Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Following on from valuation update with notes from Q1 report.

Cashflow positive milestone achieved.

The Good:

- Positive operating cashflow of $0.2m and positive EBITDA of $0.1m for the quarter. Mark and the team have been clawing toward this goal for the last two years. It has taken longer than was originally forecast but Novatti has been through significant restructures and narrowing of strategy and it looks to be finally paying off. In the results webinar, Mark did indicate that in turnarounds there is a period of time where cashflows will bump around the break even level, so results like this could be expected before cashflows start trending higher. With the positive cashflow and the sale of Emersion, the cash position has improved to $3.6m.

- Operating expenses have held steady, but it will be good to see next quarter where they sit without the impact of business transactions.

- Step change in group gross margins up to 54% from 26%. The top line has taken a hit to deliver this, but a significant step toward the target of 70%.

- AUDD up to $5.9m in circulating supply. This is only a small amount, but continues to trend higher and the recent partnership with Coinbase should assist in ongoing growth.

The Not So Good:

- After foreshadowing for some time and making the necessary changes in the business to improve revenue mix and gross margins, the actual revenue for the quarter was not reported. It was indicated that the service was a reduction in around $6m of quarterly revenue which would put revenue at about $8m. This is about a 40% drop. The removal of Emersion was only completed in September so the revenue figure will continue to move around until all business sales have been completed.

Watch Status:

Positive Improvement

Valuation:

$0.05

What To Watch:

- Reiterated 70% gross margin targets for the AU/NZ business for FY27. ✅ Gross Margin improvement to 54% - Q1. Monitor for ongoing for improvements toward 60% in FY26

- Review of all business units and subsidiaries ongoing. ✅ Emersion Systems sale complete. Other asset sales talks continue.

- Organic revenue growth. Overall revenue will continue to fluctuate if parts of the business continue to be offloaded. Target annual growth of 15%. ✅ 7% for Q1

- Onboarding rate of remaining pipeline going forward. ❌ Onboarding delayed until systems updated. Reported as completed. Continue to watch and monitor reported onboarding.

- Sales team spent “considerable” time in Q3 on several larger scale opportunities. Watch for updates in next 6 months. ✅ Tier 1 Telco and Global Airline - Continue to monitor.

- Next area of business in focus - Acquiring which is still operating with a negative EBITDA margin

- AUDD Market Cap - Increase contribute to growth in AUDD holding - $5.9m

@Strawman I know Novatti has a long way to go before they are a solid business and have torched quite a bit of capital in evolution, but its been a while since they were in the hotseat. Since stepping in as CEO Mark Healy has streamlined the business significantly with the sales of IBoA and Emersion and after 2 years it looks like he may have some traction in the turnaround of the business. In company presentations Mark is very direct and sticks very much to his key talking points. It would be good to get some more freeform questions and some more details on his history with turnarounds. Thoughts on a potential interview?

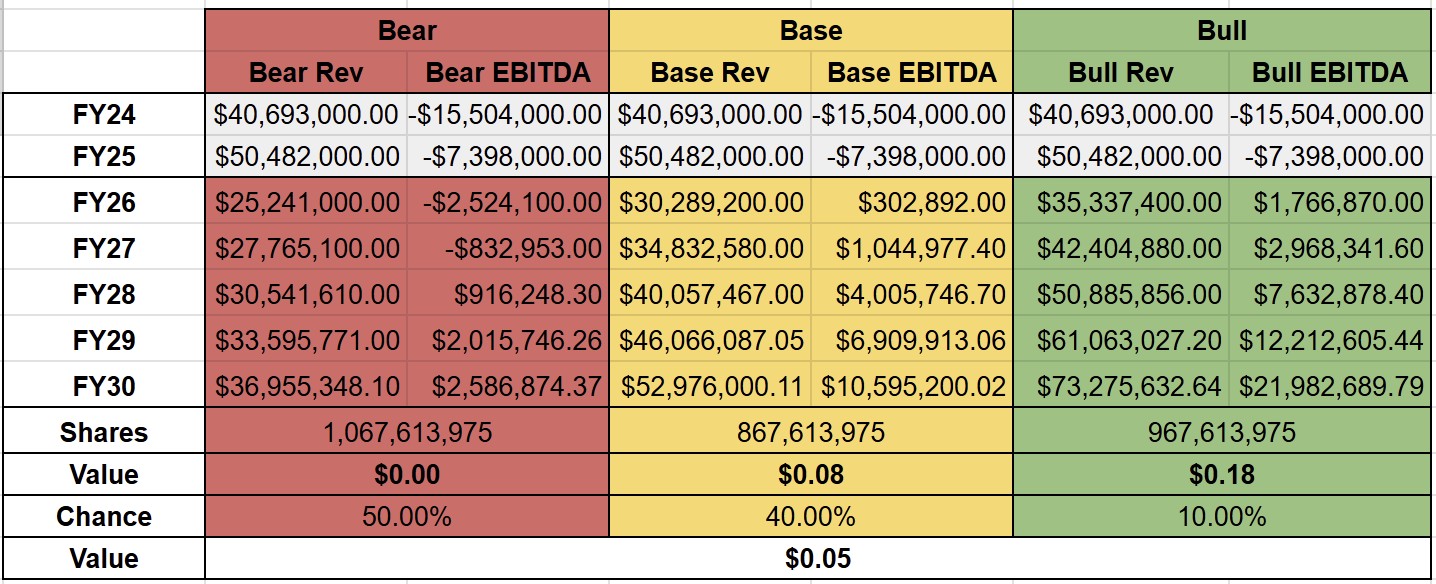

Updated Valuation Nov 2025

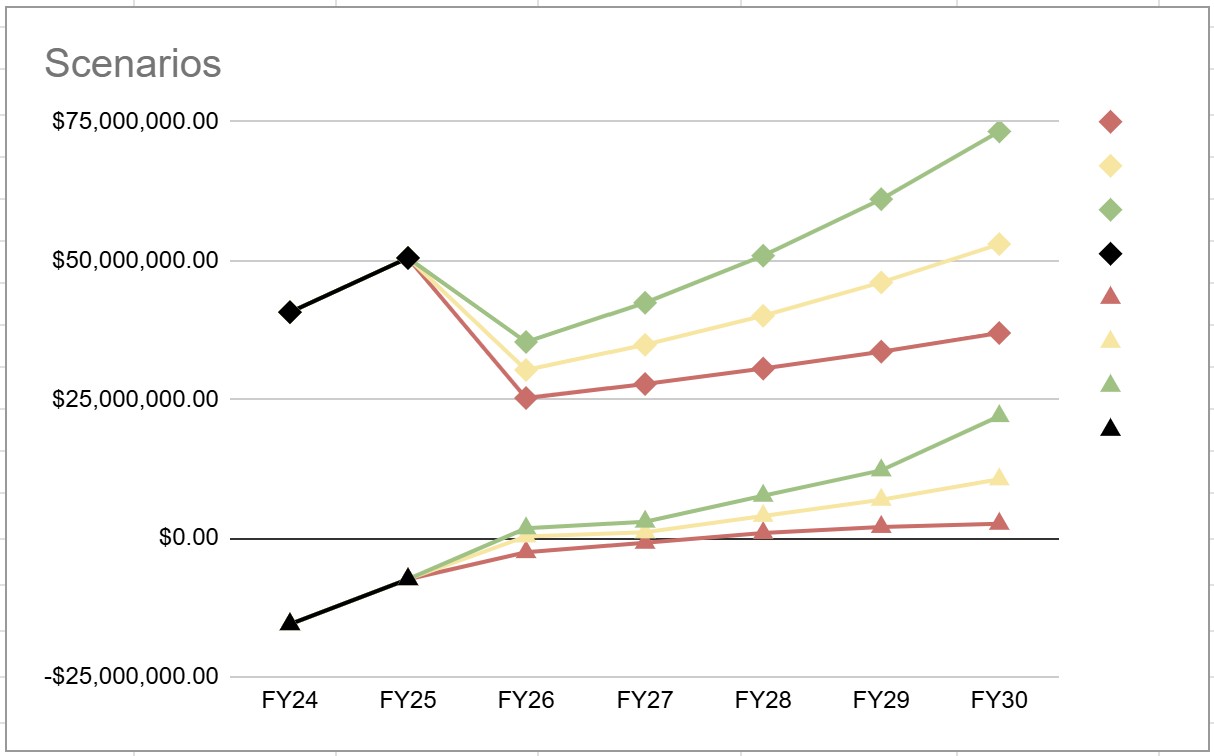

Scenarios - Will tighten up range at half year report

Bear

Indicative min performance for $0 value - Sets min bar

10% Annual Growth, 8% EBITDA Margin FY30, $0 AUDD Value

Base

Rough target based on Q1 report. Long term gross margin ~55%

15% Annual Growth, 20% EBITDA Margin FY30, AUDD Value 50% last sale

Bull

Turn around successful. Long term gross margin ~60%

20% Annual Growth, 30% EBITDA Margin FY30, AUDD Value 100% last sale

Novatti has fallen off my radar after it became one of those companies that have fallen so much that you just put them aside. So how are things looking back at the Q3 update.

The Good:

- Quarterly revenue has continued to increase and is now at $13.4m. 18% growth YoY isn’t shooting the lights out but it is continuing in the right direction which Novatti need.

- The heavily adjusted and often shifted positive operating cashflow or should I now say (positive cash EBITDA?) was achieved in Q3. While it still needs time for these remaining costs from IBoA to shake out, Novatti may actually be starting to show signs of a viable business underneath.

- Branding has been updated. The look is cleaner than it was before, but not sure of the impact it will have.

https://www.novatti.com/blog/novattis-brand-refresh

- AUDC continues to develop and maintain involvement in several government trials. While it is self funded this is ok, but it feels like a bit of a distraction at this point unless there are some viable payment rails there for Novatti.

- RentPay one of Novatti’s older partnerships continues to grow. Which is a good demonstration of the types of customers that Novatti can work with. They also still retain a 10% stake in the RentPay subsidiary

https://www.novatti.com/blog/rentpay-platform-reshaping-how-australians-pay-rent

The Not So Good:

- Even with all the positive spin on we are doing what we said we would, Novatti still burnt $2.2m for the quarter. No indication provided on when all the legacy costs will be removed.

- Onboarding of the customer pipeline (500+ merchants) moving towards 50%compared to nearly 40% in Q2. This was originally announced to be completed by H1FY25 (6 months). New target date hasn’t been updated, which at a rate of 50 / month it will be another 18 months

Watch Status:

Slight improvement as operating cash burn decreases

Valuation:

To be updated after Full Year results. Current market cap of $11.5m with $4m in cash means the market doesn’t have much faith in Mark fully righting the ship. Novatti is still shopping around some of their assets, which at the moment, means the sum of the parts is likely greater than the whole.

What To Watch:

- Reiterated 70% gross margin targets for the AU/NZ business for FY27.

- Review of all business units and subsidiaries ongoing. Current active discussions interested parties for 4 different assets. This is the direction that Mark has indicated that will be used to provide ongoing capital to continue to fund the turn around.

- Onboarding rate of remaining pipeline going forward. There are talks of a refocus on growth so this would be expected to increase in future quarters.

- Sales team spent “considerable” time in Q3 on several larger scale opportunities. Watch for updates in next 6 months.

- Further updates from RentPay

There has been quite a bit of upheaval in Novatti recently which has now culminated in a capital raise announcement this morning at a solid discount to the last traded price. This has resulted in a 25% share price drop.

A dreaded strategic review of business operations was announced in the Q1 activities report as part of the simplification strategy.

First has been the sale of the 19.9% holding in Reckon at a large discount to the market price. ($0.40 vs the trading price of ~$0.60 at the time) Granted there have been an accumulation of dividend payments during the holding, which has meant that they have been able to come out fairly even, but this move felt rushed. The funds from the sale have been used to close out the Bond facility, with the idea of reducing future interest commitments.

Then in December it was announced that there was a sale of 9% of the AUDD holding company valuing it at $2.7m. There has been a recent surge in the amount of AUDD minted on the stellar network with the supply jumping from $44k to $2.5m since mid November.

In the same announcement it was announced that a Series A raise is in the works for IBoA. Currently Novatti holds 91%. Further divestment will be required as part of the regulatory approval and banking requirements.

Which then brings us to the capital raise, which was announced today. Novatti is looking to raise $5.5m through a series of convertible notes and a SPP with an options attachment.

The convertible notes attract 10% per annum which is slightly cheaper than the rate they had on the Bonds which was 90 Day BBSW + 6.5% (currently around 10.85%) but probably also allows the interest payments to be issued through equity rather than cash, optimising future cash flow given the recent push of cash flow positive (Operational) by end of FY24.

Sentiment for the company is now in at all time lows given the ongoing under performance and cash burn. The only positives I can take out of the announcement is that additional funds are required for security collateral on payments which means that this division is continuing to grow and management are participating in the convertible notes to the tune of $750k (Pending Shareholder approval, which may not go through given the current sentiment)

The SPP offer opens on 5th of February, so there will be time for existing shareholders to review the Q2 performance before committing to allocating funds.

Very precarious times for Novatti.

Target is operating cash flow positive mid 2024

: 11:00am (AEDT) on Tuesday, 28 November 2023 In-person: William Buck - Spring & Exhibition Rooms, Level 20, 181 William Street MELBOURNE VICTORIA 3000 Virtually: Via a web-based meeting porta

Return (inc div) 1yr: -67.20% 3yr: -33.19% pa 5yr: -16.74% pa

Return (inc div) 1yr: -67.20% 3yr: -33.19% pa 5yr: -16.74% pa

This morning Novatti provided an update to the market. Is this the first sign of the potential? Increasing revenue, better margins, clearer explanations (rather than fluff) and a simplified focus!!! The report reads significantly better than previous including a feel that it’s focused on developing a profitable business. Back on my watch list. CEO Mark Healy seems to have been the right choice to lead the next phase of Novatti’s growth.

Peter Cook today announced he was stepping aside. The full announcement below…

THESIS BROKEN: When it boils down to it NOV has had its hands in too many pies all of which presently take such small clips the margins are to small to be profitable without significant volumes.

So what I thought was actually the building out of an ecosystem appears now appears to be the add on of different business ventures looking to find an area that actually could generate significant revenue and then profits.

It also looked great that they were also funding so many starts ups, but, again in hindsight it looks like they were throwing a dart at a dart board with the hope of striking something big.

WARNING MISSED: CEO continually talking things up and not delivering on time. There was always an excuse on offer or the use of distraction via highlighting new developments to shift focus from cost and profit issues. I think there was also a flag on Strawman when the CEO was interviewed and he said something related to future market cap or price which, I believe Andrew noted at that time and had me wondering where his focus was (My recollection is not exactly clear).

SUMMARY: 1. Beware of those who talk too much and say nothing. The payments area is low volume so you better make sure you are consistently seeing significant growth each quarter.

Holdings: held but will be out today.

Novatti issued a media release today announcing a partnership with Datamesh Group to integrate their POS terminal solutions with Novatti’s acquiring payment system.

A bit more on Datamesh group here:

https://www.datameshgroup.com/

This will allow Novatti to offer physical payment receipt terminals as part of their acquiring offering. There should be some minor commercial benefits to this over time as the existing customer base take on the terminals as it should increase the overall transaction value that Novatti is handling.

The bigger upside is this partnership builds off previous one’s such as the partnership with Riskified to continue to improve their product differentiation in a very competitive market.

Below is a recent analyst report on Novatti. It’s quite comprehensive and worth a read for those interested.

https://novatti.com/wp-content/uploads/2022/12/MST-Access-NOV-Update-8Dec22.pdf

Disclaimer: This report has been commissioned by by Novatti Group Limited and prepared and issued by Glen Wellham of MST Access in consideration of a fee payable by Novatti Group Limited. MST Access receives fees from the company referred to in this document, for research services and other financial services or advice we may provide to that company.

Well, the license has come through (see here) -- exactly as CEO Peter Cook told us it would when we spoke with him in August (see here).

It's always hard to differentiate between management hubris and reasonable expectation! Anyway, shares are up 70% on the news -- Could've, would've, should've...

And that's not entirely unreasonable, given how central this was to the company's strategy.

I'm of the view that payments is ripe for disruption -- the current systems are slow, expensive and cumbersome. Even the services that have a decent UX are built on top of ancient legacy systems.

And, yes, I'll even say that I think Bitcoin (the network) will likely play a dominant role. I mean, an open source protocol that offers superior security, costs, speed and trust, on which anyone can build and integrate into their own product? c'mon! (a rant for another day perhaps).

What's less certain is to what degree Novatti will 'win' in this fast evolving space. Sure, the legacy banks aren't as nimble and forward looking, but should they shift their focus that'd be formidable competition. End then you have the likes of Block, Strike etc -- big US tech with super talented people and lots of funding.

Anyway, there's probably enough opportunity for a good number of early movers to benefit from this structural shift. So am happy to maintain my small position for now.

Thanks @Strawman for lining up the interview with Peter Cook. Andrew tried to dig down into what makes Novatti different and this is what I was hoping to get from Peter. He did keep his responses fairly high level but did provide a few insights for me to look further into.

Some takeaways from the interview:

- After restricted licence approval, NOV is obligated to deploy first services within 6 months of approval, then targeting the full bank licence within 12 months. Peter noted that any revenues during the restricted phase are unlikely to be significant.

- The launch of AUDD stable coin across the stellar, ripple then ethereum networks is a key focus for the company short term, with the focus then shifting to integration into their existing platforms and payments ecosystems.

- Future acquisitions would be targeted at expanding operational and licencing footprints in the B2B space. Not interested in acquiring technology specifically. Businesses would need to be cash flow positive or close to it.

Thanks @Bradbury for suggesting Novatti -- it seems like a really interesting company.

Just a few quick notes from the meeting (recording will be up shortly).

The business has grown revenue at 76%pa, on average, over the last 5 years. Or about 50% if you only look at organic growth.

MD Peter Cook said that they were currently on a $4m+ per month run rate, so about $50m per year (compared to $32.5m for FY21).

So, taking that at face value, you have a business that is on a forward Price-to-sales of 1.4x. Further, one with $14m of cash (post Reckon dividend), and that is focused on hitting CF breakeven in the near term. Even under the current burn rate they have an 18 month runway.

While payment processing is the lion's share of revenue, you have a few new initiatives that look set to come on line in the coming year or so. The stablecoin initiative is fascinating, and I think there's a legitimate use case there -- but it's a fast evolving space and I'd consider this aspect of the business as very speculative at this early stage.

At any rate, given all of that, Novatti looks dirt cheap. PROVIDED they do indeed maintain sales momentum, pivot to CF+ and manage to scale effectively. On that last point, Peter did mention the attractive economics you see in payments companies when they do hit scale, so hopefully he's focused on seeing that realised.

And I personally have no doubt that Peter is right when he talks about the digital transformation of payments. Whether or not Novatti ends up doing well, this is space that is going to change very rapidly over the coming decade -- So i think he's right to point to massive industry tailwinds.

The harder part is understanding Novatti's chances of winning in a competitive space with lots of notable players. Peter said that it's not all about cost but increasingly functionality -- that is, their customers want to make and receive payments, but these need to integrate into existing ERP systems. And worth remembering too that half their customers are other payment providers, so it's not that all players in payments are competing with each other.

He was also at pains to point out the competitive advantage afforded by the licensing regime, as well as their various partner agreements (eg Visa, Apple Pay etc). Obtaining the banking license, which seems more like a question of when, not if, will be a good advantage.

Anyway, i'm missing a lot here, but just writing down a few thoughts while it's still fresh. I might take a small watching position on Strawman.

Reckon has announced the sale of its accounting practice management group for $100m. As 19.9% owner, Novatti will end up with ~$7m to $8m in cash post sale.

Going forward, Reckon will focus on the cloud business where Novatti has integrated its payments platform.

With the transaction expected to take around 3 months, the special dividend is well timed and will give Novatti a further 6 months of cash runway limiting how much debt they may need to take on to cover operation costs. (Based on Q3 cash flow). At this point in time based on previous updates the company should be getting close to cash flow break even.

Novatti is nominated as a finalist for two categories in the 2022 FinTech Australia Finnies.

The ceremony is on 23-06-22, so we will find out how they go then. Not sure how much stock I really place in industry awards but any recognition is good for the brand.

In 2021 they took out best Fintech Payments Provider so maybe they can go back to back in the payments field.

Peter Cook has been pounding the pavement carrying out an investor relations interview with ACB News which is a Chinese language business news site in Australia.

The slides from the presentation are here. These are pretty much the standard slides that have been attached to most market announcements / updates. What does provide a bit more information is the transcript from the interview on the ACB website here. (English version is at the bottom of the page)

Peter provides some updates around ChinaPay and other segments but also states that the business is aiming to be cash flow positive in 12 to 18 months.

Having a bit of a look at this, and assuming they reach this point at the end of FY23. At Dec 21 the company had $13m in cash available or 4.6 Qtrs at the current operating cash outflow of $2.8m (including $676k of Reckon dividends).

If they can get this down closer to the $2m mark for the upcoming Q3 update it will indicate that they should be able to nurse cash balances along until the cash flow positive target date.

But. This does not account for any investing spend and I doubt that ATX will be the last bolt on acquisition, it also does not allow for any further growth in business. What we will likely see then is a capital raise once the banking licence is finalised or the company holding off hoping for some share price appreciation before another raise. (Last raise was carried out at $0.55)

The company has had a fair amount of justified negative sentiment recently given the delays to the banking licence and ongoing cash burn, so there needs to be some decent news over the next few months to swing momentum. Peter states at the end of the interview that in 5 years he'd like to see Novatti as a multi billion dollar company. I will let that one slide for now, however if big pumpy statements like that keep popping up in the future it will be a bit of a warning sign for me.

Yesterday Novatti announced that the Novatti payments platform has been integrated into the Reckon One accounting software platform with a new invoicing app that is ready for launch.

Announcement (Side note - Reckon always seem to provide much clearer, more detailed announcements. Here)

As the platform is ready for launch, there should be a contribution to Q4 revenue from this agreement. The transaction fees are currently at a reduced rate to try to encourage uptake and the revenue will be split 50/50 with Reckon.

To get an indication of what this could look like, I have used the following scenario:

Total Customers - 114,000

Customer Online Payment Revenue - $35,000 (Based on median small business revenue in 2018 - $118,000 & 30% Online payments)

Uptake - 5%

Fee - 1% Split 50/50 (Standard acquiring fee 1.75% From Novatti website)

This results in $997,500.00 for Novatti, which is not a massive increase (~4%) to overall revenue which I was forecasting for the full year at around the $25 million mark prior to this announcement. This will be a key area to keep an eye on at the release of the Q4/H2 results to get an early indication of uptake.

What is encouraging is that there is indication of the two companies looking at further integrations across their offerings. Potential for similar revenue splits would be an attractive alternative to Reckon to replace their current providers and Novatti would also benefit from this with their 20% ownership.

Novatti have been pretty light on details with their ambitions with Reckon with vague general statements like 'continuing discussions on servicing the needs of Reckon customers'. Reckon have done more than Novatti to provide a level of comfort that there is something of substance in the works in their Investor Roadshow Presentation. It may not be something that provides any significant contributions to revenue in the near term, however it does timestamp a target window for the launch of Novatti payments within the Reckon platform.

I have held Novatti for a while in both Strawman and IRL but was not able to fully articulate what they do and the core elements of their business, so decided it was time for another dive to rectify that.

What Does Novatti Do?

Novatti is an Australian based fintech company that focuses on billing and digital payments which listed on the ASX in January 2016. Originally starting with a focus on payments and billing, Novatti has continued to grow its business to provide a wider range of digital payment technologies and describes its business activities across five verticals: Issuing, Acquiring, Processing, Billing and Banking. There is overlap between these across some of the business divisions as each of the elements are linked in the payment processing chain.

Issuing is where a customer is provided branded physical and digital prepaid Visa cards through Novatti and Vasco Pay. Novatti is working to expand its offering in this area through partnerships with other fintech platforms. Examples of these are implementing Marqeta’s prepaid card launch in Australia, providing payment cards for Afterpay in New Zealand and Visa payment cards for Cryptopay.As Novatti continues to expand licensing and approvals across more regions, it is expected this segment of the business will continue to grow through further partnerships. In FY21 the issuing business had a revenue of $935k up from $100k in FY20.

Acquiring allows businesses to accept payments online and through point-of-sale. Previously Novatti provided this service through a third party, however in early November, Novatti announced that they had been awarded principle acquiring licences from both Visa and Mastercard. The image below from the Mastercard website shows where the acquirer sits in the payment processing chain.

In FY21 the Novatti did not generate any revenue from providing acquiring services, however in the Q1FY22 update it was stated that this business is now live and generating revenue.

Where Novatti currently generates most of its revenue is from Payments and Billing services. This amounted to $15.5million in FY21, up from $10.8million in FY20.

Billing services are provided under the Basis2 and Emersion platforms which focus on utilities (Simply Energy) telcos (Telstra, FibreMax) and other service providers. Emersion launched in the US in March 2021 to expand into a larger global market.

Some of the services that are under the payments banner are the Flexewallet business, recent acquisition Malaysian based ATX, cross border payments with Ripple partnership in Philippines and Thailand and the recently launched Verv in Europe. Novatti also provides the technology and at times taking ownership positions for other payment platforms such as LITT, Lifepay (25%) and RentPay (2.5%) developed for Rent.com.au.

Novatti holds a 70% interest in Novatti B Holding Company (NBHC) which will form Novatti’s banking division. Currently NBHC is awaiting approval of its restricted banking licence from APRA, which was previously targeted for November 2021. Series A Investor funding is pending the licence approval by the end of February 2022.

In September 2020, Novatti launched Digital Payments accelerator program to foster and grow new payment technologies, e.g. working with University of Victoria on multi-crypto payment gateway patents.

Outside of its core business, in June 2021, Novatti raised funds to acquire 19.9% of ASX listed accounting software provider Reckon, to open up access for synergies between platforms and access to Reckons customer base. Beyond that , the ownership stake provides Novatti with a position in a profitable growing business that has been paying a regular dividend.

Management

The board of directors has a range of experience across the payments industry, in particular CEO Peter Cook and Paul Burton. The recent addition of Abigail Cheadle onto board of directors and chair of Audit and Risk committee brings strong experience working with companies in Asia and along with increasing diversity of the board.

Directors hold around 11% interest in the company which provides alignment with shareholders, however several of the directors along with the COO & CFO have significant options at lower than the current share price.

Opportunities / Catalysts

Outside of general tailwinds from ongoing growth in the digital payments market, there are several catalysts over the short term which have potential to add value to the Novatti business.

First is the launch of the banking business which will add to Novatti’s payments ecosystem. Novatti have been preparing for this for the last several years and should be able to hit the ground running once licences have been granted which is expected to be announced this quarter.

Second is the ongoing expansion into new regions and markets through acquisitions and partnerships. The recent ATX acquisition allows Novatti to expand their presence in South East Asia, building on their partnerships with Ripple in Thailand and the Philippines. Novatti also has a pending application for an E-Money licence in Europe, which will allow them to provide digital payment services.

The third area where there could be a boost to short term revenue is if the investment in Reckon has some outcomes that allow Novatti to incorporate into the Reckon platform. In the September quarterly update it was announced that discussion had begun, however all updates around this to date have been fairly light on specifics.

Valuation

Refer to Valuation Straw.

Risks

The digital payments market is a highly contested segment with competitors typically competing on fractions of fees of transactions. There are some barriers to entry in terms of the range of licences required to provide a full range of services, however even with this there are alot of players in the space. This includes large international competition that provide a full suite of integrated acquiring and payment technologies i.e Stripe, Paypal and have bigger budgets to compete on the technology front.

Novatti also historically has high levels of cash burn and that has continued into FY22 with a negative cash flow of $3.8 million in Q1. Novatti has been direct with their growth strategy of investing in a payments ecosystem, however unless those elements start to generate capital they drag down the profitable sections of the business. With a current cash reserve of approx $13.5m, this will be a key area to watch as another capital raise could be on the cards in CY22 if cash flows are not improved.

NOV to be added to the S&P/ASX All Tech Index from Sept 20.

NOV's Principal Activity is the provision of payment services by way of financial transaction processing, subscriber billing, card issuing, merchant acquiring services and payment network integration.

Afterpay partners with Novatti in New Zealand

Highlights

- Afterpay partners with Novatti for delivery of payment cards in New Zealand

- Leverages Novatti’s Visa partnership and recent new licences in New Zealand

Novatti Group Limited (ASX:NOV) (Novatti or Company), a leading digital banking and payments company, is pleased to announce that it has been selected by Afterpay for the delivery of its payment card program in New Zealand.

Afterpay is an Australian fintech company listed in the S&P/ASX 20 that has revolutionised the way that consumers pay for goods and services. It has grown into a leading international player in the Buy Now Pay Later (BNPL) sector, with over 14 million active customers globally.

As part of this new partnership, Novatti will leverage its licence with Visa to enable Afterpay to issue Visa card solutions. This includes enabling Afterpay’s users to access Afterpay-branded payment cards in their digital wallet for use at participating merchants across New Zealand.

The initial agreement is for three years. Novatti will receive project setup, monthly recurring and, dependant on the take up of the service, transaction-based fees.

DISC: I hold APT & NOV

Emersion launches in US ahead of strong forecast market growth

Highlights

- Subscriber billing and payments platform, Emersion, completes next step in international expansion with on time launch in US

- Full SAAS model expected to result in high-margin, recurring revenues from each new customer

- Launch comes ahead of strong forecast growth for key US market segments, including the accounts payable automation market, expected to reach US$4b by 2025

- Emersion going from strength to strength having achieved continuous revenue growth in each quarter since Novatti’s acquisition in April 2020

DISC: I hold

Novatti’s fintech underpins record-breaking hybrid social media platform LITT

Highlights

- Novatti’s fintech is underpinning LITT’s innovative hybrid social media platform by providing members access to Visa Prepaid cards

- Highlights increasing convergence between social media and fintech platforms, as payments and transactions are placed at the centre of users’ daily life

- LITT’s recent $1.5m record equity crowd source funding raise highlights strong interest in this sector

- Revenues for Novatti based on leveraging the existing digital banking and payments ecosystem while continuing to increase B2C exposure

.....

This announcement follows some of Novatti’s other recent growth-focused achievements, including:

- Supporting innovative fintech platform Lifepay to move to a full commercial launch( 4)

- Record half-year sales revenue of $7.35m, up 49% year-on-year, highlighting consistent, long term growth(5)

- New record quarterly sales revenue of $3.79m, up 52% year-on-year(6)

- Novatti’s Visa Prepaid cards now being supported by Apple Pay(7)

(4) Novatti ASX Announcement – Lifepay moves to commercial launch – 16 March 2021

(5) Novatti ASX Announcement – Half year update and Appendix 4D – 25 February 2021

(6) Novatti ASX Announcement – Another quarter of record revenue as investment in platforms delivers growth – 29 January 2021

(7) Novatti ASX Announcement – Novatti’s Visa Prepaid cards now supported by Apple Pay – 22 January 2021

Disc~small holding

Lifepay taps into Novatti’s ecosystem to launch new B2C fintech platform

Highlights

- New, innovative fintech platform, Lifepay, launched leveraging Novatti’s technology and licences

- Enables users to manage daily life transactions, personal and social finances from a mobile device

- Lifepay has agreed a Series A fundraising with a pre-money valuation of $20.5m

- Novatti’s 25% shareholding, pre Series A funding, followed a technology and services contribution, and implies a valuation of $5.125m

Disc; I have small holding

Bear Case

Looking at Novatti's financials (FY19-20 Annual Report) I'm getting a much different view than some of the ones already posted.

•Revenue has increased 31% yoy

•Net loss has more than doubled yoy

•Cash flow negative -$2.763M

•Less than 1 years cash runway suggesting another capital raise is on the near horizon

•Negative shareholders’ equity