Without covid I don't think I would have really given Alliance aviation (AQZ) a second look, but the way they have managed the impact and used it as an opportunity to expand and unpgrade their fleet is very impressive and speaks volumes to the quality of the management in this buisness. They also cancelled their dividend in 2020-2021 to direct funding towards growth (did a cap raise and took on some debt too), which I think were excellent capital allocation decisions.

In the initial months after the covid shutdown in 2020 when most fleets were grounded they did two deals with distressed sellers to buy 30 x E190's (includes spare parts, spare engines, tooling and a full flight Simulator) for a bargain price of $165M (5.5M/plane). Basically they were able to upgrade and expand the quality of their current fleet from older Fockker aircraft to modern jets with better range and greater fuel efficeincy.

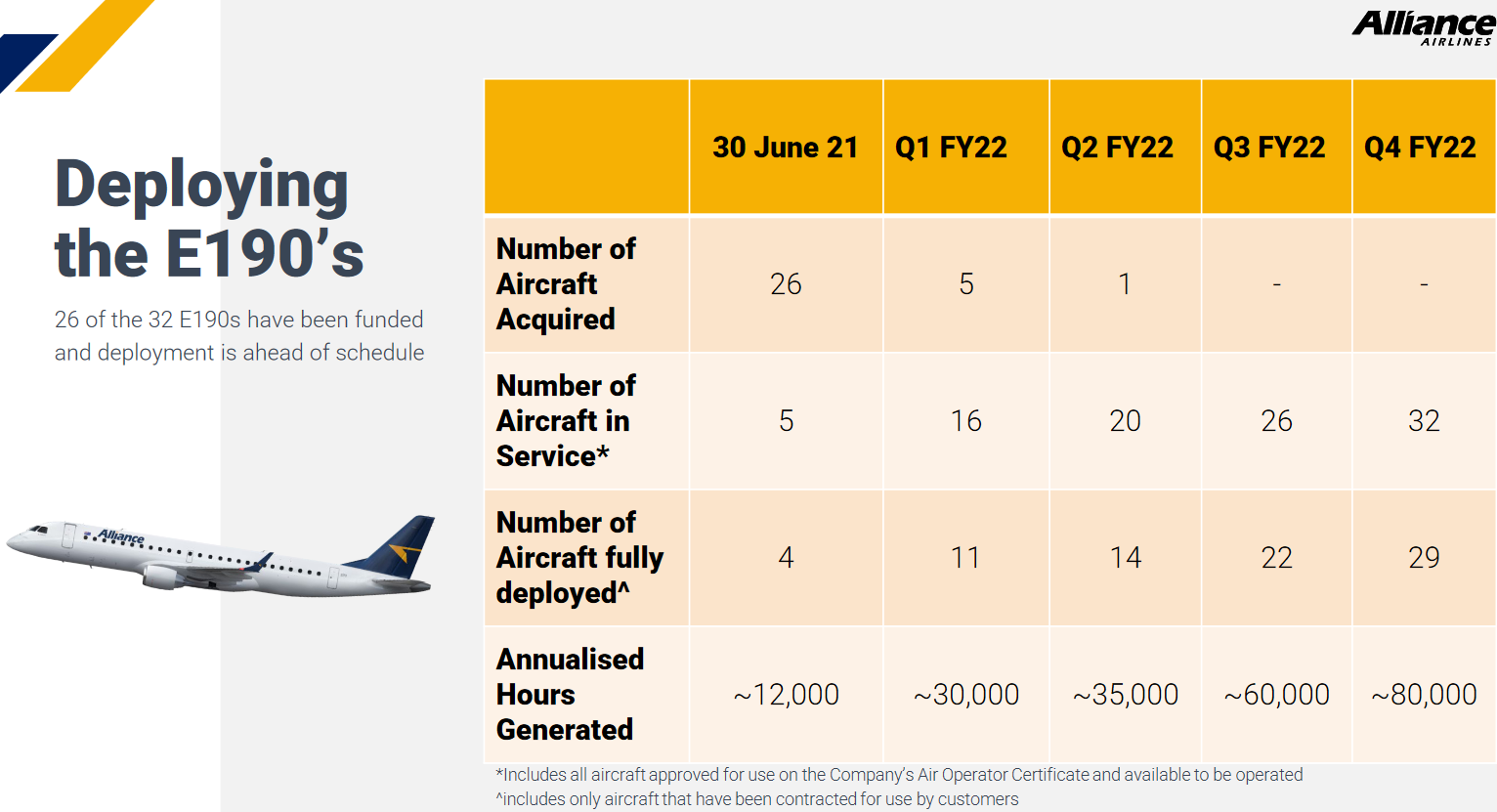

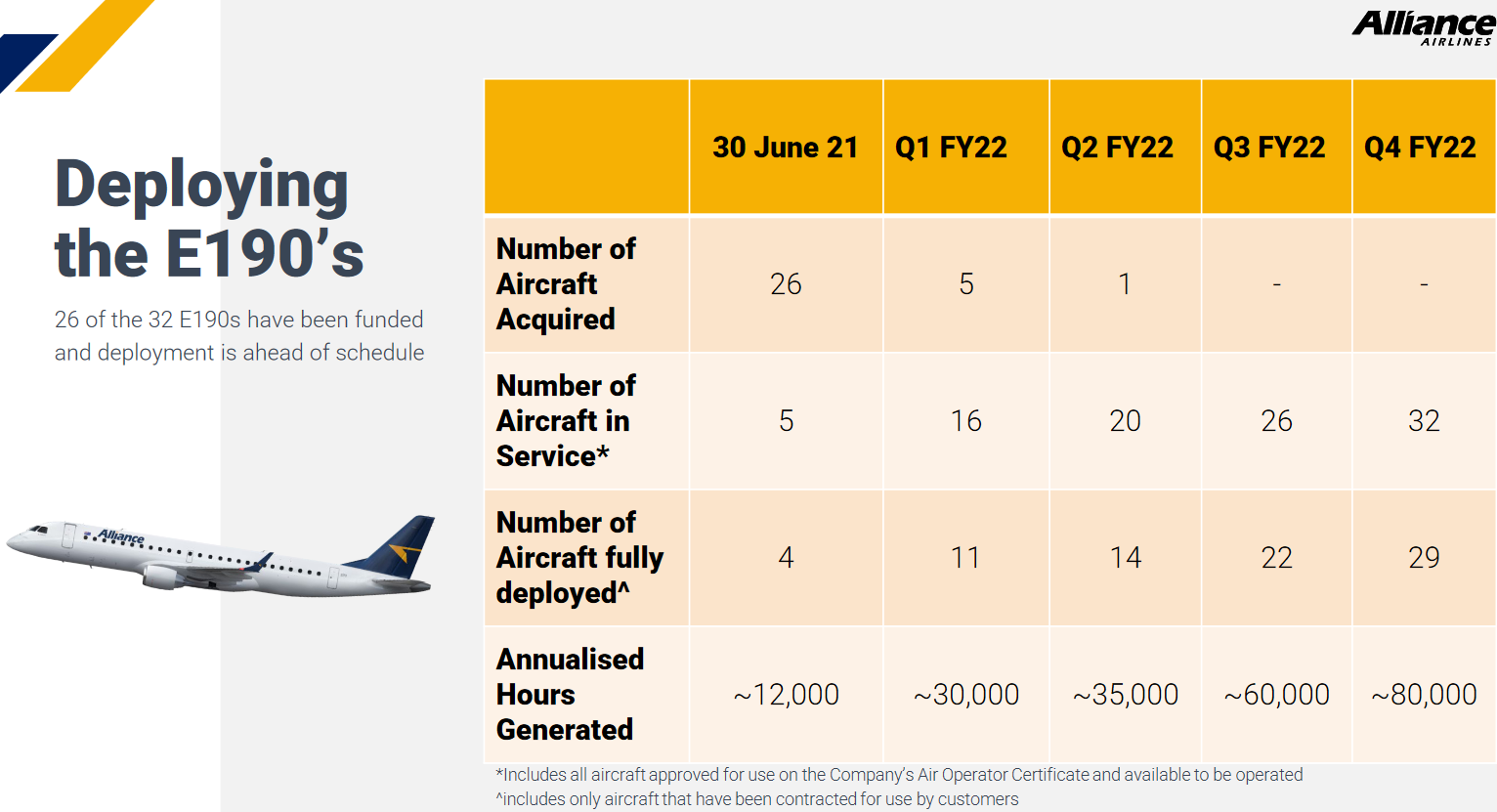

These aircraft are being crewed and deployed during FY22 and from their FY21 presentation - the number of aircraft (E190's) deployed and total flying hours will increase greatly this year. The 43 x Fockker fleet (F100 x 24, F70 x 13 and F50 x5) are still in the air with the E190's primarily being used for expansion not replacement. Total flight hours for AQZ in 2020 and 2021 was 36-37K, in 2022 this is forecast to be between 113-130K hours for the group.

Main customers are resource companies where they do contract work using them for FIFO workforce at mine sites, the thing I like about these contracts is that they don't take any fuel price risk as this is just passed on to the customer. These contracts are generally long lived and are usually renewed. Three are up for renewal in 2022 and four in 2023 but I will be surprised if the majority of these are not renewed as they seem to provide a quality service and have an ontime performace of 93-95% over the last 2 years. 70% of AQZ's revenue comes from contract flying so a downturn in mining would be bad but I think that is unlikely to happen anytime soon.

-10 (can increase to 14 if needed) of the new E190's have been wet leased to Qantas. They fly them using their pilots under the Qantas banner. They expect 5% of total revenue (worth around 15M) to come from this deal.

-Have a similiar deal with Virgin but the details are less advanced. In total AQZ have said they expect 12-16 aircraft to be wet leased by March 22.

The addition of the E190's gives them the capacity to expand there charter flight revenue, whcih I think is higher margin but more sporadic and I consider this to be an opportunistic bonus but not core to the valuation.

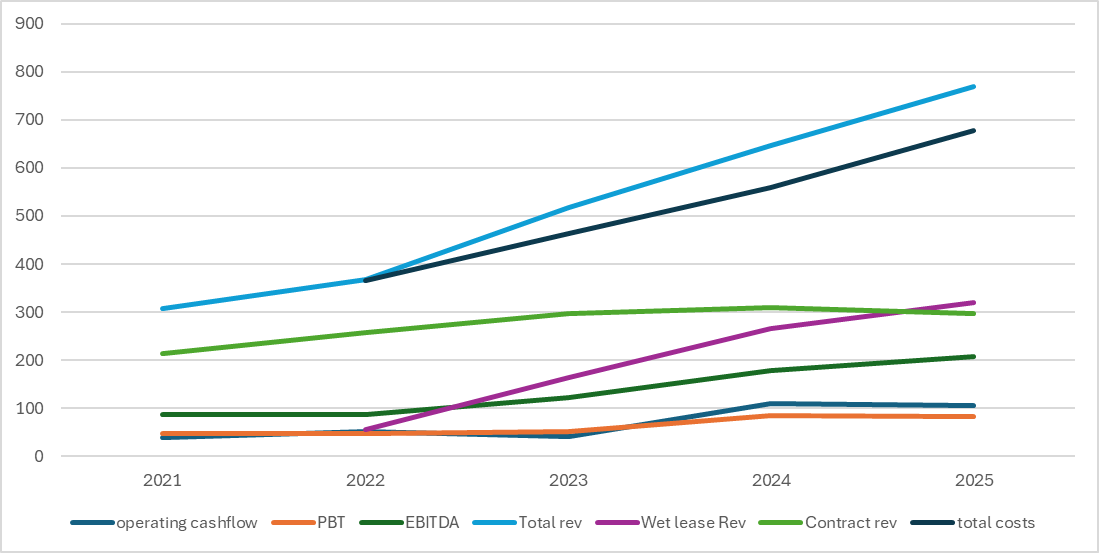

The key to the valuation will be the utilisation of the E190's and so far nothing from the company indicates that this isn't going to plan. In 2021 NPAT was up 23% to 34M

Underlying cash flow was 75M

Total debt - 178.5M

Consensus forecast EPS - 0.26 (FY22), 0.36 (FY23)

At a PE ratio of 15 Fy22 it is worth $3.90 and has a FY23 value of $5.40. I think 15 is justified given the quality of management and the contract revenue they have and their ability to manage expenses. I just use this as a rough ball park anyway. This one isn't a load up the triuck bargain, but I like this company and I think it will be bigger in the next few years and I am planing on increasing my holding in RL. I also think they will surprise on the upside as the E190's take off.