Following on from valuation update with notes from Q1 report.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-03017037-3A680314&v=undefined

Cashflow positive milestone achieved.

The Good:

- Positive operating cashflow of $0.2m and positive EBITDA of $0.1m for the quarter. Mark and the team have been clawing toward this goal for the last two years. It has taken longer than was originally forecast but Novatti has been through significant restructures and narrowing of strategy and it looks to be finally paying off. In the results webinar, Mark did indicate that in turnarounds there is a period of time where cashflows will bump around the break even level, so results like this could be expected before cashflows start trending higher. With the positive cashflow and the sale of Emersion, the cash position has improved to $3.6m.

- Operating expenses have held steady, but it will be good to see next quarter where they sit without the impact of business transactions.

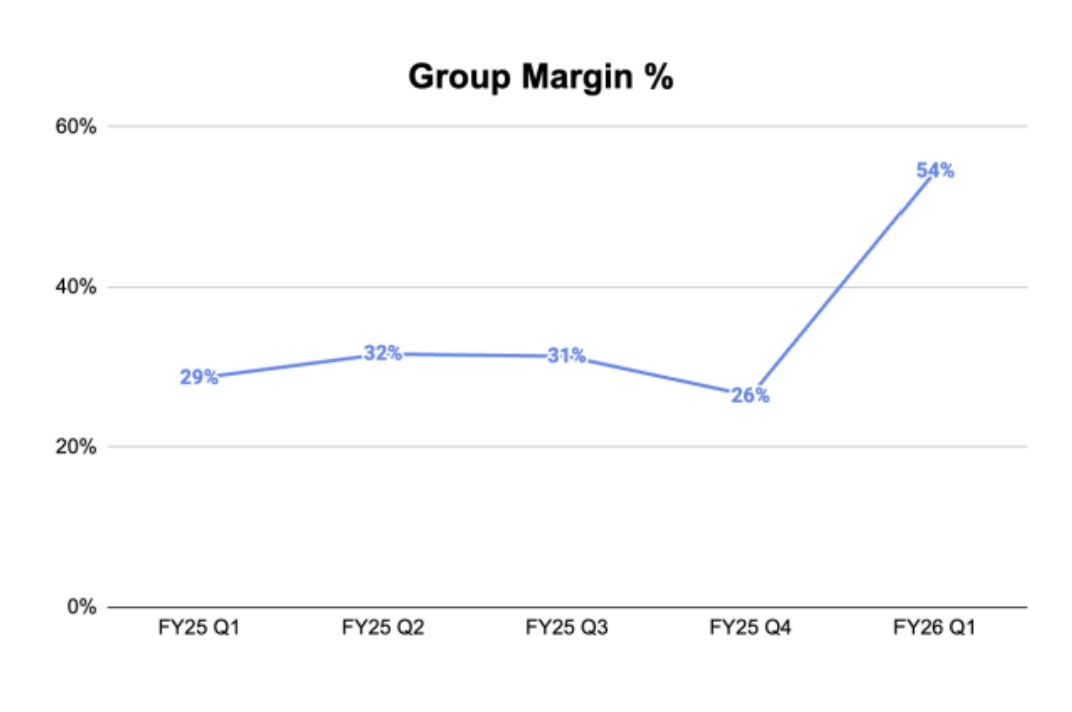

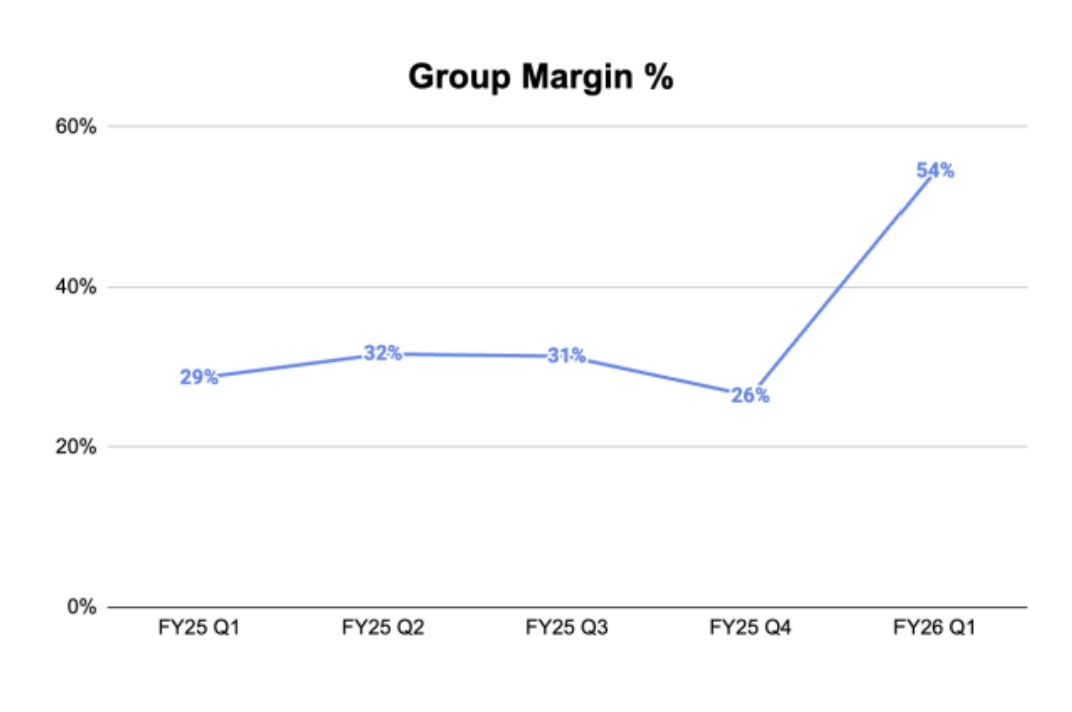

- Step change in group gross margins up to 54% from 26%. The top line has taken a hit to deliver this, but a significant step toward the target of 70%.

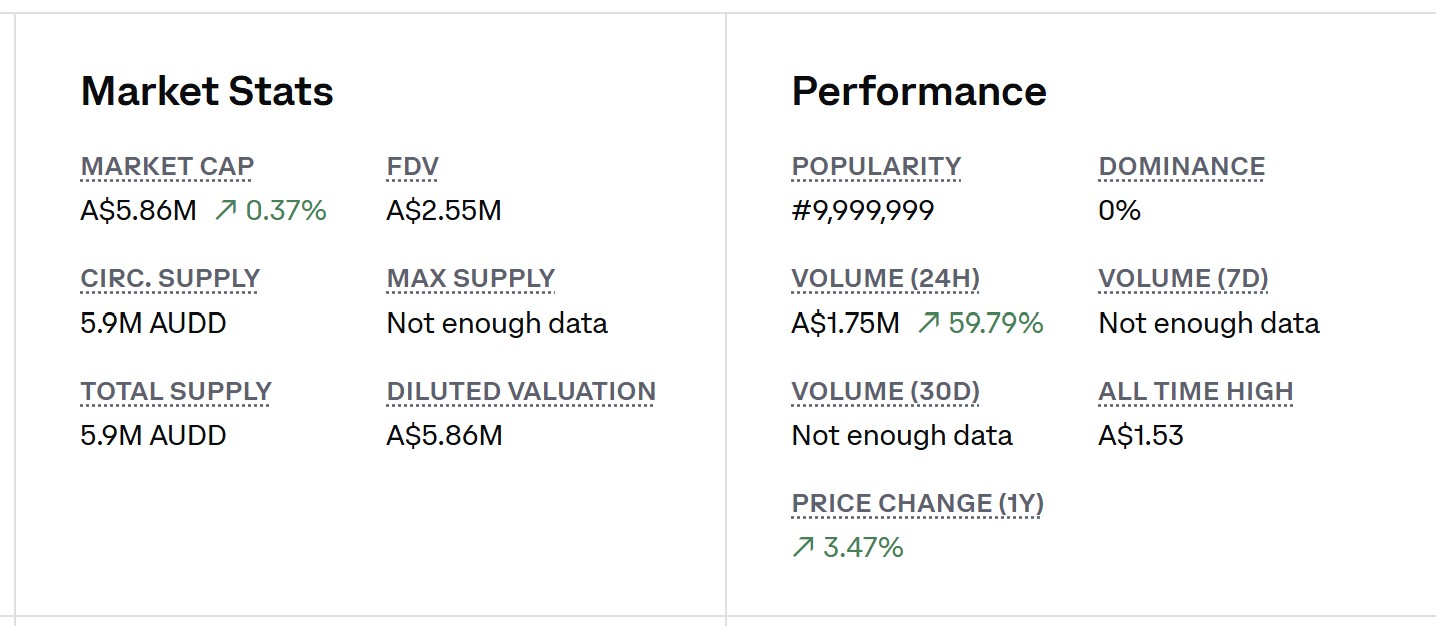

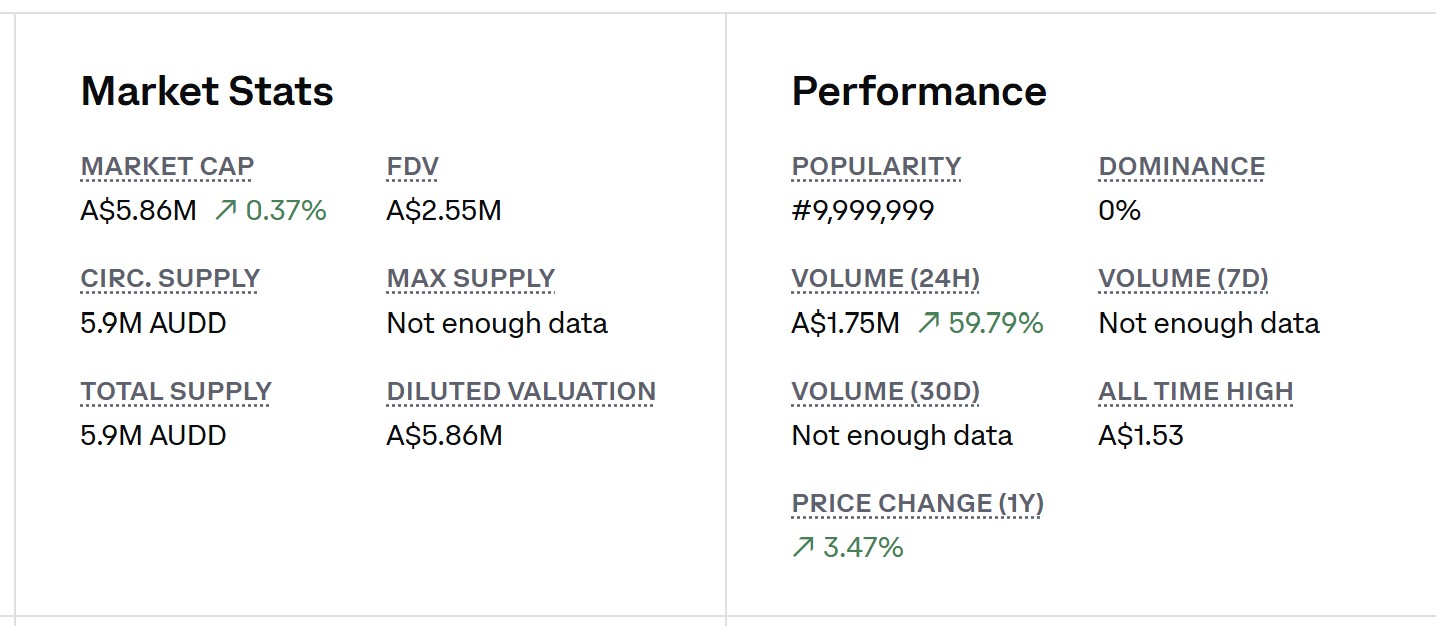

- AUDD up to $5.9m in circulating supply. This is only a small amount, but continues to trend higher and the recent partnership with Coinbase should assist in ongoing growth.

The Not So Good:

- After foreshadowing for some time and making the necessary changes in the business to improve revenue mix and gross margins, the actual revenue for the quarter was not reported. It was indicated that the service was a reduction in around $6m of quarterly revenue which would put revenue at about $8m. This is about a 40% drop. The removal of Emersion was only completed in September so the revenue figure will continue to move around until all business sales have been completed.

Watch Status:

Positive Improvement

Valuation:

$0.05

What To Watch:

- Reiterated 70% gross margin targets for the AU/NZ business for FY27. ✅ Gross Margin improvement to 54% - Q1. Monitor for ongoing for improvements toward 60% in FY26

- Review of all business units and subsidiaries ongoing. ✅ Emersion Systems sale complete. Other asset sales talks continue.

- Organic revenue growth. Overall revenue will continue to fluctuate if parts of the business continue to be offloaded. Target annual growth of 15%. ✅ 7% for Q1

- Onboarding rate of remaining pipeline going forward. ❌ Onboarding delayed until systems updated. Reported as completed. Continue to watch and monitor reported onboarding.

- Sales team spent “considerable” time in Q3 on several larger scale opportunities. Watch for updates in next 6 months. ✅ Tier 1 Telco and Global Airline - Continue to monitor.

- Next area of business in focus - Acquiring which is still operating with a negative EBITDA margin

- AUDD Market Cap - Increase contribute to growth in AUDD holding - $5.9m

@Strawman I know Novatti has a long way to go before they are a solid business and have torched quite a bit of capital in evolution, but its been a while since they were in the hotseat. Since stepping in as CEO Mark Healy has streamlined the business significantly with the sales of IBoA and Emersion and after 2 years it looks like he may have some traction in the turnaround of the business. In company presentations Mark is very direct and sticks very much to his key talking points. It would be good to get some more freeform questions and some more details on his history with turnarounds. Thoughts on a potential interview?