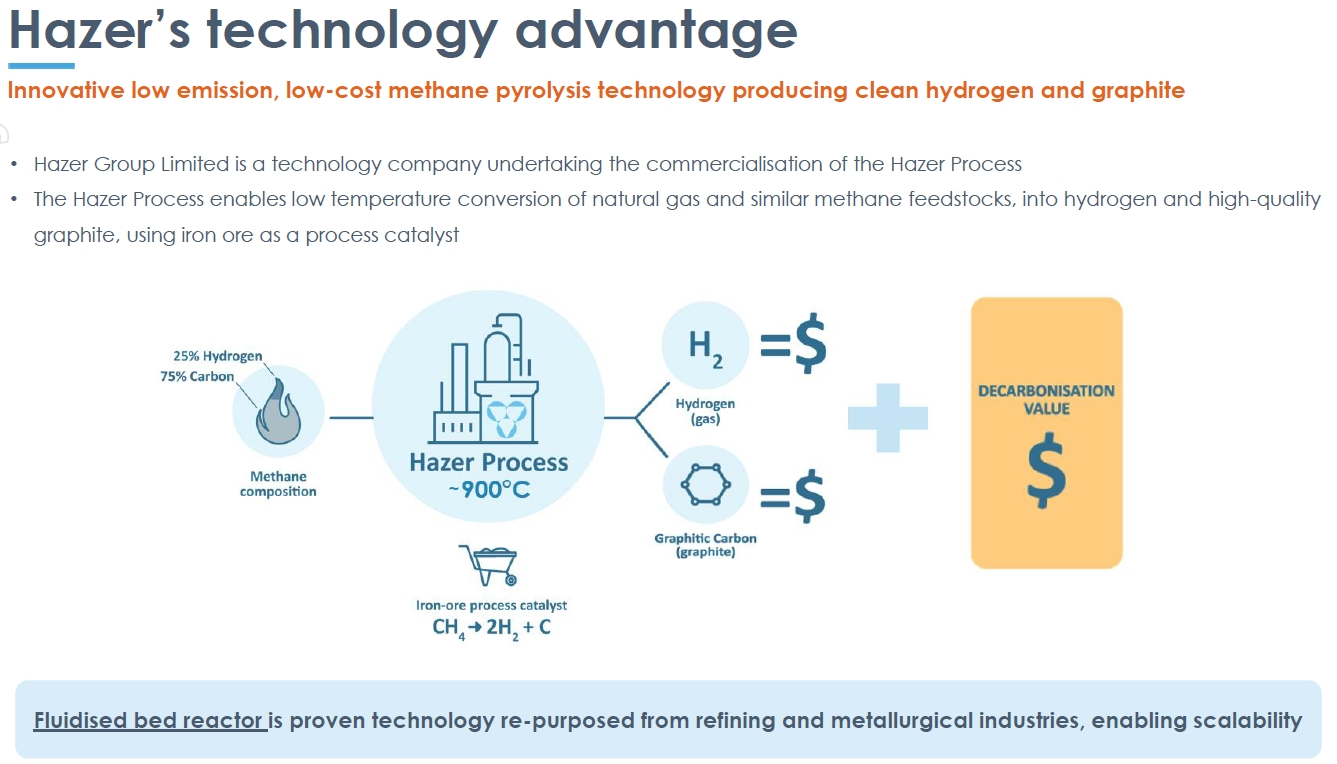

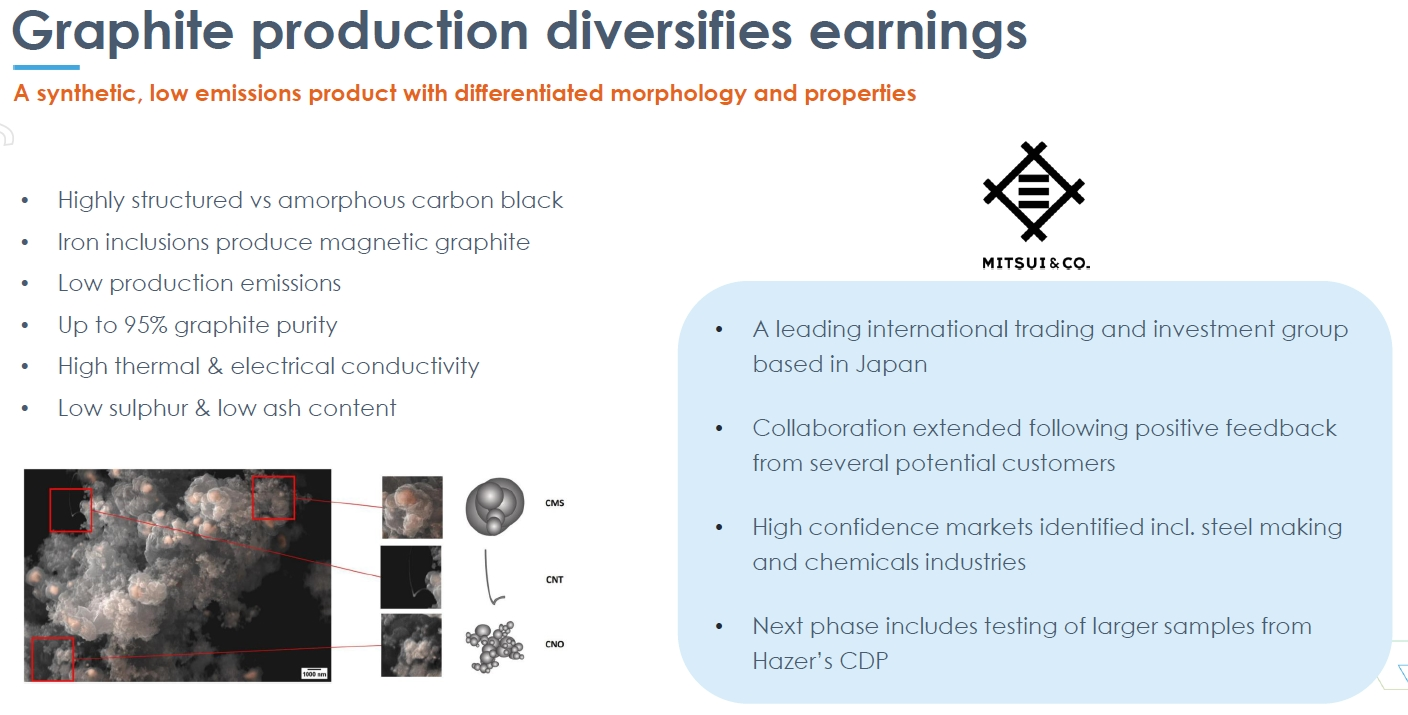

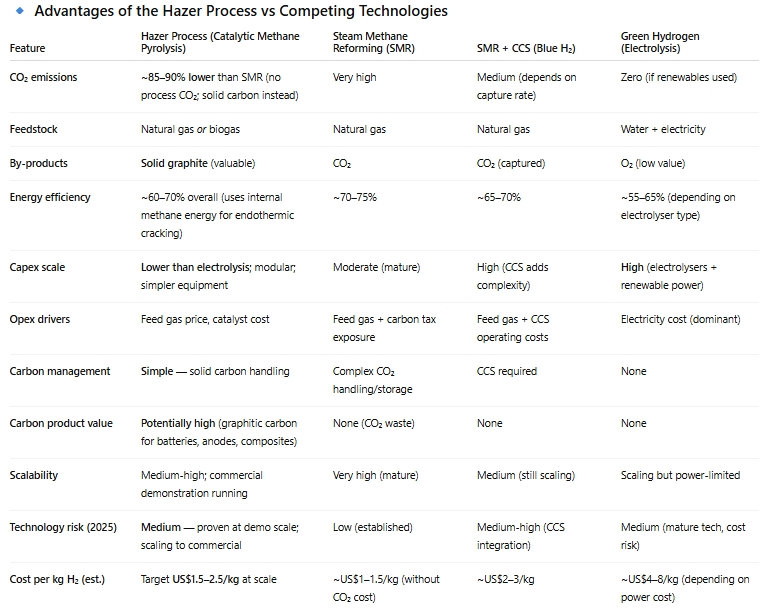

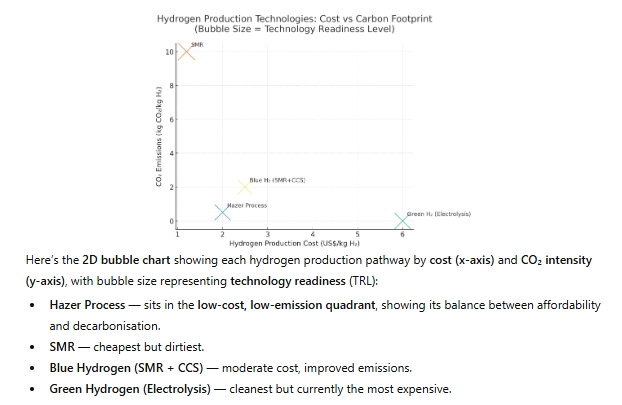

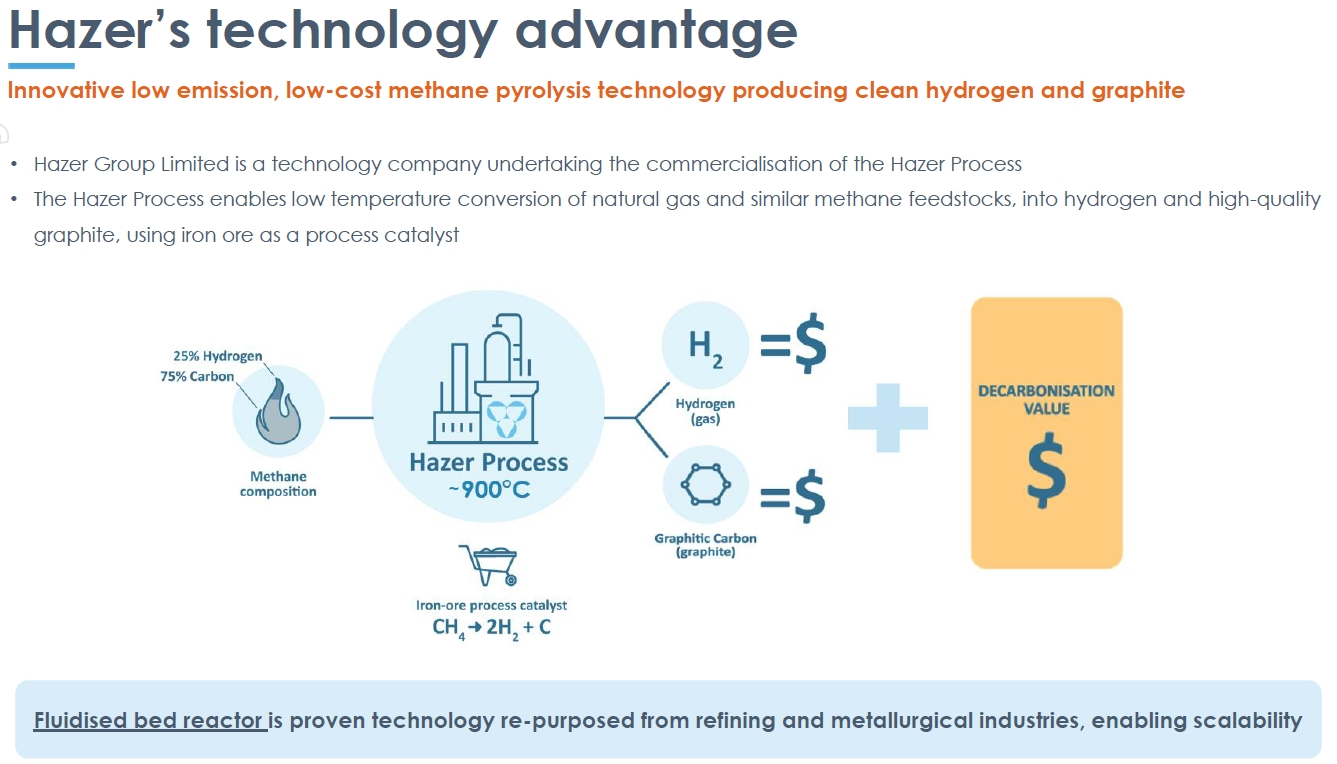

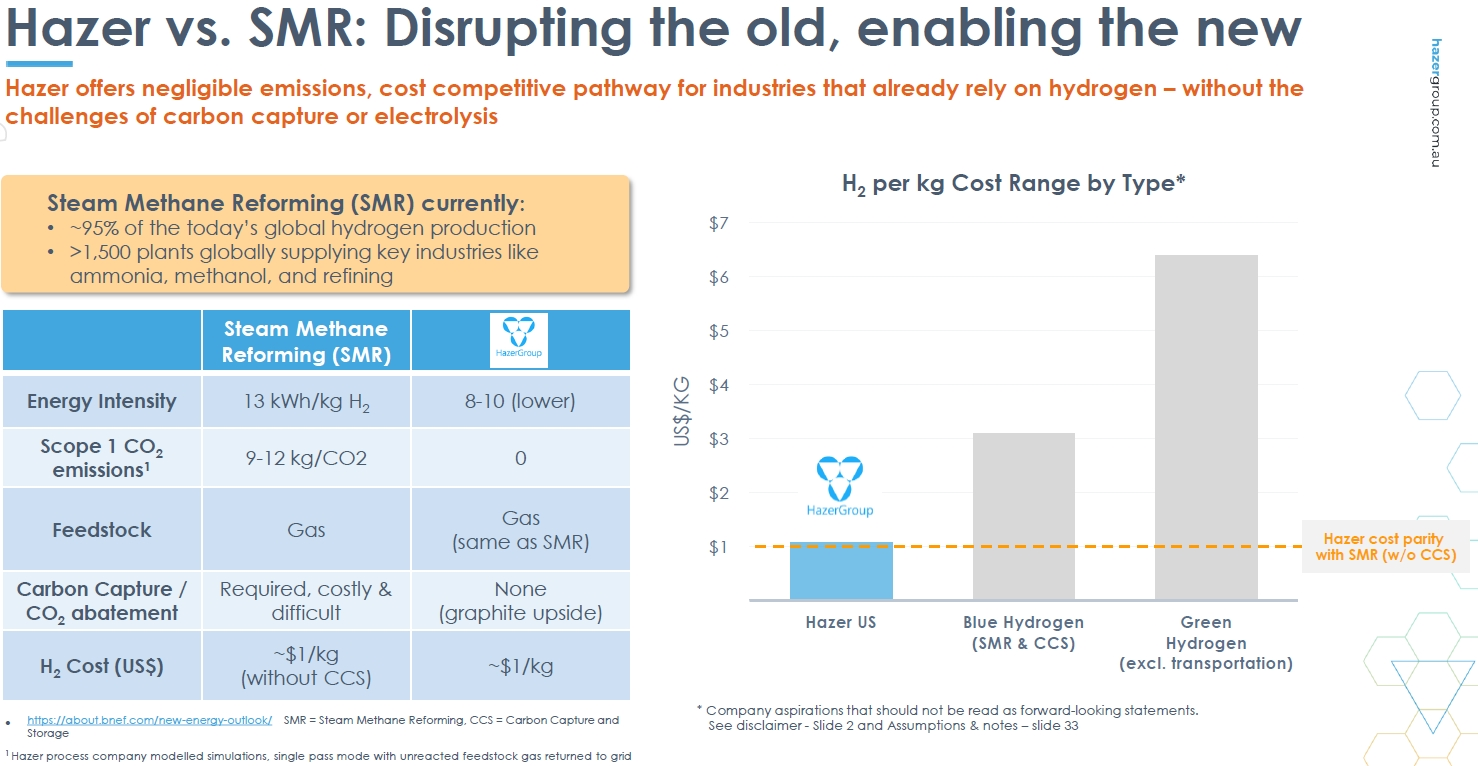

The Hazer process is a low-emission method for producing hydrogen and graphite from natural gas or biogas. It uses a low-cost iron ore catalyst to crack methane into hydrogen gas and solid, high-quality graphite. This process offers a cleaner alternative to traditional hydrogen production by capturing the carbon as a valuable solid product instead of releasing it as carbon dioxide.

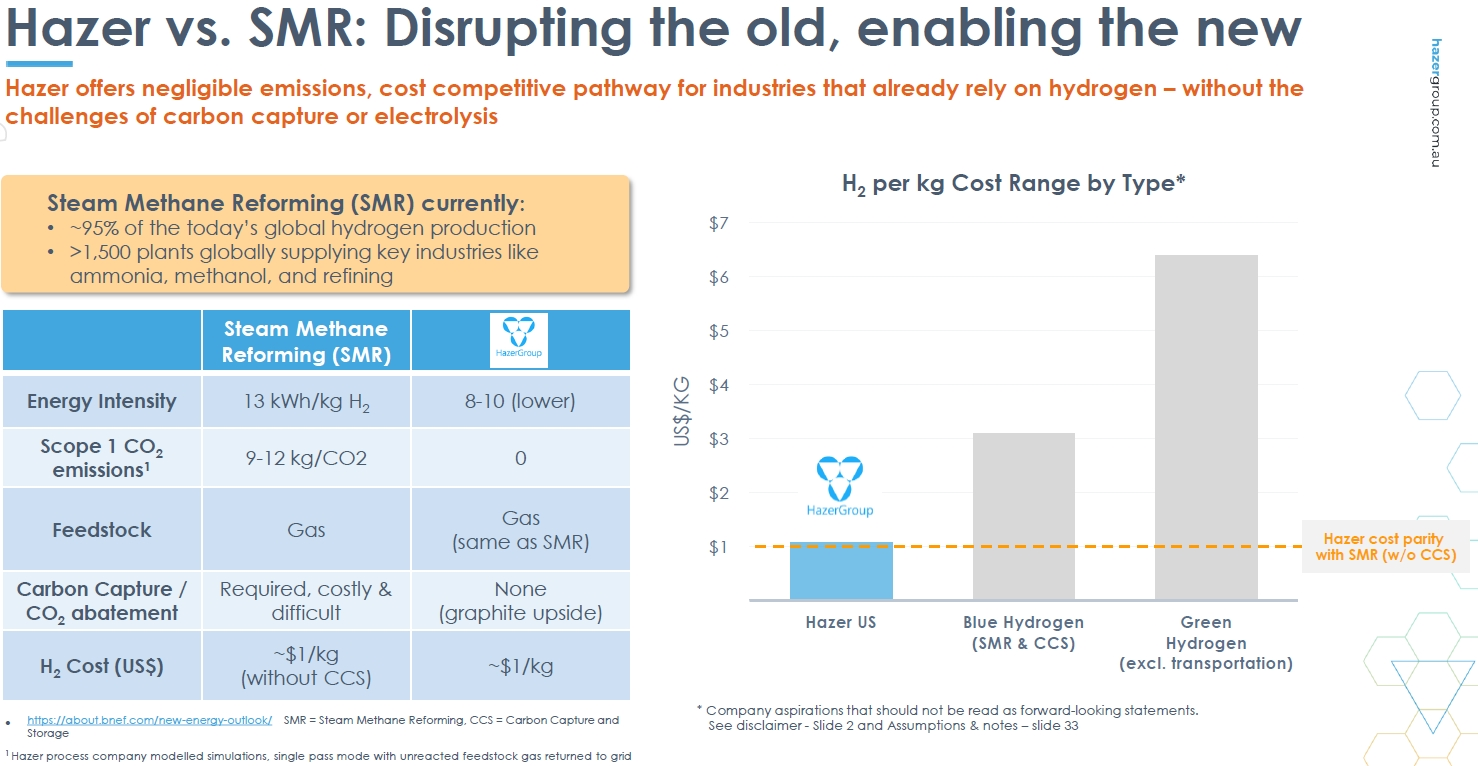

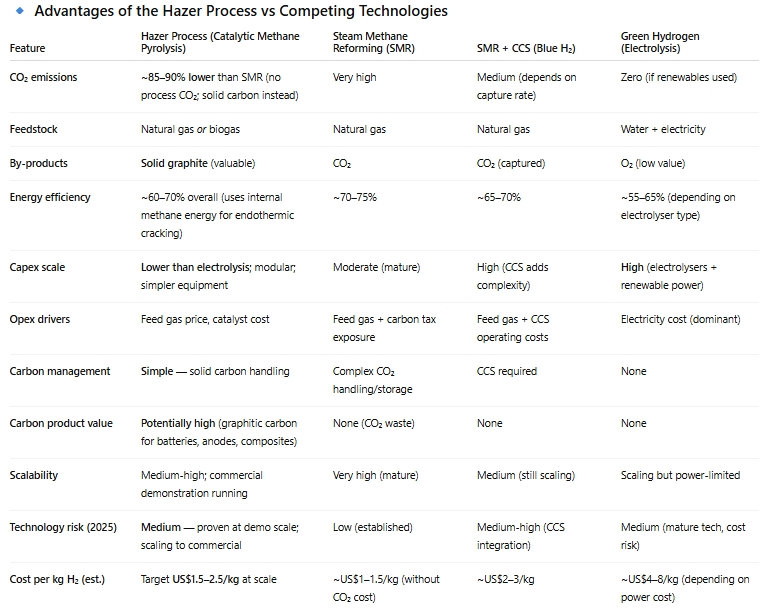

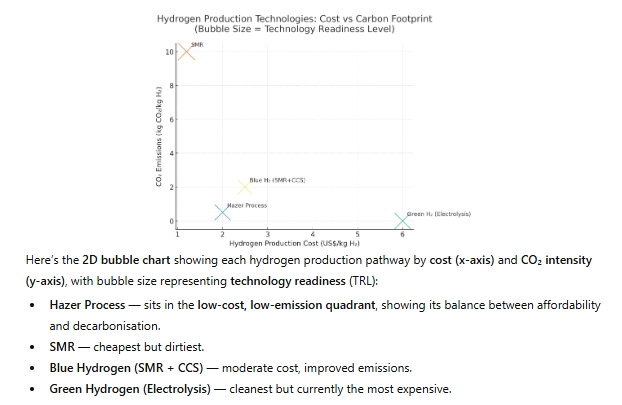

There are significant benefits to the Hazer Process vs the current dominant Steam Methane Reforming (SMR) method of producing hydrogen - zero carbon emission, low energy requirement, no requirement for carbon capture storage, valuable carbon graphite co-product which can be monetised

The Hazer Process is categorised as a “methane pyrolysis” method of producing hydrogen

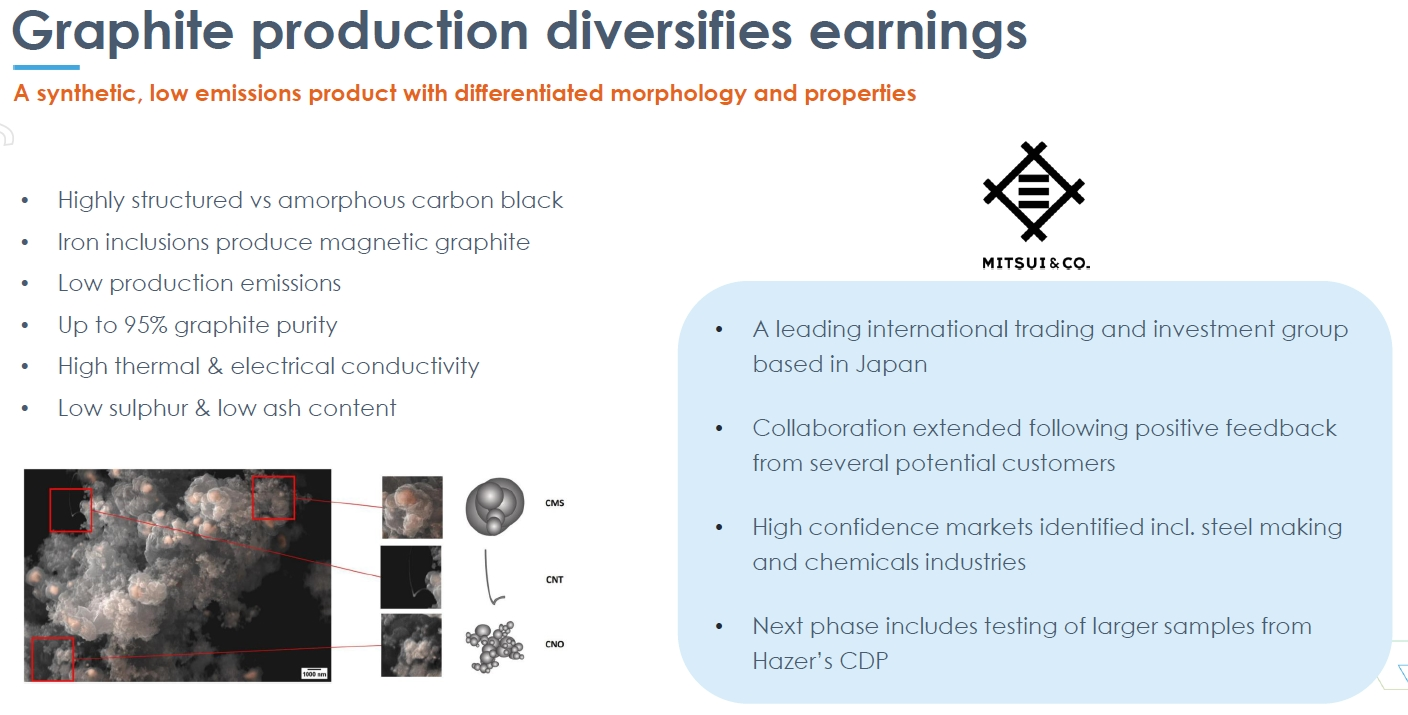

Other companies have developed variations of the methane pyrolysis method, but the Hazer process is differentiated by the following advantages: (1) the use of Iron Ore as a catalyst (2) creates high quality Graphite Carbon as a co-product (3) avoids need for carbon capture storage (4) low electricity cost

The choice of which methane pyrolysis methods for a given plant/site will depend on several factors, including (1) energy source & footprint (2) scale & deployment model (3) carbon product quality

The focus in the past few years has been to build the Commercial Demonstration Plant (CDP) in Munster, WA, which has been fully operational since Nov 2024 - this was a key milestone to demonstrate the commercial readiness of the Hazer Process technology

WHAT IS ATTRACTIVE

The Hazer process has huge technology advantages over current methods of producing hydrogen, including other alternative methane-pyrolysis approaches

Hard yards to scale up and prove the Hazer process has already been done - the technology appears to be ready for scale-up and commercialisation

This is feeling very much like C79, minus the Capex spend on the Photon Assay machines - the Hazer technology is set to disrupt the current dirty method of producing hydrogen by offering a more efficient and clean approach, with the economic benefit of high quality carbon graphite as a co-product which can be monetised

A. BUSINESS MODEL

Has IP rights to a technology developed a The University of Western Australia which allows the production of hydrogen gas from methane (natural gas) with negligible carbon dioxide emissions and the co-production of a high purity graphite product (the “Hazer Process”)

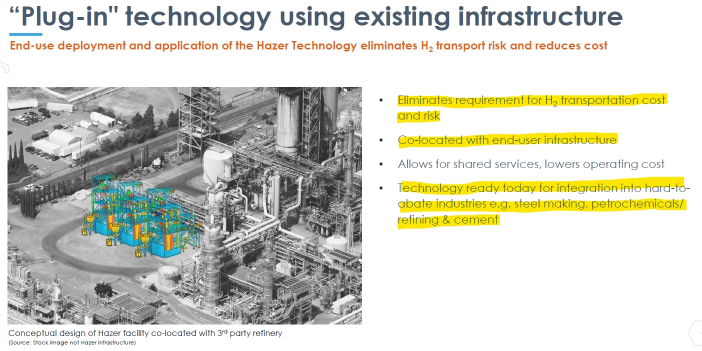

Business model is focused on scaling-up and commercialising the Hazer Process so as to supply hydrogen gas and high purity bulk graphite to the significant global hydrogen and graphite markets.

B. HAZER’S MISSION

Our mission is to play a significant role across three multi-billion dollar global markets. Hazer Group’s technology can potentially provide an innovative solution for the global industrial hydrogen market, by producing hydrogen at lower cost than alternative options, while also reducing users’ CO2 footprint.

The low-emissions associated with the HAZER Process also potentially provides a gateway for hydrogen to more effectively penetrate the sustainable energy market for both vehicle fuel and stationary power applications. Hazer is also looking to provide high quality synthetic graphite for energy storage and other large global graphite applications.

C. THE HAZER PROCESS

The Hazer process is a low-emission method for producing hydrogen and graphite from natural gas or biogas.

It uses a low-cost iron ore catalyst to crack methane into hydrogen gas and solid, high-quality graphite.

This process offers a cleaner alternative to traditional hydrogen production by capturing the carbon as a valuable solid product instead of releasing it as carbon dioxide.

HAZER’S DISRUPTIVE ADVANTAGE - METHANE PYROLYSIS METHOD vs INCUMBENT SMR TECHNOLOGY

The Methane Pyrolysis technology method has very clear economic benefits over the current Steam Methane Reforming (SMR) method BUT HZR is not the only company with technology in the Methane Pyrolysis space.