I am in the process of writing up my notes from last week's Acadia Pharmaceuticals ($ACAD) earnings call, however, one of the most important insights in the call was a reference by CEO Catherine Owen to a question from Jack Allen (Robert W Bird & Co. Incorporated) about reimbursement in Canada.

TLDR: The Canadian Drug Expert Committee of the CDA in August 2025 filed its decision: "Do Not Reimburse" for trofinetide (DAYBUE)"

I've decided to elevate this to a stand-alone straw for two reasons. First, it is bad news, and in my opinion it could have a significant bearing on the pending EU/UK approval outcome (even though these are completely independent of each other).

Second, I am concerned that it demonstrates a lack of candour by both Acadia and Neuren management, given that I have conducted an extensive search and can find no proactive references to it in investor communications. (And of course, if it is proven I have missed something, then I withdraw this comment unreservedly. This is also why I am flagging the point, in case other eagle-eyed $NEU investors have picked up something I've missed.)

On the call, analyst Allen asked: "I wanted to ask about reimbursement in Europe. I know there were [... inaudible,.. line cut out] ... in Canada over the summer...."

CEO Catherine Owen replied; "Thanks, Jack. So yes, we are obviously in the middle of discussions and thinking right now around reimbursement in Europe. And you're right, we did have a disappointing decision in Canada. Tom, do you want to share a little bit more about how we're thinking about reimbursement in terms of the sequential approach to that in Europe?"

Tom Garner (VP Commercial) continued ... absolutely no reference to Canada!

Both companies have proactively disclosed and continue to communicate that DAYBUE is approved for use in Canada. And that is true. But after approval (based principally on efficacy and safety), a drug has to gain a reimbursement decision. For countries with a mixed public and private healthcare system, the reimbursement outcome by the responsible public agency, has a significant bearing on prices that will be covered by entities like health insurance payers. So the public reimbursement milestone is critical for determining the revenues that can ultimately be achieved in a market.

And yet, the only reference to the Canadian issue either verbally or in writing that I can find are the following words by Catherine Owen "we did have a disappointing decision in Canada". (Again, other $NEU shareholders, please tell me what I've missed.)

So, I've structured this straw as follows:

1. The Canadian CDA-CDEC Decision

2. How Reimbursement Works in Canada

3. Why I think there is a potential, broad "Read Across" to other Jurisdictions

4. Implications for Valuation

5. Investment Decision

----------------------

1. The CDA-CDEC Decision

I attach the link to the full CDA-CDEC decisions. These are published for transparency in the Canadian Journal Of Health Technologies. It makes for interesting reading.

CDEC Decision

My BA has summarised the document for you as follows:

Summary of Decision

Agency: Canada’s Drug Agency (CDA-AMC)

Committee: Canadian Drug Expert Committee (CDEC)

Date: August 2025

Decision: DDO NOT REIMBURSE trofinetide (DAYBUE) for the treatment of Rett syndrome in adults and children ≥ 2 years of age and ≥ 9 kg.

Key Reasons for the “Do Not Reimburse” Decision

a. Uncertain Clinical Meaningfulness

- The pivotal LAVENDER trial (N = 187) showed statistically significant improvements in caregiver-reported behaviour (RSBQ –3.1 points, 95% CI –5.7 to –0.6) and clinician-rated global improvement (CGI-I –0.3 points, 95% CI –0.5 to –0.1).

- However, no minimal important differences (MIDs) were established, so the committee could not determine if these changes were clinically meaningful

- The trial had high discontinuation (≈25%), missing data, and relied on outcomes not used in Canadian clinical practice.

b. Lack of Evidence on Quality of Life and Function

- The trial provided no measure of health-related quality of life (HRQoL) for patients or caregivers, and data on communication, motor skills, and caregiver burden were limited and unvalidated.

- CDEC therefore could not determine if trofinetide addresses the unmet needs identified by patients and caregivers.

c. Very Low Certainty of Evidence

- The committee rated the overall certainty of evidence as “very low” due to bias, imprecision, and indirectness between the trial population and the broader Health Canada indication.

- Open-label extension (LILAC/LILAC-2) and supportive studies (DAFFODIL, LOTUS) did not resolve these uncertainties.

d. High Cost

- Annual treatment cost estimated at CA $427,000 – $1.34 million per patient, depending on weight

e. Adverse Effects

- Diarrhea (81%) and vomiting (27%) were common, leading to 17% discontinuations in the treatment arm vs 2% with placebo.

- While manageable, these events raised concerns about unblinding and trial validity.

f. Reconsideration and Patient Input

- Sponsor Request: Acadia requested reconsideration, arguing the RSBQ endpoint was valid and that CDEC had undervalued caregiver-reported benefits.

- Patient & Clinician Feedback: Groups emphasized the severe unmet need and the importance of even small improvements in communication and daily function.

- CDEC Outcome: Acknowledged these perspectives but upheld the original decision, concluding the evidence was too uncertain to demonstrate meaningful benefit or long-term safety

2. How Reimbursement Works in Canada

Now it is important to recognise that the report is a recommendation, and not a binding decision. However, for all practical purposes, I consider reimbursement unlikely, unless $ACAD can submit further evidence that addresses the grounds for denial. Clearly, the company will be working on this, and has in fact already had one shot at it.

Let me explain why I feel this is the case, by explaining how the system works in Canada.

The CDA-AMC conducts independent clinical and economic evaluations of new drugs and medical technologies on behalf of Canada’s publicly funded health systems (federal, provincial, and territorial, except Quebec). It does not set drug prices or directly fund products, but rather provides evidence-based recommendations to help governments decide whether to include drugs on their public formularies (lists of reimbursible medicines).

The Canadian Drug Expert Committee (CDEC) is an independent panel within CDA-AMC composed of physicians, pharmacists, health economists, and patient representatives. It reviews clinical trial data, real-world evidence, cost-effectiveness analyses, and patient submissions. The committee then issues a non-binding recommendation to federal, provincial, and territorial drug plans.

Provincial/Territorial Decision-Making: Each province/territory makes its own final reimbursement decision, typically following the CDEC recommendation. In practice, a “Do Not Reimburse” recommendation from CDA-AMC almost always results in non-listing (no public coverage) across the provincial drug plans.

Private insurers may make separate decisions but usually reference the same HTA findings.

Reconsideration and Transparency: Manufacturers can request reconsideration (as Acadia did for DAYBUE). The CDA-AMC publishes both the original recommendation and any reconsideration outcome on its website and in the Canadian Journal of Health Technologies for public transparency.

3. Why I think there is a potential broad "Read Across" to other Approvals

My reading of this situation starts to answer a question I always had on my "issues" list. DAYBUE is by any measure an expensive drug, and it was a question for me how jurisdictions would deal with it in places where cost-benefit analysis has a stronger bearing on the reimbursement decision. While the US is increasingly alert to healthcare economics, there is no question that it is more permissive of reimbursing high cost drugs where the cost-benefit is open to challenge.

It seems the Canadians have issues with both the strength of the effiicacy data, the side effects, tolerability and low persistance of the drug (all indications impacting Quality of Life) and the high cost.

The EU process will follow a similar path to Canada. The EMA-CHMP will make its decision on scientific grounds, whereupon each countries HTA (Health Technology Assessment) process will kick in, leading to the reimbursement decions. In the EU/UK, public medicine is a much larger share of the drug budget than North America, so the single-buyer country agencies will have a lot of clout in the pricing decision. And European countries have even greater pressures on public health budgets, given weak economies, unfavourable demographics, and a greater taxpayer contribution to the healthcare spend.

All European HTAs consider cost-effectiveness, clinical value, budget impact, and comparative benefit (albeit there is no other treatment for Rett). And so I believe the Canadian decision is a potential canary in the coalmine for Europe. Even though the European process is completely independent, I imagine all the European decision-makers will read the Canadian document. In Europe, there is also greater political pressure than in the US for challenging high cost drugs, and even more so when there are clear question marks on quality of life benefits.

In the best case scenario, I anticipate this will result in European prices heavily discounted to the US price. By heavily discounted, I mean 40%, 50% and even up to 70% or more!

4. Implications for the Valuation of Neuren

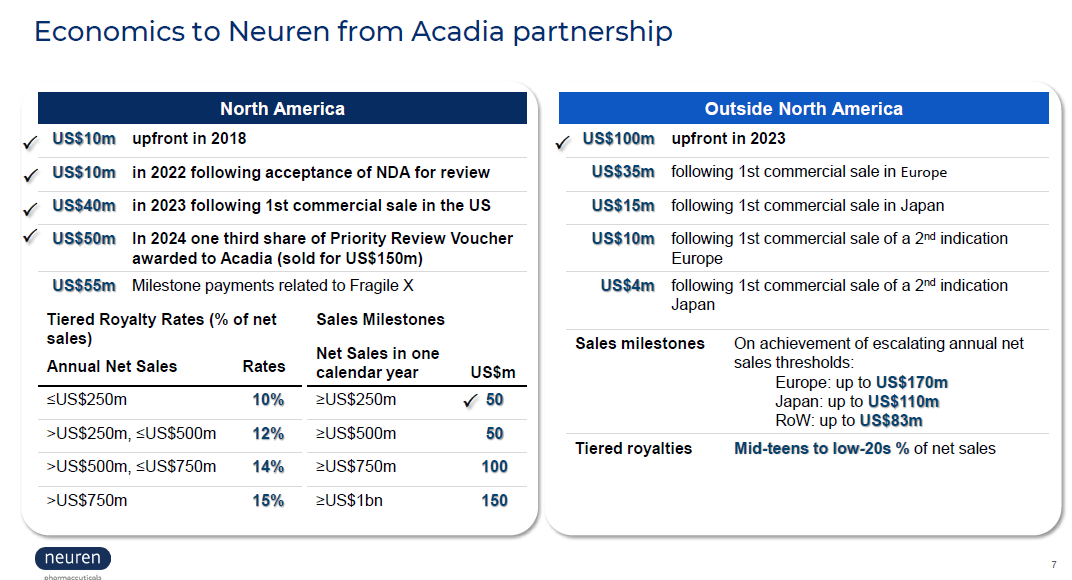

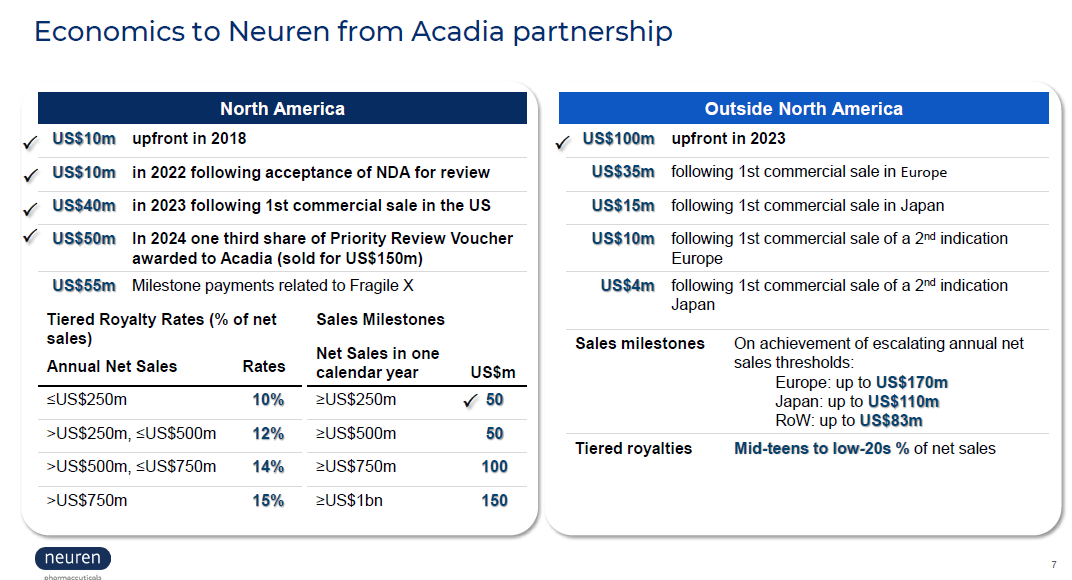

The Canadian "canary in the coalmine" puts a questionmark over the remaining value in the right-hand slide above. While RoW paitents may be given access to the drug on special grounds ("early access programs"), these are unlikely to trigger the "commercial sale" milestone payments. Privately-funded patients might also find ways to get access to the drugs.

The Canadian decision also indicates to me that negotiations towards an acceptable reimbursement decision could be protracted. $ACAD needs to hold out for a good enough price that make sense, given that it is on the hook for the initial milestone payments irrespective of the value of the commercial sales. So, in Europe, it will have to see revenues that cover: US$35m royalty + "mid teens to low-20's" tiered royalties + distributors margin (or fixed cost of sales force, if direct).

So with potentially a much lower price, a relatively high fixed royalty, and a lower Gross-To-Net, $ACAD will need to see material revenues, before agreeing to launch.

The reimbursement negotiation is therefore likely to be protracted. $ACAD will marshall all the real world data that they can from the US, as well as the continuing open lable trial data on long term persistency (now down to 45% at 18 months, down from 50% at 12 months) potentially pushing RoW cash flows further into the future.

5. Investment Decision

I haven't crunched this all in my model. However, on a risked view, I am materially marking down my Outside North America DAYBUE revenues (start, ramp, peak), and therefore also the royalties to $NEU (note: the percentage tiered royaties here are significantly higher than the US.)

By eyeballing my current model my "2 for the price of 1 thesis" is blown for $NEU at $18.

In round numbers, my valuation of DAYBUE ($12-$20), has clearly fallen to the lower end, with a significantly lower downside case if DAYBUE cannot achieve significant commercial traction outside the US.

Which means that much more of the current share price rests on the development of NNZ-2591. I had given NNZ-2591 $8 of value at a 50% risking (from $16). Perhaps that is harsh, but until I have a better view, then that is my number.

Which means that at a SP of $18, I need to see $10 of value in DAYBUE, and I don't see that with confidence, as I will make clear in my next write-up on the $ACAD results.

For me, the bottom line here is that more of the value in this business lies in drug development risk, rather than commercial execution. Looking across my entire portfolio, I am carrying quite a bit of this risk, and I am not confident that I have a good grip on the outlook for $NEU. I'd therefore like to take 2-3 quarters to evaluate DAYBUE's progress from the sidelines. And that's because I think there is a reasonable chance that we will soon have visibility of US DAYBUE plateau sales below US$500m (downside) and not much more (upside). I'll sketch this out in more detail in my next note.

Accordingly, I have sold my shares in $NEU.

Disc: Not held