AQZ had their AGM yesterday so it was good to get a bit more detail about the recent significant downgrade. It was worse than I had originally thought. It looks like the business has grown too quickly and the finance control aspects in particular were lagging. The unexpected jump in depreciation costs and the forecast debt position for the end of 2026 to go from $310 in Aug to $390m 2 months later really makes the CFO and systems look out of his depth. The new board are painting a poor picture of the past business, how much is true and how much is what new management always do is hard to tell. The early retirement of Scott Macmillon didn't inspire confidence or the shutting down of the aviation services aspect of the business. I was viewing this part as a way to raise cash to help with the debt repayments. I think this was Scotts baby so without him it might be too hard.

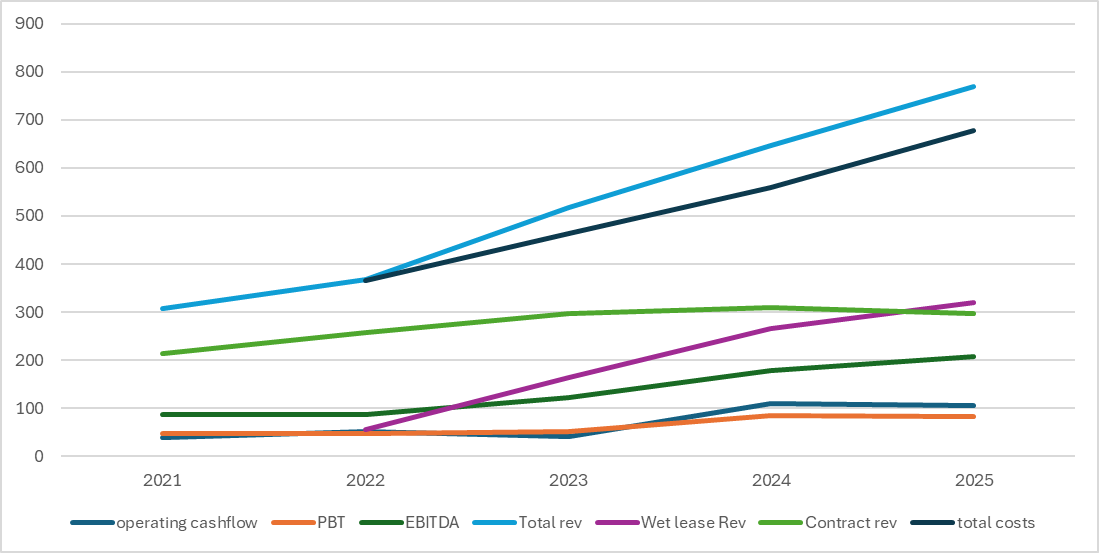

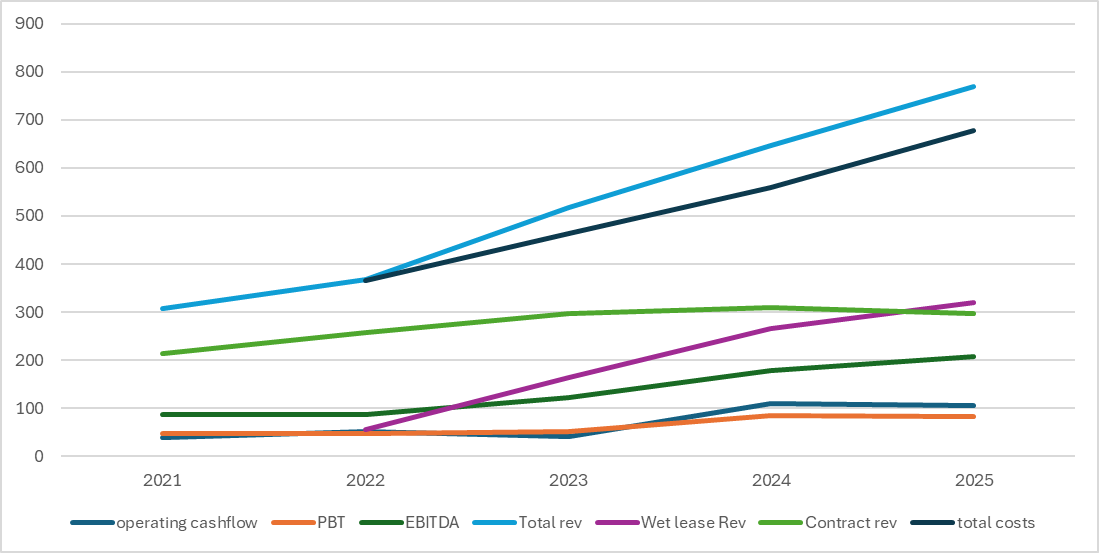

My investment thesis for AQZ was largely that more planes in the air flying more hours will result in more profit. I was right about more planes in the air flying more hours and revenue definitely increased but profit isn't going anywhere good from here. I had trust in management that they were on top of the operating aspects as their history in this area was very good. They buy their planes secondhand for cheap, own them outright along with their own spares and effectively operate counter cyclically to the rest of the airline industry. Their customers were historically FIFO mining contracts whereby costs were passed onto the customer, so they took on little of the normal risk profile of an airline. This FIFO component is a stable, profitable business that generates around $300m revenue a year, with an estimated EBITDA margin of around %20-25 (this is my guess back solved guess as its never disclosed). They very rarely lose a customer and when they do it is usually around a mine closure. The growth aspect of this business was coming from the wet lease deal with Qantas where the E190 planes are being put into use. These planes are all financed with debt which is significant ($436m currently, and should be peak debt, but current market cap is $218m) but I was previously assuming that the wet lease margin would be the same as the contract FIFO margin. The blue line (total revenue) in the chart will largely flatline now but the black line (costs) has the potential to keep going up, making the orange line (PBT) go down. Debt will then become a a very real issue. They currently still have good cash flow and the debt should be serviceable, although 2028 repayments looks a bit dicey, which is probably why they are looking to sell some assets to raise cash.

Their big problem is that they seem to have made a fundamental error in the wet lease contract, and appears to be the same error that many mining services companies make with fixed price contracts and costs get out of control. They priced the wet lease contract in 2021 using the first tranche of E190, which they got very cheap and labor costs/parts were abnormally low. Now that has all changed just as the planes are all in the air, so costs are going up quickly and they have no formal procedure in the contract to pass these along. This is bad operating leverage the more they fly the worse it is. As such they are trying to renegotiate with Qantas as an out of cycle review and they are bringing on a senior person (more cost) to do this. I cant work out the current margin they are getting on these flights as the accounts are still messy as they are still adding E190 and have fit out costs etc, but I now think it is much lower than the 20%, probably barely break even or at a loss. This has the potential to further erode as 2026 is the first full year where all 30 wet lease planes will be flying and this lease goes until 2030. So what should have been a very stable and profitable growth engine for AQZ has become a bit of a noose. Now its possible that Qantas are nice and as a 20% shareholder of AQZ come to the party and absorb some of the cost inflation, but I give this a low chance. I weight a much higher probability that Qantas tell them to bugger off, let them get into distress and buy some plane assets on the cheap or something similar. Qantas did try t buy AQZ for $4.40 a few years ago, so their is definitely interest in getting the assets.

Overall I think this was a good investment idea and was until the last month, and with the benefit of hindsight the last 6 months was chugging along. However it is now clear that my original thesis is well and truly busted. I have sold my holding for a not insignificant loss in my actual portfolio. But I look at the business now and can't see a reason why I would buy it today beyond it is very cheap if everything works out.

Some sound bites to round out this investment

Hope is not an investment strategy

You don't need to make it back the way you lost it

The earliest loss is the best loss

F@XK airlines!