Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

AQZ had their AGM yesterday so it was good to get a bit more detail about the recent significant downgrade. It was worse than I had originally thought. It looks like the business has grown too quickly and the finance control aspects in particular were lagging. The unexpected jump in depreciation costs and the forecast debt position for the end of 2026 to go from $310 in Aug to $390m 2 months later really makes the CFO and systems look out of his depth. The new board are painting a poor picture of the past business, how much is true and how much is what new management always do is hard to tell. The early retirement of Scott Macmillon didn't inspire confidence or the shutting down of the aviation services aspect of the business. I was viewing this part as a way to raise cash to help with the debt repayments. I think this was Scotts baby so without him it might be too hard.

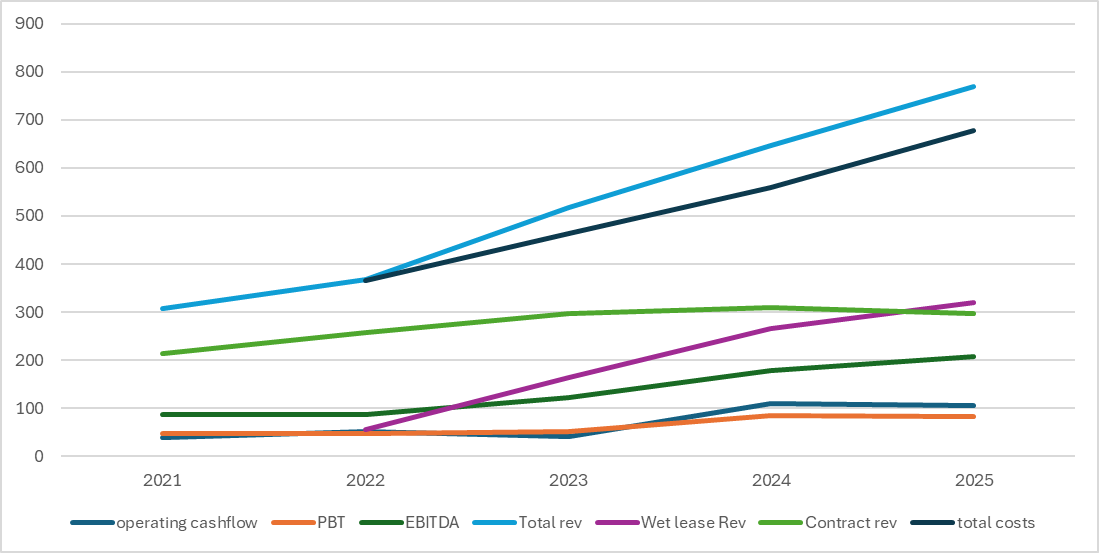

My investment thesis for AQZ was largely that more planes in the air flying more hours will result in more profit. I was right about more planes in the air flying more hours and revenue definitely increased but profit isn't going anywhere good from here. I had trust in management that they were on top of the operating aspects as their history in this area was very good. They buy their planes secondhand for cheap, own them outright along with their own spares and effectively operate counter cyclically to the rest of the airline industry. Their customers were historically FIFO mining contracts whereby costs were passed onto the customer, so they took on little of the normal risk profile of an airline. This FIFO component is a stable, profitable business that generates around $300m revenue a year, with an estimated EBITDA margin of around %20-25 (this is my guess back solved guess as its never disclosed). They very rarely lose a customer and when they do it is usually around a mine closure. The growth aspect of this business was coming from the wet lease deal with Qantas where the E190 planes are being put into use. These planes are all financed with debt which is significant ($436m currently, and should be peak debt, but current market cap is $218m) but I was previously assuming that the wet lease margin would be the same as the contract FIFO margin. The blue line (total revenue) in the chart will largely flatline now but the black line (costs) has the potential to keep going up, making the orange line (PBT) go down. Debt will then become a a very real issue. They currently still have good cash flow and the debt should be serviceable, although 2028 repayments looks a bit dicey, which is probably why they are looking to sell some assets to raise cash.

Their big problem is that they seem to have made a fundamental error in the wet lease contract, and appears to be the same error that many mining services companies make with fixed price contracts and costs get out of control. They priced the wet lease contract in 2021 using the first tranche of E190, which they got very cheap and labor costs/parts were abnormally low. Now that has all changed just as the planes are all in the air, so costs are going up quickly and they have no formal procedure in the contract to pass these along. This is bad operating leverage the more they fly the worse it is. As such they are trying to renegotiate with Qantas as an out of cycle review and they are bringing on a senior person (more cost) to do this. I cant work out the current margin they are getting on these flights as the accounts are still messy as they are still adding E190 and have fit out costs etc, but I now think it is much lower than the 20%, probably barely break even or at a loss. This has the potential to further erode as 2026 is the first full year where all 30 wet lease planes will be flying and this lease goes until 2030. So what should have been a very stable and profitable growth engine for AQZ has become a bit of a noose. Now its possible that Qantas are nice and as a 20% shareholder of AQZ come to the party and absorb some of the cost inflation, but I give this a low chance. I weight a much higher probability that Qantas tell them to bugger off, let them get into distress and buy some plane assets on the cheap or something similar. Qantas did try t buy AQZ for $4.40 a few years ago, so their is definitely interest in getting the assets.

Overall I think this was a good investment idea and was until the last month, and with the benefit of hindsight the last 6 months was chugging along. However it is now clear that my original thesis is well and truly busted. I have sold my holding for a not insignificant loss in my actual portfolio. But I look at the business now and can't see a reason why I would buy it today beyond it is very cheap if everything works out.

Some sound bites to round out this investment

Hope is not an investment strategy

You don't need to make it back the way you lost it

The earliest loss is the best loss

F@XK airlines!

November 2025 - see straw for why I no longer rate the business very highly

After the recent downgrade I think they will only manage a baseline profit of between $30-50m going forward. Aviation services is contributing $18m to their revised guidance and this will be a one off but also might not happen. So working on $30m (PBT), with 161m shares EPS is probably around the 0.13c as a base going forward with little growth and potential for higher costs from here along with a large debt to repay. I think a PE ratio of 6 is probably appropriate until this business earns a higher multiple by restraining costs and getting the debt paid off, which gives a price of 0.80.

---------------------------------------------------------------------------------------------------------------

April 2023 -I am reducing my value to $4 as they have had some delays to where I thought they would be by FY23. Still comfortable in the direction they are heading and I think they have plenty of upside to come now that they have the aircrews and planes flying.

They should have an EPS of 22c in FY 23 and if they do that then I think they upward trajectory will continue and will reassess after the full year results. I think $4 is a fair value for FY 24 if they hit their guidance.

--------------------------------------------------------------------------------------------------

Old valuation - I was a tad optimistic as they experienced many Covid inspired delays with a slow rollout of the qantas wet lease deal.

See straw for details but I like the quality of this company and do not think they are your typical airline. 70% of revenue comes from contract flying for the resource industry. NPAT was 34M in FY21 and total flight hours will increase 3-5 fold over the next year.

Using a PE of 15 and consensus EPS of 0.26(Fy22) and 0.36(FY23) I get a current value of $3.90 and $5.40 in Fy23.

I like the management and the way they have used Covid as an opportunity to expand their fleet and I think the payoffs will start to flow through this year. I am happy to pay a slightly higher price for a quality operator which I consider AQZ to be.

28-11-23

Just tuned into the AGM and everything is still looking good. Board and management projected a happiness in where the buisness is currently and where will be over the next 2-3 years. Return to dividends an objective for calender year 25. Comfortable with the debt levels. 2nd half will be much stronger the 1st half, similar to FY23. Recruitment for the E190's largely complete. They are very happy with the Rockhamptom hanger and it will save them considerable opex costs.

Reaffirmed Net profit before tax guidance of $83.7m, which gives them a rough EPS of 36c. At a PE of 10 and 15 this gives a target price range of $3.60- $5.40. I think a PE of closer to 15 is fair so will put a $5 valuation on it.

Alliance Announces Leadership Succession:

Founder Scott McMillan to transition from Managing Director role; Stewart Tully to assume the role of sole Managing Director

Alliance, one of Australia’s leading aviation services companies, today announces a planned leadership transition that will see founder Scott McMillan step down as Joint Managing Director at the company’s Annual General Meeting (“AGM”) on 27 November 2025.

Stewart Tully, currently Joint Managing Director, will assume the role of sole Managing Director following the AGM, marking the successful conclusion of a 12-month succession plan.

Scott McMillan was one of the founders of Alliance Airlines in 2002 and has led the company through more than two decades of sustained growth, including its successful ASX listing in 2011. Under his leadership, Alliance has become one of Australia’s largest aviation companies, serving key industries and communities while building a workforce of 1,450 employees.

“It has been an incredible privilege to lead Alliance from its inception through to becoming a leading Australian aviation services provider,” Mr McMillan said. “I am immensely proud of what we have built together; a company known for operational excellence, safety, and reliability. Alliance has provided uninterrupted service to its customer base through pandemic, global financial crisis and numerous cycles in the resource industry, and I thank all our staff, past and present directors, suppliers, customers and past and present shareholders for their support over the past 24 years”

Mr McMillan will remain in an executive capacity until July 2026, focusing on the completion of several key strategic projects to ensure continuity and to support the leadership transition.

Mr McMillan will remain on his current fixed annual salary until his retirement in July 2026. However, he has elected not to participate in the company’s short-term incentive or long-term incentive plan in the current financial year ending 30 June 2026. He will retain his entitlement to 33,771 company performance rights, earned in previous years that will vest upon his retirement in July 2026.

Stewart Tully brings a decade of experience with Alliance to his new role as Managing Director. His appointment as Chief Executive Officer over 12 months ago, followed by his elevation to Joint Managing Director in August 2025, formed part of a deliberate succession strategy designed to ensure seamless continuity of leadership.

“I am honoured to be appointed Managing Director and grateful for the confidence the Board and Scott have placed in me,” Mr Tully said. “Alliance has a remarkable foundation built over more than two decades, and I am committed to building on that legacy.”

Mr Tully emphasised that the company’s core focus remains unchanged: “Delivering safe, reliable aviation services to our customers while supporting our people and the communities we serve. I am excited about the opportunities ahead and look forward to leading our talented team as we pursue our strategic objectives.”

James Jackson, Chairman of Alliance Aviation, paid tribute to Mr McMillan’s contribution while expressing confidence in the leadership transition.

“The company owes a deep debt of gratitude to Scott, who has been instrumental in building one of Australia’s largest aviation companies, servicing key industries and communities,” Mr Jackson said. “Under his leadership, Alliance has grown from a start-up operation to a substantial ASX-listed aviation business with a strong market position and an excellent reputation.

“Stewart Tully is well respected in the aviation industry and well equipped to lead the company through this next important chapter in its development. His decade of experience with Alliance, combined with his operational expertise and deep understanding of our business, positions him ideally for this role.”

After offloading a few engines for $US40m a few days ago, AQZ has followed it up with a inventory sale worth another $US32.5m.

Its not entirely clear whether this is all the inventory (minus the engines, airframe, power units) for all of the E190's they have bought, the announcement implies it is but this goes against there policy of keeping spares for everything in house, so not sure if this sale is just the excess inventory.

Either way it will make a good contribution to reducing the debt, they had around $430m debt at end of June so this lazy AUS$110m from inventory sales should see them easily hit there guided debt levels for 2026 (315-360)

I have followed their journey now for several years and the transformation of the company is really quite impressive and has surprisingly been largely ignored by the market. The SP is more or less back to where it was in 2020 but the company is very different as these slides in the recent preso highlight.

and the important bit total flight hours are up up and away

Yet the SP is back to multi year lows. This can only last for so long. Getting the debt down and reinstating the dividend will be the triggers that get the markets attention.

PO Box 1126, Eagle Farm QLD 4009 T +61 7 3212 1212 | F +61 7 3212 1522 www.allianceairlines.com.au

24th June 2025

ASX Release

Alliance Aviation Services Limited (“Alliance”) (ASX: AQZ)

Engines Sale Realise USD40.2m

Alliance is pleased to announce that the Company has entered into a binding sale and purchase agreement with Beautech Power Systems (Dallas, Texas) for the sale of twelve (12) General Electric CF34-10 engines.

These engines will be delivered to Beautech ex Knock, Ireland after having been removed from six airframes sold to Eirtrade and previously announced on 4th September 2024. Ten engines will be delivered this current financial year and the remaining two will be delivered in early FY26.

Total consideration for this transaction is approximately $62.3m (USD40.2m) with the final amount subject to standard adjustments for delivery conditions and the prevailing AUD/USD exchange rate.

This transaction will have no impact on the current profit guidance provided for the current financial year.

The sale of these engines will lead to a substantial reduction in inventory value in this financial year, and a consequent and significant reduction in the net debt position of the Company.

Commenting on this transaction, Alliance Managing Director, Scott McMillan stated, “We are delighted with this outcome where we have again, been able to monetise inventory at values commensurate with current market prices and take advantage of the low AUD/USD exchange rate. Our Aviation Services business has and will continue to make a significant contribution to the financial performance of the Company. Most of the engines sold have remaining lives that are surplus to the Company’s current requirements. This transaction is consistent with our Company objectives of reducing overall inventory levels, unlocking surplus value and retiring debt.

“We are also delighted to have formed a strong relationship with Beautech who a leading trader and lessor of aircraft engines are and well situated in the General Electric CF34-10 market.”

Lee Beaumont, Founder, President and CEO of BeauTech commented, “Over the course of our recent negotiations with Alliance, we have developed a strong and collaborative relationship, supported by several visits to Brisbane by myself and the BeauTech team. We hold Alliance’s commercial approach in high regard and are particularly impressed by the strength and uniqueness of their business model. As the world’s leading lessor and financier of CF34 engines, BeauTech is deeply committed to this platform and is investing significantly in the -10E variant. We see a strong alignment in the entrepreneurial mindset shared by both organisations and look forward to supporting Alliance in the years ahead.”

[ ends ]

Here's a copy of a post on LinkedInby my nephew (an aviation newbie).

I'm looking at this from an $AQZ perspective, particularly in relation to the Virgin purchase of the new Embraer planes. As the largest maintenance and parts supplier for Embraer in SE Asia, it can only be good news for $AQZ

Here's his post:

Yesterday I was invited to check out ASL Airlines Australia’s gorgeous Embraer E190-E2.

Based on the incredibly popular Embraer E190, the E190-E2 “Profit Hunter” features modern engines and wings, which give it a longer range, better performance, and lower operating costs. The Embraer E2 family is taking the world by storm, with 350+ orders from customers in 18 different countries. One of the latest customers to join the club is Virgin Australia Regional Airlines (VARA), with an order for eight brand-new E190-E2s to be delivered in just a few months.

For VARA, the E190-E2 is more than just a replacement for the airline’s aging Fokker 100 fleet; it’s the start of a new era in regional aviation. Capable of taking off on a runway that’s just over a kilometre long, and with a range of 5,500 km with a full passenger load, the E190-E2 brings a new capability to the regional market that has never been seen before in Australia. This allows for new routes to be launched, and existing routes to be served better and more efficiently. The E190-E2 uses 30% less fuel than a Fokker 100 while carrying the same number of passengers.

The E2 also packs some innovative technology that has never been seen on an aircraft of this size before. Trailing link landing gear gives the aircraft better takeoff and landing performance while enhancing safety. An advanced computer-designed wing with a “gull-wing” shape increases lift and efficiency while compensating for the aircraft’s larger engines.

The E2 is also the first regional airliner to feature raked wingtips—a design element usually found on long-range widebodies like the Boeing 777—to reduce drag and allow the E2 to fly even further. Embraer continues to actively improve the E2; last year, Embraer announced the launch of the “E2TS” takeoff software, which perfectly matches the plane’s speed and angle during takeoff to gain the best performance and safety off short runways.

I am so thankful for the amazing team at VARA and ASL Airlines Australia for allowing me the opportunity to get to know this fascinating aircraft up close!

#Embraer #Aviation #ASLairlines #VirginAustralia #RegionalAviation #AustralianAviation #Aircraft #Airliners #Travel

Just noticed $AQZ has popped by >7% today, with no asx announcements. Quite a bit for a steady as she goes type business with little share price volatility (usually).

Any thoughts.....not that I'm complaining.

Held IRL & SM Portfolios

If Buffett ever set up his help-line for Airlines Anonymous, I should probably call it.. I just cant help but see a lot of positives with Alliance.

The recording of the meeting is on the Meetings page, and I attach the transcript here (AQZ Transcript.pdf) if anyone wants to interrogate it with AI. But the high level thoughts are:

> Scott is obviously keenly tuned into what matters most (customer satisfaction -- ie, reliable, on-time, safe flights) and they have structured the balance sheet in a way that optimises for resilience over efficiency. He knows what blows airlines up, and isnt about to try and get cute with financial engineering to juice earnings at the expense of existential robustness.

> The other north star is return on capital. Be it debt financed or equity financed, that's all that matters, and their track record is exemplary here. Speaking of debt, it's very modest relative to operating earnings, and well under their covenants. Not trying to suggest there isnt risk here -- debt ALWAYS enhances risk -- but it's far from reckless, and for a capital intensive business that is steadily expanding, a very useful tool if used judiciously.

> Carrying value of assets is extremely conservative, be it with parts inventory (he reckons the market value is double the carrying value) or the aircraft itself (mandated by accounting rules).

> He is a big shareholder (aligned) and recently bought more on market. He explained off air they only have a 3 day window to buy shares, and almost always do when they can.

> was surprised by the share price performance given everything they have delivered was in line with what they told the market and, more to the point, results reveal a healthy and growing business.

> his knowledge of the industry and aircraft is clearly very deep.

> The head office is extraordinarily modest. He even quoted Rob Milner "the thicker the carpet, the thinner the dividends". Love it.

> The implementation of the new IT system, and how they went about it, also reveals how keenly they are aware of return on investment. He reckons they'll get a 12 month pay back on that investment! Also, after going live a couple weeks ago, only one small issue (anyone who follows ERP implementations knows that they usually dont go smoothly)

I bet I'm forgetting a lot of things, but I just have a soft spot for hands on management teams that are ROC focused and long term oriented. Especially when they have a long and impressive track record.

Anyway, the forward PE is 7x based on their guidance which he strongly hinted they were on track for -- which represents 7% PBT growth. Insanely cheap *if* they can sustain even modest growth.

Now.. they have all kinds of counterparty risk, and key customers could take a hit with all the global issues taking place. So it's not a slam dunk (nothing is). But it just strikes me as a well run business trading at a cheap price -- which is always a good combination.

I hold a rather small position, but may add some more if i can get my hands on some cash. I'll buy some on SM today

Call me silly & a confirmation bias ‘wonk’, but I still regard AQZ as good value BUT we will not see that value reflected in the share price this calendar year…it’s a year of caution, foundered upon a very aggressive plane investment strategy and the over reliance on cash from operations to properly fund those acquisitions.

By my reckoning, AQZ will have tapped out their borrowing headroom as at 1HFY25 of $55m + some $19m in cash and still need around $50m in cash from operations to fund the $107m CAPEX required in cash + working capital in 2HFY25. I think this is doable but 1HFY26 sees them acquire an additional 6 E190’s (3 due in September & 3 in December) at approximately $16m each or $96m.

Again, this puts enormous strain on cash ops for 1HFY26 to find this CAPEX. Sure, they can possibly defer an acquisition, so it slips into 2HFY26, or obtain vendor finance, but there’s not much room for error here. Hopefully the new CFO is right across the cash revenue streams and its absolutely no wonder why they aren’t paying a dividend. And I’d hate for them to cop yet another ‘going concern’ qualification (making 3 in all).

I will acknowledge the AQZ board have ‘balls’; they have backed themselves with this aggressive acquisition and thumbed their nose at the auditors. I like that spirit, even though the auditors are technically correct, the Board have been commercially forceful, and it has paid off…except we poor shareholders haven’t seen it yet. But its coming. Indeed, it could already have come had not the ACCC stepped in and quashed the QAN offer. I did a quick calculation, todays AQZ price of $2.44 ish would be worth $6.70 in QAN shares – another pin in the ACCC voodoo doll.

The good news is that in 2HFY26 there is only the final E190 to worry about and the revenue streams will be particularly strong thereafter. I do hope they use it to pay down debt which by then will be at or over 100% of equity. Mind you, this is a piffling % when you look at the QAN Balance Sheet or REX for that matter when they were operating. Indeed, look at all international airlines and they carry enormous debt to cover their capital requirements.

What I am particularly excited about (in addition to the continuous revenue stream from FIFO contracts & wet leases) is the opportunity of AQZ to monetize that capital build up in planes. The parts division will really come into its own going forward.

As Scott McMillan said on the presentation – words to this effect – “world-wide demand for parts and planes is very strong. What better timing to have secured them at a rock-bottom price and have them ready to sell into a hot market.”

At 3am in the morning I do wonder whether I am a confirmation bias wonk, a supporter of a value trap, or an investor who just needs to wait for things to play out. Right now, the market thinks I am an idiot…and that may be so.

Our Rockhampton Aviation Maintenance (RAM) facility celebrated the commencement of its first line of maintenance last month.

QantasLink's VH-UZD (Embraer E190) entered the hangar for a scheduled C-Check in mid-November.

Commencing the first line of maintenance is a significant milestone for our Rockhampton teams and has been many years in the making.

The first check is also representative of Alliance Airlines' commitment to long-term sustainable employment in regional Australia and our focus on an Australian-based future for aircraft maintenance.

A second and third line of maintenance will commence in the coming year, with recruitment for RAM staff an ongoing priority.

Congratulations to everyone involved in achieving this milestone.

I never thought i'd find myself saying this about an airline but.. wow, Alliance is super impressive.

MD Scott McMillan clearly has a deep understanding of the industry and knows better than most the struggles most airlines face. He also struck me as a straight shooter -- even emphasizing some mistakes and negatives (entirely unprompted).

So the usual problem with airlines are all the variable costs, most of which are beyond your control, paired up with huge CAPEX requirements and uncertain/variable demand in a hyper-competitive (and often irrational and distorted) market.

AQZ mitigates this as such:

- extremely astute buying of assets, most of which are picked up opportunistically from the hands of forced sellers. pennies on the dollar type stuff.

- contracts which allow for regular (monthly) repricing to accommodate things like fuel, FX and cost inflation

- contracts (be that for FIFO or wet leasing) that are volume agnostic. ie. they dont care if the plane is empty or full

- work only with sound counterparties that have strong balance sheets

- diversity of exposure in terms of minerals and geography.

- bringing key services in house and, impressively, turning some of these into their own profit centers.

- A clear understanding of their strengths and a resolute focus only on areas where they have an edge (eg. zero interest in carrying regular passengers)

Like I said in the intro -- this company has never reported a FY operating loss since listing and generates ~10% net margins and ROE. Revenue has CAGR'd at 13%pa since the float and net profit has tripled. Clearly they are doing something right.

I dont believe any specific guidance has been given, but clearly they are expecting further growth. The 'north star' here, as revealed in the chat, was the size of the fleet. A bigger fleet = more revenue, and (in theory) better shareholder returns assuming a continuation of cost discipline and ongoing attractive return on capital.

And the PE is ~8 after they just reported a 66% lift in per share earnings!

Anyway, some highlights from the chat:

- They will only pay out dividends when there is no more opportunity to reinvest at high rates of return and after some debt has been pared back

- On debt, Scott clearly sees it as advantageous -- vanilla debt that is amortized over a long time frame, at low rates helps avoid dilution, juice returns and allow for further opportunistic purchases. It'll be wound back a bit down the track, but for now they are expanding the fleet.

- I really got the sense this is an MD who isn't worried about building an empire. He clearly sees little opportunity outside of AUS/NZ and even in those places its the regional routes they care about. I suspect at maturity you will see them payout a significant majority of free cash flows.

- What really matters with aircraft is engines -- the board spends 60% of their time thinking about this. And being able to service things in house is a huge edge and cost advantage (the new facility in Rocky should start to enhance things in the coming years)

- no budget on marketing, he considers AQZ a wholesaler

- He didnt quantify it, but suggested AQZ is by far the largest player in its chosen niche

- "Wet leasing" (where they provide the aircraft, crew, maintenance, and insurance to another airline, who then handle all the operational components) is, in effect, the same in nature to the FIFO work. These contracts are very long term in nature and essentially help 'solve' the capital investment requirements for customers, and allowing them to manage capacity better.

- no capital raises since 2020, where $100m was raised to bolster the fleet

- Qantas has a 19.9% stake, which it acquired without the board's say-so when they picked it up from Luthansa (who sold planes to Alliance, at bargain basement rates, for shares). Scott wasnt happy about that at first, but Qantas does not have a directorship or exert any control over Alliance’s operations, and they are now their largest customer. (I wonder if we see a takeover offer at some point?)

- There is a good amount of insider ownership, including from the original founding shareholders. Scott himself owns about 2.4% of the company.

- Scott expressed surprise by the market's reaction to the latest set of results -- despite the record numbers across the group, shares are essentially back at where they were in 2020.

I am going to initiate a small watching position here on Strawman, and (as always) keen for someone to throw some cold water on this. But I was very impressed with Scott.

I'm guessing a 1.6% upside to today's price is validation for the benefits $AQZ will glean from $REX tough current situation in administration.

Whilst $REX and $AQZ have different business models and client bases, i.e. Rex doing flights between capital cities (or was before EY were appointed as administrators) and also regional destinations (still operating) and Alliance focusing on FIFO and wet/dry leasing to almost anyone without bias, the current struggles at Rex must be seen as a great opportunity for Alliance.

After discussions with the TWU today, it was reported that as many as 610 workers will be laid off. Whilst this is horrid news for Rex, one of the significant roadblocks to Alliance and their switched-on management team kicking even bigger goals for their ever increasing fleet (and the spare parts business they are now renowned for both regionally and globally) is qualified personnel. Assuming some of these could be secured via these proposed lay-offs, it can only be good news for MD Scott McMillan and his team.

RL portfolio holder only of $AQZ

The universal hatred of airlines as an investment because they are so capital intensive with flukey revenue streams and a POO (price of oil) which can be extremely erratic does have a few exceptions, one of which is Alliance Airlines (AQZ).

Let’s debunk these assertions right now:

Capital intensive, yes, by the very nature of the assets involved, but this is substantially lessened by astute buying, something which AQZ absolutely excels at.

Take the initial 30 E190’s they acquired in Covid times (2021) at $5m a pop. Marry this up with the recent announcement (May 29) of them selling 5 E190 engines at $5m a pop.

E190’s have two engines indicating that we have a significant accretion over cost. The second tranche of 30 E190’s will likely average around the $10m to $11m each, so again, brilliant buying. My very quick analysis of world-wide used E190’s would suggest their true value is somewhere around $18m AUD.

The 1HFY24 Balance Sheet reflected Planes to be worth $595m; that’s for the 37 Fokker fleet and 33 E190’s. At $18m apiece for the E190’5, we are carrying the entire Fokker fleet at nil value!

Bring in the extra 30 E190’s at a cost of $10m each and a real value of $18m and we have a mark to market advantage of at least $200m

Next points: Flukey revenue & erratic POO! – Over half of AQZ revenue comes from fixed FIFO contracts & we have some 26 planes wet leased to QAN which means 'bums on seats' (one or many) are a non-issue AND in both cases there are escalation clauses to protect AQZ from POO movements (sorry toilet type humour isn’t my intention here, because this is a seriously undervalued company.)

Oh yes, sleepy old Mr Market also missed yesterday’s announcement of a 60% increase in NPBT for FY24 and based upon their business model this can only get better.

Discluosure: I am a long term holder and a few of those years have been tough, but this is now flying and dividends will be re-institued next year.

In their last report the auditors had AQZ as a going concern regarding how they were going to pay for the additional 30 aircraft that they had agreed to purchase for somewhere between $280-336m. 17 of those aircraft were scheduled for delivery in this calendar year, this $182-204m was the going concern for the auditors. This has now been remedied and debt funding has been secured through their existing financiers -ANZ - they will increase their loan facility to $117m (up $50) and extend the duration til 2028.

in addition instead of the 17 aircraft settling in 2024 it is now only likely to be 12 for a cost of somewhere between $128-140m - depends on the quality of each plane at sale point.

i think this is actually a positive as a slower feed of new aircraft will enable more time for AQZ to go through all of the steps to get them ready for service. As we saw last time that you need to do a lot of recruiting and training of pilots, aircrews and ground staff. Slowing the delivery of plans down will also enable them to pay for a larger component of them through there own cash flow generation, which I am expecting to expand over the next 2 years. It’s also beneficial, as it’s not clear yet where, or how much of a demand for these planes there is, as there is no wet lease deals with Qantas as their were for the batch bought in 2020.

Securing this funding removes the largest short term risk that the company was facing. Now it’s just about execution!

Over the last couple of days managing director Scott McMillan has been doing some pretty decent buying.

15/12 - bought 88,339 shares ($250,459 worth) in the family investment trust. He also received another 46,047 shares as part of his performance bonus.

20/12- bought 21,661 shares ($64983) in his super fund.

That is a pretty strong statement about how he thinks the company is performing and where it is going. Nice bit of confirmation bias for me too.

Since september Alliance have now had two separate FIFO contract renewals from BHP, one for iron ore mines in the Pilbara (14 return services/wk from Perth) and one for Olympic Dam in SA (contract details not released). Both were for an initial 5yr base contract +2yr extension option. AQZ have had these contracts since 2009. This will make them a 21 year service provider to BHP. This is as close to ARR as you get - they charge a fixed fee and take on no passenger or fuel risk..

This slide from their annual results really sums up why they shouldn't be considered a typical airline. The key to this business is them getting more planes in the sky and flying more hours. As @PortfolioPlus lays out in his straw that is what they are doing, with the fleet size doubling by 2026/27

I think this is one of the most overlooked or misunderstood business's and I am expecting this to be a consistent compounder over the next 5 years. I bought more this morning and am expecting a positive update at the AGM next week, where they either confirm their guidance and hit an EPS of around 30c (up from 22c in FY23).

Alliance Airline (AQZ) is a diamond in an unfashionable, capital intensive industry where competition and uncertain macro-economic events puts pressure on pricing and revenue, whilst fuel, staffing costs and necessary maintenance puts significant pressure on profits.

The perfect airline would have the ability to pass on costs and locked in contacts to protect revenue. And that’s exactly AQZ, indeed, it has a strong moat around it, which airlines like REX and QAN would love and ‘would be’ airlines like BONZA and all those cheapies before it would have killed to have.

So, why is AQZ different and why is it worth more than a glance? Afterall, it made a loss in FY22, but has returned to profitability in FY23.

Different, YES. It derives 57% of its revenue from locked in Fly-In-Fly-Out (FIFO) contacts with the cream of Australian mining. It is the largest FIFO supplier in Australia and has been for many years. This has to be a very strong moat. I cannot recall it losing a client and this year it added two more major clients. Plus, these contracts have clauses in place to accommodate rising costs, so margins are protected.

So, let me tell you about the loss in FY22 – not significant, given this was a year to reflect the damages of Covid, as the results of QAN & REX will attest. The major reason for the loss was an abnormal cost of $28m to reflect the infrastructure& administrative costs of recruiting and training staff to man their 33 Embraer E190 jets which they acquired at a bargain price of $5m each when the real market value was around $50m apiece. Such was the depression in the airline industry during Covid.

AQZ had more infrastructure costs in FY23 but chose not to capitalize them in the accounts. Long story short, 30 of those 33 jets are now under wet or dry leases and the revenues and profits will be streaming in during FY24 and beyond.

Such is the expected future demand, AQZ in May this year announced yet another major capital purchase of an additional 30 E190’s and some 16 of these will be made ready for service by June 2024 – that said, the costs of establishing staff and infrastructure will be done at a much more economical cost. Besides up to 16 of this acquisition might well be cannibalized for parts and replacements which will lower their operating costs plus provide also commercial opportunity in selling to others as well. At this stage it should also be noted that AQZ – with the assistance of Government funding – has established a substantial hangar at Rockhampton in Queensland to service its growing fleet. This will automatically save on maintenance costs as previously this was done overseas. The hangar is open for business in early September 2023.

Now, you probably know that QAN (20% ownership of AQZ) has lobbed a $4.75 takeover bid which has been kyboshed by ACCC. It’s not dead, as QAN are boxing on, though I’d be sure the $4.75 price tag will have to be upped to well over $5, given the impressive runway now pretty well laid out and ready for take-off.

Why their interest? Well, they have an agreement to take up to 30 of the initial E190’s under a wet lease and have so far executed some 22 of them – with more to follow.

AQZ are positioning themselves to become wet and dry lease wholesalers as well as FIFO specialists; all of these have protection against cost increases. So, a dry lease is one where they simply lease out the plane and the lessee pays all costs. With a wet lease, AQZ supply the plane plus staff at an hourly rate, but the lessee in this instance pays airport charges, fuel, sells the tickets etc.

Why consider AQZ and what are the catalysts?

One line summary: Infrastructure in place for more planes travelling more hours at reduced operational maintenance costs with fuel costs covered by customers; mosy of whom are largely ASX200 entrants.

The company has a very experienced board & management team with a very strong shareholding interest.

Moat like status in both core areas of the industry (a) FIFO (b) Wet leasing

Very great majority of infrastructure and start-up costs of the E190 fleet now met from past years results. The E190 fleet plus parts will number around 63 by FY25.

AQZ sell plane hours and for that you need planes. At FY23 they have 68 planes (Fokkers and E190’s) in the fleet. This grows to 84 in FY24 and 94 in FY25.

The new Rockhampton hangar will provide cost reductions on annual maintenance. Expect better margins going forward.

Substantially more flying hours in FY24, FY25 and beyond.

Dividends likely to be reintroduced at 1HFY24 – analysts see 3c to interim FY24 and 16c in FY25.

The value of the planes has been recorded at cost though the market value is likely to be substantially higher given the brilliant acquisition price, particularly of the first 33 E190’s at a low point in the cycle.

Analysts Considerations on Value

Analysts have FY24 revenue improving by 20% and 15% in FY25. EPS expected to be 37c in FY24 (v 22.7c in FY22) and 42c in FY25.

3 analysts value AQZ at $4.55 – 1 Strong Buy and 2 Buy

Potential Headwinds

Failure to place E190’s under wet or dry leases - unlikely in short to medium term given the pent-up demand for travelling presently – acknowledged by the company.

Debt Levels are high as they digest the two E190 acquisitions. Net debt to equity at 61% FY23. That said, my estimate of interest cover at end of FY24 is 3.6 – so comfortable.

Disclosure: a long-term fan and held IRL

The ACCC has rejected the proposed ($4.75) takeover by Qantas on grounds that it will reduce competition, which I am sure it probably would have but thats never stopped them at other times! It took them a year to come to that conclusion. Qantas is appealing this decision, they do own 19.9%, so there is a risk that if they lose the appeal they become sellers. I don't know over what timeframe this appeals process would take.

I would have been happy to get this bid approved and take the quick money, but am equally happy to keep holding this one and let AQZ reap the rewards of their heavy investment of the last few years, I think the next few years will be positive for AQZ.

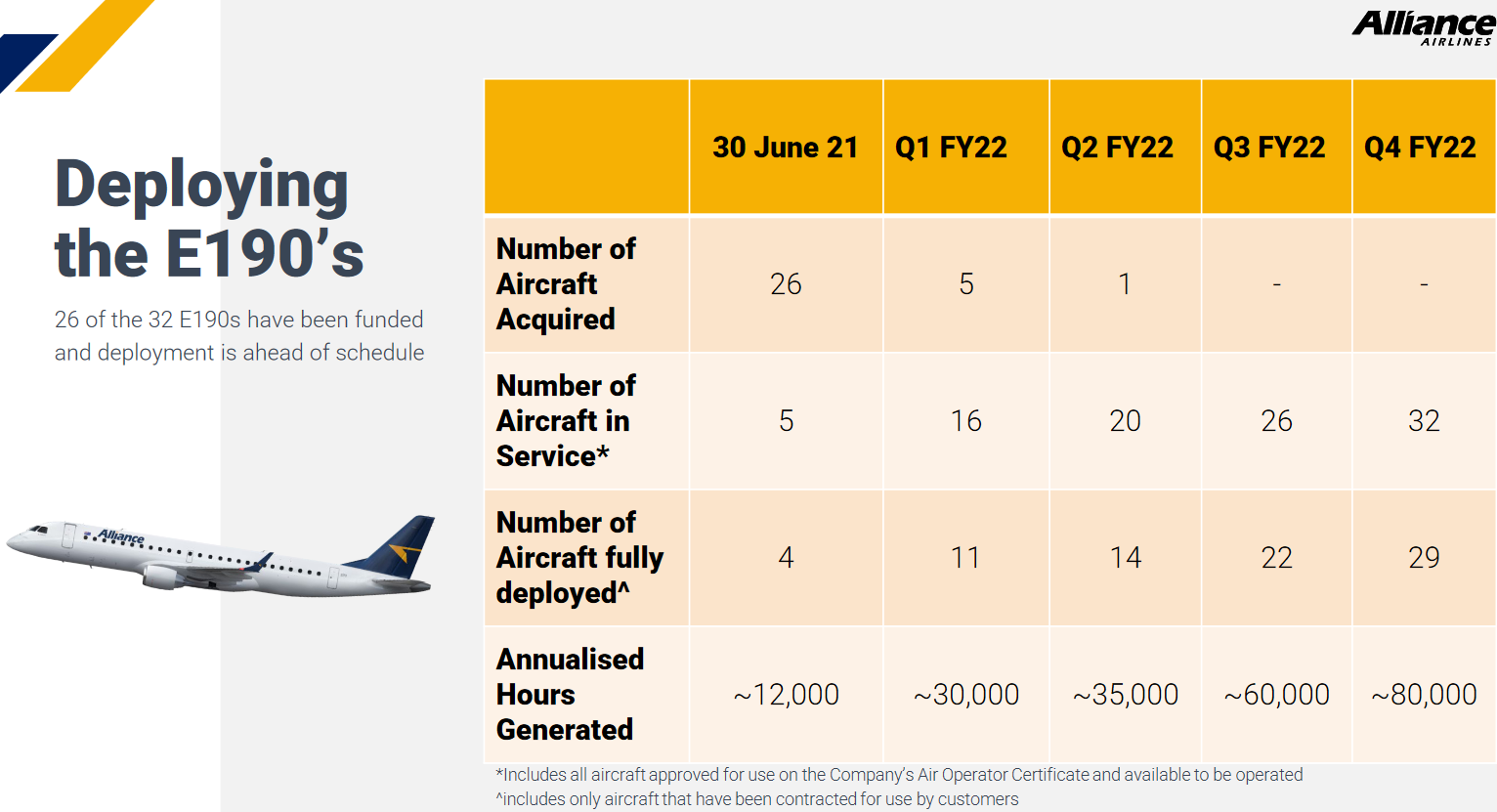

Since this bid was launched AQZ have commited to purchase another 30 Embraer jets over the next two years, and have increased the wet lease deal with Qantas from 18 to 30 planes. They have also increased the length of these leases from 3 to 7 years (through 2yr extension options), so plenty of revenue coming through. The total flight hours the planes are in the air is also rising month on month with a 50% increase from Jan 22 to Jan 23. Total flight hours to Dec 22 were 32000 hours, which should triple again with expected flight hours of approx 99000 by June 23. This is primarily driven by more planes in the air. Over the period I have been following AQZ, I haven't seen them lose a mining client when it comes to fly in/fly out contract renewals.

At the recent half year results the company has guided for PBT (FY23) of between $50-55m and are comforrtable with analysts consensus estimates of $74m (PBT) for FY24. This is an EPS of around 22c (FY23) and 30c (FY24). So at its current price of $3.20-30, they on a fwd PE of 15 (FY23) and 10 (FY24) respectively. I think they will keep falling a little bit more as the Qantas decison washes through and am hoping they will get back to sub $3 in the next few weeks, but this might prove to be too optimistic.

It seems like the market has decided that the ACC will be a roadblock to the Qantas takeover plans. I have no idea how they will view the deal, but my guess would be that it will be ok as they aren't really competing in the same markets and I can't see how it will meaningfully reduce competition. But given that the business is going only very nicely and in the last month has announced two contract renewals from mine clients, I think it is not a bad place to park some money and either get a quick payback of $4.75 (Qantas takeover) or wait for the market to start assessing its value again, which I think will happen over the next 12 months when all of the new planes it bought are flying.

-CITIC Pacific Mining - 6 yr renewal for 22 flights per week

-Agnew gold mining - 3 yr renewal for 12 flights per week

AQZ is just slowly going about their buisness. So far this month they have announced that they bought an additional E190, the sister ship of two they already own and bringing the total fleet up to 33. Cost of this one wasn't disclosed but am assuming they got it for a cheap price given the price of the other 32 planes. I am also assuming that being sister ships they will have additionalmaintence benefits e.g quicker/cheaper etc., but still need to confirm this.

Today they announced that Qantas had exercised the four remaining options on the wet lease deal, bringing the total number of planes up to 18. These four planes are set for deployment between Nov 22 and Jan 23, with each lease set for a 3 year period.

In the Feb results Qantas had excercised 10/18 wet leases. So I am now thinking that they must have comitted to use all 18 planes, but haven't set a start date for four of these leased planes (14/18 have start dates). I am taking this as a positive in that Qantas sees travel numbers increasing from next year and wants to lock in the seat capacity.

I am also expecting to see the total number of flying hours increasing from the 33K (dec 21) to >90K (Dec 22) as per their forecasts in their results presentation.

After 1HFY22 results were announced, MS moved their valuation to $3.94 whilst Ord Minnett are more bullish at $5.00.

My personal view on DCF is $4.79 based upon a stabilized eps for FY23 at 33c, a 7.5% growth factor for 5 years wth a terminal at inflation rate say 3% and discounted by 11% = $4.79

Average of the three = $4.57

I am a big fan of AQZ, it's strategy and execution by a good management team – but the poor 1HFY22 results are a reminder of two things.

(1) Business “gobbledy-gook” can cloud reality. The company guidance of $45m to $50m in ‘underlying’ NPBT for FY22 translates into a breakeven (at best) ‘statutory’ NPAT and likely no final dividend either.

(2) the difference between “underlying” and “statutory” results can be put down to two events; one predictable and the other an abnormality.

The predictable extra expense was the massive one-off cost in preparing to take on a much larger flying fleet; hiring and training of extra crew, maintenance on the additional E190’s, ground infrastructure etc.

The unpredictable event was of course Covid and its impact on flying. It put back their E190 fleet deployment by at least three months, perhaps more.

So FY22 is an absolute ‘dot-ball’ and the focus must be on FY23 where we will possibly reap 75% of the benefits of the very much enlarged flying fleet and FY24 should really reflect the full value of the bargain based purchase of the 32 E190 planes.

Of mild concern is management’s failure to advise the market of the loan covenant breach and the huge expenditure impact of onboarding the E190’s. As investors, we probably should have taken the latter into consideration, but the extent of the impact was what stunned me.

Still, onwards and upwards and I can see FY23 eps of around 33c with a 18c ff dividend which isn’t too shabby at current $3.75 SP. That said, I do think there are better opportunities atm and I will just sit and watch how effectively they complete the roll-out.

The headline result wasn't great with a $3.4M loss for the period, however overall the quality of the report was pretty good. Its a messy result but the headline loss is mainly due to investing for growth in the E190 program (crew and fitout costs) and covid impacts on a reduction in use by the Qantas wet leases. It looks like everything is still on track and it is just a bit delayed, outlook for E190's to "reap significant rewards from April 2022". Contract flying is up and they are confident this will continue to grow organically and operating cashflow is still very healthy so no real risk of defaults etc.

Key takeouts

-Revenue up 16% to $171M vspcp

-Underlying operating cash flow of $50.5M

-Debt increased by $11.4M

-$12M cash on hand down from $36M

-$69.6M cash expenditure - Fleet operations and services ($18.4M), $51M on E190 introduction costs and rockhamptom maintenance hanger.

-Staff costs up $19.2M -- added 78 pilots, 77 cabin crew, 36 engineers, 25 corporate staff (shows confidence that the demand for these new planes is real)

-8 of the E190's are in service - 2 in dry lease

-Only 5 of the 10 wet leased (Qantas) planes were flying through the period (covid impact)- added $14.3M revenue but lower than forecast, expected to increase from April.

-56 planes flying up from 43 in pcp.

-13,892 total flying hours up 6% from pcp.

-on time performance at 97%

-Expect all E190's to be in crewed and operating by December 2022.

-Maintained no dividend payout but do have 9M franking credits on the books.

FY guidance for underlying PBT between 45-50M (was 20.7M for the half)

Without covid I don't think I would have really given Alliance aviation (AQZ) a second look, but the way they have managed the impact and used it as an opportunity to expand and unpgrade their fleet is very impressive and speaks volumes to the quality of the management in this buisness. They also cancelled their dividend in 2020-2021 to direct funding towards growth (did a cap raise and took on some debt too), which I think were excellent capital allocation decisions.

In the initial months after the covid shutdown in 2020 when most fleets were grounded they did two deals with distressed sellers to buy 30 x E190's (includes spare parts, spare engines, tooling and a full flight Simulator) for a bargain price of $165M (5.5M/plane). Basically they were able to upgrade and expand the quality of their current fleet from older Fockker aircraft to modern jets with better range and greater fuel efficeincy.

These aircraft are being crewed and deployed during FY22 and from their FY21 presentation - the number of aircraft (E190's) deployed and total flying hours will increase greatly this year. The 43 x Fockker fleet (F100 x 24, F70 x 13 and F50 x5) are still in the air with the E190's primarily being used for expansion not replacement. Total flight hours for AQZ in 2020 and 2021 was 36-37K, in 2022 this is forecast to be between 113-130K hours for the group.

Main customers are resource companies where they do contract work using them for FIFO workforce at mine sites, the thing I like about these contracts is that they don't take any fuel price risk as this is just passed on to the customer. These contracts are generally long lived and are usually renewed. Three are up for renewal in 2022 and four in 2023 but I will be surprised if the majority of these are not renewed as they seem to provide a quality service and have an ontime performace of 93-95% over the last 2 years. 70% of AQZ's revenue comes from contract flying so a downturn in mining would be bad but I think that is unlikely to happen anytime soon.

-10 (can increase to 14 if needed) of the new E190's have been wet leased to Qantas. They fly them using their pilots under the Qantas banner. They expect 5% of total revenue (worth around 15M) to come from this deal.

-Have a similiar deal with Virgin but the details are less advanced. In total AQZ have said they expect 12-16 aircraft to be wet leased by March 22.

The addition of the E190's gives them the capacity to expand there charter flight revenue, whcih I think is higher margin but more sporadic and I consider this to be an opportunistic bonus but not core to the valuation.

The key to the valuation will be the utilisation of the E190's and so far nothing from the company indicates that this isn't going to plan. In 2021 NPAT was up 23% to 34M

Underlying cash flow was 75M

Total debt - 178.5M

Consensus forecast EPS - 0.26 (FY22), 0.36 (FY23)

At a PE ratio of 15 Fy22 it is worth $3.90 and has a FY23 value of $5.40. I think 15 is justified given the quality of management and the contract revenue they have and their ability to manage expenses. I just use this as a rough ball park anyway. This one isn't a load up the triuck bargain, but I like this company and I think it will be bigger in the next few years and I am planing on increasing my holding in RL. I also think they will surprise on the upside as the E190's take off.

The Pandemic has made an absolute mess of the airlines and tourism, yet there is one exception. It Alliance Airlines (AQZ) where FY21 revenue was up 3%, underlying NPBT was up 25% and underlying cash ops up a massive 73%!

And wait for it, FY22 will trump this like Donald, because anticipated annual flight hours could be as much as 3 times higher than FY21.

Apart from good and astute management, the secret sauce here is the brave, even audacious, decision to buy 32 Embraer E-190’s at the bottom of the cycle and now these ridiculously cheap E90’s at approx. $5.5m each will generate around $2m EBITDA annually according to Credit Suisse analysts. By the way, not that many months before the FY20 collapse these E190’s were valued as much as $50m each!

So QAN now have them flying and likely there will be 18 of them wet leased in QAN colours before FY22 is concluded. Indeed all 32 of the E190’s are likely to be in service come end of FY22 where annual flying hours at that point will be around 80,000 from the E190’s alone. Plus there is the usual workload of the Fokkers where around 37,000 hours pa can be expected.

Demand is strong and management are very confident in their E190 fleet.

So FY22 will be a transformative year as they roll out their E190’s progressively and whilst they didn’t give an outlook in figures, this very conservative management team did state - quote – “Alliance retains a positive outlook for the FY22 year with organic opportunities geographically and across contract, charter and wet lease revenue streams.”

Analyst coverage of (1 strong buy 2 buy and 1 hold) suggests FY22 eps of 26.5c (FY21 20.9c) and a huge 35.7c in FY23. Personally, I don’t believe they have fully factored in the progressive rev/profit from the E190 roll out and I believe it could be close to 30c in FY22.

Net debt to equity is a manageable 37.5% with interest cover of 12.72x. Plus management are not declaring a final dividend and I suspect this will be the same for 1HFY22 as they digest the debt of the E190 purchase.

AQZ made a massively cheap purchase of E190's in 2020 and the recent Qantas agreement suggests they are going to get them out very quickly on wet or dry leases. This will give them a brilliant ROI and don't forget its not just the Aussie marketplace. These E190's will be deployed throughout Asia in due course. A great company which will grow NPAT yoy. But likely no divvy in 2020 as they crunch the debt burden.

RECORD HALF YEAR FINANCIAL PERFORMANCE

Key Half Year Highlights

~ Statutory profit before tax - $33.6 million, up $18.1 million or 116.8%;

~ Underlying profit before tax - $26.7 million, up $11.2 million or 72.3%;

~ Operating cash flow for the half year - $47.5 million, up $32.9 million or 225.3%;

~ Total revenue - $154.8 million1 , up $3.5 million or 2.3%;

~ Net debt $6.8 million and leverage ratio of 0.53; and

~ Alliance retains a positive outlook for the 2021 financial year and growth in the 2022 financial year and beyond as the additional aircraft are deployed

DISC: I have held previously

Wet Lease Agreement for up to 14 x E190 Aircraft with Qantas Airways Limited

• Alliance to provide capacity using recently acquired Embraer E190 aircraft commencing from mid-2021.

• Range and route economics make the E190 an attractive option in a post COVID-19 aviation market.

• The transaction confirms Alliance’s confidence in deploying the recently acquired E190s.