Pinned straw:

11th November 2025: I hold a small position in Agrimin (AMN) in my speculative company portfolio and it's only there as a value play. Their flagship project for the past few years has been their Mackay Potash Project which they made a fair bit of progress on and even got some permits for, but they stumbled at the project financing stage and after a strategic review, as expected, they've admitted that in the current environment, Mackay Potash won't be able to proceed.

In their Mackay-Potash-Project-Strategic-Review-Outcomes.PDF announcement on October 23rd (less than 3 weeks ago), they said:

The Strategic Review has concluded, and the Board has endorsed, that given existing and foreseeable medium term conditions, continued allocation of capital to the Project is not in the best interests of the Company and its shareholders.

The key reasons for this conclusion include:

- Despite securing Western Australian State environmental approval for the development of the Project in January 2025, the protracted approvals process, the significant inflation associated with mining developments and the failure of several Western Australian SOP developments in recent years has dramatically eroded the appetite of potential funders, both conventional and strategic, for such projects.

- The tenement rents and shire rates associated with a brine-hosted mineral deposit (the Project’s tenement package covers over 3,000 km2) present a uniquely prohibitive medium/long-term holding cost.

- No offers from third parties to purchase and/or fund advancement of the Project were received during the conduct of the Strategic Review. In addition to not presenting a suitable exit pathway, this also means that retaining a long-term exposure to the Project would require the Company to continue to fund all, or at least the great majority of, ongoing holding costs.

As a result of this conclusion, Agrimin is set to commence a process of withdrawing from the Project. This process is expected to involve the full or partial surrenders of the several Exploration Licences which cover the majority of the brine-hosted potash minerals. Given this expectation, Agrimin also considers it prudent to withdraw its existing Mineral Resource and Ore Reserve statements for the Project.

The Company will maintain full compliance with environmental and native title obligations, and rehabilitation activities are ongoing in consultation with native title holders. In addition, discussions will be initiated to responsibly conclude the Native Title Mining Agreement in relation to the Project. Previously deferred 2025 tenement rents are to be settled when due in January 2026.

Looking ahead, Agrimin plans to focus on exploration for non-potash minerals in the West Arunta region. The Company intends to retain certain portions of its current Exploration Licences which cover untested strike extent, along trend from WA1 Resources Ltd’s (ASX: WA1) Luni niobium deposit.

The Geological Survey of Western Australia recently commenced detailed airborne magnetic and radiometric geophysical surveys across the broader West Arunta region. The datasets and reports will be made available at no cost. The survey is expected to significantly improve the quality of the available magnetic data for Agrimin’s Exploration Licences.

The Company is considering the potential addition of tenure in other highly prospective mineral provinces across Australia. All business development opportunities are being reviewed in the context of Agrimin’s strong track record and continued management capability to execute remote exploration activities safely and cost effectively.

The Company is well funded with $2.3 million in cash as at 30 September 2025, following its successful equity raising in May 2025.

--- end of announcement excerpt --- [Link above]

OK, this was entirely expected by me and hopefully most others who have seen a number of southern hemisphere potash projects fail at various stages, but even after doing a CR pre-results-of-strategic-review (at the end of September, smart move), they only have $2 million now, so they're certainly not cashed up in terms of being able to aquire something decent without raising further capital.

I - and I suspect many others - had previously been and are certainly now valuing AMN's potash assets as being worth zero, but that is not what attracted me to this company.

The most interesting thing amount Agrimin (AMN) is that they own 40% of a private company called Niobium Holdings Pty Ltd who in turn own 11.85% of WA1 who have the largest and highest grade niobium deposit in Australia in the Arunta region of WA near the NT border. According to AMN's September quarter report, they still own 40% of Niobium Holdings but Niobium Holdings now own approx. 11% of WA1, which might be because WA1 have issued more shares which have diluted Niobium Holdings' position in WA1 a bit. More about Niobium Holdings Pty Ltd in a minute.

Agrimin also own 27% of a tiny explorer who they (Agrimin) recently spun out (IPO'd) who own land (tenements) to the south and south east of WA1's massive Luni Niobium deposit. That tiny explorer is called Tali Resources and their ticker code is TR2. The various connections between WA1, TR2 and AMN is like a spider's web, and I went down the rabbit hole with all of them a few weeks ago - and posted about it here: BCI > Down the Rabbit Hole.

That was posted under BCI because BCI have the most advanced project of any of these companies, their Mardie Salt & Potash Project, which they refer to as "a Tier One project located on the Pilbara coast in the centre of Western Australia's key salt production region", so they are probably going to be on more radars at this point (with a $1.11 Billion market cap) than much smaller companies like AMN ($27m m/cap) or TR2 ($79m m/cap). WA1 is big enough, with a $1.17 Billion m/cap, and their market value was around +29% higher one month ago when their SP briefly tagged $22.28 (their year high) on 9th Oct (2025).

As I explained in that straw and subsequent forum post, BCI have fully switched out of iron ore now and have spent over $1 billion on infrastructure at their Mardie Salt project so far, and have a credible timeline through to not only production but also to paying dividends to their shareholders, which is likely why their two largest shareholders are Ryan and Kerry Stokes' investment vehicle Wroxby Pty Ltd with 36.12% and Australia's largest superannuation fund, AustralianSuper, with 32.07%. It is unusual to see such high insto and HNWI ownership in a company (being 68.2% between them) unless it's an infrastructure play, and I reckon that's how the Stokes boys and AustralianSuper are viewing BCI at this point. BCI have some minor residual royalty income (related to iron ore tenements they used to hold) however the bulk of their worth is now attributable to the infrastructure they are building at Mardie - as explained - with pictures - in that straw I posted a few weeks back.

I found it interesting that BCI also own 9.79% of Agrimin (AMN) - and are Agrimin's largest shareholders (BCI have the largest single stake in Agrimin) however that stake is valued at only $2.6 million today because AMN's m/cap is so low (around $27 million).

And Agrimin have their own potash project (Mackay) which is likely worth zero because it is so far inland, on the WA/NT border, and a LONG way from any existing or potential port facilities, and because potash as a commodity has been a graveyard for investor capital over recent years.

Sure, BCI want to also produce SOP - Sulphate of Potash - from their Mardie Salt project, which is on WA's west coast, obviously a far better location, and they're building their own ship loading infrastructure at the end of their own jetty, however they are being smart about it and they are planning to get the salt revenue happening first before trying to also produce potash after that. Industrial Salt should be very straightforward; the jury is probably still out on the potash side of it.

But back to Agrimin (who BCI are the largest shareholders of): What interests me most about Agrimin is their indirect 4.4% ownership of WA1 - whose Luni niobium mine WILL become a producing niobium mine - albeit it's going to take years to get into production. That 4.4% stake in WA1 is held via AMN's 40% holding in the private company Niobium Holdings Pty Ltd who own close to 11% of WA1, and because Niobium Holding's 11% of WA1 is worth $128.7 million and Agrimin's 40% of that means they indirectly own $51.5 million worth of WA1 shares, the fact that Agrimin's entire market cap today is only $27 million makes them look super cheap.

Agrimin's $51.5m stake in WA1 Resources is worth almost twice Agrimin's current market cap based on the closing share prices of WA1 and AMN yesterday (10th November 2025) without allocating ANY value at all to Agrimin's 27% stake in TR2 or their other assets (which are mostly just land around Lake Mackay) which of course could actually be worth nothing, time will tell.

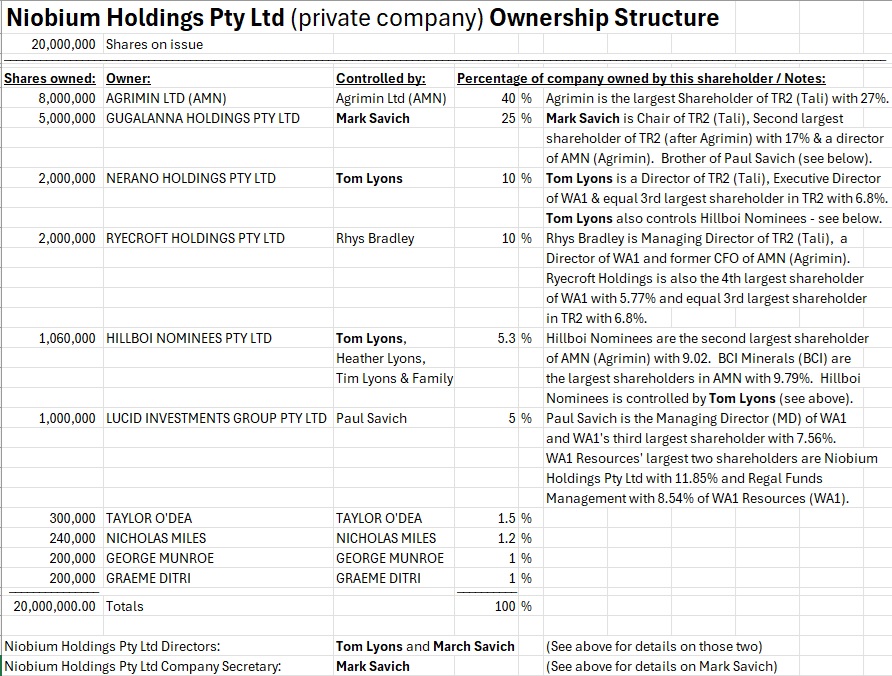

It occurred to me over the weekend that a 40% stake in a private company might not be a great position to be in if the owners of the other 60% of the company do not have interests that are aligned with yours, and that got me thinking about who owns the rest of Niobium Holdings Pty Ltd, so I did something I don't do very often and paid ASIC $10 to obtain a "Company Extract" of Niobium Holdings (see here: Niobium-Holdings-Company-Extract.pdf). From that info I created a spreadsheet and this is how that turned out:

The extract says the company only has 2 million shares, but they were clearly missing a zero because the shares that the 10 shareholders own adds up to 20 million shares, as shown in my spreadsheet extract above.

I could have spent more money getting company extracts of all of those holding companies (Gugalanna, Nerano, Ryecroft, Hillboi and Lucid) but I already knew who controlled all of those companies from my work back when I was getting the data together for that BCI straw, so I didn't need to spend any more than the first $10. Everything else was available through various company announcements for WA1, TR2 and AMN over the past 1 to 2 years. TR2 has only been listed since July THIS year, but the other two have longer historys.

Notes on that spreadsheet:

- The largest three shareholders of Niobium Holdings are Agrimin (AMN, 40%), Mark Savich (25%) and Tom Lyons (15.3% through Nerano and Hillboi). Between them, those three hold 80.3% of Niobium Holdings Pty Ltd (NHPL) and Mark Savich and Tom Lyons are the only directors of NHPL.

- If you include the 5% of NHPL that is owned/controlled by Mark Savich's brother Paul Savich, then that's 85.3%.

- If you also include Rhys Bradley's 10% share, that's 95.3% of NHPL controlled by those 4 gentlemen plus Agrimin.

- Because it is a private company, there is no market value that can be easily found for NHPL, however the company's only asset appears to be their 11.85% of WA1 Resources (WA1), and that stake is currently worth $138.6 million based on a WA1's closing share price on 10th Nov of $15.88. Edit/Correction: AMN's Sept Qtrly Activities Report states that Niobium Holdings now owns approx. 11% of WA1, so there may have been further dilution due to more WA1 shares being issued; An 11% stake in WA1 is currently worth $128.7 million.

- Based on their closing share price yesterday of $15.88/share, WA1's market cap yesterday was $1.17 Billion, substantially less than one month ago (10th Oct) when they closed at over $20/share after reaching a year high of $22.28 the previous day (9th Oct 2025). Yesterday AMN's SP was -28.7% below that recent high, in just one month, but their share price appears to be recovering in recent days. Up again a little today (11th Nov) to close at $16.03 after getting up to $16.335/share earlier in the day.

Getting company extracts from ASIC for $10 gives you the current company structure, shareholders, officeholders and directors of private companies that are registered with ASIC - and all Pty Ltd companies here in Australia should be registered with ASIC. For an extra $10 (so you pay $20 instead of $10) you can get the historical details, so how the share structure, ownership, officeholders and directors have changed over time, but I don't need to know that - I just wanted to know the current structure and ownership in this case, so I just paid the base $10 for the current details.

You can argue that this information should be free to the public, but they don't charge much, so it doesn't bother me, especially as I don't have to delve into private companies like these very often.

It is interesting for me to see that 40.3% of the company (Niobium Holdings Pty Ltd/NHPL) is owned or controlled by the two Directors, Tom Lyons and Mark Savich, another 5% is controlled by Mark's brother Paul Savich (who is the MD and 3rd largest shareholder of WA1), and when you include Rhys Bradley's 10% (Rhys is the MD of TR2 and the 4th largest shareholder in WA1) that means that 55.3% of NHPL is owned or controlled by those 4 (the Savich brothers, Rhys Bradley and Tom Lyons).

All 4 of them have connections to Agrimin who own 40% of NHPL themselves and are NHPL's largest shareholders. Rhys Bradley was the CFO of Agrimin before Agrimin spun Tali Resources (TR2) out into a separate company and Bradley became the MD of Tali (TR2). WA1 itself was originally spun out of Agrimin, so there are plenty of connections between AMN, TR2, WA1 and Niobium Holdings. Mark Savich is still a director of AMN, the Chair of the TR2 Board and a Director and Company Secretary of Niobium Holdings. His brother Paul is the MD of WA1.

In terms of the links between Tali Resources (TR2) and Niobium Holdings Pty Ltd (NHPL), there are plenty.

- Mark Savich is the the Chair of the TR2 Board and a Director and Company Secretary of NHPL. He is also the second largest shareholder of NHPL (with 25%) and also the second largest shareholder of TR2 (with 17%).

- Tom Lyons is a director of both TR2 and NHPL and the third largest shareholder of NHPL (controlling 15.3% through two holding companies) and the equal third largest shareholder of TR2 (with 6.8%, same as Rhys Bradley).

- Rhys Bradley is the MD of TR2 and the 4th largest shareholder of NHPL (with 10%) as well as being the equal third largest shareholder of TR2 (with 6.8%).

It was an interesting exercise, and the only new names that showed up were the 4 shareholders of NHPL on the bottom of that spreadsheet screenshot who together own just 4.7% of NHPL so I do not regard them as significant enough to do any further digging on them. I know of the main players who together own 95.3% of NHPL, and there is plenty of alignment between them so I reckon they are all on the same page in terms of trying to maximise value through both WA1 and TR2 At least I have no reason to think or suspect otherwise.

Getting back to AMN (Agrimin) though, most of those 4 guys - other than Mark Savich who remains a Director of AMN - seem to have mostly moved on from Agrimin, and that makes me wonder if I should also move on from AMN. What has kept me there so far has actually been the value in the cashbox-type status of the company where they have decided their main project is uneconomic and they are backing away from it as fast as they can, but they so far don't have any other project to call their "main undertaking" - something they can wrap a business model around. So I have been attracted to the hidden value, mostly in their 40% of NHPL.

However the ASX have a few rules designed to make it hard for cashbox companies to remain listed on the ASX, as I found out a couple of years ago when I was briefly researching a bunch of companies connected to a dude called Farooq Khan, mostly Bentley Capital (BEL, less than $2 million market cap), Queste Communications (QUE, less than $2 million m/cap) and Orion Equities (OEQ, less than $3m m/cap) - they were bigger then (when I was looking into them a couple of years ago and made a quick profit on BEL), especially Bentley (BEL), but all have provided far better returns for their office holders and employees (Farooq Khan and his associates) than they have for ordinary retail shareholders.

There are good reasons why the ASX tries to discourage and make it hard for such companies to continue to remain ASX-listed. With Farooq Khan's companies, there were connections to (slightly) larger companies like Strike Resources (SRK, $10.8m m/cap, they were a lot bigger back then) where Farooq Khan is SRK's Board Chair and has the usual suspects (from his other companies) filling SRK's other Board positions, but they were all value traps for anybody who thought there was any value there in the first place. SRK own 27.7% of Lithium Energy (LEL, who have exactly the same Board members as SRK) and LEL have been suspended from trading for over a year now because they had become a cashbox in the eyes of the ASX. In LEL's 26th September 2025 Update-on-Suspension-of-Trading-on-ASX.PDF announcement, they said:

- As previously announced on 25 October 2024, the Company confirmed, based upon the successful sale of its Solaroz Lithium Brine Project in Argentina for approximately US$63 million (~A$97 million) that trading in the shares of LEL was suspended by ASX on the basis that the Company had disposed of its main undertaking and that the Company would thereby be required to demonstrate a sufficient level of other operations to warrant the trading of its securities on the ASX.

- Since that time the Company has been in discussions with ASX to determine the timing and basis upon which a lifting of the suspension of its securities on ASX and a reinstatement to trading may occur.

- The ASX has confirmed that given the disposal of its main undertaking, the Company will need to demonstrate that its current mining projects and operations have advanced to a sufficient scale in order to warrant reinstatement.

--- end of excerpt from Lithium Energy's Update-on-Suspension-of-Trading-on-ASX.PDF announcement --- [26-Sept-2025]

There is clearly a concern that AMN could find itself in the same boat - having now declared their main undertaking (the Mackay Potash Project) to be uneconomic at this point in time and stating that they are withdrawing from the project now. AMN have not sold their main undertaking (Mackay) for cash, because it's likely not worth anything now, which might be an important distinction between the two cases in the eyes of the ASX, however AMN is now a listed company with $2m in cash plus 40% of Niobium Holdings (NHPL) and 27% of Tali Resources (TR2) but otherwise they don't have a business model or a project to advance, and I wouldn't expect $2m is enough to buy themselves anything decent.

So what will/could they do?

- A merger of TR2 and AMN with or without NHPL included would make sense, but that would be a little strange since AMN only just spun TR2 out in July this year.

- They could get suspended and stay suspended either forever or until they satisfy the ASX that they have a viable project that they are significantly progressing (whichever comes first). In my experience, we only tend to find out about the ASX issuing such a query to a company after the ASX has already put them into a trading halt or suspension so there isn't always an exit opportunity.

- AMN can't sell their 27% of TR2, or any TR2 shares actually, until July 2027 because they agreed to a voluntary 24-month escrow period that began on the day Tali Resources first listed on the ASX (in July this year), however presumably AMN could sell some or all of their 40% of Niobium Holdings (NHPL) even though NHPL is a private company, as long as the other shareholders of NHPL agreed. If Agrimin were able to monetise some or all of that indirect position in WA1 that they hold through their 40% of NHPL then AMN might then have enough to buy something decent that they could then progress to the satisfaction of the ASX's anti-cashbox rules.

- In their Mackay-Potash-Project-Strategic-Review-Outcomes.PDF announcement on October 23rd they said: "The Company intends to retain certain portions of its current Exploration Licences which cover untested strike extent, along trend from WA1 Resources Ltd’s (ASX: WA1) Luni niobium deposit" - so they could find something decent that's worth progressing in those tenements, however I get the strong impression that their best tenements were spun out into WA1 and their next best tenements were spun out into TR2 and what they've got left are not nearly as prospective, so I'm not overly confident that Agrimin will find a commercially viable mineral deposit within the relatively small land position they have left now after excluding Lake Mackay which they have previously described as being the world's largest undeveloped potash-bearing salt lake - I assume it doesn't have other viable mineral deposits below it - and even if it did, I'm not sure AMN would get the permits required to destroy the lake to get to them. In any case, AMN have stated now that they are in the process of relinquishing those Lake Mackay tenements due to the high holding costs so they are clearly giving back most of their land and it's unclear how much land they're going to still have after that.

None of those four scenarios look super-promising from an investor return POV, so my thoughts are that I should probably cut my losses on Agrimin before their SP falls any further or they get suspended, despite their indirect ownership of WA1 shares being worth almost twice their current market cap.

Too much risk, not enough upside.

@Dangles commented here 4 weeks ago (in response to my rabbit hole straw):

- Particularly interested in the AMN situation, but I guess the query I have is do you have an expected catalyst for it to unlock the value?

- It's nice just as a discounted way to buy WA1, but I can't ascribe any value to TR2 as a pure-play explorer, they (AMN) just furloughed their CEO and seems like they're about to give up on developing their Mackay Potash Project for the moment and it owes $1m rent per year to the government on that too. Cash burn last year was $3m with $2.5m in the bank at year-end.

- So seems like its headed straight to a capital raising? Or more likely a sell-down of some of their investments?

- Love the idea and the assets, just not sure what their plan is I guess.

--- ends ---

Good call @Dangles - I did provide a lengthy response to that at the time however what I had to say could probably be summarised by my final paragraph:

- There are always risks with these value plays, and they won't be for everyone, and as you say, you usually need a catalyst to unlock that value, but I think this re-rate might be more gradual than sudden as others also identify the opportunity and Agrimin look to further monetise their assets over time.

...

Yeah, nah, having thought about that some more, especially over the past 4 days, I reckon the whole cashbox situation is where this thing could turn really pear-shaped - even more than they have already - which is saying something - so I'm leaning now more towards AMN being a value trap than an opportunity. I'll sell them in the morning. I usually do my trading first and then post about it later, but my AMN position is small and I'm fairly confident that nobody here owns any AMN anyway, so I'm not overly concerned about telegraphing my intentions on this one.

This has just been an exercise for me in getting my thoughts in order and jotting them down - in relation to AMN at least - I do still hold some BCI. I sold my small TR2 position this morning to take advantage of the bounce they had yesterday (Monday, up +15.52%) on the back of their "Gravity Survey Results" announcement. I used that money to top up my Antipa (AZY) position today before they go back over 60 cents/share - I'm confident that AZY are (probably) either going to turn their Minyari Dome Gold project into an operating gold mine or else they are going to get acquired by Greatland Resources (GGP) because of the tenements that AZY control:

It won't happen overnight but... (Well, in the case of M&A, it could happen overnight, but probably won't)

It's a nice tenement package that AZY have there (in orange or gold) between Greatland's Telfer gold mine and their (Greatland's) large Havieron gold project.

[Not advice, just personal opinion]

That's it for tonight.

If you've stuck with this post through to the end, well done!!

DrPete

Awesome read @Bear77. I read through to the end! Even though I've never invested in speccy miners. I was just interested in your research and thinking process.

And it highlights one of the pains that I've had to learn to accept as an investor. Sometimes we can spend many hours researching a company, but ultimately choose not to invest. It's easy to think that it was a huge waste of time. Or worse, we invest money just because we've invested a lot of time. But instead we have to find joy in the research process. Or at least reframe the lost time in turning over unsuccessful rocks as just part of the big picture of finding the rare winners.

Arizona

@Bear77 Wow. Your research and write-ups are second to none.

AMN came to my attention many years ago.

I was employed by the traditional owners of Lake Mackay or "Wilkinkarra".

I worked many years at Kintore and Kiwirrkura, two small communities either side of the WA/NT Border.

Kiwirrkura sits on the "edge" of Lake Mackay.

There was a lot of work put into digging trenches in the lake, roads, employment for locals etc. It was a big deal in a small remote community.

It struck me at the time that this project would have to be huge, either in the prices for potash or the volume produced in the operation. Simply because it is so remote and the roads to get there are so poor. You are 700k's west of Alice Springs. There is no infrastructure to speak of.

The talk back then was that the product would be trucked to Alice Springs and loaded on the train, for transport to either Darwin or Adelaide.

The whole thing never made sense to me. That 700k trip was problematic in a landcruiser. The idea that multiple semi trailers were going to be running back and forth across the 700k stretch of sand seemed ludicrous. They may have been able to head North to the Tanami road (used by Newmonts granites gold mine ) but this had many issues too.

It always seemed to me that someone was not being fair dinkum regarding transport.

Bear77

Thanks for the background story on Lake Mackay / Wilkinkarra and Kiwirrkura @Arizona - is it just coincidental that your Strawman handle evokes an image of a dry desert landscape (albeit, in the US) and that you worked in one of Australia's most remote and hard to access areas - of desert? That would have been some hot and thirsty work. What did the traditional landowners employ you to do there?

I was never attracted to Agrimin because of Lake Mackay or potash - I have never invested directly in any potash companies for exposure to potash actually. In AMN's case, it's hard to think of a worse location in terms of trucking potash to any port in WA or NT, so as you say that project would never be viable except at massively higher potash prices that justified building the road infrastructure they would need to make it work, so realistically it was never going to get up.

It is amazing how companies can spend so much money on projects that seemed doomed from the outset. Looking at it now it seems reasonably clear to me that the people involved in AMN knew this for at least the past couple of years and that's why they spun out all of their land that was prospective for anything other than potash, like niobium, and everybody jumped ship.

The remaining Board members at Agrimin all have other jobs as well, many with WA1 or TR2, so if AMN folds (goes broke) or gets suspended, they have already got more than a foot out the door - they've basically only got one foot left in the door. They obviously can't announce that they believe AMN has no viable future but they're not going down with the ship if it goes down.

I sold my AMN about 20 minutes ago at 7.1 cents per share. Less than a $3K loss because I had only bought 100,000 AMN for 10 cps a while back (so spent just $10K and will get just over $7K for those shares). My sale was the first sale of the day, and at 1:48pm Sydney time (1:18pm Adelaide time) there has only been one $500 trade since, so 3 trades all up in AMN today so far, and two of those were mine, as my 100,000 shares were sold by Commsec partly on the ASX and the remainder were sold on CBOE (Chi-X) so they show up as two trades at exactly the same time even though it was a single sell - but two buys.

The loss doesn't bother me because I just put it down to education costs. I think my original idea with AMN being a value play was not terrible, however I underestimated how the market would react to their strategic review outcome. I had assumed that the market was already pricing in that their Lake Mackay project was worthless, but I was clearly wrong judging by the market reaction to that announcement. So then I went back over my investment thesis and looked at the comments by @Dangles where they made some excellent points that I clearly needed to think more about - what is the plan? What is the catalyst that is going to release the value?

And then I started to think that maybe this was perhaps all part of the exit plan for AMN Board members and employees and that got me thinking about the cashbox-status-related risks of AMN getting suspended and removing my exit opportunities and then it really got down to: Is this really the best place I can think of to have that cash (what's left of it) invested at this point in time, knowing what I know, what I think / expect, and what I clearly don't know? The answer was No, so I sold.

I reinvested that $7K into some more Emmerson Resources Limited (ERM) shares. It's a company I already held in my RL speccy companies portfolio and it is currently the second best performer (after MEK) from a share price performance. HRZ (Horizon Minerals) was previously doing very well for me, but their SP has recently come back from around 9 cps to under 5 cps and they're still under 6 cps today, so while I'm still in front on HRZ they aren't the performers they were a month ago. I'm confident HRZ will grind higher from here - they are a producer through toll treating their ore at third party mills - so they have cashflow already - and are developing multiple projects as well as converting the Black Swan processing facility (mill) from nickel to gold with the assistance of GNG (who I also hold shares in, quite a few actually, GR Engineering are my second largest real life position now).

ERM (who I topped up today) is an explorer who is developing a gold royalty business. The Company has an extensive landholding in the Tennant Creek Mineral Field (TCMF, around the town of Tennant Creek) in the Northern Territory, and they are a very interesting company because the deals they've done mean that some of their assets, which they've sold down through farm-in or other agreements, are free carried for them through to production, so they have this guaranteed income stream and bugger-all expenditure commitments - well, less than most developers anyway.

I am finding the gold and royalty space very interesting at this point because whether the gold price rises further or trades sideways for a while, either way there are strong tailwinds for companies like these to get some of these projects significantly progressed through to either production or a takeover by a larger company eager to get more resources and reserves so they can make even more money while the gold price is this high.

Making hay while the sun shines, and I'm expecting the trend that got interrupted around a month ago by the small (less than -10%) gold price correction to continue in terms of money flowing down from punters / investors moving down the quality curve and up the risk curve from the producers who have run hard down to emerging producers like MEK and project developers and then on down to explorers. When a sector is this hot, eventually the money flows down to those at the bottom, and I'm looking for the better companies with the better projects at the smaller end of the sector now - as I'm already set with decent positions in the majors.

Not all of my speccy companies are in the gold sector - Firefly Metals (FFM) is one that I was going to add to that speculative company portfolio but because they're in the ASX300 already I have been able to have that position in my SMSF instead, and if you check their chart you can see why FFM has been one of my best performers in my SMSF over the past 2 months. They are developing a very good copper project in Canada right next to a hydro power station. They have good management (some ex-NST) and despite being on an island they have plenty of infrastructure in place there already. And they're finding plenty of decent grade copper.

Anyway, I'm waffling now - getting distracted. Point being, I'm not bothered by taking the odd loss here and there. It's a lot better than leaving money in an idea that is unlikely to provide the best returns, or could go broke. And a few capital losses just reduces my capital gains tax liability a bit because I've been locking in a number of gains by trimming winning positions here and there. I've learned that letting your winners run without ever locking in profits has some negatives, with HRZ's recent run and quick retracement being an example of that. At the smaller end it seems to usually be up by the stairs and down by the elevator - and sometimes down via an elevator shaft without an elevator. So locking in some profits now and then has proved useful for me. As has fully exiting companies quickly when the investment thesis no longer stacks up in my view.

Arizona

@Bear77, very astute. I have an affinity for the desert, no doubt. Central Australia is “home” to me, though I can’t be there at the moment. While it can be harsh, there is a space and a light that I crave.

For 20 plus years I worked throughout the NT, WA and the top of SA with Aboriginal artists. Though most of my time I was employed by the Pintupi people of the Western Desert, whose traditional lands straddle the WA/NT border and comprise some 21,000 square kilometres.

The Pintupi own a company that, in short, facilitates the creation of their artwork - paintings, by supplying and distributing the raw materials, and collects then exhibits and markets the paintings to galleries and collectors globally.

Steve Martin and Beyonce are both collectors of Pintupi art:

The country is very remote and has been left unsettled by “white fellas” as its unsuitable for stock etc. Some of the people I worked for had their first contact with the Western world, in 1984. Prior to that they had been living a traditional nomadic existence. When you stop and think about that for a bit, its mind blowing. These people quite literally walked out of the past and the western world, the 20th century, landed right on top of them. Its up there with little green men turning up in space ships.

That has been my life for a long time and its been a hell of a ride to be a young man travelling through the desert in a landcruiser. I have been fortunate to have been shown some incredible places, by some amazing people.

Whilst I am doing some work in that area at the moment, I am focused on my family and raising a couple of kids, while reinventing myself. Ain’t life grand.

Back to AMN, I watched that play out on the ground over a number of years. I flew over the operation a number of times, discussed it with local people. I just can’t see how they could seriously entertain the idea, beyond some preliminary tests and back of the envelope number crunching.

The cynic in me wonders weather there was an alter motive of some kind at play. But what would I know.

Love your work @Bear77