Pinned valuation:

Bull Case:

Diggers and Dealers Conference 2025 Presentation by Turaco Gold - from Justin Tremain, Managing Director

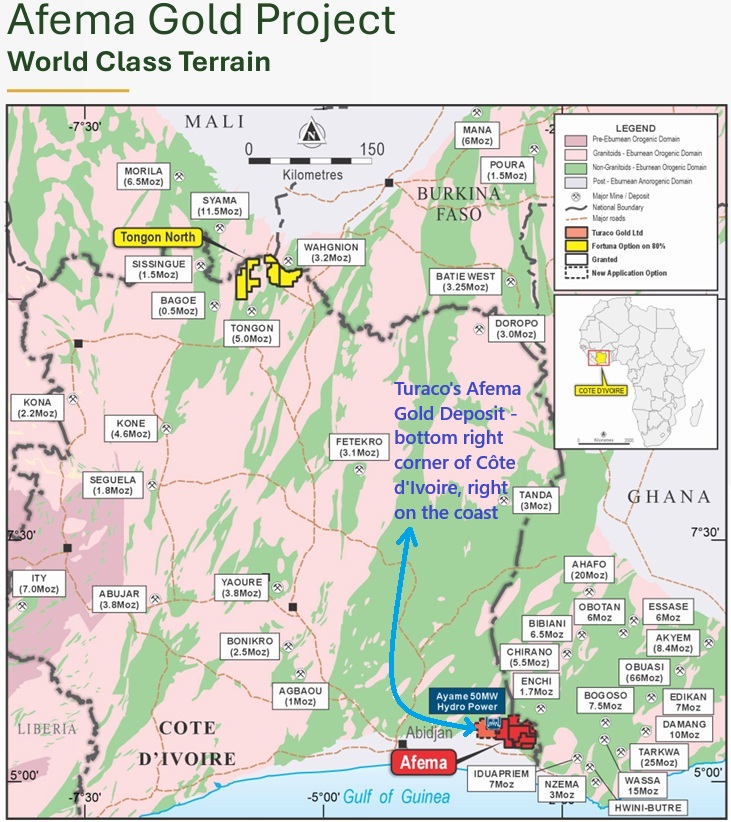

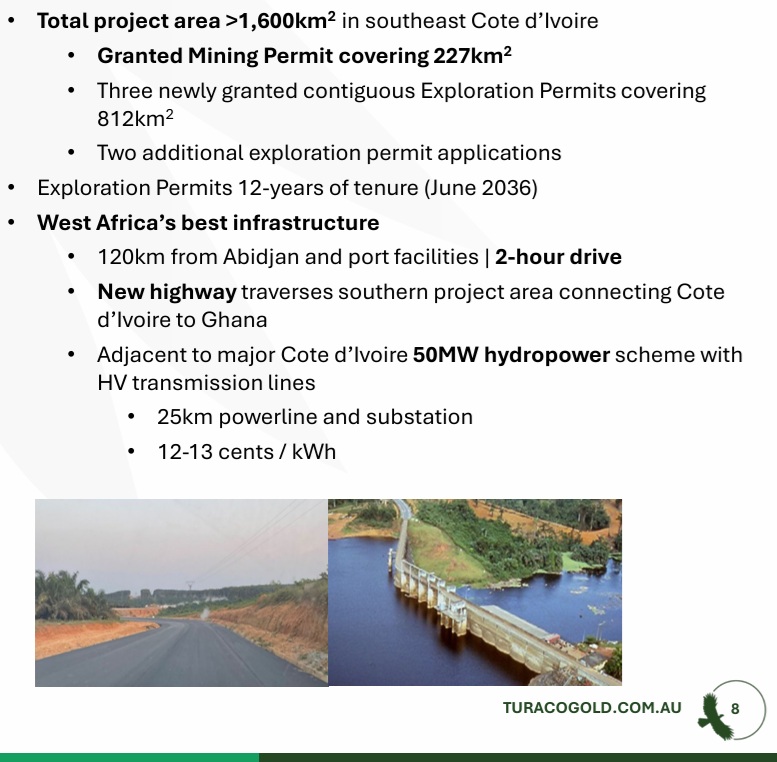

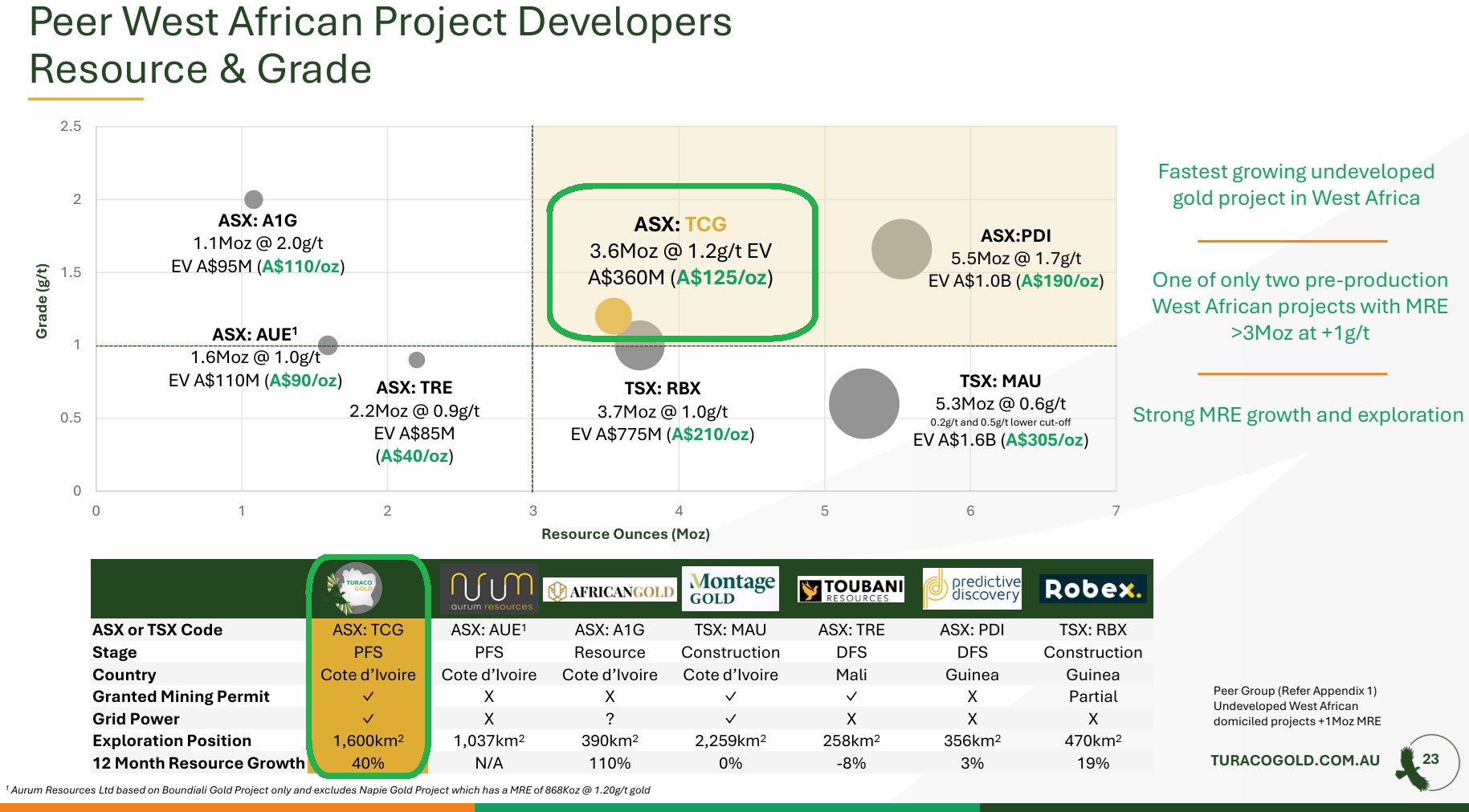

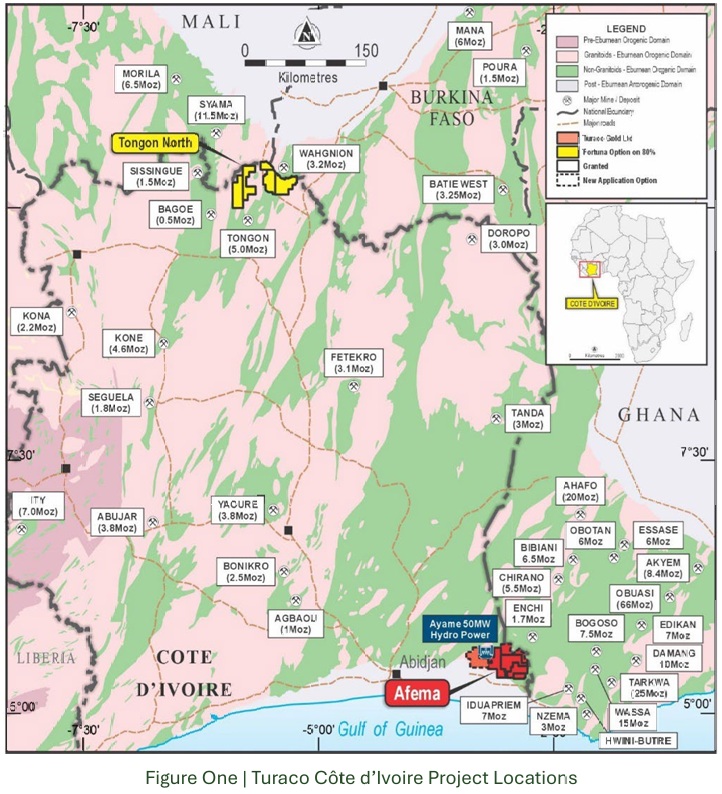

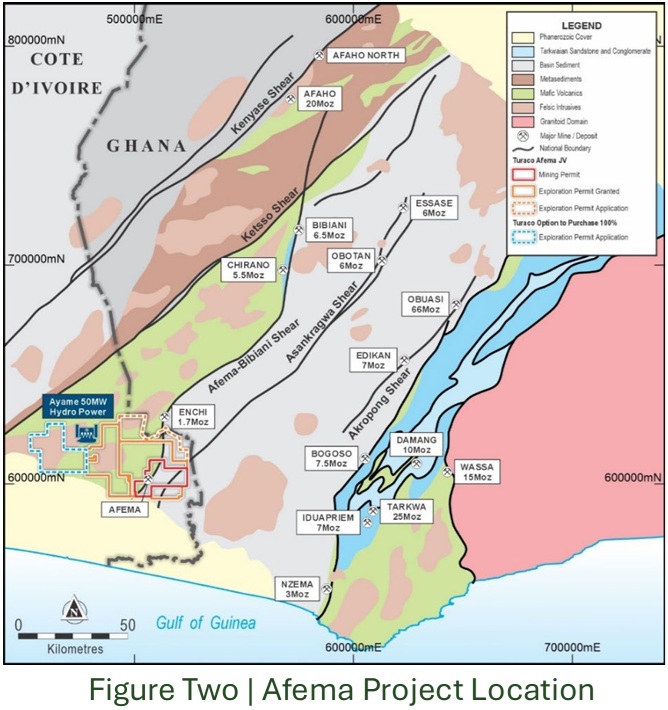

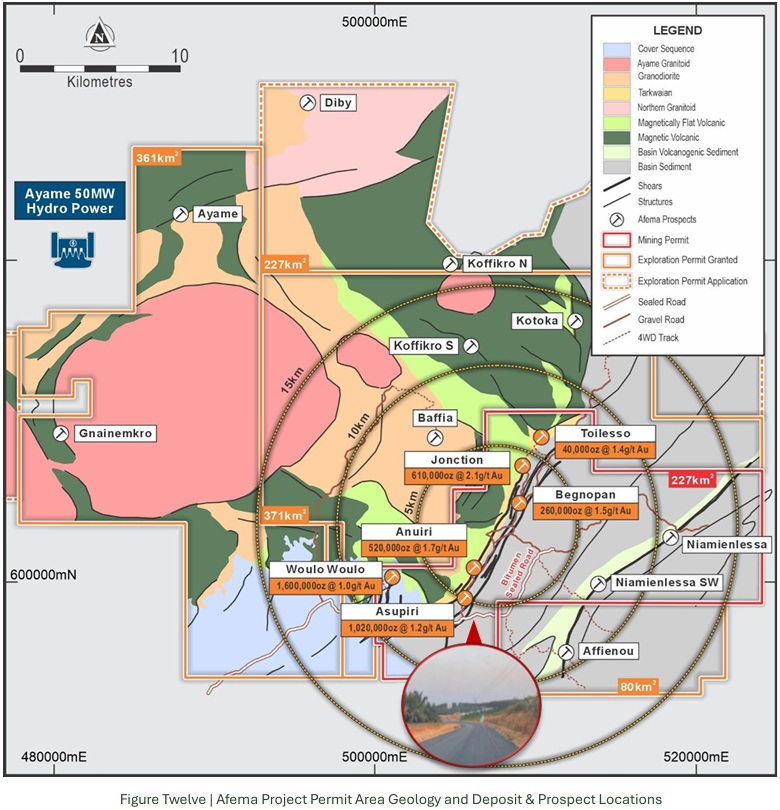

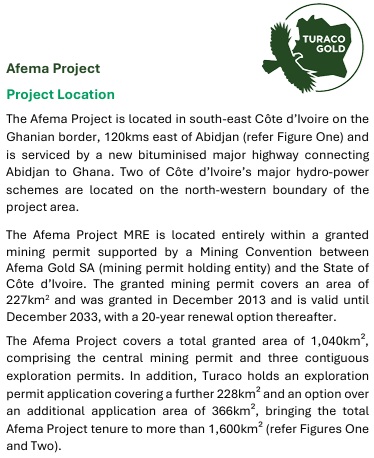

As you can see below (and above), the grades are quite average, but very simple chemistry, the gold is simple - and cheap - to extract, they're situated right next to a 50MW hydropower station, so cheap power, they're about as far away from the trouble spots in West Africa as you can get without moving into the ocean, their permitting is well advanced, they have plenty of land and plenty of exploration upside, good sealed roads all the way through to the country's capital and through into Ghana, great relationships with the government there in Côte d'Ivoire and the local community, and they're not expensive compared to their peers on a dollars per ounce of gold basis.

Afema WILL become a mine, most likely in 2027, and I would expect they'll have found significantly more gold between now and then as well, which will keep driving up their valuation.

West African gold project developers (peer) comparison:

These (above) are all slides from this recent presentation: TCG's 04-Aug-2025 D&D Presentation.PDF

If any of the above slides are too small to read, and you want to read the details, click on that link above and you can look at the source material and blow it up as large as you like.

I should also thank @Scoonie - who first got me interested in this company last year.

That's Scoonie's 45% return on TCG in less than 10 months. It would be better, but those shares were unfortunately sold on 3rd March this year @ 33 cps - TCG closed today at 50 cps.

I'm a bit late to the story, buying in only last week both here on SM and in my real-money 5-company speculative goldies portfolio (I hold much larger positions in much larger gold producers in other portfolios). It would have been nice to have got into TCG last year...

That's their 3 year chart with weekly data points. There are a few metals explorers and project developers, especially in gold, that exhibit that sort of SP growth, but their potential isn't always obvious in their earlier stages.

I have to say, looking back, that Turaco's potential was actually pretty obvious last year, I was however suffering under the strong bias that West African gold miners were best left alone, and project developers and explorers in West Africa even more so, and apart from some short stints in PRU and WAF (who both produce gold from multiple mines there already) - until I got cold feet - I did manage to mostly give West African gold a wide berth - apart from holding Lycopodium (LYL) throughout (and still do) - who build many of the gold mills over there - but anyway, better late than never with TCG.

The best bull thesis for Turaco Gold is summed up in less than 17 minutes here: Presentation by Turaco Gold - from Justin Tremain, Managing Director (at D&D earlier this month).

Higher risk, as they do not produce gold yet, and won't be producing any before late 2027 or 2028, but still plenty of potential for share price appreciation if they keep finding more gold and keep progressing Afema towards becoming a gold mine in Côte d'Ivoire.

Conversely, if the gold price falls, and/or TCG do NOT find significantly more gold, then there's also downside here, so this sort of company certainly won't suit everybody.

Discl: Holding.

https://turacogold.com.au/

03-Nov-2025: I was looking through a number of Quarterly reports for the September Qtr over the weekend, and the one from Turaco (TCG) certainly caught my eye and reminded me again why I'm invested in them, despite the fact that their project is in West Africa.

31-Oct-2025: Quarterly Activities/Appendix 5B Cash Flow Report.PDF

30-Oct-2025: Further Afema Resource Growth to in Excess of 4Moz Gold.PDF

I've already mentioned in my bull case / val why I like them, but just to recap, their project, Afema, is in the bottom right hand corner of Côte d’Ivoire, on the border with Ghana, and those two countries (Côte d’Ivoire & Ghana) are considered two of the safest countries for foreign-owned miners (including gold miners) to operate in, in West Africa, which is generally considered a dangerous place to operate, and some countries, like Mali, are indeed very dangerous places to operate. Mali is directly north of Côte d’Ivoire, but if Afema was any further south of Mali it would be underwater in the Atlantic Ocean (specifically in the Gulf of Guinea):

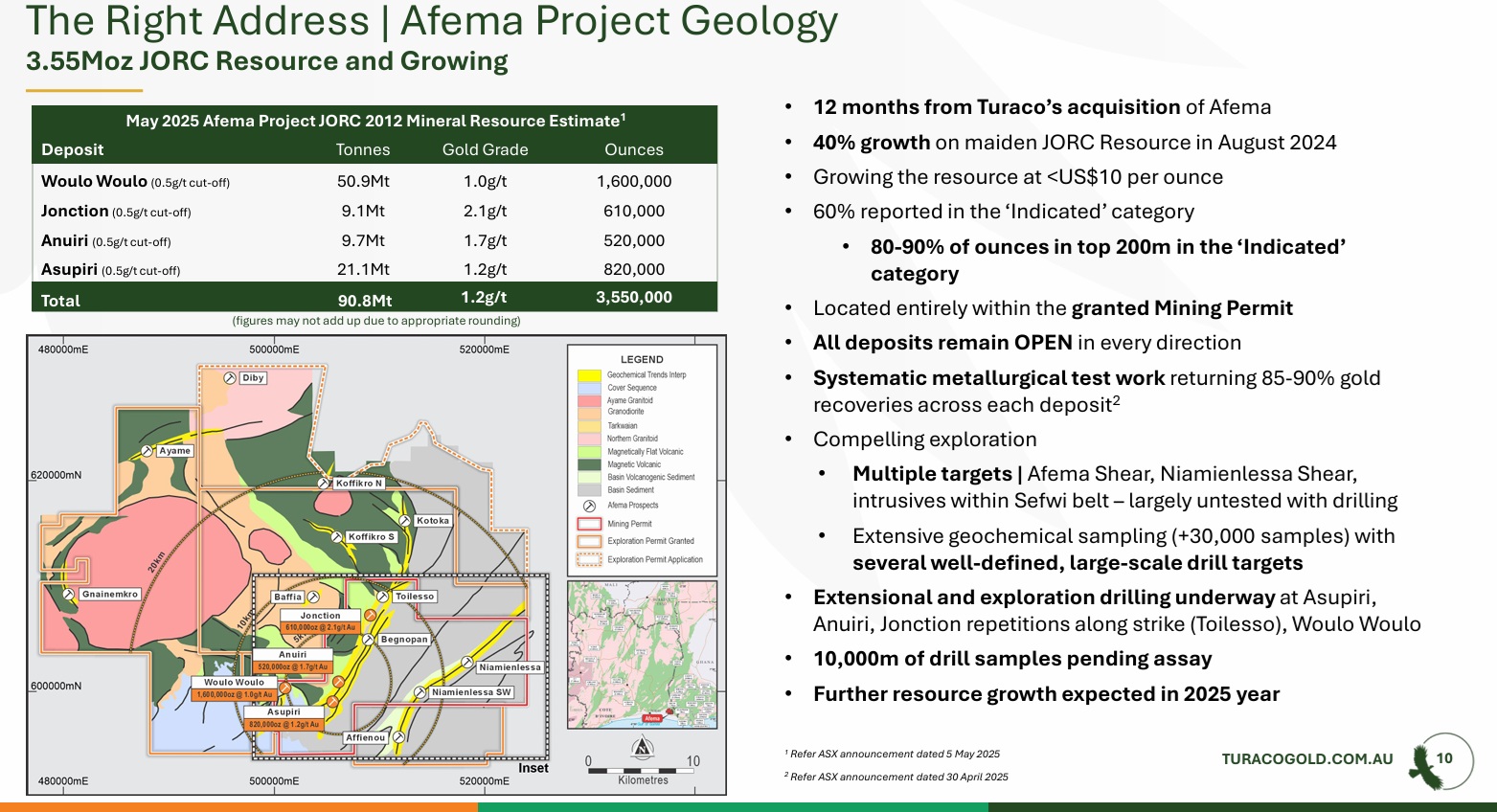

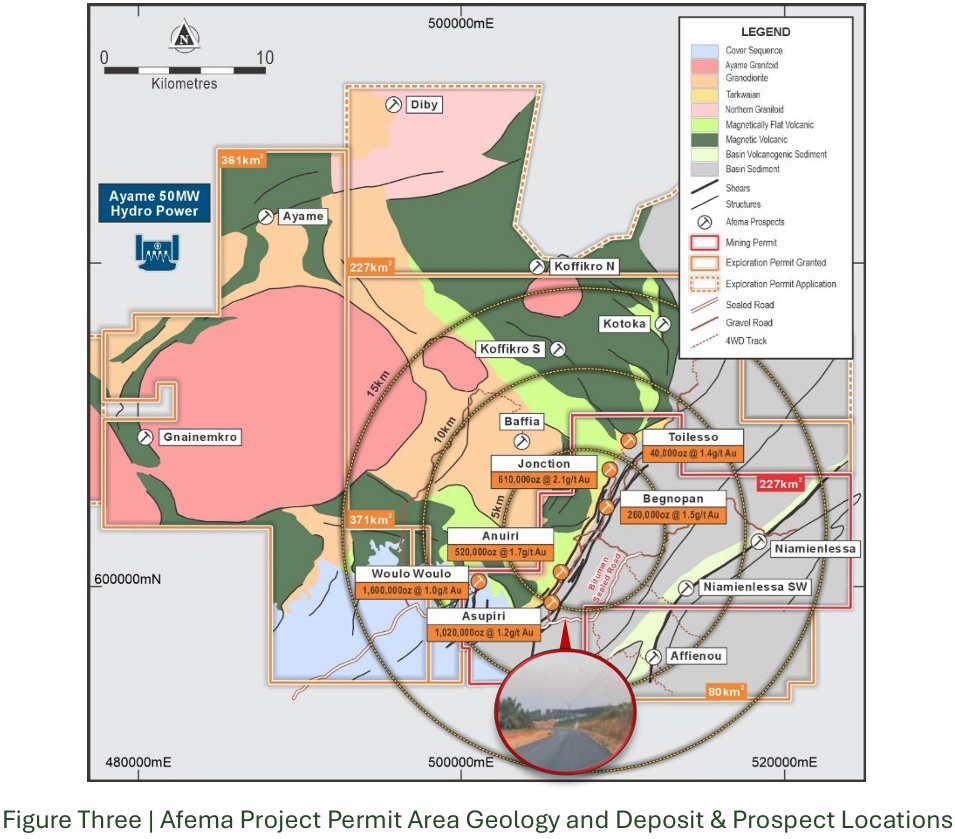

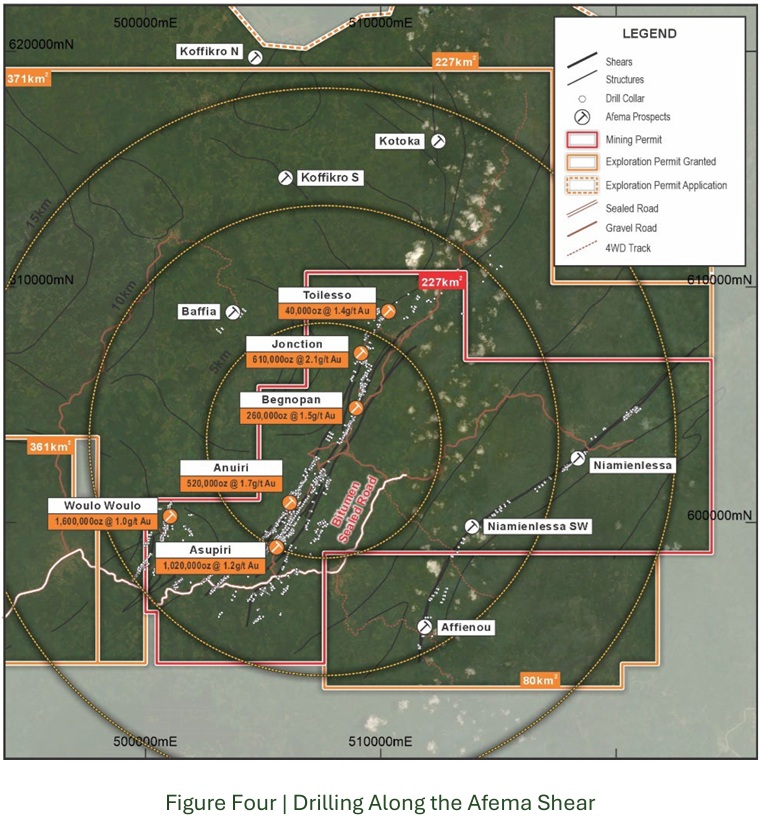

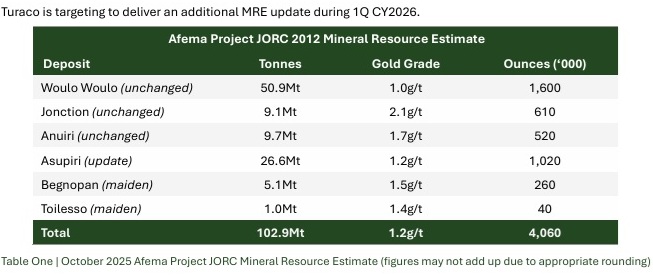

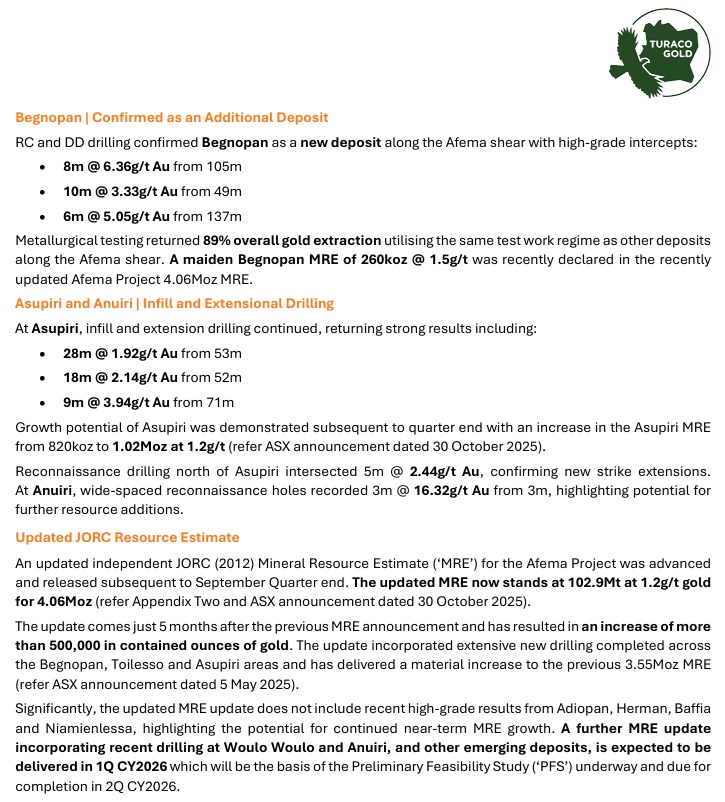

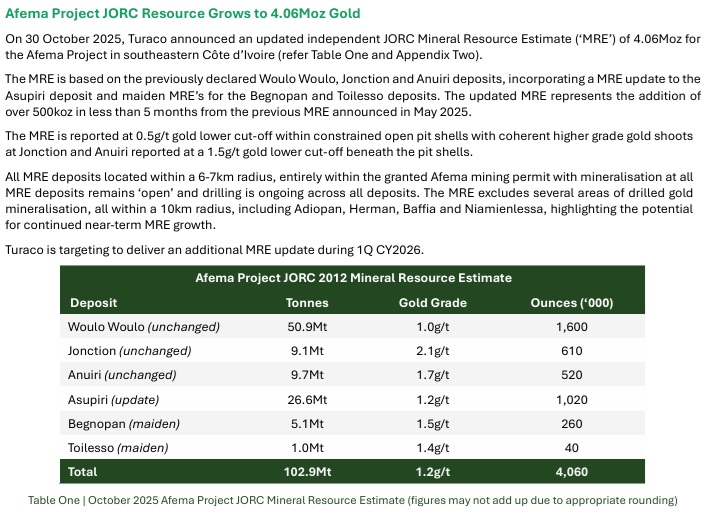

Now the main features of Afema are the low grades - between 1g/t and 2.1g/t across their 6 deposits, as listed below, but also low costs which include cheap power from the nearby Ayame 50 MW Hydro Power Station - that sits on the north west edge of Afema. But they have a LOT of gold there across those 6 deposits, more than 4 million ounces of gold, as shown below, and those 6 deposits are ALL within a granted mining lease, as shown above. And TCG also have multiple prospects within granted Exploration Permit areas surrounding their mining lease, and further prospects within areas that are covered by applications they have lodged for further exploration permits, as shown two maps up from here.

So not only have they already got over 4 million ounces in their current MRE, they are absolutely going to grow that MRE (Mineral Resource Estimate). More on that in a minute.

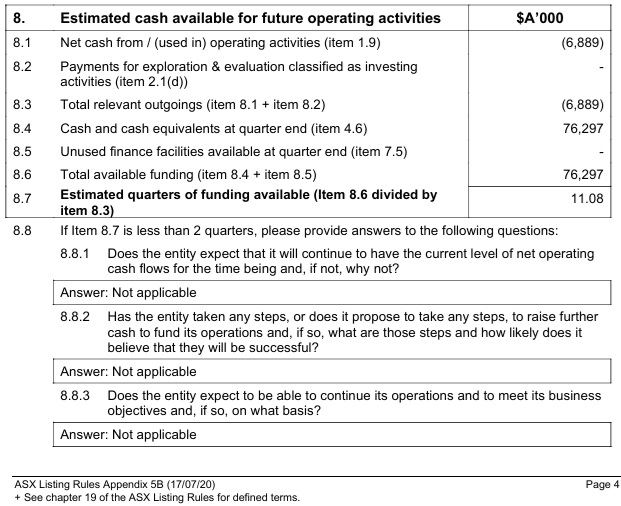

Firstly, as always, I did check their cash balance at the end of the quarter, and it was good, thanks to a CR in July:

That (above) is from their 5-page Appendix 5B (Cash Flow Report) that can be found at the end of their 25 page activity report (Quarterly Activities/Appendix 5B Cash Flow Report.PDF).

Eleven Quarters of funding is 33 months (or 2.75 years) based on their $6.9m cash burn in the September quarter. All good. (Tick.)

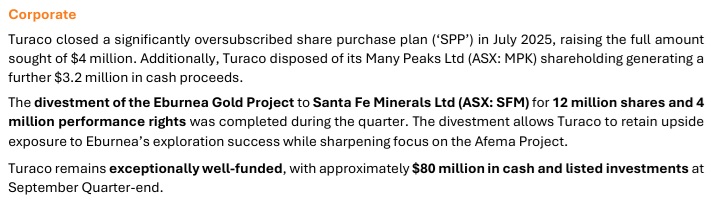

Further, they had this to say on the second page of their activities report:

All good. (Tick.)

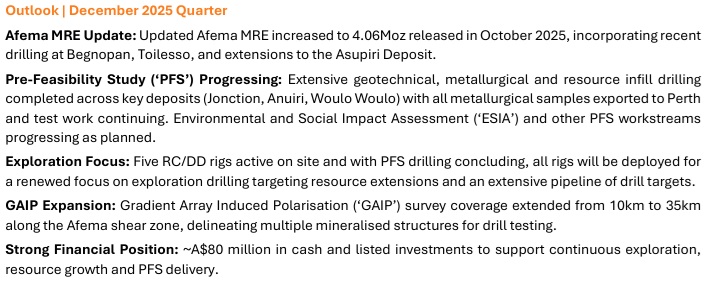

Next, let's jump ahead to their outlook for the current and future quarters:

All good, still drilling with five rigs on site doing both DD and RC exploration drilling. Cashed up. PFS progressing well. All good. (lots of ticks)

Report Highlights:

Further Reading:

Some fun facts:

Fun Fact One:

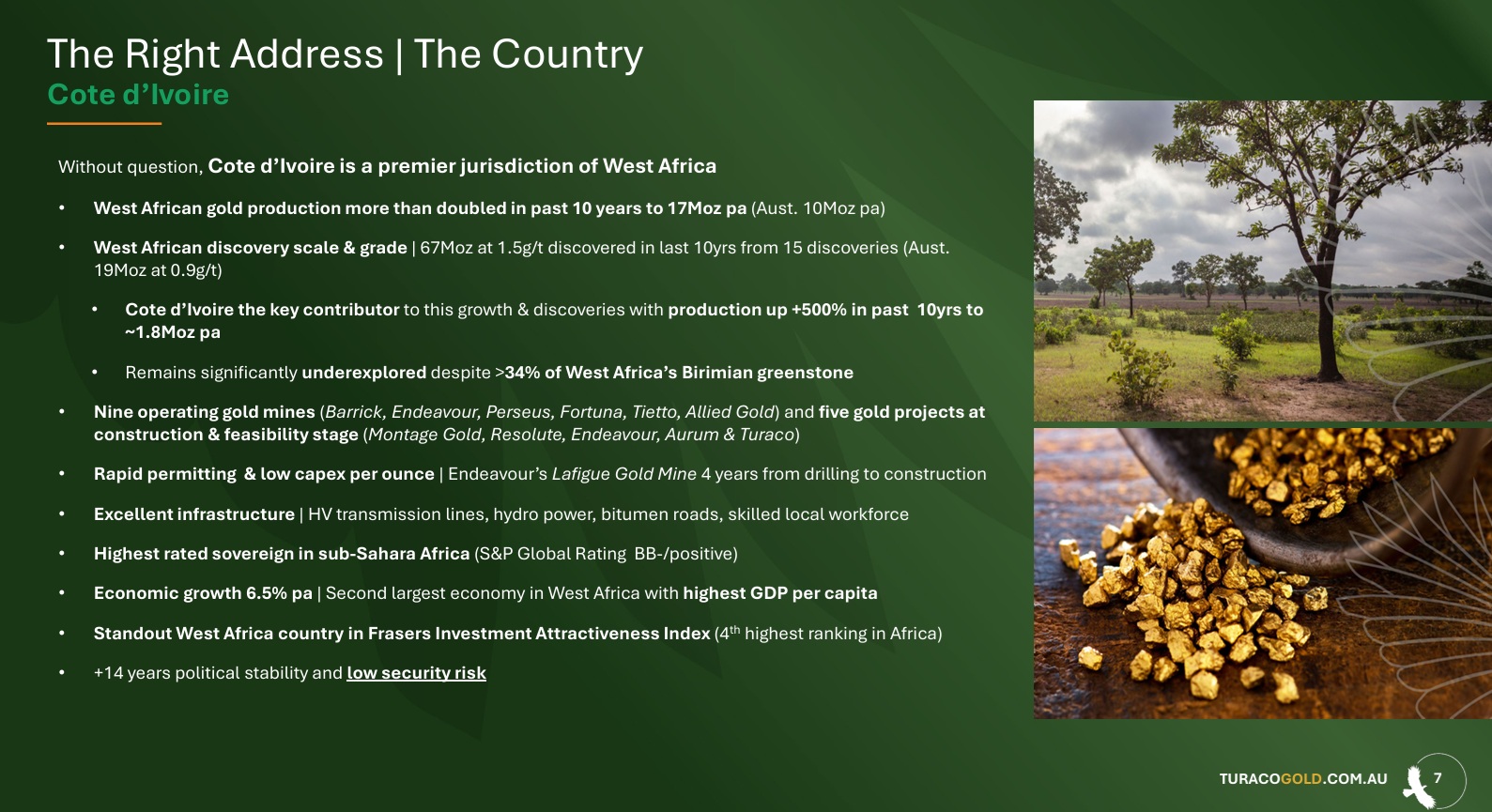

In that D&D presso (link directly above), Justin Tremain, Managing Director of Turaco says that West Africa currently produces twice the gold that Australia does, which surprised me. ChatGPT gives me a figure of 1.7 x rather than 2 x and Google AI is a little lower than that, but all agree that more gold is produced annually in West Africa than is produced by all of the gold mines across Australia, so West Africa is very significant in terms of global gold supply, producing more gold per year than Australia does.

Approximate share of global production in 2024:

Africa (continent) ~ 1,010 tonnes ~ 27-28% (1,010 t out of ~3,661 t)

Australia (country)~ 290-300 tonnes ~ 8% (290-300 t out of ~3,661 t)

Source: ChatGPT

Considering that Africa produces 3.5 x the gold that Australia does - or did last year - it is entirely conceivable that West Africa does produce twice the gold that Australia does - however slide 7 from TCG's D&D presso in Kal in August suggests it's 1.7 times - That slide can be found below - it's mostly green and is all about Côte d’Ivoire and is titled "The Right Address : The Right Country".

Fun Fact Two:

They were drilling about 10,000 metres per month with 4 rigs in July/August this year, and that has now accelerated as they have come out of the wet season. They are now using 5 drill rigs doing both Diamond Drilling (DD) and Reverse Circulation (RC) drilling. Also all PFS-related drilling is now complete, so those 5 rigs are all doing exploration drilling to grow their MRE (Mineral Resource Estimate) even further, and it's already over 4 million ounces of gold at Afema - and growing.

Fun Fact Three:

All of the management team are significant shareholders in the company, and Justin says with $80m in the bank, they will not need to raise more money between now and FID when they raise the big money for the actual plant build. ...If they are not taken out (acquired) before then, which is a very real possibility. One of the companies Justin previously founded and managed (Exore) was bought out by Perseus (PRU) and is now an operating mine in Côte d’Ivoire, or to be more specific that Bagoe Project has become an ore source for PRU's nearby Sissingué Gold Mine in northern Côte d’Ivoire. Before that Justin founded and ran Renaissance Minerals which owned the Okvau Gold Deposit in Cambodia and its associated exploration licences - and Renaissance was acquired by Emerald Resources (EMR) who have been very successful in Cambodia with Okvau and are now developing a second mine there as well as a third gold mine which this time is in WA. In fact all 4 gold projects that Justin Tremain has been in charge of prior to him becoming the MD of Turaco, have become operating gold mines, and he assures us that Afema will also become a gold mine, and with an MRE of 4m ounces and growing fast, I have to agree with him.

Fun Fact Four:

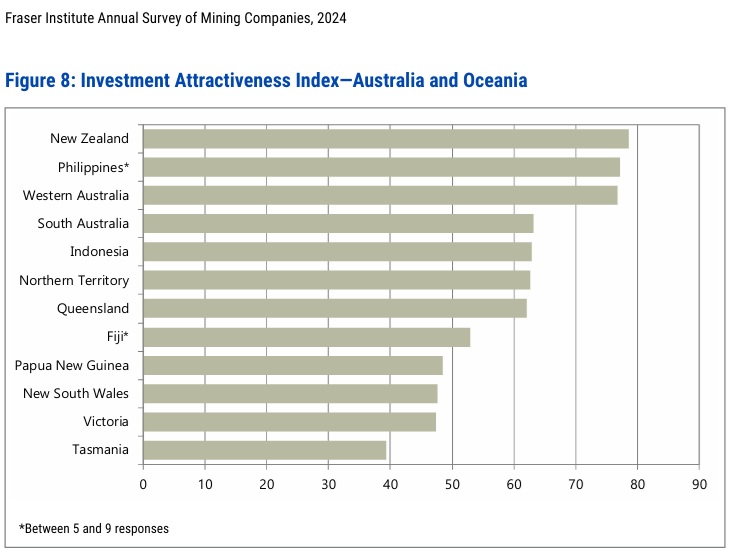

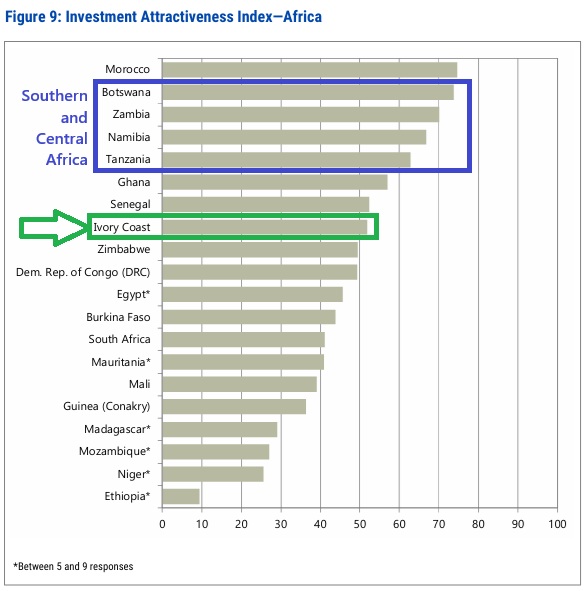

Justin says that within West Africa, Côte d’Ivoire is "the stand-out country", it's the most developed country in West Africa, it is the most affluent (highest GDP per capita) because agriculture is the country's largest industry, so they don't just rely on mining employment, royalties and taxes, and it is also one of the safest - rated 4th highest in Africa by the Frasers Investment Attractiveness Index, as shown below:

Source: Slide 7 from Justin Tremain's TCG Presentation at Kalgoorlie's Diggers and Dealers (D&D) Mining Forum on Monday, 4 August 2025

Source: Page 36 of https://www.fraserinstitute.org/sites/default/files/2025-07/annual-survey-of-mining-companies-2024_0.pdf

As you can see below, in the Fraser Institute survey last year, Côte d’Ivoire received a higher investment attractiveness Index score (of 51) than New South Wales, Victoria and Tasmania (as shown above, all scoring below 50).

Source: Page 39 of https://www.fraserinstitute.org/sites/default/files/2025-07/annual-survey-of-mining-companies-2024_0.pdf

Of the top 11 African countries in the table above (those above Burkina Faso), only 4 are in West Africa, with some maps, like the one below not including Morocco, but Morocco is in the top left corner of Africa, the north western corner, as shown two maps below. Counting Morocco, Côte d’Ivoire was rated the 4th most attractive country in West Africa for mining by the Fraser Institute poll in 2024 - and the 8th best country in all of Africa, and not counting Morocco, Côte d’Ivoire is the 3rd best (most attractive from a mining investment perspective) country in West Africa.

West Africa:

Africa:

Further Reading:

https://minerals.org.au/resources/australia-tops-list-for-mining-investment-attractiveness/ [05-May-2023]

https://australianminingreview.com.au/news/australias-freefall-in-fraser-institute-rankings/ [31-July-2025]

So yes, Côte d’Ivoire is a risky place to try to develop and run a mine, but apparently so is NSW. And the risks aren't as great as they are generally perceived to be by the average investor. My personal thoughts are that this one is worth the risk with an appropriately small portion of my investable capital. I believe they'll get bought out by a larger gold mining company within the next 12 to 24 months, at a decent premium. And if they don't they'll develop Afema into a profitable gold mining camp themselves. Either way, they look like good upside to me.

Disclosure: Held IRL and here. This is my only current West African gold exposure.