Tuesday 14th October 2025: Firstly, looking back at previous (now stale) straws here from @elpaso96 and @Hands I see that BCI Minerals were previously an iron ore company (which they certainly were when I last held them) but were more recently regarded as a royalty company.

In light of the fact that BCI has a very interesting ownership structure which I'll explain further in a minute and that their focus now appears to be on Salt and Potash, I thought I'd ask ChatGPT: Does BCI Minerals own any royalty streams or have they sold those?

ChatGPT said:

Here’s what I found about BCI Minerals and their royalty streams — what they currently own, what they’ve sold, plus recent changes. If you want, I can also pull up the latest financial / ASX disclosures to check if anything has changed since.

What royalty interests BCI Minerals owns

BCI (formerly BC Iron) has several royalty and deferred payment arrangements.

Key ones include:

Project / TenementRoyalty / Payment Arrangements

Bungaroo South

Sold to Mineral Resources Limited (MIN) in 2020. Alongside purchase, BCI gets a 1% FOB revenue royalty on iron ore mined from Bungaroo South. Also deferred payments of A$14M tied to milestones. bciminerals.com.au

Kumina

Sold to MIN in Oct 2018. Final A$4M deferred payment due after first export. bciminerals.com.au

Nullagine

In 2016, BCI sold its 75% interest in Nullagine to Fortescue Metals Group. However, it retained a royalty: for ≥55% Fe iron ore — 1.0‑2.0% of FOB revenue; for <55% Fe — a tonne rate (A$0.50 to A$1.50) with adjustments. There are also conditions like reduction of royalty rate beyond certain production thresholds. bciminerals.com.au

Koodaideri South

BCI is entitled to a 2% FOB revenue royalty on any ore mined from that area. bciminerals.com.au

Extension Project (owned by Australian Aboriginal Mining Corporation ‒ AAMC)

BCI is entitled to a cash payment (A$1.75M) 90 days after production commences, and a royalty between 1.25% to 2.50% FOB revenue on iron ore produced. bciminerals.com.au

Other earlier‑stage iron ore tenements

BCI has (or had) a portfolio of “potential iron ore royalties” in the Pilbara. bciminerals.com.au

What they have sold / divested

BCI has sold several iron‑ore assets, often keeping royalty rights, and more recently sold the Iron Valley assets entirely. Key divestments:

- Iron Valley: In June 2024, BCI agreed to sell its Iron Valley iron ore assets to Polaris Metals (a subsidiary of Mineral Resources) for up to A$72.6M. bciminerals.com.au+NS Energy Business+The Australian Mining Review

- After this sale, Polaris takes over state and third‑party royalties and rehabilitation obligations from a certain date. NS Energy Business

- This means BCI no longer owns that operation, but presumably sold out the asset (and likely royalty‑like cash flows tied to it). Listcorp

- Other assets (like Bungaroo South, Nullagine, Kumina, etc.) have been sold in prior years, with BCI often retaining royalties or deferred payments. bciminerals.com.au

Recent change: Iron Valley sale implications

Because Iron Valley was a material source of “royalty‑like earnings” for BCI, its sale meaningfully changes their royalty income profile.

Some specifics:

Summary & current situation

- Yes, BCI still owns several royalties / revenue streams, especially from projects already sold (e.g. Nullagine, Bungaroo South, Koodaideri South, Extension).

- No, they no longer own Iron Valley, so that royalty‑like income from Iron Valley has ended (post‑transfer).

- Their business strategy appears to be shifting: focusing more on their Mardie Salt & Potash project, while divesting iron ore assets and streamlining royalty holdings.

--- ends ---

OK, so yes, still some royalty income. But that's no longer their main game.

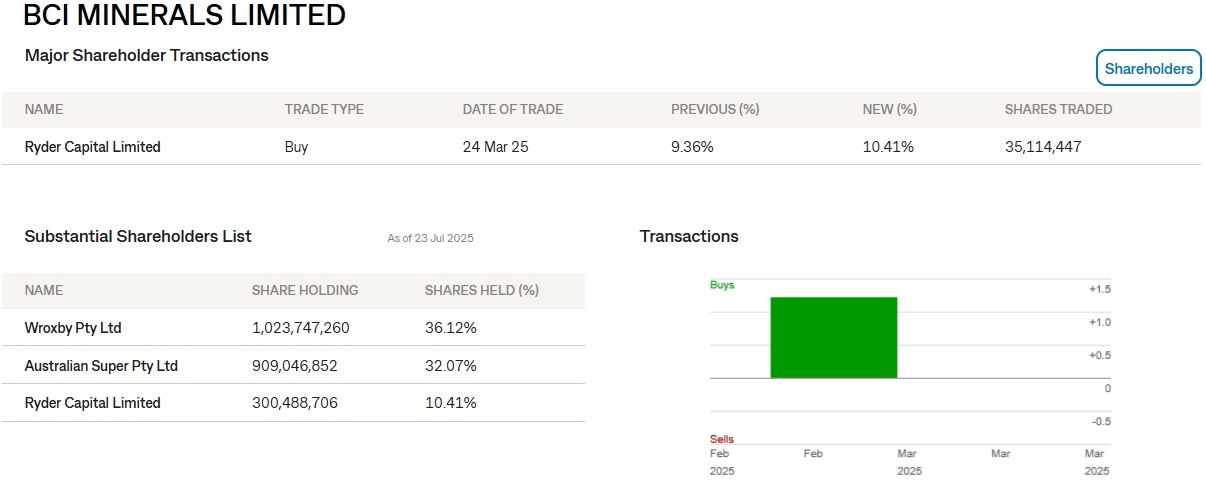

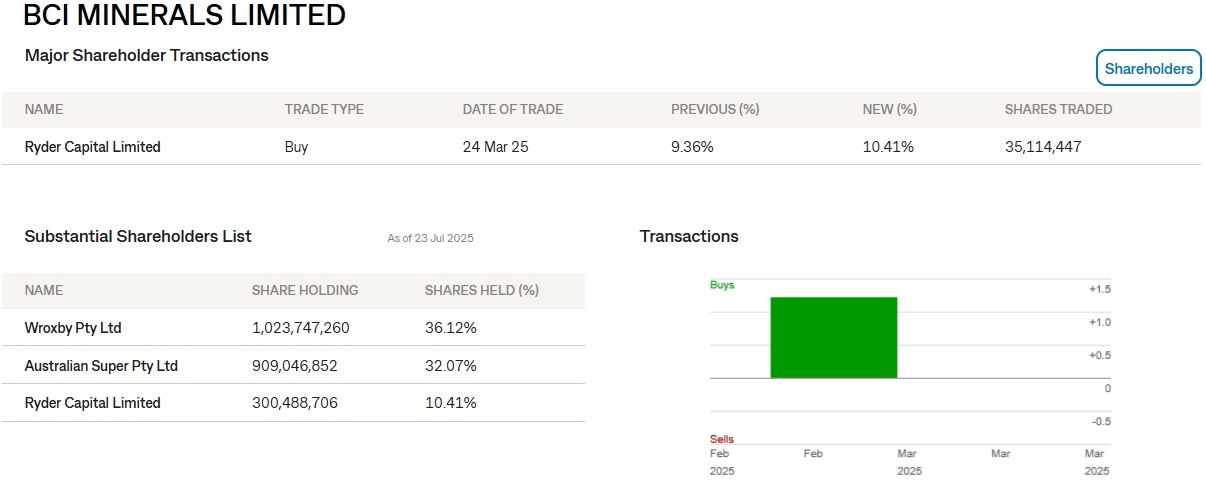

Here's their ownership structure, below, right:

Source - page 2 of BCI's 23/07/2025 Noosa Mining Conference Presentation

See also: 22/08/2025: FY25 Full Year Results and 19/05/2025: Investor Roadshow Presentation

Quick note on the brown squircles above: BCI are now big enough to get into the ASX300 based on their market cap, which is now over $1 billion (currently $1.19 Billion according to the ASX website today) except that they have bugger-all free float, and free-float is more important to S&P than market capitalisation when they are deciding whether to include a company in an index or not - i.e. they look at the free float rather than the entire market cap. The free-float is reduced by Australian Super owning 32% of the company and Kerry and Ryan Stokes' Wroxby owning another 36%. When you add those two to Ryder Capital's 10%, that's 78% of the shares accounted for leaving a free-float of only 22% of the company (shown above as "Other Shareholders), however that 22% includes some management and board ownership of the company.

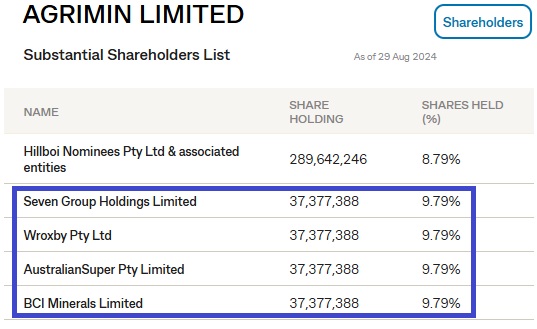

Here's how Commsec display BCI's Substantial Holders ("Subs"):

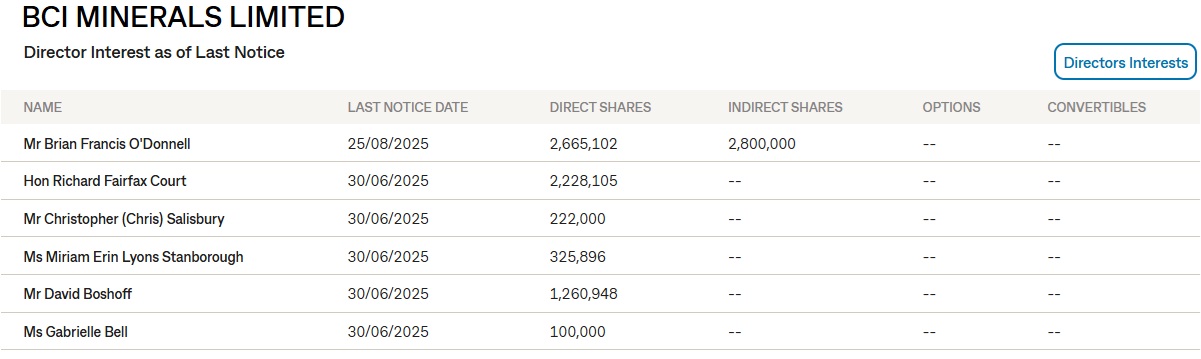

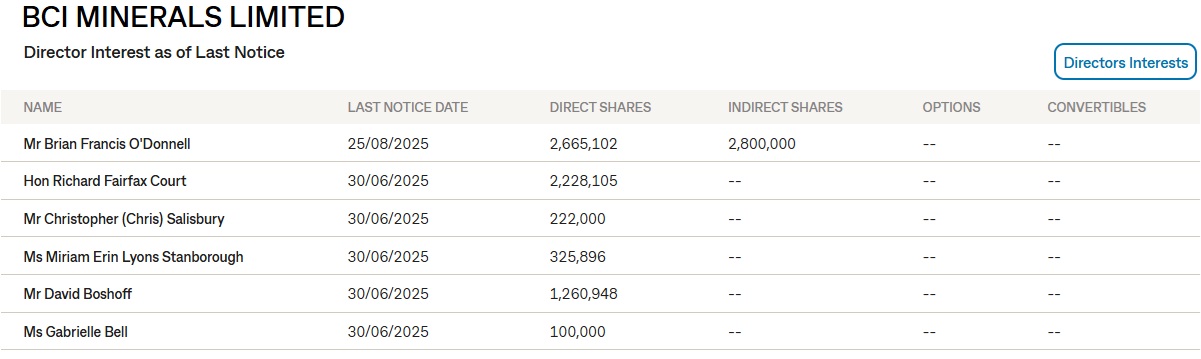

And here's their Board member ownership:

Source: Commsec.

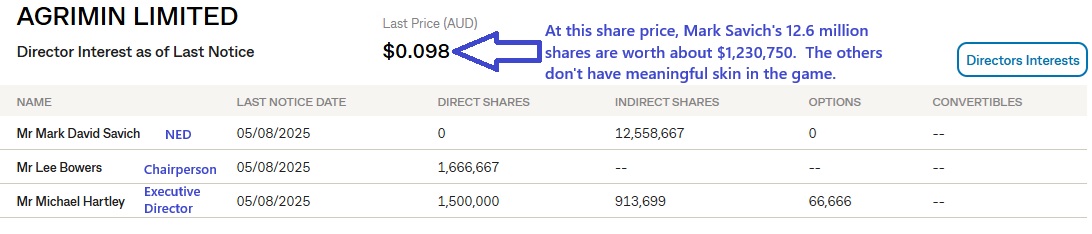

Considering their share price is sub-50-cents, currently 41 cps, that's not a huge amount of skin in the game however it's something, and the top two have around $1 million worth of shares each (Brian O'Donnell a little over $1m, Richard Court closer to 900K worth).

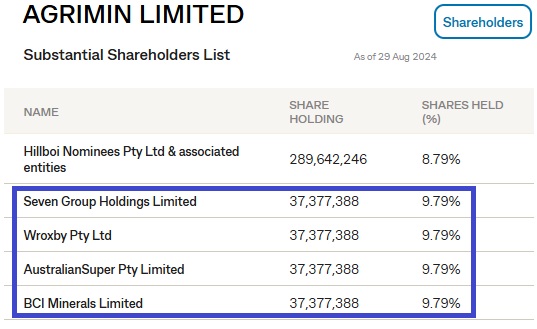

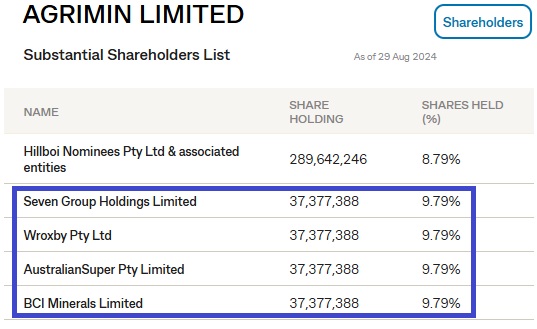

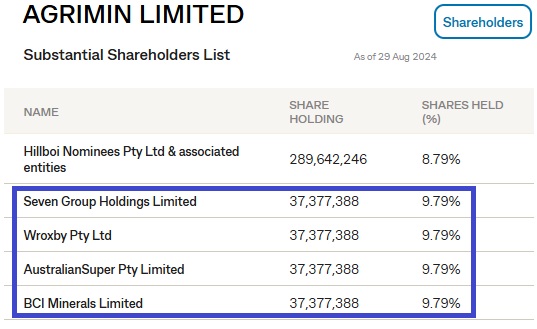

Here's something interesting however; because Australian Super (Australia's largest super fund) and Wroxby (the private investment vehicle of Kerry and Ryan Stokes who also control SGH - formerly known as Seven Group Holdings) BOTH own more than 20% of BCI, and BCI owns 9.79% of Agrimin (AMN), under s608(3)(a) of the Corporations Act both are considered to hold a relevant interest in AMN held through a body corporate (BCI Minerals Limited) because their voting power in BCI is above 20% (as explained on page 3 of this Change-in-substantial-holding.PDF notice by Australian Super), so below, the four holdings in the blue rectangle are all actually the same holding, being the 9.79% of Agrimin that BCI Minerals owns, but Wroxby and Australian Super have to lodge mirror notices because they own more than 20% of BCI, and SGH have to also lodge a mirror notice because they are considered to be an associate and/or controlled entity of Stokes - who controls Wroxby - because KM Stokes and associates (including through Wroxby Pty Ltd and other holding companies like ACE) own 50.93% of SGH.

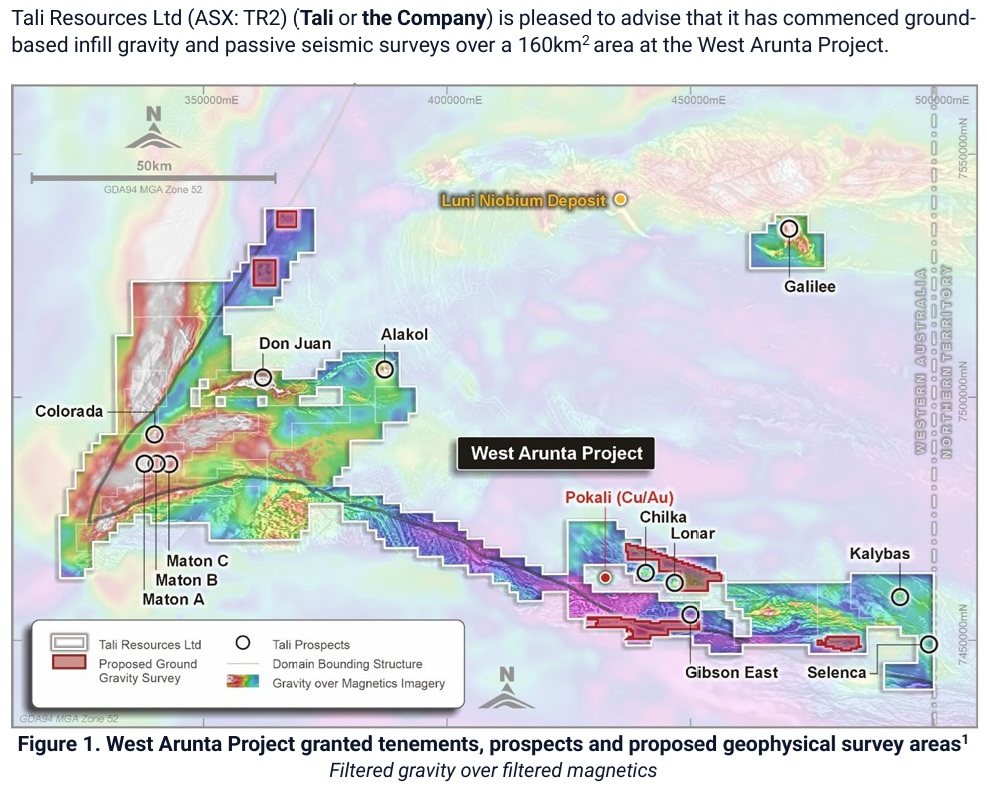

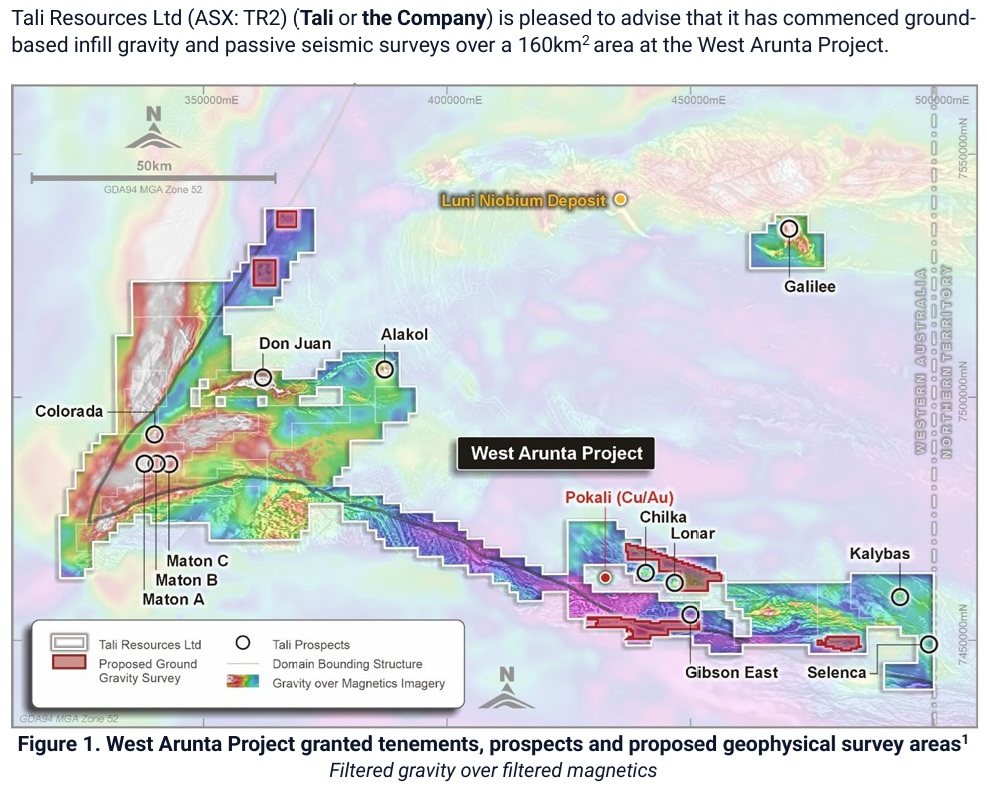

OK, so back to BCI - for a minute - and what got me looking at a company that plans to become a major industrial salt and potash (Sulphate Of Potash or SOP) producer? Well, it all started with Niobium and WA1 Resources (WA1) which I would love to own shares in but they look way too expensive to me for where they are in their journey, so I was looking at some of the nearology plays, had a dabble in Encounter (ENR), made some profit on that one, and I was looking at TR2, Tali Resources, whose board is made up of people from WA1 and who own a decent chunk of land running east to west, that sits southwest, south, and southeast of WA1's huge Luni niobium deposit in WA.

Source: TR2-West-Arunta-Geophysical-Surveys-Commenced-01-Sept-2025.PDF

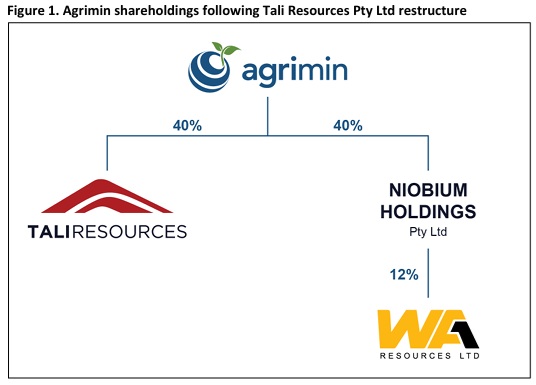

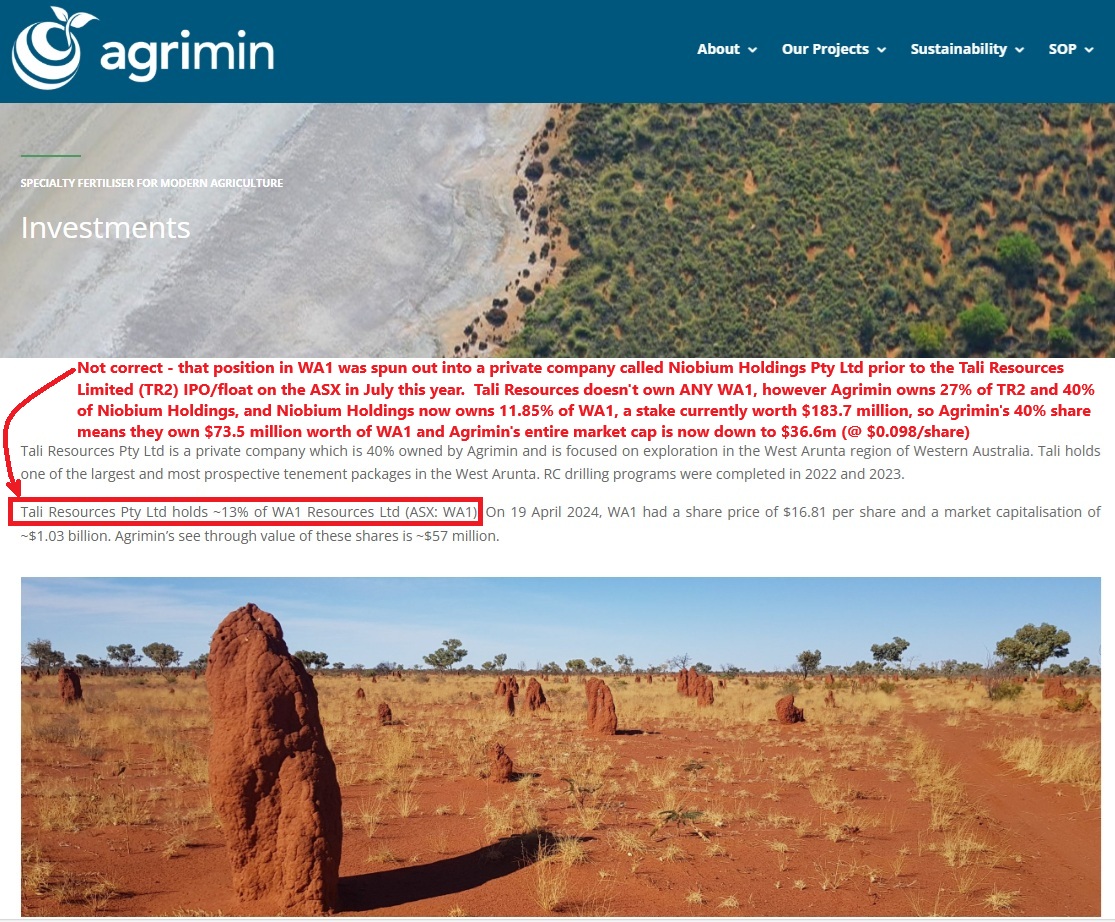

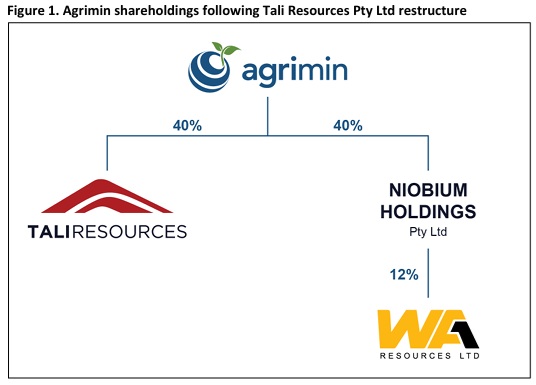

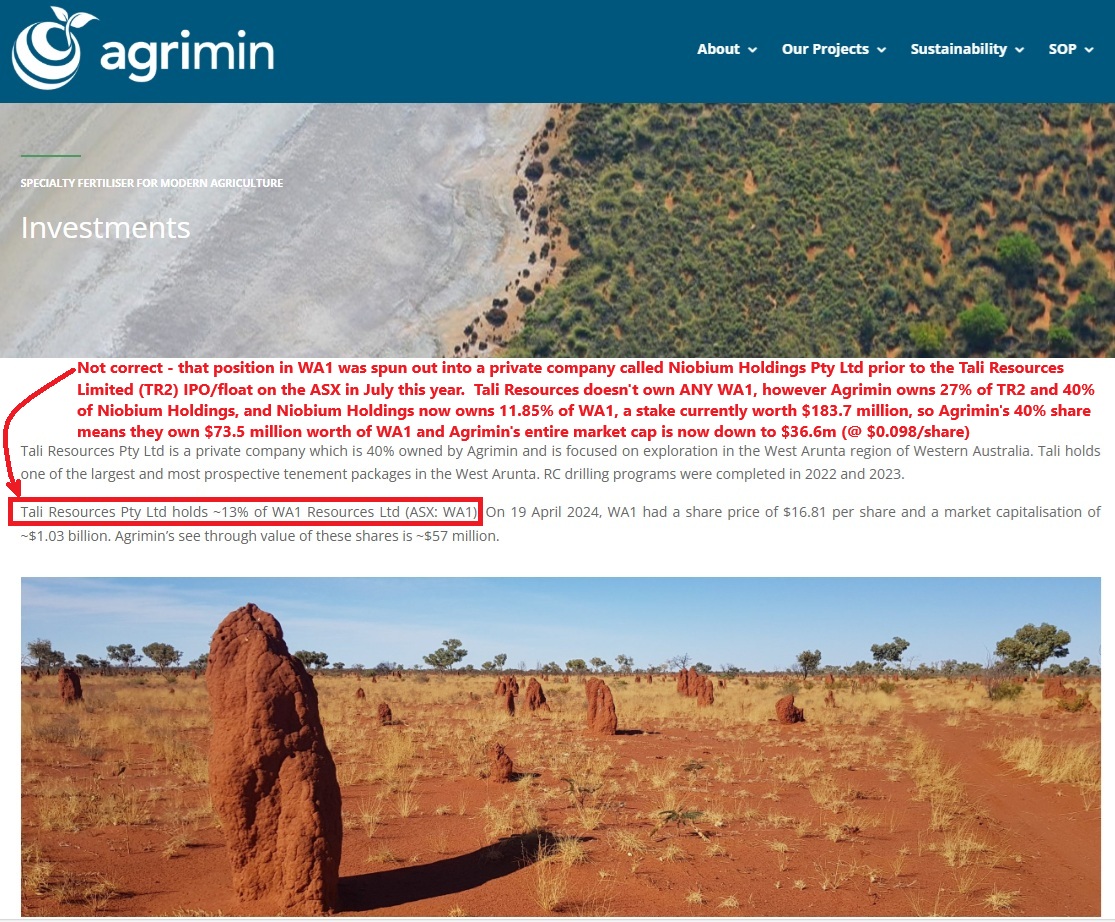

Turns out that Agrimin owned 40% of Tali (TR2) and since the recent IPO (float) of Tali Resources (TR2), Agrimin now own 27% of Tali Resources (TR2). Agrimin also own 40% of a private company called Niobium Holdings Pty Ltd (see slide below) which in turn owns 11.85% of WA1 - as shown below (they've rounded it up to 12%):

Source: Agrimin-Corporate-Update-19-May-2025.PDF

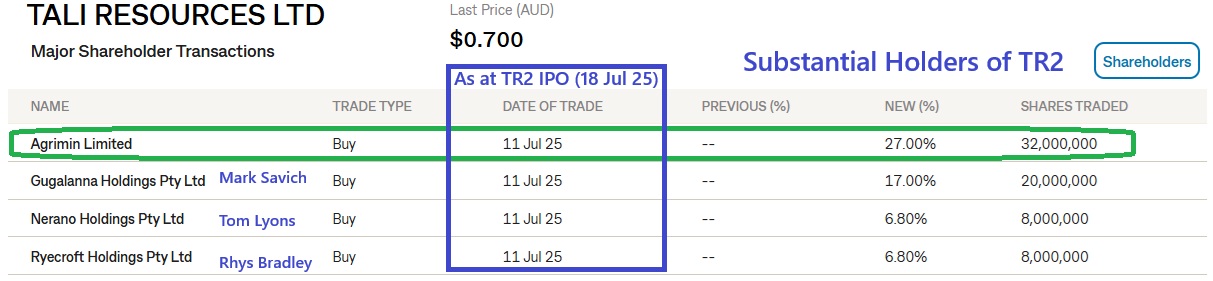

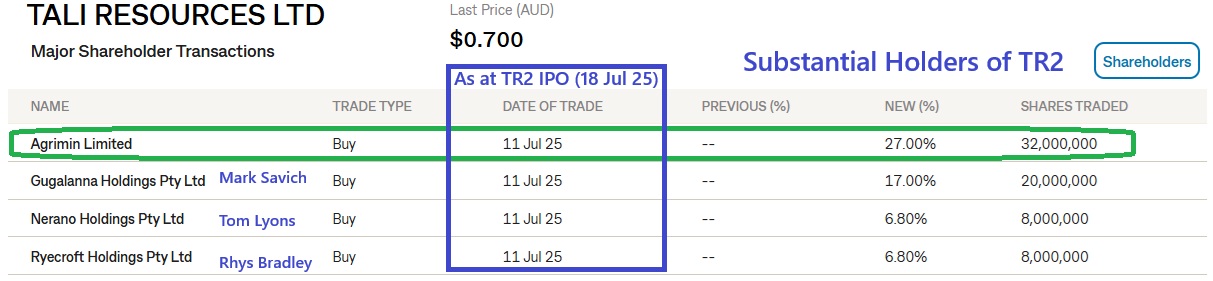

That was back in May prior to the ASX IPO of Tali (TR2), and Agrimin now owns 27% of Tali with a fair chunk of insider ownership at Tali as well:

Source (above and below): Commsec.

Source (above and below): Commsec, with additions (in blue) by me.

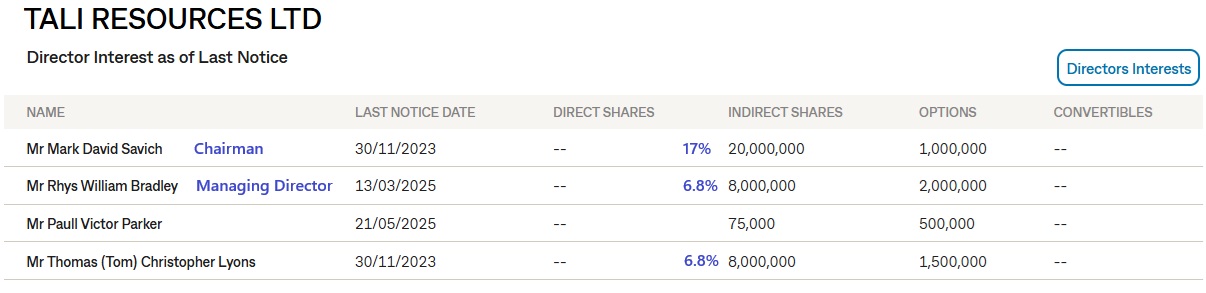

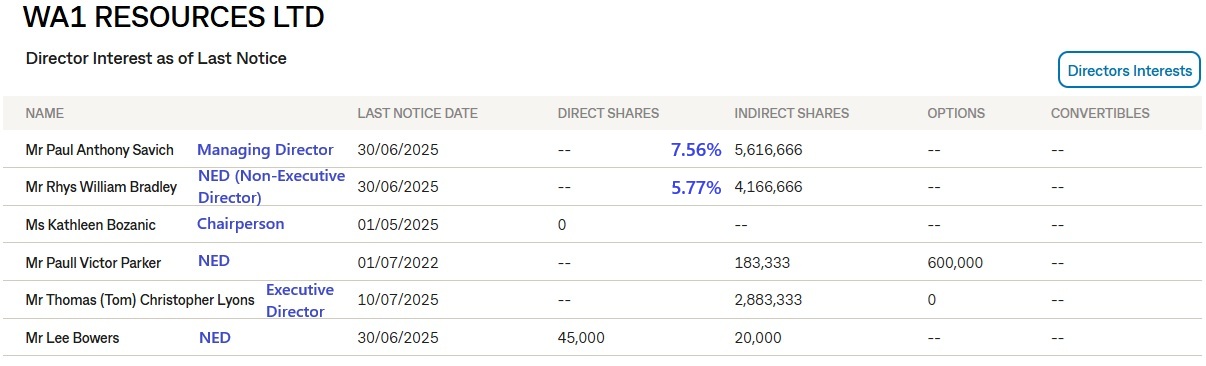

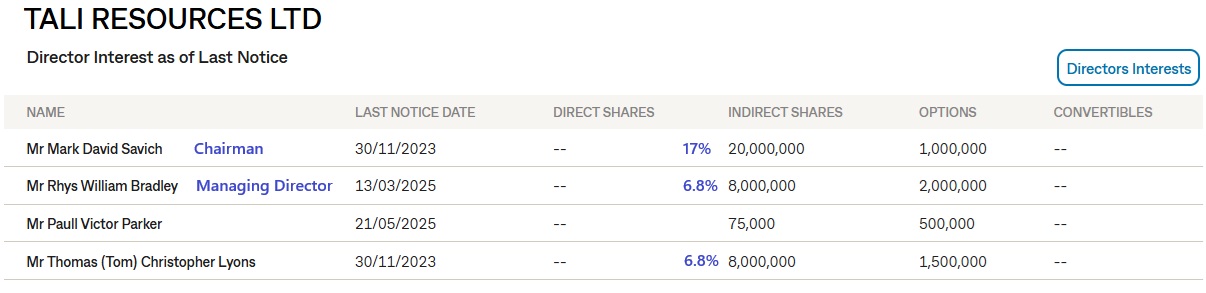

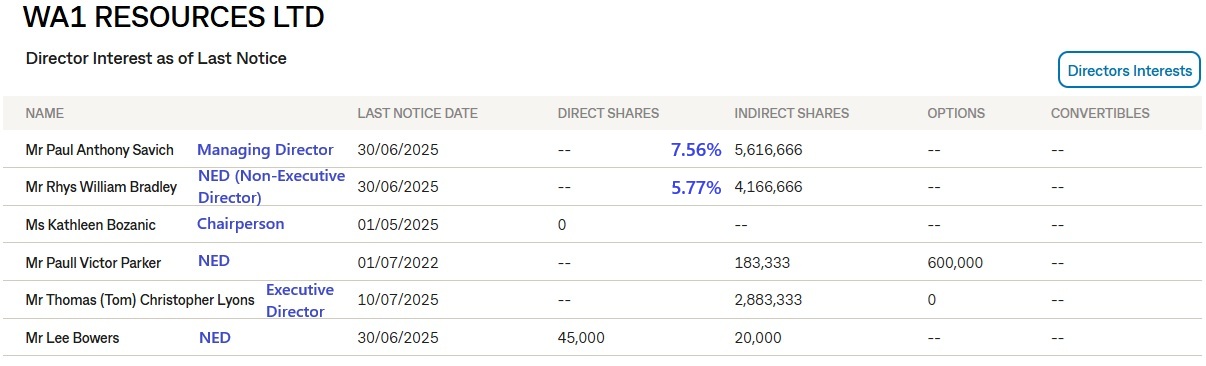

Tali Resources (TR2) is a small $82 Million explorer who have only been trading since they IPO'd 3 months ago in July. WA1 is a LOT bigger - their current market cap is over $1.5 Billion. Now have a look at the WA1 Board:

Source (above and below): Commsec.

Lots of familiar names - Rhys Bradley and Paull Parker and Tom Lyons are all also on the WA1 Board and so is Paul Savich's brother Mark Savich.

Tali Resources doesn't own any shares in WA1, that was an error by Commsec's data provider - they didn't scrape the notice properly. It is Niobium Holdings that own that 11.85% stake.

After piecing most of this jigsaw together yesterday (Monday) and today (Tuesday), I came across this AFR article which explains a lot, most of which I'd already worked out the hard way:

Critical minerals IPO stars return with copper float

by Peter Ker, AFR Resources reporter, Jun 12, 2025 – 5.00am:

The last time Rhys Bradley tried to float a greenfield mineral exploration company, he had to extend the offer period and pull money from his personal offset account to get it over the line.

The struggle to raise $4.5 million from the initial public offering of WA1 Resources shares in 2022 proved to be worth the effort; by last year the company had turned into a $1.3 billion market darling after it discovered a huge niobium deposit in Western Australia’s remote West Arunta region.

Rhys Bradley and Mark Savich will lead Tali Resources onto the ASX. Ross Swanborough

Now Bradley and key members of the group behind WA1 – Mark Savich, Paul Savich and Tom Lyons – are trying to repeat the success with another exploration IPO, and this time audiences are more keen to listen.

The crew is seeking $7.5 million for a float of Tali Resources; a new company that will explore for copper and other valuable metals about 700 kilometres west of Alice Springs and fewer than 100 kilometres south of WA1’s flagship Luni niobium discovery.

“There’s much more interest this time,” says Bradley of the market reception to Tali’s plan to float this year.

“These are credible targets and deserve to be drilled. People are happy to listen and are excited to see that. They’ve seen what can happen if it goes really well.”

Tali will have 4000 square kilometres of tenements to explore near Kiwirrkurra; a tiny hamlet close to the WA-Northern Territory border.

Although it’s possible the tenements contain more of the niobium-bearing carbonatites that made WA1 a roaring success, Tali’s focus will be on copper.

Tali’s tenements are close to Rincon Resources’ Pokali deposit, where previous drilling campaigns have returned hits of more than 0.5 per cent copper.

“Previous explorers have seen copper in the system and hence why we’re probably leaning towards copper for this,” says Bradley of Tali’s tenements.

If the float goes ahead as planned, Tali will be the third ASX-listed company to emerge from effectively the same syndicate of explorers working in the West Arunta region.

The journey began with Agrimin; a sulphate of potash aspirant that was worth more than $100 million in 2022, but has since shrunk to a market value of just $23 million amid investor scepticism generated by the failure of several rival potash companies in WA.

Both WA1 and Tali have been spun out of Agrimin, as the latter company focused on potash and sought to give its other tenements a new life under a different banner.

Agrimin still owns 40 per cent of Tali, but is expected to have its shareholding diluted down to about 27 per cent once the IPO is complete.

The warm reception for the Tali float comes despite a cooling market for mineral exploration; data published this week by advisory firm BDO showed that only 26 ASX-listed exploration companies managed to secure more than $10 million in funding during the March quarter; down from 57 in the previous quarter.

Spending on minerals exploration in the March quarter was the weakest in almost four years.

The success of WA1 has undoubtedly boosted investor confidence in Bradley and the Savich brothers, but Bradley reckons it has also boosted confidence in the prospecting potential of the West Arunta region.

“The belt now actually hosts a tier-one deposit. So that is a tangible change that we can point to,” said Bradley.

WA1 Resources was worth $987 million on Wednesday, making it 107 times more valuable than at IPO.

--- ends ---

Source: https://www.afr.com/companies/mining/critical-minerals-ipo-stars-return-with-copper-float-20250609-p5m60d

[June 12th 2025]

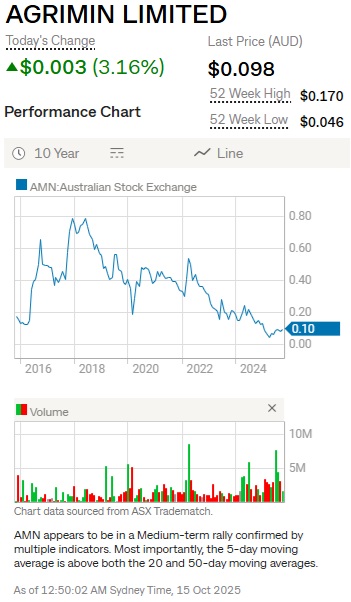

So that's the big link - WA1 and TR2 have both been spun out of Agrimin, and Agrimin still owns 27% of TR2 and 4.74% of WA1, being 40% of Niobium Holdings which owns 11.85% of WA1 (so 40% of 11.85% = 4.74%) and that 4.74% of WA1 is currently worth $73.5 million because WA1's market cap is currently $1.55 Billion.

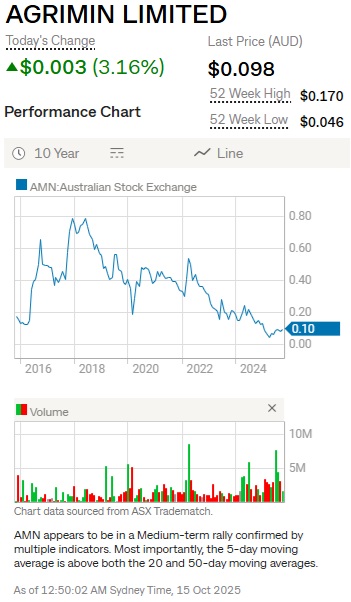

And despite owning $73.5 million worth of WA1, Agrimin (AMN) has a current market cap of less than $37 million according to the ASX. That's based on their closing share price today of 9.8 cps (cents per share) and is subject to change as their share price changes obviously, but that's what it was today.

That's their 10 year chart using monthly data points, not weekly or daily data points.

Their website is also not up to date - as shown by this snapshot I took tonight - the red stuff was added by me after I took the screenshot.

Tali Resources definitely does NOT own any shares in WA1 now - those were spun out into Niobium Holdings Pty Ltd just before Agrimin IPO'd Tali Resources (TR2)

It's probably obvious by now, but yes, I did buy some Agrimin (AMN) shares today.

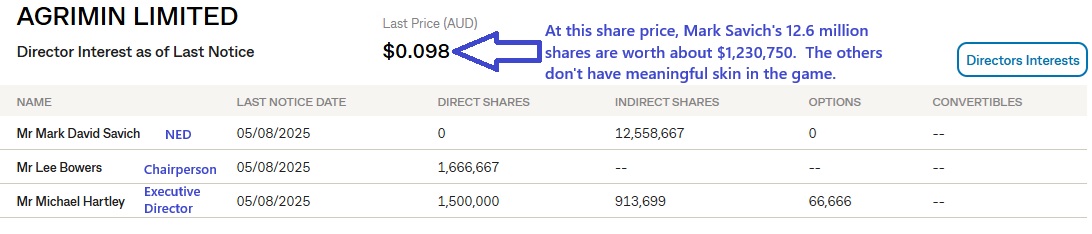

Here's what their Board hold:

Source: Commsec + https://agrimin.com.au/board-of-directors/

It's not a lot, only Mark Savich has significant skin in the game, however Lee Bowers is also on the WA1 Board and owns shares in WA1 directly, and Agrimin is turning into an investment company now rather than a SOP (potash) project developer.

As well as being the director with the most skin in the game at Agrimin, Mark Savich is also the Chair of TR2 (Tali) and owns or controls 17% of TR2 personally, and his brother Paul Savich is the MD of WA1 and owns 7.56% of WA1.

Just circling back to this table below that I included earlier in this straw:

The 4 holdings in the blue rectangle are all the same single 9.79% holding by BCI, as I explained earlier, with mirror notices by the other three because they all hold over 20% of BCI, but I also checked out who Hillboi Nominees Pty Ltd and associated entities are (just above the blue rectangle above), and it's Tom Lyons, Executive Director of WA1 and non-executive Director of TR2, plus Mrs. Heather Mary Lyons, Mr Timothy Lyons and family (see here: Hillboi-Nominees-June-2016.PDF). Tom also uses another company called Nerano Holdings Pty Ltd to hold his 8 million TR2 shares (6.8% of TR2) and his 2.883 million WA1 shares (see here: Change-of-Director's-Interest-Notice-Tom-Lyons-WA1-10-July-2025.PDF).

So now I'm looking back one further step at Agrimin's largest shareholder, BCI Minerals.

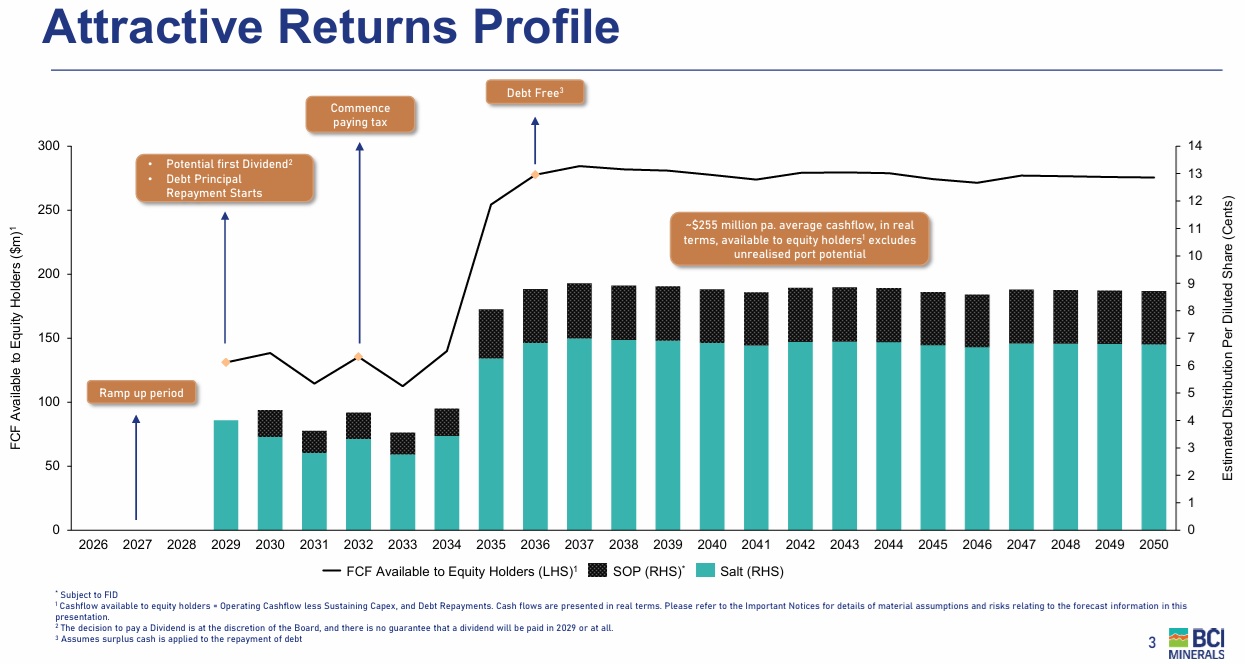

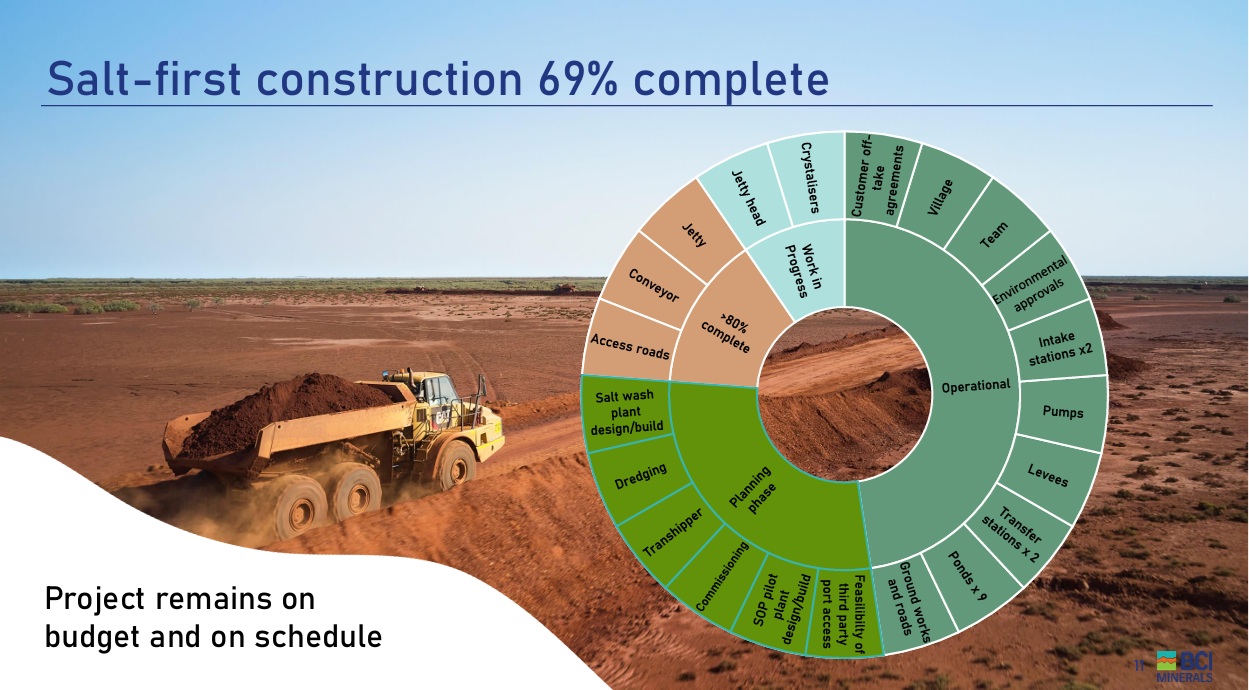

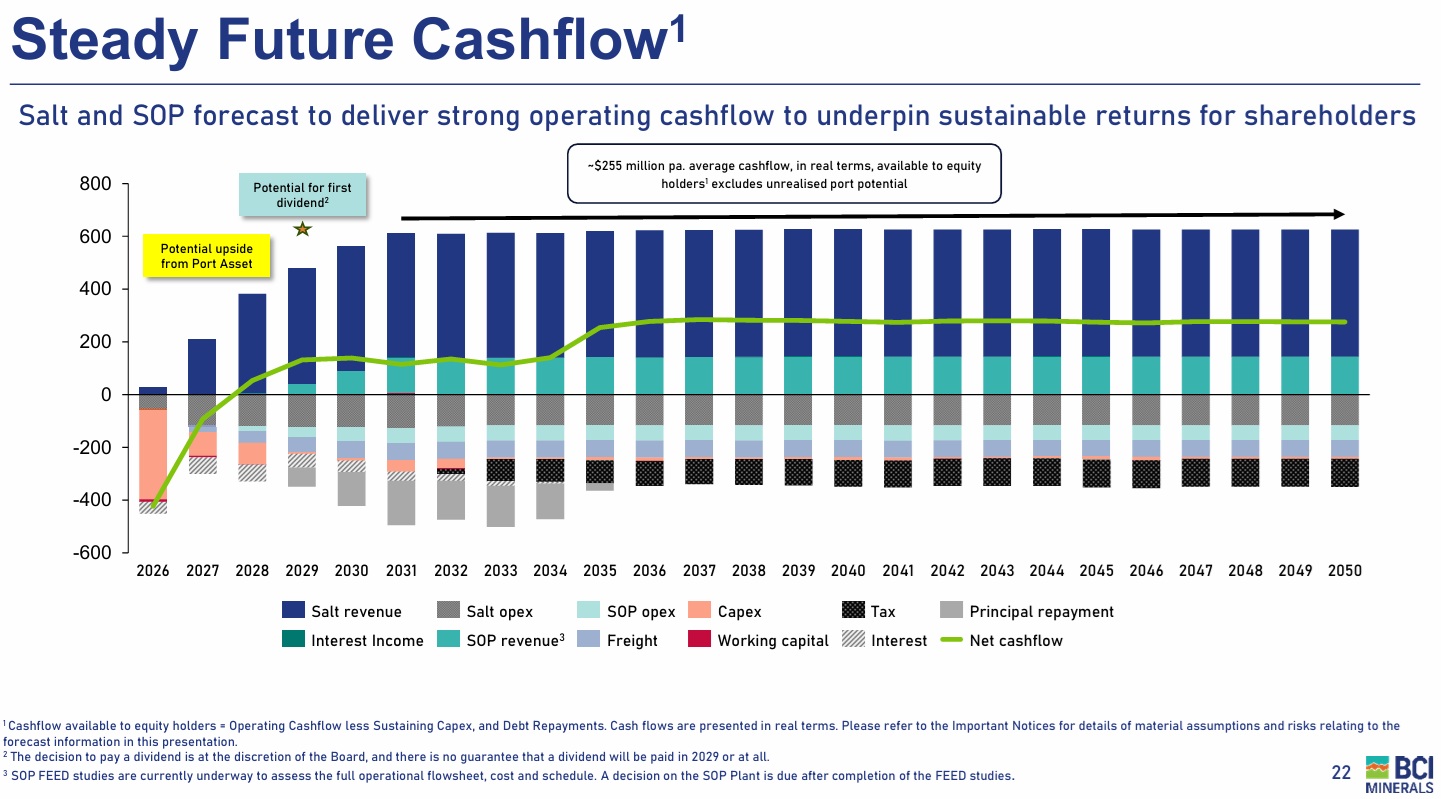

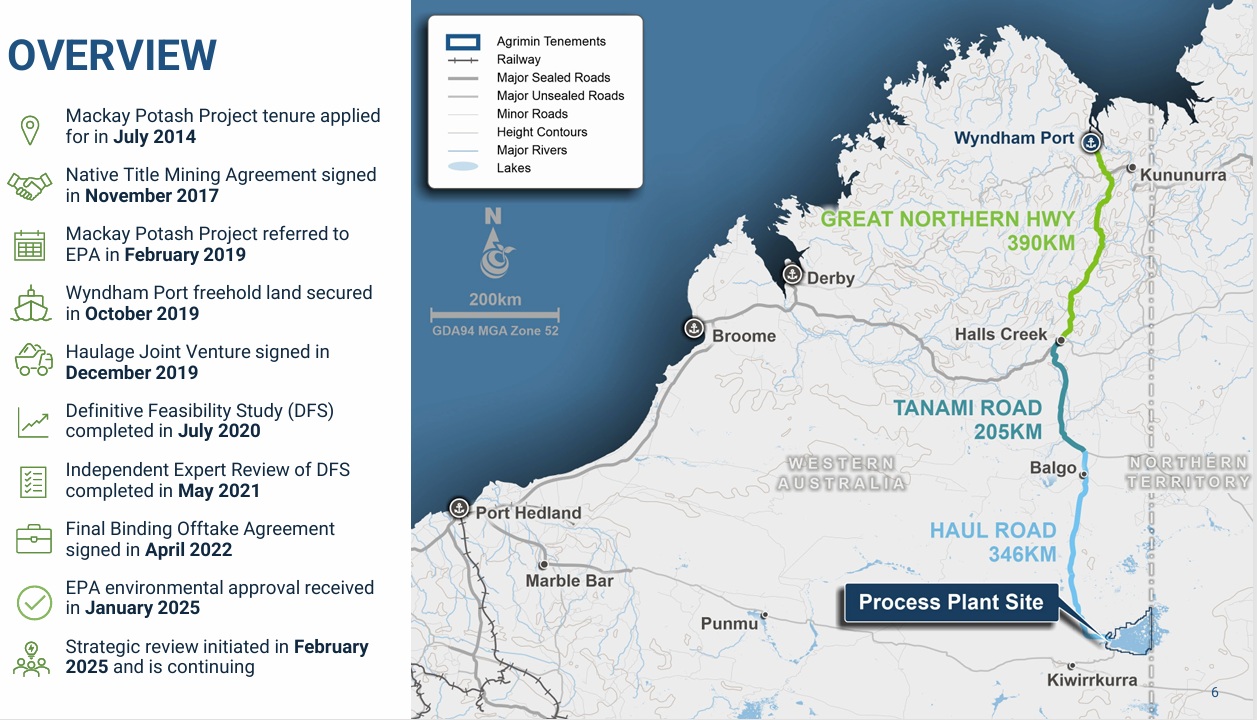

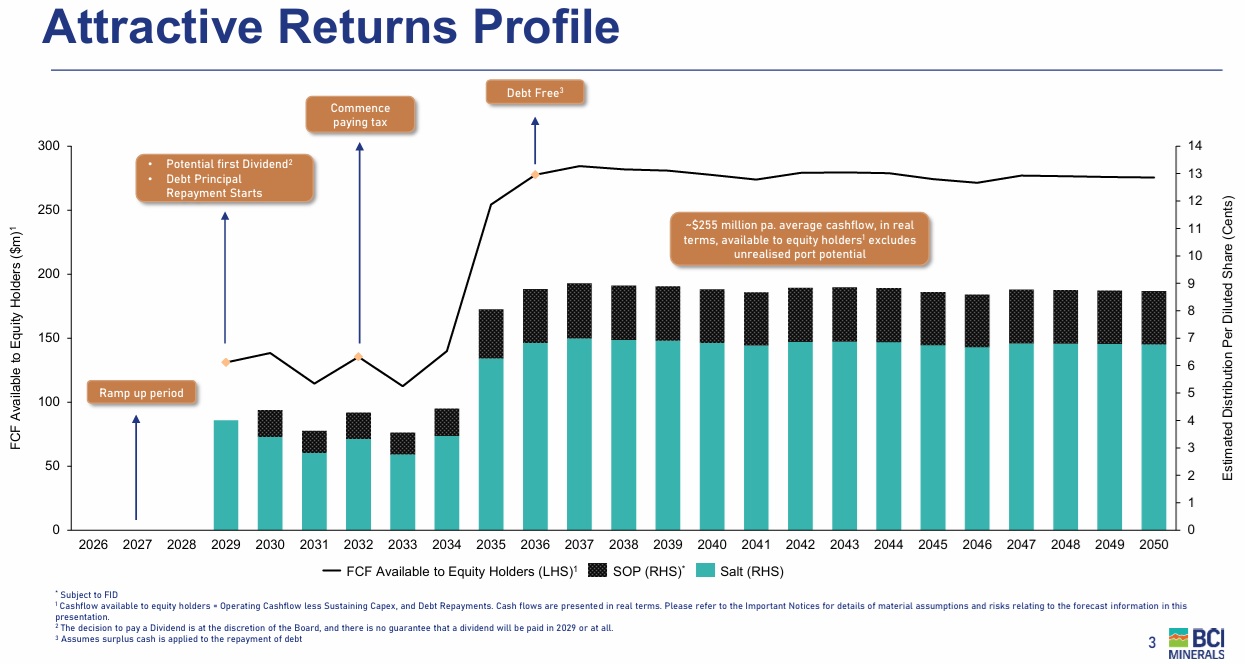

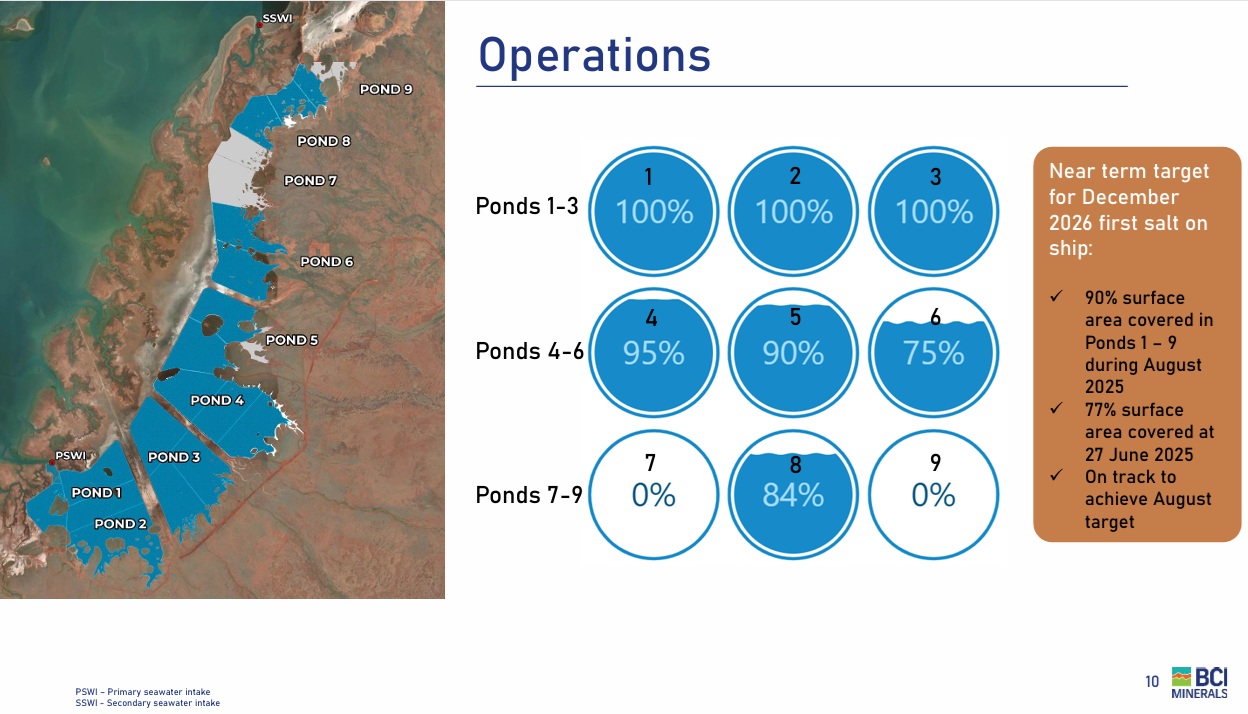

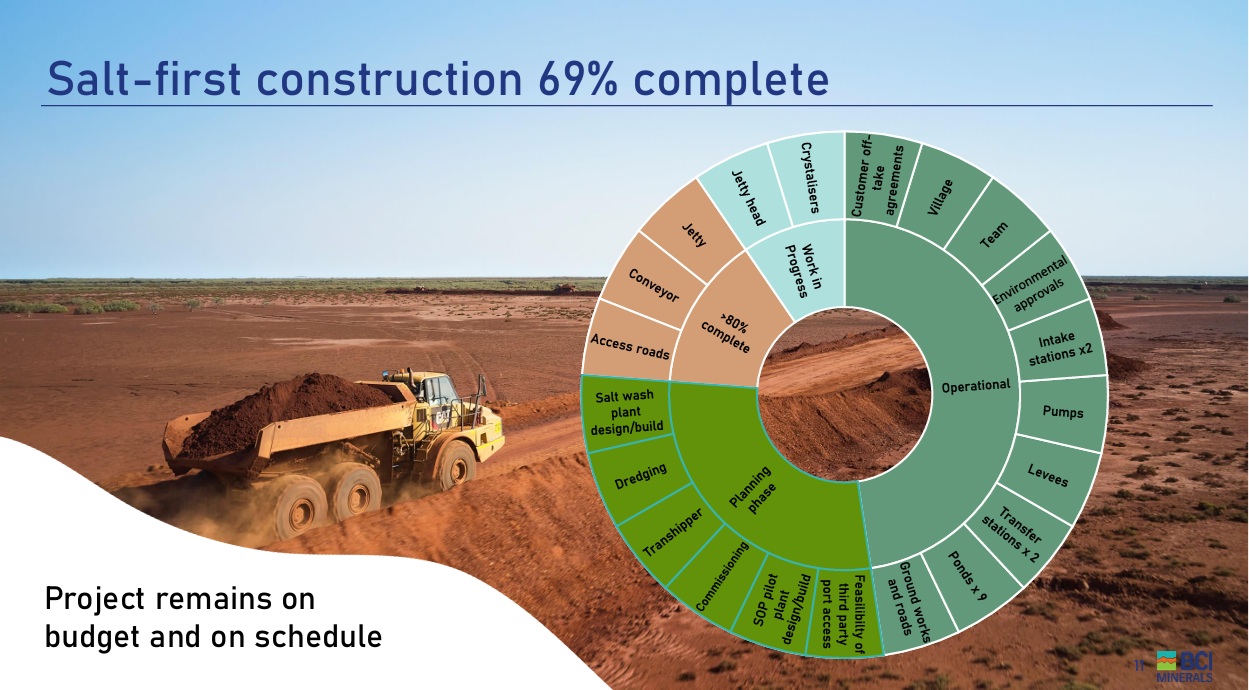

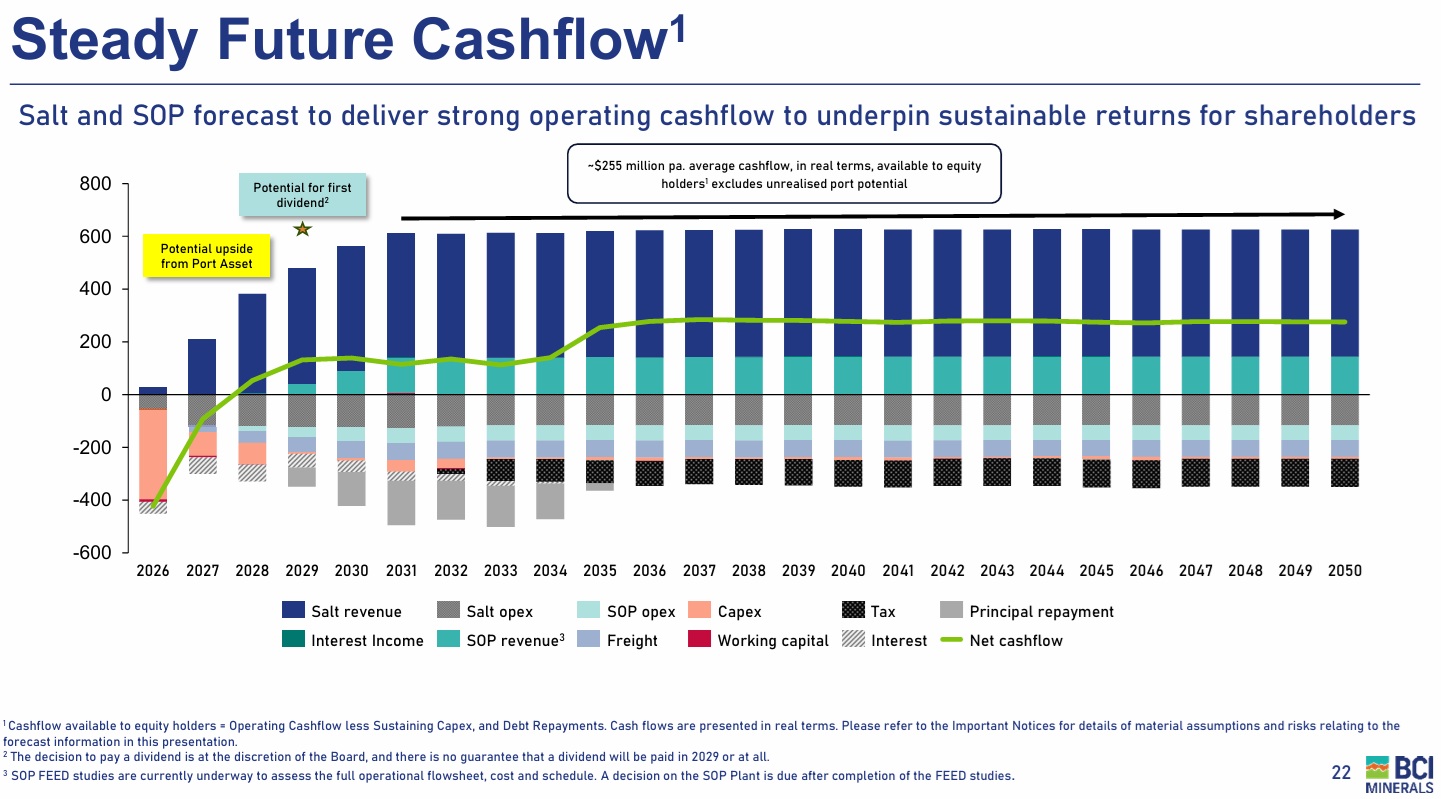

BCI's current market cap is $1.19 Billion and they've sunk at least $1.1 Billion into salt and port assets - remember the brown squircles on the slide near the top of this straw? No, me neither, so here it is again:

They have major backing from Stokes' Wroxby and Australian Super, who between them own 68% of the company, and they own 9.79% of Agrimin, who themselves are looking very undervalued by the market based on their investment in WA1 alone.

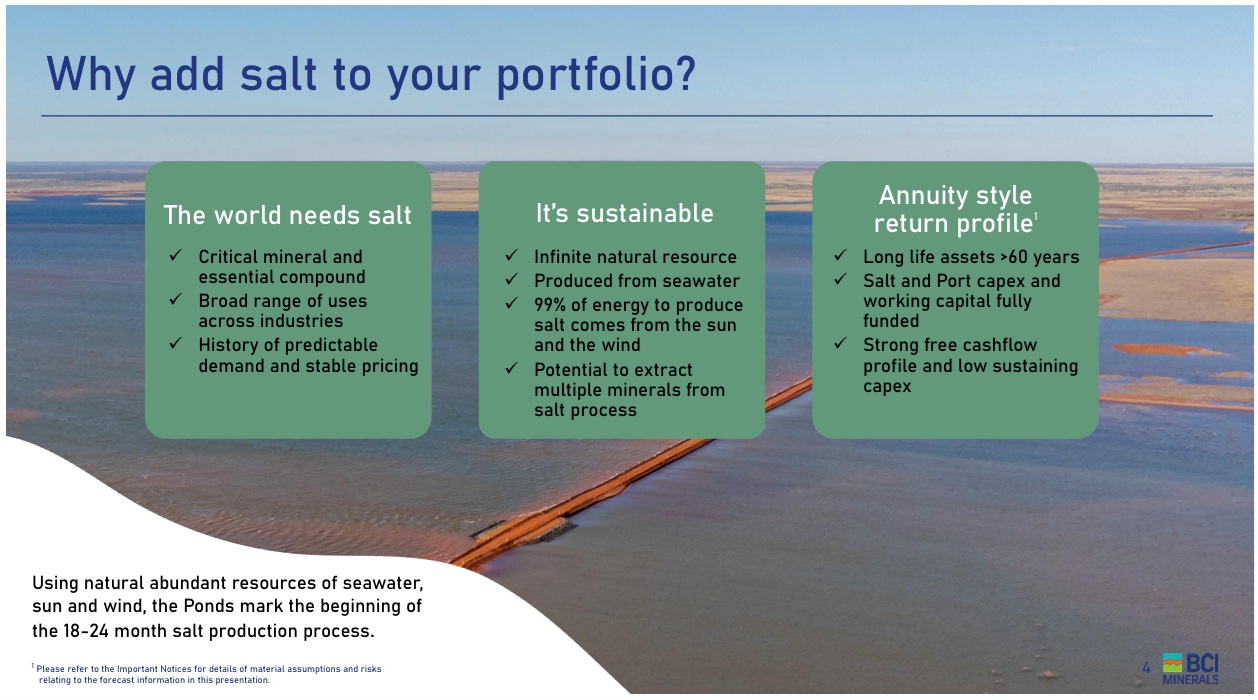

I think BCI isn't so much a value play like AMN is, BCI is more of an infrastructure play, hence the funding interest (shares and convertible notes acquired) by Australian Super, Australia's largest Super Fund, who are always looking for longer term reliable income generators with little downside risk.

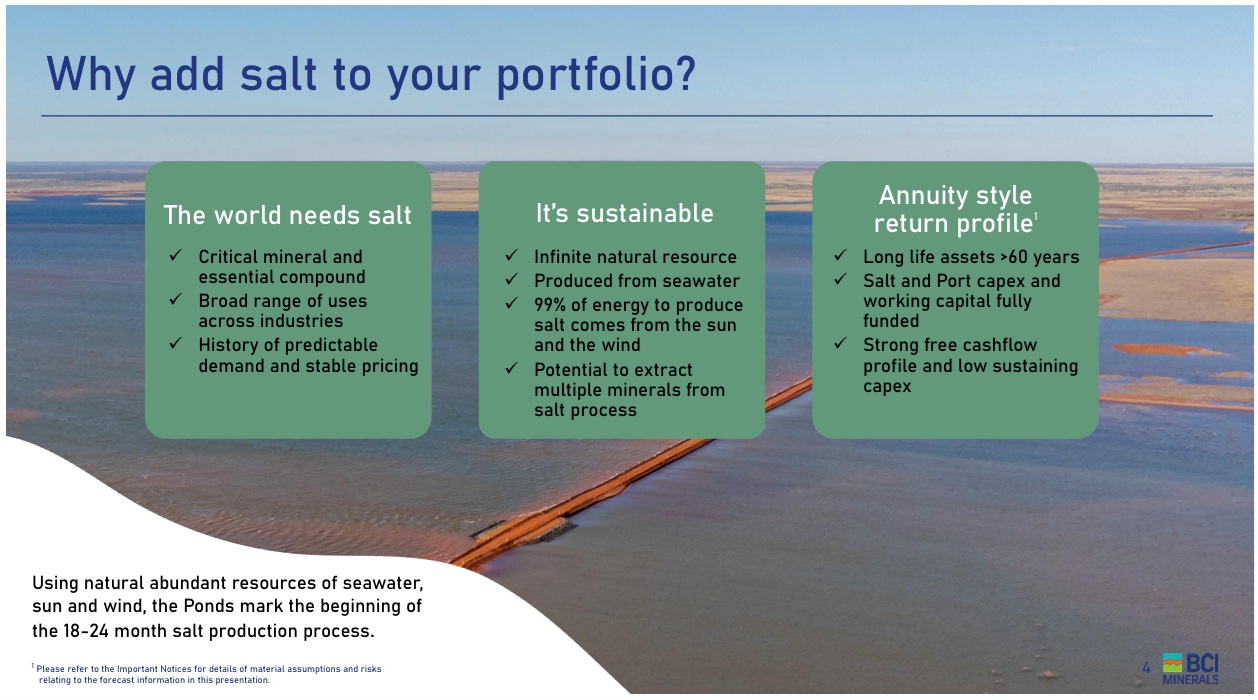

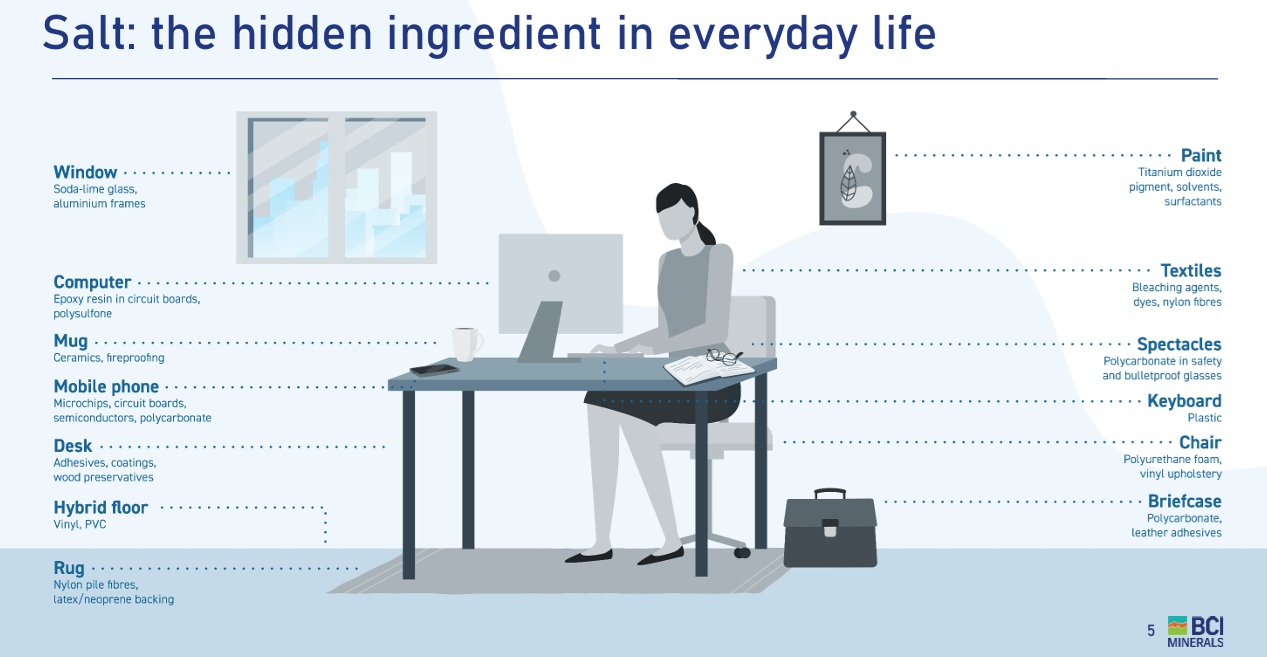

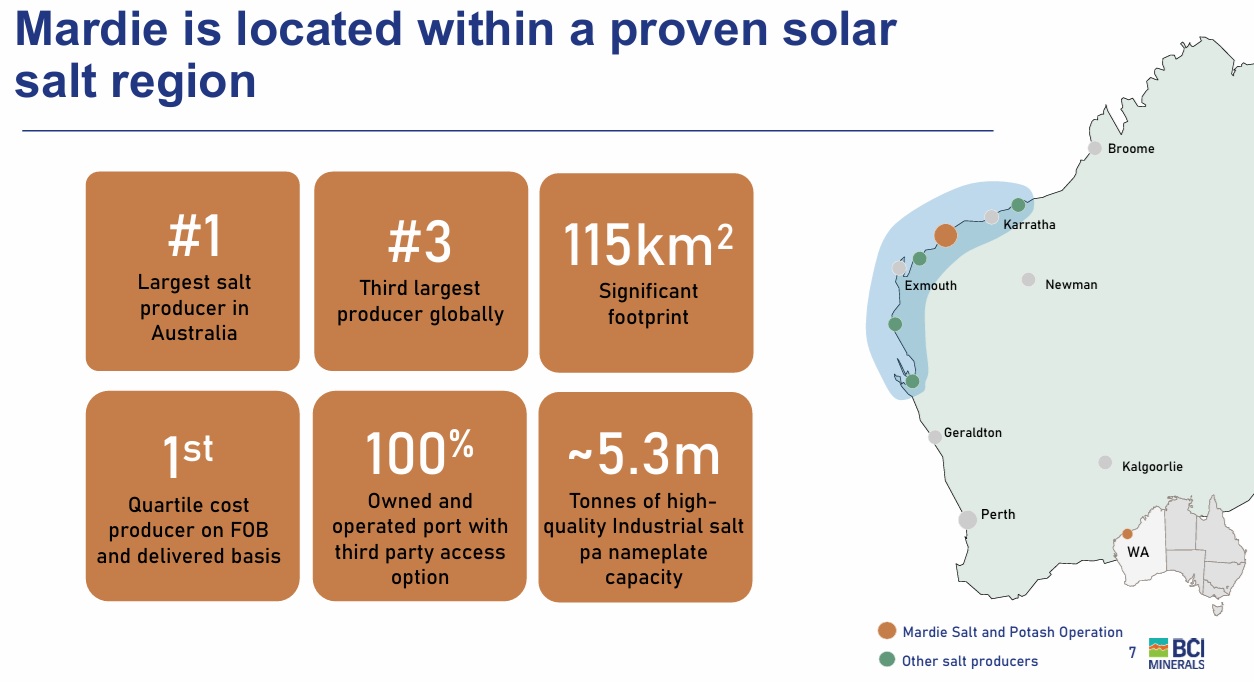

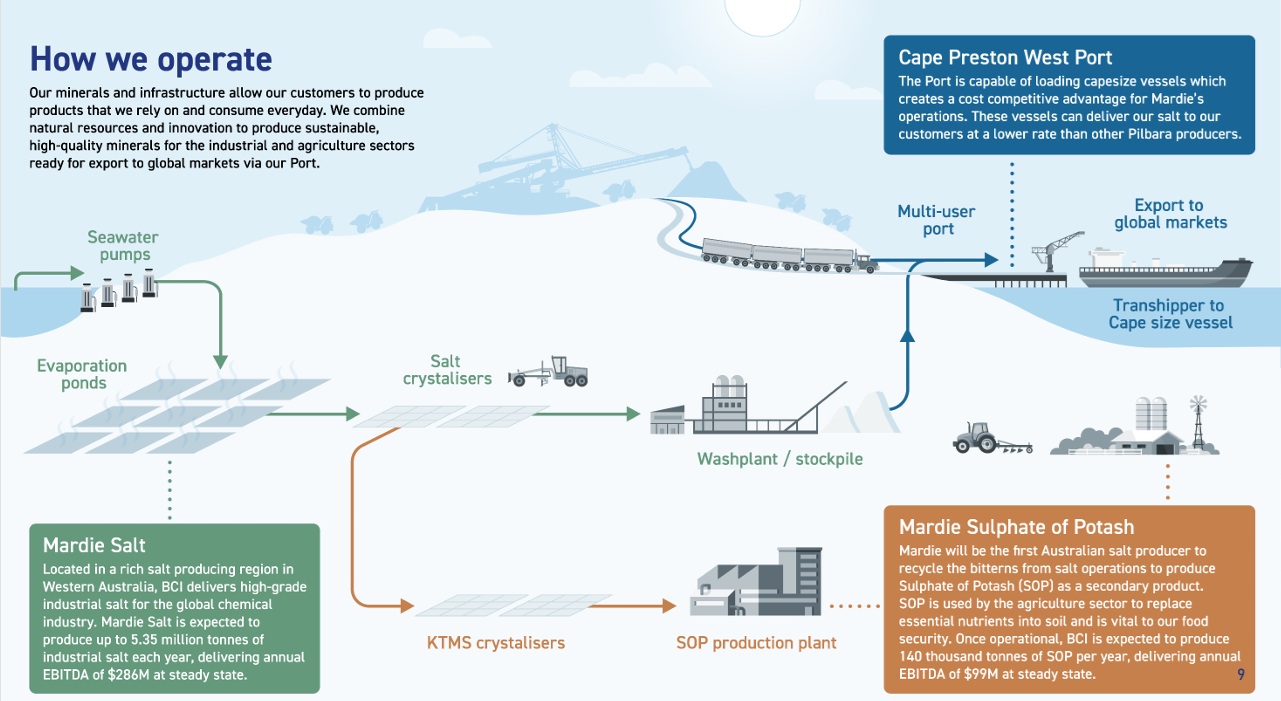

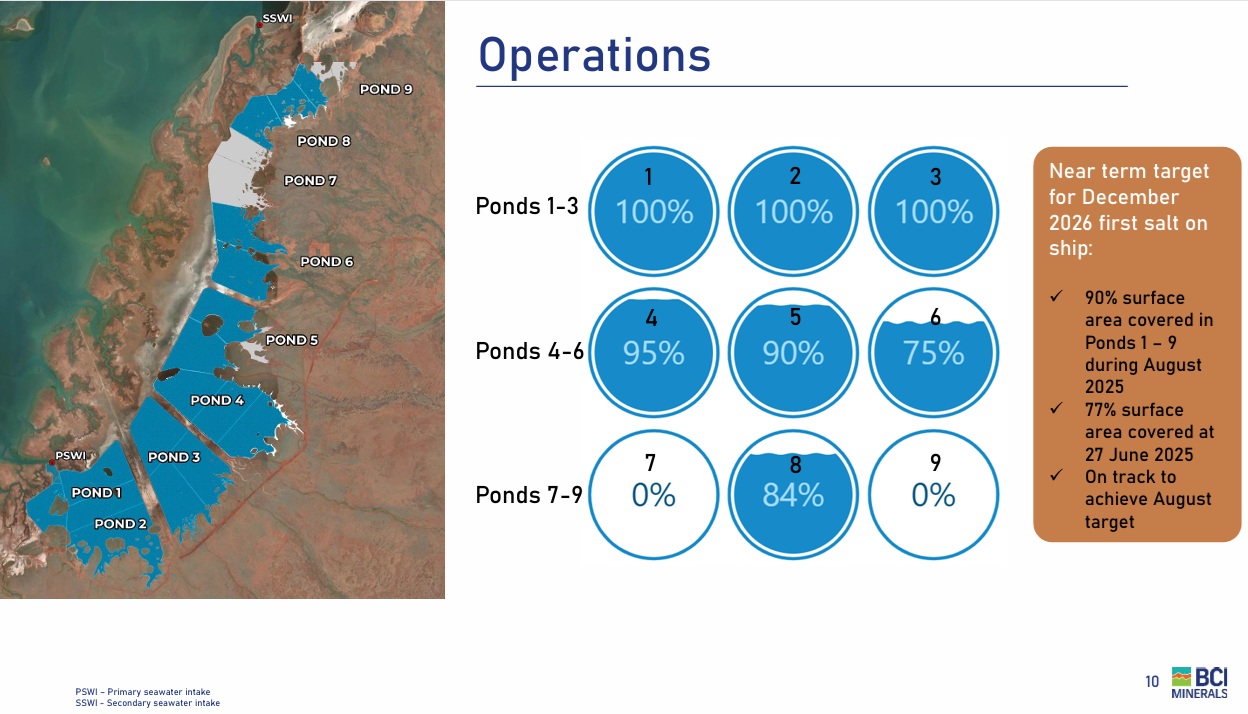

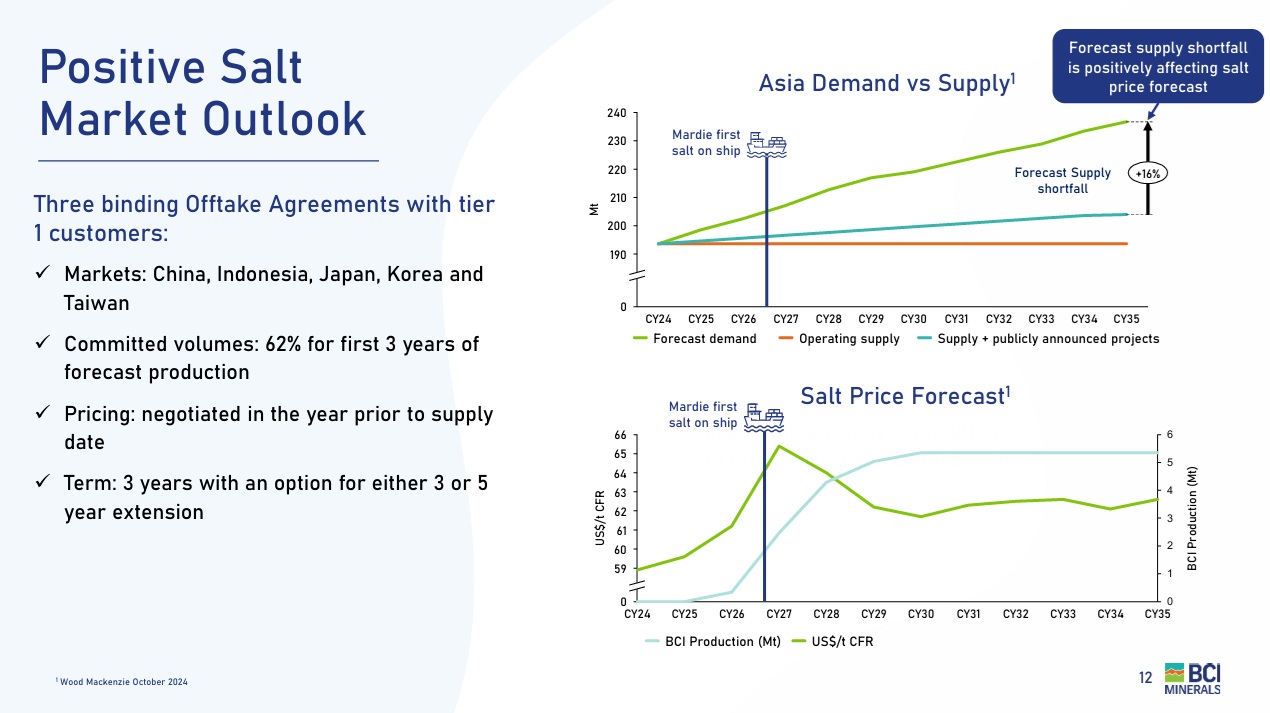

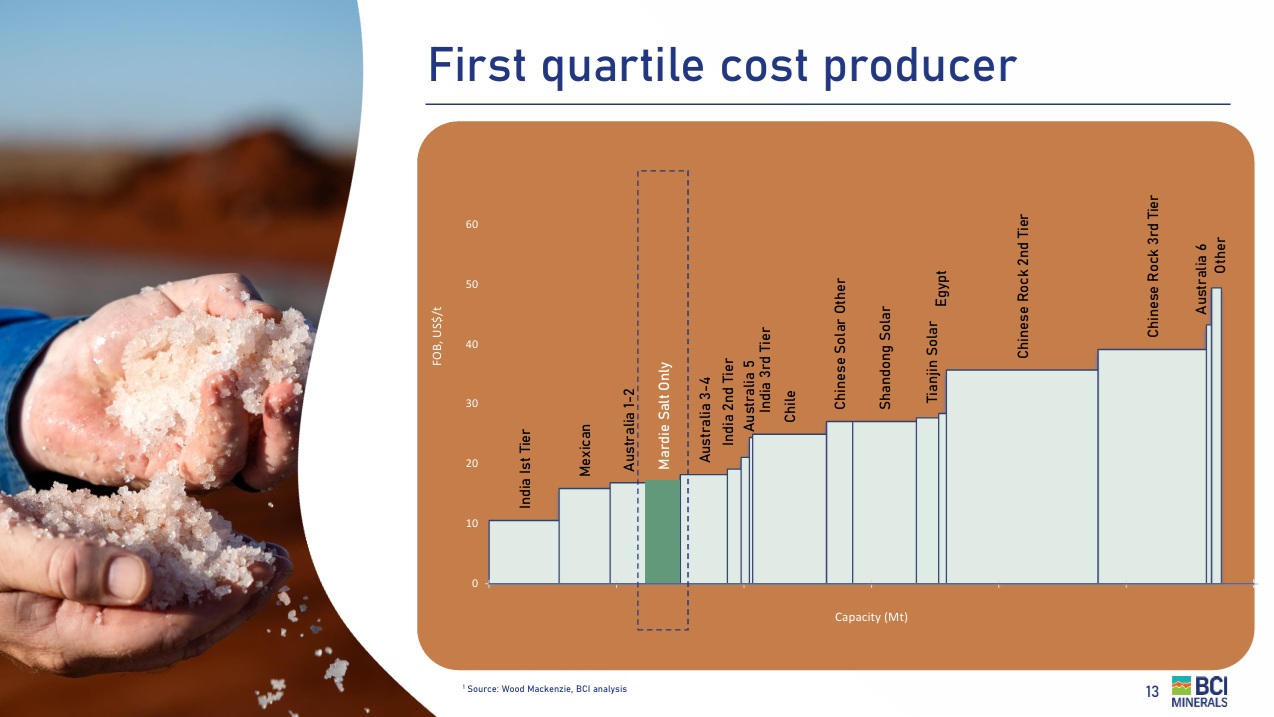

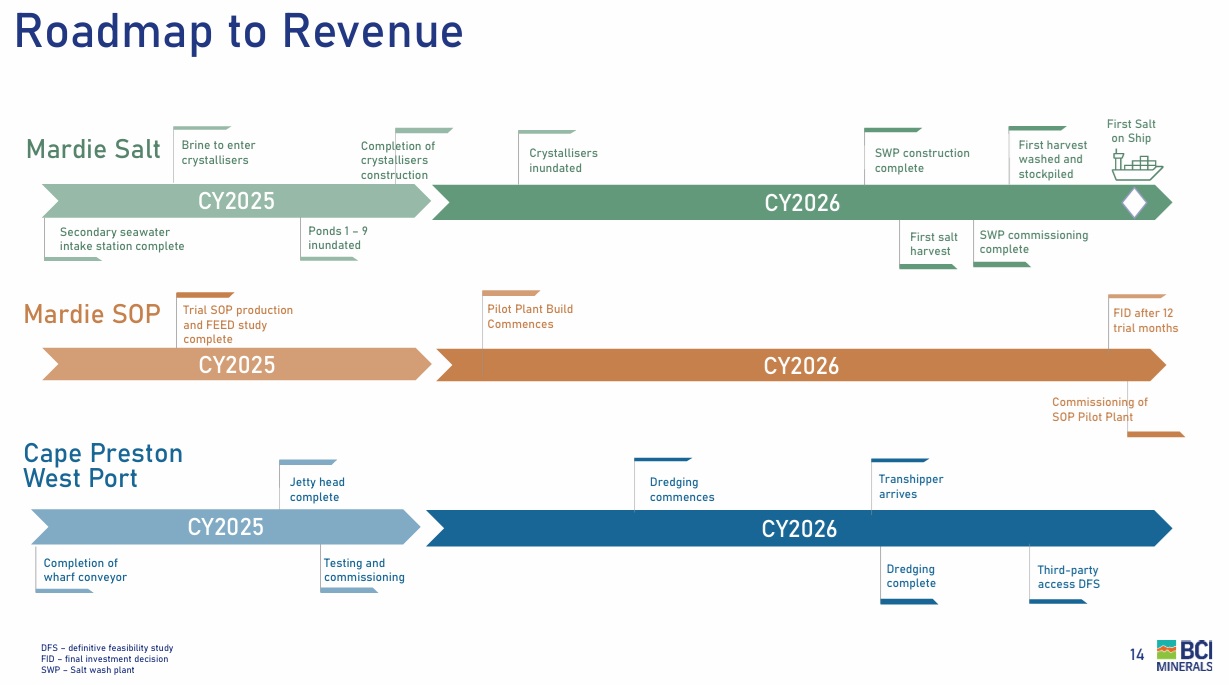

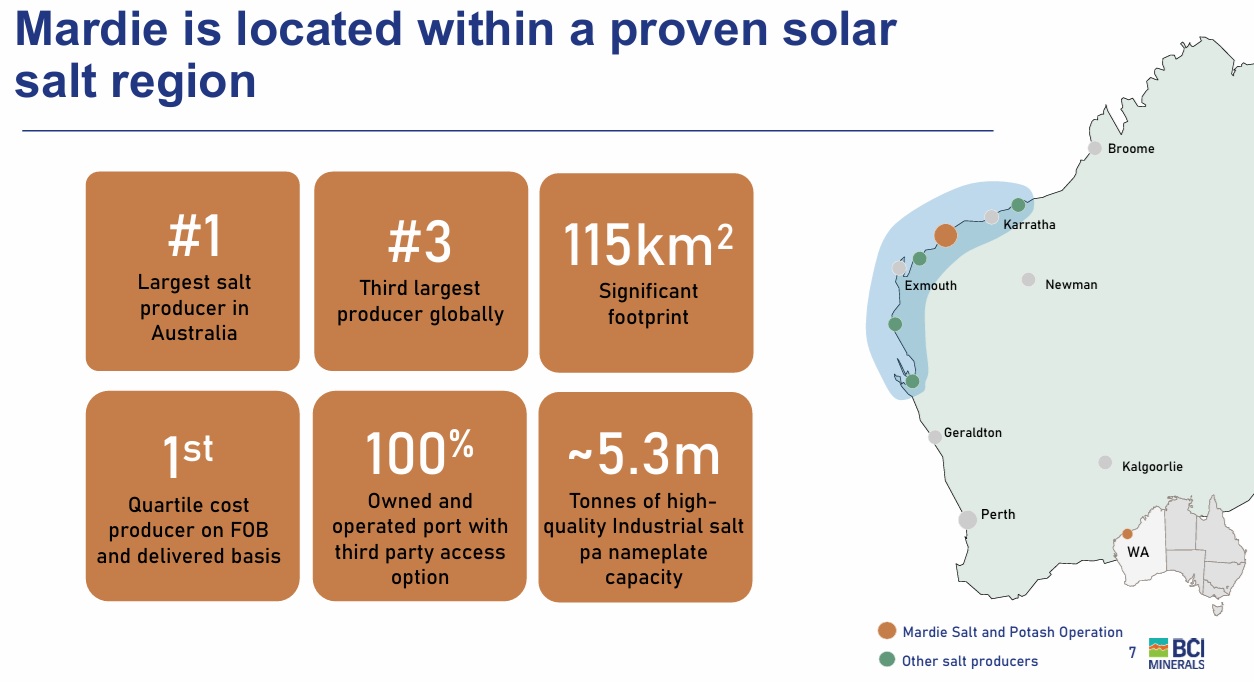

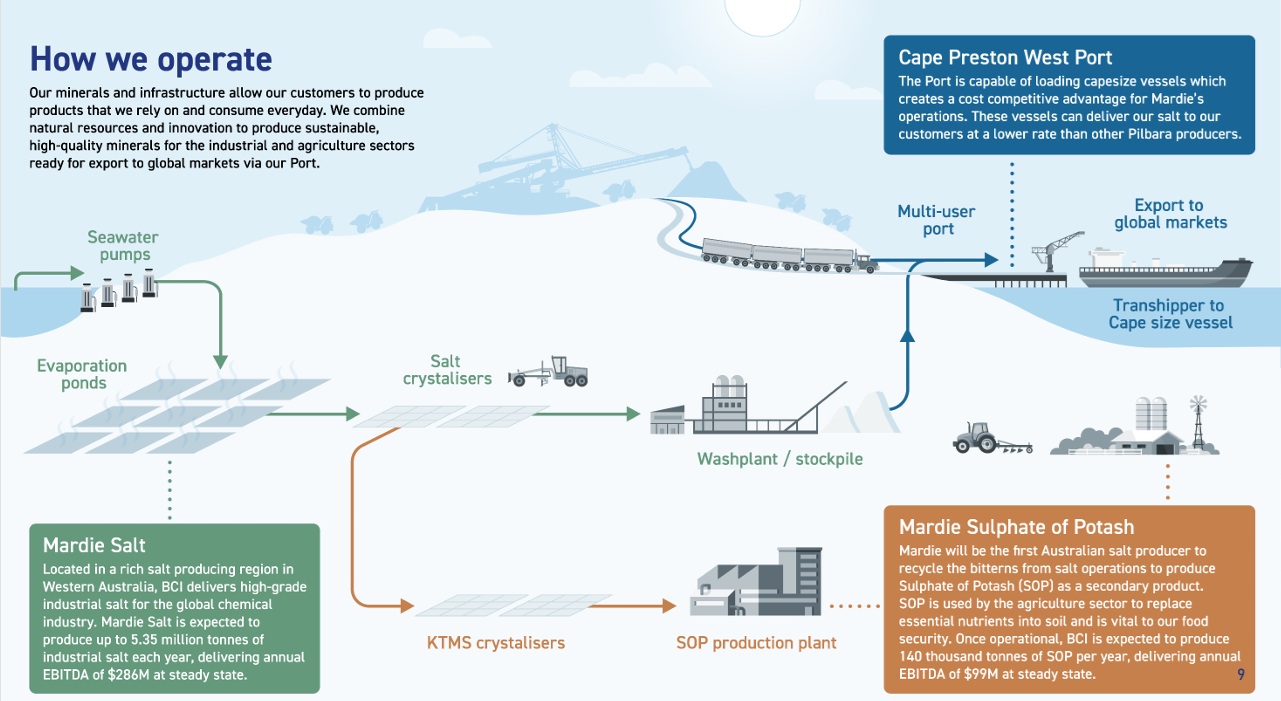

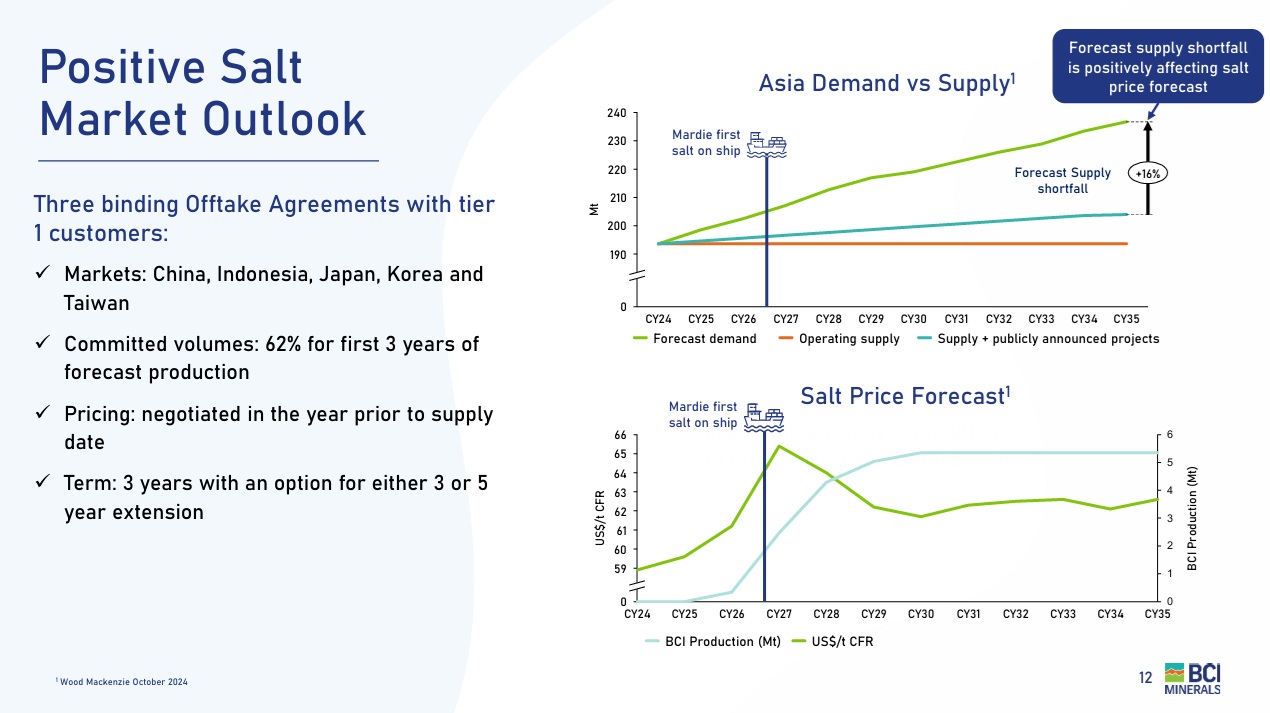

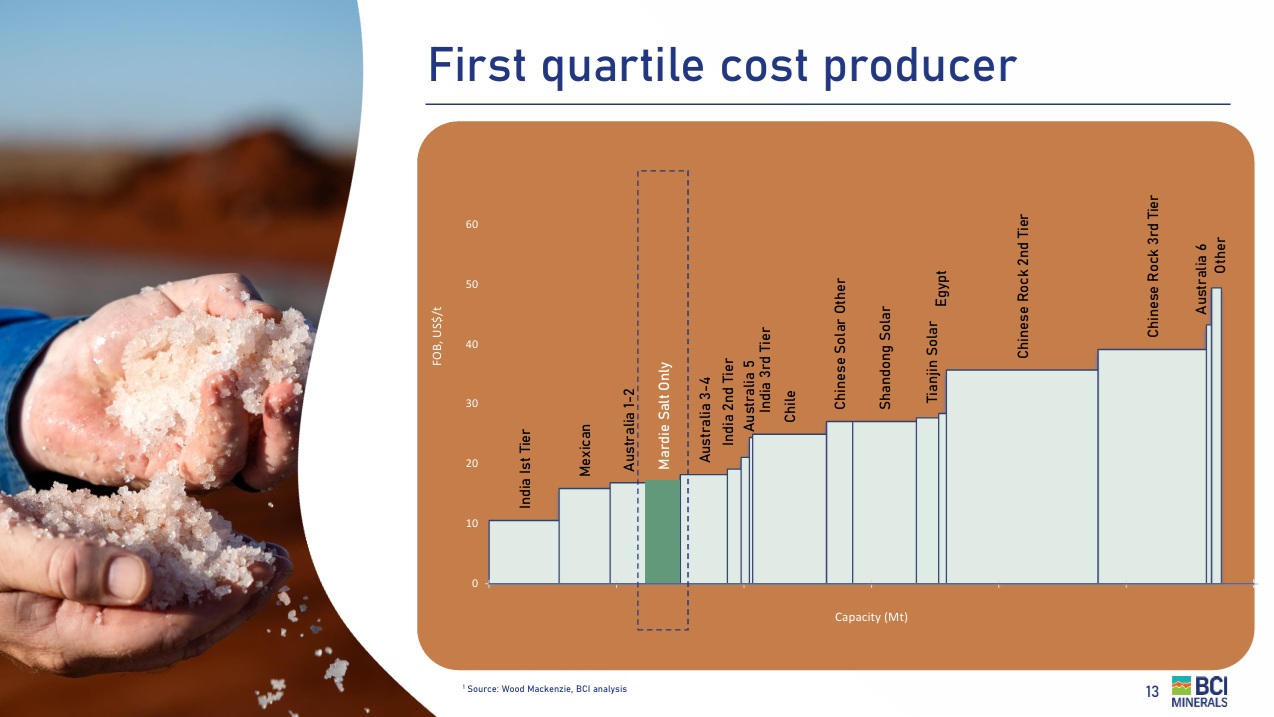

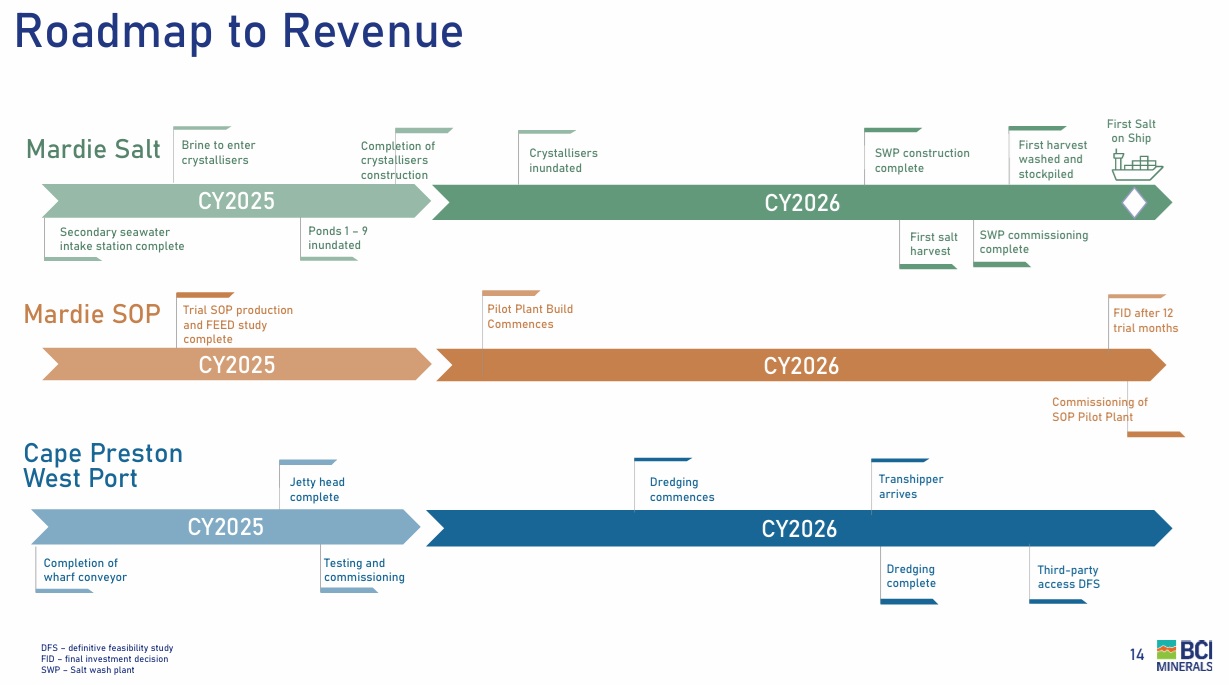

I'll share a couple of slides (more like a dozen actually) from a recent BCI presentation so you can understand how they are positioning themselves. They are even calling salt a critical mineral!

Source: 23/07/2025: Noosa Mining Conference Presentation

One more - they've been spending substantial money setting this thing up:

Anyway, that's what I've been looking into lately - in addition to the gold and copper explorers, developers and producers.

With this rabbit hole, I started chasing Niobium and Copper and ended up with Salt and Potash.

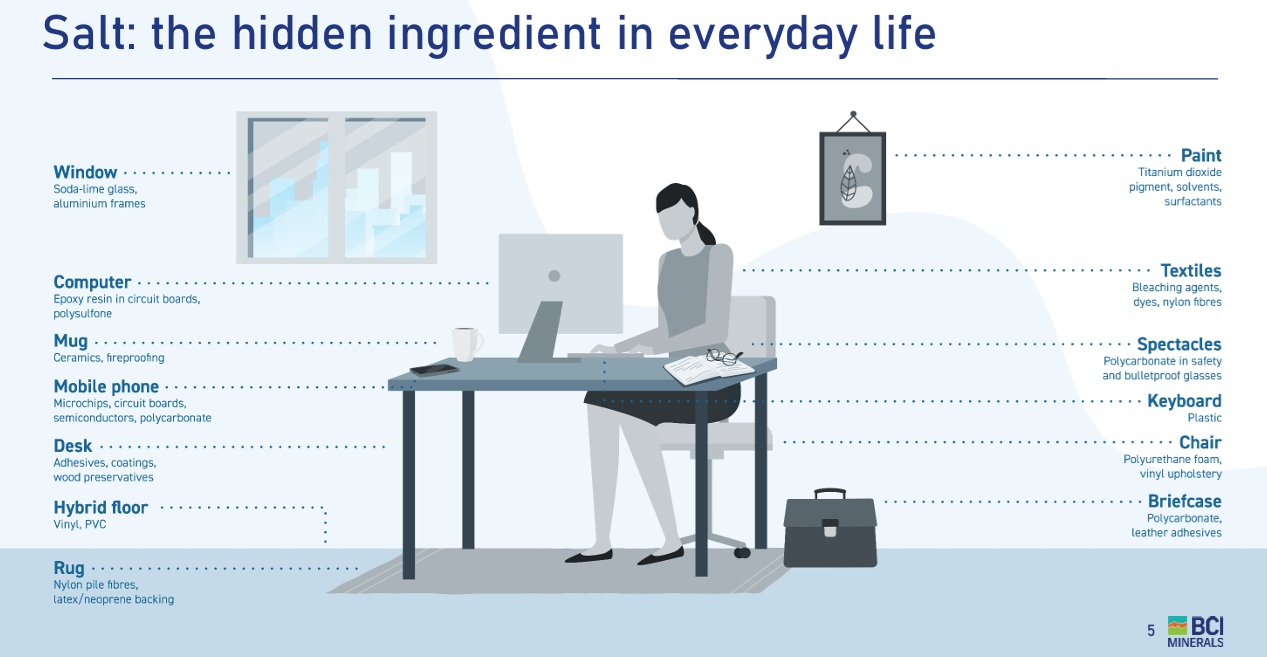

And I learned that salt goes into a lot more stuff than I ever imagined.

I have taken a small $10K position in both BCI and AMN today. I already bought $7K of TR2 last week. WA1 remains too expensive in my view to be investing in directly, but I do now have WA1 exposure through AMN and a bit through BCI as well.

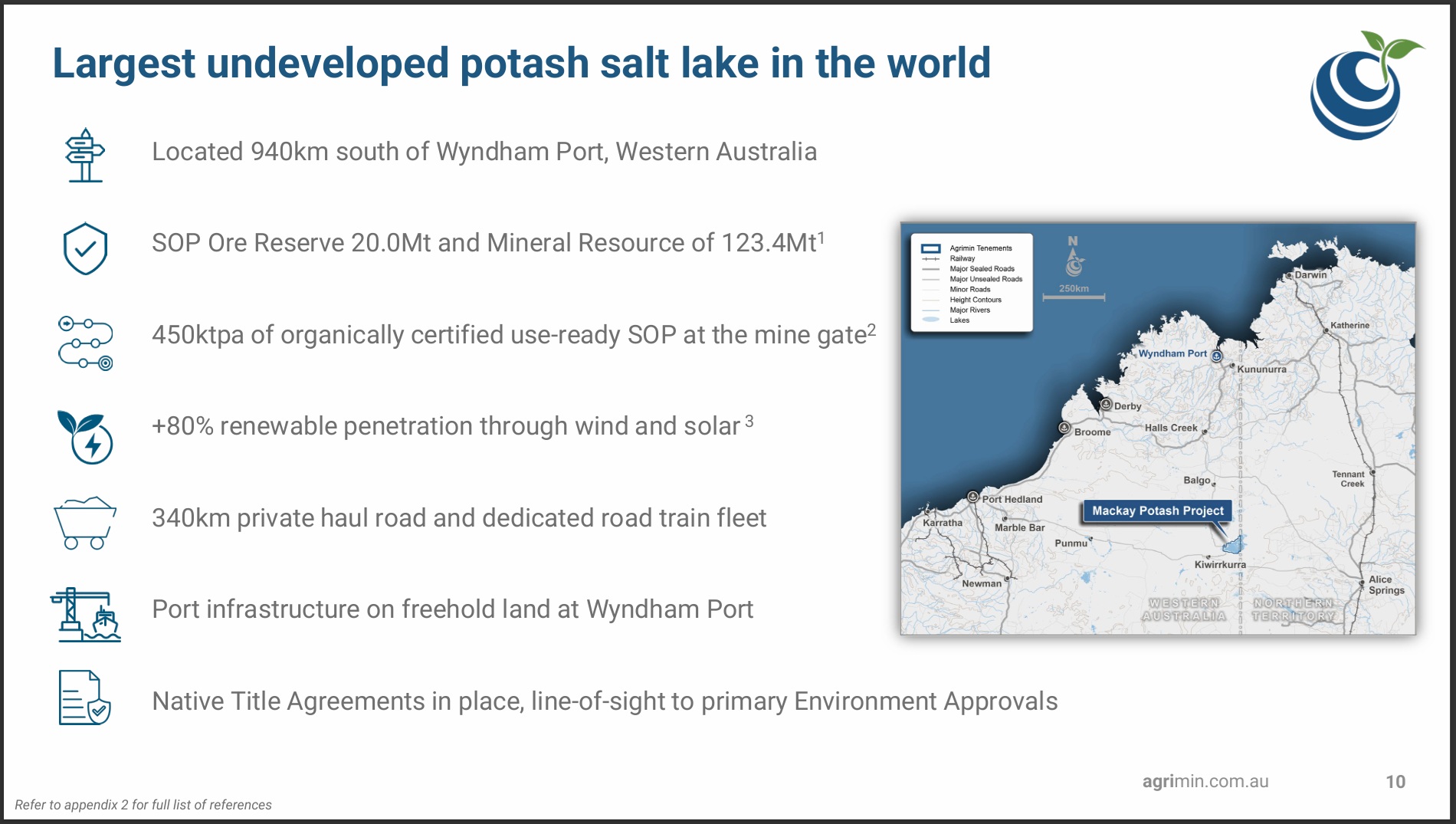

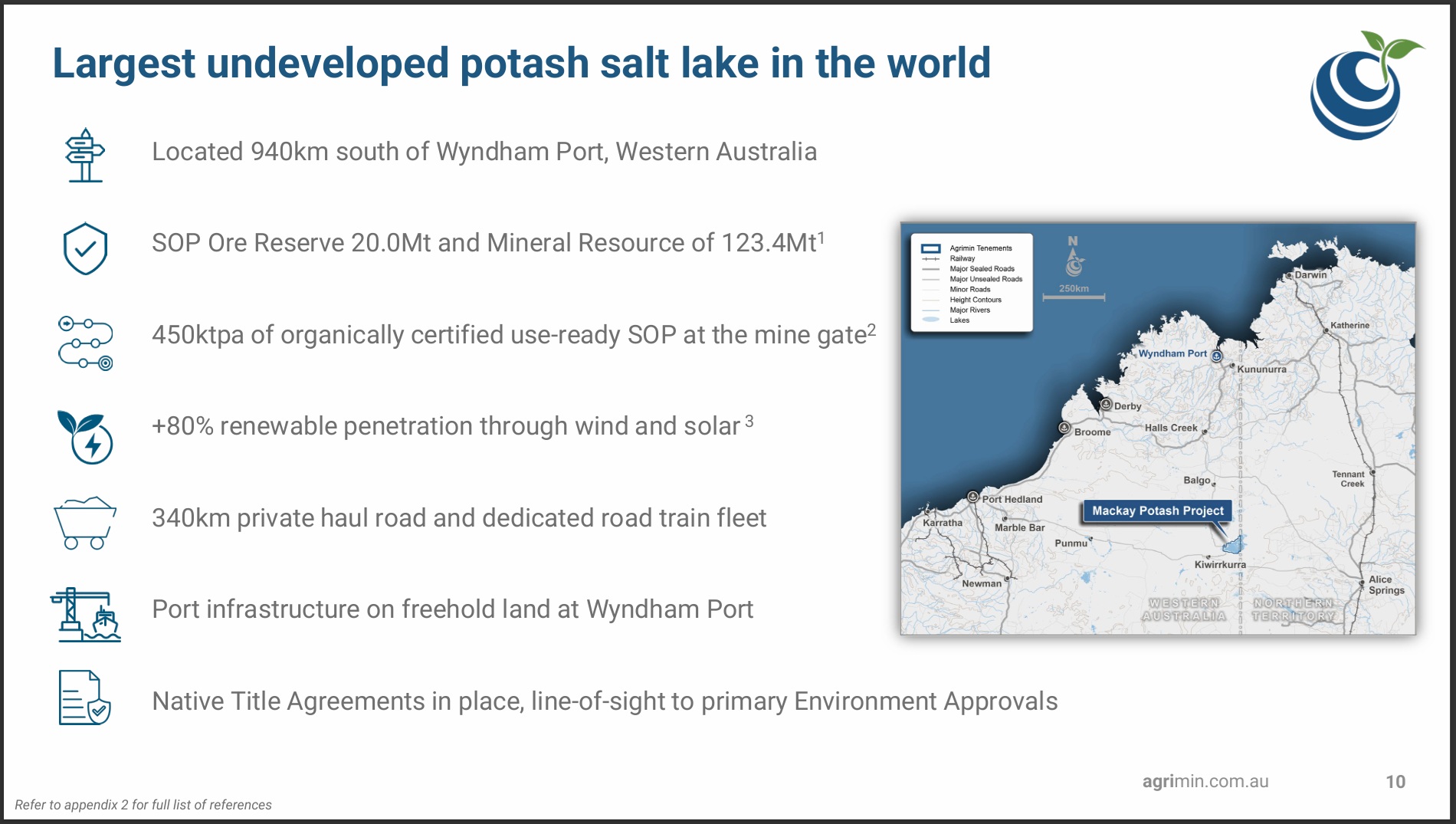

AMN's potash project is far less impressive (see below) than BCI's salt and potash project is - but I'm buying AMN for their ownership of and exposure to WA1 mostly:

Source: Slide 10 of AMN's 19/11/2024 "121 Mining Investment Dubai" Presentation.PDF

Here's a more recent presso from AMN: 29/05/2025 Investor Presentation May 2025.PDF

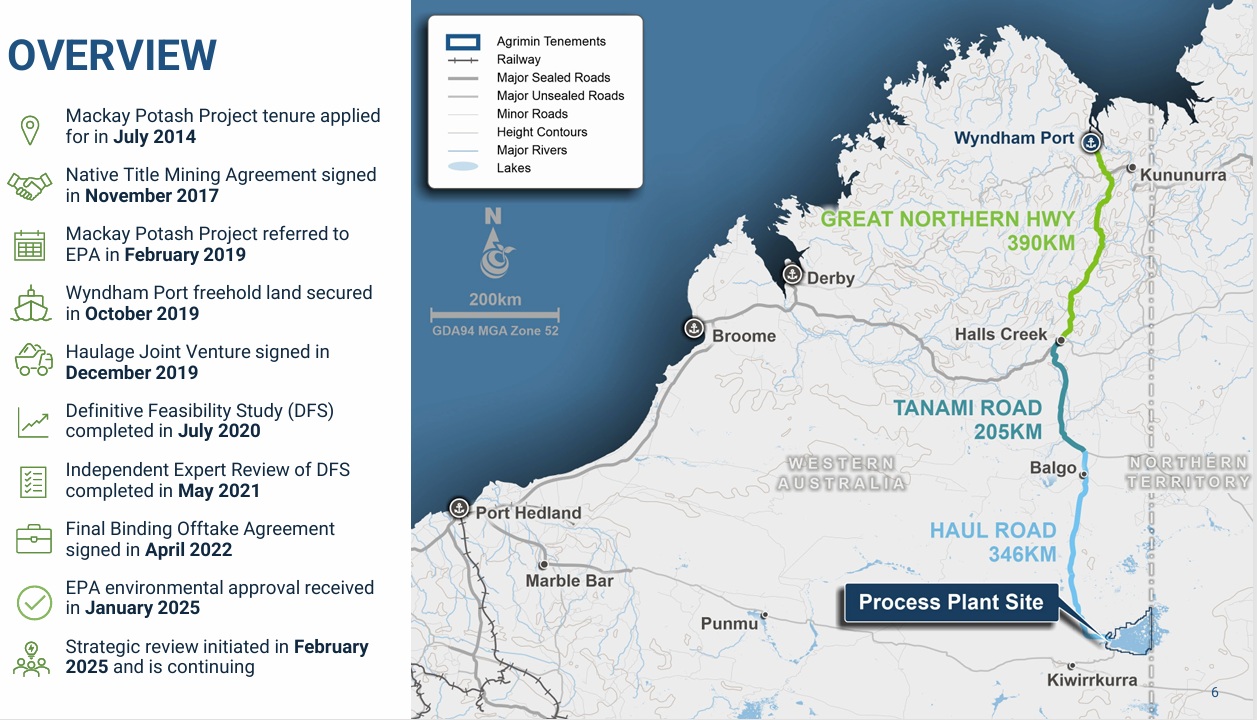

And it has a more up to date slide:

However, note the dreaded words in the bottom left corner: "Strategic review initiated".

Not usually a great sign when they call for a strategic review. It's often because the project economics no longer stack up, and that is certainly the case here with Agrimin and their Mackay project.

Agrimin sent out their annual report last month and they had this to say in their "Chair's Letter to Shareholders" (from pages 3 & 4 of their 2025 Anuual Report):

Strategic review

However, what cannot be ignored is that broader capital markets are simply not supportive of further development of Australian-domiciled SOP projects at this time. This is undoubtedly a function of the limited success experienced in recent years by select early movers in the Australian SOP [potash] space.

Against this backdrop, in February 2025 we commenced a strategic review of Mackay. This review is designed to evaluate all available options for Mackay and is being undertaken in a highly disciplined fashion, led by Agrimin Executive Director, Michael Hartley.

The review process is now at an advanced stage and expected to conclude in the next month or so, with reporting of key outcomes at that time.

Corporate streamlining

As part of this review process, we also scaled back site activities and implemented cost reduction initiatives across both operational and corporate levels. These decisions were not made lightly but were necessary to ensure the sustainability of our business and to protect shareholder value.

In support of these changes, Deb Morrow stepped down from her role as CEO and Managing Director in February 2025. I would like to thank Deb for her dedication to this role, including the instrumental role she played in securing the recent State environmental approval.

Value unlock activities

In parallel, we have been busy fostering initiatives aimed at growing and unlocking long-term value within our broader portfolio. Tali Resources Pty Ltd, in which Agrimin held a 40% interest, undertook a corporate restructure during the first half of calendar 2025.

This restructure separated its West Arunta mineral exploration licences and its shareholding in WA1 Resources Ltd (ASX: WA1) into two separate companies – Niobium Holdings Pty Ltd and Tali Resources Ltd, respectively.

Agrimin continues to hold 40% of Niobium Holdings Pty Ltd, which owns approximately 12% of WA1, owner of the world-class Luni Niobium Project in the West Arunta.

Tali Resources Ltd (ASX:TR2) subsequently undertook an Initial Public Offering (IPO) to raise A$7.5 million and commenced trading on the Australian Securities Exchange in July 2025. Following its IPO, Agrimin holds approximately 27% of TR2.

We are delighted that TR2 is being led by Agrimin’s former Chief Financial Officer, Rhys Bradley. I would like to take this opportunity to thank Rhys for his many years of outstanding service to Agrimin and we naturally wish him every success in building the TR2 exploration business.

Agrimin also undertook a A$2.5 million equity raising in May 2025, with the funds raised being applied to progression of the strategic review of Mackay and assessment of other exploration and project generation opportunities.

In combination with the corporate streamlining and cost reduction initiatives, these activities have left our business leaner and more efficient, our balance sheet bolstered, and our broader portfolio in a considerably stronger position to lever additional long-term value growth.

--- end of excerpt ---

Not much to get excited about with Agrimin except that they own $73.5 million worth of WA1 Resources (WA1) and Agrimin (AMN) has a current market cap of less than $37 million so their WA1 position (40% of Niobium Holdings which owns 11.85% of WA1) is worth TWICE Agrimin's market cap. The risk of course is that WA1's share price halves, which could happen. It's possible. But that still wouldn't be attributing ANY value to any other assets that AMN own, including their 27% of TR2 (Tali Resources). It's an interesting one.

I'll save this as a private straw as it's 2:27am right now, and I'll proof read it again in the morning and then post it (turn the privacy setting back off).

Yeah, Wednesday now (15th October) - all good - made some minor changes. I'll post the straw now.

Disclosure: I'm now holding BCI, AMN and TR2. I am not holding WA1 and I have sold my ENR - who owned land tenements in the same remote area of WA (next to the NT border) as WA1 and TR2 - some of their tenements are actually in the Northern Territory as well.