Pinned straw:

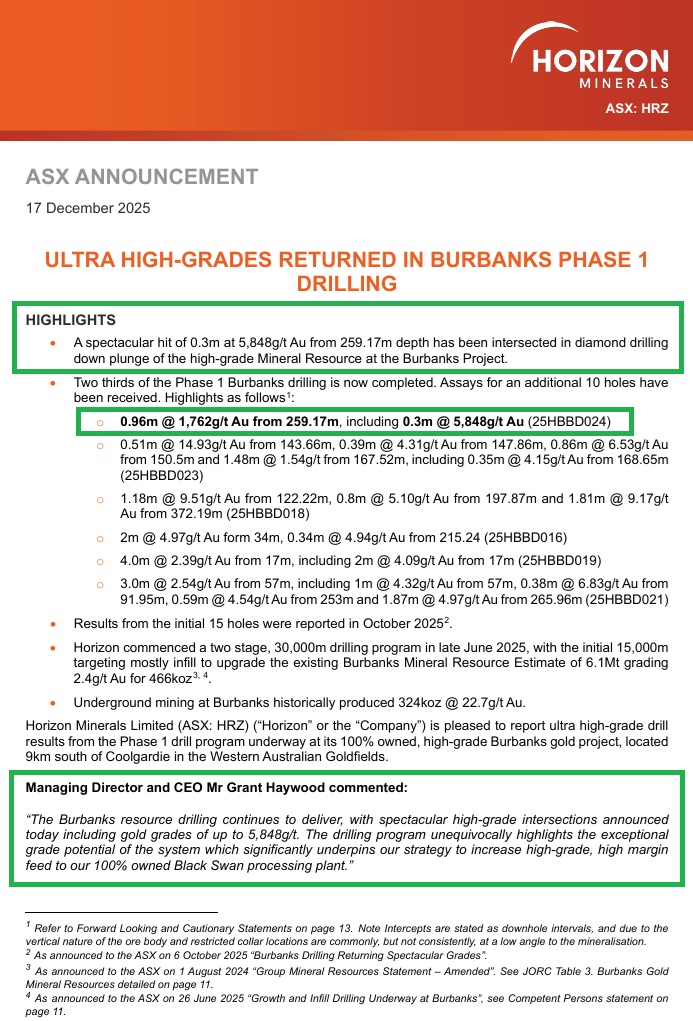

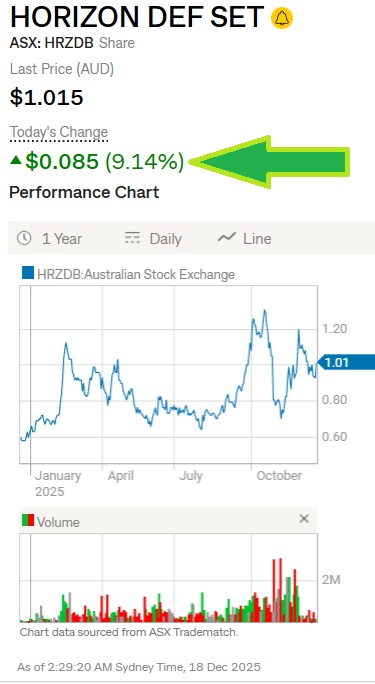

Monday 22nd December 2025: On a very positive day across the gold sector, Horizon Minerals is head and shoulders above the pack in terms of being up over +20% so far today. In fact earlier today they got up to $1.25/share which was a new 52-week high for them:

Below is a snapshot of the biggest moves across the Aussie gold sector around half an hour ago, with HRZ firmly at the top - the companies are listed in descending order of today's share price rises in percentage terms (up until the time the screenshot was taken - i.e. about 1:50pm Sydney time), from the best % rises on down. This is just the top part of my watchlist but it's worth noting (IMO) just how many emerging producers (like HRZ) and project developers (also HRZ) are making greater daily share price gains (in percentage terms) than a lot of the much larger well-established gold producers like RMS, RSG, WGX, GMD and NEM (who all do make the list below). For context, Australia's largest two goldies, NST and EVN were up +3.5% and +2.85% respectively. [NEM is there below because it's still considered part of the Aussie Gold Sector for some reason, even though it's a US company]

The Gold price is up by only +0.6% to +0.7% (see below), but making new all time highs in US Dollars:

Google: The gold price has reached a new all-time nominal high in the last 24 hours, surging to approximately US$4,383.73 per ounce on Monday, December 22, 2025. This surpasses the previous record of around US$4,381.52 set in October of this year.

The current live spot price is near this record high, influenced by:

- Expectations of further US Federal Reserve interest rate cuts.

- Sustained demand for gold as a safe-haven asset amid global geopolitical tensions.

- A weaker US dollar, making the metal more affordable for buyers using other currencies

Thanks Google. I'm thinking that global geopolitical tensions is a big one, like Trump intercepting and seizing a third Venezuelan oil tanker (source: https://www.abc.net.au/news/2025-12-22/us-intercepting-third-venezuelan-oil-tanker/106169160) and the bombing Syria (source: https://www.abc.net.au/news/2025-12-20/us-strikes-dozens-of-islamic-state-targets-in-syria/106165794) and blowing up fishing boats that are suspected of transporting fentanyl to the US - with zero proof - and killing all of the survivors. Anything to distract from those pesky Epstein files.

I maintain what I have said a couple of times here - Trump is bad for the USA, very bad for the rest of the world, but good for a rising gold price.

And when he was elected for the second time, I increased my exposure to the Aussie gold sector even further.

I'd never vote for him if I was a US citizen, but it is what it is, and these are the times we live in, so gold continues to be a good way to play Trump, in my opinion.

And there is still clearly money moving down to the smaller players, including gold project developers and emerging producers.