With the "Canada issue" out of my system in Part 1, here is a summary of last week's $ACAD (Acadial Pharmaceuticals) 3Q Results call.

1. Commercial Performance and Market Dynamics

- Net sales: US $101.1 million in Q3 2025, up 11% year-over-year, marking Acadia’s largest quarterly sales for DAYBUE. This was the highest quarter for net product sales overall

- Market penetration: Approximately 40% overall in the U.S. Rett syndrome market, with 27% penetration in community settings

- Referral growth: Achieved the largest quarter-over-quarter increase in referrals since launch, driven by expansion of the field team and outreach to community prescribers.

- Community prescribers: Now account for 74% of new prescriptions, up from 64% the prior year.

- Persistency: > 50% of patients remain on therapy at 12 months, and > 45% remain on therapy at 18 months, indicating durable adherence.

- Global access: Named-patient supply programs are expanding in Europe, Israel, the Middle East, and Latin America, with 1,006 patients treated worldwide to-date

- Guidance (FY 2025): DAYBUE net sales forecast US$385 – $400 million, with gross-to-net 22.5 – 23.5%, reaffirming momentum

(From Q&A)

- Management reiterated that growth was broad-based across both academic and community prescribers, with community uptake now sustaining most new patient starts. (Note: some 75% of the addressible market is treated by community prescribers, and this segment remains relatively under-penetrated)

- They emphasized that the larger field force deployed earlier in 2025 directly contributed to improved referral rates.

- No change was announced to 2025 guidance, indicating confidence in continued double-digit growth.

2. Regulatory and Geographic Expansion

From presentation

- DAYBUE (trofinetide) is approved only in the U.S. and Canada for treatment of Rett syndrome in adults and pediatric patients ≥ 2 years

- A Phase 3 trial of trofinetide in Japan has been initiated, marking Acadia’s first pivotal trial outside North America

- The company filed a Marketing Authorisation Application (MAA) with the European Medicines Agency (EMA), with an anticipated CHMP opinion in 2026

- Named-patient supply programs already operate in multiple regions (EU, Israel, Middle East, Latin America).

(From Q&A)

- Executives stated that the EMA filing was accepted in Q3, and the CHMP opinion is expected mid-2026.

- They confirmed that Japan’s Phase 3 trial uses the same dosing and endpoints as the U.S. approval study, designed for regulatory alignment.

- Early named-patient use is providing real-world data that will support broader access discussions post-CHMP.

- "Disappointing decision in Canada" (what??! See Part 1 Straw)

3. R&D and Pipeline Integration

From presentation

- DAYBUE remains the core commercial rare-disease asset, while ACP-2591 (cyclo-GPE analogue) is a next-generation follow-up in Rett and Fragile X syndromes

- The company is building a global Rett-syndrome franchise, leveraging DAYBUE’s success to expand to additional indications and geographies.

(Q&A)

- R&D leadership highlighted that DAYBUE’s durable efficacy data continue to inform the design of ACP-2591 Phase 2 planning, with a goal of complementary rather than cannibalistic positioning in Rett syndrome.

- Management also noted interest from academic consortia in exploring DAYBUE in combination therapies, though no new trials have yet been initiated.

4. Other Q&A Comments

- CFO Mark Schneyer confirmed that DAYBUE’s gross-to-net deduction (~23%) is expected to remain stable in 2026 given payer mix and limited rebate pressure.

- Analysts asked about inventory levels; management stated they are “healthy and in line with volume growth,” with no channel stuffing anticipated year-end.

My Assessement (thinking out loud, so apologies for the stream of consciousness format)

DAYBUE sales of US$101.1m for the Q came in below the low case of my model ($102.3 - $104.3 - $106.2). My model had them hitting a FY range of $388.5 - $400.5, and so with the lower number achieved in Q3, I'm expecting they'll be towards the lower end of the narrowed guidance of $385 - $400m.

But this is really splitting hairs, and the key message is that management have confirmed my view form earlier this year that they have a good grip on how the product is performing in the market, and sales force productivity, and so will be making good resource allocation decisions.

What we don't know is how much of the revenues came from outside the US, given that the product is being made available to patients ex-US in an increasing number of markets in early access programs. It's a high-value product, so it doesn't take for many patients accessing the drug from overseas to start to move this dial.

But I am disappointed at the growth rate, because in Jan-25 the company announced a 30% sales force expansion. This was completed in May-25, and while it will have taken some months for new starters to get traction with their accounts, the period Jul-Oct has in my view enjoyed a full quarter with the expanded field force, focused on the community-based prescribers. My range was meant to capture the full ("80%") confidence I perceived at the time.

A year ago, the 3Q-on-2Q growth rate was +7.8%, so even with the +30% expanded sales force in 2025, the sequential q-o-q growth of +5.2% indicates just how much of a headwind patient churn is. That said, Persistency seems to be holding up: c. 50% at 12 months and 45% at 18 months are again reported, and it will probably not be until next year that we get to see what this is becoming out to 24 months.

So, let's have a stab at considering US Revenue Growth from here:

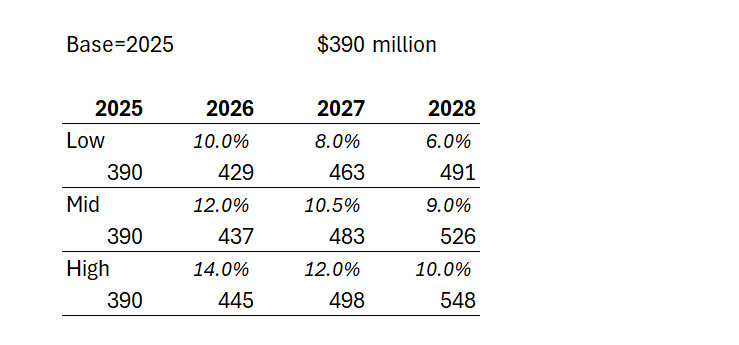

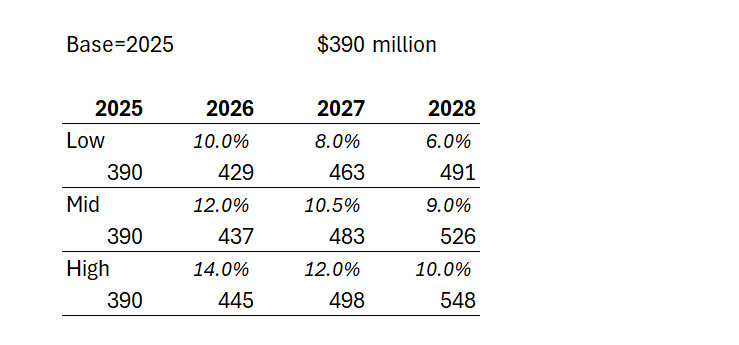

Case 1: Management say they will continue double digit annual revenue growth. So giving them the full benefit of the doubt and assuming they hit 2025 revenue of $390m, at 10% for two years, that gets them to $472m in 2027, and $520m in 2028 - likely the year of plateau sales,... or maybe they'll eek out some further growth in 2029.

Case 2: Being generous, let's assume an upside QoQ growth of 4% or 17% pa for two years. That gets them $533m in 2027, and a likely plateau sales in year 5 of $623m in 2028.

But, then again, I think Case 2 is overly generous. Afterall, the 2025-2024 PCP growth rate was only 11%, and let's trim that to 10% to allow for some overseas patients. The sales force expansion has helped the last quarterly result, and so they will likely struggle to do much better than 10% p.a. over two years, even if the 2026 FY number gives a full year with the expanded salesforce cycling an earlier year before the ramp up, and so exceeding 10% in 2026 should be doable in all scenarios. But it can't be sustained IMHO. The persistency drag is just too high.

Looking at the historical trends, the rate of growth is maturing rapidly. For example, even while benefiting from a full quarter of expanded sales force, 3Q/2Q-2025 was +5.2%, compared with 3Q/2Q-2024 at +7.8%. So there is defintely a sequential decline at play towards a plateau that doesn't look that far off (s-curve).

So, in the table below I've modelled three scenarios for annual US revenue growth over the next 3 years (all in $USm):

Depending on how longer term persistency evolves, we could find either 2028 or 2029 as the plateau year for the US. And in the illustration above, in the low scenario, $NEU doesn't get anymore milestone payments, and on the other two scenarios, will get the US$50m milestone only in 2028. The $750m milestone looks well and truly off the table to me.

I haven't pulled this through my $NEU valuation model yet; however, it is a significant deterioration on my earlier projections.

So, what does this mean for $NEU?

Well, US sales of US$490-$550m in round numbers are $NEU royalties of US$54-$62m or A$83-$95m, and that's much, much lower that the analysts have for $NEU.

Why?

Because I think the analysts are including all of the following things I haven't included:

- Assume continuing growth, and not modelled an s-curve with a continuing persistency driving decline after year-5 plateau

- Added milestone payments

- Added RoW

My model is too complicated to pull through a simple set of number for the value of DAYBUE to $NEU. However, my earlier projections gave me $12 - $20/share (US growth and pro rata RoW offset by 3-4 years)

Today, I believe US DAYBUE will have a plateau in 2028 or 2029 and immediate steady decline, as new patients arrivals fail to keep pace with churn. So, if all we have is the US, then valuing $NEU at 5x peak contining royalties of, let's be generous and say, A$85m to A$120m gives A$425m - $600m, or with SOI of 126.5m shares, that's $3.35 - $4.75 /share.

Yes, that's what $NEU (US-DAYBUE only) could be, if it can't get reimbursement beyond the US and if it can't sustain growth,

Wow.

Of course, I think it will be worth more than that. But hopefully, you can see that at $18/share, NNZ-2591 is now potentially doing a lot of heavy lifting. And it might be worth it. But it also might not.

But that's not what my "2 for the price of 1" investment thesis was all about. So my thesis is well and truly broken.

BIG CAVEAT: I wasn't going to post this, because I was sure I've made an error somewhere. But I have gone through everything a couple of times, and also used a couple of independent methods, and keep getting similar results. And to be clear, I haven't accounted for $NEU's massive cash pile. But I am not doing an enterprise valuation of $NEU, but rather only the value of the royalty stream from US DAYBUE. So, as ever, this is not advice. But it is enough for me to take the decision I have already executed. Oftentimes, more analysis doesn't add more value.

That said, over the coming months, I will properly update my model. And that's because I want to know at what price I am prepared to buy back in for the value of NNZ-2591. But I don't think there is any hurry. The PMS Phase 3 trial has some way to run.

Disc. Not held