Pinned straw:

I just bought some (around 3%) IRL

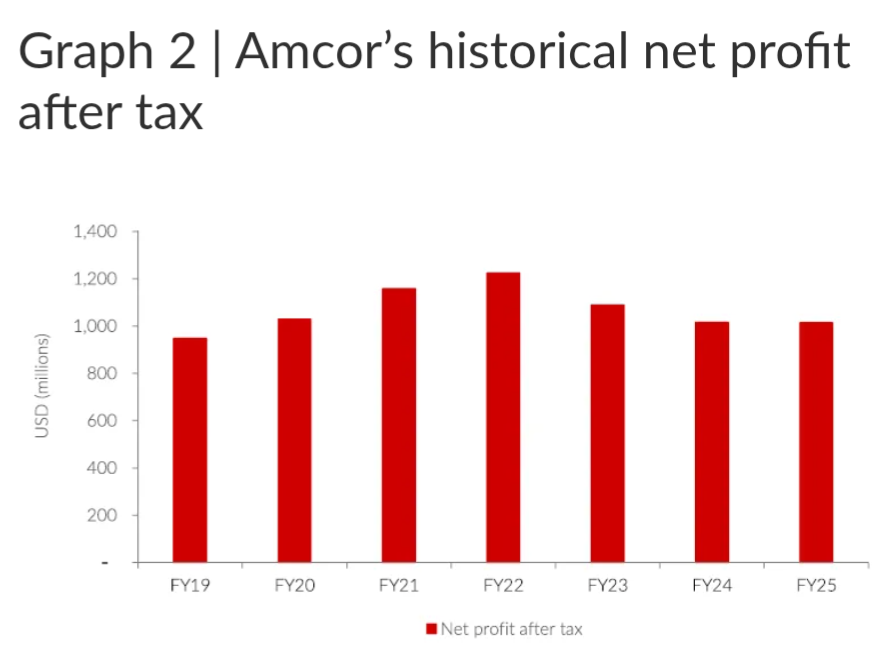

In addition to my earlier comments, not only is AMC undervalued, but also there are some clear potential catalysts for a re-rate:

- Volume growth normalises. Potential for packaging industry as a whole to revert to the mean. Also the final bit of unwinding of the overstocking/destocking cycle.

- Synergies are delivered. Currently the market pricing pretty much implies no synergies

- Debt-reducing asset sales

Thanks for the post.

I agree about point 1, volumes have been weak. While I do think that part of it may still be the overstocking hangover, it seems that the packaging industry generally is a bit challenged currently. Tariffs, trade wars, inflation and recession fears certainly won't have been helping.

Am I missing something re point 2? Amcor spun off its share in a N American rigid plastics joint venture (BCNA) for $122 million. That deal completed in Dec 24. I am not aware of any other pending asset sales, although there is talk of "exploring" asset sales of either the N American beverage business and/or other smaller non-core businesses, with no definite timeline.

Agree i like it as a defensive - $0.20 per quarter dividend why you wait too.

I think the market is unhappy that:

- volumes have been weak, with concern about recession especially with the inflation in the US at the grocery store.

- The sale of the north American rigids business has been delayed, as the key to deleverage.

- The kick last week was the index changes.

Contrary to the market, they will be cycling easier comps in 2026 and they did indicate margins could improve. However, we get plenty of earnings growth assuming the synergies come through. A catalyst would be the sale of the north American rigids business assuming a decent price - talk of a possible joint venture spin off given the size, it's just timing. I think the debt is really the major wart and the concern. The lower US interest rates and tight credit spreads are helping - even though it is still IG debt.

I don’t think plastics are an issue, AMC is the leader in developing new materials like fibre - they’re the ones that would lead the change. In the current environment, outside of europe, it’s definitely not a major issue it seems for governments. Pre Berry they had all packaging recyclable by this year - 25.